HMS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

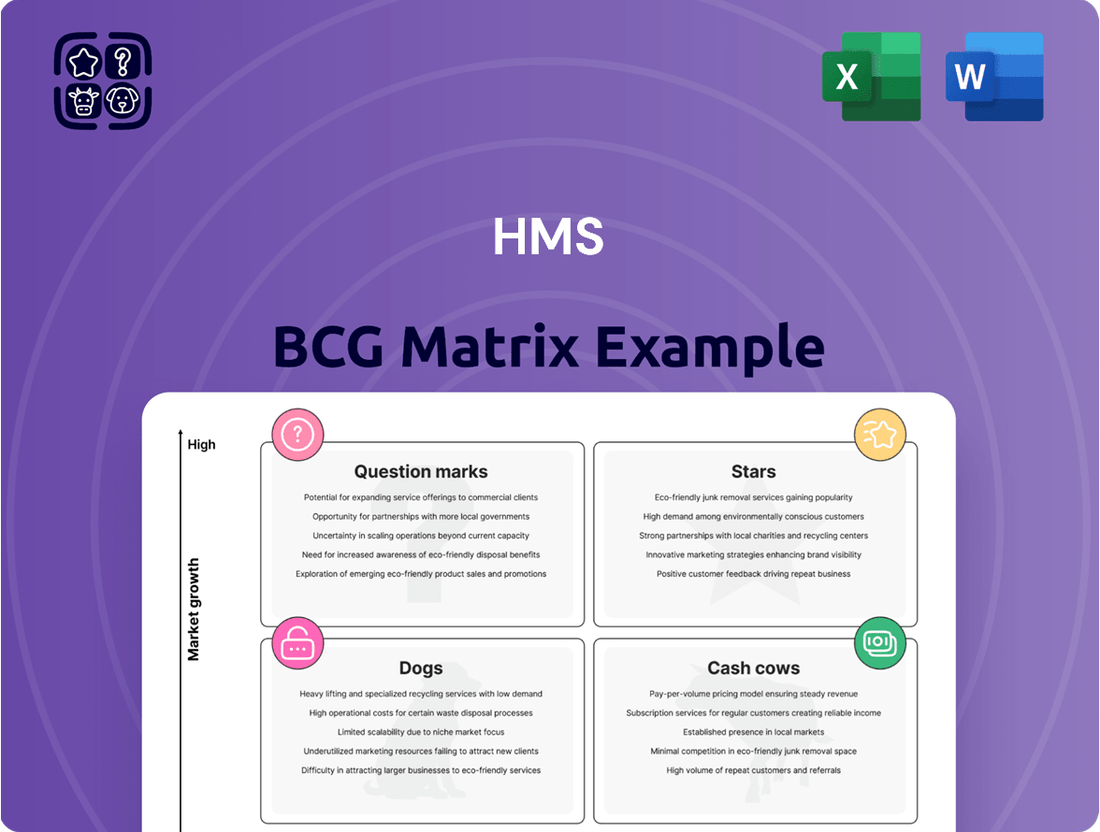

Understand the core of your company's product portfolio with this insightful glimpse into the BCG Matrix. See how your offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks, guiding your initial strategic thoughts.

This preview offers a foundational understanding, but to truly master your product strategy, you need the full picture. Dive deeper into the nuances of each quadrant and uncover the hidden potential and risks within your business.

Purchase the complete BCG Matrix to unlock detailed analysis, data-driven recommendations, and actionable insights. Gain a clear roadmap for optimizing resource allocation, driving growth, and making confident investment decisions.

Don't let uncertainty dictate your business's future. Equip yourself with the comprehensive BCG Matrix and transform your product portfolio into a powerful engine for success.

Stars

Ewon's remote access and IIoT solutions are strategically positioned for significant growth within the Industrial Internet of Things (IIoT) landscape. Their enhanced cybersecurity measures and expanding cloud and edge capabilities are key differentiators in a rapidly evolving market.

The global IIoT market is expected to experience robust expansion, with a projected compound annual growth rate (CAGR) of 12.7% between 2025 and 2033. This upward trajectory underscores the increasing demand for connected industrial environments and advanced data management.

Ewon's commitment to secure remote access and efficient data collection directly addresses critical needs in the digital transformation of manufacturing. This focus allows them to capitalize on the trend of smart factories and Industry 4.0 initiatives, where reliable and safe connectivity is paramount.

By offering solutions that facilitate seamless remote monitoring and control of industrial equipment, Ewon enables businesses to improve operational efficiency, reduce downtime, and gain deeper insights from their manufacturing processes. This value proposition is highly attractive to a market increasingly reliant on data-driven decision-making.

Red Lion Industrial Automation & Networking Solutions, acquired by HMS Networks in 2024, represents a significant move into high-growth industrial segments. This acquisition bolstered HMS's offerings in HMIs, data acquisition, visualization, cloud connectivity, and edge intelligence.

Red Lion's robust performance, especially in the North American market, played a crucial role in HMS's rebounding order intake during the latter half of 2024. This strategic integration positions HMS to capitalize on the increasing demand for real-time data in challenging industrial settings.

These solutions are vital for enhancing real-time data visibility in demanding industrial environments, a key growth driver within the expanding Industrial Internet of Things (IIoT) market. In 2024, the IIoT market saw substantial investment, with projections indicating continued strong growth driven by the need for operational efficiency and data-driven decision-making.

Anybus Industrial Ethernet Gateways are strategically positioned within the Stars quadrant of the BCG Matrix, reflecting their strong market position in a rapidly expanding sector. The dominance of Industrial Ethernet, which captured 76% of new factory automation nodes in 2025, up from 71% in 2024, underscores the high-growth environment these gateways operate in.

Supporting leading protocols such as PROFINET, EtherNet/IP, and EtherCAT, Anybus gateways are essential for bridging diverse industrial devices. HMS's internal data further solidifies this, showing PROFINET's continued leadership, which directly benefits these gateway products.

Edge Computing & Cloud Connectivity Solutions

HMS Networks, via its Red Lion and Ewon brands, is strategically investing in edge computing and cloud connectivity solutions. These areas represent significant growth opportunities within the Industrial Internet of Things (IIoT) landscape, catering to the increasing need for distributed data processing and robust cloud integration.

The market for edge intelligence is expanding rapidly. For instance, the global edge computing market was valued at approximately $12.5 billion in 2023 and is projected to reach over $100 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 35%. This growth is fueled by the demand for low-latency data analysis and autonomous operations at the network's edge.

HMS Networks' offerings in this space are well-positioned to capitalize on these trends. Their solutions facilitate seamless data flow from industrial devices to cloud platforms, enabling enhanced monitoring, analytics, and control. This focus aligns with the burgeoning IIoT market, which is expected to grow substantially in the coming years, driven by digital transformation initiatives across various industries.

- High-Growth Segments: Edge intelligence and cloud connectivity are identified as key growth drivers for HMS Networks.

- Market Demand: Increasing requirements for real-time data processing at the source and cloud integration are accelerating the adoption of these solutions.

- IIoT Alignment: HMS's strategy directly supports major IIoT trends anticipated for 2025 and beyond.

- Market Valuation: The edge computing market is a prime example of this growth, with significant expansion projected.

Solutions for Industrial Cybersecurity

As industrial operations become more digitized, the demand for robust cybersecurity solutions is surging. HMS Networks, particularly through its Ewon brand, is strategically positioning itself in this high-growth sector. Their focus on aligning with stringent standards like IEC 62443 underscores their commitment to providing secure remote access and network protection for increasingly interconnected industrial environments.

The market for industrial cybersecurity is expanding rapidly, driven by the growing threat landscape and the critical need to safeguard operational technology (OT). HMS's investment in this area reflects a proactive approach to a crucial challenge facing modern factories. By offering solutions that fortify industrial networks against cyber threats, HMS is addressing a key concern for businesses undergoing digital transformation.

- Market Growth: The global industrial cybersecurity market was valued at approximately USD 14.5 billion in 2023 and is projected to reach over USD 30 billion by 2028, exhibiting a compound annual growth rate (CAGR) exceeding 15%.

- Standard Alignment: Adherence to IEC 62443, an international standard for industrial automation and control system security, is a key differentiator for solutions like those offered by HMS Ewon, ensuring a baseline level of security assurance.

- Ewon's Role: HMS's Ewon products, such as secure remote access gateways, are vital for enabling safe connectivity in industrial settings, facilitating maintenance and data acquisition without compromising network integrity.

- Digitalization Impact: Increased IoT adoption and the convergence of IT and OT in industrial settings have created new vulnerabilities, making specialized cybersecurity solutions indispensable for maintaining operational continuity and data safety.

Stars represent products with a high market share in a high-growth industry. For HMS Networks, Anybus Industrial Ethernet Gateways fit this description perfectly. Their strong presence in the rapidly expanding Industrial Ethernet sector, supported by the increasing adoption of protocols like PROFINET, positions them as a leading solution.

The substantial market share of Industrial Ethernet, evidenced by its dominance in new factory automation nodes, directly correlates with the success of Anybus gateways. This sustained growth in the underlying market ensures that Anybus products continue to be strong performers for HMS Networks.

Stars require ongoing investment to maintain their growth trajectory and fend off competitors. HMS Networks' continued focus on supporting key protocols and expanding the capabilities of their Anybus solutions reflects this strategic necessity.

This strategic positioning allows HMS Networks to leverage the high growth within industrial automation, ensuring their Anybus gateways remain key contributors to the company's overall portfolio.

| Product Category | Market Growth | Market Share | BCG Matrix Position | HMS Strategy |

| Anybus Industrial Ethernet Gateways | High (Industrial Ethernet adoption) | High (Leading protocol support) | Star | Continued investment and support |

| Ewon Remote Access Solutions | High (IIoT, Cybersecurity) | High (Secure connectivity) | Star | Focus on cybersecurity and cloud integration |

| Red Lion HMIs & Data Acquisition | High (Industry 4.0, Edge Computing) | High (North American market strength) | Star | Integration into broader HMS offerings |

What is included in the product

Strategic overview of product portfolio by market share and growth rate.

Guides investment decisions by categorizing products as Stars, Cash Cows, Question Marks, or Dogs.

A clear, visual representation of your portfolio, the BCG matrix eliminates confusion by categorizing business units.

Cash Cows

Anybus embedded network interfaces, crucial for industrial automation, represent a classic Cash Cow for HMS Networks. These modules, supporting widely adopted protocols like EtherNet/IP and PROFINET, have achieved a significant market share.

Their deep integration into millions of industrial devices ensures stable, recurring revenue streams. This stability is a hallmark of Cash Cows, reflecting a mature market where HMS has established a dominant presence.

For 2023, HMS Networks reported that its Anybus product line continued to be a strong contributor to revenue, demonstrating consistent demand. The industrial Ethernet market, a key segment for these interfaces, saw continued growth, further solidifying the Cash Cow status of these offerings.

Ewon's foundational remote access appliances, the backbone for standard PLC/HMI management and troubleshooting, are firmly entrenched in the industrial automation landscape. These products have achieved significant market penetration, solidifying their position as reliable solutions for a mature segment.

In 2024, Ewon's standard appliances continue to be a consistent profit generator. Their established presence means marketing spend is minimal, leveraging strong brand recognition and widespread adoption. This allows for sustained cash flow with limited reinvestment.

Intesis Building Automation Gateways, particularly within the HVAC sector, represent a significant Cash Cow for HMS. These products are crucial for enabling communication and interoperability in building management systems, a market that, while mature, offers consistent demand. In 2023, the building automation market saw continued growth, with HVAC controls being a substantial component, demonstrating the stable revenue stream these gateways provide.

N-Tron Rugged Industrial Ethernet Switches

N-Tron, now part of HMS Networks following their 2024 acquisition, operates as a classic cash cow within the BCG matrix. Their rugged industrial Ethernet switches have established a strong foothold in a niche market demanding extreme reliability. This focus has translated into a high market share and steady, predictable revenue streams, characteristic of a mature product in a stable industry.

These switches are engineered for harsh environments, making them indispensable for sectors like manufacturing, transportation, and energy. By consistently meeting these demanding requirements, N-Tron has solidified its position, generating significant cash flow that can be reinvested into other areas of HMS Networks' portfolio. For instance, the industrial automation market, where N-Tron excels, saw continued growth in 2024, with global spending on industrial network infrastructure projected to increase, further supporting N-Tron's cash cow status.

- Market Leadership: N-Tron commands a substantial share in the rugged industrial Ethernet switch market.

- Consistent Revenue: The demand for reliable industrial networking ensures a predictable and stable income.

- Brand Recognition: N-Tron's reputation for durability and performance is a key asset.

- Mature Product Cycle: Benefiting from a well-established product in a stable, albeit specialized, market.

Ixxat In-Machine Communication & Safety Solutions

Ixxat's in-machine communication and safety solutions are firmly positioned as cash cows within the HMS Networks portfolio, particularly in established industrial sectors. These products, critical for ensuring reliable and safe operation in automated systems, benefit from a significant market share in a mature segment of the industrial communication landscape.

The Ixxat brand offers a robust suite of products designed for seamless communication between various components within a machine, alongside solutions that address functional safety requirements. This dual focus caters to the ever-present need for both operational efficiency and stringent safety standards in industrial automation.

- Established Market Presence: Ixxat solutions are well-entrenched in sectors like industrial automation, automotive, and medical technology, where their reliability is highly valued.

- High Demand for Safety: With increasing regulatory focus and industry best practices, demand for functional safety components remains consistently strong.

- Mature Technology: While mature, the underlying technologies for in-machine communication and safety are essential and continue to see steady adoption and replacement cycles.

- Revenue Generation: These established product lines consistently generate substantial and predictable revenue for HMS Networks, contributing significantly to overall profitability.

Cash Cows within HMS Networks, like Anybus, Ewon, Intesis, N-Tron, and Ixxat, represent mature products with dominant market positions. These offerings generate substantial and stable cash flow with minimal investment, allowing HMS to fund growth initiatives in other areas.

The industrial automation and building automation markets, where these products are prominent, continue to show resilience and steady demand. For instance, the industrial Ethernet market, a key area for Anybus, was projected to grow significantly through 2024 and beyond.

In 2023, HMS Networks' Anybus product line demonstrated continued strong revenue contribution, reflecting the sustained demand for these embedded network interfaces. Similarly, Ewon's standard appliances in 2024 continued their role as consistent profit generators due to minimal marketing spend and strong brand recognition.

| Product Line | Market Segment | BCG Status | Key Strengths | 2023/2024 Data Insight |

|---|---|---|---|---|

| Anybus | Industrial Automation (Embedded Network Interfaces) | Cash Cow | High market share, deep integration, stable recurring revenue | Strong revenue contributor in 2023; Industrial Ethernet market growth solidified status. |

| Ewon | Industrial Automation (Remote Access Appliances) | Cash Cow | Significant market penetration, strong brand recognition, low marketing spend | Consistent profit generator in 2024; leverages widespread adoption for sustained cash flow. |

| Intesis | Building Automation (HVAC Gateways) | Cash Cow | Crucial for interoperability, consistent demand in a mature market | Provided stable revenue in 2023; HVAC controls are a substantial component of the growing building automation market. |

| N-Tron | Industrial Automation (Rugged Industrial Ethernet Switches) | Cash Cow | Niche market leadership, extreme reliability, high market share | Benefited from industrial automation market growth in 2024; global spending on industrial network infrastructure projected to increase. |

| Ixxat | Industrial Automation (In-Machine Communication & Safety) | Cash Cow | Established market presence, high demand for safety solutions, mature technology | Consistently generate substantial and predictable revenue; regulatory focus on safety sustains demand. |

Full Transparency, Always

HMS BCG Matrix

The preview you're currently viewing is the exact, unedited HMS BCG Matrix document you'll receive immediately after purchase. This comprehensive analysis tool is fully formatted and ready for immediate application in your strategic planning sessions. You'll gain access to the complete, professional-grade report without any watermarks or introductory content. Invest in this powerful strategic framework to clearly visualize and manage your product portfolio for optimal business growth.

Dogs

Legacy Fieldbus Protocol Gateways fall into the Dogs category of the BCG Matrix. These products, supporting older protocols like PROFIBUS, DeviceNet, and Modbus RTU, face a rapidly shrinking market. HMS's own data shows a decline in new fieldbus node installations from 22% in 2024 to an anticipated 17% in 2025, highlighting their accelerated obsolescence.

Products in this category typically possess a low market share within a declining industry. Consequently, they require minimal strategic investment, focusing instead on managing existing revenue streams or eventual phase-out. The primary objective for these legacy gateways is to maintain profitability with the least amount of capital expenditure.

Niche, low-demand custom communication modules represent the Dogs in the BCG Matrix. These are highly specialized components designed for very specific, limited industrial applications, meaning the overall market for them is quite small. For instance, a custom module for a legacy industrial automation system with only a few dozen active installations worldwide would fit this description.

Products in this category typically possess a low market share because the niche is so small to begin with. Furthermore, they often operate within low-growth or even stagnant market segments. Consider specialized radio frequency modules for outdated meteorological equipment; the demand here is minimal and unlikely to increase.

Given their limited market and lack of growth, expensive turnaround plans or significant investment are unlikely to yield profitability for these niche modules. The cost of developing new features or expanding production for such a small customer base often outweighs any potential revenue gains. In 2024, the market for certain legacy communication protocols, for example, continues to shrink as newer technologies emerge.

Basic wired serial communication converters, especially those not integrated into modern Industrial Internet of Things (IIoT) solutions, are prime candidates for the 'dog' category in the BCG matrix. Their utility is significantly reduced as the industrial landscape rapidly adopts Industrial Ethernet and wireless technologies.

The market for purely serial, non-networked converters is shrinking. For instance, while the overall IIoT market is projected to reach $1,512.10 billion by 2027, a CAGR of 26.2%, the segment for standalone serial converters without network capabilities is experiencing a considerable slowdown.

These devices operate in a low-growth market with declining relevance. Their functionalities are increasingly being superseded by more advanced, networked solutions that offer greater flexibility and data accessibility. Companies relying heavily on these outdated converters may face challenges in future-proofing their operations.

Undifferentiated Basic Network Diagnostics Tools

Undifferentiated basic network diagnostic tools, those that primarily offer simple connectivity checks without advanced features like AI-driven predictive analytics or sophisticated remote monitoring, are often categorized as Dogs in the BCG Matrix. These tools are essential for fundamental troubleshooting but suffer from a highly commoditized market. For instance, the global network monitoring market, while growing, sees basic diagnostics as a mature segment with limited differentiation.

The challenge for these tools lies in their lack of unique value propositions. As of 2024, many businesses are seeking integrated solutions that offer proactive issue identification and automated remediation, areas where basic tools fall short. This makes it difficult for vendors to command premium pricing or achieve substantial market share gains.

- Market Saturation: The market for basic diagnostic tools is crowded, with numerous vendors offering similar functionalities.

- Low Differentiation: Products lack advanced features, making them easily replaceable and offering little competitive advantage.

- Limited Growth Potential: The segment experiences slow growth as more advanced solutions gain traction, impacting revenue potential.

- Price Sensitivity: Due to commoditization, customers are highly price-sensitive, squeezing profit margins for providers.

Older, Less Secure Remote Access Versions

Older, less secure remote access versions, particularly those predating robust cybersecurity frameworks like IEC 62443, are increasingly becoming a liability for industrial operations. These legacy systems often lack essential features such as advanced encryption, multi-factor authentication, and seamless cloud integration, making them vulnerable to sophisticated cyber threats. As of 2024, the industrial cybersecurity market is experiencing significant growth, with reports indicating an increase in targeted attacks on operational technology (OT) environments. This escalating threat landscape is driving a clear migration away from outdated remote access solutions.

These older versions are falling into the 'Dog' category of the BCG Matrix. They represent products with low market share and low growth potential. The demand for these solutions is declining as industries prioritize security and operational efficiency. For instance, a significant portion of the industrial sector is still reliant on older VPNs or proprietary remote access tools that are no longer supported by vendors or meet current regulatory requirements.

- Declining Market Share: Many legacy remote access solutions have seen their market share shrink considerably as newer, more secure alternatives emerge.

- Low Growth Potential: The demand for these older versions is stagnant or decreasing due to their inherent security vulnerabilities and lack of modern features.

- Cybersecurity Imperative: Increased awareness and regulatory pressure regarding industrial cybersecurity, such as adherence to standards like IEC 62443, render these older systems obsolete.

- Customer Migration: Industrial clients are actively seeking to replace insecure remote access methods with solutions offering enhanced security, cloud connectivity, and better remote management capabilities.

Products classified as Dogs in the BCG Matrix, such as legacy fieldbus protocol gateways, represent declining market segments with low market share. These offerings, like PROFIBUS or DeviceNet gateways, are being phased out as newer technologies emerge, with HMS noting a drop in fieldbus node installations from 22% in 2024 to an anticipated 17% in 2025.

The strategy for these products is typically to manage existing revenue with minimal investment, aiming for profitability until eventual discontinuation. This includes niche custom communication modules for outdated industrial systems, where the market is inherently small and growth is negligible.

Basic serial communication converters not integrated into IIoT solutions also fall into this category, as the industrial landscape shifts towards Industrial Ethernet and wireless technologies. The market for standalone serial converters is contracting, contrasting with the robust growth of the broader IIoT sector, projected to reach $1,512.10 billion by 2027.

Furthermore, older, less secure remote access solutions are becoming liabilities due to increasing cybersecurity threats and the demand for compliance with standards like IEC 62443, leading to customer migration towards more secure alternatives.

Question Marks

HMS is venturing into 5G industrial communication solutions, recognizing its potential for the future of IIoT and smart factories. However, the widespread adoption of 5G in factory automation is still in its nascent stages, characterized by slow implementation in industrial settings. This positions 5G solutions as potential 'question marks' within the BCG matrix, demanding significant investment to capture future market share.

The industrial 5G market is projected for substantial growth, with analysts forecasting it to reach approximately $10 billion by 2028, a significant jump from its 2023 valuation of around $3 billion. Despite this promising outlook, HMS's current market share in dedicated industrial 5G solutions is likely low. This means these ventures require considerable investment to develop, market, and establish a foothold, aiming to transform them into future 'stars'.

HMS's AI/ML-driven predictive maintenance offerings are positioned within a high-growth IIoT market, projected to reach $12.7 billion by 2025, with a CAGR of 21.6%. These solutions, likely integrating data from HMS's Ewon and Red Lion products, represent newer initiatives. While the market shows strong potential, HMS's current market share in this specific segment is likely low due to the emerging nature of these advanced analytics and the significant investment required for R&D and market penetration.

Time-Sensitive Networking (TSN) is a rapidly expanding segment within industrial Ethernet, offering the critical real-time communication capabilities that many advanced industrial applications demand. This makes it a significant area for growth.

While HMS's established Anybus products hold a strong position in the standard Industrial Ethernet market, their specific TSN-enabled products are likely newer entrants, currently possessing a smaller market share as the technology's widespread adoption continues to unfold. For instance, the industrial Ethernet market was valued at approximately $17.5 billion in 2023 and is projected to grow significantly, with TSN being a key driver.

Strategic investment in TSN technology is therefore paramount for HMS to secure and solidify its future market leadership in this evolving landscape. Companies are increasingly looking to integrate TSN for enhanced determinism and efficiency in areas like factory automation and autonomous systems.

PEAK-System Automotive Ethernet Solutions

With the acquisition of PEAK-System in late 2024, HMS Networks significantly bolstered its capabilities in automotive communication technologies, particularly Automotive Ethernet. This strategic move positions HMS within a high-growth niche of industrial communications and vehicle testing, a sector projected to see substantial expansion. By integrating PEAK-System's expertise, HMS is now better equipped to capitalize on the increasing demand for robust in-vehicle networking solutions.

The Automotive Ethernet solutions brought into the HMS portfolio by PEAK-System can be viewed as Stars within the BCG matrix. This classification stems from their operation in a market segment characterized by rapid technological advancement and increasing adoption rates. While PEAK-System's specific market share in this specialized area is still establishing itself, the overall growth trajectory of Automotive Ethernet suggests strong future potential for these offerings. For instance, the global Automotive Ethernet market size was valued at approximately USD 2.8 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 15% from 2024 to 2030, driven by the increasing complexity of vehicle electronics and the demand for higher bandwidth.

- High Growth Market: Automotive Ethernet is a rapidly expanding sector driven by advanced driver-assistance systems (ADAS), infotainment, and autonomous driving technologies.

- Developing Market Share: While the market is growing, HMS's specific penetration in this niche is still in its developmental stages following the PEAK-System acquisition.

- Strategic Importance: This segment is crucial for HMS's long-term strategy to provide comprehensive connectivity solutions across industrial and automotive applications.

- Investment Focus: Resources are likely to be invested to further develop and market these Star products, aiming to capture a larger share of the growing Automotive Ethernet market.

Solutions for Industry 5.0 and Human-Machine Collaboration

Industry 5.0, with its focus on seamless human-machine integration and a strong emphasis on sustainability, is a defining trend expected to gain significant traction by 2025. HMS is strategically positioned to capitalize on this by developing solutions that foster advanced human-machine collaborations and pioneer new sustainable industrial practices. This places HMS in a burgeoning, high-growth market where its innovative products, though likely possessing low current market share, represent a crucial opportunity for substantial strategic investment to elevate them to future 'Stars' in the BCG matrix.

These nascent solutions are designed to empower workers by augmenting their capabilities, not replacing them, a core tenet of Industry 5.0. For instance, advancements in cobots (collaborative robots) and AI-driven assistive technologies are enabling safer and more efficient manufacturing processes. Companies are investing heavily in these areas; the global cobot market alone was projected to reach $8.6 billion by 2025, indicating substantial growth potential.

- Industry 5.0 Focus: Emphasizes human-machine synergy and environmental responsibility.

- HMS's Position: Developing cutting-edge solutions for advanced collaboration and sustainable practices.

- Market Potential: Operating within a nascent, high-growth sector with significant future potential.

- Strategic Imperative: Requires investment to transition from low market share to market leadership ('Stars').

Question Marks represent new ventures with low market share in high-growth markets. HMS's 5G industrial communication solutions fit this category, requiring substantial investment to capture future market share in an evolving IIoT landscape. Similarly, their AI/ML-driven predictive maintenance offerings are in a high-growth segment, but HMS's current share is likely minimal, necessitating R&D and market penetration investments.

Time-Sensitive Networking (TSN) is another area where HMS's newer TSN-enabled products are positioned as Question Marks. While the broader industrial Ethernet market is robust, HMS's specific TSN offerings are still developing their market presence, demanding strategic investment to capitalize on TSN's growing importance for real-time industrial communication.

| HMS Offering | Market Growth | Current Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| 5G Industrial Communication | High (projected $10B by 2028) | Low | Question Mark | Investment for market penetration |

| AI/ML Predictive Maintenance | Very High (21.6% CAGR, $12.7B by 2025) | Low | Question Mark | R&D and market development |

| Time-Sensitive Networking (TSN) | High (driver of Industrial Ethernet growth) | Developing | Question Mark | Strategic investment for leadership |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, comprehensive market research reports, and industry expert interviews to provide a robust strategic overview.