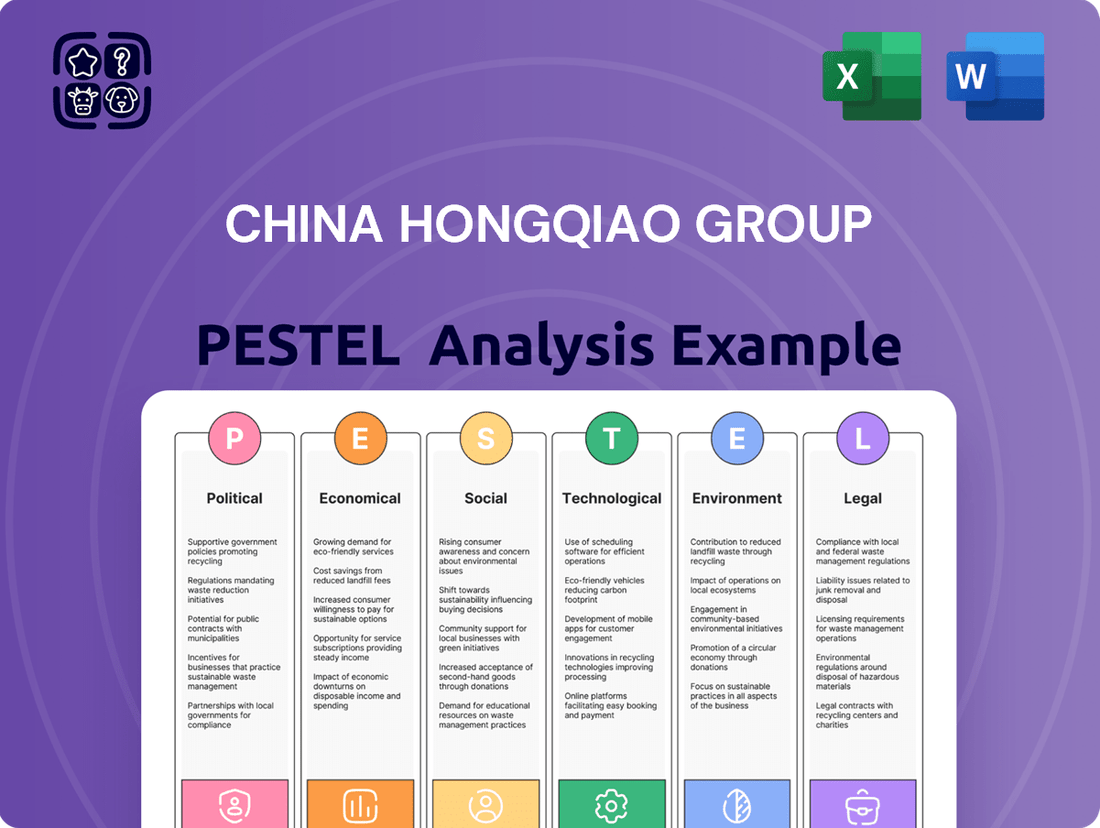

China Hongqiao Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Hongqiao Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping China Hongqiao Group's trajectory. Our PESTLE analysis provides an expert-level view of these external forces, essential for any strategic decision-maker. Download the full version now to gain a competitive edge and navigate the complex landscape with confidence.

Political factors

China's government is a significant player in the aluminum industry, wielding considerable influence through its policies on production capacity and energy consumption. These regulations are designed to manage the sector's growth and environmental impact, directly affecting companies like China Hongqiao Group.

A key policy is the maintenance of a 'capacity ceiling' for primary aluminum production, with strict controls on the establishment of new smelting facilities. This approach aims to prevent oversupply and encourage more sustainable operational practices within the industry.

Furthermore, the 'Energy Conservation and Carbon Reduction Action Plan for 2024-2025' sets ambitious targets for the aluminum sector. This plan mandates improvements in energy efficiency and an increased reliance on renewable energy sources, pushing companies to adopt greener technologies and processes.

China's commitment to its 'dual carbon' targets, aiming to peak emissions by 2030 and achieve carbon neutrality by 2060, significantly impacts energy-intensive sectors like aluminum. The government is actively pushing for a greater share of renewable energy in aluminum production.

Specifically, the target is for renewable energy to constitute over 25% of the energy used in electrolytic aluminum by 2025. Furthermore, by 2030, industries with high energy consumption, including non-ferrous metals, will be mandated to source 40% of their power from green sources.

Trade policies and geopolitical tensions are major influences on the global aluminum market, directly affecting China Hongqiao Group. For instance, in 2023, ongoing trade disputes and geopolitical instability contributed to significant price volatility for aluminum, with LME prices fluctuating between approximately $2,100 and $2,500 per metric ton. These shifts are often tied to evolving Chinese industrial policies and international trade relations.

China Hongqiao Group must actively manage the risks associated with potential trade barriers and disruptions to global trading routes. The imposition of tariffs or sanctions by major economies could impact the company's export markets and sourcing of raw materials. For example, if key markets implement new import restrictions on aluminum products, it could force the company to re-evaluate its sales strategies and potentially seek alternative markets.

Government Support for Electrification and Infrastructure

China's commitment to electrification and infrastructure modernization, including incentives for replacing older equipment, directly drives demand for aluminum. For instance, the nation's ambitious plans for expanding its electric vehicle (EV) charging network and upgrading its power grid rely heavily on aluminum for its conductivity and lightweight properties. This government push for greener technologies and enhanced energy efficiency in manufacturing processes creates a favorable environment for aluminum producers like China Hongqiao Group.

The government's focus on sustainable consumption patterns and energy efficiency improvements in manufacturing processes directly benefits the aluminum industry. China's 14th Five-Year Plan (2021-2025) emphasizes green development and carbon emission reduction, which translates into support for industries that enable these goals, including aluminum production for new energy vehicles and renewable energy infrastructure. In 2024, China continued to be the world's largest producer and consumer of aluminum, with domestic demand supported by these industrial policies.

Key government initiatives impacting aluminum consumption include:

- Support for Electric Vehicle (EV) Production: Incentives for EV manufacturing and charging infrastructure development boost aluminum demand for vehicle components and grid upgrades.

- Infrastructure Investment: Continued spending on high-speed rail, airports, and renewable energy projects (solar, wind) requires significant aluminum.

- Energy Efficiency Standards: Stricter regulations on industrial energy use encourage the adoption of lighter, more energy-efficient materials like aluminum in manufacturing.

- Green Building Initiatives: Policies promoting sustainable construction practices favor aluminum in building envelopes and structural components.

Regional Policy Implementation and Compliance

The effectiveness of central government policies in China, particularly concerning environmental regulations and industrial development, hinges significantly on regional implementation and compliance capabilities. Provinces like Shandong, where China Hongqiao Group has substantial operations, are tasked with meeting specific renewable energy targets for energy-intensive sectors such as aluminum production.

China Hongqiao Group's ability to adapt to and comply with these varied regional directives is paramount for its ongoing operational continuity and future expansion plans. For instance, Shandong province has been actively promoting green development, with provincial plans often setting more stringent requirements than national guidelines for reducing carbon emissions and increasing renewable energy usage in industrial processes.

The company's performance is directly influenced by how well it integrates these regional policy nuances into its operational strategy. This includes investments in cleaner production technologies and securing renewable energy sources to meet local mandates. Failure to comply could result in operational restrictions or penalties, impacting production capacity and market access.

- Regional Renewable Energy Targets: Shandong province aims to increase the proportion of non-fossil fuel energy consumption in its total energy consumption, with specific implications for heavy industries like aluminum smelting.

- Compliance Costs: Adherence to stricter regional environmental standards may necessitate additional capital expenditure for pollution control equipment and renewable energy infrastructure.

- Operational Flexibility: Varying regional enforcement levels can create challenges in maintaining uniform operational standards across different production sites.

- Government Support: Conversely, proactive compliance with regional green development initiatives can sometimes unlock access to local government incentives and support programs.

China's government actively shapes the aluminum sector through production caps and energy efficiency mandates, directly impacting China Hongqiao Group. The nation's 'dual carbon' targets, aiming for carbon neutrality by 2060, push for increased renewable energy use, with a goal of over 25% renewable energy in electrolytic aluminum by 2025.

Trade policies and geopolitical factors also play a significant role, as seen in 2023's aluminum price volatility, with LME prices ranging from approximately $2,100 to $2,500 per metric ton, influenced by global trade relations and Chinese industrial policies.

Government support for electric vehicles and infrastructure, such as the expansion of EV charging networks, drives aluminum demand due to its lightweight and conductive properties. China's 14th Five-Year Plan (2021-2025) further emphasizes green development, benefiting aluminum producers supporting new energy vehicles and renewable energy projects.

Regional policy implementation, particularly in provinces like Shandong, presents both challenges and opportunities. Stricter local environmental standards may increase compliance costs, but proactive adherence can unlock government incentives and support programs for companies like China Hongqiao Group.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting China Hongqiao Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities derived from current market trends and regulatory landscapes.

A PESTLE analysis of China Hongqiao Group provides a structured framework to identify and mitigate external challenges, acting as a pain point reliever by offering clarity on political, economic, social, technological, environmental, and legal factors impacting their operations.

This analysis helps alleviate pain points by proactively addressing potential disruptions and capitalizing on emerging opportunities within the complex global landscape.

Economic factors

The global aluminum market is on a strong upward trajectory, driven by increasing demand across key sectors like automotive, aerospace, construction, and packaging. This robust growth is expected to continue, with the market valued at USD 178.5 billion in 2024.

Projections indicate a compound annual growth rate (CAGR) of 5.9% for the period between 2025 and 2034, highlighting sustained expansion in aluminum consumption worldwide. This trend suggests significant opportunities and potential challenges for major players in the industry.

Aluminum prices are anticipated to stay strong but fluctuate in 2025. This is driven by a recovering global economy, ongoing geopolitical events, and persistent cost pressures impacting production.

While the market anticipates an easing of alumina shortages, which could lower production expenses, the overall high cost of operations and the vulnerability of supply chains are set to keep aluminum prices in flux. For instance, in early 2024, the LME aluminum price hovered around $2,300 per metric ton, reflecting these underlying pressures.

China Hongqiao Group has shown impressive financial gains, with revenue and net profit seeing substantial boosts. The company's net profit surged by 95.2% in 2024, a result of both elevated sales prices and a greater volume of aluminum alloy and alumina products sold.

This upward trajectory in sales volume and profit is anticipated to persist into the first half of 2025, indicating continued strong market demand and effective operational strategies for the group.

Impact of Deflation and Overcapacity in China

While China's property sector downturn impacts steel demand, the aluminum industry, where China Hongqiao Group operates, has demonstrated resilience. This resilience is partly due to declining power costs, a significant input for aluminum production. For instance, by mid-2024, industrial electricity prices in many Chinese provinces saw a notable decrease compared to the previous year, bolstering profitability for energy-intensive sectors like aluminum smelting.

Government initiatives promoting electrification, particularly in the automotive and renewable energy sectors, continue to drive demand for aluminum. This sustained demand, coupled with favorable energy costs, has helped improve profit margins for aluminum producers. China Hongqiao Group, as a major player, is positioned to benefit from these trends, with its 2024 first-half results showing improved operational efficiency and profitability driven by these factors.

However, the broader economic climate in China, characterized by deflationary pressures and the risk of overcapacity in other industrial segments, presents indirect challenges. Persistent deflation can erode purchasing power and corporate revenues, potentially leading to reduced overall industrial activity. Furthermore, overcapacity in sectors like steel or manufacturing could spill over into supply chain dynamics or dampen broader economic sentiment, indirectly affecting even resilient sectors.

Key considerations for China Hongqiao Group include:

- Falling Power Costs: Continued reduction in industrial electricity prices directly boosts aluminum production margins.

- Electrification Demand: Growth in EVs and renewable energy infrastructure remains a strong tailwind for aluminum consumption.

- Deflationary Risks: Broad-based price declines could impact overall economic activity and demand for industrial goods.

- Overcapacity Spillover: Potential for excess capacity in other sectors to create competitive pressures or economic instability.

Investment in Downstream Processing and Circular Economy

China Hongqiao Group is actively investing in downstream aluminum processing to boost its operational efficiency and champion a circular economy model. This strategic move supports the growing global emphasis on sustainability within the aluminum sector.

This expansion is in lockstep with China's broader industrial push towards recycling, with projections indicating that the nation's recycled aluminum production will surpass 15 million tonnes by 2027. This trend is crucial for reducing the carbon footprint associated with primary aluminum production.

- Increased Recycled Aluminum Production: China's recycled aluminum output is expected to reach over 15 million tonnes by 2027, a significant jump that highlights the industry's shift.

- Resource Efficiency: Downstream processing allows for better utilization of aluminum resources, minimizing waste and maximizing value from existing materials.

- Environmental Benefits: A greater reliance on recycled aluminum significantly cuts down on energy consumption and greenhouse gas emissions compared to primary aluminum smelting.

- Market Competitiveness: By integrating deep processing, Hongqiao Group aims to enhance its product offerings and solidify its position in a market increasingly prioritizing sustainable and value-added aluminum products.

China's economic landscape presents a mixed bag for China Hongqiao Group. While falling power costs in mid-2024 provided a significant boost to aluminum production margins, deflationary pressures and potential overcapacity in other industrial sectors pose indirect risks. The strong demand from electrification, particularly in EVs and renewables, continues to be a key growth driver, as evidenced by Hongqiao's substantial profit surge of 95.2% in 2024, driven by higher sales volumes and prices.

What You See Is What You Get

China Hongqiao Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Hongqiao Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic positioning within the global aluminum industry.

Sociological factors

China Hongqiao Group prioritizes its workforce, employing over 43,000 individuals across its 11 production bases. The company is committed to fostering a healthy, safe, and comfortable work environment, offering various development opportunities to its staff.

The group actively implements policies to safeguard the rights of its female employees, addressing needs during pregnancy, childbirth, and breastfeeding. Furthermore, China Hongqiao maintains a strict zero-tolerance policy against workplace sexual harassment, ensuring a respectful atmosphere for all.

China Hongqiao Group emphasizes a core value of 'from society and for society,' actively contributing to social welfare and demonstrating a strong commitment to corporate social responsibility. This philosophy guides their operations, aiming to foster a positive societal impact.

The company actively engages with and responds to evolving sustainable development challenges, prioritizing the creation of a harmonious balance between its economic growth objectives and the overall well-being of the communities in which it operates. This proactive approach is crucial for long-term stakeholder relations and operational sustainability.

In 2023, China Hongqiao Group reported significant investments in community initiatives, including educational support and environmental protection projects, reflecting their dedication to social upliftment. For instance, their contributions to local infrastructure development in Shandong province have demonstrably improved living standards for thousands.

Consumer demand for low-carbon and sustainable aluminum is on the rise globally. This trend is driven by increasing environmental awareness among consumers and a broader industry push for greener solutions. For instance, in 2024, the global market for sustainable aluminum is projected to see significant growth, with many brands actively seeking suppliers who can demonstrate reduced carbon footprints in their production processes.

This societal shift directly impacts aluminum producers like China Hongqiao Group. They are increasingly pressured to adopt and prioritize sustainable manufacturing practices. Investing in and implementing low-carbon smelting technologies is becoming crucial for maintaining market competitiveness and meeting the evolving expectations of environmentally conscious consumers and business partners.

Safety and Quality Standards

China Hongqiao Group prioritizes innovation and precision to uphold stringent safety and quality standards across its product lines and manufacturing operations. This focus is vital for building and retaining consumer confidence, particularly as the company diversifies its offerings. For instance, in 2023, the company reported a significant investment in research and development, with a substantial portion allocated to enhancing production efficiency and product quality control.

Meeting and exceeding industry benchmarks is paramount for Hongqiao's sustained growth and market position. The group's commitment to quality is reflected in its operational procedures and product certifications, which are regularly reviewed and updated to align with evolving global and domestic regulations. This dedication ensures that their aluminum products consistently meet the high expectations of a diverse customer base.

- Commitment to R&D: China Hongqiao Group's investment in research and development in 2023, a key driver for quality enhancement.

- Consumer Trust: Maintaining high safety and quality standards is essential for fostering long-term consumer trust and brand loyalty.

- Industry Standards: Adherence to rigorous industry standards and certifications underpins the company's operational integrity.

- Product Portfolio Expansion: The drive for quality is crucial as the company broadens its range of aluminum products.

Talent Attraction and Retention

The aluminum industry, including giants like China Hongqiao Group, is grappling with a significant skills gap, a common issue across many sectors. This shortage impacts everything from operational efficiency to the pace of innovation. In 2024, reports indicated a growing demand for specialized engineering and technical roles within the manufacturing sector, a trend likely to persist.

China Hongqiao Group's strategic emphasis on creating an appealing workplace, offering varied career paths, and fostering employee development is crucial for overcoming these talent challenges. By investing in its workforce, the company aims to attract and keep the skilled individuals necessary for maintaining its production capabilities and driving future technological advancements in aluminum processing.

Key aspects of China Hongqiao Group's talent strategy include:

- Employee Training Programs: Investing in continuous learning to upskill the existing workforce and adapt to new technologies.

- Competitive Compensation and Benefits: Offering attractive packages to draw in and retain top talent in a competitive labor market.

- Career Development Pathways: Providing clear opportunities for advancement and specialization within the company.

Societal expectations are increasingly shaping the aluminum industry, with a growing demand for sustainable and ethically produced materials. China Hongqiao Group recognizes this, investing in community initiatives and aiming for harmonious growth. For instance, their 2023 community investments in Shandong province improved living standards for thousands.

The company's commitment to employee well-being, including safeguarding female employees' rights and a zero-tolerance policy for harassment, reflects evolving workplace social norms. This focus on a positive work environment and corporate social responsibility is vital for attracting and retaining talent in a competitive market, especially given the industry's skills gap.

Technological factors

Technological advancements are significantly reshaping the aluminum sector, with China Hongqiao Group benefiting from innovations in smelting and production. These breakthroughs focus on enhancing production capacity and operational efficiency. For instance, the development of advanced reduction cells, capable of higher amperage, directly translates to increased output and a reduced environmental footprint.

These technological leaps are crucial for maintaining competitiveness. By adopting more efficient smelting methods, companies like China Hongqiao Group can lower energy consumption, a major cost driver in aluminum production. This not only improves profitability but also aligns with growing global demands for sustainable manufacturing practices, a trend likely to intensify through 2025.

China Hongqiao Group is leveraging digitalization and automation to significantly boost its operational efficiency. The integration of advanced technologies like AI and IoT sensors allows for real-time monitoring across its production facilities, leading to better resource management and reduced waste. For instance, by implementing automated processes in its smelting operations, the company can achieve more precise temperature control and energy consumption, directly impacting cost-effectiveness and environmental performance.

The adoption of advanced robotics in material handling and quality inspection further streamlines production lines, minimizing human error and enhancing product consistency. This technological push is crucial in the competitive global aluminum market, where efficiency gains translate directly into a stronger market position. In 2024, investments in smart manufacturing technologies are expected to continue, aiming to further optimize the entire value chain from raw material processing to finished product output.

Technological advancements are pivotal for China Hongqiao Group's sustainability efforts, particularly in enhancing aluminum recycling. Innovations in sorting and separation are crucial for building a robust circular economy, allowing for more efficient recovery of aluminum scrap.

These technologies directly support decarbonization by reducing the need for energy-intensive primary aluminum production. For instance, advancements in eddy current separators and optical sorters can significantly improve the purity of recycled aluminum, making it a more viable alternative to virgin metal.

The global aluminum recycling rate was around 76% in 2023, a figure China aims to increase. By adopting cutting-edge recycling technologies, China Hongqiao Group can bolster its environmental credentials and operational efficiency, aligning with China's ambitious carbon neutrality targets.

Development of New Alloys and Materials

Research into new aluminum alloys is significantly enhancing material properties, leading to increased strength, reduced weight, and improved corrosion resistance. These advancements are crucial for industries like aerospace and automotive, where lighter and stronger materials translate to better fuel efficiency and performance. For instance, the automotive sector is increasingly adopting advanced high-strength aluminum alloys, with global demand for aluminum in vehicles projected to reach over 10 million metric tons by 2028, up from approximately 8.5 million metric tons in 2023.

These material innovations unlock new applications and drive demand within the aluminum sector. China Hongqiao Group, as a major player, benefits directly from this trend as it can offer more sophisticated products to its clients. The development of specialized alloys, such as those used in electric vehicle battery enclosures, represents a growing market segment. By 2025, the demand for aluminum in EVs alone is expected to more than double compared to 2022 levels.

The technological push in materials science directly impacts the competitiveness and product offerings of companies like China Hongqiao Group.

- Enhanced Material Properties: New alloys offer superior strength-to-weight ratios and greater durability.

- Industry Adoption: Aerospace and automotive sectors are key drivers of demand for advanced aluminum materials.

- Market Growth: Innovations create new market opportunities and expand the use cases for aluminum.

- Competitive Advantage: Companies investing in R&D for new alloys can secure a stronger market position.

Clean Energy Technologies

The push towards cleaner aluminum production is heavily reliant on technological advancements. China Hongqiao Group is investing in technologies like green hydrogen and inert anodes, which are key to slashing carbon emissions. This strategic focus is central to their low-carbon transition, with a goal of significantly reducing their environmental footprint in aluminum manufacturing.

By embracing these innovations, China Hongqiao aims to align with global decarbonization efforts and enhance its sustainability profile. The company's commitment to exploring and applying these clean energy solutions underscores a forward-looking approach to responsible industrial growth.

- Green Hydrogen: Essential for reducing emissions in smelting processes.

- Inert Anodes: Technological shift away from traditional, carbon-emitting anodes.

- Carbon Reduction Goals: China Hongqiao's active pursuit of substantial emission cuts.

- Low-Carbon Transformation: Integrating these technologies into their core operational strategy.

Technological factors are pivotal for China Hongqiao Group, driving efficiency and sustainability in aluminum production. Innovations in smelting, such as advanced reduction cells, boost output and lower environmental impact. Digitalization and automation, including AI and IoT, optimize operations and resource management, as seen in precise energy control in smelting. The company is also investing in advanced robotics for handling and quality control, aiming for greater precision and consistency.

Advancements in aluminum recycling technologies are crucial for China Hongqiao's circular economy goals. Improved sorting and separation techniques enhance scrap purity, supporting decarbonization by reducing reliance on energy-intensive primary production. China's push to increase its recycling rate, targeting a significant rise from its 2023 level of around 76%, directly benefits companies adopting these cutting-edge methods.

Material science innovations, particularly in new aluminum alloys, are expanding market opportunities for China Hongqiao. These alloys offer enhanced strength and reduced weight, crucial for sectors like automotive, where aluminum use in vehicles is projected to exceed 10 million metric tons by 2028. The demand for aluminum in electric vehicles is also a key growth area, expected to more than double by 2025 compared to 2022.

| Technology Area | Impact on China Hongqiao | Key Benefit | Relevant Data Point |

|---|---|---|---|

| Advanced Smelting Cells | Increased production capacity, reduced energy consumption | Lower operational costs, improved environmental footprint | Higher amperage cells enhance output |

| Digitalization & Automation | Real-time monitoring, optimized resource management | Enhanced efficiency, reduced waste | AI and IoT integration in facilities |

| Aluminum Recycling Tech | Improved scrap purity, support for circular economy | Reduced reliance on primary production, aligns with carbon goals | Global recycling rate ~76% in 2023 |

| New Aluminum Alloys | Opens new market applications, enhances product value | Increased demand from automotive and aerospace | Aluminum in vehicles projected >10M MT by 2028 |

Legal factors

China Hongqiao Group operates within the People's Republic of China's stringent environmental protection framework. This includes adherence to regulations governing air and greenhouse gas emissions, waste management, and overall environmental impact mitigation. The company's 2024 Environmental, Social, and Governance (ESG) report underscores its commitment to complying with these critical legal mandates.

China's legal framework actively manages the electrolytic aluminum sector through capacity replacement policies. For instance, by the end of 2023, the National Development and Reform Commission (NDRC) continued to emphasize the retirement of outdated capacity to make way for more efficient production. This legal push directly impacts companies like China Hongqiao Group by dictating the pace and nature of their operational upgrades and expansions, ensuring compliance with national industrial optimization goals.

Strict energy and environmental standards are also legally mandated for new aluminum smelting projects. These regulations, enforced by ministries such as the Ministry of Ecology and Environment, set benchmarks for emissions, energy consumption per unit of output, and waste management. For 2024 and beyond, adherence to these evolving legal requirements is critical for China Hongqiao Group to secure approvals for any new capacity additions or significant technological upgrades, aligning with the nation's broader environmental protection and carbon neutrality targets.

China's national Emission Trading Scheme (ETS) now encompasses the aluminum sector, a significant development for companies like China Hongqiao Group. For 2025, compliance was eased with free allowances mirroring 2024 emissions.

However, looking ahead to subsequent years, carbon intensity benchmarks will be implemented. This shift means China Hongqiao Group will need to actively manage its carbon footprint to meet these evolving standards, potentially necessitating the purchase of carbon credits to cover any excess emissions.

Corporate Governance and Reporting Requirements

China Hongqiao Group, as a company listed on the Hong Kong Stock Exchange, must adhere to rigorous corporate governance and reporting standards. This includes the mandatory preparation of annual reports and Environmental, Social, and Governance (ESG) reports, ensuring transparency and accountability to stakeholders. For instance, their 2023 annual report detailed significant progress in their sustainability initiatives, aligning with global reporting frameworks.

The company's commitment to ESG is further demonstrated through its dedicated Sustainability Committee. This committee actively oversees and manages all ESG-related affairs, ensuring that China Hongqiao Group not only meets but often exceeds the required disclosure obligations. This proactive approach is crucial for maintaining investor confidence and navigating the evolving regulatory landscape.

Key reporting areas for China Hongqiao Group include:

- Financial Performance: Detailed reporting of revenue, profit, and key financial ratios as per Hong Kong listing rules.

- Environmental Impact: Disclosure of carbon emissions, energy consumption, and waste management practices.

- Social Responsibility: Reporting on labor practices, community engagement, and supply chain management.

- Governance Structure: Information on board composition, executive compensation, and internal controls.

Labor Laws and Employee Rights

China Hongqiao Group operates under stringent labor laws, ensuring employee rights are protected. The company's policies, such as its Policy on Gender Equality and Protection of the Rights and Interests of Female Employees, are developed in strict adherence to these regulations. This framework guarantees the safeguarding of employees' legitimate rights and fosters a workplace with zero tolerance for harassment.

The legal landscape in China mandates fair labor practices, including provisions for working hours, minimum wage, and social insurance. For instance, China's Labor Contract Law, effective from 2008 and subsequently amended, provides a robust legal basis for employment relationships, which Hongqiao Group must comply with.

- Compliance with Labor Contract Law: Ensuring all employment agreements meet statutory requirements.

- Protection Against Discrimination: Upholding gender equality and preventing workplace harassment as per company policy and law.

- Social Insurance Contributions: Adhering to regulations for employee social security and housing fund contributions.

- Workplace Safety Standards: Meeting legal obligations for providing a safe and healthy working environment.

China Hongqiao Group navigates a complex legal environment, particularly concerning environmental regulations and industrial policy. The nation's focus on capacity replacement in the electrolytic aluminum sector, as emphasized by the NDRC through 2023, directly influences operational upgrades. Furthermore, stringent energy and environmental standards for new smelting projects, enforced by bodies like the Ministry of Ecology and Environment, dictate compliance for expansion. The inclusion of the aluminum sector in China's national Emission Trading Scheme (ETS) by 2025, with initial free allowances, signals a growing emphasis on carbon management, requiring proactive footprint control from companies like Hongqiao.

The company is also bound by robust labor laws, ensuring employee rights and fair practices, as exemplified by its Policy on Gender Equality. Adherence to the Labor Contract Law and provisions for social insurance contributions are critical. Moreover, as a Hong Kong-listed entity, China Hongqiao Group must comply with stringent corporate governance and reporting standards, including detailed ESG disclosures, with their 2023 annual report highlighting sustainability progress.

| Legal Factor | Description | Impact on China Hongqiao Group | 2024/2025 Relevance |

| Environmental Regulations | China's strict environmental protection laws on emissions, waste, and impact. | Requires compliance with emission standards and waste management protocols. | Ongoing adherence to evolving standards and ESG reporting mandates. |

| Industrial Policy | Capacity replacement and efficiency standards for the aluminum sector. | Drives operational upgrades and dictates expansion pace. | Continued focus on modernizing production to meet national goals. |

| Emissions Trading Scheme (ETS) | Inclusion of aluminum sector in national ETS by 2025. | Necessitates carbon footprint management and potential credit purchases. | Compliance with carbon intensity benchmarks and trading mechanisms. |

| Corporate Governance | Listing rules on Hong Kong Stock Exchange for reporting and transparency. | Mandates detailed annual and ESG reporting, ensuring accountability. | Maintaining investor confidence through robust disclosure practices. |

| Labor Laws | Protection of employee rights, fair wages, and safe working conditions. | Requires adherence to labor contracts, anti-discrimination policies, and social insurance. | Ensuring compliance with the Labor Contract Law and workplace safety. |

Environmental factors

The aluminum industry, inherently energy-intensive, presents a significant environmental challenge due to its substantial greenhouse gas emissions. China Hongqiao Group recognizes this and is making concerted efforts to mitigate its impact. The company has set a clear target to peak its operational carbon emissions by 2025, demonstrating a commitment to immediate action.

Furthermore, China Hongqiao Group is focused on a long-term strategy to reduce the carbon intensity of its primary aluminum production. By 2030, the company aims for a notable decrease in this intensity, primarily by increasing its reliance on renewable electricity sources and implementing cutting-edge, energy-efficient technologies across its operations.

China Hongqiao Group is actively addressing the energy-intensive nature of aluminum production by prioritizing clean energy. In 2024, the company significantly boosted its renewable energy usage, consuming 17.932 TWh of renewable electricity. This strategic shift not only supports environmental goals but also resulted in an estimated avoidance of 14.9283 million tonnes of CO2e emissions.

Further demonstrating its commitment to a greener energy profile, China Hongqiao Group is strategically relocating its smelting capacity. This relocation is focused on areas abundant in green hydropower resources, a move designed to further enhance the proportion of clean energy in its overall consumption structure.

China Hongqiao Group is actively pursuing a circular economy model, with a significant emphasis on recycled aluminum. This strategic shift aims to reduce reliance on primary aluminum production and its associated environmental footprint. For instance, in 2023, the company reported an increase in its recycled aluminum processing capacity, contributing to a more sustainable supply chain.

A key area of focus is the improved management of red mud, a byproduct of alumina refining. Hongqiao is investing in technologies to increase the utilization rate of newly generated red mud. This includes exploring innovative methods for extracting critical minerals from bauxite residue, thereby mitigating the environmental hazards traditionally associated with red mud disposal and transforming a waste product into a potential resource.

Environmental Impact of Production Facilities

China Hongqiao Group is actively engaged in a significant 'Green Transitioning' Capacity Relocation Project. This initiative involves shifting a portion of its aluminum smelting operations to Yunnan Province, a region rich in hydropower resources. This strategic relocation is designed to significantly decrease the company's dependence on coal-fired power generation, a key driver for carbon emission reduction.

The move to Yunnan is projected to yield substantial carbon reductions, aligning with China's broader environmental goals. By utilizing green hydropower, Hongqiao aims to foster a more sustainable aluminum production model. This transition is crucial for the long-term viability and environmental responsibility of the aluminum industry. In 2023, China Hongqiao announced plans to invest approximately RMB 6 billion in this green transition, highlighting the scale of their commitment.

Key aspects of this environmental strategy include:

- Leveraging Hydropower: Shifting smelting capacity to Yunnan to utilize abundant green energy sources.

- Carbon Emission Reduction: Significantly lowering the carbon footprint associated with aluminum production by moving away from coal.

- Sustainable Industry Promotion: Setting a precedent for a more environmentally conscious approach within the aluminum sector.

- Capacity Relocation: Transferring approximately 1 million tonnes of aluminum smelting capacity to the new, greener location.

Sustainability-Linked Financing and ESG Commitments

China Hongqiao Group's engagement with sustainability-linked financing, notably a Sustainability-Linked Loan (SLL), underscores a strategic pivot towards environmental responsibility. This financial instrument is directly tied to achieving specific carbon emission reduction targets, reflecting a commitment to greener operational practices.

The company has established annual emission reduction goals that are benchmarked against the International Aluminum Institute's recommended pathways. This alignment signals an intention to adhere to industry-wide best practices for environmental stewardship within the aluminum sector.

- Sustainability-Linked Loan (SLL) Issued: Focuses on carbon emission reduction.

- Environmental Commitment: Demonstrates dedication to sustainable business practices.

- Emission Targets: Aligned with International Aluminum Institute pathways.

China Hongqiao Group is actively integrating environmental considerations into its core strategy, particularly through its significant investment in green energy and emission reduction initiatives. The company's commitment is evident in its substantial renewable electricity consumption and its strategic relocation of smelting capacity to regions with abundant hydropower resources.

These efforts are not just about compliance but about fundamentally transforming their operational footprint. By prioritizing clean energy and innovative waste management, Hongqiao is positioning itself for a more sustainable future in the energy-intensive aluminum sector.

The company's proactive approach includes setting ambitious carbon emission targets and aligning with international environmental benchmarks, further solidifying its dedication to environmental stewardship.

| Environmental Initiative | 2023 Data/Commitment | 2024 Data/Commitment | 2025 Target | 2030 Target |

|---|---|---|---|---|

| Renewable Electricity Consumption | Increased recycled aluminum processing capacity | 17.932 TWh | Increase reliance on renewable electricity | |

| Carbon Emission Reduction | Investment of RMB 6 billion in green transition | Estimated avoidance of 14.9283 million tonnes of CO2e | Peak operational carbon emissions | Notable decrease in carbon intensity of primary aluminum production |

| Capacity Relocation | Focus on Yunnan Province for hydropower | Transferring 1 million tonnes of smelting capacity | ||

| Red Mud Management | Investing in technologies for increased utilization |

PESTLE Analysis Data Sources

Our PESTLE analysis for China Hongqiao Group is informed by data from official Chinese government publications, international financial institutions like the World Bank, and reputable industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.