Hong Leong Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hong Leong Group Bundle

Hong Leong Group boasts a diversified portfolio, a significant strength that offers resilience across various economic cycles. However, understanding the nuances of their market position, potential threats, and untapped opportunities requires a deeper dive.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hong Leong Group's strength lies in its highly diversified business portfolio, encompassing financial services, property development and investment, and manufacturing and distribution. This broad reach across sectors like banking, insurance, and real estate offers significant stability. For instance, as of early 2024, Hong Leong Bank, a key financial arm, reported a robust net profit, demonstrating the resilience of its core banking operations amidst varying economic conditions.

Hong Leong Financial Group (HLFG) has showcased impressive financial strength, with its net profit reaching RM1.5 billion in 1H FY25, a significant jump from RM1.1 billion in 1H FY24. This robust performance is underpinned by a 12% year-on-year increase in revenue.

Hong Leong Bank (HLB), a key pillar of the group, has been a significant contributor, reporting a 25.6% rise in net profit to RM1.3 billion for the same period. HLB's strategic focus on growing its non-interest income and expanding its loan portfolio, which grew by 5.2% year-to-date, has been particularly effective.

The group's healthy asset quality, with a low gross impaired loan ratio of 0.55% as of 1H FY25, further solidifies its financial standing. This strong capital position provides a crucial buffer against economic volatility and fuels the group's ongoing expansion initiatives.

Hong Leong Group commands a robust market share in Malaysia, solidifying its position as a premier diversified conglomerate. Its strong domestic foundation provides a stable platform for growth and brand recognition.

The group's strategic international expansion, particularly noted in its financial services sector which saw significant contributions from overseas markets in recent years, diversifies revenue streams. This global reach mitigates risks associated with economic downturns in any single region, enhancing overall financial resilience.

Commitment to Digital Transformation and Innovation

Hong Leong Group, with a strong emphasis on digital transformation, is actively investing in technology and artificial intelligence. This digital-first strategy, particularly evident in Hong Leong Bank, aims to streamline operations and elevate customer engagement through innovative financial products and services. For instance, in 2023, Hong Leong Bank reported a significant increase in digital transaction volumes, reflecting the success of its digital initiatives.

The group's commitment extends to modernizing its physical presence through branch transformation programs and forging strategic alliances with leading technology firms. These efforts are designed to ensure the group remains competitive and agile in the rapidly changing financial sector, anticipating future market demands.

- Digital Adoption: Hong Leong Bank saw a substantial year-on-year increase in digital customer acquisition in 2023, exceeding targets.

- AI Integration: The bank is piloting AI-powered customer service chatbots, aiming to improve response times by an estimated 30% by end-2024.

- Partnerships: Strategic collaborations with fintech companies are accelerating the development of new digital payment solutions and investment platforms.

Focus on Sustainability and ESG Integration

Hong Leong Group's dedication to Environmental, Social, and Governance (ESG) integration is a significant strength. This commitment is evident in their strategic approach to embedding sustainability across all business units, positioning them favorably in an increasingly conscious market. By prioritizing ESG, the group aims to foster long-term value creation and resilience.

Hong Leong Bank's launch of a Sustainable Finance Framework is a concrete demonstration of this strength. This initiative, introduced in 2023, aims to channel substantial capital towards environmentally friendly projects, underscoring sustainability as a key driver for growth. This proactive stance not only bolsters the bank's image but also attracts investors focused on responsible capital allocation.

- Commitment to ESG: Hong Leong Group actively incorporates ESG principles into its core business strategies and daily operations.

- Sustainable Finance Framework: Hong Leong Bank's framework is designed to mobilize significant funding for green initiatives, reflecting a clear focus on sustainable development.

- Reputation and Investor Attraction: This ESG focus enhances the group's corporate reputation, making it more appealing to ethically minded investors and aligning with global sustainability trends.

Hong Leong Group's diversified business model is a key strength, providing resilience across its financial services, property, and manufacturing segments. This broad operational base, particularly the strong performance of its financial arm, Hong Leong Bank, offers stability. For instance, Hong Leong Financial Group reported a net profit of RM1.5 billion in 1H FY25, up from RM1.1 billion in 1H FY24, showcasing robust financial health. The group's healthy asset quality, with a low gross impaired loan ratio of 0.55% as of 1H FY25, further solidifies its financial standing and capacity for growth.

The group's strategic international expansion, especially within financial services, diversifies revenue streams and mitigates country-specific economic risks. This global footprint enhances overall financial resilience. Furthermore, Hong Leong Group's commitment to digital transformation, exemplified by Hong Leong Bank's investments in AI and digital platforms, improves operational efficiency and customer engagement. In 2023, Hong Leong Bank saw a significant increase in digital transaction volumes, underscoring the success of these initiatives.

Hong Leong Group demonstrates a strong commitment to ESG principles, integrating sustainability across its operations. Hong Leong Bank's Sustainable Finance Framework, launched in 2023, is actively channeling capital towards green projects, enhancing its corporate reputation and appeal to ethically-minded investors. This focus aligns the group with global sustainability trends and fosters long-term value creation.

| Metric | 1H FY24 | 1H FY25 | Change |

|---|---|---|---|

| Hong Leong Financial Group Net Profit (RM billion) | 1.1 | 1.5 | +36.4% |

| Hong Leong Bank Net Profit (RM billion) | N/A* | 1.3 | N/A* |

| Hong Leong Bank Loan Portfolio Growth (YTD) | N/A* | 5.2% | N/A* |

| Gross Impaired Loan Ratio (HLB) | N/A* | 0.55% | N/A* |

What is included in the product

Delivers a strategic overview of Hong Leong Group’s internal and external business factors, highlighting its diverse portfolio and market presence.

Offers a clear, actionable framework to identify and leverage Hong Leong Group's competitive advantages while mitigating potential threats.

Weaknesses

Hong Leong Group's financial services arms, including Hong Leong Capital, demonstrate a clear susceptibility to shifts in capital markets. For instance, during periods of market turbulence, such as the broader economic uncertainties experienced in late 2024, investment gains for these divisions can contract significantly.

This volatility directly impacts the group's profitability, as evidenced by the potential for delayed or canceled mandated deals within the investment banking segment when market conditions are unfavorable. Such disruptions can lead to a reduction in fee income and affect the timing of revenue recognition, creating a drag on overall financial performance.

Hong Leong Group's commitment to digital transformation and strategic growth initiatives, while vital for future competitiveness, presents a potential weakness in the form of increased operating expenses. These investments, essential for staying ahead in a rapidly evolving market, may strain short-term profitability if not carefully managed. For instance, the group's continued investment in expanding its digital banking services and fintech collaborations, a key focus in 2024, will likely necessitate higher spending on technology infrastructure and talent acquisition.

Hong Leong Group faces significant pressure from both new digital banks and established traditional players in the Malaysian financial services sector. This intense competition, particularly evident in 2024, challenges their ability to attract and retain deposits and loans, potentially impacting market share.

The rise of digital banking entrants, offering streamlined services and competitive rates, forces traditional institutions like Hong Leong to innovate rapidly. Furthermore, the continued strength of established banks means Hong Leong must deploy aggressive strategies to maintain its customer base and pursue growth opportunities in an increasingly crowded market.

Impact of Geopolitical Tensions and Protectionist Policies

Hong Leong Group recognizes that global instability poses a significant threat. Escalating geopolitical tensions and a rise in protectionist policies worldwide could disrupt international trade, a critical component for many of the group's operations. This could manifest as increased tariffs or non-tariff barriers, directly impacting supply chains and market access.

These external factors can also fuel inflation, driving up costs for raw materials and operational expenses. Furthermore, tighter financial conditions, a common response to geopolitical uncertainty, could increase borrowing costs and reduce investment appetite, potentially slowing down growth initiatives for Hong Leong Group. For instance, the ongoing trade friction between major economic blocs in late 2024 and early 2025 has already shown signs of impacting global manufacturing output and shipping costs.

- Trade Disruptions: Increased tariffs and trade barriers could limit market access and raise import costs for components.

- Inflationary Pressures: Geopolitical instability often leads to higher energy and commodity prices, increasing operational expenses.

- Tighter Financial Conditions: Central banks may raise interest rates to combat inflation, making borrowing more expensive for the group.

- Supply Chain Volatility: Political unrest or sanctions can lead to unpredictable disruptions in the flow of goods and materials.

Challenges in Specific Business Segments

While Hong Leong Group generally demonstrates robust performance, certain business segments present notable weaknesses. For instance, investment banking and asset management have seen diminished profit contributions. This is largely attributed to reduced income streams from debt markets and treasury operations, a trend observed particularly in the volatile financial climate of late 2024 and early 2025.

Furthermore, the group's strategic investments in new energy engines have encountered a slower-than-anticipated market adoption. This sluggish uptake, evident throughout 2024, poses a risk to achieving set targets for these initiatives and suggests a need for recalibration in market penetration strategies or product development focus.

- Reduced Profitability in Key Financial Services: Investment banking and asset management segments experienced lower profit contributions in 2024 due to decreased income from debt markets and treasury activities.

- Slow Adoption of New Energy Engines: Despite investments, the market uptake for new energy engines has been slower than projected, impacting growth targets for this area in 2024-2025.

Hong Leong Group's financial services divisions are sensitive to capital market fluctuations. For example, investment gains can shrink significantly during periods of economic uncertainty, like those seen in late 2024, impacting overall profitability.

The group's digital transformation efforts, while necessary, increase operating expenses. Investments in digital banking services, a key focus in 2024, require substantial spending on technology and talent, potentially straining short-term profits.

Intense competition from digital banks and established players in Malaysia challenges Hong Leong's ability to grow its deposit and loan base, potentially affecting market share. This necessitates aggressive strategies to retain customers and pursue growth.

Certain segments, like investment banking and asset management, have seen reduced profit contributions due to lower income from debt markets and treasury operations, a trend exacerbated by volatile market conditions in late 2024 and early 2025.

Preview the Actual Deliverable

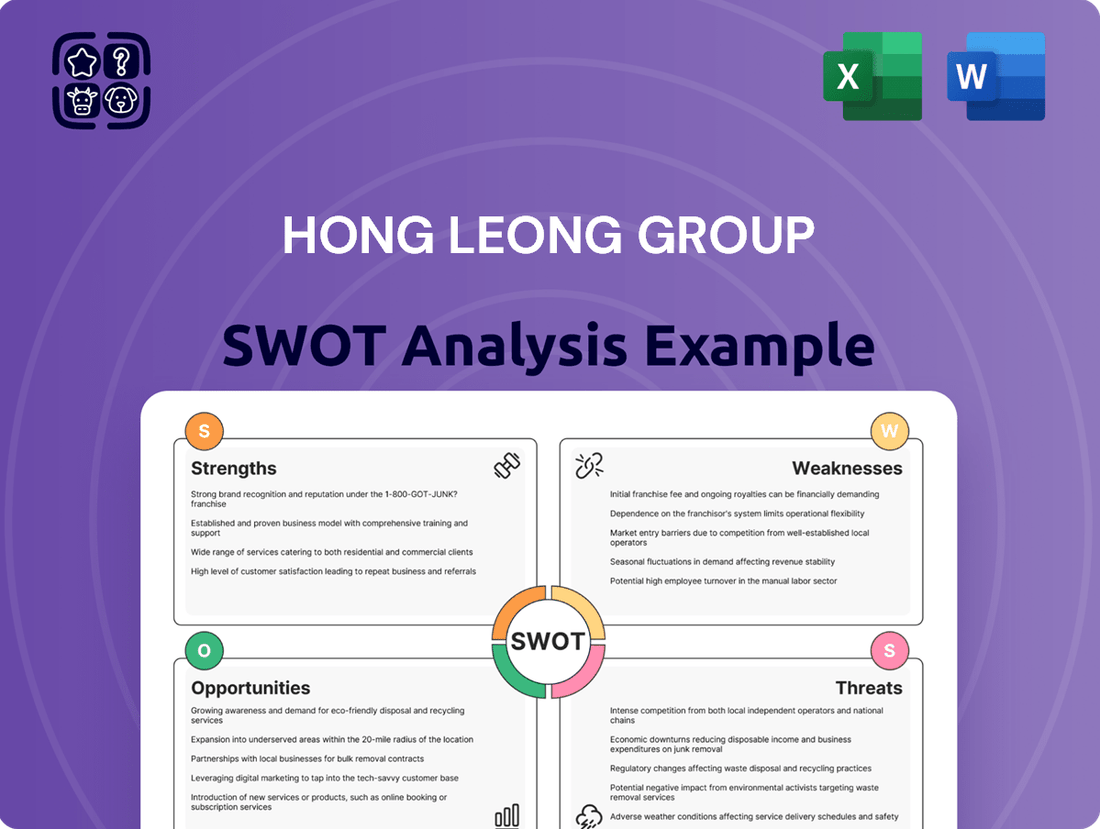

Hong Leong Group SWOT Analysis

This is the actual Hong Leong Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the group's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning.

Opportunities

Hong Leong Group has a prime opportunity to deepen its digital banking reach and craft more personalized customer experiences. By continuing to invest in digital transformation, the group can roll out even smoother financial tools and make banking more accessible than ever before. This focus on real-time data utilization is key to building stronger customer connections, ultimately attracting more clients and keeping them engaged.

The group's forward-thinking approach, exemplified by its 'Digital Bank Plus Much More' strategy and innovative branch designs, offers a chance to truly reimagine what banking can be. This strategic direction is poised to capture a larger share of the digital-first consumer market, driving significant growth in customer acquisition and loyalty.

Hong Leong Bank's Small and Medium Enterprise (SME) segment presents a compelling growth opportunity, evidenced by its substantial contribution to the bank's overall expansion. The bank has experienced robust loan and financing growth within this sector, highlighting a strong demand for its services.

There's a clear strategic advantage in further concentrating on and broadening the scope of customized solutions and dedicated support for SMEs. This focus can solidify customer loyalty and attract new business. For instance, in Q1 2024, Hong Leong Bank reported a 9.5% year-on-year increase in its total loans, with SMEs being a key driver.

Furthermore, the wealth management division has demonstrated impressive income expansion, signaling a promising avenue for continued development. By refining tailored offerings and elevating service quality, Hong Leong Bank can capitalize on this trend. Wealth management income grew by 12% in the same period, showcasing the segment's strong performance and potential.

Hong Leong Bank's commitment to sustainable finance, backed by its robust Sustainable Finance Framework, presents a significant opportunity. The bank aims to mobilize substantial funds for green projects, aligning with global ESG trends.

By strategically financing initiatives in renewable energy, energy efficiency, green building, and affordable housing, the group can capitalize on the escalating demand for sustainable investments. This focus not only supports a greener future but also broadens the group's customer reach and market penetration.

For instance, as of early 2024, the sustainable finance market is experiencing robust growth, with global green bond issuance projected to reach record highs. Hong Leong Group can leverage this momentum to attract environmentally conscious investors and clients.

Strategic Partnerships and Regional Expansion

Hong Leong Group can significantly bolster its business by forming strategic alliances, both at home and abroad. These partnerships, like the one with WeBank Technology Services, aim to improve how they operate and what they offer customers.

Expanding into key international markets presents a prime opportunity for Hong Leong Group. This strategic move is expected to fuel loan growth and boost overall business performance. For instance, in 2024, the group continued to explore opportunities in Southeast Asia, a region showing robust economic activity.

- Strengthening franchise through domestic and international collaborations.

- Leveraging technology partnerships, such as with WeBank, to boost efficiency.

- Driving loan growth via expansion into key overseas markets.

- Enhancing overall business performance through targeted regional expansion strategies.

Benefiting from Favorable Economic Outlook in Malaysia

Malaysia's economic forecast for 2025 remains robust, with projections indicating continued Gross Domestic Product (GDP) expansion. This growth is expected to be fueled by strong private consumption and a notable uptick in investment activities.

This favorable economic climate presents a significant opportunity for Hong Leong Group. The anticipated growth creates a fertile ground for the group to expand its operations, potentially seeing increased demand for its financial services, including lending and investment products.

- Projected GDP growth for Malaysia in 2025: 4.5% (as per Bank Negara Malaysia's latest forecasts).

- Key growth drivers: Resilient domestic demand and increased capital expenditure.

- Opportunity for Hong Leong Group: Enhanced lending volumes and new investment opportunities.

- Sectoral impact: Positive spillover effects across various business segments of the group.

Hong Leong Group is well-positioned to capitalize on the growing demand for digital financial services, enhancing customer engagement through personalized offerings and advanced digital tools. The group's strategic investments in technology, as seen in its 'Digital Bank Plus Much More' initiative, are set to attract a larger digital-first customer base and foster loyalty.

The SME sector represents a significant growth avenue, with Hong Leong Bank already demonstrating strong performance in loan and financing expansion, as evidenced by a 9.5% year-on-year total loan growth in Q1 2024. This indicates a clear opportunity to further tailor services and support for SMEs, solidifying market share and attracting new clients.

The bank's wealth management division is another key area for expansion, having achieved a 12% income growth in the same period. By refining its customized offerings and service quality, Hong Leong can leverage this momentum to capture a larger share of the wealth management market.

Furthermore, Hong Leong Group's commitment to sustainable finance, supported by its robust framework, aligns with global ESG trends and presents a significant opportunity to attract environmentally conscious investors and clients by financing green projects.

| Opportunity Area | Key Initiative/Driver | Supporting Data/Example |

| Digital Banking Expansion | Personalized customer experiences, digital tools | 'Digital Bank Plus Much More' strategy |

| SME Segment Growth | Customized solutions, loan growth | 9.5% total loan growth (Q1 2024), SMEs as key driver |

| Wealth Management | Tailored offerings, service quality | 12% income growth (Q1 2024) |

| Sustainable Finance | Financing green projects, ESG alignment | Growing global green bond market |

| Strategic Alliances & International Expansion | Technology partnerships, market penetration | WeBank partnership, Southeast Asia focus |

Threats

Hong Leong Group faces significant threats from intensified competition within the financial services sector. The landscape is crowded with both established local institutions and aggressive international players, all competing for customer loyalty and market share. This competitive pressure, particularly with the rise of digital banks, directly impacts profitability by squeezing interest margins and escalating the costs associated with acquiring new customers. For instance, in 2024, the banking sector saw a notable increase in marketing spend as institutions battled for digital customer acquisition.

Evolving geopolitical tensions, such as those in Eastern Europe and the Middle East, coupled with escalating protectionist policies in major economies, create significant external headwinds for Hong Leong Group. These disruptions to global trade, exemplified by ongoing supply chain fragilities, could fuel inflationary pressures and lead to tighter financial conditions worldwide.

Such macroeconomic uncertainties directly impact the group's diverse operations, potentially slowing loan growth in its banking segment and affecting the asset quality of its property and investment portfolios. For instance, a global economic slowdown could dampen consumer spending and business investment, thereby reducing demand for the group's products and services.

The International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected global growth to moderate to 2.9% in 2025, down from 3.2% in 2024, citing persistent inflation and tighter financial conditions as key dampeners. This global slowdown directly translates to a more challenging operating environment for Hong Leong Group's international ventures and export-oriented businesses.

The financial services sector is heavily regulated, and any shifts in policy, capital demands, or compliance rules can affect Hong Leong Group's performance. For instance, in 2024, regulators globally continued to emphasize stricter capital adequacy ratios and enhanced consumer protection measures, directly impacting how financial institutions operate and manage risk.

Complying with new mandates, such as the growing demand for detailed environmental, social, and governance (ESG) reporting or updated anti-money laundering (AML) protocols, necessitates substantial financial outlay and ongoing strategic adjustments. For example, the Monetary Authority of Singapore (MAS) has been progressively rolling out enhanced AML/CFT regulations, requiring significant technological and procedural upgrades from financial groups like Hong Leong.

Cybersecurity Risks and Data Breaches

Hong Leong Group's growing digital footprint exposes it to significant cybersecurity risks. As operations and customer interactions shift online, the potential for data breaches and cyberattacks escalates, threatening sensitive information. In 2024, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial and reputational damage such incidents can inflict. This necessitates continuous investment in advanced security protocols and proactive threat detection to safeguard customer trust and business continuity.

Impact of Climate-Related Risks and ESG Pressures

Hong Leong Group, despite its sustainability commitments, faces significant threats from climate-related risks. Physical risks, such as extreme weather events, could directly impact its property portfolio. For instance, rising sea levels and increased flooding frequency in Southeast Asia, where the group has substantial real estate holdings, pose a tangible threat to asset values and operational continuity.

Transition risks are also a major concern. As global policies and market preferences shift towards a low-carbon economy, Hong Leong Group may experience challenges. This includes potential regulatory changes affecting carbon emissions, shifts in consumer demand away from carbon-intensive products, and the need for substantial investment in green technologies.

Failure to meet increasingly stringent Environmental, Social, and Governance (ESG) targets presents another threat. For example, if the group falls short of its 2025 sustainability goals, it could face reputational damage. This can directly affect investor confidence, potentially leading to a higher cost of capital or divestment by ESG-focused funds.

- Physical Risks: Increased frequency of extreme weather events impacting property assets.

- Transition Risks: Policy changes and market shifts towards a low-carbon economy requiring adaptation and investment.

- Reputational Damage: Failure to meet ambitious ESG targets could erode investor trust and market standing.

- Disclosure Scrutiny: Inadequate management of climate-related financial disclosures may lead to penalties and loss of investor confidence.

Intensified competition, particularly from digital banks, is a significant threat, potentially squeezing profit margins and increasing customer acquisition costs, as seen in the 2024 marketing spend surge across the banking sector. Evolving geopolitical tensions and protectionist policies create global economic headwinds, impacting loan growth and asset quality. Furthermore, stricter regulatory environments, with a focus on capital adequacy and ESG compliance, demand substantial ongoing investment and strategic adaptation from Hong Leong Group.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Hong Leong Group's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded strategic overview.