China Hongqiao Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Hongqiao Group Bundle

Discover the intricate workings of China Hongqiao Group's business model with our comprehensive Business Model Canvas. This detailed breakdown unveils their strategic approach to value creation, customer relationships, and revenue streams, offering invaluable insights for any business strategist.

Unlock the full strategic blueprint behind China Hongqiao Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

China Hongqiao Group's operations are fundamentally dependent on securing a consistent flow of essential raw materials. This includes bauxite, the primary ore for alumina, alongside critical inputs like coal for power generation and anode carbon blocks for the smelting process. These partnerships are vital for maintaining production levels and managing cost volatility.

To mitigate supply risks and ensure cost competitiveness, Hongqiao has forged strategic alliances with bauxite mining entities. Notably, its investments in overseas bauxite assets, particularly in Guinea, underscore a commitment to achieving greater self-sufficiency in bauxite sourcing. This proactive approach to raw material procurement is a cornerstone of its business model.

China Hongqiao Group actively collaborates with leading research institutions and technology firms to pioneer advancements in aluminum production. These partnerships are crucial for enhancing energy efficiency, a key focus given the energy-intensive nature of aluminum smelting. For instance, in 2024, the company continued its efforts to integrate artificial intelligence and automation across its operations, aiming to optimize resource utilization and reduce waste.

A significant aspect of these collaborations involves developing and implementing next-generation, low-carbon technologies. This includes exploring innovations like inert anodes, which promise to significantly reduce greenhouse gas emissions during the smelting process, and integrating green hydrogen as a clean energy source. These initiatives directly support Hongqiao's commitment to sustainability and its long-term environmental, social, and governance (ESG) objectives.

China Hongqiao Group's strategic focus on self-generated power, particularly its expansion into hydropower, wind, and solar energy, necessitates strong alliances with energy providers and infrastructure developers. These partnerships are crucial for accessing and integrating renewable energy sources into its operations, especially in regions like Yunnan province, known for its hydropower potential.

Collaborations with regional power grids are essential for China Hongqiao to effectively distribute and utilize its self-generated green energy, thereby reducing its dependence on traditional fossil fuels. For instance, in 2023, China Hongqiao continued to invest heavily in its integrated power generation facilities, aiming to further bolster its renewable energy capacity.

Downstream Processing and Manufacturing Companies

China Hongqiao Group actively partners with downstream processing and manufacturing firms that integrate aluminum alloy products into their operations. These collaborations are crucial for expanding market reach and diversifying sales channels.

Key partnerships include companies involved in the production of new energy vehicles (NEVs), lithium batteries, and photovoltaic (PV) products. By supplying high-quality aluminum alloys to these sectors, Hongqiao taps into rapidly growing industries.

For instance, the NEV market is a significant growth driver. In 2023, global electric vehicle sales surpassed 13 million units, a substantial increase from previous years. Aluminum's lightweight properties are essential for improving EV range and performance, making Hongqiao's products highly sought after.

Similarly, the renewable energy sector, particularly solar power, relies heavily on aluminum for frames and mounting structures. The International Energy Agency reported that solar PV capacity additions reached a record high in 2023, underscoring the demand for aluminum in this area.

- Market Penetration: Collaborations allow Hongqiao to enter and solidify its presence in high-growth sectors like electric vehicles and renewable energy.

- Product Diversification: Supplying aluminum for NEVs, lithium batteries, and PV products diversifies Hongqiao's customer base and revenue streams.

- Adaptability to Demand: These partnerships enable Hongqiao to stay abreast of and respond to evolving industrial requirements and technological advancements in downstream applications.

Financial Institutions and Investors

China Hongqiao Group's financial health and strategic growth are deeply intertwined with its relationships with financial institutions and investors. These partnerships are crucial for securing the necessary capital for operations, expansion, and its commitment to green initiatives.

The company actively engages with banks to secure various financing facilities. Notably, in 2023, China Hongqiao Group successfully issued sustainability-linked loans, demonstrating its commitment to environmental, social, and governance (ESG) principles while accessing capital. These loans are structured to offer better terms as the company meets predefined sustainability targets, such as reducing carbon emissions or increasing renewable energy usage in its operations.

Furthermore, relationships with investors are vital for capital management. China Hongqiao Group has utilized bond issuances to raise significant capital, providing long-term funding for its extensive industrial operations. In 2024, the company continued to explore and execute equity buyback plans, a strategy often employed to enhance shareholder value and signal confidence in the company's future prospects. These actions collectively ensure financial stability and provide the liquidity needed to pursue strategic investments and maintain operational momentum.

- Financing Facilities: Access to diverse loans, including sustainability-linked loans, supports green initiatives and operational costs.

- Investor Relations: Bond issuances and equity buyback programs are key tools for capital raising and shareholder value enhancement.

- Financial Stability: These partnerships are fundamental to managing capital effectively and ensuring the company's ongoing financial resilience.

- Strategic Investment Support: The capital secured through these relationships directly fuels China Hongqiao Group's strategic investments and growth plans.

China Hongqiao Group's key partnerships extend to downstream sectors, particularly those driving demand for aluminum alloys. Collaborations with manufacturers in new energy vehicles (NEVs) and the renewable energy industry, such as solar photovoltaic (PV) product makers, are crucial. For instance, the global NEV market saw sales exceed 13 million units in 2023, highlighting the demand for lightweight aluminum components to enhance EV range and performance. Similarly, the solar sector's record PV capacity additions in 2023 underscore the need for aluminum in frames and mounting structures.

| Partnership Area | Key Collaborators | Strategic Importance | 2023/2024 Data Point |

| NEV Manufacturing | Automotive Component Suppliers | Supplying lightweight aluminum for EV chassis and components | Global NEV sales surpassed 13 million units in 2023 |

| Renewable Energy | Solar Panel Frame Manufacturers | Providing aluminum for solar panel structures and mounting systems | Record solar PV capacity additions in 2023 |

| Lithium Battery Production | Battery Casing Manufacturers | Supplying aluminum for battery enclosures and thermal management | Growing demand driven by EV and energy storage markets |

What is included in the product

China Hongqiao Group's business model focuses on vertically integrated aluminum production, from bauxite mining to downstream aluminum products, leveraging cost efficiencies and scale to serve industrial customers globally.

China Hongqiao Group's Business Model Canvas effectively addresses the pain point of complex supply chain management by visually mapping its integrated operations from raw materials to finished aluminum products.

This allows stakeholders to quickly grasp how Hongqiao mitigates risks and optimizes costs, providing a clear, one-page snapshot of their pain-point-relieving strategy.

Activities

China Hongqiao Group's core operations revolve around the mining of bauxite and the subsequent production of alumina. This vertical integration is crucial, as bauxite is the primary ingredient for aluminum. By controlling both stages, Hongqiao can better manage its costs and ensure a stable supply of this essential raw material, giving it a significant edge in the market.

In 2024, China Hongqiao continued to solidify its position in the alumina market. The company's extensive bauxite reserves and advanced production facilities are key to its success. This integrated approach allows for greater efficiency and cost control throughout the value chain, directly impacting its competitiveness in the global aluminum industry.

China Hongqiao Group's core activity centers on the energy-intensive smelting of alumina into molten aluminum alloy and finished ingots. This process demands significant operational scale, with the company managing extensive smelting pot capacities to satisfy substantial global demand for aluminum.

In 2024, China Hongqiao Group maintained a robust production output. The company reported a primary aluminum output of approximately 6.5 million tons for the year, showcasing its ability to operate at high capacity utilization rates and meet the consistent demand from various downstream industries.

China Hongqiao Group extends its operations beyond primary aluminum production by engaging in the sophisticated processing of aluminum alloys. This involves transforming raw aluminum into value-added products such as casting-rolling materials and electrical busbars, directly serving a wider array of industrial applications.

This deep processing capability allows Hongqiao to meet specialized customer requirements, enhancing its market position. For instance, in 2023, the company's aluminum alloy processing and product manufacturing segment contributed significantly to its overall revenue, demonstrating the strategic importance of this value-added chain.

Power Generation and Energy Management

China Hongqiao Group's power generation and energy management is a cornerstone of its operations, primarily focused on self-supplying electricity for its energy-intensive aluminum smelting. This strategic vertical integration is crucial for cost control and operational stability.

The company has made substantial investments in developing its own power infrastructure, with a significant portion of this capacity derived from renewable sources. This transition is driven by both environmental considerations and the pursuit of energy independence, aiming to mitigate reliance on external power grids and fluctuating energy prices.

By 2024, China Hongqiao has continued its push towards green energy, with a substantial portion of its power generation capacity coming from hydropower, wind, and solar. This strategic shift not only lowers its carbon footprint but also enhances its competitive edge in a market increasingly focused on sustainability.

- Renewable Energy Focus: Significant investments in hydropower, wind, and solar power to fuel aluminum production.

- Energy Independence: Self-generation of power reduces reliance on external grids and market volatility.

- Cost Efficiency: Lowering operational costs through captive power generation, especially from renewables.

- Environmental Commitment: Transitioning to cleaner energy sources to reduce carbon emissions and meet sustainability goals.

Research and Development for Green Technologies

China Hongqiao Group actively invests in research and development to drive innovation in green technologies. This focus is crucial for advancing their production processes, aiming for greater energy efficiency and the creation of low-carbon aluminum. A significant part of this R&D involves exploring cutting-edge solutions to minimize environmental impact.

Key research areas include the development of inert anodes, a promising technology for reducing emissions in aluminum smelting, and finding more effective ways to utilize bauxite residue, a byproduct of aluminum production. These initiatives are central to the group's commitment to circular economy principles and enhancing overall sustainability.

- Technological Advancements: Investing in R&D for energy-efficient production methods and low-carbon aluminum.

- Circular Economy: Exploring innovations like inert anodes and improved bauxite residue utilization.

- Sustainability Focus: Driving continuous improvement in environmental performance through technological innovation.

China Hongqiao Group's key activities encompass the entire aluminum value chain, from raw material extraction to finished product manufacturing. This includes mining bauxite, producing alumina, smelting primary aluminum, and processing aluminum alloys into specialized products.

A significant operational pillar is the group's extensive captive power generation, with a strong emphasis on renewable energy sources like hydropower, wind, and solar, ensuring energy independence and cost control. The company also actively invests in research and development, focusing on green technologies and circular economy principles to enhance production efficiency and reduce environmental impact.

In 2024, the group reported a primary aluminum output of approximately 6.5 million tons, underscoring its large-scale production capabilities and market presence.

| Key Activity | Description | 2024 Data/Focus |

| Bauxite Mining & Alumina Production | Vertical integration for raw material supply. | Securing stable bauxite reserves. |

| Primary Aluminum Smelting | Energy-intensive conversion of alumina to aluminum. | Output of ~6.5 million tons of primary aluminum. |

| Aluminum Alloy Processing | Manufacturing value-added products like casting-rolling materials. | Meeting specialized industrial application needs. |

| Power Generation | Captive power for smelting, with a focus on renewables. | Increased capacity from hydropower, wind, and solar. |

| Research & Development | Innovation in green technologies and sustainability. | Focus on inert anodes and bauxite residue utilization. |

Full Document Unlocks After Purchase

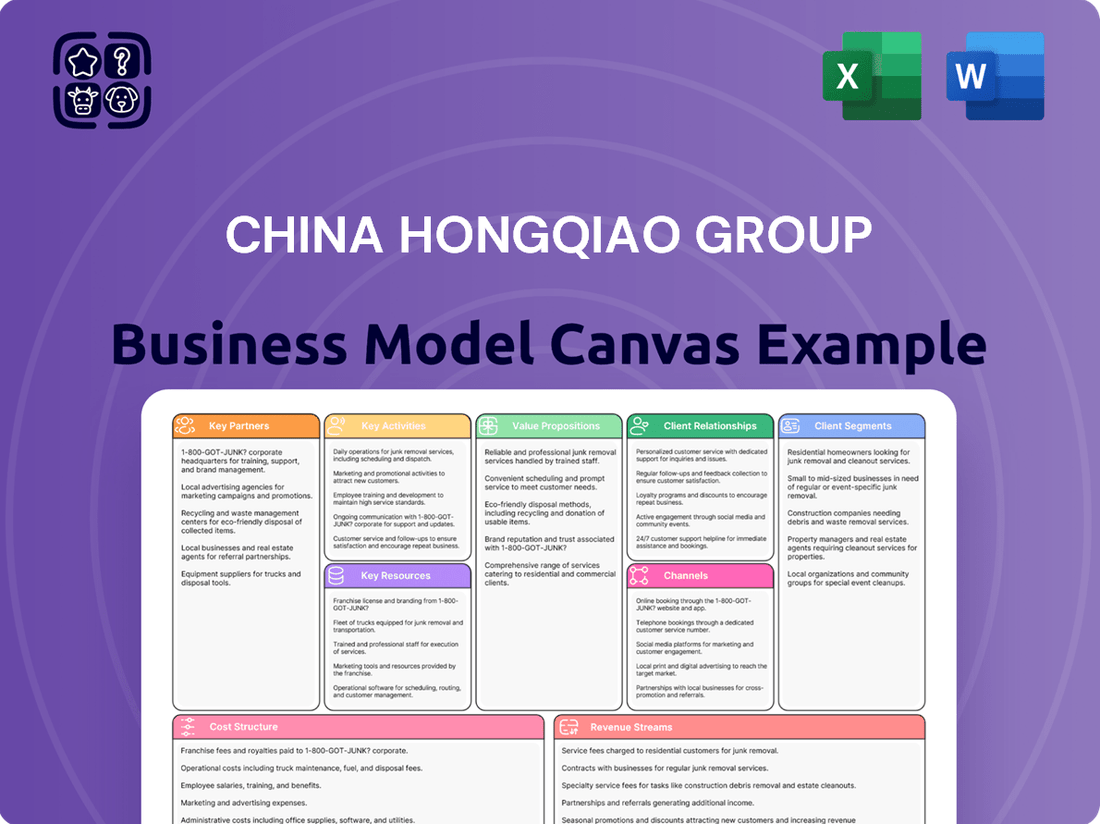

Business Model Canvas

The Business Model Canvas preview you're viewing for China Hongqiao Group is the actual document you will receive upon purchase. It provides a comprehensive overview of their operations, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. This direct preview ensures you know exactly what you're getting – a complete, ready-to-use analysis of China Hongqiao Group's business model.

Resources

China Hongqiao Group's business model is heavily reliant on its extensive bauxite reserves, notably through strategic overseas investments in Guinea, a nation boasting some of the world's richest bauxite deposits. This secures a stable, long-term supply of the primary raw material needed for aluminum production.

Complementing these reserves are the group's large-scale alumina refineries. In 2023, China Hongqiao reported significant operational capacity in its alumina production, underscoring its vertical integration. This integration allows for cost efficiencies and greater control over the production chain, from raw material extraction to finished aluminum products.

China Hongqiao Group's large-scale aluminum smelting facilities are its core physical assets, enabling its massive production output. The company boasts numerous advanced facilities strategically located across China and Indonesia, featuring cutting-edge smelting pot technology, including 400 kA and 600 kA units. These significant investments in infrastructure are fundamental to maintaining its position as a leading global aluminum producer.

China Hongqiao Group's captive power plants, increasingly powered by renewable sources like hydropower, wind, and solar, are a cornerstone of its operations. This self-sufficiency in energy generation, with a growing emphasis on green alternatives, offers a substantial cost advantage in its aluminum production. For instance, by 2023, the group had significantly expanded its renewable energy capacity, contributing to a more stable and predictable operating cost structure.

Skilled Workforce and Technical Expertise

China Hongqiao Group leverages a substantial workforce of over 43,000 individuals across its production facilities. This extensive team includes a significant number of engineers and technical specialists crucial for the complex processes involved in aluminum production, energy management, and research and development initiatives.

This skilled human capital is a cornerstone of the company's operational effectiveness and its capacity for innovation in the aluminum industry. Their expertise directly contributes to maintaining high production standards and driving advancements.

- Employee Count: Over 43,000 employees as of recent reporting.

- Key Expertise: Engineers and technical experts in aluminum smelting, power generation, and R&D.

- Impact: Vital for operational efficiency, process optimization, and technological innovation.

Proprietary Technology and Intellectual Property

China Hongqiao Group's proprietary technology and intellectual property are cornerstones of its business model, driving operational excellence. The company actively invests in research and development, leading to patented smelting technologies and sophisticated algorithms that optimize production processes. These innovations are crucial for maintaining a competitive advantage.

These intellectual assets translate directly into tangible benefits for China Hongqiao. By leveraging advanced smelting techniques and data-driven production, the company achieves enhanced efficiency and significantly reduced operational costs. For instance, their focus on technological upgrades has been a key factor in managing energy consumption, a major cost driver in aluminum production.

- Patented Smelting Technologies: Enabling more efficient and cost-effective aluminum production.

- Advanced Production Algorithms: Optimizing energy usage and output quality.

- R&D Investments: Fueling continuous innovation and the development of new intellectual property.

- Competitive Edge: These IP assets provide a distinct advantage in the global aluminum market.

China Hongqiao Group's key resources include its substantial bauxite reserves, particularly through overseas investments, ensuring raw material security. Its large-scale alumina refineries and advanced aluminum smelting facilities, equipped with cutting-edge technology, form the core of its production capacity. Crucially, the group's captive power plants, with an increasing share of renewable energy, provide significant cost advantages and operational stability.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Bauxite Reserves | Strategic overseas bauxite deposits, primarily in Guinea. | Secures long-term, stable supply of primary raw material. |

| Alumina Refineries | Large-scale production facilities. | Significant operational capacity, contributing to vertical integration and cost efficiencies. |

| Aluminum Smelting Facilities | Advanced facilities with 400 kA and 600 kA smelting pot technology. | Massive production output, maintaining global leadership. |

| Captive Power Plants | Self-sufficient energy generation, increasingly using renewables. | Provides substantial cost advantage; growing renewable capacity enhances cost predictability. |

Value Propositions

China Hongqiao Group's commitment to cost-effectiveness in its aluminum products stems from its deeply integrated value chain. This integration, encompassing everything from bauxite mining to its own power generation facilities, allows for unparalleled control over production costs.

This vertical integration is a key differentiator. For instance, in 2023, China Hongqiao reported a significant portion of its electricity needs were met by its self-owned power plants, a crucial factor in managing the energy-intensive aluminum smelting process and thus offering competitive pricing.

The ability to control raw material sourcing and energy supply directly translates to lower per-unit production costs. This cost advantage enables Hongqiao to present its aluminum products to the market at prices that are highly attractive to a broad range of industrial customers.

China Hongqiao Group offers a comprehensive selection of aluminum products, encompassing molten aluminum alloy, aluminum alloy ingots, and a variety of processed aluminum alloys. This broad portfolio effectively addresses the varied needs of numerous industrial sectors and specific client requirements, ensuring a high degree of customization and application flexibility.

In 2024, the company's commitment to quality and diversity in its aluminum forms is a cornerstone of its business model. Hongqiao's extensive product range allows it to serve a wide array of downstream industries, from automotive and construction to electronics and packaging, solidifying its position as a versatile supplier in the global aluminum market.

China Hongqiao Group's reliable supply and large production capacity are cornerstones of its business model. As a global leader, the company boasts an annual aluminum production capacity exceeding 6 million tonnes, ensuring customers receive a consistent and dependable source of this essential metal. This scale allows Hongqiao to effectively meet even the most substantial market demands.

Commitment to Sustainable and Low-Carbon Aluminum

China Hongqiao Group is making significant strides in its commitment to sustainable and low-carbon aluminum production. This focus is a key value proposition for customers who prioritize environmental responsibility in their supply chains.

The company is actively transitioning to renewable energy sources, with a clear goal of achieving carbon neutrality by 2035. This strategic shift is supported by substantial investments in green technologies, positioning Hongqiao as a leader in eco-friendly aluminum.

- Renewable Energy Integration: China Hongqiao is increasing its reliance on hydropower and other renewable sources to power its operations, significantly reducing its carbon footprint.

- Green Technology Investment: The group is investing in advanced technologies that minimize emissions and enhance energy efficiency throughout the aluminum production process.

- Market Demand Alignment: This commitment directly addresses the growing global demand for low-carbon materials, attracting environmentally conscious clients and partners.

- 2035 Carbon Neutrality Target: The ambitious goal of achieving carbon neutrality by 2035 underscores the company's dedication to long-term sustainability and responsible manufacturing.

Technological Innovation and Advanced Solutions

China Hongqiao Group leverages technological innovation to provide cutting-edge aluminum production solutions. By integrating advanced technologies like AI and automation into its R&D and manufacturing, the company enhances product quality and operational efficiency for its clientele.

These advanced solutions translate into tangible benefits for customers, such as improved material properties and streamlined production workflows. For instance, in 2024, China Hongqiao's investment in smart manufacturing technologies contributed to a reported 5% increase in energy efficiency across its key production facilities.

- AI-driven process optimization: Enhances yield and reduces waste.

- Automation in smelting and casting: Improves consistency and safety.

- Development of high-performance alloys: Meets evolving industry demands.

- Smart factory integration: Boosts overall operational intelligence and responsiveness.

China Hongqiao Group's value proposition centers on delivering cost-effective, high-quality aluminum products through a highly integrated and efficient operational model. This integration allows for significant cost advantages, making their offerings attractive to a wide customer base.

The company provides a diverse range of aluminum products, catering to the specific needs of various industries, from automotive to construction. This product breadth, combined with a commitment to quality, ensures they meet varied client requirements.

Reliability and scale are key; with a massive production capacity, Hongqiao ensures a consistent supply of aluminum, a critical factor for industries dependent on this metal. Their focus on technological innovation further enhances product performance and operational efficiency.

Furthermore, Hongqiao's dedication to sustainability, with a 2035 carbon neutrality target, appeals to environmentally conscious customers and aligns with global trends towards greener materials.

| Value Proposition | Key Features | Supporting Data/Facts |

|---|---|---|

| Cost Leadership | Vertically integrated value chain, self-owned power generation | In 2023, significant portion of electricity met by self-owned plants, contributing to competitive pricing. |

| Product Diversity & Quality | Comprehensive range of aluminum alloys and processed forms | In 2024, extensive product portfolio serves automotive, construction, electronics, and packaging sectors. |

| Supply Reliability & Scale | Large-scale production capacity | Annual aluminum production capacity exceeding 6 million tonnes ensures consistent supply. |

| Sustainability & Low-Carbon Production | Transition to renewable energy, carbon neutrality target | Aiming for carbon neutrality by 2035, with investments in green technologies. |

| Technological Innovation | AI and automation in R&D and manufacturing | 2024 investment in smart manufacturing boosted energy efficiency by 5% in key facilities. |

Customer Relationships

China Hongqiao Group prioritizes strong customer connections through its dedicated sales force, which actively guides clients through product selection and application. This hands-on approach ensures customers find the right solutions for their needs.

Beyond sales, comprehensive technical support is a cornerstone of Hongqiao's strategy. This support extends to troubleshooting and offering expert advice, fostering a sense of partnership and reliability.

By providing this dual focus on sales assistance and technical expertise, Hongqiao aims to not only meet but exceed customer expectations, cultivating enduring loyalty and repeat business within the aluminum industry.

China Hongqiao Group frequently secures long-term supply agreements with major industrial clients, a strategy that fosters significant stability and predictability in its operations. These arrangements are crucial for building robust trust and ensuring a steady, reliable revenue stream for the company.

For instance, in 2024, the company continued to leverage these agreements to solidify its position in the aluminum market, providing a bedrock of demand for its extensive production capabilities. This approach directly contributes to predictable cash flows, a key element for investor confidence and ongoing strategic planning.

China Hongqiao Group actively seeks customer feedback through various channels, including direct communication and market surveys, to understand evolving needs. In 2024, this proactive approach allowed them to refine product offerings and improve service quality, directly impacting client satisfaction.

The company's ability to offer customized aluminum products, tailored to specific client requirements, is a key differentiator. This customization capability, evident in their 2024 production lines, ensures they meet diverse industrial demands, fostering strong, long-term customer relationships and enhancing loyalty.

Industry Engagement and Collaboration

China Hongqiao Group actively participates in major industry exhibitions, showcasing its latest aluminum products and advanced manufacturing technologies. This direct engagement allows for valuable feedback and strengthens relationships with existing and potential customers. In 2023, the group reported significant participation in key global aluminum forums, highlighting its commitment to industry advancement.

Collaborating with industry partners and research institutions is a cornerstone of Hongqiao's strategy. These partnerships foster innovation and enable the co-development of new applications for aluminum, aligning with evolving market demands. For instance, collaborations in 2024 focused on sustainable aluminum production methods, a critical area for the industry.

- Industry Exhibitions: Participation in events like the International Aluminium Conference provides direct customer interaction and market insights.

- Strategic Partnerships: Collaborations with technology providers and research bodies drive product innovation and market penetration.

- Customer Engagement: Direct dialogue at trade shows and through joint projects ensures product development aligns with customer needs.

- Industry Leadership: Showcasing technological advancements reinforces Hongqiao's position as a key player in the global aluminum sector.

Investor Relations and Transparency

China Hongqiao Group prioritizes investor relations through consistent and transparent communication. This includes readily available annual reports, quarterly financial results, and prompt responses to investor inquiries, building essential trust with its financial stakeholders.

- Annual Reports and Financial Disclosures: The company regularly publishes detailed annual reports and financial statements, offering a comprehensive overview of its performance and strategic direction. For instance, in its 2023 annual report, China Hongqiao Group highlighted a significant increase in revenue and profit, demonstrating its financial health.

- Investor Communications: Regular updates via press releases and investor calls ensure that financial stakeholders are kept informed about operational developments and market positioning.

- Engagement with Financial Analysts: Proactive engagement with financial analysts helps to disseminate accurate information and manage market expectations, contributing to a stable valuation.

- Commitment to Transparency: The group's commitment to transparency is a cornerstone of its strategy to maintain strong relationships with its investor base, a critical customer segment for any listed entity.

China Hongqiao Group cultivates strong customer relationships through a dedicated sales force offering guidance and technical support, fostering partnerships and reliability. Long-term supply agreements, like those solidified in 2024, provide stability and predictability. The company also actively seeks customer feedback and offers customized products to meet diverse industrial demands, enhancing loyalty.

Channels

China Hongqiao Group leverages its dedicated sales force and robust distribution infrastructure to connect directly with industrial clients. This direct approach ensures tailored customer service and streamlined delivery of substantial quantities of aluminum products, fostering strong client relationships.

In 2024, China Hongqiao's commitment to direct sales was evident in its operational efficiency, enabling it to manage the complex logistics of supplying large-scale industrial users. The company’s ability to bypass intermediaries allows for better control over product quality and delivery timelines, a critical factor in the heavy industrial sector.

China Hongqiao Group utilizes a network of regional sales offices to manage its domestic operations and reach customers effectively across China. This localized presence allows for tailored sales strategies and responsive customer service.

For international expansion, particularly in emerging markets like Southeast Asia and Africa, the company may leverage local agents. This strategy helps navigate diverse regulatory environments and build trust within new customer bases, facilitating market penetration.

China Hongqiao Group leverages its official corporate website as a primary channel for disseminating vital information to investors, potential partners, and the public. This platform is crucial for investor relations, offering updates on financial performance, corporate governance, and strategic initiatives. For example, as of the first half of 2024, the company reported revenue of RMB 61.41 billion, with its website serving as the go-to source for detailed financial statements and annual reports.

The website also acts as a gateway for product inquiries, showcasing the group's extensive aluminum products and their applications across various industries. This digital presence significantly enhances the company's visibility and accessibility, allowing stakeholders worldwide to engage with China Hongqiao's operations and offerings. In 2023, the company's total assets stood at RMB 222.7 billion, underscoring the scale of operations that are communicated through this online channel.

Industry Trade Fairs and Exhibitions

China Hongqiao Group actively participates in key industry trade fairs and exhibitions. For instance, their presence at major events like Hannover Messe provides a vital platform to display their extensive range of aluminum products and advanced manufacturing technologies. This direct engagement is crucial for fostering relationships with both new and established clients, as well as for staying abreast of industry trends and competitor activities.

These exhibitions serve as a powerful channel for lead generation and brand visibility. In 2023, for example, participation in international trade shows contributed to a significant increase in inquiries and potential business partnerships for companies in the advanced materials sector. China Hongqiao leverages these opportunities to highlight its commitment to innovation and sustainable practices, reinforcing its market position.

The strategic selection of trade fairs allows China Hongqiao to target specific markets and customer segments. By showcasing their capabilities, they can directly address customer needs and gather valuable market intelligence. This approach is essential for refining their product offerings and business strategies in a dynamic global marketplace.

Key benefits of this channel include:

- Direct Customer Engagement: Facilitates face-to-face interactions with potential and existing clients, allowing for immediate feedback and relationship building.

- Product and Technology Showcase: Provides a venue to exhibit the latest advancements in aluminum production and processing, demonstrating competitive advantages.

- Market Intelligence Gathering: Offers insights into market demands, competitor strategies, and emerging technological trends, informing future business development.

- Brand Visibility and Networking: Enhances brand recognition within the industry and creates opportunities for strategic partnerships and collaborations.

Investor Relations Platforms

Investor relations platforms are vital for China Hongqiao Group to communicate with its stakeholders. These channels, including the Hong Kong Stock Exchange's HKEXnews, financial data providers like MarketScreener, and the company's dedicated investor relations website, are where official financial reports, press releases, and other critical updates are published.

These platforms ensure transparency and accessibility of information for investors. For instance, during 2024, China Hongqiao Group would have utilized these channels to disseminate its quarterly and annual financial results, providing key figures such as revenue, profit margins, and production volumes.

- HKEXnews: Essential for official filings and announcements, ensuring regulatory compliance and immediate access for listed company information.

- MarketScreener: Offers aggregated financial data, company profiles, and news, providing a broader market perspective for investors analyzing China Hongqiao Group.

- Company Website: Serves as a central hub for investor-specific content, including annual reports, presentations, and corporate governance information, directly from the company.

China Hongqiao Group utilizes a multifaceted channel strategy, blending direct sales with strategic use of digital platforms and industry events. This approach ensures broad market reach and deep customer engagement.

The company's official website serves as a crucial information hub for investors and clients, detailing its extensive aluminum product offerings and financial performance. For example, in the first half of 2024, the company reported RMB 61.41 billion in revenue, with its website providing access to detailed financial statements.

Participation in industry trade fairs, such as Hannover Messe, allows for direct client interaction and product showcasing, reinforcing brand visibility and market intelligence. In 2023, total assets were RMB 222.7 billion, highlighting the scale of operations communicated through these channels.

Investor relations are managed through the HKEXnews platform, financial data providers, and the company's website, ensuring transparency and accessibility of critical corporate information for stakeholders.

| Channel | Primary Function | Key Data/Example (2023-2024) |

|---|---|---|

| Direct Sales Force | Industrial client engagement, tailored service | Streamlined logistics for large-scale industrial users |

| Regional Sales Offices | Domestic market penetration, localized strategies | Effective reach across China |

| Official Website | Investor relations, product inquiries, information dissemination | H1 2024 Revenue: RMB 61.41 billion; Total Assets 2023: RMB 222.7 billion |

| Industry Trade Fairs | Lead generation, brand visibility, market intelligence | Showcasing advanced manufacturing technologies |

| Investor Relations Platforms (HKEXnews, MarketScreener) | Official filings, financial data, corporate updates | Dissemination of quarterly/annual financial results |

Customer Segments

Industrial manufacturers, particularly in the automotive, construction, and packaging sectors, represent a core customer segment for China Hongqiao Group. These businesses rely heavily on aluminum for their operations, needing everything from molten aluminum alloys to finished products like ingots and processed forms. For instance, the burgeoning new energy vehicle market, a key driver of demand, saw global sales of electric vehicles reach approximately 13.6 million units in 2023, a significant increase that directly translates to higher aluminum consumption for lightweighting.

Within the construction industry, aluminum's use in facades, window frames, and structural components continues to grow. Global construction output is projected to expand, with significant investment in infrastructure projects worldwide. Similarly, the packaging sector, driven by consumer demand for sustainable and lightweight solutions, is a consistent consumer of aluminum. In 2024, the global aluminum market size was valued at over $200 billion, underscoring the sheer scale of demand from these industrial users.

Companies within the power and energy sector are key customers for China Hongqiao Group, particularly for aluminum products essential for electrical conductivity. Busbars, for instance, are critical components in power transmission and distribution systems, demanding high-quality aluminum.

China Hongqiao Group's integrated business model, which includes its own power generation facilities, creates a dual opportunity. Not only can Hongqiao supply external energy companies with necessary aluminum products, but its internal power generation units also represent a significant internal demand, showcasing a degree of vertical integration.

In 2023, China Hongqiao Group reported that its primary products, including aluminum, served a wide range of industries, with the power sector being a notable consumer. The company's substantial production capacity, reaching 6.9 million tons of electrolytic aluminum in 2023, positions it as a major supplier capable of meeting the large-scale demands of this segment.

While China Hongqiao Group's alumina production is largely dedicated to its internal aluminum smelting operations, a portion is strategically offered to external buyers. This segment includes other aluminum smelters who require a reliable source of high-quality alumina. In 2023, China Hongqiao's total alumina output was substantial, with a significant portion available for these external sales, contributing to the broader aluminum supply chain.

Beyond direct aluminum producers, China Hongqiao also supplies alumina to chemical companies. These businesses utilize alumina in various industrial processes, such as the production of ceramics, refractories, and catalysts. The group's capacity to produce consistent and pure alumina makes it an attractive supplier for these specialized chemical applications, further diversifying its customer base.

International Buyers and Global Markets

China Hongqiao Group actively seeks to broaden its international footprint, with a strategic focus on emerging markets in Southeast Asia and Africa. These regions represent significant growth potential for industrial development and demand for aluminum products.

This customer segment comprises a wide array of industrial buyers, each with unique needs for aluminum to fuel their domestic economies. From construction to manufacturing, these global partners are crucial for Hongqiao's expansion.

In 2024, China Hongqiao Group's international sales contributed significantly to its overall revenue, reflecting the growing demand for its aluminum products in diverse global markets. The company reported a substantial increase in export volumes, particularly to countries in the Belt and Road Initiative, which includes many Southeast Asian and African nations.

- Target Markets: Southeast Asia and Africa are key growth regions.

- Customer Profile: Diverse industrial buyers requiring aluminum for economic development.

- 2024 Data: Significant increase in international sales and export volumes, especially to Belt and Road Initiative countries.

Recycling and Circular Economy Partners

China Hongqiao Group is increasingly collaborating with partners integral to the aluminum recycling and broader circular economy landscape. These entities are crucial for sourcing secondary aluminum raw materials, a key component of Hongqiao's evolving strategy. In 2024, the global aluminum recycling rate stood at approximately 70%, highlighting the growing importance of these partnerships.

These partners include specialized recycling companies, waste management firms, and technology providers focused on resource regeneration. Their involvement is vital for establishing efficient collection, sorting, and processing systems for aluminum scrap. For instance, in 2023, the European Union processed over 3.7 million tonnes of recycled aluminum, demonstrating the scale of operations these partners manage.

- Recycling Companies: Businesses specializing in the collection, processing, and supply of secondary aluminum raw materials.

- Waste Management Providers: Entities managing waste streams that contain aluminum, facilitating its diversion for recycling.

- Technology Innovators: Firms developing advanced sorting and purification technologies to enhance the quality and efficiency of recycled aluminum.

- Industrial Symbiosis Partners: Companies that can utilize or provide by-products that can be integrated into Hongqiao's aluminum production or recycling processes.

China Hongqiao Group's customer base spans a wide industrial spectrum, with key segments including automotive, construction, and packaging manufacturers who depend on aluminum for lightweighting and structural integrity. The power and energy sector is also a significant buyer, utilizing aluminum for its excellent conductivity in components like busbars.

The group also supplies alumina to other aluminum smelters and chemical companies for specialized industrial applications, demonstrating a diversified market reach. Furthermore, Hongqiao is actively expanding into emerging markets in Southeast Asia and Africa, catering to industrial development needs.

Partnerships with recycling companies and waste management firms are growing, reflecting a strategic focus on the circular economy and secondary aluminum sourcing. In 2023, China Hongqiao's total electrolytic aluminum production reached 6.9 million tons, underscoring its capacity to serve these diverse customer segments.

Cost Structure

Raw material costs represent China Hongqiao Group's most substantial expense. The company's primary inputs are bauxite for its alumina operations and coal and anode carbon blocks for its aluminum smelting processes.

For instance, in 2023, the price of bauxite saw significant volatility, impacting Hongqiao's cost of goods sold. Similarly, global energy prices, particularly for coal, directly influenced the cost of production for aluminum, a key driver of profitability for the group.

China Hongqiao Group's cost structure is heavily influenced by energy and power expenses due to the energy-intensive nature of aluminum production. The cost of electricity, whether sourced from their own power plants or purchased from the grid, is a significant operational outlay. For instance, in 2023, electricity costs represented a substantial portion of their production expenses, impacting overall profitability.

While China Hongqiao Group has invested in self-generation capabilities to manage energy costs and ensure supply stability, the ongoing shift towards cleaner energy sources necessitates considerable capital investment. This transition to renewable energy, while strategically important for long-term sustainability and regulatory compliance, presents upfront financial commitments that are factored into their cost structure.

China Hongqiao Group's extensive operations, spanning numerous production bases, rely on a workforce exceeding 43,000 individuals. This significant human capital represents a core component of their cost structure.

Labor expenses, encompassing wages, comprehensive benefits packages, and ongoing employee training and development, form a substantial portion of the company's overall operational expenditures. For instance, in 2023, the group reported employee benefits and remuneration costs amounting to approximately RMB 13.7 billion.

Depreciation and Capital Expenditure

China Hongqiao Group's cost structure is heavily influenced by substantial depreciation and capital expenditure. The company's extensive investments in its vertically integrated production facilities, including smelters and power plants, naturally result in significant depreciation charges. For instance, in 2023, China Hongqiao reported depreciation and amortisation expenses of RMB 10.4 billion.

Maintaining and expanding its vast operational footprint necessitates continuous capital expenditure. This ongoing investment is crucial for keeping its assets modern, efficient, and compliant with evolving environmental standards, as well as for increasing production capacity. In 2023, the group’s capital expenditure amounted to RMB 14.3 billion, reflecting this commitment to asset upkeep and growth.

- Depreciation Expense (2023): RMB 10.4 billion, reflecting the wear and tear on extensive production and power generation assets.

- Capital Expenditure (2023): RMB 14.3 billion, highlighting ongoing investment in facility maintenance, upgrades, and expansion.

- Impact on Cost Structure: These significant non-cash and cash outflows are core components of the group's operational costs, directly affecting profitability and cash flow.

Research and Development Expenses

China Hongqiao Group's commitment to innovation is reflected in its significant investment in research and development, a key component of its cost structure. These expenditures are directed towards developing advanced technologies, enhancing energy efficiency across its operations, and pioneering low-carbon solutions within the aluminum industry. For instance, in 2023, the group continued its focus on upgrading production processes to reduce energy consumption and emissions, a strategy that underpins its long-term sustainability objectives and competitive positioning.

These R&D efforts are not merely about staying current; they are fundamental to maintaining a competitive edge in a rapidly evolving global market. By investing in cutting-edge research, Hongqiao aims to optimize its production, reduce its environmental footprint, and develop new, more sustainable aluminum products. This proactive approach to innovation is essential for meeting increasingly stringent environmental regulations and capturing new market opportunities driven by the demand for greener materials.

- Technological Innovation: Investments are channeled into developing and implementing advanced manufacturing techniques for aluminum production.

- Energy Efficiency: Significant R&D is dedicated to reducing the energy intensity of smelting and processing operations.

- Low-Carbon Solutions: Research focuses on developing and adopting cleaner energy sources and processes to lower carbon emissions.

- Competitive Advantage: R&D spending is crucial for maintaining market leadership and driving future growth through innovation.

China Hongqiao Group's cost structure is dominated by raw material and energy expenses, reflecting the capital-intensive nature of aluminum production. Significant investments in depreciation and ongoing capital expenditure to maintain and upgrade its vast operational base are also key cost drivers.

Labor costs, including wages and benefits for its large workforce, represent another substantial outlay, with employee remuneration and benefits reaching approximately RMB 13.7 billion in 2023. Furthermore, the company dedicates resources to research and development aimed at enhancing energy efficiency and developing sustainable, low-carbon solutions.

| Cost Component | 2023 (RMB Billion) | Significance |

| Raw Materials | N/A | Primary input costs (bauxite, coal, anode carbon) |

| Energy/Power | N/A | Significant due to energy-intensive smelting |

| Labor Costs | 13.7 | Wages, benefits for over 43,000 employees |

| Depreciation & Amortisation | 10.4 | Reflects wear on extensive assets |

| Capital Expenditure | 14.3 | Investment in maintenance, upgrades, and expansion |

| Research & Development | N/A | Focus on efficiency and sustainability |

Revenue Streams

China Hongqiao Group's core revenue generation stems from the sale of primary aluminum products. This includes molten aluminum alloy, which is directly supplied to downstream manufacturers, and aluminum alloy ingots, a more standardized form for broader industrial use.

In 2023, China Hongqiao Group reported a significant portion of its revenue from the sale of aluminum products. For instance, the company's total revenue was RMB 233.5 billion, with its aluminum business segment being the primary contributor, demonstrating the critical role of these sales in its financial performance.

China Hongqiao Group generates revenue through the sale of processed aluminum alloy products. These include specialized items like casting-rolling products and busbars, which are crucial for various industrial uses.

In 2024, the demand for these value-added aluminum products remained robust, driven by sectors such as construction and manufacturing. This segment represents a key area for enhancing profitability beyond primary aluminum production.

China Hongqiao Group actively sells alumina, a key component in aluminum production, to external manufacturers. This external sales segment, while secondary to its internal consumption, provides a valuable revenue stream. In 2023, the company's alumina production reached approximately 19.8 million tonnes, with a notable portion available for market sale.

Power Generation and Energy Sales

China Hongqiao Group's captive power plants, primarily designed for self-consumption to fuel its extensive aluminum production, also present opportunities for revenue generation through surplus energy sales. Any excess electricity, especially from their growing renewable energy portfolio, can be fed back into the national grid.

In 2024, while specific figures for surplus energy sales are not separately disclosed by China Hongqiao Group, the company's significant investment in renewable energy capacity, including hydropower and solar, suggests a growing potential for such revenue. For instance, their commitment to developing clean energy aims to not only reduce operational costs but also to capitalize on grid-tie opportunities.

- Primary Use: Power generation for internal consumption in aluminum smelting operations.

- Surplus Sales Potential: Any excess electricity generated, particularly from renewable sources, can be sold to the national grid.

- Renewable Energy Focus: Investments in hydropower and solar power enhance the potential for profitable surplus energy sales.

Recycled Aluminum Products

China Hongqiao Group's recycled aluminum products represent a burgeoning revenue stream, driven by the global push towards a circular economy. This segment taps into increasing market demand for sustainable materials, directly supporting the company's environmental, social, and governance (ESG) commitments.

By processing and selling recycled aluminum, Hongqiao Group diversifies its revenue base beyond primary aluminum production. This strategic move not only capitalizes on growing consumer and industrial preference for eco-friendly options but also offers a cost advantage in raw material sourcing.

The company's commitment to recycling is underscored by its operational scale. For instance, in 2023, China Hongqiao Group processed a significant volume of recycled aluminum, contributing to its overall revenue and reinforcing its position as a leader in sustainable aluminum manufacturing.

- Growing Market Demand: The global market for recycled aluminum is expanding rapidly, with projections indicating continued growth in the coming years due to environmental regulations and corporate sustainability goals.

- Cost Efficiency: Utilizing recycled aluminum as a feedstock can offer cost savings compared to primary aluminum production, enhancing profit margins for the company's recycled product lines.

- Sustainability Alignment: This revenue stream directly supports China Hongqiao Group's sustainability objectives, appealing to environmentally conscious investors and customers.

- Diversification of Revenue: The recycled aluminum products segment provides an additional avenue for income, reducing reliance on traditional aluminum markets and mitigating price volatility.

China Hongqiao Group's revenue streams are multifaceted, primarily driven by the sale of aluminum products, including molten aluminum alloy and aluminum alloy ingots. The company also generates income from processed aluminum alloys like casting-rolling products and busbars, catering to specific industrial needs.

Beyond its core aluminum business, Hongqiao Group profits from selling alumina to external manufacturers, a segment that contributed significantly given its 2023 alumina production of roughly 19.8 million tonnes. Furthermore, surplus electricity from its captive power plants, especially from renewable sources, is sold to the national grid, a growing area of potential revenue in 2024.

The company is also capitalizing on the demand for sustainable materials through its recycled aluminum products segment. This diversification not only aligns with ESG goals but also leverages cost efficiencies in raw material sourcing, contributing to overall revenue growth.

| Revenue Stream | Primary Products/Services | 2023 Data/Notes | 2024 Outlook/Notes |

| Aluminum Products | Molten aluminum alloy, aluminum alloy ingots | Total revenue RMB 233.5 billion, with aluminum business as primary contributor | Continued demand from construction and manufacturing sectors |

| Processed Aluminum Alloys | Casting-rolling products, busbars | Key contributor to profitability beyond primary production | Robust demand expected |

| Alumina Sales | Alumina sold to external manufacturers | Approx. 19.8 million tonnes alumina produced in 2023 | Valuable revenue stream from external sales |

| Electricity Sales | Surplus electricity from captive power plants | Potential from renewable energy investments (hydropower, solar) | Growing potential for grid-tie opportunities |

| Recycled Aluminum Products | Processed recycled aluminum | Significant volume processed, supporting ESG commitments | Expanding market demand for sustainable materials |

Business Model Canvas Data Sources

The China Hongqiao Group Business Model Canvas is informed by extensive financial disclosures, operational reports, and market intelligence. These data sources provide a comprehensive view of the company's value chain, customer base, and competitive landscape.