China Hongqiao Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Hongqiao Group Bundle

The China Hongqiao Group faces significant competitive pressures, with a moderate threat from new entrants and substantial bargaining power held by buyers in the aluminum industry. Understanding these dynamics is crucial for any stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore China Hongqiao Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

China Hongqiao Group's reliance on bauxite for its alumina production makes it vulnerable to supplier power. The global bauxite market experienced significant price volatility in 2024, with benchmark prices for Australian premium-grade bauxite averaging around $60 per tonne, a 15% increase from the previous year, driven by increased demand and tightening supply.

Environmental regulations in key bauxite-producing nations, such as Indonesia and Australia, have led to stricter mining practices and, at times, export restrictions. These factors, coupled with geopolitical tensions in regions like West Africa, can disrupt supply chains and increase the cost of this essential raw material for Hongqiao, directly impacting its production costs and profitability.

In 2024, alumina prices saw a significant increase, driven by supply disruptions. This put considerable pressure on aluminum producers, impacting their production costs.

However, the market is expected to shift in 2025. New alumina production capacity coming online in Indonesia and India is projected to alleviate shortages, potentially leading to a surplus. This increased supply could ease the bargaining power of alumina suppliers and reduce input costs for companies like China Hongqiao Group.

China Hongqiao Group's significant reliance on electricity for its primary aluminum production means energy costs are a critical factor. While the company has invested in self-sufficiency through its own power generation facilities, global energy price fluctuations and increased demand from sectors like data centers can still impact its overall cost structure. This dynamic means that even with internal generation, the potential for external energy supply competition can influence their bargaining power.

Input Material Cost Fluctuations

Beyond the major inputs of alumina and energy, China Hongqiao Group's profitability is also sensitive to the price of other critical raw materials. These include essential components like coal, which is vital for power generation in their smelters, and anode carbon blocks, a consumable in the aluminum production process.

The company experienced a favorable shift in these input costs during 2024. Specifically, China Hongqiao reported a reduction in the expenses associated with coal and anode carbon blocks. This decrease in material costs directly contributed to an improvement in the group's overall profitability.

- Input Cost Sensitivity: China Hongqiao's financial performance is significantly influenced by fluctuations in the cost of key raw materials beyond alumina and energy.

- 2024 Cost Reductions: In 2024, the company benefited from lower prices for coal and anode carbon blocks.

- Profitability Impact: These decreased material expenses were a contributing factor to the higher profits reported by China Hongqiao Group.

Technological Suppliers

As the aluminum industry increasingly prioritizes low-carbon production, China Hongqiao Group's reliance on suppliers of advanced technologies for energy efficiency, carbon reduction, and renewable energy integration is growing. This heightened dependence grants specialized technology providers greater leverage.

For instance, suppliers of cutting-edge electrolysis cell technologies or advanced carbon capture solutions are in a strong position. In 2024, the global market for green aluminum technologies saw significant investment, with companies developing proprietary solutions commanding premium pricing.

- Increased Demand for Green Tech: The push for sustainability in aluminum manufacturing elevates the importance of suppliers offering energy-efficient and low-emission technologies.

- Supplier Specialization: Providers of niche, high-performance equipment and software for carbon monitoring and reduction hold considerable bargaining power.

- Technological Lock-in: Once China Hongqiao adopts specific advanced technologies, switching costs can be high, further strengthening supplier positions.

- Limited Alternatives: The availability of comparable, equally advanced technological alternatives may be scarce, concentrating power among a few key suppliers.

The bargaining power of suppliers for China Hongqiao Group is influenced by the availability and cost of critical inputs like bauxite, alumina, and energy. While the group has strategies to mitigate these pressures, such as investing in captive power generation, external market dynamics remain a significant factor.

The company's reliance on specific raw materials, particularly bauxite, exposes it to price volatility. For example, in 2024, the average price for Australian premium-grade bauxite increased by 15% year-on-year, reaching approximately $60 per tonne. This rise was attributed to heightened demand and tighter supply conditions.

Furthermore, the increasing demand for environmentally friendly production methods means suppliers of advanced green technologies are gaining leverage. Companies offering specialized solutions for energy efficiency and carbon reduction are well-positioned to command premium pricing, especially given the limited availability of comparable alternatives.

What is included in the product

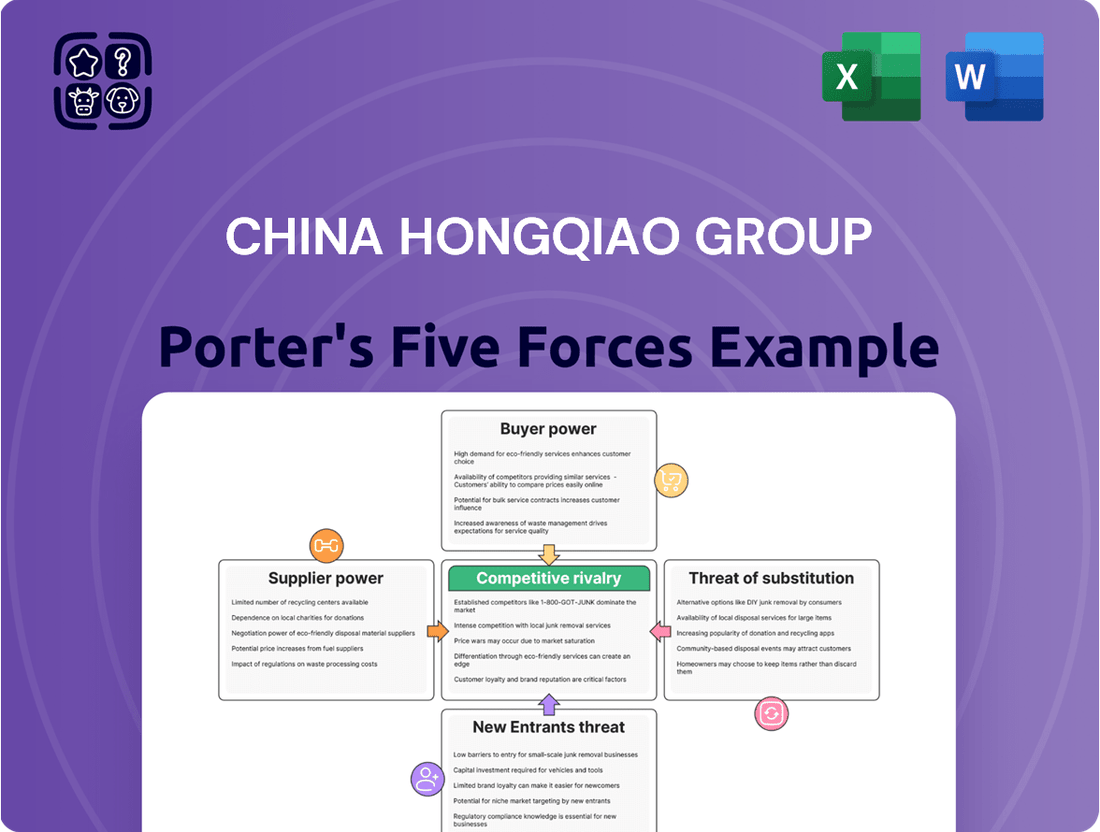

This Porter's Five Forces analysis is tailored exclusively for China Hongqiao Group, dissecting the competitive intensity within the global aluminum industry and evaluating the group's strategic positioning against key market forces.

Understand the competitive landscape for China Hongqiao Group with a detailed Porter's Five Forces analysis, immediately identifying key threats and opportunities.

Gain clarity on the bargaining power of suppliers and buyers, enabling more effective negotiation strategies for China Hongqiao Group.

Customers Bargaining Power

China Hongqiao Group's diverse application base for its aluminum products significantly dampens customer bargaining power. With aluminum used across critical sectors like transportation, construction, electrical and electronics, and packaging, the company isn't overly reliant on any single industry. This broad market reach means that if one customer segment attempts to negotiate harder, Hongqiao has alternative buyers.

The increasing need for lighter, stronger materials in industries like automotive and aerospace significantly boosts demand for aluminum. This trend, fueled by the rise of electric vehicles and fuel efficiency mandates, directly enhances the bargaining power of customers who can leverage this demand to negotiate better terms with major aluminum producers like China Hongqiao Group.

Customers are increasingly prioritizing sustainably produced and low-carbon aluminum, a trend that significantly impacts the bargaining power of buyers. This growing demand for green products means that companies like China Hongqiao, which are investing in cleaner production methods, can differentiate themselves. However, it also empowers customers who can now choose suppliers that meet their environmental, social, and governance (ESG) criteria, potentially driving down prices for less sustainable options.

Global Market Consumption

China's position as the world's largest consumer of aluminum, accounting for over 55% of global consumption in 2024, grants its buyers significant bargaining power. This immense demand means that suppliers must often cater to the specific needs and pricing expectations of Chinese customers. For China Hongqiao Group, this translates to a substantial and relatively stable domestic customer base, a key advantage in managing its sales volume.

However, this deep integration into the Chinese market also presents a vulnerability. Any slowdown in China's economic growth or shifts in its industrial policies, particularly those affecting construction and manufacturing sectors which are major aluminum users, can directly impact demand for Hongqiao's products. For instance, a 2024 government initiative to curb overcapacity in certain industries could indirectly reduce aluminum demand, forcing Hongqiao to adapt its production or pricing strategies.

- China's aluminum consumption in 2024 is projected to exceed 45 million metric tons.

- The construction sector accounts for approximately 40% of China's aluminum demand.

- China Hongqiao Group's domestic sales represented roughly 70% of its total revenue in the first half of 2024.

- Government efforts to reduce carbon emissions in China's industrial sector could influence aluminum production costs and, consequently, pricing for domestic buyers.

Price Sensitivity and Commodity Nature

Aluminum, despite its widespread use in sectors like aerospace and construction, largely functions as a commodity. This commodity nature inherently makes customers price-sensitive, as they can readily switch between suppliers based on cost. For China Hongqiao Group, this means that even with growing demand, significant price fluctuations can occur.

Global market dynamics play a crucial role in shaping this bargaining power. Surpluses in aluminum production, often driven by increased output from various global players, can amplify customer leverage. For instance, during periods of oversupply, buyers can negotiate more favorable terms, forcing producers like China Hongqiao to compete aggressively on price. Economic slowdowns further exacerbate this, as reduced industrial activity leads to lower demand, giving customers more options and thus greater power.

- Price Sensitivity: Aluminum's commodity status means customers prioritize cost, impacting China Hongqiao's pricing strategies.

- Market Surpluses: Global overproduction of aluminum increases buyer bargaining power by offering more competitive pricing options.

- Economic Slowdowns: Reduced industrial demand during economic downturns empowers customers with greater negotiation leverage.

- Customer Options: The availability of multiple suppliers in a surplus market allows customers to easily switch, driving down prices for producers.

The bargaining power of customers for China Hongqiao Group is moderate, influenced by aluminum's commodity nature and the concentration of demand within China. While the broad applications of aluminum offer some diversification, customers can readily switch suppliers based on price, especially during periods of global oversupply. China's significant domestic consumption, projected to exceed 45 million metric tons in 2024, grants its buyers considerable leverage, with the construction sector alone accounting for around 40% of this demand.

| Factor | Impact on Customer Bargaining Power | China Hongqiao Group Relevance |

| Aluminum as a Commodity | High Price Sensitivity | Customers can easily switch suppliers based on cost. |

| China's Domestic Demand (2024 Est.) | Significant Leverage | Over 55% of global consumption, granting Chinese buyers strong negotiation power. |

| Sectoral Demand Concentration (Construction) | Moderate Influence | Approximately 40% of China's aluminum demand, giving construction buyers some sway. |

| Global Supply/Demand Balance | Variable Influence | Surpluses increase buyer power; shortages decrease it. |

What You See Is What You Get

China Hongqiao Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for China Hongqiao Group, detailing the competitive landscape within the aluminum industry. You're viewing the actual, professionally crafted document that you will receive immediately after purchase, offering a comprehensive understanding of the forces impacting Hongqiao's market position. This means you'll gain instant access to the same in-depth analysis, ready for immediate use without any placeholders or surprises.

Rivalry Among Competitors

China Hongqiao Group operates within a fiercely competitive global aluminum market, characterized by a multitude of large multinational corporations and niche producers. As one of the world's leading aluminum manufacturers, the company faces intense rivalry, demanding constant innovation and cost efficiency to maintain its market position.

The global aluminum industry saw significant production shifts in 2024, with China continuing to be the dominant force. Despite global economic headwinds, China's aluminum output remained robust, contributing over 60% of the world's total primary aluminum production. This sheer volume from China, coupled with major players like Chalco and other international giants, amplifies the competitive pressure on companies like China Hongqiao.

China's government-imposed cap on aluminum production, set at 45.5 million tonnes annually, directly constrains the expansion capabilities of domestic players like China Hongqiao Group. This regulatory ceiling intensifies competition, forcing companies to vie for market share within a fixed production volume.

China Hongqiao Group benefits immensely from its highly integrated industrial chain, encompassing everything from alumina production to its own power generation facilities. This vertical integration is a cornerstone of its cost competitiveness, allowing for greater control over input costs in an industry known for its energy intensity.

In 2023, China Hongqiao's self-sufficiency in power generation, with a significant installed capacity, directly mitigated the impact of fluctuating electricity prices, a major operating expense for aluminum smelters. This strategic advantage allows the company to maintain a lower cost base compared to competitors reliant on external power sources.

Technological Innovation and Sustainability Efforts

Competitive rivalry in the aluminum sector is intensifying, driven by significant investments in technological innovation and sustainability. Competitors are pouring resources into developing and implementing advanced production methods, particularly those focused on energy efficiency and reducing carbon footprints. This includes a growing emphasis on low-carbon aluminum, a key differentiator in today's market.

China Hongqiao Group's strategic focus on green transformation and carbon reduction is therefore paramount to its long-term competitiveness. By prioritizing these initiatives, the company aims to maintain and enhance its market position amidst evolving industry standards and customer preferences. For instance, by 2023, China Hongqiao had already made substantial progress in its green development initiatives, with a significant portion of its production capacity aligned with environmentally friendly practices.

- Technological Advancements: Competitors are actively adopting technologies that improve energy efficiency, such as advanced smelting processes and waste heat recovery systems.

- Sustainability as a Driver: The push for low-carbon aluminum is becoming a critical factor, influencing market share and brand reputation.

- China Hongqiao's Strategy: The group's commitment to green transformation, including investments in renewable energy sources for its operations, is a key element in navigating this competitive landscape.

- Market Impact: Companies that successfully integrate sustainable practices and innovative technologies are better positioned to meet regulatory demands and attract environmentally conscious customers.

Geopolitical and Trade Tensions

Ongoing geopolitical and trade tensions, especially between China and major economies like the United States and the European Union, significantly impact the aluminum industry. These tensions often manifest as tariffs and trade restrictions, directly affecting the cost of raw materials and finished aluminum products for companies like China Hongqiao Group.

For instance, the imposition of tariffs can increase the cost of importing bauxite or exporting aluminum, forcing companies to absorb these costs or pass them onto consumers. This creates a more volatile and unpredictable competitive landscape. In 2024, these tensions continued to shape global trade patterns, with ongoing discussions and potential policy shifts creating uncertainty for supply chain management and international sales.

- Trade Tensions: Tariffs and retaliatory measures between major economic blocs create unpredictable cost structures and market access challenges for aluminum producers.

- Supply Chain Disruptions: Geopolitical instability can lead to rerouting of supply chains, increasing logistics costs and potentially impacting the availability of critical inputs for aluminum production.

- Market Volatility: Trade disputes contribute to price volatility in the global aluminum market, making it harder for companies to forecast demand and manage inventory effectively.

The global aluminum market is characterized by intense competition, with China Hongqiao Group facing numerous large multinational corporations and specialized producers. In 2024, China's dominant position in primary aluminum production, exceeding 60% of the global total, intensified this rivalry, forcing companies to prioritize cost efficiency and innovation to remain competitive.

Technological advancements and a growing emphasis on sustainability are key drivers of this competitive landscape. Companies are investing heavily in energy-efficient production methods and low-carbon aluminum, making environmental performance a critical differentiator. China Hongqiao's strategic focus on green transformation, with significant progress in environmentally friendly practices by 2023, is vital for its sustained market position.

Geopolitical and trade tensions, including tariffs and restrictions between major economies, further complicate the competitive environment. These factors create unpredictable cost structures and market access challenges, impacting raw material imports and finished product exports. The ongoing trade disputes in 2024 contributed to market volatility, affecting supply chain management and international sales for aluminum producers.

| Key Competitor Landscape Factors | Impact on China Hongqiao Group | 2024 Market Dynamics |

|---|---|---|

| Intense Global Rivalry | Requires continuous cost optimization and innovation. | China's output >60% of global primary aluminum. |

| Technological Advancements | Drives need for energy efficiency and low-carbon production. | Focus on advanced smelting and waste heat recovery. |

| Sustainability Push | Brand reputation and market share influenced by green practices. | Growing demand for low-carbon aluminum. |

| Geopolitical & Trade Tensions | Increases costs and creates market access uncertainty. | Tariffs and trade restrictions impacting supply chains. |

SSubstitutes Threaten

Aluminum's inherent strengths, like its exceptional strength-to-weight ratio and natural corrosion resistance, position it as a leading material. These properties are crucial in sectors such as automotive and aerospace, where weight reduction and durability are paramount, making direct substitution challenging for core applications.

For instance, in the automotive industry, aluminum's use in vehicle bodies and components contributes to fuel efficiency. By 2024, the global automotive aluminum market was projected to reach over $120 billion, highlighting its significant role and the difficulty in finding cost-effective, high-performing alternatives for these specific functions.

While recycled aluminum offers a more energy-efficient option, its current availability is constrained by limitations in scrap supply and the complexities of quality control. These factors significantly curb the immediate threat of recycled aluminum acting as a perfect substitute for primary aluminum production.

For instance, in 2023, the global aluminum recycling rate hovered around 70-75%, indicating that a substantial portion of aluminum demand still relies on primary production. China Hongqiao Group, a major player, navigates this by managing its own primary production capacity, mitigating the direct impact of these recycling supply constraints.

Advances in other materials, such as advanced plastics, composites, and high-strength steels, present a long-term threat to aluminum demand. As these materials improve in properties and cost-effectiveness, they could displace aluminum in applications where it is currently the preferred choice. For instance, the automotive sector is increasingly exploring lightweight composites to meet fuel efficiency standards, potentially reducing reliance on aluminum components.

Cost-Performance Trade-offs

The choice between aluminum and its substitutes hinges on a delicate balance of cost and performance. For instance, while steel might be cheaper upfront, its higher weight and susceptibility to corrosion can lead to increased transportation and maintenance expenses, potentially making aluminum more cost-effective over the long term. In 2024, global aluminum prices fluctuated, with the London Metal Exchange (LME) aluminum price ranging between approximately $2,200 and $2,500 per metric ton, influenced by energy costs and geopolitical factors.

Significant changes in these cost-performance dynamics can sway market preference. If processing costs for aluminum were to rise substantially due to new regulations or energy price spikes, or if substitute materials like advanced plastics or composites offered comparable performance at a lower overall cost, the threat of substitution would intensify. For example, the automotive industry continuously evaluates materials, and a sustained increase in aluminum input costs could accelerate the adoption of lighter, more resilient composite materials, which saw significant investment and development throughout 2024.

Key considerations in this trade-off include:

- Material Cost: Fluctuations in raw material prices for aluminum versus competing materials like steel, copper, or composites.

- Processing Costs: Energy consumption, labor, and specialized equipment required for manufacturing with each material.

- Performance Characteristics: Factors such as strength-to-weight ratio, durability, corrosion resistance, and recyclability.

Regulatory and Environmental Pressures

China Hongqiao Group, like other major aluminum producers, faces the threat of substitutes driven by increasing regulatory and environmental pressures. As governments globally, including China, intensify their focus on sustainability and circular economy principles, materials with lower carbon footprints or more straightforward recycling processes become more attractive. This trend could bolster the appeal of substitutes if aluminum production, particularly energy-intensive smelting, doesn't adapt to cleaner technologies or improved recyclability.

For instance, China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 directly impacts energy-intensive industries like aluminum. If aluminum producers, including Hongqiao, lag in adopting greener energy sources or enhancing recycling rates, other materials could gain a competitive edge. For example, the global recycled aluminum market is projected to grow, offering a more sustainable alternative to primary aluminum production, which is crucial for companies like Hongqiao that are heavily invested in primary smelting.

- Environmental Regulations: Stricter emissions standards and waste management policies can increase operating costs for primary aluminum production.

- Circular Economy Push: Growing emphasis on recycled content may favor materials with higher and more efficient recycling rates than aluminum in certain applications.

- Material Innovation: Development of advanced composites or bio-based materials with comparable performance characteristics and lower environmental impact poses a direct substitute threat.

While aluminum's inherent properties make it strong in key sectors, the threat of substitutes is evolving. Advanced plastics and composites are gaining traction, particularly in the automotive industry, driven by a need for lighter materials and improved fuel efficiency. For example, by 2024, the automotive sector continued to explore lightweight composites, potentially impacting aluminum demand.

The cost-performance balance remains critical. Although steel might be cheaper initially, its weight and corrosion issues can increase long-term costs. In 2024, LME aluminum prices ranged roughly between $2,200 and $2,500 per metric ton, influenced by energy and geopolitical factors, a dynamic that affects the competitiveness against substitutes.

Environmental pressures also play a role. As sustainability becomes paramount, materials with lower carbon footprints or more efficient recycling processes could gain an advantage. China's carbon neutrality goals by 2060 mean that energy-intensive aluminum production, like that of China Hongqiao Group, must adapt to cleaner technologies to mitigate the threat from more eco-friendly alternatives.

| Material | Key Substitute Threat Factors | 2024 Market Context |

|---|---|---|

| Aluminum | Competition from advanced composites, high-strength steels, and plastics in automotive and construction. | Global aluminum market projected to exceed $120 billion in automotive alone. LME prices fluctuated, impacting cost-competitiveness. |

| Composites | Improving performance-to-weight ratios and cost-effectiveness. | Significant investment in composite material development for automotive lightweighting. |

| High-Strength Steel | Lower upfront cost compared to aluminum. | Continued use in automotive where weight is less critical or cost is the primary driver. |

Entrants Threaten

The aluminum industry, especially primary smelting and alumina refining, demands enormous capital. Think billions of dollars for state-of-the-art facilities, specialized machinery, and the crucial energy infrastructure needed to power these energy-intensive operations. This sheer financial hurdle acts as a formidable barrier, making it incredibly difficult for newcomers to even consider entering the market.

New entrants face significant hurdles in securing essential raw materials like bauxite and alumina, as well as consistent, affordable energy. China Hongqiao Group's robust vertical integration, encompassing mining, refining, and power generation, creates a formidable barrier. For instance, in 2023, the global average cost of electricity for industrial users in China was approximately $0.07 per kWh, a crucial factor for energy-intensive aluminum production, and new players would struggle to match such integrated cost efficiencies.

China Hongqiao Group faces significant barriers to entry due to stringent environmental regulations. For instance, the Chinese government's intensified focus on pollution control, particularly in the aluminum sector, has led to stricter standards for emissions and waste management. New entrants must invest heavily in advanced pollution abatement technologies to comply with these regulations, such as those addressing red mud disposal, a byproduct of alumina refining. These upfront capital expenditures and ongoing operational costs for environmental compliance can deter potential competitors.

Established Players and Market Saturation

The global aluminum market is highly consolidated, with giants like China Hongqiao Group leveraging significant economies of scale. This dominance, coupled with entrenched supply chains and strong customer loyalty, creates substantial barriers for newcomers. For instance, in 2023, China Hongqiao reported revenue of approximately $24.5 billion, showcasing its immense operational capacity.

New entrants face the daunting task of matching the production volumes and cost efficiencies of established firms. The capital investment required to build competitive aluminum smelting and processing facilities is enormous, often running into billions of dollars. This financial hurdle, combined with the need to secure reliable raw material sources and distribution networks, significantly dampens the threat of new entrants.

- Economies of Scale: Established players benefit from lower per-unit production costs due to high output volumes.

- Capital Requirements: Building new, competitive aluminum facilities demands massive upfront investment.

- Supply Chain Integration: Existing players often control key aspects of the supply chain, from raw materials to distribution.

- Brand Loyalty and Relationships: Long-standing customer relationships are difficult for new entrants to replicate.

Technological Expertise and Intellectual Property

Developing the sophisticated technological expertise needed for efficient, high-quality aluminum production, encompassing advanced smelting and processing, demands significant R&D investment and considerable time. This steep learning curve and capital requirement act as a considerable barrier for potential new entrants aiming to compete with established players like China Hongqiao Group.

Furthermore, the protection of intellectual property, including proprietary technologies and patents related to production processes, creates an additional hurdle. Companies that have invested heavily in innovation and secured these rights can leverage them to maintain a competitive edge, making it harder for newcomers to replicate their operational efficiencies and product quality.

- R&D Investment: Significant capital is required to develop and implement advanced aluminum production technologies.

- Time to Expertise: Mastering complex smelting and processing techniques takes years of dedicated effort and learning.

- Intellectual Property: Patents and proprietary knowledge protect existing players, raising the barrier for imitation.

The threat of new entrants in China Hongqiao Group's operating environment is significantly low due to the immense capital required for primary aluminum smelting and alumina refining. These operations demand billions of dollars for facilities, machinery, and essential energy infrastructure, creating a substantial financial barrier. Newcomers also face challenges in securing raw materials and affordable energy, areas where China Hongqiao's vertical integration provides a distinct cost advantage.

Stringent environmental regulations in China further deter new entrants, requiring significant investment in pollution abatement technologies. The established market's consolidation and economies of scale, exemplified by China Hongqiao's 2023 revenue of approximately $24.5 billion, make it difficult for new players to match production volumes and cost efficiencies. Furthermore, the time and R&D investment needed to develop technological expertise and protect intellectual property act as additional deterrents.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | Enormous upfront investment for smelters, refineries, and energy infrastructure. | Very High | Billions of USD for a competitive facility. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | High | China Hongqiao's 2023 revenue of ~$24.5 billion indicates massive scale. |

| Supply Chain Integration | Control over raw materials (bauxite) and energy. | High | Reduces input cost volatility for established players. |

| Environmental Regulations | Strict standards for emissions and waste management. | High | Requires significant investment in pollution control technology. |

| Technological Expertise | Mastery of advanced smelting and refining processes. | Moderate to High | Significant R&D and time needed to achieve efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Hongqiao Group is built upon a foundation of publicly available financial reports, industry-specific market research, and government economic data. This comprehensive approach ensures a robust understanding of the competitive landscape.