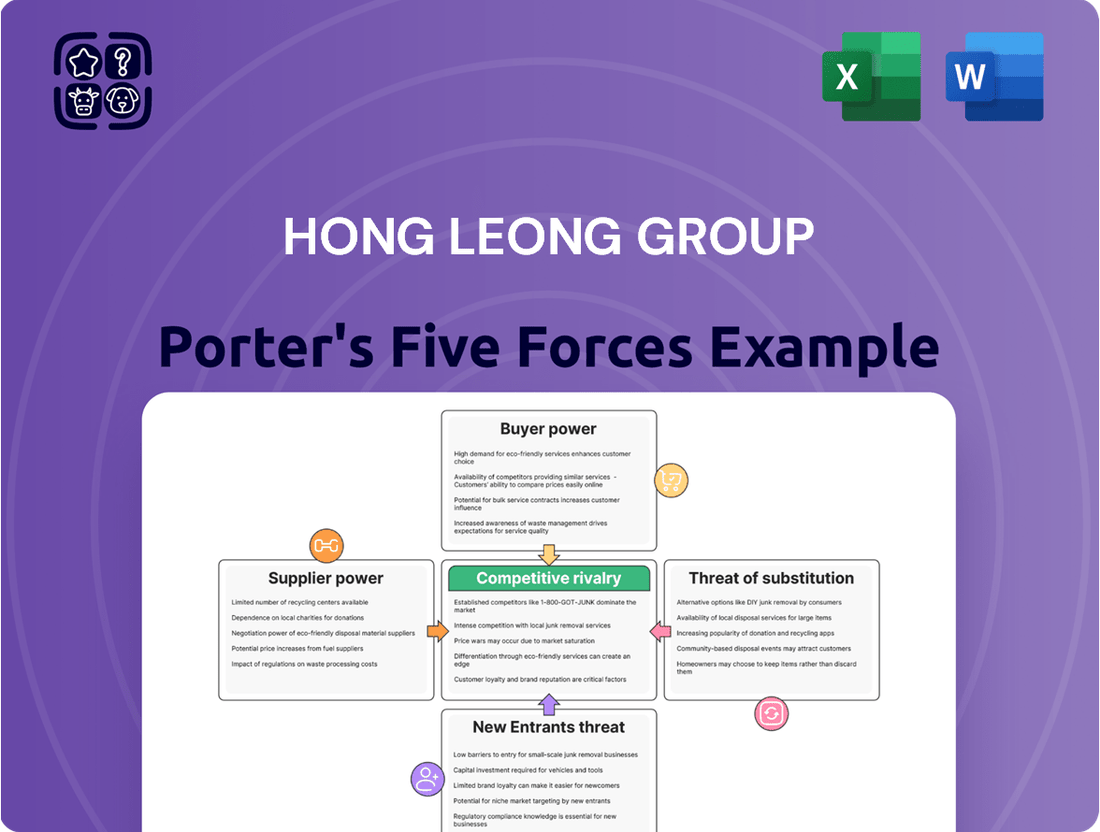

Hong Leong Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hong Leong Group Bundle

The Hong Leong Group navigates a complex competitive landscape, facing varying degrees of threat from new entrants and the bargaining power of both suppliers and buyers. Understanding these forces is crucial for strategic planning and identifying growth opportunities within its diverse business segments.

The complete report reveals the real forces shaping Hong Leong Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the bargaining power of suppliers for Hong Leong Group. For instance, in its manufacturing divisions, if there are only a handful of companies that can supply specialized components or advanced technology, those suppliers hold considerable sway. This limited supply base means Hong Leong Group might face higher prices or less favorable terms. In 2024, industries reliant on niche technologies, like advanced semiconductor manufacturing equipment, often see supplier concentration leading to extended lead times and increased input costs for buyers.

The uniqueness of inputs significantly shapes supplier bargaining power. For Hong Leong Group, if a supplier provides highly specialized financial software or proprietary data analytics crucial for its banking and financial services operations, that supplier gains considerable leverage. For instance, in 2024, the demand for advanced AI-driven financial platforms saw significant growth, meaning providers of such unique solutions could command higher prices or more favorable terms.

The bargaining power of suppliers for Hong Leong is significantly influenced by switching costs. For example, if Hong Leong were to change its core banking system provider, the financial outlay for new software, data migration, and extensive staff retraining could easily run into millions of dollars, making such a switch a daunting prospect. This high barrier to entry for new suppliers strengthens the position of existing ones, allowing them to potentially dictate terms more favorably.

Threat of Forward Integration by Suppliers

Suppliers in industries where Hong Leong Group operates possess the potential to integrate forward, effectively transforming into competitors. This capability significantly enhances their bargaining power, as they can capture a larger share of the value chain. For instance, a major supplier of construction materials could launch its own property development arm, directly challenging Hong Leong’s core business.

The threat of forward integration is particularly potent when suppliers possess deep industry insights and substantial financial resources. Such suppliers can leverage their existing knowledge of Hong Leong's operations and customer base to gain a competitive edge. This scenario would allow them to dictate terms more aggressively, impacting Hong Leong's profitability and market position.

- Supplier Capability: Suppliers can leverage their existing expertise and capital to enter Hong Leong's markets.

- Competitive Landscape Shift: Forward integration turns suppliers into direct rivals, increasing competitive intensity.

- Leverage for Suppliers: Enhanced bargaining power allows suppliers to demand better terms or impose stricter conditions.

- Industry Examples: A building materials supplier entering property development or a software firm offering financial services are potential threats.

Importance of Hong Leong to Suppliers

The significance of Hong Leong Group as a customer directly impacts its bargaining power with suppliers. If Hong Leong constitutes a substantial portion of a supplier's overall sales, that supplier will likely be more amenable to Hong Leong's pricing and terms, thereby reducing the supplier's leverage. For instance, in 2024, Hong Leong's diverse operations across property, financial services, and manufacturing meant it could consolidate purchasing power, making it a key client for many raw material and component providers.

Conversely, if Hong Leong represents a small percentage of a supplier's business, the supplier may hold more sway. This is because the supplier has less to lose by pushing back on Hong Leong's demands or seeking alternative clients. For example, a specialized technology provider might find Hong Leong to be just one of many significant customers, allowing them to dictate terms more effectively.

Hong Leong's strategic sourcing and supplier relationship management are crucial in mitigating supplier power. By diversifying its supplier base and fostering long-term partnerships, Hong Leong can ensure competitive pricing and reliable supply chains. In 2024, reports indicated Hong Leong's continued focus on supply chain resilience, which often involves negotiating favorable terms with key suppliers to secure necessary inputs for its extensive manufacturing and development projects.

- Hong Leong's substantial purchasing volume can reduce supplier reliance.

- A diversified supplier base strengthens Hong Leong's negotiation position.

- Supplier dependence on Hong Leong limits their ability to dictate terms.

The bargaining power of suppliers for Hong Leong Group is influenced by the concentration of suppliers in its various industries. When few suppliers can provide essential inputs, their leverage increases, potentially leading to higher costs for Hong Leong. For instance, in 2024, sectors requiring specialized components saw suppliers with limited competition able to command premium pricing.

The uniqueness of supplied inputs also plays a significant role. If a supplier offers proprietary technology or specialized services that are difficult to substitute, they gain considerable bargaining power. This was evident in 2024 with the growing demand for advanced AI solutions in financial services, where providers of unique platforms could negotiate more favorable terms.

Switching costs for Hong Leong are a critical factor; high costs associated with changing suppliers, such as for core IT systems, empower existing suppliers. Furthermore, the threat of suppliers integrating forward into Hong Leong's business areas, like a materials supplier entering property development, significantly enhances their leverage and competitive position.

Hong Leong's substantial purchasing volume can, however, diminish supplier power, especially when it represents a significant portion of a supplier's revenue. Conversely, if Hong Leong is a minor client, suppliers may have more freedom to dictate terms. Strategic sourcing and strong supplier relationships are key to mitigating these pressures.

| Factor | Impact on Hong Leong Group | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Increased bargaining power for suppliers with limited competition. | High for specialized manufacturing inputs. |

| Uniqueness of Inputs | Suppliers of proprietary or hard-to-substitute items gain leverage. | Significant for advanced financial technology providers. |

| Switching Costs | High costs to change suppliers strengthen the position of incumbents. | Crucial for IT systems and specialized machinery. |

| Forward Integration Threat | Suppliers entering Hong Leong's markets increase competitive pressure. | A potential risk in construction materials and financial services. |

| Hong Leong's Purchasing Volume | Large volume can reduce supplier power; small volume increases it. | Hong Leong's diverse operations provided leverage in 2024. |

What is included in the product

This analysis delves into the competitive intensity within Hong Leong Group's diverse industries, examining supplier and buyer power, the threat of new entrants and substitutes, and the group's strategic positioning.

Easily identify and address competitive pressures by visualizing the intensity of each of Porter's Five Forces for Hong Leong Group.

Customers Bargaining Power

The concentration of Hong Leong Group's customer base significantly influences customer bargaining power. In sectors like retail banking or general property sales, a broad and fragmented customer base typically results in lower individual customer leverage. For example, while millions of retail banking customers interact with Hong Leong Bank, no single customer holds substantial power due to their small transaction sizes.

Conversely, for large corporate clients within Hong Leong Group's financial services arm or major bulk purchasers in property development projects, their substantial transaction volumes can grant them considerable bargaining power. These entities can negotiate more favorable terms due to the significant revenue they represent. This is a critical factor in business-to-business segments of their operations.

This dynamic of customer concentration and its impact on bargaining power varies considerably across Hong Leong Group's diverse portfolio. For instance, in 2024, while the group's property division might see large developers negotiating bulk purchase discounts, its insurance segment would likely experience a more diffused customer power due to a vast number of individual policyholders.

The bargaining power of customers for Hong Leong Group is significantly influenced by the availability of substitute products and services. When customers can easily find alternatives in financial services, property, or manufactured goods, their ability to negotiate better terms with Hong Leong increases.

In 2024, the financial services sector, a key area for Hong Leong, saw continued growth in digital-only banks and fintech platforms. For instance, the global fintech market was projected to reach over $1.1 trillion by 2024, offering consumers a wider array of choices beyond traditional banking. This proliferation of digital alternatives means customers can readily switch if Hong Leong's pricing or service quality doesn't meet their expectations.

Similarly, in the property market, the availability of diverse housing options from various developers, coupled with rental markets, provides customers with leverage. If Hong Leong's property developments are perceived as too expensive or lacking in desirable features, buyers can easily turn to competitors. This competitive landscape ensures customers have substantial bargaining power.

The costs customers face when moving from Hong Leong Group's offerings significantly shape their bargaining power. For example, switching banks involves the hassle of updating direct debits, credit cards, and online banking, which can be time-consuming and inconvenient, thus increasing switching costs.

In the property sector, the substantial financial and emotional investment tied to a purchase means switching costs are inherently high once a buyer commits to a Hong Leong Group development, limiting their ability to easily change providers.

However, if Hong Leong Group operates in manufacturing sectors where its products are largely commoditized, customers can switch to competitors with minimal financial or effort-based barriers, thereby increasing their bargaining power.

Customer Price Sensitivity

Customer price sensitivity significantly impacts Hong Leong Group's bargaining power of customers. When customers can easily switch to alternatives due to similar offerings, their power increases. This is particularly evident in commoditized sectors like basic building materials or standard financial products where price is a primary differentiator.

In 2024, with ongoing inflationary pressures and fluctuating interest rates, consumers and businesses alike are exhibiting heightened price sensitivity. For instance, the property market, a key area for Hong Leong Group, saw a noticeable shift in buyer behavior in early 2024, with demand becoming more elastic in response to mortgage rate adjustments and construction cost increases. This means customers are more likely to delay purchases or seek out lower-cost alternatives if prices rise significantly.

- Price Sensitivity in Property: In 2024, rising construction costs and interest rates have made potential homebuyers more sensitive to the final price of properties offered by developers like Hong Leong Group.

- Financial Services Sensitivity: Customers in the banking and insurance sectors are increasingly comparing rates and fees, especially for standard products, giving them more leverage to negotiate or switch providers.

- Impact of Economic Conditions: Persistent inflation in 2024 forces customers to scrutinize spending, making them more receptive to competitive pricing across all of Hong Leong Group's diverse business segments.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing the goods or services they currently purchase, can significantly boost their bargaining power against Hong Leong Group. This is particularly relevant for large corporate clients who possess the resources to develop their own capabilities. For instance, major developers could explore manufacturing certain construction materials in-house, reducing their reliance on external suppliers like those within the Hong Leong Group's ecosystem.

While this threat is minimal for individual retail customers, it poses a more tangible risk for significant institutional clients. Consider the financial services sector: large corporations might opt to establish their own internal financing divisions rather than exclusively using banking services provided by entities like Hong Leong Bank. This move would directly diminish the bank's leverage over these clients.

- Customer Back-Integration Threat: Customers may develop their own in-house capabilities to produce goods or services previously sourced from Hong Leong Group, thereby increasing their bargaining power.

- Examples: Large corporations could create their own financing arms instead of solely using banks, or major developers might manufacture some building materials internally.

- Impact on Hong Leong Group: This reduces the reliance of key clients on Hong Leong's offerings, potentially leading to price pressures or loss of business.

- Customer Segmentation: The threat is generally low for individual retail customers but can be a significant factor for large institutional or corporate clients.

The bargaining power of customers for Hong Leong Group is shaped by several key factors, including customer concentration, availability of substitutes, switching costs, price sensitivity, and the threat of backward integration.

In 2024, the group's diverse operations meant these forces varied significantly. For instance, the financial services sector, a major contributor, faced intense competition from fintech, increasing customer leverage due to readily available digital alternatives. Similarly, the property market saw buyers with more options, especially in 2024, as construction costs and interest rates influenced their price sensitivity and willingness to explore other developers.

The ability for customers to switch providers with minimal hassle or cost is a critical determinant of their power. High switching costs, often seen in complex financial products or significant property investments, tend to reduce customer bargaining power. Conversely, in more commoditized segments, lower switching costs empower customers to demand better terms.

The threat of customers integrating backward, where they develop their own capabilities, is a more pronounced concern for large corporate clients than for individual retail customers. This potential for self-sufficiency can significantly shift the balance of power, forcing Hong Leong Group to offer more competitive pricing and terms to retain these key accounts.

| Factor | Impact on Customer Bargaining Power | Hong Leong Group Context (2024) |

|---|---|---|

| Customer Concentration | High concentration = Low power; Low concentration = High power | Retail banking: Millions of customers, low individual power. Large corporate clients: Significant power due to transaction volume. |

| Availability of Substitutes | More substitutes = Higher power | Fintech alternatives in banking; diverse developers in property. Global fintech market projected over $1.1 trillion by 2024. |

| Switching Costs | High costs = Lower power; Low costs = Higher power | Property: High financial/emotional investment. Banking: Hassle of updating services. Commoditized goods: Low switching costs. |

| Price Sensitivity | High sensitivity = Higher power | Heightened in 2024 due to inflation and interest rates, especially in property and standard financial products. |

| Threat of Backward Integration | Higher threat = Higher power | Potential for large corporations to develop in-house financing or developers to manufacture materials. |

Same Document Delivered

Hong Leong Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Hong Leong Group's Porter's Five Forces Analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The sheer number and varying sizes of competitors across Hong Leong Group's diverse business segments directly shape the intensity of competitive rivalry. In Malaysia's banking arena, for instance, established giants like Maybank and CIMB, alongside other significant players, create a highly competitive landscape where market share gains are hard-won.

Within the property development sector, a multitude of developers, from large corporations to smaller, specialized firms, are constantly vying for prime locations and customer attention. This fragmentation naturally fuels robust competition as each entity strives to differentiate itself and capture market share.

In manufacturing, the competitive environment is equally dynamic. Hong Leong Group faces competition from both domestic Malaysian companies, often with deep local market understanding, and formidable international corporations possessing vast resources and global reach, making the rivalry particularly challenging.

The growth rate of the industries where Hong Leong Group operates significantly influences competitive rivalry. In mature or slower-growing sectors, companies often intensify their efforts to capture market share, leading to more aggressive competition. For instance, in the established banking sector, where growth might be moderate, Hong Leong Bank faces intense rivalry from both local and international players vying for customer deposits and loan portfolios.

Conversely, high-growth areas present a different competitive dynamic. In the burgeoning digital payments and fintech space, where Hong Leong Group has made strategic investments, the focus is often on rapid expansion and innovation. While competition exists, the expanding market size allows multiple players to grow simultaneously without necessarily engaging in the same level of price-based competition seen in mature markets. For example, the digital banking initiatives in Malaysia are attracting new entrants, but the overall demand for digital financial services is also increasing, creating opportunities for expansion.

The degree to which Hong Leong Group's competitors differentiate their offerings significantly influences the intensity of rivalry. When products and services are highly similar, competition often escalates into price wars, impacting profitability across the industry. For instance, in the highly competitive Malaysian banking sector, where Hong Leong Bank operates, the ability to stand out through superior digital services or personalized customer experiences is crucial for retaining market share.

Hong Leong Group's strategic advantage lies in its capacity to differentiate its diverse portfolio. In property development, this might involve unique architectural designs or integrated lifestyle amenities, as seen in some of their award-winning residential projects. For its financial services, differentiation can stem from a strong brand reputation built over decades and a commitment to exceptional customer service, which can command customer loyalty even when pricing is competitive.

The group's manufacturing arm also benefits from differentiation through product innovation and quality. For example, if competitors offer standard industrial components, Hong Leong's ability to supply specialized or higher-performance materials can reduce direct price-based competition. This focus on unique value propositions across its business segments helps Hong Leong Group mitigate the pressures of intense rivalry.

Exit Barriers

High exit barriers for Hong Leong Group, particularly in capital-intensive sectors like banking and manufacturing, mean that even unprofitable ventures may persist. This prolongs intense competition, as shedding assets or operations can be prohibitively expensive. For instance, the significant fixed assets in manufacturing and the specialized labor and regulatory hurdles in banking create substantial costs for withdrawal.

These elevated exit barriers can lead to prolonged periods of intense rivalry, even when firms are struggling financially. This situation often results in market overcapacity and a downward pressure on prices as companies fight to survive. In 2024, the banking sector, a key area for Hong Leong, continued to face stringent capital requirements and regulatory oversight, making divestment complex and costly.

- Significant Fixed Assets: Sectors like automotive manufacturing, a part of Hong Leong's diverse portfolio, involve substantial investments in plant and machinery that are difficult and costly to liquidate.

- Specialized Labor: Industries requiring highly skilled or specialized workforces, such as engineering or financial services, present challenges in workforce reduction and retraining costs upon exit.

- Regulatory Obligations: Financial institutions, like Hong Leong Bank, face strict regulations and compliance costs that can make exiting the market a lengthy and expensive process.

- Contractual Commitments: Long-term supply agreements or leases can also act as exit barriers, obligating firms to continue operations or incur penalties.

Strategic Stakes

The strategic importance of success within key markets significantly fuels competitive rivalry for Hong Leong Group and its peers. When a market represents a critical avenue for future expansion, technological leadership, or brand prestige, companies are often driven to commit substantial resources and engage in aggressive competition, even if it means sacrificing immediate profits. This dynamic is particularly pronounced in sectors undergoing rapid digital evolution.

For instance, the financial services sector, a core area for Hong Leong Group, is witnessing intense competition driven by the imperative of digital transformation. Companies are investing heavily in fintech capabilities and digital platforms to capture market share and enhance customer experience. By 2024, the global fintech market was projected to reach over $2.5 trillion, underscoring the high stakes involved.

- Digital Transformation Investments: Major financial institutions, including those within the Hong Leong Group's sphere of influence, are allocating billions to upgrade their digital infrastructure and develop innovative online services.

- Market Share Focus: Success in digitally-driven markets is crucial for long-term growth and reputation, leading competitors to vie aggressively for customer acquisition and retention.

- Technological Advancement: The race to adopt and develop cutting-edge technologies like AI and blockchain in financial services intensifies rivalry as firms seek a competitive edge.

- Reputational Stakes: Leading in digital innovation enhances brand image, making these markets strategically vital for maintaining and improving market standing.

The competitive rivalry for Hong Leong Group is intense across its diverse business segments, fueled by numerous players and varying industry growth rates. Differentiation is key to mitigating price-based competition, especially in mature markets like banking where Hong Leong Bank faces strong rivals.

High exit barriers in capital-intensive sectors like manufacturing and banking mean that competition can persist even for struggling firms, as seen with ongoing regulatory complexities in 2024. Strategic importance, particularly in the rapidly evolving digital financial services sector, drives aggressive competition and significant investment in new technologies.

| Business Segment | Key Competitors | Competitive Intensity Factor |

|---|---|---|

| Banking | Maybank, CIMB, Public Bank | High (Mature market, numerous players) |

| Property Development | Sime Darby Property, UEM Sunrise, SP Setia | High (Fragmented market, location competition) |

| Manufacturing | Local and International Industrial Firms | High (Global reach, resource disparity) |

| Digital Financial Services | Local Banks, Fintech Startups | Very High (Rapid growth, innovation race) |

SSubstitutes Threaten

The appeal of substitute offerings hinges on their price-performance balance. For financial services, fintech innovations such as digital payment platforms and online lending provide alternatives, often at a reduced cost or with enhanced user experience compared to traditional banking. For instance, the global fintech market was projected to reach over $300 billion in 2024, indicating significant customer adoption of these alternatives.

Customer willingness to switch to substitutes in Malaysia is on the rise, driven by growing awareness of alternatives and the perceived benefits they offer. A significant portion of Malaysia's population, particularly the younger demographic, is tech-savvy and increasingly comfortable with digital platforms, making them open to exploring new financial solutions.

The increasing digital literacy across Malaysia, with internet penetration reaching 96.8% in 2023 according to the Malaysian Communications and Multimedia Commission (MCMC), directly fuels customer propensity to substitute. This digital adoption means more consumers are exposed to and capable of utilizing fintech alternatives to traditional banking services offered by groups like Hong Leong.

Perceived risk and trust remain crucial factors. While digital alternatives offer convenience, customers in financial services often weigh this against the security and reliability of established institutions. However, as digital trust frameworks mature and successful fintech adoption grows, this barrier to substitution is gradually diminishing.

The relative price of substitutes directly influences the threat they pose to Hong Leong Group. If alternative offerings, such as digital financial services or alternative property developers, provide comparable utility at a lower cost, customers have a strong incentive to switch. For instance, the increasing affordability of online investment platforms compared to traditional brokerage fees can significantly shift customer preference.

Quality and Features of Substitutes

The quality and features of substitutes pose a significant threat to Hong Leong Group. For instance, the banking sector sees digital-only banks offering slick user interfaces and innovative features like instant loan approvals, directly competing with traditional offerings. In 2023, digital banks in Southeast Asia, including those in Malaysia, reported substantial growth in customer acquisition, with some onboarding millions of new users within months, highlighting their appeal.

Similarly, in the property development sector, prefabricated or modular construction methods are gaining traction. These solutions can drastically reduce construction timelines compared to traditional methods, offering a compelling advantage for developers and buyers alike. Reports from 2024 indicate a growing interest in off-site construction, with companies aiming to deliver projects up to 30% faster.

Hong Leong Group must therefore stay ahead by continuously enhancing its own product and service offerings. This means not only matching the features of substitutes but also innovating to create unique value propositions that resonate with customers. The user experience is paramount; a seamless and intuitive digital banking platform or a property development that incorporates smart home technology can be a powerful differentiator.

The threat is amplified when substitutes offer a superior combination of price, performance, and user experience. For example, if a fintech startup can offer a more personalized and cost-effective wealth management service than traditional banking channels, it directly erodes Hong Leong Group's market share. In 2024, the fintech sector continued its rapid expansion, with investment in digital financial services reaching record highs globally, underscoring the competitive pressure.

Switching Costs to Substitutes

The threat of substitutes for Hong Leong Group is amplified by low switching costs for customers. For instance, in the banking sector, customers can readily move their deposits to a competitor offering better rates or a more user-friendly digital platform. Similarly, in the insurance or property segments, alternative providers often present competitive pricing or innovative products that are easy to adopt.

This ease of transition means that if Hong Leong Group's offerings are not perceived as superior or uniquely valuable, customers have little incentive to remain loyal. For example, a customer might easily switch from a traditional bank account to a fintech solution offering higher interest rates or more convenient mobile banking features. By mid-2024, digital-only banks in Southeast Asia were rapidly gaining market share, indicating a clear preference for convenience and potentially better value.

To counter this, Hong Leong Group must focus on building customer stickiness. This involves developing integrated service ecosystems that make it less appealing to switch, such as offering bundled banking, insurance, and investment products. Loyalty programs that reward long-term customers and a consistently superior customer experience across all touchpoints are also crucial. For instance, a well-designed mobile app that simplifies transactions and provides personalized financial advice can significantly reduce the likelihood of a customer seeking alternatives.

- Low Switching Costs: Customers can easily move funds or services to alternative providers in banking, insurance, and property sectors.

- Digital Adoption: The rise of fintech and digital-only banks in Southeast Asia by mid-2024 highlights customer willingness to switch for convenience and better value.

- Mitigation Strategies: Hong Leong Group needs to create customer loyalty through integrated services, rewarding loyalty programs, and an exceptional customer experience.

The threat of substitutes for Hong Leong Group is significant, particularly in financial services where fintech innovations offer competitive alternatives. These substitutes often provide a better price-performance ratio, enhanced user experience, and lower switching costs, driving customer adoption. For example, the global fintech market was projected to exceed $300 billion in 2024, indicating a strong customer inclination towards these new solutions.

Malaysia's increasing digital literacy, with internet penetration at 96.8% in 2023, further fuels this trend, making consumers more receptive to digital banking and other fintech services. This ease of transition, coupled with the growing appeal of digital-only banks which saw substantial customer acquisition in Southeast Asia during 2023, necessitates that Hong Leong Group focus on creating customer loyalty through superior service and integrated offerings.

| Industry Segment | Substitute Examples | Key Differentiators | Impact on Hong Leong Group |

|---|---|---|---|

| Banking | Fintech payment platforms, digital-only banks | Lower fees, faster transactions, user-friendly interfaces | Erosion of market share in retail and SME banking |

| Property Development | Modular/prefabricated construction | Faster project completion, potentially lower costs | Competition for development projects and buyer interest |

| Investments | Robo-advisors, online trading platforms | Lower management fees, accessibility, personalized advice | Reduced demand for traditional wealth management services |

Entrants Threaten

New companies entering the financial services sector, for example, would struggle to match Hong Leong Group's cost advantages derived from its vast customer base and high transaction volumes. This scale allows Hong Leong Bank to spread fixed costs over a larger output, reducing its per-unit cost.

In property development, a new entrant would find it difficult to achieve the same bulk purchasing power for materials and land acquisition that Hong Leong Properties enjoys. This procurement advantage directly impacts their cost of goods sold.

Similarly, in manufacturing, Hong Leong Group's established production lines and distribution networks enable them to operate at a lower cost per unit compared to a smaller, newer competitor. For instance, in 2024, major automotive manufacturers leveraging economies of scale often achieve production costs that are 20-30% lower per vehicle than those with smaller production runs.

The substantial capital required to enter Hong Leong Group's core industries acts as a significant barrier. For instance, establishing a new bank in Malaysia, a key market for Hong Leong Bank, typically requires a minimum paid-up capital of RM1 billion (approximately USD 210 million as of mid-2024), a figure that deters many potential entrants.

Launching large-scale property developments, another cornerstone of the group, also demands immense financial investment. In 2023, major property developers in Malaysia reported project costs ranging from hundreds of millions to billions of Ringgit, a sum few new players can readily provide without significant backing.

Building new manufacturing plants, especially in sectors like automotive components or consumer goods where Hong Leong Industries operates, also necessitates substantial upfront capital for machinery, infrastructure, and regulatory compliance, further limiting the threat of new entrants.

This is particularly true for regulated sectors like financial services, where compliance costs and capital adequacy ratios are stringent, making it exceptionally difficult for new, undercapitalized entities to compete effectively against established players like Hong Leong Group.

New entrants face significant hurdles in securing access to the well-established distribution channels that Hong Leong Group leverages across its diverse businesses. For instance, in the banking sector, replicating Hong Leong Bank's extensive physical branch network and its sophisticated digital banking platforms presents a formidable challenge for newcomers.

Similarly, in property development, establishing the same caliber of sales networks and agent relationships that Hong Leong Properties commands requires substantial investment and time. New developers often find it difficult to gain traction without these established channels, impacting their ability to reach potential buyers efficiently.

In manufacturing and consumer goods, new players must navigate complex supply chains and secure retail partnerships, areas where Hong Leong Group has cultivated long-standing relationships. Building these from the ground up is not only time-consuming but also capital-intensive, creating a high barrier to entry.

Government Policy and Regulation

Government policies and regulations significantly deter new entrants into Hong Leong Group's core sectors. For instance, stringent licensing and capital requirements in financial services, as overseen by Bank Negara Malaysia, create substantial hurdles. These regulations, which include asset caps for new digital banks, deliberately slow down the growth trajectory of emerging players, thereby protecting established institutions.

The property development and manufacturing industries also face a barrage of permits and compliance standards. Navigating these complex regulatory landscapes demands considerable resources and expertise, acting as a strong deterrent for potential newcomers. This regulatory environment effectively limits the threat of new entrants by increasing the cost and time associated with market entry.

- Strict licensing and capital requirements in financial services, as mandated by Bank Negara Malaysia, raise entry barriers.

- Asset caps for new digital banks imposed by Bank Negara Malaysia limit the scale and speed of new entrants' growth.

- Property development and manufacturing sectors are subject to numerous permits and compliance standards, increasing operational complexity for new firms.

- These regulatory frameworks collectively reduce the likelihood of new, disruptive players entering the market and challenging established players like Hong Leong Group.

Brand Identity and Customer Loyalty

Hong Leong Group's deeply entrenched brand identity and significant customer loyalty in Malaysia act as a formidable barrier to new entrants. This established trust, particularly within the financial services and property sectors, is not easily replicated. It requires substantial time and investment for newcomers to build comparable recognition and rapport with consumers.

The group's long history, dating back to its founding in 1966, has allowed it to cultivate enduring relationships with its customer base. This loyalty translates into a consistent demand for its products and services, making it challenging for new players to gain immediate traction and market share. For instance, Hong Leong Bank consistently ranks among Malaysia's top financial institutions by assets, demonstrating its sustained market presence.

- Brand Recognition: Hong Leong Group benefits from decades of brand building, fostering high consumer awareness and trust.

- Customer Loyalty: Established customer relationships in banking and property sectors create a sticky customer base, resistant to switching.

- Investment Barrier: The significant capital and time required to build a comparable brand and customer loyalty deter potential new entrants.

- Market Share Protection: Existing loyalty helps protect Hong Leong Group's market share from erosion by new competitors.

The threat of new entrants for Hong Leong Group is generally low due to substantial barriers across its core industries. High capital requirements, particularly in banking and property development, deter new players. For instance, establishing a new bank in Malaysia requires significant paid-up capital, a substantial hurdle for emerging firms.

Economies of scale provide Hong Leong Group with cost advantages, making it difficult for smaller new entrants to compete on price. Established distribution channels and strong brand loyalty further solidify the group's market position, requiring immense investment and time for newcomers to replicate.

Stringent government regulations and licensing requirements in sectors like financial services act as a significant deterrent. These regulatory frameworks increase the cost and complexity of market entry, effectively limiting the potential for new, disruptive competitors to challenge established players like Hong Leong Group.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Hong Leong Group is built upon a robust foundation of data, drawing from the group's official annual reports, investor presentations, and financial disclosures. We supplement this with insights from reputable industry research firms, market intelligence reports, and relevant economic databases to provide a comprehensive view of the competitive landscape.