HMS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

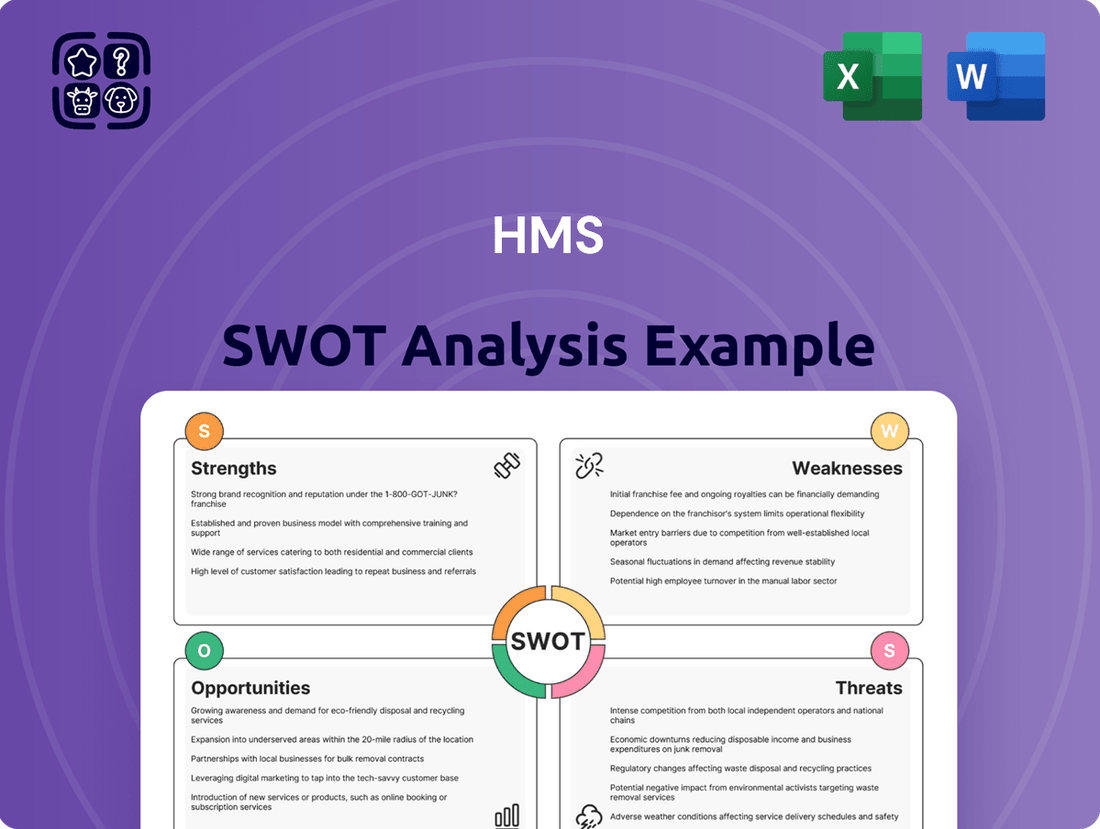

The HMS SWOT analysis highlights key areas of strategic importance, revealing both its competitive advantages and potential vulnerabilities. Understanding these dynamics is crucial for navigating the current market landscape effectively. This initial glimpse offers a foundation, but the true depth of strategic opportunity and risk lies within the complete report.

Want to fully grasp HMS's market position and future trajectory? Purchase the complete SWOT analysis to unlock actionable insights, detailed strategic recommendations, and expert commentary designed to inform your decision-making.

Strengths

HMS Networks holds a commanding position as a market leader in Industrial Information and Communication Technology (ICT). This strength is built upon a robust and diverse product offering, encompassing well-regarded brands like Anybus, Ixxat, Ewon, Intesis, Red Lion, and N-Tron. These brands collectively cover a vast spectrum of industrial communication requirements, solidifying HMS's comprehensive market presence.

HMS Networks boasts a remarkably broad and deep product portfolio, encompassing everything from industrial gateways and remote access solutions to embedded communication modules and specialized Ethernet switches. This diversity allows them to serve a wide array of industrial automation needs.

The strategic acquisitions of Red Lion Controls and PEAK-System Technik in recent years have significantly bolstered this offering, bringing in complementary technologies and expanding HMS's reach into new market segments. For example, Red Lion Controls' expertise in human-machine interfaces and data acquisition further strengthens HMS's position in visualization and control.

This comprehensive suite of products provides a distinct competitive advantage, enabling HMS to act as a one-stop shop for many industrial communication requirements. It also creates substantial cross-selling opportunities, as customers implementing one HMS solution are likely to find value in others within their expanded catalog.

By covering a wide spectrum of industrial communication and connectivity needs, HMS is well-positioned to capture market share across various vertical industries, from manufacturing to building automation, solidifying its role as a key player in the Industrial Internet of Things (IIoT) ecosystem.

HMS Networks leverages its strong global presence, evidenced by over 1,100 employees and more than 20 international sales offices, to effectively serve a worldwide customer base. This expansive network, bolstered by a wide array of distributors and partners, ensures efficient market penetration across key regions like North America, Europe, and Asia.

Their significant global reach translates into localized sales and support capabilities, allowing HMS Networks to remain close to its customers and respond effectively to diverse market needs. This proximity is crucial for building strong relationships and driving adoption of their industrial communication solutions.

Strategic Acquisitions for Expanded Capabilities

HMS Networks has strategically enhanced its capabilities through key acquisitions, notably Red Lion Controls in April 2024 and PEAK-System Technik in November 2024. These moves have significantly broadened their market reach, particularly strengthening their presence in the United States and Germany. The integration of these companies also brought new production capacities and specialized expertise in critical areas like automotive communication protocols and advanced data visualization solutions.

These acquisitions are instrumental in expanding HMS Networks' product portfolio and technological depth. By bringing in new competencies, HMS is better positioned to offer comprehensive solutions across various industrial sectors. For instance, the Red Lion Controls acquisition bolstered their human-machine interface (HMI) and industrial gateway offerings, while PEAK-System Technik added significant expertise in the automotive diagnostics and testing space. This proactive approach to inorganic growth is a core strength, enabling faster market penetration and the development of more integrated product suites.

The financial impact of these strategic integrations is expected to be substantial. While specific revenue contributions for the full year 2024 and 2025 from these acquisitions will become clearer in future reporting, the initial integration aims to leverage cross-selling opportunities and operational synergies. This expansion of capabilities directly addresses evolving market demands for connected and intelligent industrial systems, solidifying HMS Networks' competitive advantage.

Key benefits include:

- Expanded Market Footprint: Increased penetration in the US and German markets.

- Enhanced Technological Expertise: Acquisition of specialized knowledge in automotive communication and data visualization.

- Broader Product Portfolio: Integration of new HMI, gateway, and diagnostic solutions.

- New Production Capabilities: Diversification and strengthening of manufacturing capacity.

Focus on Industrial Ethernet and IIoT Growth

HMS Networks is strategically positioned to benefit from the significant growth in Industrial Ethernet and the Industrial Internet of Things (IIoT). Their focus directly addresses the industry's ongoing migration towards digitalized and connected operations.

Market projections for 2025 strongly indicate that Ethernet-based networks will continue their ascendancy in industrial environments. HMS's product portfolio is specifically developed to enable this digital transformation, facilitating crucial data analysis and enabling efficient remote management capabilities for industrial processes.

- Dominant Market Trend: Industrial Ethernet is projected to be the leading network technology in factories by 2025, with an estimated 70% of new installations expected to utilize it.

- IIoT Enablement: HMS's solutions are key enablers for IIoT, supporting the secure and reliable exchange of data from machines to cloud platforms, a critical component for smart manufacturing.

- Digital Transformation Support: The company's offerings directly support the industry's drive for digital transformation by providing the necessary connectivity and data gateways.

- Remote Operations: HMS's technology is vital for remote monitoring and control, a trend that has seen accelerated adoption, particularly post-2020, improving operational efficiency and reducing downtime.

HMS Networks' extensive and diversified product portfolio is a significant strength, covering a broad range of industrial communication needs. This comprehensive offering, featuring brands like Anybus and Ewon, positions them as a one-stop solution provider.

The strategic acquisitions of Red Lion Controls in April 2024 and PEAK-System Technik in November 2024 have substantially broadened HMS's market reach and technological capabilities, particularly in the US and German markets, enhancing their product depth in areas like HMI and automotive communication.

Leveraging a strong global presence with over 20 international sales offices and a vast network of distributors, HMS effectively serves a worldwide customer base, ensuring localized support and efficient market penetration.

HMS Networks is well-aligned with major industry trends, including the growth of Industrial Ethernet and IIoT, with their solutions actively facilitating digital transformation and remote operations in industrial settings.

| Strength Area | Key Brands/Acquisitions | Impact | 2025 Projection Relevance |

|---|---|---|---|

| Product Portfolio Breadth | Anybus, Ixxat, Ewon, Intesis, Red Lion, N-Tron | One-stop shop, cross-selling opportunities | Addresses diverse industrial connectivity needs |

| Strategic Acquisitions | Red Lion Controls (Apr 2024), PEAK-System Technik (Nov 2024) | Expanded US/Germany presence, new tech (HMI, automotive) | Strengthens competitive edge in key growth markets |

| Global Reach & Support | 20+ international sales offices, extensive distributor network | Localized service, efficient market penetration | Facilitates adoption of IIoT and Industrial Ethernet globally |

| Market Trend Alignment | Industrial Ethernet, IIoT, Digital Transformation | Enables data analysis, remote management | Supports the projected 70% factory installation of Industrial Ethernet by 2025 |

What is included in the product

Delivers a strategic overview of HMS’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform decision-making.

Offers a clear, structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

HMS's reliance on capital expenditure cycles makes it susceptible to economic downturns. Challenging economic environments and market uncertainties can directly impact customer spending on new equipment. For instance, a slight slowdown in newly installed nodes within the industrial network market was observed in 2024, highlighting this sensitivity to macroeconomic conditions.

Huawei's (HMS) historical reliance on a steady flow of electronic components, even as recent shortages have subsided, presents a potential weakness. A resurgence in supply chain disruptions, similar to those experienced in 2022-2023, could again impede their ability to manufacture essential hardware, impacting product availability and delivery timelines.

The integration of recent acquisitions, such as Red Lion Controls and PEAK-System Technik, presents a notable weakness for HMS. Merging diverse product portfolios, distinct corporate cultures, and disparate IT infrastructures demands significant capital and meticulous planning. These integration efforts, particularly for PEAK-System Technik, are projected to extend well into 2025, potentially diverting resources from other growth initiatives and creating operational complexities.

Organic Sales Decline in Q1 2025

HMS Networks faced a significant challenge with an organic net sales decline of 17% in the first quarter of 2025. This downward trend continued into the second quarter, with organic net sales falling by 5% during the same period. While the company saw overall sales growth fueled by strategic acquisitions, these figures highlight potential issues within the core business operations. It indicates that the company's existing products and services are not performing as strongly in the market. This organic sales contraction suggests that HMS Networks may need to re-evaluate its product development, marketing strategies, or competitive positioning to revitalize its underlying business performance.

The observed organic sales decline points to several potential underlying weaknesses:

- Market Saturation or Increased Competition: The core markets HMS operates in might be becoming more saturated, leading to intensified competition that erodes market share and pricing power for their organic offerings.

- Product Lifecycle or Innovation Lag: Existing product portfolios may be reaching the end of their lifecycle, or the company might be experiencing a lag in introducing innovative solutions that resonate with current customer demands.

- Economic Headwinds Affecting Core Demand: Broader economic conditions or specific industry slowdowns could be directly impacting the demand for HMS's non-acquired products and services.

- Integration Challenges Affecting Organic Focus: The significant effort and resources dedicated to acquisitions might inadvertently divert attention and investment away from nurturing and growing the existing organic business.

Cybersecurity Risks in Products

Cybersecurity remains a significant concern for HMS Networks, particularly given the nature of its industrial communication products. Devices like the Ewon Flexy are critical for connecting and managing industrial assets, making them potential targets for cyber threats. A key weakness lies in the inherent susceptibility of connected systems to vulnerabilities that could compromise data integrity or operational continuity. For example, the Ewon Flexy 202 was noted for a vulnerability concerning weak credential encoding, underscoring the constant need for vigilance in product security. This highlights the ongoing challenge of ensuring robust protection against evolving cyberattack methods.

The continuous threat landscape necessitates proactive security measures and rapid response to emerging vulnerabilities. HMS must prioritize the development and deployment of strong authentication mechanisms and secure data transmission protocols across its product portfolio. Regular security audits and penetration testing are essential to identify and remediate potential weaknesses before they can be exploited. The industry saw a notable increase in reported vulnerabilities in industrial control systems in 2023, with over 300 new vulnerabilities disclosed, emphasizing the critical importance of this focus for HMS.

- Product Vulnerabilities Products like the Ewon Flexy can be susceptible to cybersecurity weaknesses.

- Credential Encoding Issues Past vulnerabilities, such as weak credential encoding in the Ewon Flexy 202, require ongoing attention.

- Need for Updates Timely firmware updates are crucial to patch security flaws and protect connected industrial systems.

- Evolving Threat Landscape The increasing sophistication of cyber threats demands continuous investment in cybersecurity research and development.

HMS's dependence on capital expenditure cycles makes it vulnerable to economic slowdowns, as demonstrated by a slight decrease in newly installed industrial network nodes in 2024. Supply chain disruptions, similar to those seen in 2022-2023, remain a risk, potentially hindering hardware manufacturing. The integration of acquisitions like Red Lion Controls and PEAK-System Technik, with PEAK-System Technik integration expected into 2025, strains resources and can create operational complexity.

Preview Before You Purchase

HMS SWOT Analysis

The preview you see is the same HMS SWOT analysis document the customer will receive after purchasing. There are no hidden surprises, just the complete, professional-quality analysis. This ensures you know exactly what you're getting before you commit. Unlock the full, detailed report instantly upon purchase.

Opportunities

The global push for industrial digitalization, including the adoption of the Industrial Internet of Things (IIoT), is a major tailwind for HMS Networks. Companies worldwide are investing heavily in smart factory initiatives to boost efficiency and gain competitive advantages.

This trend directly fuels demand for HMS's expertise in connecting diverse industrial equipment and enabling seamless data flow. For instance, the IIoT market was projected to reach $111.7 billion in 2024, with significant growth expected in industrial automation segments where HMS excels.

Businesses are actively seeking solutions to optimize production processes, reduce downtime, and improve real-time decision-making, all areas where HMS's connectivity and protocol conversion technologies provide critical value.

HMS Networks has a significant opportunity to broaden its reach beyond traditional industrial automation into emerging, high-growth sectors. The company's recent organizational changes signal a strategic focus on areas like Building Automation and Vehicle Communication. This diversification allows HMS to tap into new markets demanding sophisticated communication solutions.

By leveraging its established expertise in industrial networking and integrating technologies from acquisitions such as PEAK-System, HMS is well-positioned to capture market share in these specialized verticals. For instance, the growing demand for smart building technology, projected to reach $167.8 billion by 2030 according to some market forecasts, presents a substantial avenue for expansion.

While industrial 5G adoption is still maturing, the long-term benefits for mobility, adaptable networks, and upgrading older equipment are significant. HMS Networks can capitalize on this by developing and integrating next-generation wireless solutions, including 5G, to proactively address the evolving industrial connectivity landscape.

The global industrial 5G market is projected to grow substantially, reaching an estimated USD 11.1 billion by 2027, according to various market analyses, highlighting a clear future demand. This presents HMS with a strategic opportunity to enhance its product portfolio with robust wireless capabilities, positioning itself as a key enabler of the smart factory revolution.

By focusing on solutions that facilitate seamless data exchange and real-time control over wireless networks, HMS can empower industries to achieve greater operational efficiency and flexibility. This includes retrofitting existing machinery with advanced wireless modules, thereby extending the lifespan and connectivity of legacy assets.

Geographical Market Expansion, particularly North America

North America represents a significant opportunity for HMS Networks, bolstered by a clear recovery in order intake. This rebound is largely attributable to the strategic acquisition of Red Lion, which has effectively expanded HMS's footprint and product offerings in the region.

The U.S. government's commitment to incentivizing domestic manufacturing directly translates into a heightened demand for automation and industrial communication solutions. This trend plays directly into HMS's strengths, positioning the company to capitalize on this growing market need.

Furthermore, the North American market offers substantial potential for geographical expansion. As manufacturing sectors continue to invest in modernization and efficiency, HMS is well-placed to capture market share.

- North American order intake shows a robust recovery, indicating strong market demand.

- The Red Lion acquisition has been a key driver in unlocking this regional growth potential.

- U.S. manufacturing incentives are expected to boost the need for automation and industrial communication.

- HMS is strategically positioned to benefit from these favorable market dynamics in North America.

Cross-Selling and Synergies from Recent Acquisitions

The integration of recently acquired companies, such as Red Lion Controls and PEAK-System Technik, presents significant opportunities for cross-selling and unlocking technological synergies. By bringing together diverse product portfolios and leveraging combined expertise, HMS can develop more robust and integrated solutions, thereby strengthening its market presence. For instance, pairing Red Lion's advanced control panels with Ewon's secure remote access technology allows for a more compelling and complete offering to customers in industrial automation. This consolidation is expected to boost revenue streams and create a more cohesive customer experience.

These acquisitions are strategically designed to capitalize on evolving market demands for connected industrial solutions. The 2024 and 2025 outlook suggests a continued emphasis on smart factory initiatives, where integrated hardware and software solutions are paramount. HMS's ability to combine the strengths of its acquired entities, such as Red Lion's human-machine interface (HMI) capabilities with Ewon's connectivity expertise, positions the company to capture a larger share of this growing market. The financial projections for 2024 indicate an acceleration in revenue growth driven by these combined product offerings.

- Enhanced Product Bundling: Offering combined solutions like Red Lion HMIs with Ewon connectivity platforms.

- Technological Synergies: Integrating R&D efforts to develop next-generation industrial IoT solutions.

- Market Penetration: Leveraging the customer bases of acquired companies for cross-selling opportunities.

- Revenue Growth: Anticipated increase in sales due to expanded and more comprehensive product portfolios.

HMS Networks is well-positioned to capitalize on the growing demand for industrial digitalization and the Industrial Internet of Things (IIoT). The company's expertise in connecting diverse industrial equipment and facilitating data flow is crucial as businesses invest in smart factory initiatives to enhance efficiency. The projected growth of the IIoT market, anticipated to reach $111.7 billion in 2024, underscores the significant opportunities for HMS in industrial automation.

Diversifying into emerging sectors like Building Automation and Vehicle Communication presents a substantial growth avenue for HMS. The company's strategic acquisitions, such as PEAK-System, strengthen its capabilities in these areas. With the smart building technology market expected to reach $167.8 billion by 2030, HMS can leverage its networking expertise to capture a significant share.

The ongoing development and adoption of industrial 5G technologies offer a long-term opportunity for HMS to enhance its wireless solutions. The industrial 5G market is forecast to grow, reaching an estimated USD 11.1 billion by 2027, presenting a clear demand for HMS's capabilities in enabling efficient and flexible wireless industrial connectivity, including retrofitting legacy assets.

North America represents a key growth region for HMS, driven by a strong recovery in order intake, partly due to the Red Lion acquisition. Government incentives promoting domestic manufacturing further boost the demand for automation and industrial communication solutions, positioning HMS favorably to expand its market presence in the region.

The integration of acquired companies like Red Lion Controls and PEAK-System Technik creates opportunities for cross-selling and technological synergies. Combining product portfolios, such as Red Lion's HMIs with Ewon's remote access, allows HMS to offer more comprehensive solutions, enhancing customer value and driving revenue growth in the evolving industrial IoT landscape. Financial projections for 2024 indicate accelerated revenue growth from these combined offerings.

| Opportunity Area | Market Projection/Growth Driver | HMS Relevance | Key Acquisition/Strategy |

| Industrial Digitalization & IIoT | IIoT Market: $111.7B (2024) | Connectivity & data flow expertise | Core business |

| Emerging Sectors (Building Automation, Vehicle Comm.) | Smart Building Market: $167.8B (by 2030) | Diversification of revenue streams | PEAK-System Technik |

| Industrial 5G | Industrial 5G Market: $11.1B (by 2027) | Next-gen wireless solutions | Product portfolio enhancement |

| North America Expansion | Manufacturing reshoring initiatives | Increased demand for automation | Red Lion Controls acquisition |

| Acquisition Integration | Synergies for bundled solutions | Expanded product offerings, cross-selling | Red Lion, PEAK-System |

Threats

The industrial ICT sector is a hotbed of activity, with many companies battling for dominance. This intense rivalry, from both seasoned players and nimble newcomers, could squeeze HMS's pricing power and chip away at its market share. For instance, in 2024, the industrial IoT market alone was projected to reach over $200 billion, indicating a vast but crowded space.

To stay ahead, HMS must constantly innovate and find ways to stand out from the pack. Failure to do so could lead to a decline in profitability as competitors offer similar solutions at lower prices. The need for continuous R&D investment becomes paramount in this environment, a challenge many companies face as they navigate evolving technological landscapes.

Global supply chains remain a significant vulnerability for many industries, including healthcare. Issues with accessing critical resources and ensuring the consistent availability of essential components are ongoing concerns that could affect manufacturing and delivery timelines.

Geopolitical shifts present a tangible threat, particularly given the heightened tensions around Taiwan and China. Such instability can directly impact HMS's ability to secure necessary resources, access key markets, and potentially alter customer purchasing patterns, as highlighted in their own risk assessments.

For instance, the semiconductor shortage experienced globally throughout 2021-2023 demonstrated how disruptions in one region could cascade, affecting the production of medical devices reliant on these components. This underscores the interconnectedness and fragility of modern supply networks.

The ongoing trade disputes and the potential for further sanctions or import/export restrictions stemming from geopolitical events create an unpredictable operating environment. These factors can lead to increased costs, delays, and necessitate costly adjustments to sourcing strategies for companies like HMS.

The industrial communication sector is experiencing a relentless surge in technological innovation. For HMS, this means keeping pace with advancements like gigabit Ethernet, Time-Sensitive Networking (TSN), and the increasingly crucial Single Pair Ethernet. The ongoing convergence of Operational Technology (OT) and Information Technology (IT) also demands constant adaptation.

Failure to integrate these evolving standards swiftly could render HMS's current product portfolio obsolete. Consider the rapid adoption of TSN, which is becoming a de facto standard for real-time industrial automation. Companies that don't offer TSN-compatible solutions risk losing market share to competitors who do.

In 2024, the IIoT market is projected to reach over $1 trillion, highlighting the immense opportunity but also the intense competition driven by technological progress. HMS must invest heavily in research and development to ensure its offerings remain cutting-edge, particularly in areas like cybersecurity for IIoT, which is becoming non-negotiable for industrial clients.

Cybersecurity Regulations and

Upcoming cybersecurity regulations, like the NIS2 directive set to fully apply by October 2024, will significantly impact companies like HMS. These regulations necessitate a re-evaluation of how industrial systems connect, leading to increased compliance expenses and a more complex product development cycle. The European Union's NIS2 directive aims to harmonize cybersecurity rules across member states, impacting critical infrastructure and digital service providers.

The growing complexity and frequency of cyberattacks present a direct danger to the security and dependability of industrial communication products. In 2023, the manufacturing sector experienced a notable rise in ransomware attacks, with some reports indicating an increase of over 40% compared to the previous year, highlighting the escalating threat landscape.

These evolving threats translate into tangible risks for HMS:

- Increased operational costs: Adapting to new regulatory frameworks like NIS2 and implementing advanced security measures will require substantial investment.

- Product development delays: Ensuring new products meet stringent cybersecurity standards can extend time-to-market.

- Reputational damage: A successful cyberattack on HMS products could severely damage customer trust and brand reputation.

- Potential for service disruption: Compromised industrial communication systems can lead to significant operational downtime for clients.

Macroeconomic Headwinds and Customer Inventory Adjustments

The industrial network market faced significant headwinds throughout 2024. A challenging macroeconomic environment, characterized by persistent inflation and rising interest rates, contributed to a noticeable slowdown. This economic uncertainty directly impacted customer behavior, leading many businesses to reassess their spending and adjust their inventory levels.

Consequently, companies like HMS experienced reduced order intake as clients worked through existing stock and postponed new purchases. While the pace of inventory adjustments began to moderate towards the end of 2024, the lingering effects of these economic pressures continue to pose a threat to future demand.

- Slowdown in Industrial Network Market: The market experienced a contraction in 2024, forcing companies to navigate a more challenging sales landscape.

- Customer Inventory Overhang: Many customers were still working through excess inventory at the start of 2024, delaying new orders.

- Economic Uncertainty: Persistent macroeconomic concerns, including inflation and geopolitical instability, dampened business investment and consumer spending.

- Impact on Organic Growth: These combined factors directly translated into slower organic sales growth for many players in the sector.

Intense competition within the industrial ICT sector, with an estimated industrial IoT market over $200 billion in 2024, pressures HMS's pricing and market share. Failure to innovate against rapid technological advancements like TSN could render their products obsolete, especially as the broader IIoT market is projected to exceed $1 trillion by 2024. Furthermore, evolving cybersecurity regulations, such as the NIS2 directive applicable from October 2024, increase compliance costs and product development complexity.

Geopolitical instability, particularly concerning Taiwan and China, poses a significant risk to HMS's supply chain and market access, as evidenced by the semiconductor shortages experienced in 2021-2023. The industrial network market's slowdown in 2024, driven by economic uncertainty and customer inventory overhang, directly impacts HMS's organic sales growth.

| Threat Category | Specific Threat | Impact on HMS | Relevant Data/Context |

|---|---|---|---|

| Competition | Intense rivalry in Industrial ICT | Pricing pressure, market share erosion | Industrial IoT market projected >$200B in 2024 |

| Technology | Rapid technological advancements (e.g., TSN) | Product obsolescence risk | IIoT market projected >$1T by 2024 |

| Regulation | New cybersecurity mandates (e.g., NIS2) | Increased compliance costs, development delays | NIS2 directive fully applicable by Oct 2024 |

| Geopolitics | Supply chain disruption, market access issues | Resource insecurity, altered customer behavior | Semiconductor shortages (2021-2023) |

| Macroeconomics | Market slowdown, customer inventory | Reduced order intake, slower organic growth | Industrial network market contraction in 2024 |

SWOT Analysis Data Sources

This analysis draws upon a robust foundation of data, including internal financial reports, comprehensive market research, and expert opinions from industry leaders to provide a thorough SWOT assessment.