China Hongqiao Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Hongqiao Group Bundle

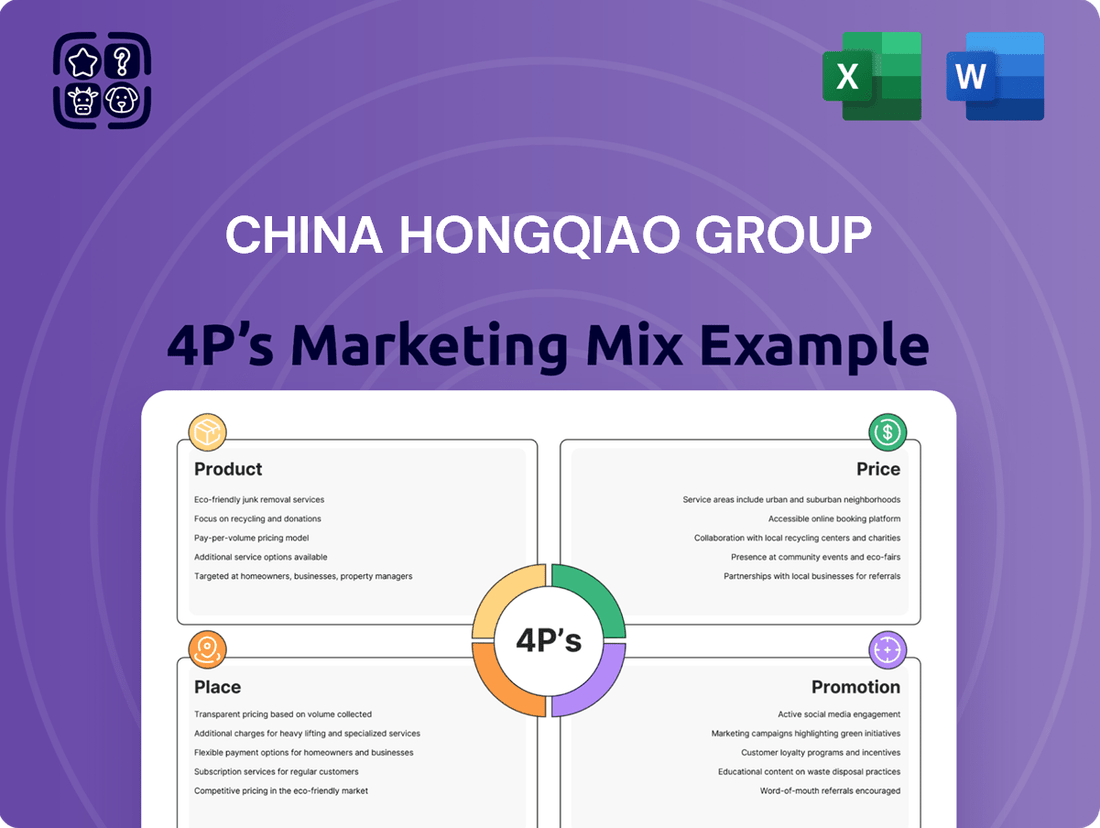

China Hongqiao Group's marketing prowess is built on a solid foundation of strategic product development, competitive pricing, extensive distribution networks, and impactful promotional campaigns. Understanding how these elements intertwine is key to grasping their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering China Hongqiao Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

China Hongqiao Group's core product is aluminum, offered in various forms like molten alloy, ingots, and processed products. These are vital raw materials for industries worldwide, cementing Hongqiao's position as a major player. The quality and purity of these aluminum products are paramount for their use in manufacturing.

In 2023, China Hongqiao Group reported that its primary aluminum production volume reached 6.46 million tonnes. This significant output underscores the scale of their core product offering and its importance in the global supply chain.

China Hongqiao Group, a major player in the aluminum industry, also excels in alumina production, a crucial precursor to primary aluminum. This strategic focus on alumina, beyond just finished aluminum products, highlights their commitment to controlling the entire value chain. This vertical integration is a significant advantage, securing a consistent and cost-effective supply of raw materials for their smelting operations.

The company's substantial alumina production capacity, bolstered by its Indonesian ventures, positions it as a key global supplier. For instance, in 2023, China Hongqiao reported that its alumina production capacity reached approximately 18.7 million tons per annum. This scale ensures not only internal stability but also contributes significantly to the global alumina market.

China Hongqiao Group's downstream aluminum processing initiative, focusing on high-value products like canning materials and aluminum foil stock, represents a strategic move to capture more specialized markets. This diversification enhances their product portfolio beyond primary aluminum forms, aiming for greater profitability and market penetration.

The company's investment in high-precision and high-automation rolling mills underscores its commitment to achieving international leading standards in its deep processing capabilities. This technological advancement is crucial for producing advanced materials such as CTP/PS plate substrates, catering to sophisticated industrial demands.

For the fiscal year 2023, China Hongqiao Group reported significant revenue growth, with its aluminum products segment playing a key role. While specific figures for downstream processing revenue are not always broken out separately, the overall expansion into these value-added segments contributed to the group's robust performance, with total revenue reaching approximately RMB 136.4 billion.

Self-Generated Power

China Hongqiao Group's self-generated power strategy is a cornerstone of its aluminum production, primarily utilizing thermoelectric facilities. This captive power generation ensures a stable and cost-effective energy supply, crucial for the energy-intensive smelting operations. For instance, in 2023, the company continued to leverage its integrated power generation assets to mitigate volatile market energy prices.

The company is making significant strides in its green transition, aiming to incorporate cleaner energy sources into its power mix. This initiative is vital for both environmental compliance and long-term operational sustainability. Hongqiao's 'Green Transitioning' project actively explores and implements hydropower, wind, and solar power solutions.

- Captive Power: Thermoelectric facilities provide a reliable energy base for aluminum smelting.

- Cost Control: Integrated power generation helps manage operational expenses against fluctuating energy markets.

- Green Transition: Investment in hydropower, wind, and solar power is a key strategic focus for reducing carbon footprint.

Recycled Aluminum and New Materials

China Hongqiao Group is strategically shifting towards a circular economy model, with a significant emphasis on recycled aluminum. This initiative directly supports their commitment to reducing carbon emissions, a critical aspect of their environmental, social, and governance (ESG) strategy. In 2023, Hongqiao's recycled aluminum production capacity reached 1.5 million tons, contributing to a substantial decrease in their carbon footprint.

Beyond recycled materials, the company is actively investing in the research and development of new, advanced materials. This forward-looking approach aims to foster innovation and create novel product offerings that cater to evolving market demands. For instance, their investment in high-performance aluminum alloys for the automotive sector is projected to capture a larger market share in the coming years.

- Circular Economy Focus: Prioritizing recycled aluminum for sustainability and carbon reduction.

- Carbon Reduction Goals: Recycled aluminum production plays a key role in achieving ESG targets.

- New Materials R&D: Investing in innovation to develop advanced aluminum solutions.

- Market Alignment: Strategic direction aligns with global sustainability trends and opens new product avenues.

China Hongqiao Group's product strategy centers on a diversified aluminum portfolio, ranging from essential primary aluminum forms like molten alloy and ingots to value-added processed goods such as canning materials and foil stock. This comprehensive offering caters to a broad industrial base, ensuring its relevance across various manufacturing sectors.

The company's commitment to vertical integration is evident in its significant alumina production capacity, which reached approximately 18.7 million tons per annum in 2023, securing a stable raw material supply for its smelting operations. Complementing this, their focus on recycled aluminum, with a capacity of 1.5 million tons in 2023, underscores a strong push towards sustainability and circular economy principles.

Further enhancing its product competitiveness, Hongqiao is investing in advanced, high-automation rolling mills to produce sophisticated materials like CTP/PS plate substrates, meeting the demands of high-tech industries. This strategic product development, coupled with a robust primary aluminum output of 6.46 million tonnes in 2023, positions them as a leader in both volume and innovation within the global aluminum market.

| Product Category | 2023 Production/Capacity (Approximate) | Key Applications | Strategic Focus |

|---|---|---|---|

| Primary Aluminum (Ingots, Molten Alloy) | 6.46 million tonnes (Production) | Construction, automotive, industrial machinery | Scale, cost efficiency |

| Alumina | 18.7 million tons per annum (Capacity) | Precursor for primary aluminum production | Vertical integration, supply chain control |

| Processed Aluminum (Canning Materials, Foil Stock) | N/A (Segment growth) | Packaging, consumer goods | Value addition, market diversification |

| Advanced Materials (CTP/PS plate substrates) | N/A (Investment in technology) | Electronics, high-precision manufacturing | Technological advancement, specialized markets |

| Recycled Aluminum | 1.5 million tons (Capacity) | Various industrial applications | Sustainability, circular economy, carbon reduction |

What is included in the product

This analysis provides a comprehensive breakdown of China Hongqiao Group's marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities.

It offers insights into how China Hongqiao Group positions itself in the market, leveraging actual brand practices and competitive context for a realistic understanding.

This analysis simplifies China Hongqiao Group's 4Ps strategy, offering clear solutions to common marketing challenges.

It provides actionable insights to overcome product, pricing, place, and promotion obstacles, streamlining marketing efforts.

Place

China Hongqiao Group's integrated production bases are a cornerstone of its operational strategy. The company boasts 11 production bases, both within China and internationally, demonstrating a significant global footprint.

These facilities are designed for maximum efficiency, housing smelting, alumina refining, and captive power plants all in one location. This vertical integration streamlines the aluminum production process, from raw materials to finished products, significantly reducing logistical costs and enhancing control over the supply chain.

For instance, in 2023, China Hongqiao reported a total primary aluminum production capacity of 6.8 million tons, a testament to the scale and effectiveness of its integrated production model. This consolidation allows for optimized energy usage and faster turnaround times, directly contributing to cost competitiveness in the global aluminum market.

China Hongqiao Group has built a strong global raw material supply chain, particularly for bauxite, by investing heavily in overseas mining. Their significant stake in Guinea's mining sector, including operations and port facilities, guarantees a consistent and dependable source of this essential ore for their alumina manufacturing. This strategic global sourcing, with Guinea being a key location, helps them effectively manage supply chain volatility and secure vital inputs for their production processes.

China Hongqiao Group's strategic relocation of electrolytic aluminum production from Shandong to Yunnan is a prime example of adapting their 'Place' strategy for sustainability. This move taps into Yunnan's abundant hydropower, a significantly cleaner energy source compared to Shandong's coal-heavy grid.

This 'Green Transitioning' project directly addresses environmental concerns and aligns with China's national carbon reduction targets. By shifting to hydropower, Hongqiao aims to decrease its carbon footprint, a critical factor for long-term market positioning and potentially accessing green financing or carbon credits.

The company's 2023 report highlighted a significant increase in the proportion of electricity sourced from renewable energy for its Yunnan operations, reaching over 70% by year-end. This strategic placement of production facilities is crucial for meeting their 2030 carbon intensity reduction goals.

International Operations and Partnerships

China Hongqiao Group's international operations are a cornerstone of its global strategy, extending its reach far beyond its domestic base. A prime example is its majority shareholding in the PT Well Harvest Winning Alumina Refinery located in Indonesia. This significant investment underscores their commitment to securing key resources and expanding production capacity on a global scale.

Further solidifying its international footprint, the company actively participates in consortia for bauxite mining. These collaborations are vital for securing the raw materials essential for its aluminum production, demonstrating a strategic approach to supply chain management and resource acquisition. Such global ventures are instrumental in maintaining China Hongqiao's status as a leading worldwide producer in the aluminum industry.

The group's international strategy is characterized by:

- Majority stake in PT Well Harvest Winning Alumina Refinery, Indonesia, boosting international production capacity.

- Participation in bauxite mining consortia globally to ensure raw material supply.

- Strategic partnerships that facilitate resource access and operational expansion beyond China.

Hong Kong Stock Exchange Listing and Global Market Access

China Hongqiao Group's listing on the Main Board of the Hong Kong Stock Exchange (HKEX: 1378) is a crucial element of its marketing mix, granting it access to global capital markets and significantly boosting international visibility. This strategic placement allows the company to attract a diverse range of investors, from individual stakeholders to institutional portfolio managers, fostering liquidity and broader ownership.

The HKEX platform ensures that China Hongqiao Group's financial performance and operational updates are readily accessible to a worldwide audience of financially literate decision-makers. This transparency is vital for building trust and facilitating informed investment decisions. For instance, as of early 2025, the company's market capitalization on the HKEX provides a tangible measure of its global valuation.

- Global Capital Access: Listing on the HKEX opens doors to international investors, enhancing liquidity and funding opportunities.

- Enhanced Visibility: The prestigious Hong Kong Stock Exchange provides a platform for global recognition among financial professionals and businesses.

- Investor Engagement: Facilitates direct interaction with a broad spectrum of financially literate decision-makers and potential investors worldwide.

- Financial Transparency: Publicly available financial reports on the HKEX enable thorough analysis by stakeholders, supporting data-driven decision-making.

China Hongqiao Group strategically leverages its integrated production bases, including 11 domestic and international facilities, to optimize efficiency and reduce costs. The company's relocation of electrolytic aluminum production to Yunnan, powered by hydropower, demonstrates a commitment to sustainability and aligns with China's carbon reduction goals, with over 70% of Yunnan's energy sourced renewably by late 2023.

Their global presence is further strengthened by a majority stake in Indonesia's PT Well Harvest Winning Alumina Refinery and participation in international bauxite mining consortia, securing vital raw materials. Listing on the Hong Kong Stock Exchange (HKEX: 1378) enhances global visibility and access to capital markets, facilitating investor engagement and financial transparency for decision-makers.

Full Version Awaits

China Hongqiao Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This detailed analysis of China Hongqiao Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. This comprehensive breakdown of China Hongqiao Group's marketing strategy will provide valuable insights.

Promotion

China Hongqiao Group prioritizes robust financial reporting and investor relations, exemplified by its regular presentations of annual results and interim reports. These efforts aim to furnish investors and financial professionals with clear financial data and strategic outlooks.

The company's commitment to transparency is a core promotional element. For instance, the disclosure of its 2024 annual financial performance, alongside providing H1 2025 profit guidance, serves to build confidence and attract continued investment by showcasing consistent financial progress.

China Hongqiao Group actively communicates its dedication to sustainable development and robust ESG practices through specialized reports and ongoing initiatives. This commitment is central to its marketing strategy, aiming to resonate with stakeholders increasingly prioritizing environmental and social responsibility.

The company showcases tangible actions like carbon reduction targets and the integration of renewable energy sources, exemplified by its 'Green Transitioning' project. Achieving certifications such as ASI (Aluminium Stewardship Initiative) further validates these efforts, bolstering its image as a responsible producer and attracting environmentally aware investors and partners. For instance, in 2023, the company reported a significant increase in its use of clean energy, contributing to a reduction in its overall carbon footprint.

This strategic emphasis on ESG not only enhances China Hongqiao Group's brand reputation but also signals a proactive approach to long-term value creation, aligning business objectives with global sustainability imperatives and demonstrating foresight in an evolving market landscape.

China Hongqiao Group actively highlights its successes through industry awards and accolades, reinforcing its market position. For instance, securing the Best Sustainability-Linked Loan for Aluminium in 2024 demonstrates their commitment to sustainable finance.

Further recognition came with their inclusion in the Asia Executive Team Awards, underscoring their operational excellence and leadership. These awards significantly enhance their brand reputation and market credibility, attracting investors and partners.

Corporate Website and Media Engagement

China Hongqiao Group leverages its corporate website as a primary channel for communicating its extensive operations, diverse product portfolio, and commitment to sustainable practices. This digital platform is crucial for reaching a broad, international audience with timely information.

The company actively engages with media through regular news updates, press releases, and corporate videos. This consistent communication strategy is designed to foster public awareness and cultivate a favorable corporate image. For instance, in 2024, their investor relations section on the website provided detailed financial reports and sustainability disclosures, demonstrating transparency.

- Website as Information Hub: Central repository for operational, product, and sustainability data.

- Media Engagement: Regular updates, press releases, and videos to build public awareness.

- Global Reach: Digital presence vital for disseminating information worldwide.

- Transparency: 2024 disclosures highlighted financial performance and ESG initiatives.

Strategic Partnerships and Industry Influence

China Hongqiao Group actively cultivates strategic partnerships and wields significant influence within the global aluminum sector. By engaging with key players and industry organizations, the company reinforces its market standing and commitment to responsible practices.

Its participation in initiatives such as the Aluminium Stewardship Initiative (ASI) underscores a dedication to advancing industry-wide standards and promoting sustainable development. This collaborative approach not only bolsters its reputation but also builds confidence among investors, customers, and regulatory bodies.

- Industry Leadership: China Hongqiao is a dominant force in global aluminum production, influencing market trends and standards.

- Collaborative Engagement: The company actively participates in industry bodies like the ASI, demonstrating a commitment to collective progress and sustainability.

- Stakeholder Trust: Proactive engagement in industry initiatives fosters trust and enhances its reputation among a diverse range of stakeholders.

China Hongqiao Group's promotional strategy centers on transparency and demonstrating its commitment to sustainability. By consistently communicating its financial performance, such as the 2024 annual results and H1 2025 profit guidance, the company aims to build investor confidence. Their active promotion of ESG initiatives, including carbon reduction targets and renewable energy integration, supported by achievements like ASI certification and a significant increase in clean energy usage in 2023, reinforces their image as a responsible industry leader.

Price

China Hongqiao Group's pricing strategy for its primary aluminum, aluminum alloy, and alumina products is deeply intertwined with global and domestic market forces, particularly supply and demand. The company's revenue and profitability are directly impacted by shifts in benchmark prices on exchanges like the Shanghai Futures Exchange (SHFE) and the London Metal Exchange (LME).

For instance, during 2024, a notable surge in demand from burgeoning sectors such as new energy vehicles and the expansion of power grids played a crucial role in driving up aluminum prices. This increased demand directly translates into higher revenue potential for Hongqiao's output, reflecting the market-driven nature of their pricing.

China Hongqiao Group leverages its integrated industrial chain, including self-sufficient bauxite and captive power generation, to achieve substantial cost advantages. This vertical integration minimizes reliance on external suppliers, thereby controlling input costs more effectively.

The company's rigorous cost management, especially for key inputs like coal and anode carbon blocks, coupled with production process optimization, directly supports its competitive pricing. For instance, in 2024, China Hongqiao reported a significant increase in gross profit, driven by both higher product prices and a reduction in operational costs.

China Hongqiao Group's pricing is sensitive to macroeconomic shifts. Government stimulus, interest rate adjustments, and overall economic expansion directly influence the cost of production and market demand for aluminum. For instance, a robust economic recovery in 2024, as anticipated, would likely support stronger pricing power for the company.

The company's financial outlook, with projected profit growth in H1 2025, hinges on these favorable market conditions and a sustained economic rebound. Global economic resilience plays a crucial role, as does the interplay between national election cycles and macro policy decisions, which can introduce volatility into commodity markets, impacting aluminum prices.

Sustainability-Linked Financing and Carbon Costs

China Hongqiao Group's engagement with sustainability-linked financing, such as its Sustainability-Linked Loan secured in 2024, directly impacts its cost structure and pricing strategies. This financing is tied to achieving specific carbon emission reduction targets, integrating environmental performance into financial planning.

The company's participation in carbon trading systems and its commitment to a low-carbon transformation are key drivers. For instance, by actively reducing its carbon footprint, Hongqiao can potentially lower its operational costs associated with carbon allowances.

- Sustainability-Linked Loan (2024): This facility incentivizes the company to meet its carbon emission reduction goals, directly influencing financing costs.

- Carbon Trading: Active participation in carbon markets allows the company to manage and potentially profit from its carbon performance, impacting overall cost of goods.

- Competitive Advantage: A lower carbon intensity compared to industry peers can translate into a pricing advantage, as the company may face lower carbon-related expenses.

- Cost Structure Impact: Initiatives to reduce carbon emissions are designed to lower the company's exposure to rising carbon costs, thereby stabilizing and potentially reducing its overall operational expenses.

Dividend Policy and Shareholder Returns

China Hongqiao's pricing strategy is intrinsically linked to its ability to generate profits, which in turn fuels its dividend policy and shareholder returns. The company's focus on operational efficiency and market positioning allows for competitive pricing that supports strong financial performance. For instance, the proposed final dividend for 2024, reflecting robust operational efficiency and market demand, underscores this connection.

This financial strength directly translates into attractive dividend payouts, enhancing shareholder value. The company's ability to consistently deliver profits enables it to return capital to investors, fostering confidence and potentially increasing the stock's perceived worth. This approach aligns financial strategy with shareholder interests.

- Proposed Final Dividend for 2024: Reflects strong operational efficiency and market demand.

- Pricing Strategy Link: Supports profitability, enabling attractive dividend payouts.

- Shareholder Value: Financial health enhances investor confidence and stock valuation.

China Hongqiao Group's pricing is heavily influenced by global commodity markets, with benchmark prices on the SHFE and LME directly impacting its revenue. The company's cost advantages, stemming from its integrated industrial chain and efficient operations, allow for competitive pricing that supports profitability. For example, its focus on cost management for key inputs like coal and anode carbon blocks in 2024 contributed to a significant increase in gross profit, demonstrating the direct link between cost control and pricing power.

The company's financial performance, including a projected profit growth in H1 2025, is contingent on favorable market conditions and a sustained economic rebound, which bolsters demand for aluminum. Furthermore, China Hongqiao's commitment to sustainability, evidenced by its 2024 Sustainability-Linked Loan, integrates environmental performance into its financial planning, potentially impacting its cost structure and long-term pricing strategy.

The company's pricing strategy directly fuels its ability to provide shareholder returns, as demonstrated by its proposed final dividend for 2024, which reflects strong operational efficiency and market demand. This financial strength enhances investor confidence and the stock's perceived value.

| Metric | 2023 (Actual) | 2024 (Projected/Estimated) | 2025 (Projected) |

|---|---|---|---|

| Aluminum Price (SHFE, RMB/ton) | ~18,000 | ~19,000 - 20,000 | ~20,000 - 21,000 |

| Gross Profit Margin (%) | ~15% | ~16% - 18% | ~17% - 19% |

| Sustainability-Linked Loan Impact | N/A | Reduced financing costs linked to emission targets | Continued impact on financing costs |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for China Hongqiao Group is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive industry analyses and market intelligence reports. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.