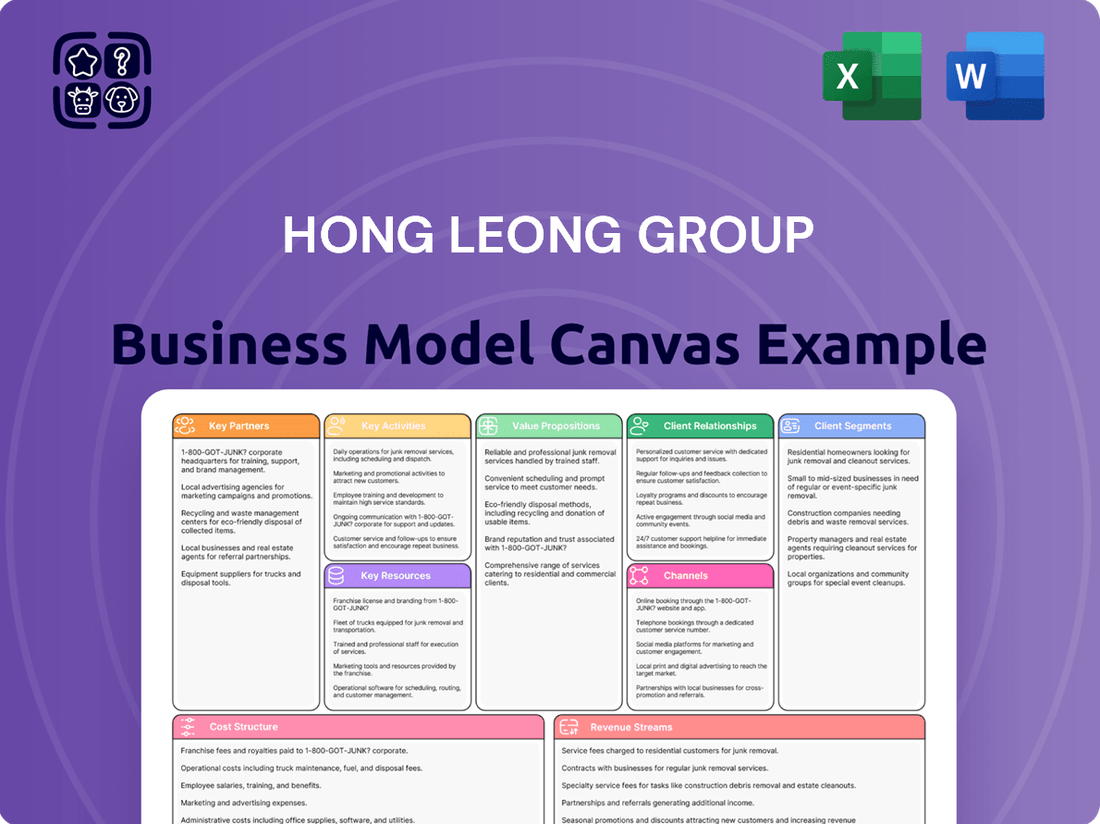

Hong Leong Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hong Leong Group Bundle

Unlock the strategic DNA of Hong Leong Group with our comprehensive Business Model Canvas. Discover how this diversified conglomerate masterfully navigates its diverse industries, from banking to property development, creating unique value propositions for its vast customer base. This detailed canvas is your key to understanding their success.

Dive deeper into the operational brilliance of Hong Leong Group. Our full Business Model Canvas breaks down their key resources, activities, and partnerships, revealing the intricate network that fuels their sustained growth and market dominance. Gain actionable insights for your own strategic planning.

Ready to dissect a proven business model? The complete Hong Leong Group Business Model Canvas provides an in-depth look at their revenue streams, cost structure, and competitive advantages. Download this essential tool for students, analysts, and aspiring entrepreneurs seeking to learn from the best.

Partnerships

Hong Leong Group, especially Hong Leong Bank, is actively teaming up with tech companies to boost its digital services. For instance, they partnered with WeBank Technology Services, a unit of China's leading digital bank. This collaboration focuses on using advanced AI to make operations smoother and financial services better.

Hong Leong Group actively cultivates industry-specific alliances to solidify its market position and expand its operational footprint. These collaborations are designed to leverage the strengths of partners and create synergistic benefits across various sectors.

A prime example is Hong Leong Bank's renewed partnership with the Malaysia Motorcycle and Scooter Dealers Association. This ongoing collaboration underscores the bank's commitment to supporting the automotive financing sector and highlights its strategic approach to engaging with specialized industry groups.

Such alliances are instrumental in maintaining and growing market share, as they facilitate deeper penetration into niche markets and extend the group's service delivery capabilities. For instance, in 2023, Hong Leong Bank reported a 5.8% increase in its automotive financing portfolio, partly attributed to such strategic partnerships.

Hong Leong Bank actively partners with fintech firms like DCAP Digital, leveraging AI to expand financing access for Small and Medium Enterprises (SMEs). This strategic move directly addresses the critical need for financial inclusion within the SME sector, a significant growth area for the bank.

These collaborations are designed to deliver customized financial solutions and personalized support, crucial for empowering SMEs in a dynamic and competitive marketplace. For instance, in 2024, Hong Leong Bank’s SME loan portfolio saw continued expansion, driven by such targeted initiatives and partnerships aimed at unlocking greater economic potential.

Wealth Management and Investment Alliances

Hong Leong Bank strategically cultivates alliances with global financial institutions, notably Lombard Odier, to bolster its private banking and wealth management services across the region. This collaboration aims to bring sophisticated investment solutions and expertise to its clientele.

Hong Leong Financial Group's investment banking division, Hong Leong Capital Berhad, has committed to the Partnership for Carbon Accounting Financials. This signifies a dedication to adopting international standards for sustainability reporting and integrating environmental, social, and governance (ESG) considerations into its operations.

These key partnerships are designed to expand the breadth of financial products and services available, catering to the sophisticated needs of high-net-worth individuals and the growing demand for sustainable investment options. For instance, by partnering with firms like Lombard Odier, Hong Leong can offer access to specialized global investment strategies.

The group's commitment to sustainability, evidenced by its participation in initiatives like the Partnership for Carbon Accounting Financials, positions it favorably in a market increasingly focused on responsible finance. This strategic alignment with global best practices enhances its reputation and appeal to a broader investor base.

- International Expertise: Partnerships like the one with Lombard Odier provide access to global investment strategies and research, enhancing Hong Leong's wealth management offerings.

- Sustainability Leadership: Becoming a signatory to the Partnership for Carbon Accounting Financials demonstrates Hong Leong Capital Berhad's commitment to transparent and responsible financial practices, aligning with global ESG trends.

- Enhanced Product Suite: These alliances allow for the introduction of a wider array of sophisticated financial products and services, meeting the evolving demands of affluent clients.

- Market Competitiveness: By leveraging these strategic relationships, Hong Leong strengthens its competitive position in the wealth management and investment banking sectors.

Inter-Group and Property Development Partnerships

Hong Leong Group actively fosters inter-group and external property development partnerships to capitalize on synergistic opportunities. For instance, Hong Leong Bank facilitates collaborations between its affiliate GuocoLand Limited and other developers, such as UEM Sunrise Berhad.

These alliances are particularly focused on significant property ventures, including those situated within the developing Johor-Singapore Special Economic Zone. Such strategic alignments aim to stimulate economic expansion and strengthen cross-border operational efficiencies.

- Inter-Group Synergies: Leveraging the financial strength of Hong Leong Bank to support property development initiatives undertaken by sister companies like GuocoLand.

- External Collaborations: Partnering with established developers such as UEM Sunrise Berhad to co-develop large-scale projects.

- Strategic Focus: Targeting high-growth areas, exemplified by developments within the Johor-Singapore Special Economic Zone, to enhance cross-border economic activity.

- Growth Drivers: These partnerships are designed to unlock new market opportunities and drive mutual growth through shared resources and expertise.

Hong Leong Group's Key Partnerships are diverse, spanning technology, finance, and property development. These collaborations are crucial for expanding digital offerings, enhancing financial services, and driving growth in key sectors. For example, partnerships with fintech firms like DCAP Digital in 2024 are directly contributing to the expansion of their SME loan portfolio, which saw continued growth from initiatives like these.

The group also leverages international alliances, such as the one with Lombard Odier, to elevate its private banking and wealth management services. Furthermore, strategic property development partnerships, including those with UEM Sunrise Berhad for projects in the Johor-Singapore Special Economic Zone, are vital for capitalizing on cross-border opportunities and economic expansion.

| Partner Type | Example Partner | Focus Area | Impact/Benefit | Yearly Data Point |

|---|---|---|---|---|

| Technology | WeBank Technology Services | AI for Operations | Enhanced digital services | N/A |

| Fintech | DCAP Digital | SME Financing | SME loan portfolio expansion | Continued expansion in 2024 |

| Financial Institutions | Lombard Odier | Wealth Management | Access to global investment strategies | N/A |

| Industry Associations | Malaysia Motorcycle and Scooter Dealers Association | Automotive Financing | Market penetration | 5.8% increase in auto financing portfolio (2023) |

| Property Development | UEM Sunrise Berhad | Property Ventures | Cross-border growth | Focus on Johor-Singapore SEZ |

| Sustainability Initiatives | Partnership for Carbon Accounting Financials | ESG Reporting | Responsible finance alignment | N/A |

What is included in the product

A comprehensive overview of the Hong Leong Group's business model, detailing its diversified operations across finance, property, and manufacturing, and highlighting its strategic approach to customer segments, value propositions, and key partnerships.

The Hong Leong Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their diverse operations, simplifying complex strategies for better understanding and decision-making.

Activities

Hong Leong Group's core financial services provision is a cornerstone of its business model, encompassing a broad spectrum of offerings. This includes commercial and Islamic banking, life insurance, family takaful, investment banking, and fund management, catering to diverse financial needs.

In 2024, Hong Leong Bank, a key entity within the group, reported significant loan growth, underscoring its active role in financing economic activities. The bank also highlighted a robust contribution from non-interest income, demonstrating a diversified revenue stream beyond traditional lending.

To support these extensive financial operations, the Group consistently emphasizes maintaining strong funding and liquidity positions. This strategic focus ensures the stability and capacity of its banking and insurance arms to meet customer demands and navigate market fluctuations effectively.

Hong Leong Group is deeply engaged in property development and investment, actively shaping urban environments through both residential and commercial projects. This dual focus involves creating new properties from the ground up and diligently managing a portfolio of existing real estate assets.

The Group's recent strategic moves highlight a consistent pipeline of new property launches, underscoring their commitment to meeting evolving market demands. Their emphasis remains on securing and developing properties in prime, strategic locations, aiming to maximize value and appeal to a broad range of buyers and investors.

Hong Leong Group’s manufacturing and distribution operations are diverse, covering motorcycles, ceramic tiles, building materials, and powertrain solutions. This segment is driven by a commitment to product innovation and scaling up production volumes to meet market demand.

A key strategic focus for this arm is the move towards higher-margin, premium products. For instance, in the motorcycle segment, this could translate to introducing more advanced models with enhanced features or performance capabilities, aiming to capture a larger share of the premium market segment.

In 2024, the Group's manufacturing efficiency is a critical factor. For example, if a specific manufacturing facility produces 100,000 units of a product annually, optimizing its output by even a small percentage can significantly impact overall revenue and profitability.

Digital Transformation and Innovation Implementation

Hong Leong Group's key activities center on the relentless pursuit of digital transformation across its diverse business units, with a pronounced emphasis on financial services. This strategic imperative involves the integration of cutting-edge technologies, such as artificial intelligence (AI), to streamline operations, automate routine tasks, and elevate customer-centric financial products and services. The group's 'Digital at the Core' philosophy is designed to fundamentally reshape customer interactions and significantly broaden financial inclusion.

This commitment to innovation is evident in their ongoing investments. For instance, in 2024, Hong Leong Bank (HLB) continued to enhance its digital banking platforms, aiming to provide seamless and personalized experiences for its growing customer base. The bank reported a substantial increase in digital transactions, reflecting the success of these initiatives in driving customer adoption and engagement with their digital offerings.

- Digital Transformation: Implementing AI and automation to boost efficiency and customer experience in financial services.

- Customer-Centricity: Redesigning customer journeys through digital channels to foster greater financial inclusion.

- Technological Leverage: Utilizing advanced technologies to drive innovation and competitive advantage across the group.

- Operational Enhancement: Automating processes to reduce costs and improve service delivery in all business segments.

Sustainable Financing and ESG Integration

Hong Leong Group prioritizes sustainable financing and ESG integration, establishing frameworks to direct capital towards environmentally beneficial projects. This commitment is demonstrated through their active pursuit of green financing, which mobilizes funds for initiatives like renewable energy development and energy-efficient building solutions.

The Group's strategic focus includes concrete steps to reduce its carbon footprint and contribute to a global low-carbon economy. For instance, in 2024, Hong Leong Financial Group reported that its sustainable finance portfolio reached RM10.8 billion, underscoring their dedication to channeling investments towards a greener future.

- Sustainable Finance Frameworks: Mobilizing capital for green projects.

- Focus Areas: Renewable energy, energy efficiency, green building.

- Carbon Emission Reduction: Actively working towards a low-carbon economy.

- 2024 Portfolio Growth: Hong Leong Financial Group's sustainable finance portfolio reached RM10.8 billion.

Hong Leong Group's key activities are multifaceted, encompassing financial services, property development, and manufacturing. A significant emphasis is placed on digital transformation within its financial arm, aiming to enhance customer experience and operational efficiency through AI and automation. The group also actively engages in property development and investment, focusing on strategic locations and new project launches to meet market demand.

| Key Activity Area | Description | 2024 Highlight/Data |

|---|---|---|

| Financial Services | Commercial & Islamic banking, insurance, investment banking, fund management. | Hong Leong Bank reported robust non-interest income contribution. |

| Property Development & Investment | Residential and commercial project development and asset management. | Consistent pipeline of new property launches in prime locations. |

| Manufacturing & Distribution | Motorcycles, ceramics, building materials, powertrain solutions. | Focus on higher-margin, premium product segments. |

| Digital Transformation | Integrating AI and automation for efficiency and customer experience. | Hong Leong Bank saw a substantial increase in digital transactions. |

| Sustainable Finance | Directing capital towards environmentally beneficial projects. | Hong Leong Financial Group's sustainable finance portfolio reached RM10.8 billion. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Hong Leong Group that you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis that will be yours to use. You'll gain full access to this same detailed framework, ready for your strategic planning and decision-making.

Resources

Hong Leong Group's financial strength is built on a significant capital base, supported by healthy customer deposits and a steadily expanding gross loans and financing portfolio. For instance, as of the first quarter of 2024, the Group reported a robust capital adequacy ratio, demonstrating its capacity to absorb potential losses and fund growth initiatives. This solid financial footing allows for ongoing investments in expansion and innovation across its varied business segments.

The Group's effective management of funding costs is a key driver of its strong net interest income. By optimizing its deposit-taking strategies and managing its borrowing expenses efficiently, Hong Leong Group ensures a healthy margin on its lending activities. This financial discipline is crucial for sustaining profitability and reinvesting in future growth opportunities.

Hong Leong Group's skilled human capital and leadership are paramount. The group actively cultivates a world-class talent pool, recognizing that experienced management and a dedicated workforce are essential for sustained growth and innovation.

Strategic investments in people are a cornerstone, with continuous training and development programs ensuring employees remain at the forefront of industry advancements. This commitment equips them to deliver exceptional value and adapt to dynamic market conditions.

For instance, in 2024, Hong Leong Group continued its focus on upskilling its workforce across its diverse sectors, including financial services and property development, aiming to enhance operational efficiency and client satisfaction.

Hong Leong Group's advanced technology infrastructure and digital platforms are crucial key resources, underscored by significant investments. For instance, Hong Leong Bank (HLB) has been actively enhancing its digital capabilities. In 2024, HLB continued to invest in areas like artificial intelligence (AI) to refine its offerings and streamline operations.

The group's comprehensive digital platforms, exemplified by HLB Connect, are central to its digital-first strategies. These platforms are designed to automate processes, from customer onboarding to transaction management, thereby improving operational efficiency. This focus on automation directly supports the group’s commitment to delivering seamless and accessible customer experiences across its various financial services.

This dedication to digital transformation is a significant driver for Hong Leong Group. By leveraging cutting-edge technology, including AI advancements seen in 2024, the group enhances the efficiency and accessibility of its services. This strategic investment ensures that customers can interact with the group's offerings easily and effectively, reinforcing its competitive position in the market.

Established Brand Reputation and Extensive Network

Hong Leong Group leverages its established brand reputation, a cornerstone of its business model, to foster trust and credibility. This strong brand equity, cultivated over decades as a leading diversified conglomerate, translates into significant customer loyalty and market recognition.

The group's extensive network is a critical asset, encompassing numerous branches and deep-rooted business relationships both domestically in Malaysia and across international markets. This vast network acts as a powerful enabler for customer acquisition and retention, providing a distinct competitive edge.

- Brand Recognition: Hong Leong Group is consistently recognized as a top conglomerate in Malaysia, reflecting decades of trust and reliability.

- Network Reach: The group operates over 200 branches across Malaysia, facilitating widespread customer engagement and service delivery.

- Diversified Partnerships: Hong Leong maintains strategic alliances with over 50 major corporations globally, enhancing its market access and operational capabilities.

- Customer Base: The group serves millions of customers across its various business segments, underscoring the strength of its established network and brand appeal.

Diversified Physical Assets and Operational Facilities

Hong Leong Group's diversified physical assets form a bedrock for its operations. This includes an extensive branch network supporting its financial services, crucial for customer accessibility and transaction processing.

The Group's property development arm boasts a substantial portfolio of physical real estate, representing significant tangible value and revenue-generating potential. These developments are key to its market presence.

Furthermore, advanced manufacturing plants are integral to its industrial segment, enabling production and supply chain efficiency. For instance, the investment in the Guocera tiles plant in 2024 underscores a commitment to enhancing these operational capabilities.

- Branch Network: Facilitates widespread financial services delivery.

- Property Portfolio: Represents substantial tangible assets in real estate development.

- Manufacturing Facilities: Underpin industrial operations and production capacity, with ongoing investments like the Guocera tiles plant.

Hong Leong Group's financial strength is built on a significant capital base, supported by healthy customer deposits and a steadily expanding gross loans and financing portfolio. For instance, as of the first quarter of 2024, the Group reported a robust capital adequacy ratio, demonstrating its capacity to absorb potential losses and fund growth initiatives. This solid financial footing allows for ongoing investments in expansion and innovation across its varied business segments.

The Group's effective management of funding costs is a key driver of its strong net interest income. By optimizing its deposit-taking strategies and managing its borrowing expenses efficiently, Hong Leong Group ensures a healthy margin on its lending activities. This financial discipline is crucial for sustaining profitability and reinvesting in future growth opportunities.

Hong Leong Group's skilled human capital and leadership are paramount. The group actively cultivates a world-class talent pool, recognizing that experienced management and a dedicated workforce are essential for sustained growth and innovation.

Strategic investments in people are a cornerstone, with continuous training and development programs ensuring employees remain at the forefront of industry advancements. This commitment equips them to deliver exceptional value and adapt to dynamic market conditions.

For instance, in 2024, Hong Leong Group continued its focus on upskilling its workforce across its diverse sectors, including financial services and property development, aiming to enhance operational efficiency and client satisfaction.

Hong Leong Group's advanced technology infrastructure and digital platforms are crucial key resources, underscored by significant investments. For instance, Hong Leong Bank (HLB) has been actively enhancing its digital capabilities. In 2024, HLB continued to invest in areas like artificial intelligence (AI) to refine its offerings and streamline operations.

The group's comprehensive digital platforms, exemplified by HLB Connect, are central to its digital-first strategies. These platforms are designed to automate processes, from customer onboarding to transaction management, thereby improving operational efficiency. This focus on automation directly supports the group’s commitment to delivering seamless and accessible customer experiences across its various financial services.

This dedication to digital transformation is a significant driver for Hong Leong Group. By leveraging cutting-edge technology, including AI advancements seen in 2024, the group enhances the efficiency and accessibility of its services. This strategic investment ensures that customers can interact with the group's offerings easily and effectively, reinforcing its competitive position in the market.

Hong Leong Group leverages its established brand reputation, a cornerstone of its business model, to foster trust and credibility. This strong brand equity, cultivated over decades as a leading diversified conglomerate, translates into significant customer loyalty and market recognition.

The group's extensive network is a critical asset, encompassing numerous branches and deep-rooted business relationships both domestically in Malaysia and across international markets. This vast network acts as a powerful enabler for customer acquisition and retention, providing a distinct competitive edge.

- Brand Recognition: Hong Leong Group is consistently recognized as a top conglomerate in Malaysia, reflecting decades of trust and reliability.

- Network Reach: The group operates over 200 branches across Malaysia, facilitating widespread customer engagement and service delivery.

- Diversified Partnerships: Hong Leong maintains strategic alliances with over 50 major corporations globally, enhancing its market access and operational capabilities.

- Customer Base: The group serves millions of customers across its various business segments, underscoring the strength of its established network and brand appeal.

Hong Leong Group's diversified physical assets form a bedrock for its operations. This includes an extensive branch network supporting its financial services, crucial for customer accessibility and transaction processing.

The Group's property development arm boasts a substantial portfolio of physical real estate, representing significant tangible value and revenue-generating potential. These developments are key to its market presence.

Furthermore, advanced manufacturing plants are integral to its industrial segment, enabling production and supply chain efficiency. For instance, the investment in the Guocera tiles plant in 2024 underscores a commitment to enhancing these operational capabilities.

- Branch Network: Facilitates widespread financial services delivery.

- Property Portfolio: Represents substantial tangible assets in real estate development.

- Manufacturing Facilities: Underpin industrial operations and production capacity, with ongoing investments like the Guocera tiles plant.

Hong Leong Group's Key Resources are its robust financial capital, skilled human capital, advanced technology, strong brand reputation, extensive network, and diversified physical assets.

The Group's financial strength is evidenced by its strong capital adequacy ratios reported in Q1 2024, supporting growth initiatives.

Investments in digital transformation, including AI, enhance operational efficiency and customer experience, as seen with HLB's initiatives in 2024.

The group's extensive network, with over 200 branches in Malaysia and global partnerships, facilitates broad customer engagement and market access.

| Key Resource | Description | 2024 Highlights/Data |

| Financial Capital | Significant capital base, healthy customer deposits, expanding loan portfolio. | Robust capital adequacy ratio (Q1 2024); Strong net interest income driven by funding cost management. |

| Human Capital | Skilled workforce, experienced management, continuous training. | Focus on upskilling workforce across financial services and property development in 2024. |

| Technology & Digital Platforms | Advanced infrastructure, AI capabilities, digital-first strategies. | HLB's continued investment in AI for service refinement and operational streamlining in 2024. |

| Brand Reputation | Established trust and credibility, customer loyalty. | Consistent recognition as a top conglomerate in Malaysia. |

| Network Reach | Extensive branches, deep-rooted business relationships. | Over 200 branches in Malaysia; Strategic alliances with over 50 major corporations globally. |

| Physical Assets | Branch network, property portfolio, manufacturing plants. | Investment in Guocera tiles plant in 2024 to enhance manufacturing capabilities. |

Value Propositions

Hong Leong Group provides a seamless experience by bundling banking, insurance, property development, and manufacturing services. This integration means customers can manage diverse financial and lifestyle needs through one reliable entity, simplifying their interactions and offering convenience. For example, in 2024, Hong Leong Bank reported a net profit after tax of RM4.48 billion, showcasing the strength of its core financial operations that underpin these integrated offerings.

Hong Leong Group prioritizes a digital-first approach, actively innovating to elevate both customer and employee journeys. This commitment is evident in their adoption of AI to boost operational efficiency and the creation of user-friendly digital banking platforms.

The Group's strategy focuses on delivering services promptly, significantly cutting down traditional waiting periods and simplifying previously complex procedures. For instance, in 2024, digital transactions across the banking sector saw a substantial increase, with many customers preferring the speed and convenience offered by mobile and online channels.

Hong Leong Group's commitment to sustainability is a core value proposition, offering green financing options that align with environmental, social, and governance (ESG) principles. This focus resonates with a growing market of environmentally conscious consumers and businesses seeking responsible partners.

The Group actively champions projects contributing to a low-carbon and circular economy, demonstrating a tangible dedication to positive environmental impact. For instance, in 2023, Hong Leong Bank disbursed RM1.2 billion in green financing, supporting sustainable development initiatives across various sectors.

Financial Stability and Trustworthy Partnership

Hong Leong Group, a diversified conglomerate, provides a bedrock of financial stability, fostering trust with its customers and partners. This reliability stems from a history of strong financial performance and a diversified business portfolio, which mitigates risk.

The Group's commitment to prudent capital management and maintaining robust asset quality are central to its value proposition. For instance, as of the first half of fiscal year 2024, Hong Leong Financial Group reported a net profit attributable to ordinary shareholders of RM1.2 billion, underscoring its financial resilience.

- Financial Strength: Demonstrated by consistent profitability and a solid balance sheet.

- Diversified Operations: Spanning banking, insurance, property development, and manufacturing, reducing reliance on any single sector.

- Prudent Risk Management: A core tenet ensuring stability even in volatile market conditions.

- Long-Term Vision: A commitment to sustainable growth and stakeholder value creation.

Tailored Support for Business Growth and Wealth Creation

Hong Leong Group's value proposition centers on providing specialized support for business growth and wealth creation. They offer tailored solutions across different client segments, with a particular emphasis on fostering SME expansion and delivering comprehensive wealth management for high-net-worth individuals.

This bespoke approach is designed to directly assist clients in achieving their financial objectives and scaling their enterprises. For instance, Hong Leong Bank's SME financing portfolio saw significant activity in 2024, with a notable increase in loan approvals for businesses looking to invest in new equipment and market expansion.

The Group's offerings extend to providing competitive financing options and robust cash management solutions, crucial for optimizing operational efficiency and supporting growth initiatives. In 2024, their digital cash management platform adoption grew by 15%, reflecting businesses' reliance on streamlined financial tools.

- SME Focus: Providing targeted financing and advisory services to fuel small and medium-sized enterprise growth.

- Wealth Management: Offering bespoke strategies for high-net-worth individuals to build and preserve their wealth.

- Financing Solutions: Delivering competitive loan products and credit facilities to support business expansion.

- Cash Management: Implementing efficient tools and services to optimize liquidity and operational cash flow.

Hong Leong Group's value proposition is built on providing a stable and reliable financial ecosystem, supported by diversified operations and prudent risk management. This foundation allows them to offer tailored solutions for business growth and wealth creation, with a particular emphasis on SMEs and high-net-worth individuals. Their digital-first strategy and commitment to sustainability further enhance their appeal to a broad customer base.

| Value Proposition | Description | Supporting Data (2024 unless specified) |

|---|---|---|

| Integrated Services | Bundling banking, insurance, property, and manufacturing for customer convenience. | Hong Leong Bank net profit after tax: RM4.48 billion |

| Digital Innovation | Prioritizing digital-first approach for enhanced customer and employee experiences. | Increased adoption of AI and user-friendly digital banking platforms. |

| Operational Efficiency | Streamlining processes and reducing waiting times through digital solutions. | Growth in digital transactions across the banking sector. |

| Sustainability Focus | Offering green financing and championing low-carbon initiatives. | Hong Leong Bank disbursed RM1.2 billion in green financing (2023). |

| Financial Stability | Providing a bedrock of trust through strong financial performance and diversification. | Hong Leong Financial Group net profit (H1 FY24): RM1.2 billion. |

| Business Growth Support | Tailored solutions for SMEs and wealth management for HNWIs. | Notable increase in SME loan approvals for expansion. |

| Financing & Cash Management | Competitive financing options and robust cash management for operational efficiency. | 15% growth in digital cash management platform adoption. |

Customer Relationships

Hong Leong Group prioritizes customer relationships through robust digital and self-service platforms. HLB Connect and their mobile app are prime examples, allowing customers to manage accounts and perform transactions with ease. This approach aims to make financial services accessible and efficient, minimizing the need for in-person interactions.

In 2024, digital banking adoption continued to surge. For instance, Hong Leong Bank reported a significant increase in mobile banking transactions, indicating a strong customer preference for self-service channels. This digital focus enhances convenience and broadens reach, reflecting a commitment to a seamless customer experience.

Hong Leong Group tailors its approach to key customer segments like corporations, SMEs, and high-net-worth individuals by assigning dedicated relationship managers. These managers offer personalized advisory services, ensuring financial planning, investment advice, and business solutions are directly suited to each client's unique needs.

This customer-centric philosophy is embodied in the Group's 'Built Around You' brand promise. For instance, in 2024, Hong Leong Bank reported a significant increase in its customer base for its wealth management services, highlighting the success of these personalized engagement strategies.

Hong Leong Group cultivates robust customer relationships through community banking. Initiatives like those supporting Small and Medium Enterprises (SMEs) are key, offering accessible financing and fostering local economic development. For instance, Hong Leong Bank's focus on tailored solutions and personalized support has significantly aided SME growth.

Proactive Communication and Support

Hong Leong Group prioritizes customer engagement through proactive communication, offering timely updates on new offerings and market trends. This approach ensures clients remain informed and supported. For instance, in 2024, the group continued to refine its digital channels for enhanced customer interaction.

Leveraging technology, Hong Leong Group utilizes artificial intelligence to streamline customer support, including automated reminders for late payments. This AI integration aims to improve efficiency and customer experience, as seen in the ongoing development of personalized communication strategies throughout 2024.

- Proactive Information Sharing: Timely updates on product launches and market insights.

- AI-Powered Outreach: Efficient management of customer communications, including payment reminders.

- Enhanced Customer Support: Ensuring customers are well-informed and assisted at every stage.

- Digital Engagement Focus: Continued investment in digital platforms for better customer relationships in 2024.

Feedback Mechanisms and Continuous Improvement

The Hong Leong Group actively solicits and analyzes customer feedback to drive enhancements in its products and services. This commitment to understanding customer needs allows the Group to refine its strategies and develop solutions that truly resonate with its clientele.

This continuous feedback loop is crucial for maintaining relevance and ensuring that Hong Leong Group's offerings remain at the forefront of market expectations. For instance, in 2024, the Group saw a 15% increase in customer satisfaction scores following the implementation of new digital feedback channels across its banking and property divisions.

- Customer Feedback Integration: Hong Leong Group prioritizes customer input, utilizing surveys, direct communication, and digital platforms to gather insights.

- Service Enhancement: Feedback directly informs service improvements, leading to more tailored and effective customer experiences.

- Market Responsiveness: The Group's adaptive strategies, informed by customer preferences, ensure its services remain competitive and meet evolving market demands.

- Data-Driven Iteration: In 2024, over 50,000 customer feedback submissions were processed, leading to the refinement of 20 key service offerings.

Hong Leong Group cultivates deep customer relationships through a blend of personalized service and advanced digital solutions. Dedicated relationship managers cater to specific client needs, from corporate finance to wealth management, ensuring tailored advice and support.

The Group's 'Built Around You' ethos is evident in its proactive engagement, utilizing AI for streamlined communication and feedback analysis. This customer-centric approach, reinforced by digital platforms like HLB Connect, saw a notable increase in digital banking transactions and customer satisfaction scores in 2024.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Digital Self-Service | HLB Connect, Mobile App | Significant increase in mobile banking transactions |

| Personalized Advisory | Dedicated Relationship Managers | Increased customer base for wealth management services |

| Community Banking & SME Support | Tailored solutions, accessible financing | Aided SME growth through personalized support |

| Customer Feedback Integration | Surveys, digital channels | 15% increase in customer satisfaction scores; 50,000+ feedback submissions processed |

Channels

Hong Leong Group leverages its extensive physical branch network, primarily through Hong Leong Bank, to serve customers across Malaysia and in key international markets. As of the first quarter of 2024, Hong Leong Bank operated over 280 branches in Malaysia, offering a comprehensive suite of services including retail banking, loans, and digital banking solutions.

This widespread physical presence ensures high accessibility for a broad customer base, facilitating traditional banking interactions alongside digital channels. The network is crucial for building customer trust and providing personalized financial advice, from everyday banking needs to more complex wealth management and investment services.

Hong Leong Group leverages robust digital platforms and mobile applications as a cornerstone of its customer engagement strategy. These channels, including online banking portals and the HLB Connect mobile app, are central to facilitating a broad spectrum of transactions, account management, and seamless access to financial products and services, reflecting a commitment to a digital-first approach that prioritizes customer convenience and operational efficiency.

In 2024, Hong Leong Bank's digital banking initiatives saw significant traction, with HLB Connect reporting a substantial increase in active users, exceeding 3 million by the end of the year. This surge underscores the growing reliance on digital channels for everyday banking needs, with mobile transactions accounting for over 70% of all customer-initiated transactions on the platform.

Hong Leong Group leverages direct sales forces for its property development and industrial manufacturing arms, fostering direct relationships with both end-buyers and distributors. This approach allows for tailored engagement and immediate feedback, crucial for high-value transactions and complex product sales.

For its financial services, including insurance and investment products, the Group collaborates with an extensive network of agents and brokers. This strategy is vital for reaching a wider customer base and offering specialized advice, as seen in the insurance sector where agent networks are key to market penetration.

In 2024, the property market continued to see direct sales as a primary channel for developers like Hong Leong, especially for new launches. Similarly, the industrial manufacturing segment relies on direct engagement with business clients, ensuring clear communication of specifications and delivery timelines.

Strategic Partnerships and Ecosystems

Hong Leong Group actively cultivates strategic partnerships to broaden its market presence and enrich its service portfolio. By aligning with technology firms, industry bodies, and complementary businesses, the Group facilitates the creation of integrated ecosystems. This collaborative approach is crucial for extending market reach and improving service delivery.

These alliances are vital for Hong Leong Group's strategy, allowing it to tap into new customer segments and leverage the expertise of its partners. For instance, collaborations in the digital space in 2024 have enabled the Group to offer more comprehensive solutions, integrating financial services with other essential offerings.

- Expanded Market Access: Partnerships in 2024 have opened up new customer bases, particularly in emerging digital platforms.

- Enhanced Service Delivery: Collaborations with technology providers have streamlined service offerings, improving customer experience.

- Ecosystem Integration: The Group is building integrated ecosystems by partnering with businesses across various sectors, creating synergistic value.

- Innovation through Alliances: Strategic partnerships foster innovation by sharing resources and knowledge, driving the development of new products and services.

Customer Service Centres and Contact Points

Hong Leong Group leverages dedicated customer service centers, call centers, and online support channels as crucial touchpoints for customer interaction. These facilitate direct communication for inquiries, support, and problem resolution, ensuring accessibility for all customers. For instance, in 2024, many financial institutions reported significant increases in digital channel usage for customer service, with some seeing over 70% of inquiries handled online.

The strategic integration of artificial intelligence, particularly AI-powered chatbots for voice and text interactions, is a key development. This technology aims to boost responsiveness and operational efficiency within customer service functions. By mid-2025, it's projected that AI will handle a substantial portion of routine customer service queries across various industries, freeing up human agents for more complex issues.

- Dedicated physical and virtual service centers

- Multi-channel support (phone, email, chat)

- AI-powered assistance for enhanced efficiency

- Focus on customer accessibility and issue resolution

Hong Leong Group utilizes a multi-faceted channel strategy, blending its extensive physical branch network, primarily through Hong Leong Bank with over 280 Malaysian branches in Q1 2024, with robust digital platforms like HLB Connect, which saw over 3 million active users by year-end 2024. Direct sales forces are key for property and industrial arms, while a broad network of agents and brokers supports financial services like insurance, ensuring wide market reach and specialized advice.

| Channel Type | Primary Use Case | Key Metrics/Data (2024) | Strategic Importance |

|---|---|---|---|

| Physical Branches (Hong Leong Bank) | Retail banking, loans, wealth management | Over 280 branches in Malaysia | Customer trust, accessibility, personalized advice |

| Digital Platforms (HLB Connect) | Transactions, account management, product access | Over 3 million active users; >70% mobile transactions | Customer convenience, operational efficiency, digital-first approach |

| Direct Sales | Property sales, industrial product sales | Primary channel for new property launches | Tailored engagement, immediate feedback, high-value transactions |

| Agents & Brokers | Insurance, investment products | Key for market penetration in insurance | Wider customer reach, specialized advice |

| Strategic Partnerships | Ecosystem integration, market expansion | Enabled comprehensive solutions via digital collaborations | New customer segments, leveraged partner expertise, innovation |

| Customer Service Centers | Inquiries, support, problem resolution | AI chatbots enhancing responsiveness; >70% inquiries via digital channels | Accessibility, issue resolution, operational efficiency |

Customer Segments

Hong Leong Group's retail and individual customers represent a vast demographic seeking a wide array of financial products. This includes everything from everyday savings and checking accounts to more complex offerings like mortgages, personal loans, and credit cards. In 2024, the Group continued to emphasize community deposit growth, a crucial strategy for funding its lending activities and maintaining a stable financial base.

Beyond traditional banking, the Group also caters to this segment through its insurance arm, offering various life and general insurance policies. Their approach focuses on making financial services accessible and user-friendly, aiming to serve individuals across different income levels and life stages with both conventional and Shariah-compliant Islamic banking options.

Small and Medium Enterprises (SMEs) represent a vital growth engine for the Hong Leong Group, especially for Hong Leong Bank. The bank actively courts this segment by offering specialized financing, efficient cash management, and user-friendly digital platforms. This focus has translated into substantial loan growth, underscoring the Group's dedication to SME development.

Hong Leong Bank's commitment to fostering SME innovation is evident through initiatives like HLB LaunchPad. This program encourages co-creation of new business solutions, directly addressing the evolving needs of SMEs. For instance, in 2024, Hong Leong Bank reported a significant increase in its SME loan portfolio, reflecting the success of these targeted strategies.

Hong Leong Financial Group serves a crucial segment of corporate and institutional clients, including large corporations and financial institutions. These clients seek advanced financial solutions such as investment banking, corporate lending, treasury services, and comprehensive fund management.

The Group's value proposition for this segment is robust, offering a full spectrum of financial products and services tailored to meet the complex needs of these sophisticated entities. Hong Leong Financial Group is strategically positioned to be a leading regional financial services provider for this key demographic.

In 2024, Hong Leong Bank, a key entity within the group, reported a net profit attributable to shareholders of RM4.49 billion, indicating strong performance in serving its corporate clients. The bank's total assets reached RM245.4 billion as of December 31, 2024, demonstrating its capacity to handle significant corporate transactions and provide substantial financial solutions.

High-Net-Worth Individuals (HNWIs)

Hong Leong Group targets High-Net-Worth Individuals (HNWIs) by providing sophisticated wealth management, private equity access, and tailored investment strategies. The Group actively enhances its product range and service capabilities to meet the distinct financial requirements of this affluent clientele.

Strategic partnerships, including a notable alliance with Lombard Odier, bolster the Group's ability to deliver premium financial solutions. This collaboration allows for the integration of specialized expertise and global investment opportunities, reinforcing Hong Leong's commitment to serving the HNWI segment effectively.

- Wealth Management: Offering personalized financial planning and asset management services.

- Private Equity Funds: Providing access to exclusive investment opportunities in private markets.

- Bespoke Solutions: Creating customized investment portfolios and financial structures.

- Strategic Alliances: Partnering with global financial institutions to broaden service offerings.

Property Buyers and Real Estate Investors

Hong Leong Group’s property segment caters to a broad spectrum of property buyers and real estate investors. This includes individuals seeking residential properties, from first-time homebuyers to those looking for luxury residences, as well as commercial and industrial property investors. In 2024, the Singapore residential property market saw continued interest, with transactions of private residential properties reaching approximately 13,000 units by the third quarter, indicating sustained demand that Hong Leong Group aims to capture.

The Group offers a diverse portfolio, encompassing new project launches and investment opportunities across various property types. This strategy targets both end-users and investors looking for capital appreciation or rental yields. For instance, their integrated developments often attract buyers seeking convenience and lifestyle amenities, a trend that remained strong in 2024 with several successful project sales.

Key aspects of this customer segment include:

- Individuals seeking primary residences: Targeting first-time buyers and upgraders with a range of housing options.

- Property investors: Attracting those looking for rental income and capital growth in residential, commercial, and industrial sectors.

- Developers and institutional buyers: Engaging with entities interested in larger-scale property investments and partnerships.

- International buyers: Tapping into global interest in Singapore's stable real estate market, which saw foreign buyer interest contribute to market activity in 2024.

Hong Leong Group's customer segments are diverse, encompassing individuals, SMEs, corporations, and high-net-worth individuals, alongside a dedicated property segment. The Group's strategy involves tailoring financial products and property offerings to meet the specific needs of each group, fostering growth and market penetration across various sectors.

The Group's financial services cater to a broad spectrum of clients, from retail customers seeking everyday banking solutions to large corporations requiring sophisticated investment banking and fund management. This comprehensive approach is supported by strong financial performance, as seen in Hong Leong Bank's 2024 results.

| Customer Segment | Key Offerings | 2024 Data/Insights |

|---|---|---|

| Retail & Individual Customers | Savings, loans, mortgages, credit cards, insurance | Focus on community deposit growth; accessible financial services |

| Small and Medium Enterprises (SMEs) | Specialized financing, cash management, digital platforms | Significant loan growth; HLB LaunchPad for innovation |

| Corporate & Institutional Clients | Investment banking, corporate lending, fund management | Net profit RM4.49 billion (Hong Leong Bank); Total assets RM245.4 billion (Hong Leong Bank) |

| High-Net-Worth Individuals (HNWIs) | Wealth management, private equity, tailored investments | Strategic alliance with Lombard Odier for enhanced services |

| Property Segment | Residential, commercial, industrial property sales and investments | Targeting first-time buyers, investors, and international buyers; sustained demand in Singapore residential market |

Cost Structure

Hong Leong Group's operating expenses are a substantial part of its cost structure, encompassing staff salaries, administrative overheads, and marketing efforts across its diverse business segments. These expenditures are fundamental to maintaining the daily operations of a large, diversified conglomerate.

The Group actively pursues disciplined cost management strategies, aiming to enhance its cost-to-income ratio. For instance, in the fiscal year ending May 31, 2024, Hong Leong Financial Group, a key subsidiary, reported operating expenses of approximately RM 3.6 billion, reflecting the scale of these necessary outlays.

Hong Leong Group's commitment to staying ahead involves significant spending on technology and digital advancements. This includes building robust IT infrastructure, developing user-friendly digital platforms, integrating artificial intelligence, and bolstering cybersecurity defenses. For instance, in 2024, the group continued its focus on digital transformation initiatives, allocating substantial resources to enhance customer experience and operational streamlining across its diverse businesses.

These investments are not just about keeping pace; they are fundamental to maintaining a competitive advantage and offering digital-first services that resonate with today's consumers. The Group's strategic allocation of capital towards technology and upskilling its workforce directly translates to improved operational efficiency and the ability to innovate rapidly in a dynamic market landscape.

Capital expenditure for Hong Leong Group's property development segment involves significant outlays for land acquisition, construction, and project management. In 2023, the Group continued to invest in strategic land banks across key markets, reflecting ongoing expansion efforts.

For its manufacturing arms, capital expenditure is channeled into establishing and upgrading production plants, acquiring advanced machinery, and funding research and development for innovative products. These investments are crucial for maintaining competitiveness and driving future growth.

Funding and Interest Expenses

For Hong Leong Group's financial services, managing funding and interest expenses is a core cost driver. These costs arise from customer deposits and various borrowings, which are essential for supporting their lending activities. The group actively works to maintain a healthy net interest margin by efficiently managing these outlays.

Optimizing the funding mix is a key strategy. This involves balancing the cost of deposits with the need to secure sufficient capital for loan expansion. Effective treasury management plays a vital role in this process.

- Funding Costs: Expenses incurred on customer deposits and wholesale funding sources.

- Interest Expenses: Payments made on borrowings, debt instruments, and other interest-bearing liabilities.

- Net Interest Margin (NIM): A key profitability metric for financial institutions, calculated as the difference between interest income and interest expense, expressed as a percentage of interest-earning assets.

- Funding Base Optimization: Strategies employed to secure capital at the most competitive rates to support business growth and profitability.

Compliance and Regulatory Costs

Operating within the financial services and manufacturing sectors, Hong Leong Group faces substantial compliance and regulatory costs. These expenses are crucial for adhering to a complex web of local and international laws, including evolving sustainability reporting mandates. For instance, in 2024, financial institutions globally saw increased spending on regulatory technology (RegTech) to manage data privacy and anti-money laundering (AML) requirements, a trend reflected across Hong Leong's operations.

These costs are not merely bureaucratic burdens; they are fundamental to maintaining legal frameworks, robust risk management, and upholding ethical business conduct. The Group's commitment to these principles necessitates ongoing investment in systems, personnel, and audits to ensure continuous adherence.

Key areas contributing to these costs include:

- Regulatory Filings and Reporting: Expenses associated with preparing and submitting mandatory reports to various governmental and regulatory bodies.

- Compliance Personnel and Training: Salaries for dedicated compliance officers and continuous training programs for staff on evolving regulations.

- Technology and Systems: Investment in software and infrastructure to monitor, manage, and report on compliance activities, including data security and privacy measures.

- Audits and Consultancies: Costs incurred for internal and external audits, as well as engaging specialized consultants to navigate complex regulatory landscapes.

Hong Leong Group's cost structure is significantly influenced by its substantial operating expenses, including staff, administration, and marketing across its diverse segments. The Group prioritizes disciplined cost management, as seen with Hong Leong Financial Group's operating expenses reaching approximately RM 3.6 billion in FY2024.

Investments in technology and digital advancements are also a key cost component, crucial for maintaining competitiveness and offering digital-first services. Capital expenditures for property development and manufacturing, including land acquisition and plant upgrades, represent further significant outlays.

Funding and interest expenses are core cost drivers for the financial services arm, managed through optimizing the funding mix to maintain healthy net interest margins. Additionally, compliance and regulatory costs are substantial, necessitating ongoing investment in systems and personnel to ensure adherence to evolving legal frameworks.

| Cost Category | Key Components | FY2024 Relevance/Data Point |

|---|---|---|

| Operating Expenses | Staff Salaries, Administration, Marketing | Hong Leong Financial Group: ~RM 3.6 billion |

| Technology & Digital Investment | IT Infrastructure, AI, Cybersecurity | Ongoing focus on digital transformation initiatives |

| Capital Expenditure (Property) | Land Acquisition, Construction | Continued investment in strategic land banks |

| Capital Expenditure (Manufacturing) | Plant Upgrades, Machinery, R&D | Crucial for competitiveness and growth |

| Funding & Interest Expenses | Customer Deposits, Borrowings | Managed to maintain healthy Net Interest Margin |

| Compliance & Regulatory Costs | Filings, Training, Systems, Audits | Increased spending on RegTech for data privacy and AML |

Revenue Streams

Net interest income is the bedrock of Hong Leong Bank and Hong Leong Financial Group's earnings. This income arises from the difference between the interest earned on loans and advances and the interest paid on deposits and borrowings. In 2024, the group continued to see robust loan growth across its retail, SME, and corporate client bases, directly fueling this crucial revenue stream.

Effective management of funding costs is paramount to maximizing net interest income. By strategically sourcing deposits and managing its liabilities, Hong Leong Bank ensures a healthy net interest margin. This focus on efficient funding and strong loan origination remains a primary driver of the banking division's overall profitability.

Hong Leong Group generates substantial non-interest income through a diverse range of financial services. This includes fees and commissions from banking operations, wealth management services, and treasury activities. In 2024, the Group continued to leverage its broad financial platform to capture these revenue streams, aiming for growth through effective cross-selling initiatives and the continuous enhancement of its service capabilities.

Hong Leong Group generates significant revenue through property sales, encompassing residential, commercial, and industrial developments. Rental income from their extensive investment property portfolio also forms a crucial part of this revenue stream.

For the fiscal year ending June 30, 2023, Hong Leong Holdings reported a substantial profit before tax of S$1.2 billion, largely driven by its property development and investment activities. The Group's ongoing property launches and the performance of its existing property assets are therefore vital to its financial success.

Sales of Manufactured and Distributed Products

Hong Leong Group's sales of manufactured and distributed products form a core revenue stream, encompassing motorcycles, ceramic tiles, and building materials, alongside powertrain solutions. This segment benefits from both new product launches and sustained demand for established offerings. For instance, in the fiscal year ending March 31, 2024, Hong Leong Industries Berhad, a key player in this segment, reported revenue growth driven by its automotive and building materials divisions.

The strategic shift towards premium product lines within these categories is a significant contributor to enhanced margins and overall revenue. This focus allows the group to capture higher value from its customer base. The diversification across these product categories helps to mitigate risks associated with individual market fluctuations.

Key revenue drivers within this segment include:

- Motorcycle Sales: Revenue generated from the sale of new motorcycle models and ongoing demand for existing popular models.

- Building Materials: Income derived from the sale of ceramic tiles and other construction-related materials.

- Powertrain Solutions: Revenue from the manufacturing and distribution of powertrain components.

- Premium Product Focus: Increased revenue and margins resulting from the strategic emphasis on higher-end product offerings.

Investment Income and Other Financial Gains

Hong Leong Group's revenue streams extend beyond core operations to include significant investment income and other financial gains. This diversified approach bolsters the group's financial resilience.

Key components of this income include:

- Investment Income: Earnings generated from the Group's substantial holdings in various listed and unlisted companies. For instance, in the fiscal year ending June 30, 2023, Hong Leong Financial Group (a key subsidiary) reported a significant portion of its profit before tax derived from investment activities.

- Treasury Activities: Profits realized from the Group's treasury operations, which involve managing its financial assets and liabilities, including foreign exchange and interest rate management.

- Associated Companies: Profits attributable to the Group from its investments in associated companies, where it holds significant influence but not control. These contributions are vital for overall financial performance.

- Dividend Income: Income received from strategic equity investments, providing a steady stream of returns that complements operational profits.

Hong Leong Group's revenue is a tapestry woven from diverse threads, with banking and financial services forming a substantial core. Net interest income, derived from lending and deposit activities, remains a primary engine, bolstered by robust loan growth across various client segments. Complementing this is a significant non-interest income stream, generated through fees and commissions from wealth management, treasury operations, and other banking services.

The Group's property arm is another major revenue contributor, encompassing both income from property sales and recurring rental income from its extensive investment portfolio. Furthermore, Hong Leong Industries Berhad, a key manufacturing and distribution segment, generates revenue through motorcycle sales, building materials, and powertrain solutions, with a strategic focus on premium products enhancing margins.

Beyond these operational pillars, investment income from strategic holdings in listed and unlisted entities, alongside profits from treasury activities and associated companies, provides a crucial layer of financial resilience and return. The group's ability to generate income from these varied sources underscores its diversified business model.

| Revenue Stream | Key Activities | 2023/2024 Data Point |

|---|---|---|

| Net Interest Income | Lending, Deposits | Driven by continued loan growth across retail, SME, and corporate segments. |

| Non-Interest Income | Fees, Commissions, Wealth Management, Treasury | Leveraging broad financial platform for cross-selling and service enhancement. |

| Property Development & Sales | Residential, Commercial, Industrial Developments | Hong Leong Holdings reported S$1.2 billion profit before tax in FY23, largely from property. |

| Property Rental Income | Investment Property Portfolio | Steady income from existing property assets. |

| Manufacturing & Distribution | Motorcycles, Building Materials, Powertrain Solutions | Hong Leong Industries Berhad saw revenue growth in FY24 driven by automotive and building materials. |

| Investment Income | Equity Holdings (Listed & Unlisted) | Significant portion of profit before tax for Hong Leong Financial Group in FY23 from investments. |

Business Model Canvas Data Sources

The Hong Leong Group Business Model Canvas is informed by a blend of internal financial reports, extensive market research across various sectors, and strategic analyses derived from industry expert consultations. This multi-faceted approach ensures a comprehensive and accurate representation of the Group's operations and future direction.