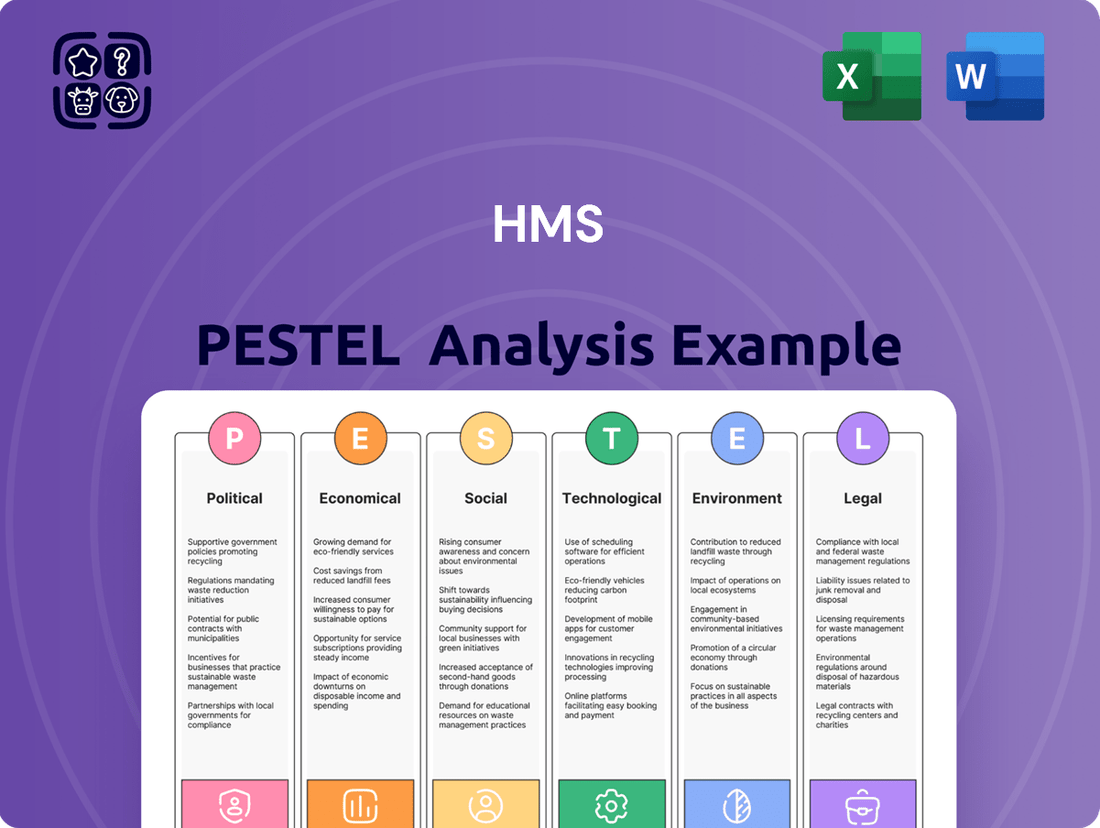

HMS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

Unlock the critical external factors shaping HMS's trajectory with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they impact the company's strategic decisions. This comprehensive report offers actionable insights for investors, strategists, and anyone seeking to gain a competitive edge. Download the full PESTLE analysis now to equip yourself with essential market intelligence and make informed decisions.

Political factors

Governments globally are actively championing Industry 4.0, recognizing its potential to drive economic growth and competitiveness. For instance, the German government's Industry 4.0 initiative, launched in 2011, continues to evolve, with significant investments in research and development aimed at fostering smart manufacturing. Similarly, the United States has various programs, like those supported by the National Science Foundation, focusing on advanced manufacturing and the Industrial Internet of Things (IIoT), which directly benefits companies like HMS Networks.

These government efforts often translate into tangible support for businesses adopting advanced technologies. Many nations offer tax credits, grants, and subsidies for investments in automation, AI, and IIoT solutions. For example, in 2024, the European Union's Digital Europe Programme continued to allocate substantial funding towards digital transformation projects, including those related to industrial connectivity and smart factories, creating a more fertile market for HMS Networks' products.

The impact of such policies on HMS Networks is significant. Increased government incentives for digitalization directly encourage manufacturers to upgrade their operational technology, leading to higher demand for the gateways, protocol converters, and embedded solutions that HMS Networks provides. A supportive policy environment can accelerate the adoption curve for Industry 4.0 technologies, translating into robust revenue growth opportunities.

Conversely, a reduction in government support or a redirection of public funds away from industrial digitalization could present a headwind. If policy priorities shift, or if funding for Industry 4.0 initiatives is curtailed, the pace of investment in automation and IIoT by businesses may slow, potentially impacting the growth trajectory for HMS Networks and its market.

Global trade policies, encompassing tariffs, trade agreements, and protectionist actions, significantly influence HMS Networks' supply chain expenses and market accessibility. For example, the United States' imposition of tariffs on goods from China, which began in 2018 and continued through 2024, has directly affected the cost of electronic components for many technology firms, including those in the network infrastructure space. These measures can inflate operational costs or restrict the company's ability to distribute its products in specific geographical markets.

Conversely, favorable trade agreements, such as the EU-Japan Economic Partnership Agreement, which went into full effect in 2019 and has seen continued trade growth into 2025, can streamline cross-border operations and expand market reach for companies like HMS Networks. A stable and open international trade landscape is crucial for ensuring efficient global logistics and fostering broader customer engagement.

Geopolitical stability is a significant factor for HMS Networks. The company's global presence means it's directly impacted by international conflicts and political instability. For instance, ongoing tensions in Eastern Europe and the Middle East in late 2024 and early 2025 could disrupt supply chains for electronic components, a critical input for HMS's products. Sanctions imposed on certain regions can also limit market access or increase operational costs.

Disruptions in key manufacturing hubs, often influenced by political climates, directly affect HMS's production and distribution capabilities. If a region experiencing political unrest is a major supplier of networking hardware, HMS might face delays or increased prices, impacting its ability to meet customer demand. This uncertainty can also cause customers, particularly those with large infrastructure projects, to postpone investment decisions, creating a ripple effect on HMS's revenue streams.

A stable global political landscape is therefore vital for HMS Networks' consistent business growth. In 2024, many technology companies experienced fluctuations in sales due to heightened global uncertainties, with some reporting Q3 2024 revenue impacts of up to 15% from geopolitical events. Maintaining strong relationships with suppliers across diverse, stable regions and diversifying manufacturing locations are key strategies HMS can employ to mitigate these risks.

Cybersecurity Regulations and National Security

Governments worldwide are intensifying their focus on cybersecurity, particularly for critical infrastructure and industrial control systems. This heightened attention translates into increasingly stringent regulations. For companies like HMS Networks, this presents a dual opportunity: a greater demand for secure communication solutions, but also the imperative to continuously update products to meet these evolving compliance standards. For instance, the NIS2 Directive in the European Union, which came into effect in January 2023, significantly broadens the scope of cybersecurity requirements for essential entities, impacting a wider range of industrial sectors.

National security considerations are also playing a more significant role in procurement decisions. There's a clear trend towards favoring technology providers deemed trustworthy, often domestic or from allied nations. This can influence market access and competitive dynamics. For example, in the United States, initiatives like the Cybersecurity Supply Chain Risk Management (C-SCRM) framework are shaping how government agencies evaluate and select vendors for sensitive projects.

- Increased Regulatory Landscape: The NIS2 Directive (EU) and similar initiatives globally mandate higher cybersecurity standards for industrial sectors.

- Demand for Secure Solutions: This regulatory push drives demand for advanced, compliant communication technologies that HMS Networks provides.

- Adaptation Imperative: HMS Networks must remain agile, continuously updating its product portfolio to meet new and evolving compliance requirements.

- National Security Influence: Procurement decisions are increasingly weighted by national security concerns, favoring trusted suppliers and potentially impacting market entry.

Industrial Policy and Standards

Government-driven industrial policies, particularly those focused on digitalization and automation in sectors like manufacturing and energy, directly impact HMS Networks. For instance, the European Union's Industry 5.0 initiative, emphasizing human-centric, sustainable, and resilient industrial processes, encourages the adoption of advanced connectivity solutions that HMS provides. This policy shift can create significant new market opportunities for their Anybus and Ixxat product lines, which facilitate seamless communication between industrial devices.

The push for standardized communication protocols, such as the ongoing development and adoption of technologies like OPC UA for Industry 4.0, is crucial. Harmonized international standards can streamline market entry and reduce integration costs for HMS, enabling broader adoption of their products globally. Conversely, a lack of standardization or the prevalence of proprietary national standards can erect significant barriers to entry, potentially requiring substantial R&D investment to ensure product interoperability across diverse markets.

Policy decisions concerning critical infrastructure modernization, especially in areas like smart grids and renewable energy integration, are key demand drivers. Governments worldwide are investing heavily in upgrading these systems to improve efficiency and reliability. For example, the US Department of Energy's Grid Modernization Initiative, with significant funding allocated through the Bipartisan Infrastructure Law, directly supports the deployment of advanced communication technologies that HMS Networks is positioned to supply.

- EU's Industry 5.0: Fosters demand for human-centric, sustainable industrial automation solutions, aligning with HMS Networks' product offerings.

- OPC UA Adoption: Standardization efforts in Industry 4.0 facilitate broader market penetration for interoperable industrial communication solutions.

- US Grid Modernization: Government investment in critical infrastructure upgrades, like smart grids, creates direct opportunities for connectivity providers.

Government initiatives promoting Industry 4.0 and digital transformation directly fuel demand for HMS Networks' industrial communication solutions. For example, the ongoing EU Digital Europe Programme in 2024-2025 allocated billions of euros to digital innovation, benefiting companies like HMS that provide the foundational connectivity for smart factories.

Trade policies, including tariffs and agreements, significantly impact HMS Networks' supply chain costs and market access. The continued evolution of global trade relations in 2024-2025 means companies must navigate varying duties and regulations, influencing the price competitiveness of components and finished goods.

Geopolitical stability is crucial for HMS Networks' global operations. Political unrest or sanctions in key manufacturing regions during 2024-2025 can disrupt component sourcing and create market access challenges, impacting revenue projections. For instance, disruptions in Asia in late 2024 impacted the availability of certain electronic components, affecting technology firms globally.

Heightened cybersecurity regulations, such as the EU's NIS2 Directive (effective 2023 and with ongoing implementation in 2024-2025), necessitate robust security features in industrial communication products. This regulatory environment drives demand for HMS's secure gateways and embedded solutions, while requiring continuous product adaptation.

What is included in the product

The HMS PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate market dynamics and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

Global industrial investment cycles significantly impact HMS Networks' revenue streams. When the global economy is robust, manufacturing and industrial sectors worldwide tend to increase their spending on automation and digitalization initiatives. This heightened capital expenditure directly translates into greater demand for HMS's connectivity solutions, as businesses upgrade their infrastructure. For instance, in 2024, many advanced economies saw a rebound in manufacturing investment, with the OECD reporting a 4.5% increase in industrial production in the Eurozone by Q3 2024.

Conversely, economic slowdowns or recessions create a challenging environment for industrial investment. During these periods, companies often scale back capital expenditures, leading to a reduction in new projects and a slower pace of technology adoption. This can directly affect HMS Networks by decreasing the volume of new sales and delaying project deployments. As of early 2025, while some sectors show resilience, lingering global economic uncertainties, including inflation and geopolitical tensions, are still prompting cautious investment strategies among many industrial players, impacting the timing and scale of their technology upgrades.

Rising inflation presents a significant challenge for HMS Networks. For instance, the US Producer Price Index (PPI) for finished goods saw a notable year-over-year increase of 2.2% as of April 2024, indicating broad-based cost pressures. This directly translates to higher expenses for raw materials and electronic components essential for HMS's product manufacturing, potentially squeezing profit margins.

HMS Networks may struggle to fully pass these escalating production costs onto its customers, particularly in the highly competitive networking solutions market. If competitors absorb some of the cost increases, HMS could lose market share. For example, in Q1 2024, many technology companies reported increased input costs but maintained relatively stable pricing strategies to retain customer loyalty.

Effectively managing supply chain expenses and enhancing operational efficiency are therefore paramount for HMS Networks in this inflationary climate. Strategies like diversifying suppliers to mitigate single-source price hikes and investing in automation to reduce labor costs will be crucial. The company's ability to adapt its cost management and pricing strategies will directly influence its financial performance through 2024 and into 2025.

Disruptions in global supply chains, like the semiconductor shortages experienced in 2022 and 2023, directly affect HMS Networks' manufacturing capacity. For instance, the automotive sector, a key market for HMS, saw production cuts due to these shortages, impacting demand for their industrial communication solutions. Ensuring component availability is therefore paramount for maintaining production schedules and meeting customer needs.

The cost and accessibility of critical electronic components, particularly semiconductors, are significant factors for HMS Networks. While prices for some components stabilized through late 2023 and into early 2024, ongoing geopolitical tensions and increased demand in other sectors could reintroduce price volatility. HMS must monitor these trends to manage production costs effectively.

Building a resilient and diversified supply chain is a strategic imperative for HMS Networks. This involves exploring alternative suppliers and potentially increasing inventory levels for crucial components, a strategy many tech companies adopted in 2023 to buffer against future disruptions. Such measures help mitigate risks and ensure consistent product delivery, supporting HMS's market position.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for HMS Networks, given its global operations. As a company dealing in multiple currencies, the conversion of foreign earnings back to its reporting currency can be heavily impacted by these movements. For instance, if the Swedish Krona (SEK), HMS's home currency, strengthens against other currencies where HMS operates, the reported revenues and profits from those regions will appear lower. This dynamic directly affects the company's consolidated financial statements.

Unfavorable currency movements can directly erode profit margins on international sales. If the currencies of key markets weaken relative to the SEK, the value of sales made in those markets decreases when translated back. Conversely, an appreciating SEK can make imported components more affordable, potentially lowering production costs. However, the net effect on profitability depends on the balance of foreign sales and foreign-sourced inputs. For example, in the first quarter of 2024, HMS Networks reported a net sales increase of 11% in SEK, reaching SEK 2,222 million. Exchange rate effects, both positive and negative, are a constant consideration in their financial reporting and strategic planning.

The volatility of exchange rates, particularly in major trading blocs like the Eurozone or North America, poses a continuous challenge. HMS Networks must actively manage currency risks through hedging strategies or by diversifying its geographical revenue streams to mitigate the impact of adverse currency swings. The strength of the US Dollar against the Euro, for example, could significantly alter the profitability of sales in the United States compared to sales in the Eurozone, impacting HMS's overall financial performance.

- Global Presence: HMS Networks operates across numerous countries, necessitating transactions in various currencies.

- Revenue Translation: Fluctuations in exchange rates directly impact the reported value of foreign earnings when converted to SEK.

- Profit Margin Impact: A strengthening SEK can reduce the value of foreign sales, thereby squeezing profit margins.

- Cost of Imports: A weaker SEK can increase the cost of components sourced from abroad, affecting production expenses.

Interest Rate Environment

The prevailing interest rate environment significantly impacts HMS Networks by influencing its industrial customers' capital expenditure decisions. As of mid-2024, major central banks like the US Federal Reserve and the European Central Bank have maintained relatively elevated interest rates to combat inflation. For instance, the Federal Funds Rate target range remained between 5.25% and 5.50% through the first half of 2024, while the ECB's key interest rates were at 4.50% for the main refinancing operations. These conditions make borrowing more expensive for HMS Networks' clients, potentially dampening their appetite for investing in new IIoT solutions and automation projects.

Higher borrowing costs directly translate to increased expenses for large-scale industrial investments, which are often financed through debt. This can lead to a slowdown or postponement of digitalization initiatives, directly affecting demand for HMS Networks' products and services. Conversely, a more favorable interest rate climate, characterized by lower borrowing costs, would likely stimulate investment. Access to affordable financing is a key driver for companies looking to upgrade their infrastructure and adopt advanced automation technologies, thereby boosting the market for industrial communication and IIoT solutions.

- Global Interest Rate Trends: Central banks in major economies, including the US and Eurozone, have kept interest rates elevated through early to mid-2024 to manage inflation.

- Impact on Capital Expenditure: Higher borrowing costs increase the expense of large capital projects for industrial customers, potentially delaying or reducing investment in automation and IIoT.

- Financing Availability: The cost and accessibility of financing are critical factors influencing customers' ability to invest in digitalization and new technologies offered by HMS Networks.

Economic growth directly fuels demand for HMS Networks' solutions as industrial sectors expand and invest in automation. For instance, in 2024, many European countries saw manufacturing output rise, with Germany's industrial production increasing by 1.8% year-on-year in the first quarter, signaling stronger demand for connectivity and automation technologies. Conversely, economic downturns lead to reduced capital expenditure, directly impacting HMS's revenue from new projects and upgrades.

Inflationary pressures, like the 3.1% UK CPI increase reported in April 2024, raise production costs for HMS Networks, potentially squeezing profit margins if these costs cannot be fully passed on to customers. Supply chain disruptions, while showing some improvement from peak 2022 levels, continue to affect component availability and pricing, with semiconductor costs remaining a key concern for the IIoT industry through early 2025. Managing these cost volatilities and ensuring supply chain resilience are critical for maintaining competitiveness.

Interest rates, such as the US Federal Reserve's maintained 5.25%-5.50% range through mid-2024, increase borrowing costs for HMS's industrial clients, potentially slowing investment in new automation and digitalization projects. Currency fluctuations also play a significant role; for example, a stronger Swedish Krona against the Euro in early 2024 could reduce the reported value of sales from the Eurozone, impacting HMS Networks' consolidated financial results. Strategic management of these economic factors is essential for sustained performance.

Same Document Delivered

HMS PESTLE Analysis

The preview you see here is the exact, fully formatted HMS PESTLE Analysis document that you will receive upon purchase. What you're looking at is the real, ready-to-use file, allowing you to confidently understand the comprehensive insights provided. No placeholders, no teasers – this is the actual document you'll be working with immediately after checkout.

Sociological factors

The growing complexity of industrial automation and the Internet of Things (IIoT) is creating a significant need for workers with advanced digital skills. This demand outpaces the current supply of qualified personnel, leading to a skills gap that can slow down the adoption of new technologies.

This skills gap directly impacts companies looking to implement these advanced systems. For instance, a 2023 report indicated that over 60% of manufacturers struggle to find workers with the necessary digital manufacturing skills, a figure that has remained stubbornly high.

For HMS Networks, this translates into a potential bottleneck for market growth. If businesses lack the in-house expertise to effectively implement and manage HMS's solutions, they may postpone or scale back their investments, directly affecting sales and adoption rates.

The financial implications are clear: companies hesitant to invest due to a lack of skilled staff could delay crucial upgrades, impacting their own productivity and, consequently, the demand for the very technologies that drive HMS's business.

The acceptance of automation and AI in industrial settings is a major sociological factor influencing the adoption of IIoT solutions. As of early 2024, surveys indicate a mixed but generally improving perception. For instance, a 2023 Deloitte survey found that while 40% of workers expressed concern about job displacement due to AI, a significant 65% also recognized the potential for AI to improve workplace safety and efficiency.

Resistance often stems from fears about job security and a lack of familiarity with how these technologies work. However, a growing understanding of the benefits, such as robots handling dangerous tasks, is helping to shift public opinion. This positive perception is essential for companies like HMS Networks, whose IIoT solutions often underpin these advanced automation systems.

Data from the International Federation of Robotics (IFR) shows a steady increase in robot installations, with over 500,000 industrial robots installed globally in 2023, a 7% rise from the previous year. This upward trend suggests a gradual societal acceptance, driven by demonstrated improvements in productivity and the creation of new roles focused on managing and maintaining automated systems.

Developed economies are grappling with aging workforces, with the average age in the US labor force projected to increase, and declining birth rates further exacerbating this trend. This demographic reality directly impacts labor availability, particularly in sectors like manufacturing, creating a pressing need for solutions like those offered by HMS Networks. Companies are increasingly looking to automation and remote management to bridge these gaps and maintain productivity.

This demographic shift is a powerful driver for industrial digitalization. As fewer workers are available, businesses are compelled to invest in technologies that allow them to do more with less, making industrial IoT and connectivity solutions from HMS Networks essential for future operational success. The push for efficiency and output in the face of a shrinking workforce is a key market opportunity.

Evolving Workplace Safety Standards

Societal expectations are pushing for increasingly stringent workplace safety. This trend directly benefits companies like HMS Networks, whose Industrial Internet of Things (IIoT) solutions are crucial for meeting these evolving standards. Remote monitoring and real-time anomaly detection, core features of IIoT, are becoming essential tools for ensuring worker protection and regulatory compliance.

The global market for industrial safety systems is projected to reach approximately $11.6 billion by 2025, indicating a significant demand for technologies that enhance safety. This growth is fueled by a heightened awareness of occupational health and the implementation of stricter safety regulations worldwide.

- Increased Regulatory Scrutiny: Governments are enacting more comprehensive safety legislation, requiring businesses to invest in advanced monitoring and control systems.

- Worker Well-being Focus: There's a growing societal emphasis on employee welfare, leading companies to prioritize technologies that proactively prevent accidents and improve working conditions.

- Demand for Connected Safety: The market is seeing a rise in demand for integrated safety solutions that offer real-time data and remote management capabilities, directly aligning with HMS Networks' product portfolio.

- IIoT Adoption for Risk Mitigation: Companies are adopting IIoT for predictive maintenance and anomaly detection to minimize risks, reduce downtime, and ensure compliance with safety standards.

Privacy Concerns and Data Trust

As industrial systems become increasingly interconnected and reliant on data, societal worries about data privacy, security, and the ethical application of operational information are growing. For instance, a 2024 survey indicated that over 70% of consumers express significant concerns about how their personal data is used by connected devices.

Customers and end-users rightfully demand assurance that their sensitive industrial data is rigorously protected and handled with the utmost responsibility. This expectation directly impacts how they perceive and adopt new technologies.

HMS Networks is therefore compelled to actively cultivate and sustain trust by embedding robust data security features within its offerings and demonstrating transparent data handling practices. This is crucial for market acceptance, especially as industrial IoT (IIoT) is projected to grow significantly, with the IIoT market expected to reach over $100 billion globally by 2025.

- Growing societal awareness of data privacy issues, with a majority of consumers expressing concern.

- Demand for assurance regarding the security and responsible use of sensitive industrial data.

- The imperative for HMS Networks to demonstrate strong data security and transparency in its products.

- The expanding IIoT market underscores the increasing relevance of data trust for technology adoption.

Societal concerns about data privacy and security are paramount, especially with the increasing interconnectedness of industrial systems. A 2024 survey revealed that over 70% of consumers worry about how their data is used by connected devices, directly influencing technology adoption. This heightened awareness necessitates robust data protection and transparent handling practices from companies like HMS Networks, particularly as the IIoT market is projected to exceed $100 billion globally by 2025.

Technological factors

The relentless march of Industrial Internet of Things (IIoT) platforms and edge computing is fundamentally reshaping how industrial data is processed and managed. HMS Networks, a key player in this space, sees its product capabilities directly influenced by these technological shifts. For instance, the increasing sophistication of IIoT platforms, with more robust analytics and AI capabilities being pushed to the edge, means HMS must continually enhance its gateways and protocol converters to seamlessly integrate with these advanced systems. This isn't just about connectivity; it's about enabling real-time decision-making closer to the source of data.

Edge computing, in particular, is a critical area. As more processing power moves from centralized clouds to devices on the factory floor, HMS's solutions need to support more complex local data analysis and control functions. The global edge computing market was valued at approximately $8.2 billion in 2023 and is projected to grow significantly, reaching an estimated $40.0 billion by 2028, according to Mordor Intelligence. This growth underscores the demand for hardware and software that can efficiently handle distributed computing tasks, directly impacting the relevance and feature set of HMS's offerings.

The integration of edge computing with cloud infrastructure is also paramount. HMS Networks must ensure its products facilitate a smooth flow of data between the edge and the cloud, allowing for both immediate on-site actions and longer-term, large-scale data analysis. Failure to adapt to these evolving IIoT and edge computing paradigms, which are increasingly incorporating AI and machine learning at the edge, risks making HMS's connectivity solutions outdated and less competitive in a rapidly advancing industrial automation landscape.

The growing complexity of cyber threats, particularly those aimed at industrial control systems (ICS) and operational technology (OT) networks, presents a substantial hurdle. These sophisticated attacks can disrupt critical infrastructure and compromise sensitive data, making robust security paramount.

HMS Networks must therefore prioritize ongoing investment in research and development. This is crucial for embedding advanced security functionalities directly into their product lines, thereby ensuring strong defenses against emerging vulnerabilities and malicious activities. For instance, the global cybersecurity market for Operational Technology (OT) is projected to reach $22.1 billion by 2026, highlighting the intense focus on this area.

The capacity to deliver secure communication solutions is not merely a competitive advantage; it's a fundamental requirement for market acceptance and customer trust. In 2024, over 80% of industrial organizations reported experiencing at least one security incident impacting their OT environment, underscoring the urgent need for reliable security measures.

The ongoing rollout of 5G networks presents significant opportunities for HMS Networks. These advanced wireless standards provide higher bandwidth, lower latency, and enhanced reliability, crucial for demanding industrial applications. By 2024, global 5G subscriptions were projected to surpass 1.5 billion, underscoring the rapid adoption.

HMS Networks can capitalize on this trend by integrating 5G capabilities into its remote access and wireless communication solutions. This expansion allows for more robust connectivity in challenging industrial settings, opening doors to new use cases such as real-time industrial IoT data transmission and advanced machine-to-machine communication.

Looking ahead, the development of 6G promises even greater advancements, with early research indicating potential speeds of 1 terabit per second and ultra-low latency. This evolution will further solidify the importance of wireless technology for industrial automation and connectivity, a core area for HMS Networks' business.

Integration of AI and Machine Learning

The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in industrial settings is a significant technological driver. These technologies rely heavily on vast amounts of data for effective operation, particularly in areas like predictive maintenance and industrial analytics. This creates a substantial demand for reliable infrastructure capable of collecting, processing, and transmitting this data efficiently. HMS Networks, with its focus on industrial communication and data connectivity, is well-positioned to capitalize on this trend.

HMS Networks' existing product portfolio, which includes industrial gateways and network modules, directly supports the data infrastructure required for AI/ML applications. By facilitating seamless data flow from operational technology (OT) to IT environments, HMS enables businesses to leverage their data for AI-driven insights. For instance, the company's Anybus technology allows for robust data exchange between different industrial networks and control systems, which is crucial for feeding AI algorithms.

Furthermore, HMS Networks has the opportunity to enhance its own value proposition by integrating AI and ML capabilities directly into its products. Imagine gateways that can perform edge analytics, identifying anomalies or predicting potential equipment failures in real-time before sending data to the cloud. This proactive approach could significantly increase the appeal and utility of HMS solutions. Companies like Siemens, a major player in industrial automation, are already heavily investing in AI-powered analytics platforms, indicating the market’s direction. By 2025, the global AI in industrial market is projected to reach tens of billions of dollars, underscoring the immense growth potential.

- AI/ML Demand: Industrial analytics and predictive maintenance are driving significant demand for data infrastructure.

- HMS's Role: HMS Networks' products facilitate the necessary data flow for AI/ML applications.

- Integration Opportunity: HMS can integrate AI/ML into its gateways and modules for enhanced solutions.

- Market Growth: The global AI in industrial market is experiencing rapid expansion, with projections indicating substantial future growth through 2025.

Competitive Technological Landscape

The industrial communication and IIoT market is a hotbed of innovation, meaning HMS Networks must stay on its toes. Competitors are constantly rolling out new communication protocols and embracing open-source movements, forcing HMS to adapt quickly. For instance, the IIoT platform market alone was projected to reach USD 28.8 billion in 2024, highlighting the intense competition and rapid evolution.

To keep pace, HMS needs to be agile in developing its products and forge strategic alliances. This proactive approach is crucial for holding onto market share and staying relevant as new technologies emerge and established players introduce their own advancements. Failing to adapt could see HMS fall behind against rivals pushing disruptive technologies.

- Rapid Protocol Evolution: Competitors are introducing new industrial communication protocols at an accelerated rate, challenging existing standards.

- Open-Source Adoption: The increasing embrace of open-source technologies by rivals necessitates strategic involvement or counter-strategies from HMS.

- Disruptive Technologies: Emerging technologies like edge computing and AI-driven analytics are being leveraged by competitors to create new market opportunities.

- Partnership Strategies: Competitors are actively forming partnerships to expand their IIoT ecosystems, requiring HMS to consider similar collaborative efforts.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into industrial processes is a major technological trend, driving demand for robust data infrastructure. HMS Networks' solutions are pivotal in enabling the seamless data flow required for these AI/ML applications, particularly in predictive maintenance and analytics.

HMS can enhance its offerings by embedding AI/ML capabilities directly into its product lines, enabling real-time edge analytics. The global AI in industrial market is expected to see substantial growth, projected to reach tens of billions of dollars by 2025.

The rapid evolution of communication protocols and the increasing adoption of open-source technologies by competitors necessitate agility and strategic partnerships for HMS Networks. Keeping pace with disruptive technologies is crucial for maintaining market relevance.

| Technological Factor | Impact on HMS Networks | Market Data/Projections (2024-2025) |

| IIoT & Edge Computing Sophistication | Requires enhanced gateways for seamless integration and support for local data analysis. | Edge computing market projected to reach $40.0 billion by 2028 (Mordor Intelligence). |

| Cybersecurity Threats in OT | Necessitates continuous R&D for embedding advanced security features into products. | Over 80% of industrial organizations reported security incidents in OT environments in 2024. |

| 5G Network Rollout | Opportunity to integrate 5G into remote access and wireless solutions for improved industrial connectivity. | Global 5G subscriptions projected to surpass 1.5 billion in 2024. |

| AI/ML Adoption in Industry | Creates demand for HMS's data infrastructure solutions; opportunity for AI integration into products. | Global AI in industrial market projected to reach tens of billions by 2025. |

| Protocol Evolution & Open Source | Requires agility in product development and strategic alliances to counter competitive pressures. | IIoT platform market projected to reach USD 28.8 billion in 2024. |

Legal factors

Global data privacy laws like GDPR are increasingly stringent, impacting how companies like HMS Networks manage operational data. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is greater, underscoring the financial risk of non-compliance. HMS Networks must ensure its industrial communication solutions enable customers to meet these mandates, especially concerning data collected from IoT devices.

Failure to comply with these regulations, such as the California Consumer Privacy Act (CCPA) which grants consumers rights over their data, can result in substantial penalties and significant damage to a company's reputation. In 2024, many companies are investing heavily in data governance and security infrastructure to avoid these risks, a trend expected to continue. HMS Networks' offerings need to align with these evolving customer priorities.

Different industries, like automotive, energy, and manufacturing, have their own strict rules and certifications for equipment and how it communicates. HMS Networks' solutions need to meet these specific demands to be accepted by customers in these fields.

For instance, automotive manufacturers often require adherence to standards like ISO 26262 for functional safety, while the energy sector might focus on cybersecurity certifications such as IEC 62443. Meeting these requirements is non-negotiable for market access, ensuring products are safe, dependable, and work well with existing systems.

As of late 2024, the automotive industry's drive towards connected vehicles and autonomous driving intensifies the need for robust communication solutions that comply with stringent safety and data integrity regulations. Similarly, the energy sector's digital transformation, including smart grids and IoT deployments, places a premium on secure and reliable industrial communication, with regulatory bodies continually updating cybersecurity mandates.

Protecting its intellectual property (IP), encompassing patents, trademarks, and trade secrets, is paramount for HMS Networks in the fiercely competitive technology landscape. Legal frameworks governing IP rights serve as the bedrock for safeguarding the company's innovations and crucially preventing the unauthorized appropriation or duplication of its proprietary technologies. For instance, in 2023, HMS Networks reported a significant portion of its revenue was driven by products incorporating its patented technologies, underscoring the financial importance of IP protection.

The diligent enforcement of these IP rights is instrumental in maintaining HMS Networks' competitive advantage and ensuring the long-term viability of revenue streams derived from its substantial research and development investments. This legal shield allows the company to confidently invest in future innovation, knowing its creations are legally protected against direct imitation by competitors.

Product Liability Laws and Safety Regulations

HMS Networks' industrial communication products are critical for the safe and reliable operation of sophisticated machinery and automated systems. Given this crucial role, the company operates under stringent product liability laws and safety regulations across the diverse global markets it serves. Failure to meet these rigorous standards can lead to significant legal repercussions, including substantial fines and damage to brand reputation.

Compliance is not merely a legal obligation but a foundational aspect of HMS Networks' business strategy. For instance, the European Union's General Product Safety Regulation (GPSR), which came into effect in December 2024, reinforces the duty of care for manufacturers and distributors, emphasizing the need for traceable and safe products throughout the supply chain. This means HMS must proactively ensure its gateways, protocol converters, and remote management solutions are designed and manufactured to prevent any potential harm or malfunction.

- Product Safety Standards: Adherence to international standards like IEC 61508 for functional safety is essential for products used in critical industrial applications.

- Regulatory Compliance Costs: In 2024, companies in the industrial automation sector often allocate 2-5% of their R&D budget towards ensuring compliance with evolving safety and environmental regulations.

- Liability Exposure: A single product defect leading to an industrial accident could result in multi-million dollar lawsuits, impacting financial performance and operational continuity.

- Market Access: Meeting specific regional safety certifications, such as CE marking in Europe or UL certification in North America, is a prerequisite for market entry.

Export Control Regulations

Export control regulations are a significant legal factor for HMS Networks, particularly concerning its advanced networking and industrial IoT solutions. These rules govern the transfer of sensitive technologies and dual-use goods, potentially restricting sales to specific nations or organizations identified as high-risk. For instance, the Wassenaar Arrangement, a multilateral export control regime, influences how countries manage the export of dual-use items and technologies, impacting the global reach of companies like HMS Networks. Failure to comply can lead to severe penalties, including fines and trade bans.

Navigating these complex legal frameworks is crucial for maintaining global operations and ensuring smooth distribution. HMS Networks must diligently adhere to international export control regimes, such as those enforced by the United States (EAR - Export Administration Regulations) and the European Union. These regulations are dynamic, often updated to reflect geopolitical shifts and technological advancements, requiring continuous monitoring and adaptation by the company. For example, in 2023, many countries reviewed and updated their export control lists, affecting a range of electronic components and software that could be incorporated into HMS products.

- Compliance with international export control regimes is mandatory to avoid legal repercussions and trade restrictions.

- Regulations like the Wassenaar Arrangement and national export control lists dictate the permissible transfer of sensitive technologies.

- HMS Networks must ensure its global distribution channels and product sales align with these evolving legal frameworks.

- Non-compliance can result in significant financial penalties and limitations on market access.

Global data privacy laws, such as GDPR, increasingly affect how companies like HMS Networks manage data, with fines potentially reaching 4% of annual global turnover. The California Consumer Privacy Act (CCPA) also imposes significant compliance burdens. In 2024, companies are prioritizing data governance and security to mitigate risks, a trend expected to continue. HMS Networks' solutions must align with these evolving customer needs for data protection and privacy.

Industry-specific regulations, like ISO 26262 for automotive functional safety and IEC 62443 for energy sector cybersecurity, are critical for market access. HMS Networks must ensure its industrial communication solutions meet these stringent demands to be viable in sectors like automotive and energy. The automotive industry's focus on connected vehicles and the energy sector's digital transformation in 2024 and 2025 further amplify the need for robust, compliant communication technologies.

Product safety and liability laws are paramount for HMS Networks, given its role in critical industrial applications. Compliance with regulations like the EU's General Product Safety Regulation (GPSR), effective December 2024, is essential. Failure to meet safety standards can result in significant fines and reputational damage, with compliance costs often representing 2-5% of R&D budgets in the industrial automation sector for 2024.

Export control regulations, including the Wassenaar Arrangement and national lists, govern the transfer of sensitive technologies. HMS Networks must adhere to these dynamic frameworks, such as the US EAR, to avoid penalties and maintain global market access. The Wassenaar Arrangement influences the export of dual-use items, impacting companies like HMS Networks' international reach.

Environmental factors

Growing global concern over climate change and rising energy costs is significantly boosting the market for energy-efficient industrial solutions. Many countries are implementing stricter energy standards, pushing industries to adopt technologies that reduce their consumption. This trend directly benefits companies like HMS Networks, whose products facilitate smarter, more efficient industrial operations.

HMS Networks' offerings, such as their Anybus communication solutions, enable real-time data collection and analysis, allowing for better control and optimization of industrial machinery. This can lead to substantial energy savings for their customers. For example, in 2024, many industrial automation projects are prioritizing energy reduction, with some reporting savings of up to 15% on their energy bills through optimized processes.

Developing and marketing products that demonstrably reduce a facility's carbon footprint is becoming a key differentiator. Companies are actively seeking partners who can help them achieve their Environmental, Social, and Governance (ESG) targets. HMS Networks' ability to support these goals positions them favorably in a market increasingly driven by sustainability.

Stricter environmental regulations, like the EU's Waste Electrical and Electronic Equipment (WEEE) directives, are reshaping how companies like HMS Networks handle their products. These rules, which are continually being updated, push for greater responsibility in managing the entire product lifecycle. In 2023, the global e-waste generated reached an estimated 62 million metric tons, highlighting the scale of the challenge and the increasing regulatory pressure for responsible disposal and recycling.

This regulatory landscape directly impacts HMS Networks, demanding a focus on designing products for longevity, ease of repair, and eventual recyclability. The push towards a circular economy means companies are increasingly expected to not only sell products but also to manage their collection and proper treatment at the end of their useful life. For instance, some European countries have targets for e-waste collection rates, which manufacturers must meet to avoid penalties.

Compliance with e-waste collection and treatment obligations across all operating regions is therefore a critical operational and strategic imperative for HMS Networks. This involves establishing robust reverse logistics systems and partnerships with certified recycling facilities. Failure to comply can lead to significant fines and reputational damage, making proactive management of these environmental factors essential for sustained business success.

HMS Networks faces increasing demands for detailed environmental, social, and governance (ESG) reporting. Investors, customers, and regulatory bodies are pushing for greater transparency regarding a company's environmental impact, supply chain ethics, and the sustainability of its products throughout their lifecycle. This pressure is significant, with a 2024 survey by PwC indicating that 86% of companies globally believe ESG is increasingly important to their investors.

Demonstrating a robust commitment to sustainability is crucial for HMS Networks. This includes clearly outlining its environmental footprint, ensuring ethical practices within its supply chain, and addressing the environmental implications of its product designs and usage. For instance, as of early 2025, European Union regulations like the Corporate Sustainability Reporting Directive (CSRD) are mandating more extensive ESG disclosures for a wider range of companies, directly impacting those operating within or selling to the EU market.

Strong ESG performance can serve as a key differentiator, attracting a growing segment of environmentally conscious investors and bolstering HMS Networks' brand reputation. Companies with strong ESG scores often see better access to capital and can command higher valuations. For example, the S&P 500 ESG Leaders index outperformed the broader S&P 500 index by approximately 10% in 2024, highlighting the financial benefits of good sustainability practices.

Climate Change Impact on Operations

Climate change presents tangible risks to HMS Networks' operational continuity. Extreme weather events, like the increased frequency of severe storms and heatwaves observed in recent years, could directly impact manufacturing facilities and logistics, leading to production delays and increased costs. For instance, a 2024 report indicated a 15% rise in weather-related disruptions for global supply chains compared to the previous decade.

Adapting to these physical impacts necessitates a focus on supply chain resilience. HMS Networks may need to diversify sourcing locations and invest in more robust infrastructure to mitigate the effects of unpredictable weather patterns. The company's commitment to sustainability also means addressing its own carbon footprint, a factor increasingly scrutinized by investors and regulators, with many major corporations setting net-zero targets by 2040.

- Supply Chain Disruption: Extreme weather events can halt production and delay shipments, impacting delivery times and customer satisfaction.

- Infrastructure Vulnerability: Manufacturing plants and distribution centers may face damage from floods, storms, or extreme temperatures, requiring costly repairs or relocation.

- Operational Costs: Increased energy demands for cooling or heating, along with potential carbon taxes, could raise operating expenses.

- Reputational Risk: Failure to adequately address climate impacts or reduce emissions can damage brand image and investor confidence.

Customer and Investor Preference for Green Solutions

Industrial customers and institutional investors are increasingly leaning towards suppliers and companies that exhibit robust environmental credentials and sustainable operational practices. This shift directly impacts purchasing decisions and the flow of investment capital, with a notable segment of the market willing to pay a premium for eco-friendly solutions.

HMS Networks can leverage this trend by clearly articulating how its offerings assist clients in achieving their own sustainability targets. Demonstrating a strong internal commitment to environmental stewardship further solidifies its market position. For instance, a recent survey in early 2024 indicated that over 60% of B2B buyers consider a supplier's sustainability efforts a significant factor in their procurement process.

This growing preference translates into tangible benefits for companies like HMS Networks. By emphasizing its sustainable innovations, the company can attract environmentally conscious customers and appeal to investors focused on Environmental, Social, and Governance (ESG) criteria. This strategic alignment is becoming a critical differentiator in the competitive landscape.

Key considerations for HMS Networks include:

- Quantifying the environmental benefits of its solutions for customers.

- Communicating its own sustainability initiatives and achievements transparently.

- Aligning product development with emerging green technology demands.

- Engaging with investors who prioritize ESG performance.

Environmental factors are increasingly shaping the industrial landscape, driving demand for energy efficiency and sustainability. Stricter regulations, like the EU's WEEE directives, also mandate responsible product lifecycle management, impacting companies like HMS Networks. As of 2024, global e-waste is a significant concern, underscoring the need for compliance.

The push for ESG reporting is substantial, with many companies prioritizing sustainability to attract investors and meet regulatory demands. For instance, a 2024 survey showed 86% of companies believe ESG is vital to investors. Strong ESG performance can lead to better capital access and higher valuations, with ESG indices outperforming broader markets in 2024.

Climate change also poses physical risks, such as supply chain disruptions from extreme weather. A 2024 report noted a 15% rise in weather-related supply chain disruptions. Adapting requires supply chain resilience and a focus on reducing carbon footprints, with many corporations aiming for net-zero targets by 2040.

| Environmental Factor | Impact on HMS Networks | Key Data/Trend (2024/2025) |

|---|---|---|

| Energy Efficiency Demand | Increased market for HMS solutions facilitating energy savings. | Industrial automation projects in 2024 targeting up to 15% energy reduction. |

| Environmental Regulations (e.g., WEEE) | Need for product lifecycle management, repairability, and recyclability. | Global e-waste reached 62 million metric tons in 2023. |

| ESG Reporting & Investor Pressure | Requirement for transparent reporting on environmental impact and sustainability. | 86% of companies view ESG as increasingly important to investors (PwC, 2024). |

| Climate Change Risks | Potential for supply chain disruptions and operational impacts from extreme weather. | 15% increase in weather-related supply chain disruptions compared to the previous decade (2024 report). |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws upon a comprehensive blend of data, incorporating official government publications, reputable market research firms, and leading academic journals. This ensures a robust understanding of political shifts, economic trends, and societal changes.