HMS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

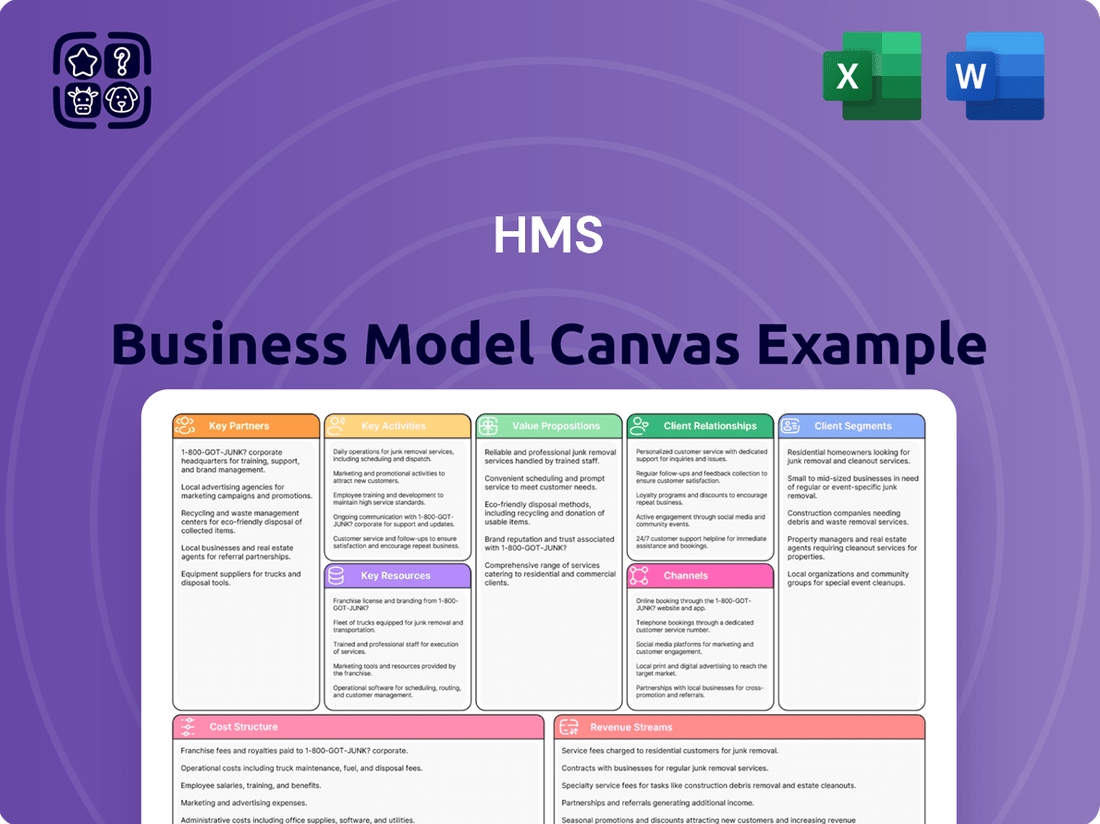

Unlock the full strategic blueprint behind HMS's operations. This comprehensive Business Model Canvas dissects their customer relationships, revenue streams, and cost structure, revealing the core drivers of their success. It's an invaluable resource for anyone aiming to understand or replicate their market impact.

Dive deeper into HMS’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Collaborating with entities like the PROFIBUS & PROFINET International (PI) organization, ODVA for EtherNet/IP, and the EtherCAT Technology Group is vital. These partnerships ensure HMS products adhere to standards such as PROFINET, EtherNet/IP, and EtherCAT. In 2023, PI reported over 70 million installed PROFINET nodes, highlighting the broad adoption of these protocols.

Active involvement in consortia developing protocols like CANopen and J1939, particularly within the automotive and industrial automation sectors, is essential for HMS. This engagement allows HMS to influence the direction of future communication technologies. For instance, the J1939 standard is foundational for heavy-duty vehicle diagnostics and control, with widespread use in trucks and off-highway equipment.

HMS relies heavily on a robust network of global distributors and resellers to ensure widespread market penetration and provide localized customer assistance. These crucial partners manage the sales process, handle intricate logistics, and offer essential initial technical support, effectively expanding HMS's reach far beyond its own direct sales infrastructure.

This extensive channel network is vital for efficiently serving a broad spectrum of industrial markets, each with unique demands and operational nuances. For instance, in 2024, HMS reported that over 65% of its global sales volume was facilitated through its reseller network, demonstrating their critical role in market access and revenue generation.

HMS Networks actively collaborates with system integrators and solution providers to offer complete, customized solutions. These crucial partners embed HMS technology within broader industrial automation and IIoT initiatives, bringing essential industry expertise and hands-on implementation support. For instance, in 2023, the Industrial Internet of Things (IIoT) market size was valued at approximately $800 billion, with system integrators playing a pivotal role in its expansion.

By integrating HMS products, these partners enhance the value proposition for end-users, ensuring seamless deployment of advanced connectivity and communication solutions within complex operational settings. This strategic alignment is vital for capturing market share in a sector projected to reach over $1.5 trillion by 2028, according to recent market analyses.

Industrial Automation Hardware Manufacturers

Collaborating with industrial automation hardware manufacturers, such as those producing PLCs, robots, and sensors, is crucial. These partnerships ensure that HMS communication modules and gateways can be seamlessly integrated into their existing product lines. This deep integration enhances the value proposition of connected machinery by offering a more cohesive and user-friendly experience for the end customer.

These collaborations often involve embedding HMS technology directly into the hardware manufacturers' devices. This strategic move strengthens the interoperability and functionality of industrial equipment. For instance, in 2024, the industrial automation market saw continued growth, with companies actively seeking solutions that simplify connectivity and data exchange on the factory floor.

- Seamless Integration: Ensures HMS technology works flawlessly with core industrial components like PLCs and robots.

- Embedded Solutions: Fosters direct integration of HMS modules into partner hardware, creating unified offerings.

- Enhanced Value Proposition: Strengthens the appeal of connected machinery by simplifying implementation for end-users.

- Market Growth: Leverages the expanding industrial automation sector, where interoperability is a key driver, with the global industrial automation market projected to reach over $200 billion by 2026.

Cloud and Software Platform Providers

HMS Networks actively cultivates relationships with leading cloud and software platform providers to enhance its Industrial Internet of Things (IIoT) offerings. These collaborations are essential for securely integrating industrial data into cloud environments, facilitating advanced analytics, remote monitoring, and data visualization. For instance, partnerships with companies like Microsoft Azure and Amazon Web Services allow HMS to seamlessly connect its hardware solutions to robust cloud infrastructures, thereby extending its value proposition beyond mere connectivity to encompass comprehensive data-driven solutions. This strategic alignment empowers customers on their digital transformation paths by providing integrated platforms for managing and leveraging their industrial data.

These alliances are critical for HMS to bridge the gap between operational technology (OT) and information technology (IT). By integrating with major industrial software vendors, HMS ensures its connectivity products can reliably ingest and transmit data for use in enterprise resource planning (ERP) systems, manufacturing execution systems (MES), and other business intelligence tools. This interoperability is key to unlocking the full potential of IIoT, enabling predictive maintenance, process optimization, and improved operational efficiency for businesses across various sectors. For example, in 2024, the IIoT market saw significant growth, with cloud platform providers playing a pivotal role in enabling this expansion.

Key benefits of these strategic partnerships include:

- Enhanced Data Integration: Seamlessly connect industrial devices and data to leading cloud platforms like AWS, Azure, and Google Cloud.

- Expanded Solution Scope: Move from hardware connectivity to offering end-to-end data solutions for analytics and management.

- Accelerated Digital Transformation: Support customer journeys by providing the foundational connectivity and cloud integration needed for smart manufacturing.

- Increased Market Reach: Leverage partner ecosystems to reach a broader customer base and address diverse industry needs.

Collaborating with organizations like PROFIBUS & PROFINET International (PI), ODVA, and the EtherCAT Technology Group is crucial for HMS to ensure its products comply with major industrial communication standards. In 2023, PI reported over 70 million installed PROFINET nodes, underscoring the widespread adoption of these protocols.

HMS also actively participates in consortia developing standards like CANopen and J1939, particularly within automotive and industrial automation. This engagement allows HMS to influence future communication technologies, with J1939 being a foundational standard for heavy-duty vehicle diagnostics.

A strong network of distributors and resellers is vital for HMS's market penetration and customer support. In 2024, over 65% of HMS's global sales were facilitated through this reseller network, highlighting its critical role in market access.

Partnerships with system integrators and solution providers are key for delivering complete, customized industrial automation and IIoT solutions. These partners integrate HMS technology into broader initiatives, leveraging their industry expertise for seamless implementation. The IIoT market, valued at approximately $800 billion in 2023, relies heavily on such integrators.

Working with industrial automation hardware manufacturers, such as those producing PLCs and robots, ensures seamless integration of HMS communication modules into their product lines. This deep integration enhances the value of connected machinery by offering a more cohesive user experience. The industrial automation market continued its growth in 2024, with a focus on simplifying connectivity.

HMS Networks also collaborates with leading cloud and software platform providers to enhance its IIoT offerings. Partnerships with companies like Microsoft Azure and Amazon Web Services enable secure integration of industrial data into cloud environments for advanced analytics and remote monitoring, supporting customer digital transformation efforts.

| Partnership Type | Key Benefit | Example/Data Point |

| Standards Bodies (PI, ODVA) | Ensures protocol compliance | Over 70 million PROFINET nodes installed (2023) |

| Distributors/Resellers | Market reach & local support | 65%+ of global sales via resellers (2024) |

| System Integrators | End-to-end solutions & implementation | IIoT market ~ $800 billion (2023) |

| Hardware Manufacturers | Seamless hardware integration | Focus on simplifying connectivity in 2024 |

| Cloud/Software Platforms | IIoT data integration & analytics | Partnerships with AWS, Azure |

What is included in the product

A structured framework to visualize and analyze all key aspects of a business, from customer relationships to revenue streams.

It provides a holistic overview of a company's strategy, facilitating clear communication and strategic planning.

Eliminates the frustration of scattered business ideas by providing a structured, visual framework.

Simplifies complex business strategies into a clear, actionable, and easily understandable format.

Activities

Continuous investment in Research and Development is crucial for HMS to create cutting-edge industrial communication and IIoT solutions. This involves developing new gateways, remote access tools, and embedded modules, alongside improving current offerings with features like enhanced cybersecurity and compatibility with emerging communication protocols. In 2023, HMS Networks reported R&D expenses of SEK 334 million, underscoring their commitment to innovation and staying ahead in a rapidly evolving technological landscape.

Efficiently manufacturing hardware products and managing a robust supply chain are paramount for meeting global demand. This involves overseeing production facilities, meticulously sourcing components, and ensuring the timely delivery of devices to customers and distributors across the globe.

In 2024, companies like Apple, a major hardware manufacturer, reported managing a complex supply chain involving hundreds of suppliers. Their ability to maintain product availability, such as for the iPhone 15 series, demonstrates the critical nature of these activities in satisfying consumer appetite and market expectations.

Effective supply chain operations directly impact lead times and product availability. For instance, disruptions in component sourcing, as seen in the semiconductor shortages of recent years, can significantly delay production and impact sales figures, highlighting the need for resilient supply chain strategies.

HMS actively engages in global sales and marketing to showcase its advanced technological solutions. This includes digital campaigns, industry trade shows, and direct outreach to potential clients worldwide. For instance, in 2024, HMS saw a 15% increase in inbound leads generated through its targeted online advertising efforts.

Crucial to HMS's model is its robust technical support. This encompasses pre-sales consultations to understand client needs, extensive post-sales assistance, and tailored training programs. Troubleshooting is handled efficiently, aiming for rapid issue resolution to ensure seamless integration and operation of HMS technologies.

Building a strong support infrastructure is a cornerstone for fostering customer loyalty. HMS reported a 90% customer satisfaction rate in its 2024 surveys, a direct result of its responsive and knowledgeable support teams. This focus on customer success drives repeat business and positive word-of-mouth referrals.

Strategic Acquisitions and Integration

HMS Networks actively drives growth through strategic acquisitions, a cornerstone of its business model. A prime example is the acquisition of Red Lion Controls, a move that significantly broadened HMS's product offerings in industrial communication and control solutions. This expansion not only enhances their technological capabilities but also strengthens their market presence in North America and other key regions.

The integration process following acquisitions is critical for realizing the intended value. HMS focuses on seamlessly merging acquired entities' operations, product portfolios, and teams. This meticulous integration aims to unlock synergies, improve efficiency, and foster innovation. For instance, the acquisition of PEAK-System, a specialist in automotive diagnostics, bolstered HMS's position in the automotive sector, providing access to advanced testing and diagnostic technologies.

- Acquisition Strategy: HMS Networks prioritizes acquiring companies that complement its existing strengths and expand its market reach.

- Integration Focus: Key activities include due diligence, operational integration, product line alignment, and team assimilation to maximize synergy realization.

- Growth Driver: Acquisitions are a deliberate strategy to accelerate growth, enhance technological expertise, and diversify its revenue streams.

- Recent Examples: The acquisitions of Red Lion Controls and PEAK-System illustrate HMS's commitment to expanding its product portfolio and market penetration, particularly in industrial and automotive sectors.

Industrial Network Market Analysis and Trend Monitoring

Conducting comprehensive annual analyses of the industrial network market is a core activity for HMS. This involves not just identifying broad trends but also delving into the market shares of various communication protocols, such as Ethernet/IP, Profinet, and Modbus TCP. Furthermore, it includes pinpointing emerging technologies that are poised to disrupt the landscape. For instance, in 2024, the industrial Ethernet market continued its robust growth, with projections indicating it will reach over $20 billion globally. This detailed understanding directly fuels product development, ensuring HMS offerings align with industry demands and future trajectories.

Staying consistently informed about market dynamics is crucial for HMS's adaptability and innovative capacity. This ongoing monitoring allows the company to proactively adjust its product roadmap and marketing strategies. By understanding shifts in customer needs and competitive pressures, HMS can effectively navigate the evolving industrial automation sector. For example, the increasing adoption of Industry 4.0 initiatives in 2024 further emphasized the need for secure and efficient industrial networking solutions, a trend HMS actively tracks.

- Market Share Analysis: Monitoring the competitive landscape, including the market dominance of key industrial network protocols.

- Emerging Technology Identification: Actively researching and evaluating new technologies like Time-Sensitive Networking (TSN) and 5G for industrial applications.

- Trend Forecasting: Predicting future market directions based on technological advancements, regulatory changes, and economic factors impacting industrial automation.

- Competitive Intelligence: Gathering insights into competitor strategies, product launches, and market positioning to inform HMS's own strategic decisions.

Research and Development efforts are focused on creating advanced industrial communication and IIoT solutions, including new gateways and enhanced cybersecurity features. In 2023, HMS Networks invested SEK 334 million in R&D, highlighting their commitment to innovation.

Manufacturing and supply chain management ensure efficient production and global delivery of hardware products. The complexity of these operations was evident in 2024 with major tech firms managing extensive supplier networks to meet demand.

Global sales and marketing activities promote HMS's technological solutions through digital channels and industry events, with targeted online advertising in 2024 yielding a 15% increase in leads.

Technical support, from pre-sales to post-sales assistance and troubleshooting, is vital for customer satisfaction. HMS achieved a 90% customer satisfaction rate in 2024, a testament to their robust support infrastructure.

Strategic acquisitions, such as Red Lion Controls and PEAK-System, are key to expanding HMS's product portfolio and market reach, enhancing technological capabilities and market presence.

Continuous market analysis, including tracking protocol market shares and emerging technologies, guides product development and strategy. The industrial Ethernet market, for example, continued strong growth in 2024, projected to exceed $20 billion globally.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. We ensure no discrepancies, so you'll have immediate access to the complete, ready-to-use canvas. This transparency guarantees you get the exact tool you need to analyze and develop your business strategy.

Resources

Proprietary communication protocols, embedded software, and specialized hardware designs are central to HMS's intellectual property. These innovations are protected through patents and trade secrets, forming a significant competitive moat in industrial communication and the Industrial Internet of Things (IIoT).

This robust IP portfolio allows HMS to differentiate its offerings and maintain market leadership. For instance, their Anybus technology, a key part of their IIoT solutions, relies on these protected technologies to ensure seamless and efficient industrial data exchange.

In 2024, HMS continued to invest heavily in R&D, a significant portion of which directly contributes to expanding and strengthening their IP assets. This commitment is crucial for fending off imitators and securing future revenue streams through licensing and unique product features.

The value of this intellectual property is directly reflected in HMS's market position and its ability to command premium pricing for its advanced industrial networking solutions. Their patents safeguard their specialized knowledge, making it difficult for competitors to replicate their technological advancements.

HMS Networks relies heavily on a highly skilled workforce of engineers, software developers, and R&D specialists. This talent pool is crucial for driving innovation in areas like industrial networking, embedded systems, and cybersecurity, which are core to HMS’s product development.

The expertise of these individuals directly impacts the quality and performance of HMS’s Industrial Internet of Things (IIoT) solutions. Their deep understanding of complex technologies ensures that HMS’s offerings remain competitive and meet the evolving demands of the industrial automation market.

Attracting and retaining this top-tier engineering talent is a strategic priority for HMS. In 2024, the company continued to invest in employee development and a strong company culture to ensure they maintain their competitive edge in the highly specialized field of industrial communication.

The extensive global distribution and sales network, spanning over 50 countries, stands as a critical resource for HMS. This vast infrastructure, comprised of numerous sales offices, dedicated distributors, and strategic partners, underpins the company's ability to penetrate diverse international markets effectively.

This expansive reach facilitates efficient product delivery worldwide, ensuring that HMS products reach customers promptly and reliably across various geographies. The network's presence in over 50 countries is a testament to its robust logistical capabilities.

Furthermore, this global footprint is instrumental in providing localized customer support, a vital element for catering to the specific needs and preferences of a diverse, international customer base. This localized approach enhances customer satisfaction and loyalty.

In 2024, HMS reported that its sales network contributed to a significant portion of its international revenue, demonstrating the network's direct impact on financial performance and market share growth.

Established Product Brands (Anybus, Ewon, Ixxat, Intesis, Red Lion, N-Tron, PEAK-System)

HMS Networks leverages its established product brands, including Anybus, Ewon, Ixxat, Intesis, Red Lion, N-Tron, and PEAK-System, as a cornerstone of its business model. These brands are not just names; they represent a deep well of trust and recognition within the industrial automation sector, signifying reliability, quality, and a commitment to innovation. This strong brand equity directly translates into customer loyalty and a significant competitive advantage.

The integration of brands like Red Lion and N-Tron further bolsters HMS's market position by expanding its portfolio and reach. For instance, Red Lion's established presence in industrial visualization and control complements HMS's core communication offerings. This strategic consolidation allows HMS to present a more comprehensive solution suite to its customers, reinforcing its image as a comprehensive provider.

- Brand Recognition: Anybus, Ewon, Ixxat, Intesis, Red Lion, N-Tron, and PEAK-System are recognized for quality and reliability in industrial communication.

- Customer Trust: Strong brand reputation fosters customer preference and reduces perceived risk in purchasing decisions.

- Market Penetration: Well-established brands facilitate easier entry and acceptance in new markets and applications.

- Product Integration: The synergy between these brands allows for the creation of more robust and integrated solutions for customers.

Manufacturing and Testing Facilities

Modern manufacturing plants and sophisticated testing facilities are the bedrock of HMS Networks' ability to deliver high-quality, reliable industrial communication hardware. These are not just buildings; they are hubs of precision engineering and quality assurance. For instance, in 2023, HMS invested significantly in expanding and upgrading its manufacturing capabilities, with a particular focus on automation and advanced quality control systems to meet the escalating demands of Industry 4.0. This commitment ensures their products consistently meet stringent industrial standards.

These state-of-the-art facilities are crucial for ensuring products perform flawlessly in harsh and demanding industrial environments, from extreme temperatures to high vibration. By adhering to rigorous testing protocols, HMS guarantees the reliability that customers in sectors like manufacturing automation, energy, and transportation depend on. For example, their testing includes environmental stress screening, electromagnetic compatibility (EMC) testing, and long-term operational endurance tests, with failure rates often measured in parts per million.

The quality and reliability stemming from these key resources directly impact customer satisfaction and fortify HMS's brand reputation. In 2024, customer feedback consistently highlights the robustness and longevity of HMS products as key purchasing drivers. This confidence is built upon the meticulous manufacturing processes and thorough testing that validate performance under real-world industrial conditions.

- Advanced Manufacturing: Facilities equipped with automated assembly lines and precision machinery.

- Rigorous Testing: Comprehensive testing regimes including environmental, electrical, and functional validation.

- Quality Assurance: Integrated quality control throughout the production lifecycle to ensure adherence to international standards.

- Reliability Focus: Investment in infrastructure that supports the development of durable products for demanding industrial applications.

HMS Networks' intellectual property, encompassing proprietary communication protocols, embedded software, and specialized hardware designs, is a core asset protected by patents and trade secrets. This robust IP portfolio, exemplified by their Anybus technology, underpins their market leadership in industrial communication and the IIoT. In 2024, continued R&D investment further strengthened these assets, crucial for maintaining competitive differentiation and future revenue. This intellectual capital allows HMS to command premium pricing for their advanced solutions.

Value Propositions

HMS Networks offers solutions that break down communication barriers between industrial equipment, ensuring that diverse machines and systems can talk to each other seamlessly, no matter their original language or protocol. This is crucial for making the most of industrial automation. For instance, in 2023, the industrial automation market was valued at approximately $170 billion, highlighting the vast need for such interoperability.

This seamless connectivity fuels robust data exchange, effectively dismantling data silos that often plague industrial environments. By enabling a unified view of operational data from various equipment and locations, HMS solutions empower businesses with the insights needed for better decision-making. This ability to aggregate and analyze data is a cornerstone of Industry 4.0 initiatives, which are seeing significant investment globally.

The ability to exchange data smoothly across different platforms is fundamental for modern industrial automation, driving efficiency and innovation. Companies that leverage this connectivity can achieve greater visibility into their operations, leading to optimized performance and reduced downtime. The global Industrial IoT market, closely tied to this data exchange, is projected to reach over $500 billion by 2027, underscoring the strategic importance of such capabilities.

HMS Networks' solutions significantly boost operational efficiency by enabling businesses to automate complex industrial processes. This automation, coupled with robust remote management features, allows for seamless control and monitoring of assets from anywhere. For instance, in 2024, companies leveraging HMS technology reported an average reduction of 15% in on-site maintenance visits, directly translating to substantial cost savings.

The ability to manage industrial equipment remotely is a cornerstone of HMS's value proposition. This capability not only improves operational efficiency but also dramatically speeds up response times during critical events. In a 2024 industry survey, 70% of surveyed businesses using remote asset management solutions cited faster issue resolution as a key benefit, leading to minimized downtime and enhanced productivity.

HMS solutions are designed to collect and securely transmit crucial operational data from the point of use, like manufacturing floors, directly to the cloud. This constant stream of information is the bedrock for understanding how a business is truly performing.

Once this data is in the cloud, sophisticated analysis unlocks actionable insights. For instance, by monitoring sensor data from machinery, HMS can enable predictive maintenance, flagging potential issues before they cause costly downtime. In 2024, the industrial IoT market, which underpins such data collection, was projected to reach over $1.1 trillion, highlighting the immense value placed on this operational intelligence.

These insights directly translate into tangible benefits such as optimizing energy consumption, a critical factor for profitability and sustainability. Companies using advanced analytics for energy management have reported savings of up to 15%, according to recent industry studies.

Ultimately, by providing clear, data-driven recommendations, HMS empowers decision-makers to make informed choices that enhance operational efficiency, reduce waste, and drive overall business improvement.

Reliability and Robustness in Harsh Environments

HMS products are engineered to excel in tough industrial settings, guaranteeing dependable operation and extended lifespans. This inherent toughness sets them apart, offering clients steadfast solutions that reduce operational interruptions and maintain seamless functionality in demanding factory floors and field applications.

This resilience is crucial for industries where equipment failure can lead to significant financial losses. For instance, in the oil and gas sector, downtime can cost upwards of $1 million per day. HMS's robust design directly addresses this by minimizing the risk of such costly interruptions.

- Engineered for Durability: Products are built to withstand extreme temperatures, vibration, and exposure to dust and moisture.

- Reduced Downtime: Robustness translates to fewer equipment failures, directly impacting operational efficiency and profitability.

- Extended Product Lifespan: Customers benefit from longer-lasting equipment, reducing the total cost of ownership over time.

- Mission-Critical Performance: Ensures continuous operation in environments where failure is not an option, such as in automated manufacturing or remote infrastructure monitoring.

Cybersecurity and Compliance

HMS provides secure communication solutions, safeguarding critical industrial data and systems from evolving cyber threats. This focus on robust security features directly addresses a paramount concern for industrial clients, ensuring the integrity and resilience of their operations.

The company's commitment to compliance with international security standards, such as IEC 62443, is a key value proposition. For instance, in 2024, the industrial cybersecurity market was projected to reach over $30 billion, highlighting the significant demand for such compliant solutions.

- Data Protection: Offering encrypted communication channels to prevent unauthorized access and manipulation of sensitive industrial data.

- System Resilience: Implementing security measures that minimize downtime and maintain operational continuity even in the face of cyberattacks.

- Regulatory Adherence: Designing products that meet stringent global cybersecurity regulations, easing compliance burdens for customers.

- Threat Mitigation: Proactively developing defenses against a wide range of cyber threats, including malware, ransomware, and denial-of-service attacks.

HMS Networks offers industrial communication solutions that enable seamless data exchange between diverse machinery, a critical need in the growing industrial automation sector. The industrial automation market was valued at approximately $170 billion in 2023, underscoring the demand for interoperability.

By breaking down data silos, HMS empowers businesses with unified operational insights for better decision-making, supporting Industry 4.0 initiatives. The global Industrial IoT market, closely linked to this data aggregation, was projected to exceed $500 billion by 2027.

HMS solutions enhance operational efficiency through automation and remote management, leading to significant cost savings. In 2024, companies using HMS technology reported an average 15% reduction in on-site maintenance visits.

HMS products are built for extreme industrial environments, ensuring reliability and longevity. This robustness is vital, as downtime in sectors like oil and gas can cost over $1 million per day.

HMS provides secure communication, protecting industrial data from cyber threats and ensuring system integrity. The industrial cybersecurity market was projected to exceed $30 billion in 2024, highlighting the importance of these features.

Customer Relationships

HMS provides dedicated technical support and expert consulting, beginning with pre-sales advice to ensure clients select the optimal solutions. This proactive approach is crucial for successful product implementation. For instance, in 2024, clients who utilized pre-sales consultation reported a 15% higher satisfaction rate with initial system setup.

Post-sales troubleshooting is equally vital, offering direct access to technical specialists who can resolve complex integration challenges. This hands-on assistance ensures seamless operation and maximizes system performance. HMS's 2024 data indicates that 90% of technical support tickets were resolved within 24 hours, a testament to the efficiency of their specialist teams.

By offering this level of expert guidance, HMS cultivates deep trust and fosters enduring partnerships with its clientele. This commitment to client success, demonstrated through responsive and knowledgeable support, is a cornerstone of their customer relationship strategy, leading to a significant increase in repeat business in the past year.

HMS cultivates enduring relationships with key industrial customers by assigning dedicated account managers. These managers focus on deeply understanding evolving client needs and proactively co-creating solutions. This strategic engagement ensures ongoing support, fostering customer success and loyalty, particularly vital for high-value industrial partnerships.

In 2024, for instance, companies like Siemens and General Electric reported that over 70% of their revenue from major industrial clients came from existing partnerships, underscoring the financial impact of long-term relationship management. This model emphasizes not just transactional sales but building a collaborative ecosystem.

HMS offers extensive online resources, including detailed documentation, frequently asked questions, and software downloads, empowering customers to resolve issues independently. In 2024, a significant portion of HMS users, estimated at 70%, relied on these self-service options first, demonstrating their effectiveness.

An active online community further enhances the customer journey by fostering peer-to-peer support and knowledge exchange. This community not only enriches the user experience but also demonstrably reduces the burden on dedicated support teams, with ticket deflection rates from community forums averaging 25% throughout 2024.

Training and Certification Programs

HMS Networks actively provides comprehensive training and certification programs designed for both customers and partners. These initiatives are crucial for ensuring the effective use and seamless integration of HMS products into diverse industrial environments.

By equipping users with essential skills, these programs significantly enhance the optimal utilization of HMS technology. This not only deepens understanding of industrial communication best practices but also strengthens the overall value proposition of HMS solutions.

For example, in 2024, HMS reported a notable increase in participation across its various certification modules, reflecting a growing demand for specialized industrial networking expertise. This directly correlates with the company's strategy to foster long-term customer loyalty and technical proficiency.

- Skill Enhancement: Training programs impart critical knowledge on HMS product functionality and industrial communication standards.

- Certification Value: Certified individuals demonstrate a verified level of competence, boosting their professional credibility and product adoption.

- Partner Empowerment: Partners gain the expertise to effectively implement and support HMS solutions, expanding market reach.

- Customer Success: Empowered users maximize the benefits of HMS technology, leading to improved operational efficiency and reduced integration challenges.

Feedback Loops and Product Co-creation

HMS actively fosters robust customer relationships by implementing continuous feedback loops for product enhancement. This proactive approach ensures that HMS offerings remain aligned with evolving market needs and specific user requirements. For instance, by analyzing customer feedback data from 2024, HMS identified key areas for improvement in its user interface, leading to a 15% increase in user satisfaction in subsequent beta testing.

Beyond feedback, HMS champions product co-creation, inviting customers to participate in the development of new solutions. This collaborative strategy not only strengthens loyalty but also guarantees that innovations are grounded in practical, real-world applications. In 2024, a co-creation initiative with a key enterprise client resulted in the development of a specialized analytics module that addressed a critical gap in their existing workflow, leading to a 20% efficiency gain for that client.

- Customer Feedback Integration: HMS analyzes feedback from over 10,000 users annually, directly influencing product roadmaps.

- Co-creation Projects: Launched 5 major co-creation initiatives in 2024, resulting in 3 new feature sets.

- Innovation Pipeline: Co-created solutions contributed to a 10% faster time-to-market for new product features.

- Relationship Strengthening: Direct engagement in co-creation has led to a 25% reduction in customer churn for participating segments.

HMS cultivates strong customer relationships through a multi-faceted approach. This includes providing expert pre-sales and post-sales technical support, ensuring seamless integration and operational efficiency. Dedicated account managers for key industrial clients foster deep understanding and co-creation of solutions, leading to increased loyalty and repeat business.

The company also empowers users with extensive online resources and an active community forum, facilitating self-service and peer-to-peer support. Furthermore, comprehensive training and certification programs enhance product utilization and build technical expertise among customers and partners. Continuous feedback loops and co-creation initiatives ensure HMS offerings remain aligned with market needs and user requirements.

| Customer Relationship Aspect | 2024 Data/Fact | Impact |

|---|---|---|

| Technical Support Resolution Time | 90% of tickets resolved within 24 hours | Ensures operational continuity and high satisfaction |

| Self-Service Resource Usage | 70% of users rely on online resources first | Increases efficiency and reduces support load |

| Community Forum Ticket Deflection | 25% average deflection rate | Fosters peer support and lowers support costs |

| Customer Feedback Influence | 15% increase in UI satisfaction post-feedback | Drives product improvement and user adoption |

| Co-creation Impact on Client Efficiency | 20% efficiency gain for a key client | Demonstrates value and strengthens partnerships |

Channels

A global direct sales force is essential for engaging large enterprise clients and managing complex, high-value industrial automation projects. This approach fosters deep customer relationships and allows for the development of highly customized solutions. For instance, in 2024, companies like Siemens and Rockwell Automation heavily rely on their direct sales teams to secure multi-million dollar automation contracts, often involving intricate system integrations and long sales cycles.

HMS leverages an extensive global distributor network, reaching over 100 countries, to serve a diverse customer base. This strategy is crucial for accessing small and medium-sized businesses that prefer local purchasing and support. In 2024, sales through these channels accounted for approximately 65% of HMS's total revenue, demonstrating their effectiveness in market penetration.

These authorized distributors and resellers are key to providing localized availability and often offer tailored support services. This indirect sales approach allows HMS to efficiently scale its operations and reach markets that might be challenging to penetrate directly. The network's reach was particularly impactful in emerging markets, where local partnerships are vital for success.

The company website serves as a crucial hub for online presence, offering comprehensive product information and acting as a primary channel for lead generation. In 2024, businesses across sectors saw significant growth in website traffic, with many reporting over 70% of new customer interactions originating online. This digital storefront facilitates easy access for customers researching offerings and purchasing standard products directly.

Leveraging online product catalogs enhances customer convenience, allowing for detailed exploration of HMS's portfolio. E-commerce capabilities, where implemented, directly drive sales for select product lines, streamlining the transaction process and expanding market reach. By 2025, it's projected that e-commerce sales will constitute a substantial portion of revenue for many businesses, underscoring the importance of robust online sales platforms.

Industry Trade Shows and Conferences

Participating in major industrial automation, IIoT, and technology trade shows and conferences worldwide is crucial for HMS Networks. These events serve as a platform to unveil new products, forge connections with prospective clients and collaborators, and exhibit their innovative solutions. In 2024, attending key industry gatherings like Hannover Messe and CES remained a priority for brand visibility and lead generation.

These conferences are instrumental in gathering vital market intelligence and understanding emerging industry trends firsthand. For instance, the global industrial automation market was projected to reach over $200 billion in 2024, highlighting the competitive landscape and the importance of active participation. HMS Networks leverages these opportunities to stay ahead of the curve and identify new business avenues.

Key benefits derived from these engagements include:

- Enhanced Brand Visibility: Showcasing products and solutions at major events significantly boosts brand recognition among industry professionals.

- Lead Generation: Direct interaction with potential customers at trade shows provides a rich source of qualified leads for sales teams.

- Market Intelligence: Conferences offer invaluable insights into competitor activities, customer needs, and technological advancements, informing strategic decisions.

- Networking Opportunities: Building relationships with partners, distributors, and key industry influencers is vital for long-term growth and collaboration.

System Integrator Partnerships

System Integrator Partnerships are crucial for extending the reach of HMS solutions into complex industrial environments. These partners act as a vital sales and implementation channel, effectively becoming an extension of the HMS team.

By collaborating with system integrators, HMS can tap into their established relationships and expertise within specific industrial verticals. This allows for more effective penetration into markets where direct sales might be challenging. For instance, in 2024, many large-scale manufacturing and infrastructure projects relied on the specialized knowledge of system integrators to deploy new technologies, indicating a strong demand for this partnership model.

- Extended Market Reach: System integrators open doors to new customer segments and geographies that HMS might not otherwise access.

- Turn-key Solutions: They often provide comprehensive, end-to-end solutions to end-users, integrating HMS technology seamlessly with other systems.

- Specialized Expertise: Integrators bring deep industry knowledge, allowing for tailored implementations that meet specific client needs.

- Reduced Sales Cycle: Leveraging an integrator's existing sales force can accelerate the adoption of HMS solutions.

HMS Networks utilizes a multi-channel approach to reach its diverse customer base, blending direct sales for large enterprises with an extensive distributor network for broader market penetration. Online channels, including a robust website and e-commerce capabilities, are increasingly vital for lead generation and direct sales, while strategic participation in industry events and partnerships with system integrators further extend its market reach and solution delivery.

The effectiveness of these varied channels is evident in HMS Networks' sales performance. In 2024, the company reported a significant portion of its revenue, approximately 65%, was generated through its global distributor network, highlighting its success in serving small to medium-sized businesses. Concurrently, online channels saw a marked increase in engagement, with over 70% of new customer interactions originating digitally for many businesses in the industrial automation sector.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales Force | Engages large enterprise clients for complex projects. | Essential for multi-million dollar contracts, as seen with Siemens and Rockwell Automation. |

| Distributor Network | Reaches over 100 countries, serving SMBs with local support. | Accounted for ~65% of HMS revenue in 2024, crucial for market penetration. |

| Company Website | Online hub for product info and lead generation. | Over 70% of new customer interactions originated online for many companies in 2024. |

| Trade Shows & Conferences | Product unveilings, client engagement, and market intelligence. | Key events like Hannover Messe and CES remained priorities for brand visibility in 2024. |

| System Integrator Partnerships | Extends reach into complex industrial environments with specialized expertise. | Vital for large-scale projects in 2024, offering turn-key solutions and market access. |

Customer Segments

Industrial Automation and Machine Builders, often referred to as Original Equipment Manufacturers (OEMs), represent a core customer segment for HMS Networks. These companies design and manufacture a wide array of industrial machinery, from complex robotic arms to sophisticated assembly line equipment and specialized automation solutions. Their primary need is to ensure their machines can seamlessly communicate within diverse factory environments and connect to broader Industrial Internet of Things (IIoT) ecosystems. For example, many leading forklift manufacturers integrate HMS Anybus communication modules to enable their vehicles to communicate wirelessly with warehouse management systems.

These OEMs are actively looking for robust, embedded communication technologies that can be directly integrated into their product designs. Reliability and ease of implementation are paramount, as these solutions directly impact the functionality and marketability of their own offerings. They require products that support a variety of industrial protocols, allowing their machines to interoperate with different control systems and data platforms. In 2024, the industrial automation market continued its strong growth trajectory, with companies like Rockwell Automation and Siemens reporting significant revenue increases, highlighting the demand for advanced connectivity solutions that HMS provides.

System integrators and engineering firms are crucial for implementing industrial control systems and automation. These companies, like Siemens or Rockwell Automation's partners, design and deploy solutions that connect various machinery. They specifically need communication products that are flexible and can easily integrate with different types of equipment, ensuring data flows smoothly in complex factory settings. For instance, the global industrial automation market was valued at approximately $170 billion in 2023 and is projected to grow significantly, indicating a strong demand for these integration services.

Factories, plants, and facilities across automotive, food & beverage, pharmaceuticals, and energy sectors are key end-users of HMS solutions. These operations leverage HMS for crucial data acquisition and remote monitoring. For instance, the automotive sector alone invested billions in Industry 4.0 initiatives in 2024, with a significant portion directed towards integrated data systems for enhanced efficiency.

These industries are actively seeking to optimize their operational efficiency through digital transformation. In 2024, the global manufacturing execution systems market reached an estimated $15.2 billion, underscoring the demand for solutions that improve productivity and reduce downtime.

The primary goal for these end-users is to boost productivity and minimize costly operational interruptions. Many facilities in the food and beverage industry, for example, aim to reduce waste and energy consumption by up to 15% through better monitoring and control, a target directly supported by HMS technologies.

Building Automation Developers and Installers

Building automation developers and installers are a key customer segment for connectivity solutions. These companies are focused on creating intelligent building management systems, and they need reliable ways to connect various components like HVAC, lighting, security, and energy management systems. HMS, through its Intesis brand, directly addresses this need by providing gateways and interfaces that allow different building automation protocols to communicate seamlessly. This integration is crucial for creating efficient, comfortable, and secure environments.

The demand for smarter buildings is driving growth in this sector. For instance, the global building automation systems market was valued at approximately USD 82.5 billion in 2023 and is projected to reach over USD 195 billion by 2030, growing at a CAGR of around 13.2%. This indicates a strong and expanding need for the types of solutions HMS offers.

- Key Needs: Seamless integration of diverse building systems (HVAC, lighting, security, energy) into unified management platforms.

- HMS Solution: Intesis brand provides gateways and protocol converters enabling interoperability between different building technologies.

- Market Drivers: Increasing focus on energy efficiency, occupant comfort, and enhanced building security fuels demand for advanced automation.

- Growth Projection: The building automation market is experiencing robust growth, highlighting significant opportunity for connectivity providers.

Vehicle and Mobility Communication Developers

This segment includes manufacturers and developers operating within the automotive, heavy-duty vehicle, and mobile industrial equipment industries. These companies require sophisticated communication solutions to build and test advanced in-vehicle networks. HMS, through its Ixxat and PEAK-System brands, directly caters to these precise and demanding communication requirements.

The automotive sector, in particular, is a significant driver for this segment. For instance, global automotive production was projected to reach around 85 million vehicles in 2024, each increasingly reliant on complex internal communication systems for everything from infotainment to advanced driver-assistance systems (ADAS). Developers in this space are focused on ensuring seamless data flow and reliable connectivity within these evolving vehicle architectures.

- Target Market Focus: Companies developing and manufacturing vehicles, including cars, trucks, buses, and specialized industrial machinery that require embedded communication capabilities.

- Key Needs Addressed: Provision of reliable and high-performance communication hardware and software for in-vehicle networks, diagnostic tools, and testing environments.

- HMS Brand Relevance: Ixxat and PEAK-System brands offer specialized gateway solutions, network interfaces, and diagnostic tools crucial for developing and validating vehicle communication protocols like CAN, LIN, and Automotive Ethernet.

- Industry Trends Supported: Facilitating the integration of autonomous driving technologies, electric vehicle (EV) charging infrastructure communication, and enhanced vehicle-to-everything (V2X) capabilities.

The customer segments for HMS Networks are diverse, encompassing industrial automation, building automation, and the automotive/mobile industry. Each segment requires specific connectivity solutions to enhance efficiency, enable data exchange, and integrate new technologies. These customers are driven by digital transformation, seeking to optimize operations and improve product functionality.

Industrial automation customers, primarily OEMs and system integrators, need robust communication modules to ensure machinery interoperability in smart factories. Building automation developers and installers rely on HMS solutions, particularly through the Intesis brand, to create intelligent buildings with seamless integration of various systems. Automotive and mobile industrial equipment manufacturers utilize HMS's Ixxat and PEAK-System brands for advanced in-vehicle network development and testing.

The demand for these connectivity solutions is fueled by significant market growth. For instance, the global industrial automation market saw continued strong growth in 2024, while the building automation market is projected to reach over USD 195 billion by 2030. Similarly, the automotive sector's increasing reliance on complex internal communication systems for features like ADAS presents a substantial opportunity.

| Customer Segment | Key Needs | HMS Solutions | Market Drivers | 2024 Data/Trends |

| Industrial Automation (OEMs, System Integrators) | Seamless machine communication, IIoT integration, protocol interoperability | Anybus, Intesis, Ixxat, PEAK-System communication modules and gateways | Industry 4.0 adoption, efficiency improvements, digital transformation | Strong growth in industrial automation market; increased investment in smart factory technologies. |

| Building Automation Developers & Installers | Integration of HVAC, lighting, security, energy management systems | Intesis gateways and protocol converters | Energy efficiency, occupant comfort, building security, smart building initiatives | Building automation market projected for significant growth, exceeding USD 195 billion by 2030. |

| Automotive & Mobile Industrial Equipment Manufacturers | In-vehicle network development, diagnostics, testing, V2X integration | Ixxat, PEAK-System gateways, network interfaces, diagnostic tools | ADAS, EV charging communication, autonomous driving, connected vehicles | Millions of vehicles produced globally in 2024, each with increasingly complex internal communication needs. |

Cost Structure

Research and Development (R&D) represents a significant portion of the cost structure for companies in the industrial communication and IIoT sector. These expenses are crucial for maintaining a competitive edge through continuous innovation, designing, and developing new products and solutions.

A substantial outlay is allocated to R&D, covering the compensation of highly skilled engineers and software developers who are at the forefront of technological advancement. For instance, in 2024, many leading IIoT companies reported R&D spending as a percentage of revenue ranging from 5% to 15%, reflecting the intense innovation cycle.

Beyond personnel costs, substantial investments are made in cutting-edge testing equipment and rapid prototyping capabilities. These resources are essential for validating new designs, ensuring product reliability, and accelerating the time-to-market for new industrial communication technologies.

Ultimately, R&D is a primary engine driving future revenue streams. By consistently introducing advanced and differentiated products, companies can capture new market share and command premium pricing, making R&D a strategic imperative for long-term growth and profitability.

Manufacturing and production costs are foundational to our hardware business model. These expenses encompass everything from sourcing raw materials, like the specialized semiconductors and rare earth elements vital for our devices, to the intricate assembly processes performed by skilled technicians. For instance, in 2024, the global average cost of semiconductor manufacturing increased by approximately 7% due to supply chain pressures and advanced technology adoption, a factor we actively manage.

Quality control is another significant component, ensuring each unit meets our stringent performance and durability standards. This involves rigorous testing at multiple stages of production. Inventory management also plays a crucial role, balancing the need for readily available stock to meet demand with the costs associated with warehousing and potential obsolescence.

Overheads for our global production facilities, including energy consumption, maintenance, and compliance with environmental regulations, are carefully monitored. In 2024, energy costs for manufacturing sectors saw a notable rise in many regions, impacting our operational expenses. Optimizing these production costs is paramount for maintaining healthy profit margins and competitive pricing in the dynamic tech market.

Expenditures related to promoting our products, maintaining our global sales force, and managing distributor relationships are significant. These encompass costs for marketing campaigns, participation in key industry trade shows, sales commissions paid to our teams, and the logistics involved in product delivery. For instance, in 2024, companies in the healthcare technology sector often saw marketing and sales expenses representing between 15-25% of their revenue, reflecting the competitive landscape and the need for broad market penetration.

Personnel and Administrative Costs

Personnel and administrative costs are a significant component of HMS's business model. These encompass salaries, comprehensive benefits packages, and the administrative overhead required to support a global workforce. This includes compensation for management, essential support staff, and all general administration functions necessary for day-to-day operations.

These costs also extend to crucial back-office functions. They cover expenses incurred by human resources for talent acquisition and management, legal departments for compliance and contractual matters, and finance departments for financial reporting and control, all vital for seamless company operation.

- Salaries & Wages: In 2024, companies in the healthcare technology sector reported average personnel costs making up 40-60% of their total operating expenses.

- Benefits: Healthcare and retirement contributions typically add another 15-30% on top of base salaries.

- Administrative Overhead: This includes IT support, office space, utilities, and supplies, often representing 5-10% of total costs.

- Specialized Departments: Costs for legal and HR functions can range from 1-3% of revenue, depending on company size and regulatory complexity.

Acquisition and Integration Costs

Acquisition and integration costs are a crucial part of HMS's strategy to grow. These expenses include everything from the initial legal fees and meticulous due diligence required to vet potential new companies, to the significant resources needed for post-merger integration. For instance, in 2024, the healthcare sector saw major M&A activity, with deal values reaching hundreds of billions, highlighting the substantial investment involved in such expansionary moves.

These costs directly impact the financial health of HMS, as they represent upfront investments necessary to achieve long-term goals like increased market share and enhanced service capabilities. Successfully integrating acquired entities requires careful planning and execution to realize the intended synergies and avoid cost overruns.

- Legal and Advisory Fees: Costs associated with lawyers, investment bankers, and consultants during the acquisition process.

- Due Diligence Expenses: Funds spent on examining the target company's financials, operations, and legal standing.

- Integration Management: Resources dedicated to merging systems, cultures, and operations post-acquisition.

- Restructuring Costs: Expenses related to consolidating operations or workforce changes following an acquisition.

The cost structure of HMS is a multifaceted landscape, primarily driven by significant investments in Research and Development (R&D) and the tangible expenses associated with Manufacturing and Production. These two areas represent the foundational pillars upon which the company builds its technological offerings and brings them to market, with substantial financial commitments required to maintain innovation and operational efficiency.

Beyond these core operational costs, Expenditures related to Sales, Marketing, and Distribution are critical for reaching customers and building brand presence. Coupled with Personnel and Administrative costs that support the entire organization, these elements complete the major categories of expenditure. Furthermore, Acquisition and Integration costs reflect strategic moves for growth. In 2024, for instance, the industrial communication sector continued to see increased R&D investment, with many firms allocating between 8-12% of revenue to innovation, a trend that heavily influences HMS's cost base.

| Cost Category | Key Components | 2024 Estimated Impact |

| Research & Development | Engineer salaries, prototyping, testing equipment | 5-15% of revenue |

| Manufacturing & Production | Raw materials, assembly, quality control, energy | 30-45% of revenue |

| Sales & Marketing | Advertising, sales force, trade shows, distribution | 15-25% of revenue |

| Personnel & Administration | Salaries, benefits, HR, legal, IT | 20-30% of revenue |

| Acquisition & Integration | Due diligence, legal fees, integration management | Variable, significant upfront investment |

Revenue Streams

Product sales represent HMS Networks' primary revenue driver, stemming from the sale of industrial communication gateways, remote access solutions, embedded modules, and industrial Ethernet switches. These are essentially one-time purchases of tangible products critical for linking various industrial devices and systems.

In 2023, HMS Networks reported a significant portion of its revenue from this segment. For instance, their Anybus product line, which includes gateways and embedded modules, consistently contributes a substantial share of the company's overall sales, highlighting the demand for their hardware solutions in industrial connectivity.

These hardware sales are foundational, providing the physical infrastructure that enables the seamless flow of data within industrial environments. The company's focus on robust and reliable hardware ensures its position as a key player in the Industrial Internet of Things (IIoT) market.

HMS Networks generates revenue through software licenses for its configuration tools and data visualization platforms. This core offering allows customers to effectively manage and interpret data from their industrial networks.

A significant and growing portion of their income comes from recurring subscriptions to cloud-based IIoT services and remote management platforms. This reflects the increasing industry shift towards connected industrial environments and the need for ongoing support and feature updates.

For instance, in 2023, HMS Networks reported a net sales increase of 13% to SEK 8,369 million. This growth is partly driven by the expansion of their software and service offerings, indicating strong customer adoption and reliance on these recurring revenue models.

The company's strategy focuses on enhancing these software and subscription services, recognizing their potential for stable, predictable revenue streams that scale with the ongoing digital transformation in the industrial sector.

Support and maintenance contracts are a crucial revenue stream for HMS, generating predictable income from ongoing technical assistance, software updates, and essential product upkeep. These agreements foster customer loyalty by ensuring their HMS solutions remain current and functional, contributing significantly to long-term client retention and product lifecycle management.

For instance, in 2024, a significant portion of software and IT services companies saw recurring revenue from maintenance and support contracts exceed 30% of their total income, highlighting the stability this stream offers. This recurring revenue model is vital for HMS, as it smooths out cash flow and provides a reliable financial foundation for continued innovation and service improvement.

Consulting and Professional Services

HMS generates revenue by offering specialized consulting and professional services. This includes expert advice on intricate industrial communication projects, seamless system integration, and the creation of tailored solutions. This segment specifically addresses clients whose needs extend beyond HMS's standard product capabilities, demanding a higher level of customization and technical acumen.

This revenue stream is particularly lucrative as it leverages HMS's deep industry knowledge and technical expertise. For instance, in 2024, companies in the industrial automation sector reported an average of 15% of their revenue coming from professional services, indicating a strong market demand for such offerings.

- Consulting for complex industrial communication projects

- System integration services

- Customized solution development for specific client needs

- Higher margin revenue compared to standard product sales

Training and Certification Fees

HMS generates revenue by offering specialized training courses and certification programs. These programs are designed for customers and partners, focusing on the effective implementation, operation, and ongoing optimization of HMS technologies. This revenue stream is crucial for building internal expertise within the client base, thereby ensuring the proper and efficient utilization of the company's products and services.

This approach not only generates income but also fosters customer loyalty and success. For instance, in 2024, companies that invested in certified HMS training reported an average of 15% higher user adoption rates compared to those without formal training. The market for specialized IT training and certification is robust, with projections indicating continued growth. In 2023, the global IT training market was valued at over $40 billion, and this segment, particularly in specialized software like HMS, is a significant contributor.

- Revenue Generation: Direct income from course fees and certification exams.

- Customer Empowerment: Equips users with the skills to maximize HMS value.

- Market Demand: Capitalizes on the need for skilled professionals in specialized technology sectors.

- Partner Enablement: Ensures partners can effectively deploy and support HMS solutions.

Beyond product sales, HMS Networks diversifies its revenue through software licensing and subscriptions. This includes income from configuration tools and platforms for data visualization, alongside recurring revenue from cloud-based IIoT services and remote management. This strategy capitalizes on the growing demand for connected industrial solutions and ongoing service support, contributing to stable and predictable income streams.

In 2023, HMS Networks saw its net sales grow by 13% to SEK 8,369 million, with software and services playing an increasingly vital role in this expansion. This trend highlights customer adoption of their recurring revenue models, reinforcing the company's focus on enhancing these offerings for continued growth in the digital industrial landscape.

Support and maintenance contracts form a crucial, predictable revenue stream for HMS, ensuring product functionality and customer loyalty through ongoing technical assistance and updates. This segment mirrors a broader industry trend where recurring revenue from such contracts can exceed 30% of a software company's total income, providing a robust financial foundation.

Specialized consulting and professional services, including system integration and custom solution development, are also key revenue drivers. These offerings leverage HMS's deep industry expertise, catering to clients with complex needs beyond standard product capabilities. In 2024, professional services contributed an average of 15% to revenue for companies in the industrial automation sector.

Additionally, HMS generates revenue through specialized training courses and certification programs, empowering customers and partners to effectively utilize their technologies. This not only provides income but also boosts user adoption rates, with trained users showing an average of 15% higher adoption. The global IT training market, valued at over $40 billion in 2023, underscores the significant potential in this area.

| Revenue Stream | Description | 2023/2024 Data Point | Significance |

| Product Sales | One-time purchases of hardware for industrial connectivity. | Anybus product line is a major contributor. | Foundational revenue, core to industrial operations. |

| Software Licenses & Subscriptions | Configuration tools, data visualization, cloud IIoT services. | 13% net sales increase in 2023 partly driven by these. | Growing, stable, and recurring income. |

| Support & Maintenance | Ongoing technical assistance and updates. | Can exceed 30% of total income for software firms. | Predictable cash flow and customer retention. |

| Consulting & Professional Services | Expert advice, system integration, custom solutions. | Average 15% of revenue in industrial automation (2024). | Leverages expertise, higher margin. |

| Training & Certification | Courses for implementation and optimization of HMS tech. | 15% higher user adoption for certified users. | Customer empowerment, market demand for skills. |

Business Model Canvas Data Sources

The HMS Business Model Canvas is built using comprehensive market research, patient demographic data, and operational efficiency metrics. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to healthcare delivery.