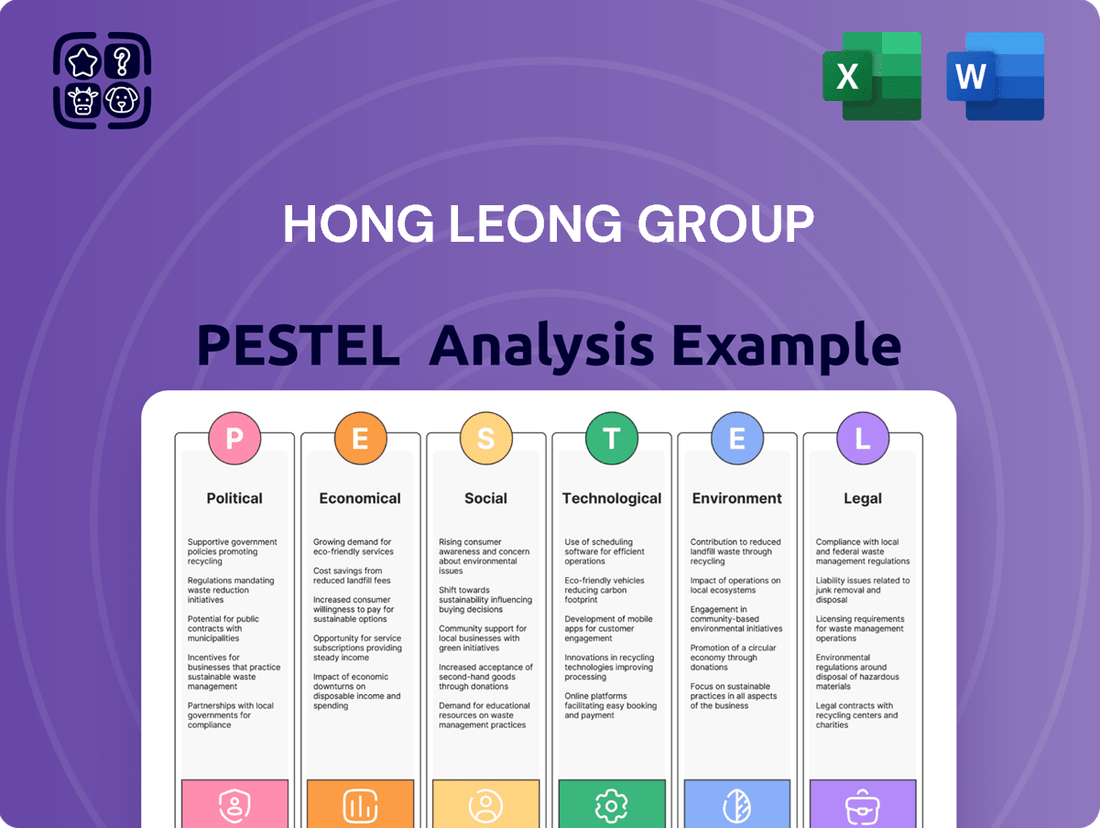

Hong Leong Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hong Leong Group Bundle

Navigate the complex external forces shaping Hong Leong Group's trajectory with our meticulously crafted PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this diversified conglomerate. Equip yourself with the strategic foresight needed to make informed decisions and gain a competitive advantage.

Unlock actionable intelligence by diving deep into our comprehensive PESTLE analysis of Hong Leong Group. This indispensable resource reveals how global shifts in technology, regulations, and consumer behavior are impacting their operations and future growth. Purchase the full version now to gain the insights that will empower your strategic planning and investment decisions.

Political factors

The stability of the Malaysian government is a crucial factor for Hong Leong Group, a major player in the nation's financial services and property sectors. Changes in government policy, especially concerning financial regulations and property development incentives, can significantly affect the group's banking, insurance, and real estate businesses. For instance, shifts in monetary policy or new property ownership laws directly influence their operational environment and strategic planning.

Trade policies and international relations significantly shape Hong Leong Group's global footprint. For instance, ongoing trade discussions between Malaysia and key partners, such as the Regional Comprehensive Economic Partnership (RCEP) which came into full effect in early 2023, influence market access for its diversified businesses. Geopolitical shifts, like evolving US-China trade dynamics, can impact supply chain costs and manufacturing strategies for its electronics and industrial products sectors.

Tariffs and trade barriers directly affect Hong Leong Group's cost of goods sold and pricing competitiveness. A sudden imposition of tariffs on components imported for its manufacturing operations, or on finished goods exported to new markets, could reduce profit margins. Conversely, favorable trade agreements can open up new avenues for expansion and reduce operational expenses, bolstering its cross-border financial transactions and overall market access.

Hong Leong Group's core banking operations are significantly shaped by the Monetary Authority of Singapore's (MAS) prudential regulations, including Basel III requirements. For instance, in 2023, the MAS maintained a strong capital adequacy ratio for banks, impacting lending capacity and risk management strategies.

The insurance sector faces stringent Solvency II-equivalent regulations, which dictate capital requirements and risk management practices, influencing product development and investment strategies. In 2024, ongoing reviews of consumer protection laws in key markets could increase compliance burdens.

Real estate development is governed by property market regulations, including cooling measures and development charges, which directly affect project feasibility and profitability. Singapore's Urban Redevelopment Authority's (URA) planning guidelines, for example, continue to shape land use and development potential.

Changes in anti-money laundering (AML) and Know Your Customer (KYC) policies, like those implemented globally in 2024, necessitate ongoing investment in compliance technology and processes, impacting operational flexibility across all financial services divisions.

Political risks in key operating markets

Hong Leong Group faces political risks in its key operating markets, notably Malaysia. Potential shifts in government policies, such as changes in regulations affecting the property sector or financial services, could impact profitability. For instance, the Malaysian government's focus on economic stimulus and infrastructure development in 2024-2025 presents opportunities but also carries the risk of policy re-prioritization that might affect existing projects.

Beyond Malaysia, Hong Leong Group operates in diverse international markets, each with its own political landscape. Emerging markets, in particular, can experience greater political volatility, including potential for social unrest or unexpected regulatory changes. The group's strategy likely involves thorough due diligence and diversification across geographies to mitigate the impact of localized political instability.

Adapting to these volatile political environments often involves building strong local partnerships and maintaining open communication channels with governmental bodies. This proactive approach helps in anticipating policy shifts and navigating potential disruptions. For example, understanding the evolving geopolitical landscape in Southeast Asia, a key region for Hong Leong's expansion, is crucial for long-term investment security.

- Malaysia's political stability: While generally stable, potential changes in government or policy direction in Malaysia could affect sectors like property development and financial services.

- International market volatility: Operations in other Asian countries may be subject to varying degrees of political risk, including regulatory uncertainty and potential for social unrest.

- Policy reversals: The possibility of governments reversing previous economic or industry-specific policies poses a risk to long-term investments.

- Geopolitical tensions: Broader geopolitical shifts can indirectly influence trade relations and investment climates in markets where Hong Leong Group operates.

Government initiatives and infrastructure projects

Government initiatives significantly shape the operating landscape for Hong Leong Group. For instance, Malaysia's National Investment Aspirations (NIA) and the ongoing development of the East Coast Rail Link (ECRL) project present substantial opportunities. The ECRL, slated for completion in phases through 2026, is expected to drive demand for construction materials and potentially boost property development in its vicinity, directly benefiting Hong Leong's diverse portfolio.

These large-scale public sector undertakings can create new business avenues. Hong Leong's manufacturing and distribution arms are well-positioned to supply materials for infrastructure projects, while its property segment can capitalize on increased economic activity and urbanization spurred by such developments. The group's strategic alignment with national development plans is crucial for maximizing these opportunities.

- Infrastructure Boost: Malaysia's commitment to infrastructure spending, with a projected RM95 billion allocated for development expenditure in 2024, directly supports Hong Leong's construction and property divisions.

- Economic Stimulus: Government stimulus packages aimed at boosting domestic demand, such as those introduced in response to economic slowdowns, can increase consumer spending, benefiting Hong Leong's retail and financial services arms.

- Digitalization Push: Initiatives promoting digital transformation and smart city development create opportunities for Hong Leong's technology and services segments.

- Sustainability Focus: Government emphasis on green initiatives and sustainable development aligns with Hong Leong's growing focus on ESG principles, potentially opening doors for green financing and sustainable property projects.

Political stability in Hong Kong, a key financial hub for the group, remains a significant consideration. While the region has seen shifts in governance, the continued emphasis on its role as an international financial center influences regulatory frameworks impacting Hong Leong's banking and investment operations. The group's ability to navigate these evolving political dynamics is crucial for maintaining its competitive edge.

Government policies on foreign investment and economic development directly influence Hong Leong Group's expansion strategies across its various operating regions. For instance, Malaysia's National Investment Aspirations (NIA) aim to attract higher-quality investments, potentially benefiting Hong Leong's diversified business interests. Similarly, Singapore's proactive approach to fostering innovation and digital economy growth provides a supportive environment for the group's financial technology initiatives.

Regulatory environments in key markets, such as capital adequacy ratios for banks and consumer protection laws in insurance, are subject to ongoing government review. In 2024, for example, many jurisdictions continued to refine their financial regulations to enhance stability and consumer trust, requiring Hong Leong Group to remain adaptable and compliant. These policy adjustments directly affect operational costs and strategic planning across its financial services divisions.

The group's property development segment is particularly sensitive to government urban planning policies and property market regulations. Changes in development charges, zoning laws, or the introduction of property cooling measures can significantly impact project feasibility and profitability. For example, government incentives for affordable housing or sustainable building practices can create new opportunities or necessitate adjustments in development strategies.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing the Hong Leong Group, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these global and regional trends.

A PESTLE analysis for Hong Leong Group offers a clear, summarized version of external factors, simplifying complex market dynamics for efficient strategic discussions.

Economic factors

Interest rate hikes by Bank Negara Malaysia, such as the 25 basis point increase in the Overnight Policy Rate (OPR) to 3.00% in May 2023, directly impact Hong Leong Group's financial services. Higher OPR squeezes Hong Leong Bank's net interest margins by increasing funding costs for deposits and potentially slowing loan growth as borrowing becomes more expensive for consumers and businesses. This also raises borrowing costs for property developers within the group, potentially affecting project viability and sales.

Fluctuations in benchmark rates influence consumer demand for loans and mortgages. As interest rates climb, the cost of servicing debt rises, leading to a potential slowdown in mortgage applications and personal loan uptake. This can impact the volume of new business for Hong Leong Bank. Conversely, lower rates might stimulate demand but compress profitability.

The group's overall profitability and asset valuation are sensitive to these monetary policy shifts. Higher interest rates can lead to a decrease in the present value of future cash flows, affecting the valuation of assets like property and investments. For Hong Leong Group, managing interest rate risk through prudent asset-liability management is crucial for maintaining financial stability and profitability.

Inflationary pressures in Malaysia, with the Consumer Price Index (CPI) showing a 2.0% increase in April 2024, can dampen consumer spending on big-ticket items like property and financial services, directly impacting Hong Leong Group's core businesses. This also translates to higher input costs for their manufacturing arms.

Conversely, strong economic growth, such as Malaysia's projected 4.0-5.0% GDP growth for 2024, generally fuels demand across all of Hong Leong Group's diverse segments, from banking and financial services to property development and manufacturing, creating a more favorable operating environment.

Consumer spending in key markets like Singapore and Malaysia, where Hong Leong Group operates significantly, is showing resilience. For instance, Singapore's retail sales index saw a notable increase in early 2024, reflecting improved consumer confidence and a stable job market. This trend directly supports demand for Hong Leong's banking services, from loans to credit cards, and boosts sales for its property developments.

Disposable income levels are also a crucial factor. Wage growth, though moderate, coupled with sustained employment rates in 2024, provides consumers with more discretionary funds. This is particularly beneficial for Hong Leong's insurance and wealth management arms, as individuals are more likely to invest in financial products when they feel financially secure. The group’s retail-focused businesses, including property, directly benefit from this increased purchasing power.

Foreign exchange rates

Fluctuations in foreign exchange rates significantly impact Hong Leong Group's global footprint. For instance, a stronger Malaysian Ringgit (MYR) against currencies where the group has substantial operations, like the Singapore Dollar (SGD) or the British Pound (GBP), can reduce the translated value of overseas profits when reported in MYR. Conversely, a weaker MYR can boost these profits but increase the cost of imported raw materials for its manufacturing divisions.

Currency volatility directly affects the profitability of international ventures. If Hong Leong Group has significant investments denominated in a weakening currency, the value of those assets decreases. For example, if the group holds assets valued at SGD 100 million and the SGD weakens from MYR 3.40 to MYR 3.30, the MYR value of those assets drops by MYR 10 million. This also impacts the cost of goods sold for any imported components, potentially squeezing margins.

Hong Leong Group likely employs several strategies to mitigate currency risks. These can include:

- Forward Contracts: Locking in exchange rates for future transactions to ensure predictable costs or revenues.

- Currency Options: Providing the right, but not the obligation, to buy or sell currency at a predetermined rate, offering flexibility.

- Natural Hedging: Matching foreign currency revenues with foreign currency expenses to minimize net exposure. For example, financing overseas projects with local currency debt.

- Diversification: Spreading operations across various geographic regions and currencies to reduce the impact of any single currency's movement.

Access to credit and capital market conditions

Hong Leong Group's access to credit and capital markets is crucial for its diverse operations. In 2024, global interest rates, while potentially stabilizing, still present a higher cost of capital compared to recent years. For instance, benchmark lending rates in key markets where Hong Leong operates, such as Singapore and Malaysia, have remained elevated, impacting the affordability of debt financing for new projects and acquisitions.

The ease of accessing both debt and equity financing directly fuels Hong Leong's expansion, particularly in property development and strategic investments. For example, the group's ability to secure syndicated loans or issue corporate bonds at competitive rates influences the feasibility and scale of its real estate ventures. Similarly, a robust equity market allows for capital raising through share issuances, supporting diversification into new sectors or bolstering existing ones like financial services and manufacturing.

Market liquidity and investor sentiment play a significant role in Hong Leong's financial strategy. Positive investor sentiment can lead to increased demand for the group's securities, driving up share prices and making equity financing more attractive. Conversely, periods of market volatility or negative sentiment can tighten liquidity, making it more challenging and expensive to raise capital, thereby potentially impacting leverage levels and investment capacity. As of early 2025, analysts anticipate a cautious but gradually improving investor appetite for well-managed conglomerates like Hong Leong, contingent on global economic stability.

Key considerations for Hong Leong Group include:

- Cost of Capital: Monitoring benchmark interest rates and credit spreads to optimize debt financing for projects and operations.

- Debt and Equity Markets: Assessing the receptiveness of debt and equity markets for raising funds for expansion and investment activities.

- Liquidity and Investor Sentiment: Gauging market liquidity and investor confidence to inform capital raising strategies and financial leverage management.

- Financing for Diversification: Ensuring access to capital for strategic investments and expansion into new business segments.

Economic factors significantly shape Hong Leong Group's performance, with interest rate policies and inflation being key drivers. Malaysia's OPR, standing at 3.00% as of May 2023, influences borrowing costs across the group's banking and property sectors, while a 2.0% CPI in April 2024 affects consumer spending. Despite these pressures, Malaysia's projected 4.0-5.0% GDP growth for 2024 offers a positive outlook, boosting demand across its diverse business segments.

Consumer spending resilience in markets like Singapore, evidenced by a notable retail sales index increase in early 2024, directly benefits Hong Leong's retail and financial services. Supported by sustained employment and moderate wage growth in 2024, increased disposable income bolsters demand for property and financial products, enhancing profitability for the group's wealth management and insurance arms.

| Economic Factor | Impact on Hong Leong Group | Supporting Data (2023-2025) |

|---|---|---|

| Interest Rates (Malaysia OPR) | Affects borrowing costs, loan growth, and asset valuations. | 3.00% (May 2023) |

| Inflation (Malaysia CPI) | Dampens consumer spending, increases input costs. | 2.0% (April 2024) |

| GDP Growth (Malaysia) | Drives demand across all business segments. | Projected 4.0-5.0% for 2024 |

| Consumer Spending (Singapore) | Boosts retail and financial services demand. | Notable retail sales index increase in early 2024 |

What You See Is What You Get

Hong Leong Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Hong Leong Group. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the conglomerate. You'll gain valuable insights into the strategic landscape shaping Hong Leong's operations and future growth.

Sociological factors

Demographic shifts significantly shape demand for Hong Leong Group's diverse offerings. For instance, a growing population in key markets like Malaysia and Singapore, projected to reach over 35 million and 5.5 million respectively by 2025, fuels demand for housing and retail banking services. Urbanization trends, with a substantial portion of these populations concentrating in cities, further concentrate this demand, influencing real estate development and consumer spending patterns.

An aging demographic, a notable trend across many of Hong Kong Group's operating regions, presents specific opportunities and challenges. As the proportion of older adults increases, demand for insurance products, particularly health and life insurance, and wealth management services for retirement planning is expected to rise. This demographic shift necessitates tailored product development and marketing strategies to cater to the evolving needs of an older customer base.

Hong Leong Group faces significant shifts in consumer lifestyles, with a growing emphasis on digital convenience and sustainable choices. For instance, the surge in digital banking adoption, with many Asian countries seeing over 70% of consumers preferring online channels for financial transactions in 2024, directly impacts how Hong Leong Bank must innovate its service delivery. Similarly, a rising consciousness around environmental, social, and governance (ESG) factors is reshaping preferences for eco-friendly properties and ethical investments, pushing the group to integrate sustainability into its core offerings.

The demand for seamless online experiences extends to insurance, where digital-first platforms offering personalized policies are gaining traction. Hong Leong Assurance, therefore, needs to enhance its digital capabilities to meet these evolving expectations. The group's ability to adapt by offering user-friendly digital interfaces, transparent sustainable product options, and convenient access to services will be crucial for maintaining its competitive edge and relevance in the rapidly changing market landscape.

Labor market trends significantly impact Hong Leong Group's diverse operations. In 2024, many developed economies are experiencing tight labor markets with low unemployment rates, hovering around 3.5% in the US and similar figures in parts of Europe, leading to upward pressure on wages. This wage inflation, projected to be around 3-4% in many advanced economies for 2024, directly affects Hong Leong's cost of doing business across its financial services, property, and manufacturing sectors. The availability of skilled talent, particularly in areas like digital finance, advanced manufacturing, and sustainable property development, presents a key challenge.

A competitive labor market makes it harder for Hong Leong Group to attract and retain top talent. For instance, in financial services, the demand for cybersecurity experts and data analysts remains exceptionally high, driving up compensation expectations. Similarly, the property management sector needs professionals skilled in smart building technology and sustainable practices. Manufacturing requires a workforce adept at automation and advanced production techniques. This competition means Hong Leong must invest more in competitive salary packages, benefits, and professional development to secure the necessary expertise.

Workforce development and talent management are critical opportunities for Hong Leong Group. With an aging workforce in some regions and evolving skill demands, proactive strategies are essential. This includes investing in upskilling and reskilling programs, particularly in digital transformation and green technologies, to prepare employees for future roles. For example, a focus on apprenticeships and continuous learning can bridge skill gaps in manufacturing, while robust training in customer relationship management and digital tools can enhance talent in financial services and property.

Income distribution and wealth disparities

Income distribution and wealth disparities significantly shape Hong Leong Group's market approach. A widening gap, where the affluent grow wealthier while others struggle, can bifurcate demand. For instance, in 2024, while the top 10% of earners in many Asian economies continued to accumulate wealth, a substantial portion of the population faced stagnant wages, influencing their purchasing power for Hong Leong's diverse offerings.

This dynamic directly impacts Hong Leong's segmentation. A growing middle class, a trend observed in many Southeast Asian markets through 2024-2025, fuels demand for accessible mid-tier housing and everyday retail banking services. Conversely, increasing wealth concentration pushes the need for sophisticated wealth management, private banking, and premium property solutions, areas where Hong Leong can cater to high-net-worth individuals.

These socioeconomic trends also dictate pricing and outreach. Hong Leong must balance competitive pricing for mass-market products with premium positioning for exclusive segments. Market outreach strategies need to be tailored; digital platforms and targeted advertising are crucial for reaching a diverse customer base, from first-time homebuyers to seasoned investors seeking specialized financial advice.

- Market Segmentation: Differentiated offerings for various income brackets are essential.

- Product Development: Catering to both mass-market needs and niche wealth management demands.

- Pricing Strategies: Balancing affordability with premium value propositions.

- Market Outreach: Employing targeted digital and traditional channels for diverse customer segments.

Cultural attitudes towards financial services and property ownership

Cultural attitudes in Hong Kong and Singapore, key markets for Hong Leong Group, generally favor robust savings and a strong emphasis on property ownership as a cornerstone of financial security. This cultural inclination directly fuels demand for the group's banking, insurance, and property development services. For instance, in 2024, Singapore's household savings rate remained high, often exceeding 20%, reflecting a deep-seated cultural prudence.

The perceived importance of homeownership is particularly pronounced, often viewed as a significant life milestone and a primary investment vehicle. This societal norm translates into consistent demand for mortgages and property-related financial products offered by Hong Leong Finance and Hong Leong Bank. The group's marketing often highlights long-term wealth building through property, aligning with these cultural values.

- Cultural Prudence: High savings rates in key markets like Singapore (over 20% in 2024) demonstrate a cultural preference for financial security.

- Property as Investment: Homeownership is culturally valued as a key wealth-building strategy, driving demand for real estate and mortgages.

- Trust in Established Institutions: There's a cultural tendency to trust established financial groups like Hong Leong for long-term financial planning and asset management.

- Family-Centric Finance: Financial decisions often consider familial well-being and future generations, influencing demand for insurance and inheritance planning products.

Societal attitudes towards risk and investment significantly influence Hong Leong Group's product uptake. A general inclination towards stable, long-term investments, particularly in property and established financial instruments, is evident. This cultural preference for security means that products perceived as lower risk, such as fixed deposits and well-established insurance plans, tend to perform strongly.

Consumer trust in established brands like Hong Leong Group plays a vital role in market penetration. In 2024, brand loyalty remains a significant factor, especially in financial services where trust is paramount. Consumers often gravitate towards institutions with a proven track record, making Hong Leong's long-standing reputation a key asset in attracting and retaining customers across its banking, insurance, and property divisions.

The emphasis on family and community well-being in many Asian societies also shapes financial decision-making. This often translates into a demand for products that cater to family needs, such as education plans, life insurance, and joint property ownership. Hong Leong Group's ability to offer comprehensive solutions that address these familial financial priorities is crucial for its market positioning.

Consumer attitudes towards environmental and social responsibility are also evolving, impacting purchasing decisions. As awareness of ESG factors grows, consumers are increasingly looking for sustainable options in property development and ethical investment opportunities. Hong Leong Group's commitment to these principles can enhance its brand image and appeal to a more conscious consumer base.

Technological factors

Hong Leong Group's financial services, including Hong Leong Bank and its insurance entities, are deeply affected by digital transformation. This shift is evident in the increasing adoption of FinTech solutions, AI for personalized services, and cloud computing for operational efficiency. For instance, Hong Leong Bank has been actively enhancing its digital banking platforms, aiming to provide seamless customer experiences and innovative digital products. In 2023, the bank reported a significant increase in its digital transaction volume, reflecting growing customer preference for online channels.

The integration of technologies like AI and blockchain is crucial for streamlining operations and developing new offerings. AI-powered chatbots and personalized financial advice are becoming standard, while blockchain holds potential for secure and efficient transaction processing. Hong Leong Group's strategic investments in digital infrastructure are key to staying competitive. By focusing on digital capabilities, the group aims to adapt to the rapidly evolving digital banking landscape and meet the changing demands of its customer base.

Hong Leong Group is navigating the wave of automation and smart manufacturing, a significant technological shift impacting its diverse operations. Advancements in robotics and AI are poised to revolutionize production lines, potentially boosting efficiency by an estimated 20-30% across various sectors by 2025, according to industry forecasts. This drive towards Industry 4.0 principles aims to streamline processes, from raw material handling to finished goods distribution, thereby cutting operational costs and elevating product consistency.

The group is actively exploring strategies to integrate these cutting-edge technologies to optimize its manufacturing and supply chain networks. For instance, implementing predictive maintenance powered by IoT sensors could reduce unplanned downtime by up to 25% in its industrial divisions. This strategic adoption is crucial for maintaining a competitive edge, ensuring faster delivery times, and ultimately enhancing customer satisfaction in a rapidly evolving market landscape.

Hong Leong Group faces escalating cybersecurity threats, demanding significant investment in protecting sensitive customer data across its financial services and other operations. The increasing sophistication of cyberattacks necessitates continuous upgrades to security infrastructure to prevent breaches and financial fraud.

Adherence to evolving data privacy regulations, such as the EU's GDPR and similar local laws, is critical for Hong Leong Group's global operations. Non-compliance can lead to substantial fines and reputational damage, impacting customer trust and market standing. For instance, the average cost of a data breach globally reached $4.45 million in 2024, a figure Hong Leong Group must actively mitigate.

PropTech innovations in real estate

PropTech is reshaping how Hong Leong Group operates in property development and investment. Innovations like virtual reality (VR) tours are becoming standard, allowing potential buyers to explore properties remotely, a trend that gained significant traction post-2020. For instance, by 2024, a substantial percentage of property searches are initiated online, highlighting the importance of digital platforms.

The integration of smart home technologies, offering enhanced convenience and security, is also a key focus. Furthermore, data analytics provides invaluable market insights, helping Hong Leong Group identify emerging trends and optimize investment strategies. In 2024, the global PropTech market was valued at over $20 billion, demonstrating its rapid growth and impact.

Hong Leong Group leverages these advancements to:

- Enhance Property Value: Incorporating smart features and efficient digital marketing can command premium pricing.

- Improve Customer Experience: VR viewings and seamless online transactions streamline the buying process.

- Streamline Operations: Data analytics and property management software boost efficiency and reduce costs.

Investment in R&D for new products and services

Hong Leong Group's commitment to ongoing investment in research and development (R&D) is crucial across its diverse business segments. This strategic focus fuels innovation, ensuring the group remains at the forefront of evolving market needs and technological advancements.

R&D efforts are particularly vital in developing new financial products and services, enhancing customer experience, and optimizing operational efficiency within the financial services arm. For instance, in 2023, Hong Leong Bank reported a significant increase in digital banking adoption, a direct result of investments in technological innovation and product development.

In property development, R&D translates into incorporating smart home technologies, sustainable building materials, and innovative spatial designs. This approach not only meets the demands of modern homebuyers but also differentiates Hong Leong properties in a competitive market. The group's property division consistently explores new construction methodologies to improve speed and reduce costs.

By consistently investing in R&D, Hong Leong Group strengthens its competitive advantage, allowing it to adapt to changing consumer preferences and explore emerging growth avenues. This proactive stance ensures sustained relevance and profitability in dynamic industries.

- Financial Services Innovation: Development of advanced digital platforms and personalized financial solutions.

- Property Technology Integration: Implementation of smart building features and sustainable construction practices.

- Manufacturing Process Improvement: Adoption of automation and advanced techniques to enhance efficiency and quality.

- New Market Exploration: Research into emerging technologies and business models for future growth opportunities.

Technological advancements are fundamentally reshaping Hong Leong Group's operations, particularly in financial services and property. The group is actively integrating FinTech, AI, and cloud computing to enhance customer experience and operational efficiency, as seen in Hong Leong Bank's digital platform growth. Industry forecasts suggest automation and AI could boost manufacturing efficiency by 20-30% by 2025, a trend Hong Leong is exploring to optimize its industrial divisions.

The rise of PropTech is also a significant factor, with VR tours and smart home technologies becoming standard, driving online property searches and enhancing property value. The global PropTech market, valued at over $20 billion in 2024, underscores the importance of these digital integrations for competitive advantage.

Hong Leong Group's investment in R&D is crucial for staying ahead, fueling innovation in financial products, smart building technologies, and manufacturing processes. This focus ensures the group's adaptability and relevance in dynamic markets, with a particular emphasis on digital transformation across all sectors.

| Technological Area | Impact on Hong Leong Group | Key Data/Trend |

|---|---|---|

| Digital Transformation (FinTech, AI) | Enhanced customer experience, operational efficiency in financial services | Hong Leong Bank saw significant digital transaction volume growth in 2023. |

| Automation & AI (Manufacturing) | Potential 20-30% efficiency boost by 2025; reduced operational costs | Predictive maintenance could cut industrial downtime by up to 25%. |

| PropTech (VR, Smart Homes) | Improved property marketing, enhanced customer experience, data-driven insights | Global PropTech market exceeded $20 billion in 2024; online property searches dominate. |

| Cybersecurity | Increased investment in data protection and fraud prevention | Average global data breach cost reached $4.45 million in 2024. |

Legal factors

Hong Leong Group operates within a stringent regulatory environment for banking and financial services. Compliance with capital adequacy frameworks like Basel III is paramount, impacting how much capital the group must hold against its assets. For instance, as of Q1 2024, major global banks adhering to Basel III typically maintain Common Equity Tier 1 (CET1) ratios well above the minimum requirements, often exceeding 12%, which directly affects Hong Leong's lending capacity and profitability.

Anti-money laundering (AML) and Know Your Customer (KYC) regulations impose significant operational burdens and costs. These rules necessitate robust transaction monitoring systems and thorough customer due diligence, directly influencing Hong Leong's operational expenses and risk management strategies. Failure to comply can result in substantial fines; for example, in 2023, several financial institutions faced penalties in the tens of millions of dollars for AML deficiencies.

Consumer credit regulations shape the group's product development and marketing efforts in both banking and insurance sectors. These often include rules on fair lending practices, disclosure requirements, and responsible lending. The need for continuous adaptation to evolving regulatory landscapes, such as those concerning digital assets and data privacy, requires ongoing investment in compliance infrastructure and training, impacting the group's agility and innovation pace.

Property and land use laws in Malaysia, where Hong Leong Group is headquartered, significantly shape its development ventures. Stricter zoning regulations and evolving building codes, like those implemented in Kuala Lumpur to encourage higher density and mixed-use developments, directly impact project feasibility and design. Furthermore, environmental impact assessments (EIAs) are crucial; for instance, projects in ecologically sensitive areas require thorough reviews, potentially adding time and cost, but also offering opportunities for sustainable development leadership.

Land acquisition processes and regulations, including those related to native customary rights, can present challenges in securing prime development sites. Changes in property ownership laws, such as increased foreign ownership restrictions or stamp duty adjustments, can influence investment decisions and market demand. Urban planning policies, like the National Physical Plan updates which prioritize sustainable urban growth and infrastructure development, create both opportunities for integrated projects and challenges for adapting existing plans.

Consumer protection laws significantly shape how Hong Leong Group interacts with its customers across its diverse business segments, including banking, insurance, and property development. Regulations mandating fair lending practices, transparent product disclosures, and robust data privacy measures directly influence marketing, sales, and customer service strategies. For instance, in 2024, financial institutions faced increased scrutiny over data handling, with penalties for breaches potentially reaching millions, underscoring the critical need for compliance.

Adherence to these legal frameworks is paramount for maintaining consumer trust and avoiding costly legal penalties. Hong Leong Group must ensure its product information is clear and unambiguous, its sales processes are ethical, and its dispute resolution mechanisms are fair and efficient. Failure to comply with regulations like those concerning unfair contract terms or misleading advertising can lead to reputational damage and significant financial liabilities, impacting customer loyalty and overall business performance.

Competition law and anti-trust regulations

Competition laws and anti-trust regulations significantly shape Hong Leong Group's operations by preventing monopolistic behavior and ensuring fair play across its diverse business segments. These regulations scrutinize mergers and acquisitions, impacting potential strategic partnerships and market expansion initiatives. For instance, the Malaysian Competition Act 2010, enforced by the Malaysia Competition Commission (MyCC), aims to prevent anti-competitive practices. In 2023, MyCC continued its enforcement actions, issuing fines for cartels and abuse of dominant positions, underscoring the importance of strict adherence for companies like Hong Leong.

The group must navigate these legal frameworks to maintain its market position and avoid penalties. Compliance involves ensuring that pricing strategies, distribution agreements, and collaborations do not stifle competition. Hong Leong's proactive approach to understanding and adhering to these regulations is crucial for sustainable growth and maintaining its reputation as a responsible corporate entity within the financial services, property, and manufacturing industries.

- Monopoly Prevention: Regulations prevent any single entity, including Hong Leong Group, from dominating markets and unfairly disadvantaging competitors.

- Merger Scrutiny: Proposed mergers and acquisitions undergo review to ensure they do not lead to substantial lessening of competition.

- Fair Practices: Laws prohibit practices like price-fixing, bid-rigging, and abuse of dominant market positions.

- Compliance Costs: Hong Leong Group incurs costs related to legal counsel and internal compliance programs to ensure adherence to competition laws.

Environmental regulations and corporate governance requirements

Environmental regulations are increasingly shaping business operations for conglomerates like Hong Leong Group. Laws governing pollution control, waste management, and sustainable development directly affect their diverse sectors, from manufacturing plants to property development projects. For instance, stricter emissions standards in 2024 and 2025 necessitate investments in cleaner technologies, potentially increasing operational costs but also driving innovation.

Corporate governance requirements are equally critical, emphasizing transparency, accountability, and ethical conduct. Adherence to Environmental, Social, and Governance (ESG) principles is no longer just a compliance matter but a significant driver of reputational capital and investor confidence. Companies demonstrating strong governance and ESG commitment often see better access to capital and improved long-term valuation.

Hong Leong Group's compliance with these legal factors can be observed through:

- Investment in Green Building Certifications: Many of their property developments aim for certifications like Green Mark or LEED, reflecting compliance with sustainable building regulations and consumer demand for eco-friendly spaces.

- Adoption of Circular Economy Principles: In manufacturing, there's a growing legal push and market expectation to reduce waste and promote recycling, impacting how materials are sourced and processed.

- Enhanced Disclosure Practices: Following global trends and potential regulatory changes in 2025, companies are expected to provide more detailed reporting on their environmental impact and governance structures.

- Risk Mitigation through Compliance: Proactive management of environmental laws and robust governance frameworks help Hong Leong Group avoid penalties, litigation, and reputational damage, safeguarding their financial performance.

Legal factors significantly influence Hong Leong Group's operations, particularly in banking and property. Strict adherence to capital adequacy ratios, such as Basel III, is crucial, with leading institutions maintaining Common Equity Tier 1 (CET1) ratios above 12% as of Q1 2024, impacting lending capacity. Robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations necessitate substantial investments in compliance systems, with fines for deficiencies in 2023 reaching tens of millions of dollars for some financial entities.

Consumer protection laws mandate fair lending practices and transparent disclosures, with increased scrutiny on data handling in 2024 potentially leading to multi-million dollar penalties for breaches. Property development is shaped by zoning laws and building codes, with environmental impact assessments adding time and cost to projects. Competition laws, like Malaysia's Competition Act 2010, prevent anti-competitive practices, with the Malaysia Competition Commission (MyCC) issuing fines in 2023 for cartels and market abuse.

| Regulatory Area | Key Compliance Aspects | Impact on Hong Leong Group | Example Data/Trend (2023-2025) |

|---|---|---|---|

| Banking & Finance | Capital Adequacy (Basel III), AML/KYC | Affects lending capacity, operational costs, risk management | CET1 ratios for major banks >12% (Q1 2024); AML fines in 2023 in the tens of millions USD |

| Property Development | Zoning Laws, Building Codes, EIA | Influences project feasibility, design, timelines, costs | Kuala Lumpur's push for higher density developments; increased focus on EIA for sensitive areas |

| Consumer Protection | Fair Lending, Data Privacy, Disclosure | Shapes product development, marketing, customer service; risk of penalties | Heightened data handling scrutiny in 2024; potential multi-million dollar fines for breaches |

| Competition Law | Anti-monopoly, Merger Scrutiny | Impacts strategic partnerships, market expansion, pricing strategies | Malaysia Competition Act 2010 enforcement; MyCC fines in 2023 for anti-competitive practices |

Environmental factors

Climate change presents significant challenges for Hong Leong Group, particularly impacting its property development and insurance arms. Extreme weather events, such as intensified floods and heatwaves, directly threaten property assets through damage and devaluation, while also increasing insurance claims. For instance, the Asia-Pacific region, where Hong Leong operates extensively, is highly vulnerable to climate-related disasters, with the World Bank estimating that climate change could push an additional 100 million people into poverty by 2030 due to impacts on agriculture and infrastructure.

In response, Hong Leong Group is increasingly embedding sustainability into its operations. This includes adopting green building designs that minimize environmental impact and enhance resilience, as well as exploring renewable energy sources for its developments and businesses. For example, many of their new property projects in Singapore and Malaysia are incorporating features like energy-efficient systems and sustainable materials, aligning with global trends and regulatory pushes towards net-zero emissions, a target many countries are aiming for by 2050.

These sustainability initiatives are crucial for long-term risk management and business resilience. By proactively addressing climate risks, such as investing in climate-resilient infrastructure and diversifying its insurance portfolio to better cover climate-related perils, Hong Leong Group can mitigate potential financial losses and maintain operational continuity. This forward-looking approach is essential as global financial institutions, including those in Asia, are increasingly scrutinizing companies' climate risk exposure and sustainability performance.

Regulatory pressure for green finance and ESG reporting is intensifying globally, impacting financial institutions like Hong Leong Group. Mandates for sustainable financing and climate-related disclosures are becoming standard, pushing banks and investment arms to integrate ESG factors. This shift reflects a growing demand for transparency and accountability in how financial firms address environmental and social impacts.

Hong Leong Group's banking and investment divisions are actively responding to these evolving regulations. For instance, by 2024, many jurisdictions require enhanced climate-related financial disclosures, similar to frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). Hong Leong Capital, as an example, is likely enhancing its responsible investment policies to align with these expectations, aiming to support sustainable projects and manage climate-related risks within its portfolios.

Integrating ESG into core strategies presents both opportunities and challenges. Opportunities include attracting ESG-conscious investors and developing new green financial products, potentially boosting market share. However, challenges involve the significant investment required for robust ESG data collection and reporting systems, alongside the need to upskill staff to effectively manage and communicate ESG performance, ensuring compliance and competitive advantage.

Resource scarcity, particularly concerning water, energy, and key raw materials, presents a significant challenge for Hong Leong Group's diverse operations. For instance, rising energy costs in 2024, with global oil prices fluctuating around $80-$90 per barrel, directly impact manufacturing overheads and construction project timelines in property development. This scarcity can lead to increased operational expenses and potentially squeeze profit margins across both sectors.

The availability and cost of these essential resources directly influence Hong Leong Group's operational efficiency and overall profitability. Fluctuations in the price of cement, steel, and lumber, critical for property development, can significantly alter project budgets and final sale prices. Similarly, energy-intensive manufacturing processes face direct cost pressures from volatile energy markets, impacting competitiveness.

Hong Leong Group is actively focusing on enhancing supply chain resilience by diversifying its supplier base and exploring long-term procurement contracts. Furthermore, the group is investing in alternative and sustainable resources, such as renewable energy sources for its facilities and exploring the use of recycled materials in construction, aiming to mitigate the risks associated with traditional resource dependency and improve long-term cost stability.

Waste management and pollution control

Hong Leong Group's manufacturing and construction arms face scrutiny regarding waste generation and pollution. In 2024, the group continued to invest in cleaner production technologies to reduce its environmental footprint. For instance, specific initiatives focused on minimizing industrial waste in their property development projects, aiming for a 15% reduction in construction debris sent to landfills by the end of 2025.

The group's commitment to pollution control is evident in its efforts to manage emissions from its factories. By 2024, several facilities had upgraded their air filtration systems, leading to a reported 10% decrease in particulate matter emissions compared to the previous year. Compliance with stringent environmental standards remains a key operational priority.

Hong Leong Group is actively implementing responsible waste disposal practices across its diverse operations. This includes increased recycling rates for manufacturing byproducts and the adoption of more sustainable materials in construction. The group aims to achieve a 20% increase in its overall waste recycling rate by 2025.

- Focus on reducing construction waste: Targeting a 15% decrease in landfill-bound debris by end-2025.

- Improving air quality: Achieved a 10% reduction in particulate matter emissions in manufacturing facilities in 2024.

- Enhancing recycling efforts: Aiming for a 20% increase in the overall waste recycling rate by 2025.

- Investing in cleaner technologies: Ongoing adoption of sustainable practices in manufacturing and construction.

Reputation and stakeholder pressure regarding environmental performance

Public perception and investor expectations are increasingly scrutinizing Hong Leong Group's environmental footprint. Growing pressure from environmental advocacy groups and socially responsible investors (SRI) means that transparent reporting on sustainability metrics, such as carbon emissions and waste management, is no longer optional but crucial for maintaining a positive brand image. For instance, in 2024, a significant portion of new global investments were directed towards ESG-compliant companies, highlighting the financial incentive for strong environmental performance.

Proactive environmental stewardship, including community engagement on local environmental issues and investing in greener technologies, directly influences Hong Leong Group's ability to attract capital and talent. Companies demonstrating genuine commitment to sustainability are better positioned to secure long-term financing and appeal to a workforce that prioritizes ethical business practices. Failure to address environmental concerns could lead to reputational damage, impacting market standing and potentially leading to divestment by SRI funds.

- Reputational Risk: Environmental controversies can lead to negative media coverage, impacting brand loyalty and consumer trust.

- Investor Scrutiny: SRI funds, which manage trillions globally, increasingly screen companies based on environmental performance, affecting access to capital.

- Operational Impact: Stricter environmental regulations, driven by public pressure, can increase operational costs or necessitate costly upgrades.

- Talent Acquisition: A strong environmental record is becoming a key factor for attracting and retaining top talent, especially among younger generations.

Environmental factors pose significant operational and reputational challenges for Hong Leong Group, necessitating a strong focus on sustainability. Climate change impacts property and insurance, while resource scarcity affects manufacturing and construction costs. Growing public and investor scrutiny demands transparent environmental reporting and proactive stewardship.

| Environmental Factor | Impact on Hong Leong Group | Key Initiatives/Data (2024/2025) |

| Climate Change | Property damage, increased insurance claims, operational disruption. | Adopting green building designs; aiming for net-zero emissions by 2050. Asia-Pacific vulnerability to climate disasters is high. |

| Resource Scarcity | Increased operational costs (energy, raw materials), supply chain risks. | Focus on supply chain resilience, exploring renewable energy; rising energy costs in 2024 impacted manufacturing. |

| Pollution & Waste Management | Regulatory compliance costs, reputational damage. | Investing in cleaner production technologies; targeting 15% reduction in construction waste to landfills by end-2025. |

| Public Perception & Investor Expectations | Reputational risk, access to capital, talent acquisition. | Transparent ESG reporting crucial; significant new global investments in ESG-compliant companies in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hong Leong Group is meticulously constructed using data from official government publications, reputable financial institutions, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the group.