China Hongqiao Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Hongqiao Group Bundle

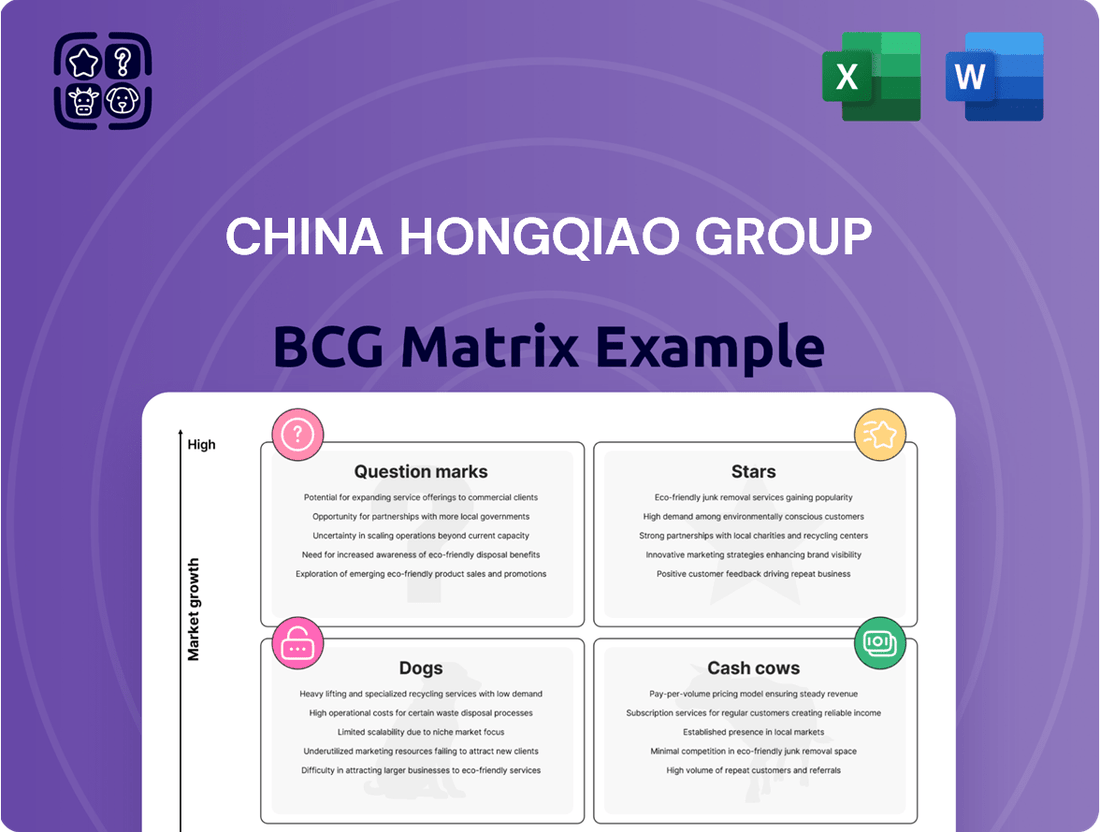

China Hongqiao Group's BCG Matrix offers a critical look at its diverse portfolio, highlighting potential growth areas and resource drains. Understand which of their operations are market leaders and which might be holding them back.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for China Hongqiao Group.

Stars

China Hongqiao Group is significantly boosting its R&D to develop advanced aluminum alloys. These include high-strength, high-toughness, and corrosion-resistant lightweight materials. This strategic move targets booming sectors like new energy vehicles (NEVs), aerospace, and solar power, all of which have a strong demand for these specialized aluminum products.

China Hongqiao Group's strategic relocation of aluminum smelting capacity to Yunnan province, capitalizing on abundant hydropower, positions this initiative as a significant star in its BCG matrix. This move, often termed 'Green Transitioning,' is designed to slash carbon emissions and production expenses, aligning perfectly with worldwide sustainability goals.

By embracing renewable energy, Hongqiao is building a strong competitive edge in the burgeoning low-carbon aluminum sector. This strategic pivot is anticipated to bolster their market standing and profitability as demand for environmentally responsible products continues to climb. For instance, by the end of 2023, China Hongqiao Group had completed the relocation of 2 million tons of aluminum smelting capacity to Yunnan, a move that significantly contributed to their renewable energy consumption ratio.

China Hongqiao Group's overseas production facilities, particularly its investments in smelting operations in Indonesia and Malaysia, are positioned as stars within its business portfolio. These strategic ventures are designed to circumvent trade barriers and tariffs, thereby lowering production expenses and broadening the company's market presence beyond China's borders. This expansion allows Hongqiao to more effectively secure a greater slice of the international aluminum market.

Aluminum for New Energy Vehicles (NEVs)

The electric vehicle (EV) market is a significant growth engine for aluminum, as manufacturers prioritize lightweight materials to boost battery range and overall efficiency. China Hongqiao Group is strategically positioned to capitalize on this trend by supplying aluminum for critical automotive components.

The demand for aluminum in the automotive sector, particularly for new energy vehicles (NEVs), is projected to surge. In 2024, the global NEV market is expected to continue its robust expansion, driving substantial demand for lightweight aluminum alloys.

- NEV Market Growth: The global NEV market is anticipated to see continued strong growth in 2024, creating a substantial demand for lightweight materials.

- Lightweighting Benefits: Aluminum's role in reducing vehicle weight is crucial for enhancing EV battery range and improving energy efficiency.

- China Hongqiao's Role: The company's focus on supplying aluminum for automotive applications places it at the forefront of this expanding market.

Aluminum for Solar Power Systems

Aluminum's role in solar power systems is a significant growth driver for China Hongqiao Group. The rapid expansion of solar energy installations worldwide is directly translating into increased demand for aluminum, especially for the mounting structures that support solar panels. This trend positions aluminum for solar applications as a strong contender within the BCG matrix.

China Hongqiao is well-placed to benefit from this burgeoning market. Their participation in supplying aluminum for solar mounting structures allows them to tap into the high growth trajectory of renewable energy infrastructure. This strategic alignment reinforces their market presence in an industry that is experiencing substantial expansion.

- Growing Demand: Global solar power installations reached approximately 440 GW in 2023, a significant increase from previous years, directly fueling aluminum demand for mounting systems.

- Market Opportunity: The solar mounting structure market is projected to grow at a CAGR of over 10% through 2030, presenting a substantial opportunity for aluminum suppliers like China Hongqiao.

- Strategic Advantage: China Hongqiao's integrated production capabilities provide a competitive edge in meeting the volume and quality requirements of the solar industry.

China Hongqiao Group's strategic focus on advanced aluminum alloys for high-growth sectors like NEVs, aerospace, and solar power positions these initiatives as strong stars in its BCG matrix. The company's relocation of smelting capacity to Yunnan, leveraging hydropower for greener production, is a key star, enhancing competitiveness and aligning with sustainability trends. Furthermore, overseas expansion into Indonesia and Malaysia serves as stars by mitigating trade barriers and increasing global market share.

The company's commitment to supplying aluminum for the booming NEV market, driven by the need for lightweight materials to improve EV range and efficiency, is a significant star. Similarly, the increasing demand for aluminum in solar power mounting structures, fueled by global renewable energy expansion, represents another star business segment. These areas demonstrate high market growth and strong competitive positions for Hongqiao.

| Initiative | Market Growth Potential | Hongqiao's Competitive Position |

|---|---|---|

| Advanced Aluminum Alloys (NEVs, Aerospace) | Very High | Strong (R&D focus, specialized materials) |

| Yunnan Hydropower Smelting Relocation | High (driven by sustainability) | Strong (cost reduction, emission control) |

| Overseas Production (Indonesia, Malaysia) | High (market access, tariff avoidance) | Strong (diversified operations, global reach) |

| Aluminum for Solar Mounting Structures | Very High (renewable energy growth) | Strong (integrated production, market demand) |

What is included in the product

The China Hongqiao Group BCG Matrix would analyze its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

China Hongqiao Group's BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Its export-ready design allows for quick integration into presentations, alleviating the pain of manual data transfer.

Cash Cows

China Hongqiao Group's primary aluminum alloy products, including molten aluminum alloy and aluminum alloy ingots, represent its core Cash Cows. These offerings dominate a mature but stable market, consistently delivering significant revenue and profit.

In 2023, China Hongqiao Group reported a revenue of RMB 127.1 billion, with its aluminum products forming the backbone of this figure. The company's substantial production capacity and vertical integration, from bauxite mining to aluminum smelting, allow it to maintain cost efficiencies and strong profit margins in this segment.

China Hongqiao Group's alumina production stands as a robust cash cow. As the primary input for aluminum smelting, its extensive alumina capacity, bolstered by secure bauxite sourcing, translates into reliable output and competitive pricing. This segment consistently generates substantial cash flow within a mature market.

China Hongqiao Group's captive power generation stands as a significant cash cow. By generating its own electricity for its energy-intensive aluminum smelting, the company significantly reduces its exposure to volatile external energy markets. This strategic move provides a substantial cost advantage, directly contributing to healthier profit margins in its core business.

Integrated Value Chain

China Hongqiao Group's integrated value chain is a significant strength, positioning its aluminum business as a cash cow. This vertical integration, from bauxite mining through to aluminum smelting and processing, grants the company substantial control over its costs and supply chain. For instance, in 2023, China Hongqiao reported that its alumina production capacity reached 19.1 million tons, largely supporting its own aluminum smelting operations, thereby mitigating the impact of volatile raw material prices.

This comprehensive control translates into a stable cost advantage and ensures a consistent supply of essential raw materials, which is crucial in the mature and often cyclical aluminum market. The ability to manage the entire production process allows for higher profit margins and predictable cash flow generation. In the first half of 2024, the company's revenue from its aluminum business remained robust, demonstrating the sustained profitability derived from this integrated model.

Key aspects of China Hongqiao's integrated value chain include:

- Control over raw material sourcing: Direct access to bauxite reserves reduces reliance on external suppliers and price fluctuations.

- Efficient production processes: Streamlined operations from mining to finished aluminum products minimize waste and enhance cost-effectiveness.

- Stable cost structure: Vertical integration allows for better management of production costs, leading to consistent profitability.

- Market resilience: The integrated model provides a buffer against market downturns by ensuring supply and maintaining competitive pricing.

Established Market Position in China

China Hongqiao Group's established market position in China is a prime example of a Cash Cow within its BCG Matrix. The company benefits from its leading role in the world's largest aluminum market, both in terms of production and consumption.

This dominance translates into a stable customer base and robust sales volumes. In 2023, China Hongqiao reported significant revenue streams from its core operations, underscoring the consistent cash flow generated from this mature domestic market.

- Market Leadership: China Hongqiao is a dominant player in China's aluminum sector.

- Stable Demand: The large and mature Chinese market ensures consistent customer demand.

- Strong Sales Volumes: The company consistently achieves high sales volumes due to its market position.

- Consistent Cash Flow: These factors combine to generate reliable and substantial cash flow.

China Hongqiao Group's primary aluminum alloy products, including molten aluminum alloy and aluminum alloy ingots, represent its core Cash Cows. These offerings dominate a mature but stable market, consistently delivering significant revenue and profit. For instance, in the first half of 2024, the company's revenue from its aluminum business remained robust, demonstrating the sustained profitability derived from its integrated model.

| Segment | 2023 Revenue (RMB billion) | Key Characteristic |

| Aluminum Alloy Products | 127.1 (Overall Group Revenue) | Mature market, stable demand, high volume |

| Alumina Production | N/A (Integrated Input) | Cost advantage, secure bauxite sourcing |

| Captive Power Generation | N/A (Cost Reduction) | Reduced energy cost exposure, profit margin enhancement |

Full Transparency, Always

China Hongqiao Group BCG Matrix

The China Hongqiao Group BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately upon purchase. This comprehensive analysis, detailing Hongqiao's business units within the BCG framework, is ready for immediate strategic application. You can confidently expect the same high-quality, professionally formatted report that is designed to provide clear insights into their market position and growth potential. This is the final, ready-to-use version for your business planning needs.

Dogs

Within China Hongqiao Group's portfolio, older, more standardized aluminum products that struggle with differentiation and face fierce price wars in a mature market can be viewed as potential dogs. These items likely exhibit sluggish growth and thinner profit margins.

Such products would necessitate minimal capital infusion while yielding modest returns. For instance, if we consider China Hongqiao's 2023 revenue of $22.02 billion, a segment with declining demand and low profitability would fit this dog category, requiring careful management to avoid becoming a drain on resources.

China Hongqiao Group's older production facilities in Shandong, particularly those still reliant on fossil fuels, are likely candidates for the 'dog' quadrant in a BCG matrix. As the company strategically shifts its capacity towards Yunnan to leverage green energy, these Shandong operations face increasing obsolescence.

These legacy Shandong plants would likely experience elevated operating costs due to higher energy consumption and stricter environmental regulations. For instance, as of early 2024, the average cost of coal power in China remained significantly higher than renewable energy sources, impacting the profitability of such facilities.

The growth potential for these outdated Shandong units is minimal, especially as the industry trend favors greener, more efficient production methods. With diminishing returns and potential for write-downs, their strategic value is questionable, making them a clear 'dog' in the portfolio.

China Hongqiao Group's aluminum products, particularly those catering to traditional consumption markets like real estate, are likely positioned as dogs in their BCG Matrix. These sectors in China have faced a noticeable slowdown, impacting demand for aluminum used in construction and related industries.

While these product lines still contribute to revenue, their growth potential appears limited due to these market headwinds. For instance, China's real estate investment growth slowed significantly in 2023, impacting downstream demand for construction materials. This sluggish growth suggests that substantial new investment in these specific aluminum segments might not yield high returns.

Segments with High Energy Consumption and Low Efficiency

Within China Hongqiao Group's extensive aluminum production, certain older smelting lines, particularly those not yet upgraded to more energy-efficient technologies or integrated with renewable power sources, represent segments likely to fall into the 'dog' category of the BCG matrix. These operations consume significant electricity, a major cost driver in aluminum smelting, while yielding lower output per unit of energy compared to newer, greener facilities.

These legacy operations are characterized by their reliance on older, less efficient electrolytic cell technologies. As of recent reports, the aluminum industry globally is striving for efficiency gains, with advancements in inert anode technology and improved cell designs offering substantial energy savings. Segments within Hongqiao that haven't adopted these upgrades are therefore at a distinct disadvantage.

- High Energy Intensity: Older smelting technologies can have an energy consumption of 13,500-15,000 kWh per tonne of aluminum, significantly higher than modern cells which can achieve below 12,000 kWh per tonne.

- Environmental Compliance Costs: Non-upgraded facilities may face increasing costs associated with meeting stricter environmental regulations, further impacting their profitability.

- Limited Investment Appeal: These segments represent a drain on capital that could be better allocated to high-growth, high-efficiency areas, making them less attractive for future investment.

Investments in Stagnant or Declining Niche Markets

China Hongqiao Group, a major player in the aluminum industry, might have certain niche product lines or minor investments in segments of the aluminum market that are not expanding or are even shrinking. These could be categorized as 'dogs' within a BCG matrix framework. Such areas would typically exhibit low market share and minimal growth prospects, thus offering limited strategic advantage to the group.

For instance, if China Hongqiao has operations focused on specific, less in-demand aluminum alloys or specialized aluminum products catering to industries facing obsolescence, these would fit the 'dog' profile. These segments would likely contribute little to overall revenue growth and might even require significant resources to maintain, offering a low return on investment.

In 2024, the global aluminum market saw varied performance across different segments. While demand for aluminum in sectors like electric vehicles and renewable energy infrastructure remained robust, certain traditional industrial applications experienced slower growth or contraction. For example, the market for aluminum used in some older construction materials or specific manufacturing processes that have been superseded by newer technologies could be considered stagnant or declining.

- Low Market Share: Investments in niche, non-growing aluminum markets would likely hold a small percentage of their respective market share.

- Low Growth Prospects: These segments are characterized by minimal to negative annual growth rates.

- Limited Strategic Value: Such 'dog' investments offer little contribution to China Hongqiao's overall competitive position or future expansion plans.

- Resource Drain: They may consume resources without generating substantial returns, potentially hindering investment in more promising areas.

Certain older, less efficient aluminum smelting lines within China Hongqiao Group's operations, particularly those not yet upgraded to utilize greener energy or advanced technologies, likely fall into the 'dog' category of the BCG matrix. These facilities often have higher energy consumption per tonne of aluminum produced, estimated to be around 13,500-15,000 kWh, compared to modern cells below 12,000 kWh.

These legacy operations face challenges from increasing environmental compliance costs and offer limited appeal for future investment due to their low growth prospects and potential for obsolescence as the industry trends towards sustainability. For example, as of early 2024, the cost differential between coal and renewable energy sources in China continued to impact the profitability of energy-intensive industries like aluminum smelting.

Segments of China Hongqiao's portfolio catering to mature or declining markets, such as certain traditional construction materials, also represent 'dogs.' China's real estate investment growth slowed in 2023, impacting demand for aluminum in this sector. These product lines may have low market share and minimal growth, potentially requiring resources without generating substantial returns.

| Category | Characteristics | Example within China Hongqiao |

|---|---|---|

| Dogs | Low market share, low growth, low profitability | Older aluminum smelting lines not yet upgraded for energy efficiency or green power. |

| High operating costs, significant environmental compliance burdens | Aluminum products for declining traditional industries like older construction materials. | |

| Minimal strategic value, potential resource drain | Niche aluminum alloys for obsolete manufacturing processes. |

Question Marks

China Hongqiao Group's exploration into entirely new, cutting-edge high-end aluminum alloys falls into the question mark category. These materials, while promising for future high-growth sectors, are currently in their nascent stages of market acceptance.

The potential for these advanced alloys is significant, particularly in applications like aerospace and electric vehicles, which are experiencing rapid expansion. However, their current market penetration remains minimal, necessitating substantial capital for research, development, and establishing market presence.

In 2024, the global specialty aluminum market is projected to reach over $50 billion, with high-end alloys representing a growing, albeit small, segment. China Hongqiao's investment in this area reflects a strategic bet on future demand, aiming to capture market share as these applications mature.

China Hongqiao Group's strategic push into recycled aluminum, aiming to build a circular economy, presents a classic question mark in the BCG Matrix. While the global demand for sustainable materials is surging, with the recycled aluminum market projected to reach $52.6 billion by 2027, Hongqiao's current penetration in this niche segment might be nascent.

Significant capital investment will likely be necessary to build the infrastructure and technology needed to effectively process and scale recycled aluminum production. This investment is crucial to capture a meaningful share of this rapidly expanding market, which is driven by environmental regulations and consumer preference.

China Hongqiao Group's investments in AI and intelligent aluminum production, such as their 'intelligent aluminum AI&L model', are positioned as question marks in the BCG matrix. These initiatives target high-growth potential for enhanced efficiency and innovation within their operations.

While these advanced technologies are crucial for future competitiveness, they are likely in early development phases, meaning their immediate market share and direct revenue contribution are minimal. Significant capital outlay is necessary to nurture these nascent technologies into mature, revenue-generating assets.

For instance, in 2024, the company continued to emphasize digital transformation and intelligent manufacturing, with substantial capital expenditure allocated to upgrading production lines and implementing AI-driven solutions. This strategic focus aims to optimize energy consumption and improve product quality, laying the groundwork for long-term growth in a rapidly evolving industry.

Expansion into New Geographic Markets for High-Value Products

China Hongqiao Group's strategic push into new geographic markets for its higher-value aluminum products presents a classic question mark scenario within the BCG matrix. While the company has existing overseas operations, establishing a strong foothold in entirely new regions for these specialized products means facing nascent brand recognition and underdeveloped distribution networks. This strategy hinges on high growth potential but is currently characterized by a low market share, necessitating substantial initial capital outlay and a careful, phased approach to market penetration.

- Market Entry Challenges: Entering new, high-growth geographic markets for advanced aluminum processing requires overcoming established competitors and building new customer relationships, a process that can be lengthy and capital-intensive.

- Investment and Risk: These ventures demand significant upfront investment in facilities, marketing, and talent, carrying a higher risk profile due to unproven market acceptance and potential regulatory hurdles.

- Growth Potential vs. Current Share: The opportunity lies in the high growth potential of these markets for value-added aluminum, but the current low market share means substantial effort is needed to capture even a small percentage of the demand.

- Strategic Importance: Despite the risks, successfully expanding into these new markets is crucial for diversifying revenue streams and moving up the value chain, aligning with long-term strategic objectives for higher-margin products.

Diversification into Green Hydrogen or Inert Anode Technologies

China Hongqiao Group's exploration into green hydrogen and inert anode technologies places these ventures in the question mark quadrant of the BCG matrix. These are considered high-growth potential areas critical for decarbonizing aluminum production, a sector where Hongqiao is a major player.

While these clean energy technologies represent the future, their commercial viability and widespread adoption are still in nascent stages. Significant investment in research and development is required, alongside substantial capital expenditure, with the immediate returns remaining uncertain. For instance, the global green hydrogen market, while projected for substantial growth, is still largely dependent on cost reductions and infrastructure development. By 2024, the cost of green hydrogen production remains a key barrier to widespread adoption, though falling renewable energy prices are a positive trend.

- Green Hydrogen Potential: Offers a pathway to reduce Scope 1 and 2 emissions in aluminum smelting, a significant challenge for the industry.

- Inert Anode Technology: Promises to eliminate greenhouse gas emissions from the traditional smelting process, a major environmental hurdle.

- Investment Horizon: These are long-term plays requiring sustained R&D and capital, with commercialization timelines still uncertain.

- Market Uncertainty: The actual market demand and competitive landscape for these technologies are still developing, adding to the question mark status.

China Hongqiao Group's venture into developing advanced, high-end aluminum alloys positions these initiatives as question marks. These materials cater to emerging, high-growth sectors but are in the early stages of market acceptance and require substantial investment for research and market penetration.

The potential for these specialized alloys is considerable, especially in rapidly expanding fields like aerospace and electric vehicles. However, their current market share is minimal, necessitating significant capital for R&D and market establishment. In 2024, the global market for specialty aluminum was valued at over $50 billion, with high-end alloys representing a growing, albeit small, segment.

China Hongqiao Group's strategic focus on new geographic markets for its higher-value aluminum products also falls into the question mark category. While the company has existing international operations, establishing a strong presence in new regions for specialized products means facing nascent brand recognition and underdeveloped distribution networks, requiring substantial initial capital and a phased market entry strategy.

These new market entries represent high growth potential but currently have a low market share. Success hinges on overcoming established competitors and building new customer relationships, a process that can be lengthy and capital-intensive, demanding significant upfront investment in facilities, marketing, and talent.

| Initiative | BCG Category | Rationale | Key Considerations | 2024 Market Context |

| High-End Aluminum Alloys | Question Mark | Nascent market acceptance, high growth potential in sectors like aerospace and EVs. | Requires significant R&D and market penetration investment. | Global specialty aluminum market > $50 billion, with high-end alloys a growing segment. |

| New Geographic Markets for Value-Added Products | Question Mark | Untapped growth potential in new regions for specialized aluminum. | Low market share, requires substantial capital for brand building and distribution. | Expansion into new markets for higher-margin products is a strategic imperative. |

BCG Matrix Data Sources

Our China Hongqiao Group BCG Matrix is built on comprehensive financial statements, industry growth forecasts, and competitor analysis to provide a clear strategic overview.