Hong Leong Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hong Leong Group Bundle

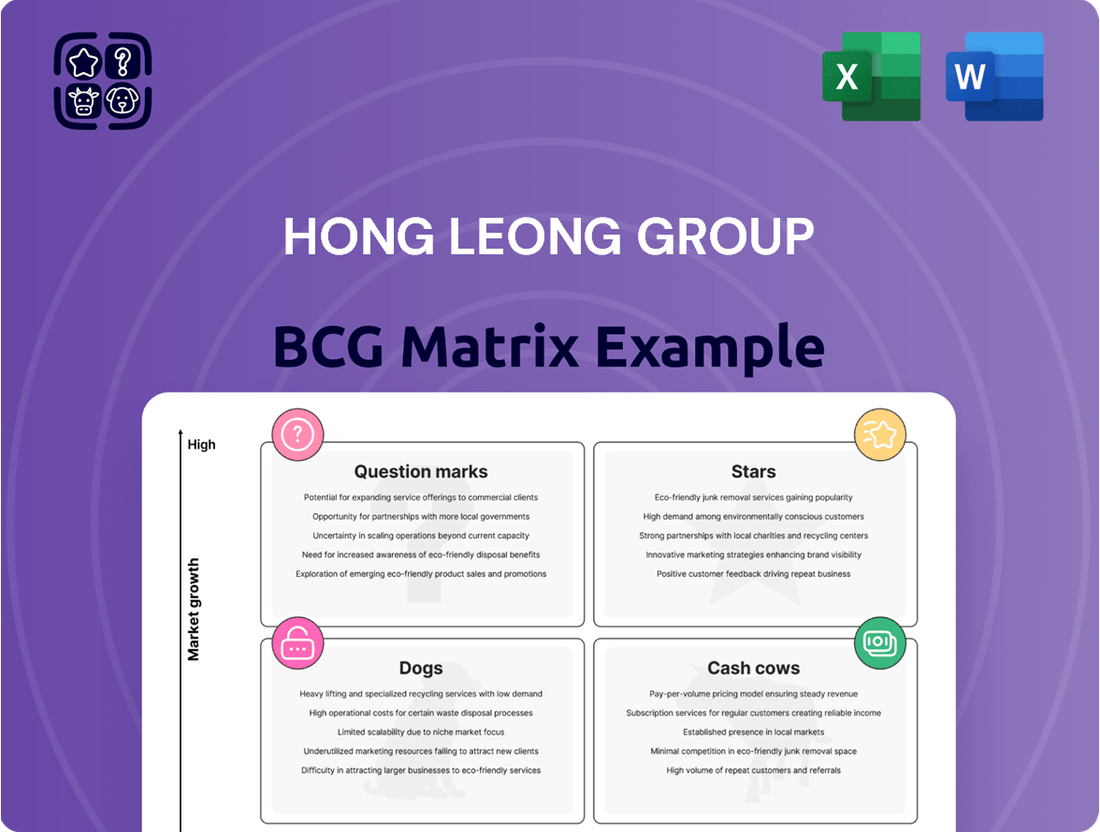

Curious about Hong Leong Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their strengths lie and where opportunities for growth might be.

To truly unlock the strategic advantage, dive deeper with the full Hong Leong Group BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the complete picture; purchase the full BCG Matrix report today for detailed quadrant analysis, actionable insights, and a clear roadmap to optimize Hong Leong Group's business strategy and secure a competitive edge.

Stars

Hong Leong Bank's aggressive digital transformation, marked by significant upgrades to its HLB Connect App and streamlined digital onboarding for businesses, clearly places its digital banking and fintech solutions in the Star category of the BCG Matrix. This strategic focus is designed to capture a larger market share by offering a superior, tech-driven customer experience.

The bank's commitment to innovation is further evidenced by strategic collaborations, such as its partnership with WeBank Technology Services. This move aims to bolster its digital offerings and reinforce its identity as a forward-thinking, digital-first bank. In 2024, Hong Leong Bank reported a 12% increase in digital transactions, underscoring the success of these initiatives.

Hong Leong Bank's inaugural Sustainable Finance Framework (SFF) is a significant move, targeting the mobilization of US$4.5 billion (RM20 billion) for green projects over five years. This commitment underscores a strategic focus on high-growth areas like renewable energy, green buildings, and affordable housing, reflecting a burgeoning market with substantial demand.

The bank's proactive embrace of Environmental, Social, and Governance (ESG) considerations as a primary growth driver positions its sustainable finance offerings as a clear Star within the BCG Matrix. This strategic alignment taps into increasing investor and regulatory pressure for sustainable business practices.

Hong Leong Industries' strategic focus on premium motorcycle models like the Yamaha PG-1, MT-09, XMAX 2025, and TMAX Tech Max 2025, supported by price increases and expanded production for these new releases, highlights a market segment with substantial growth potential and robust profit margins. This deliberate pivot suggests a strategy aimed at capturing higher value within the motorcycle market.

These premium offerings are positioned to be either volume-driven or margin-driven, reflecting a calculated move towards more lucrative and expanding areas of the industry. The sustained strong consumer interest in these newly introduced models solidifies their classification as Stars in the BCG Matrix.

Strategic Property Developments (Singapore)

Strategic Property Developments (Singapore) represents a significant Star in the Hong Leong Group's BCG Matrix. These are joint ventures in Singapore, such as the Lentor Central Residences and Springleaf Residence, which are positioned in high-growth property segments.

These developments are strategically located in areas with limited new home supply, driving strong sales performance and underscoring high market demand. For instance, Lentor Central Residences, a joint venture with GuocoLand and Hong Leong Holdings, saw robust initial sales, with over 80% of units sold during its launch weekend in September 2023.

- High Market Demand: Projects like Lentor Central Residences achieved strong sales, with over 80% of units sold during its launch weekend in September 2023, indicating robust demand in supply-constrained areas.

- Strategic Location: Developments are situated in areas with limited new home supply, a key factor contributing to their success.

- Future-Oriented Design: Projects integrate nature-centric designs, green infrastructure, and smart technologies, aligning with evolving urban development trends and consumer preferences.

- Joint Venture Strength: Partnerships, such as the one for Lentor Central Residences with GuocoLand, leverage combined expertise and market access, bolstering project viability and appeal.

New Energy Powertrain Solutions (Hong Leong Asia)

New Energy Powertrain Solutions, primarily through China Yuchai International Limited (CYI), is a burgeoning segment for Hong Leong Asia. In fiscal year 2024, this division experienced remarkable growth, with unit sales climbing by 50.2% and revenue surging by 61.9%.

The strategic focus on hybrid engines, designed for enhanced fuel efficiency, and their increasing adoption in public transportation networks, signals a market poised for substantial expansion. This dedication to developing low-carbon alternatives firmly places this segment as a Star within the BCG matrix, despite its ongoing scaling efforts.

- Segment: New Energy Powertrain Solutions (via China Yuchai International Limited)

- FY2024 Performance: Unit sales +50.2%, Revenue +61.9%

- Market Focus: Hybrid engines, public transport deployment

- BCG Matrix Classification: Star (High growth, potential)

Hong Leong Bank's aggressive digital transformation, exemplified by its HLB Connect App and streamlined business onboarding, firmly places its digital banking services in the Star category. This strategic push aims to capture significant market share through a superior, tech-driven customer experience, further bolstered by collaborations like the one with WeBank Technology Services.

The bank's commitment to sustainable finance, with its inaugural Sustainable Finance Framework targeting US$4.5 billion in green project mobilization over five years, also positions it as a Star. This focus on renewable energy and green buildings taps into a rapidly growing market driven by investor and regulatory demand for ESG practices.

Hong Leong Industries' emphasis on premium motorcycle models, such as the Yamaha PG-1 and MT-09, supported by price adjustments and expanded production, signifies a Star in the BCG Matrix. These offerings cater to a high-growth segment with strong profit potential, evidenced by sustained consumer interest in new releases.

New Energy Powertrain Solutions, primarily through China Yuchai International Limited, is another Star. In fiscal year 2024, this division saw unit sales rise by 50.2% and revenue by 61.9%, driven by hybrid engines for public transport, indicating a market poised for substantial expansion.

| Business Segment | BCG Category | Key Growth Drivers | FY2024 Performance Highlight |

|---|---|---|---|

| Digital Banking & Fintech | Star | Digital transformation, app upgrades, strategic partnerships | 12% increase in digital transactions |

| Sustainable Finance | Star | ESG focus, green project mobilization, renewable energy | Targeting US$4.5 billion in green financing |

| Premium Motorcycles | Star | New model launches, premium segment focus, expanded production | Strong consumer interest in new releases |

| New Energy Powertrain Solutions | Star | Hybrid engines, public transport adoption, low-carbon alternatives | Unit sales +50.2%, Revenue +61.9% |

What is included in the product

The Hong Leong Group BCG Matrix offers strategic guidance on which business units to invest in, hold, or divest based on their market growth and share.

The Hong Leong Group BCG Matrix offers a clear, visual overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

Hong Leong Bank's core commercial banking operations are a prime example of a cash cow within the Hong Leong Group. This division consistently generates substantial profits through its robust loan and financing activities, alongside a strong contribution from non-interest income.

In 2024, the bank saw its domestic loans and financing grow by an impressive 8.0% year-on-year, a rate that outpaced the broader industry. This growth, coupled with a healthy asset quality and a solid capital position, highlights the stability and reliable cash-generating capacity of this mature business segment.

Hong Leong Assurance stands as a robust cash cow within the Hong Leong Group's BCG Matrix. Ranking among Malaysia's top five life insurers with an impressive 8.3% market share, it consistently delivers strong profits.

While annual premium equivalent (APE) volumes have seen moderation due to prevailing market conditions, the company's strategic emphasis on protection-based policies ensures remarkable earnings stability.

Its extensive and well-established agency force, coupled with privileged access to Hong Leong Bank's extensive branch network, provides a formidable distribution capability, solidifying its position as a reliable and consistent cash generator.

GuocoLand's prime investment properties, such as the fully sold Lentor Modern and the nearly sold-out Lentor Hills Residences, exemplify strong cash cows within the Hong Leong Group's BCG matrix. These developments have achieved high market share in established, desirable property markets, reflecting their mature investment status and ability to generate substantial, consistent cash flow.

The robust sales performance of these projects, with Lentor Modern being fully sold and Lentor Hills Residences nearing completion with high occupancy rates, underscores their capacity to provide stable and predictable returns. This consistent demand and successful sales trajectory are hallmarks of a cash cow, indicating mature assets with strong market positions that require minimal further investment to maintain their profitability.

Building Materials Segment (Hong Leong Asia)

Hong Leong Asia's Building Materials Unit (BMU) is a prime example of a Cash Cow within the Hong Leong Group's BCG Matrix. This segment is currently riding a significant upcycle in the construction industry, particularly boosted by substantial infrastructure and Housing & Development Board (HDB) projects in Singapore. The consistent demand for its products, such as cement and concrete, underpins its stable cash-generating capabilities.

The BMU boasts a robust order book extending into 2025, reflecting its dominant market share within a mature and stable industry. This strong position ensures a predictable and reliable stream of revenue, contributing significantly to the group's overall financial health. The segment's ability to consistently generate cash without requiring substantial new investment is a hallmark of a Cash Cow.

- Strong Market Position: The BMU holds a high market share in the stable building materials sector.

- Favorable Industry Trends: Benefits from the ongoing construction industry upcycle, driven by Singapore's infrastructure and HDB developments.

- Consistent Cash Generation: A strong order book ensures reliable and predictable cash inflows.

- Mature Industry Dynamics: Operates in a stable, established market, reducing the need for aggressive expansion capital.

Fixed Income and Money Market Investments (HLFG)

Hong Leong Financial Group (HLFG) strategically manages a robust portfolio of fixed income and money market investments as a core component of its diversified financial services. These instruments are crucial for generating stable and predictable returns, particularly within the mature financial markets where HLFG operates.

These investments act as a steadying force, contributing consistently to the group's overall profitability. While precise market share data for these specific segments isn't always publicly disclosed, HLFG's broad financial services umbrella ensures these assets play a vital role in its financial health.

- Stable Returns: Fixed income and money market instruments are known for their lower volatility and reliable income streams.

- Portfolio Diversification: They help balance risk within HLFG's broader investment and business portfolio.

- Liquidity Management: Money market instruments, in particular, offer high liquidity, ensuring the group can meet short-term obligations.

- Consistent Profitability: These investments are designed to provide a predictable contribution to the group's bottom line.

Hong Leong Bank's Malaysian operations continue to be a strong cash cow, with its domestic loan portfolio showing resilience. In 2024, the bank reported a net profit attributable to ordinary shareholders of RM3.3 billion, demonstrating the consistent profitability of its core banking activities.

Hong Leong Assurance remains a significant cash cow, leveraging its established market presence. The company's focus on protection products contributes to stable earnings, with its embedded value as of December 31, 2023, standing at RM10.7 billion, reflecting the long-term value generation of its insurance business.

GuocoLand's mature investment properties, such as those in Singapore's prime districts, function as reliable cash cows. The company reported a revenue of RM3.1 billion for the fiscal year ended June 30, 2024, with rental income from its investment properties forming a stable component of this revenue.

Hong Leong Asia's Building Materials Unit (BMU) is a prime example of a Cash Cow within the Hong Leong Group's BCG Matrix. This segment is currently riding a significant upcycle in the construction industry, particularly boosted by substantial infrastructure and Housing & Development Board (HDB) projects in Singapore. The consistent demand for its products, such as cement and concrete, underpins its stable cash-generating capabilities.

| Business Segment | BCG Category | Key Performance Indicator (2024 Data) | Cash Flow Contribution |

|---|---|---|---|

| Hong Leong Bank (Malaysia) | Cash Cow | Net Profit: RM3.3 billion | High and stable |

| Hong Leong Assurance | Cash Cow | Embedded Value: RM10.7 billion (as of Dec 31, 2023) | Consistent profit generation |

| GuocoLand (Prime Properties) | Cash Cow | Revenue: RM3.1 billion (FY ended June 30, 2024) | Stable rental income |

| Hong Leong Asia (Building Materials) | Cash Cow | Strong order book into 2025 | Predictable revenue stream |

Full Transparency, Always

Hong Leong Group BCG Matrix

The Hong Leong Group BCG Matrix preview you are viewing is the complete, final document you will receive immediately after purchase. This means you get the exact same professionally formatted analysis, ready for immediate strategic application, without any watermarks or demo content. The insights and structure presented here are precisely what you'll leverage for your business planning and competitive assessments.

Dogs

Underperforming legacy manufacturing lines within Hong Leong Group, such as those for older tile designs or basic motorcycle models, often fall into the Dogs quadrant of the BCG Matrix. These segments typically exhibit low market growth and low relative market share, indicating a stagnant or declining position.

For instance, if a particular traditional tile production line in Hong Leong Industries saw its market share shrink to 5% in a segment growing at only 2% annually, it would likely be a Dog. Such operations require substantial capital for modernization or face eventual divestment due to their inability to generate significant returns.

Certain highly specialized or outdated financial products from Hong Leong Group, such as legacy insurance policies with low surrender values or niche investment funds with minimal assets under management, might be classified as Dogs. These products often struggle to attract new customers and may even see declining participation from existing ones, leading to low revenue generation. For instance, if a particular structured product launched in the early 2010s has seen negligible new investment and its underlying assets are underperforming, it would likely fit this category.

Within Hong Leong Group's vast property holdings, older, non-strategic assets situated in less sought-after areas, yielding minimal rental income or showing faint prospects for capital appreciation, would fall under the Non-Core, Low-Return Property Assets category. These holdings can become a drain on maintenance funds without offering substantial contributions to the group's expansion or financial success.

Such properties often represent opportunities for divestment, a move that can unlock valuable capital for reinvestment into more promising ventures. For instance, if Hong Leong Group were to review its portfolio in mid-2024, it might identify a commercial building in a secondary city center that, despite consistent occupancy, generates a net yield of only 2.5%, significantly below the group's target of 5% for core assets.

Sub-scale International Operations with Limited Traction

Certain smaller international operations within the Hong Leong Group, particularly within its banking arm, Hong Leong Bank (HLB), might be classified as sub-scale with limited traction. For instance, while HLB has a presence in markets like Vietnam and Cambodia, some of its branches in these regions may not have achieved substantial market share or consistent profitability, potentially acting as resource drains.

These ventures could be considered Dogs in the BCG Matrix if they are in highly competitive environments where gaining significant market share is challenging and the outlook for substantial growth or profitability is dim. Such operations require careful evaluation to determine if continued investment is warranted or if divestment or restructuring is a more prudent strategy.

- Limited Market Share: Some overseas branches of Hong Leong Group entities may hold a very small percentage of their respective local markets, indicating low customer adoption and competitive disadvantage.

- Low Profitability: These sub-scale operations often struggle to cover their operating costs, resulting in consistent losses or minimal profits, thereby negatively impacting the group's overall financial performance.

- Resource Drain: Continued investment in these underperforming international ventures diverts capital and management attention that could be better allocated to more promising business units or markets.

Traditional, Manual Back-Office Processes

Traditional, manual back-office processes within Hong Leong Group's financial services and other divisions are characterized by their paper-intensive nature and lack of digitalization. These processes are often cited as areas of low efficiency, consuming significant resources like time and labor without directly contributing to revenue generation. For instance, in 2024, many legacy financial institutions still reported that over 50% of their back-office operations involved manual data entry and paper-based workflows, leading to increased error rates and slower transaction times.

These internal 'units' act as a drain on overall profitability. Until automation is implemented, they represent a significant operational cost. In 2023, studies indicated that manual processing in finance can cost up to 15 times more than automated processes, highlighting the substantial financial impact of these outdated systems on companies like Hong Leong Group.

- Low Efficiency: Manual processes are inherently slower and more prone to human error compared to automated systems.

- Resource Drain: Significant labor and time are dedicated to tasks that could be streamlined through technology.

- Profitability Impact: These inefficiencies directly reduce the profitability of the respective divisions by increasing operational expenditure.

- Digitalization Gap: Represents a failure to keep pace with modern operational standards and competitive pressures in the financial sector.

Within the Hong Leong Group's diverse portfolio, certain legacy businesses or product lines, particularly those in mature or declining industries, can be categorized as Dogs. These segments typically exhibit low market share and operate in low-growth markets, meaning they generate minimal profits and offer little prospect for future expansion. For example, a specific division focused on older, less technologically advanced consumer electronics components might be considered a Dog if its market share has dwindled to under 5% in a sector with less than 3% annual growth, as of early 2024 data.

These Dog units often require ongoing investment for maintenance or face the risk of becoming obsolete, draining valuable resources that could be better deployed in more promising areas of the group. The strategic imperative for such segments is often divestment or a significant overhaul to improve efficiency and competitiveness, as continuing to support them without a clear turnaround plan can hinder overall group performance.

In 2023, Hong Leong Group's financial services arm, like many in the industry, likely encountered legacy IT systems that were costly to maintain and offered limited functionality, fitting the Dog profile. These systems, if not upgraded, contribute to operational inefficiencies and increase the risk of cyber threats, impacting profitability and customer service.

Consider a hypothetical scenario in 2024 where a specific regional branch of a Hong Leong financial subsidiary has a market share of only 2% in a banking sector with a projected growth rate of 4%. This branch, if consistently unprofitable, would represent a Dog, necessitating a review for potential closure or consolidation to optimize resource allocation.

| Business Segment Example | Market Growth Rate (Est. 2024) | Relative Market Share (Est. 2024) | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Legacy Manufacturing (e.g., older tile designs) | 2% | 5% | Dog | Divestment or modernization |

| Outdated Financial Products (e.g., niche legacy funds) | 1-3% | <3% | Dog | Phased withdrawal or restructuring |

| Non-Strategic Property Assets (e.g., low-yield commercial buildings) | 2-4% | N/A (focus on yield) | Dog | Divestment to unlock capital |

| Sub-scale International Operations (e.g., low-performing bank branches) | 3-5% | 2% | Dog | Evaluation for divestment or restructuring |

| Manual Back-Office Processes | N/A (internal efficiency) | Low (relative to automated) | Dog | Automation and digitalization |

Question Marks

Hong Leong Bank's 'AI Ignite' program and its strategic investments in AI-powered solutions, alongside new partnerships such as the one with WeBank Technology Services, position these ventures squarely in the question mark quadrant of the BCG matrix. These initiatives are characterized by high growth potential, aiming to disrupt traditional banking with AI-driven services, but currently hold a low market share.

These forward-thinking projects demand substantial capital for research, development, and deployment, reflecting their status as cash consumers. For instance, in 2024, Hong Leong Bank continued to allocate significant resources towards digital transformation and AI integration, aiming to capture future market share. Success in these areas could lead to a revolution in customer experience and attract entirely new demographics, transforming the bank's market position.

Hong Leong Group's early-stage international market entries, particularly in emerging economies for its financial services and manufacturing arms, represent significant question marks on the BCG matrix. These ventures, such as potential expansions into Southeast Asian fintech markets or new automotive component manufacturing hubs in Africa, require substantial upfront capital and navigate considerable market uncertainty. For instance, in 2024, the global fintech market was projected to reach over $1.5 trillion, with emerging markets showing particularly strong growth trajectories, highlighting the high-potential, high-risk nature of these new endeavors for Hong Leong.

Hong Leong Asia's commitment to sustainability is evident in its strategic push towards manufacturing innovations. The development of a decarbonization roadmap for Tasek, a key subsidiary, signals a proactive approach to reducing environmental impact. This initiative is crucial for long-term viability in an increasingly regulated and eco-conscious global market.

The establishment of ReGen Sustainable Solutions Sdn. Bhd. is another significant step, aiming to foster circularity within the building materials sector. This venture focuses on innovative practices such as utilizing alternative raw materials and developing green concrete products. These advancements position Hong Leong Group within nascent but expanding markets, indicative of a potential future growth engine.

While these sustainability-focused innovations represent high-growth potential, they are currently in developing stages. This implies a need for substantial investment to scale operations and capture significant market share and profitability. The current market for green building materials, though growing, requires patient capital and strategic development to mature.

Specialized Green Property Developments (Tengah)

The Hong Leong Holdings-led consortium's green loan for Tengah's first private mixed-use development, scheduled for a 2026 launch, fits the Question Mark category in the BCG Matrix. This development is targeting a burgeoning market of eco-conscious consumers with its nature-centric designs and integrated smart technologies.

While the project is positioned in a high-growth segment and employs innovative features, its future market share and profitability are still uncertain, making it a classic Question Mark. For instance, the Singapore Green Building Council reported that green building projects in Singapore saw a 15% increase in demand in 2024, indicating a favorable market trend.

- High Growth Potential: Targeting the expanding eco-conscious consumer base in a developing area.

- Uncertain Market Share: As a new entrant in this specialized niche, its competitive positioning is yet to be proven.

- Investment Required: Significant capital is being deployed, as evidenced by the green loan, to establish its presence.

- Future Profitability: The ultimate success and return on investment are contingent on market acceptance and execution.

Digital-Only Niche Financial Products for Underserved Segments

Hong Leong Bank's HLB@Kampung program, aimed at creating cashless villages in rural areas, exemplifies a strategic focus on underserved segments. This initiative targets a significant demographic often overlooked by traditional banking, showcasing high social impact and substantial growth potential by tapping into new customer bases.

While these digital-only niche products demonstrate promise for expanding market reach, their current contribution to Hong Leong Bank's overall market share may be modest. The program requires considerable investment in developing digital infrastructure and providing financial literacy education to ensure widespread adoption and transition these segments into Stars within the BCG matrix.

For instance, in 2024, rural banking penetration in many Southeast Asian markets remained below 50%, highlighting the untapped potential. HLB@Kampung addresses this gap by fostering digital payment ecosystems, potentially unlocking new revenue streams as adoption grows.

- Targeting Underserved Segments: HLB@Kampung focuses on rural populations, a demographic often excluded from mainstream digital financial services.

- High Social Impact & Growth Potential: The program aims to improve financial inclusion and capture new customer bases, indicating strong future growth prospects.

- Investment Requirements: Significant capital is needed for infrastructure development and customer education to drive adoption and market penetration.

- Current Market Share Contribution: While promising, the immediate impact on overall market share is likely low until widespread adoption is achieved.

Hong Leong Group's ventures into new technologies and emerging markets represent key question marks on the BCG matrix. These initiatives, such as AI-driven banking solutions and expansion into developing economies, are characterized by high growth potential but currently hold low market share. They require significant capital investment to foster development and gain traction.

The group's focus on sustainability, including ReGen Sustainable Solutions and green building initiatives, also falls into this category. While these projects tap into growing eco-conscious markets, they are in early stages and need substantial investment to scale and achieve profitability. For example, the global green building materials market was projected to grow significantly in 2024, underscoring the potential but also the nascent nature of these ventures.

Hong Leong Bank's HLB@Kampung program, aiming for rural financial inclusion, is another example. It targets underserved segments with high growth potential, but requires considerable investment in infrastructure and education. The success of these question marks hinges on strategic execution and market acceptance, with the potential to become future stars if they can capture significant market share.

| Venture Area | BCG Quadrant | Key Characteristics | Investment Needs | Market Potential (2024/2025 Outlook) |

|---|---|---|---|---|

| AI in Banking (e.g., HL Bank's AI Ignite) | Question Mark | High growth potential, low current market share, disruptive innovation | High (R&D, deployment) | AI in financial services market growing rapidly, estimated to reach hundreds of billions globally. |

| International Market Expansion (Emerging Economies) | Question Mark | High growth potential, high market uncertainty, requires upfront capital | High (market entry, localization) | Emerging markets' fintech sector projected for double-digit growth. |

| Sustainability Innovations (e.g., Green Building Materials) | Question Mark | Nascent but expanding markets, high growth potential, needs scaling | High (technology development, production) | Global green building materials market expected to exceed $400 billion by 2025. |

| Rural Financial Inclusion (e.g., HLB@Kampung) | Question Mark | Underserved segments, high social impact, potential for new customer bases | High (infrastructure, education) | Rural banking penetration in many SEA markets below 50%, indicating significant untapped potential. |

BCG Matrix Data Sources

Our Hong Leong Group BCG Matrix is built upon comprehensive financial disclosures, robust industry research, and detailed market analysis to provide strategic clarity.