HMS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

HMS's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business aiming to thrive in this market.

The bargaining power of both buyers and suppliers significantly influences HMS's profitability and strategic flexibility. These forces dictate pricing power and the cost of inputs, impacting the entire value chain.

Furthermore, the availability of substitute products presents a constant challenge, forcing HMS to innovate and differentiate its offerings to maintain market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore HMS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

HMS Networks' reliance on suppliers for crucial components, such as semiconductors, presents a significant challenge. The semiconductor market, in particular, is characterized by a limited number of major global manufacturers producing advanced components. This concentration inherently grants these suppliers substantial bargaining power.

For instance, the global semiconductor market was valued at approximately $612 billion in 2023 and is projected to grow, but the production of cutting-edge chips remains concentrated among a few key players. This means HMS Networks, and companies like it, have fewer viable alternatives if a primary supplier experiences production issues, imposes significant price increases, or faces geopolitical disruptions. Such concentration can lead to increased costs and potential delays for HMS Networks.

The specialized nature of industrial communication and IIoT solutions means HMS often requires highly specific and unique components or technologies. When inputs are highly customized or proprietary, the bargaining power of those niche suppliers increases significantly. This can reduce HMS's flexibility in sourcing and potentially lead to higher costs for essential components.

Switching suppliers in the industrial technology sector, like for HMS, often comes with substantial costs. These can include the expense of re-designing products to accommodate new components, the rigorous process of re-certifying those components to meet industry standards, and the investment required to re-train personnel on new equipment or processes.

These high switching costs effectively increase the bargaining power of HMS's existing suppliers. When it's costly and time-consuming for HMS to change suppliers, current providers can often command higher prices or dictate more favorable terms, as the risk and expense of transitioning away are significant deterrents.

This situation makes it challenging for HMS to readily switch to alternative suppliers, even if those new options appear more attractive in terms of price or innovation. The embedded costs of changing create a sticky situation, reinforcing the leverage of established relationships.

Supplier's Ability to Forward Integrate

Suppliers of critical technologies or specialized components possess the potential to shift into direct competition with HMS by integrating forward into the industrial communication solutions market. This threat is more pronounced with large, diversified technology firms rather than pure component manufacturers. Should a key supplier decide to offer end-to-end solutions, it could significantly alter the competitive landscape, turning a partner into a formidable rival.

Consider the potential impact if a major semiconductor provider, supplying essential chips for industrial networking, were to develop its own proprietary communication platform. This would not only remove a key component supplier but also introduce a direct competitor offering integrated hardware and software. For instance, in 2024, the industrial automation market, a key sector for HMS, saw continued growth, with companies exploring more integrated solutions. A significant player in this space launching its own communication infrastructure would directly challenge companies like HMS that rely on providing such solutions.

- Forward Integration Threat: Suppliers can leverage their core technology expertise to offer complete communication solutions, bypassing intermediaries like HMS.

- Competitive Intensification: If a supplier becomes a competitor, it leads to increased market rivalry and potential price pressures.

- Strategic Shift: Large technology conglomerates, already operating in adjacent markets, are more likely to pursue this strategy to capture greater value.

- Market Disruption: Such a move could disrupt existing supply chains and force companies like HMS to reassess their business models.

Impact of Raw Material and Semiconductor Shortages

The bargaining power of suppliers for companies like HMS Networks has been significantly amplified by recent global raw material and semiconductor shortages. These disruptions have created a scenario where demand for essential components far outstrips available supply, giving semiconductor manufacturers considerable leverage. For instance, the automotive industry alone faced production losses estimated to be in the tens of billions of dollars in 2023 due to these shortages, a situation that directly impacts the availability and pricing of components used in industrial networking solutions.

This imbalance directly translates to increased costs and longer lead times for HMS. When suppliers face overwhelming demand and limited production capacity, they are in a position to dictate higher prices and prioritize certain customers, potentially impacting HMS's ability to secure necessary components promptly. This situation underscores the critical need for robust supply chain management and diversification strategies to mitigate such supplier power.

- Increased Component Prices: Semiconductor prices saw substantial increases throughout 2023 and into early 2024, with some critical components experiencing price hikes of 10-20% or more compared to pre-shortage levels.

- Extended Lead Times: Lead times for semiconductors, which were typically a few weeks, stretched to many months, sometimes exceeding a year for highly in-demand chips.

- Supply Chain Volatility: The unpredictable nature of shortages creates significant planning challenges for manufacturers like HMS, impacting production schedules and inventory management.

- Supplier Prioritization: In a constrained market, suppliers may prioritize larger or more strategic customers, potentially disadvantaging smaller or less established buyers.

The bargaining power of suppliers is a significant factor for HMS Networks, primarily due to the concentrated nature of key component markets like semiconductors. When few suppliers dominate the production of essential inputs, they can exert considerable influence over pricing and terms. This is evident in the 2023 global semiconductor market, valued at approximately $612 billion, where limited manufacturers of advanced chips hold substantial sway.

Companies like HMS often face high switching costs when dealing with specialized or proprietary components, as re-designing, re-certifying, and retraining can be prohibitively expensive. This reliance on specific suppliers, coupled with the difficulty of transitioning, empowers existing providers to dictate terms and potentially increase prices.

The threat of forward integration, where suppliers might offer complete solutions, further amplifies their bargaining power. For instance, a semiconductor firm developing its own communication platform could turn a component provider into a direct competitor, impacting HMS's market position.

Recent global shortages have dramatically increased supplier leverage, with component prices and lead times escalating. This situation, where demand outstrips supply, forces companies like HMS to contend with higher costs and potential production delays, highlighting the critical need for robust supply chain strategies.

| Factor | Impact on HMS Networks | Example Data (2023-2024) |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Few global players dominate advanced semiconductor manufacturing. |

| Switching Costs | High costs of changing suppliers reinforce current relationships. | Product re-design, re-certification, and retraining can cost millions. |

| Forward Integration Threat | Suppliers can become competitors by offering end-to-end solutions. | A chip manufacturer launching its own communication platform. |

| Market Shortages | Demand exceeding supply grants suppliers pricing power and longer lead times. | Semiconductor price increases of 10-20%+ and lead times extending to over a year. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to HMS, providing a strategic overview of its competitive landscape.

Instantly visualize competitive intensity with a dynamic, interactive Five Forces dashboard, allowing for rapid identification of strategic threats and opportunities.

Customers Bargaining Power

HMS Networks caters to a wide array of industrial clients in sectors such as manufacturing, energy, and transportation. While a few major industrial clients may possess considerable purchasing power, the broader customer base is generally dispersed.

This fragmentation typically diminishes the individual bargaining leverage of customers against HMS. For instance, in 2023, HMS reported that its top ten customers accounted for approximately 20% of its total sales, indicating a relatively low concentration and thereby limiting the power of any single customer.

For industrial clients, switching communication solutions often incurs significant expenses. These can include the costs of integrating new systems with existing infrastructure, retraining staff on new platforms, and the potential for operational disruptions or downtime during the transition. For example, a major enterprise might spend upwards of $50,000 to $200,000 on a single large-scale communication system migration in 2024, factoring in hardware, software, and consulting fees.

These substantial switching costs effectively raise the barrier for customers looking to move to a competitor. This inherent stickiness means that once a customer is invested in HMS's solutions, they are less likely to seek out alternatives, even if slightly lower prices are offered elsewhere. This translates into a more stable customer base for HMS, bolstering their market position.

Customers seeking industrial communication solutions today face a significantly wider array of choices than in previous years. This abundance of alternatives, ranging from competing industrial automation companies to the possibility of developing proprietary in-house systems, directly impacts the bargaining power of these customers. For instance, the growing integration of advanced wireless technologies like 5G and Wi-Fi 6 into industrial settings provides more flexible and potentially cost-effective communication pathways, lessening reliance on any single vendor.

The expanding ecosystem of communication protocols and platforms further empowers customers. With options like OPC UA, MQTT, and various fieldbus technologies readily available, customers can select solutions that best fit their specific needs and existing infrastructure, rather than being locked into a single vendor's proprietary system. This increased substitutability allows customers to negotiate more favorable terms or switch suppliers if pricing or service levels are not competitive, thereby exerting downward pressure on HMS Networks' pricing and potentially impacting its profit margins.

Price Sensitivity of Customers

In industrial settings, particularly for critical infrastructure, customers often prioritize reliability and performance over slight price variations. For instance, in telecommunications or energy grids, a minor cost saving on a communication module would be unacceptable if it compromised system uptime or data integrity. This suggests that for HMS's more specialized, high-performance offerings, customer price sensitivity might be lower.

However, for communication modules that are more akin to commodities, or where differentiation is less pronounced, customers can indeed become more price-sensitive. Consider the market for standard IoT devices; here, bulk purchasing power and competitive pricing are significant factors. HMS needs to carefully segment its product lines and understand where price plays a dominant role in purchasing decisions.

HMS's strategic focus on innovation and robust customer support serves as a key lever to counteract price sensitivity. By consistently offering cutting-edge technology and reliable after-sales service, HMS can build brand loyalty and justify premium pricing. This differentiation makes customers less likely to switch solely based on a few percentage points difference in cost.

For example, HMS's Netbiter products, which offer remote management solutions, often compete in environments where downtime is extremely costly. In such scenarios, the total cost of ownership, factoring in reliability and support, becomes a more critical consideration than the initial purchase price. This highlights the nuanced nature of price sensitivity within HMS's diverse customer base.

- Industrial Applications: For critical infrastructure, reliability and performance are paramount, often overriding minor price differences.

- Commodity-like Modules: In more standardized markets, customers may exhibit higher price sensitivity.

- Differentiation Strategy: HMS mitigates price sensitivity through continuous innovation and strong customer support.

- Total Cost of Ownership: For solutions like Netbiter, reliability and support contribute more to purchasing decisions than initial price alone.

Customer's Ability to Backward Integrate

Large industrial enterprises or automation integrators possess the potential to develop their own industrial communication modules or software. This capability, though demanding significant investment and expertise, represents a latent threat to companies like HMS Networks. It could diminish their long-term dependence on external providers for such specialized components.

- Potential for In-house Development: Major players in industries relying on industrial communication can invest in R&D to create proprietary solutions.

- Reduced Supplier Reliance: Successful backward integration would directly decrease the bargaining power of suppliers in the communication module market.

- Market Dynamics: While direct backward integration is costly, the threat itself can influence pricing and innovation demands from suppliers. For instance, by 2024, the industrial automation market is projected to reach over $200 billion, highlighting the scale of potential investment.

The bargaining power of customers for HMS Networks is generally considered moderate to low. While some large industrial clients might have significant purchasing volume, the overall customer base is fragmented, preventing any single entity from wielding excessive influence. Furthermore, the substantial costs and potential operational disruptions associated with switching communication solutions lock customers into HMS's offerings, limiting their leverage.

The availability of numerous alternative communication technologies and protocols, coupled with the ongoing trend towards more open standards, does present customers with greater choice and therefore some increased bargaining power. However, the critical nature of reliability and performance in industrial applications often means that price is not the sole determinant of a purchase decision. HMS's strategy of continuous innovation and strong customer support further strengthens its position by fostering loyalty and justifying its pricing.

The potential for large customers to develop in-house communication solutions acts as a latent threat, but the significant investment and expertise required make this a less immediate concern for most. Thus, while some factors contribute to customer power, HMS's product differentiation and the inherent switching costs for its clients maintain a relatively balanced power dynamic.

| Factor | Impact on Customer Bargaining Power | HMS Networks' Mitigation Strategy |

|---|---|---|

| Customer Concentration | Low to Moderate | Fragmented customer base limits individual leverage. |

| Switching Costs | Low | High integration, training, and potential downtime costs deter switching. In 2024, a large system migration could cost $50,000-$200,000. |

| Availability of Substitutes | Moderate | Growing choice of technologies (e.g., 5G, Wi-Fi 6) and open standards increase options. |

| Price Sensitivity | Varies by Product | Lower for critical/high-performance modules, higher for commodity-like items. |

| Threat of Backward Integration | Low (Latent) | High investment and expertise needed for in-house development. Industrial automation market projected over $200 billion in 2024, indicating potential scale of investment. |

What You See Is What You Get

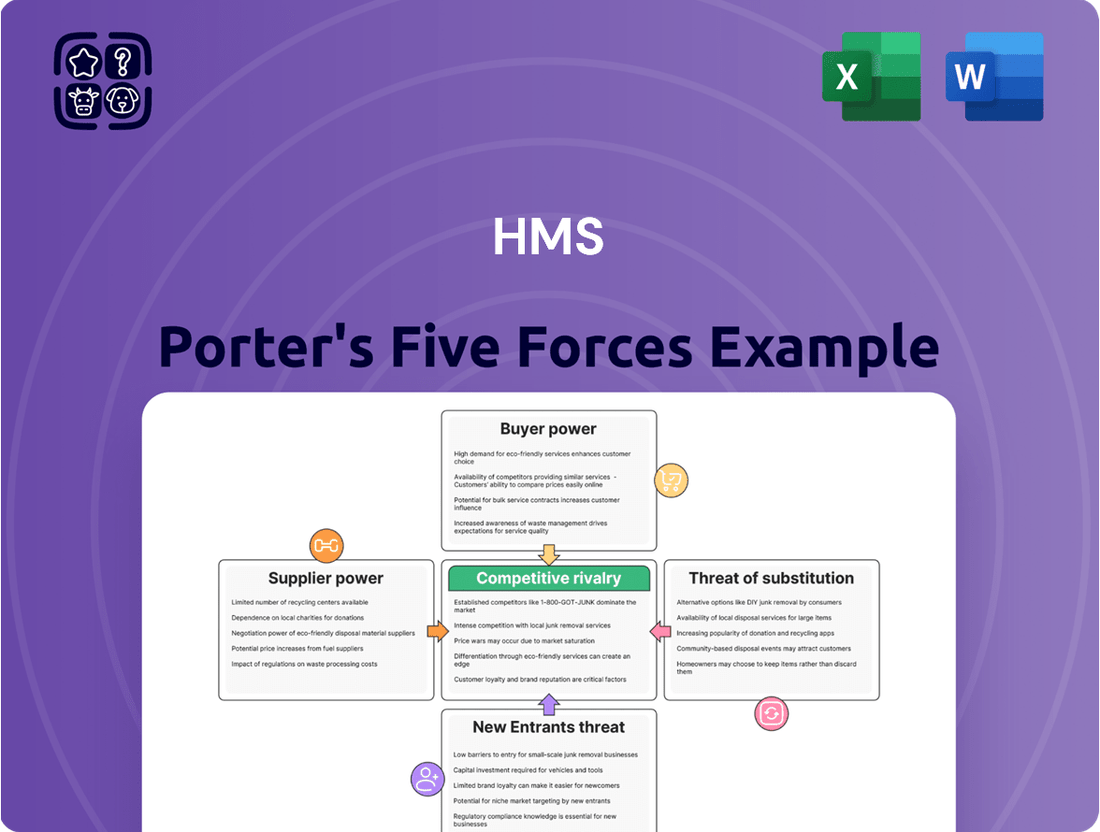

HMS Porter's Five Forces Analysis

This preview showcases the complete HMS Porter's Five Forces analysis, offering a detailed examination of competitive forces within its industry. The document you see is the exact, professionally formatted report you will receive instantly upon purchase, ensuring you gain immediate access to actionable insights for strategic decision-making. No placeholders or partial content; this is the full, ready-to-use analysis, meticulously prepared to guide your understanding of the competitive landscape. You're viewing the final deliverable, enabling you to download and apply this comprehensive assessment without delay.

Rivalry Among Competitors

The industrial communication and IIoT market is quite crowded, with a wide array of companies vying for market share. This includes major automation players like Siemens and Rockwell Automation, alongside more specialized firms such as Corinex and Maverick Technologies, and entities like MAX Automation.

This broad spectrum of competitors, from large conglomerates to niche providers, highlights the fragmented nature of the industry. For example, in 2024, the IIoT platform market alone was projected to reach over $50 billion, indicating substantial activity and numerous participants contributing to this growth.

The sheer number and varied sizes of these companies mean that competition is fierce across different segments of the market. HMS Networks faces rivals that can offer comprehensive solutions or highly specialized technologies, creating a dynamic and challenging environment.

The Industrial IoT and industrial communication sectors are thriving, which can ease competitive pressures. The global industrial IoT market is projected to hit approximately USD 2146.07 billion by 2034, expanding at a compound annual growth rate of 17.20% between 2024 and 2034. This robust expansion suggests a market with ample opportunity for multiple players.

Furthermore, the industrial communication market is anticipated to grow from USD 20.45 billion in 2025 to USD 26.06 billion by 2030, indicating a CAGR of 5.0%. This steady growth ensures there is more market share available for companies to capture without intense head-to-head competition for a limited customer base.

HMS Networks maintains a strong competitive stance through its diverse product brands like Anybus, IXXAT, and eWON, emphasizing both versatility and steadfast reliability in its offerings. This broad portfolio allows them to cater to a wide array of industrial communication needs, a key differentiator in a crowded market.

A relentless focus on innovation is paramount for HMS Networks. They continuously invest in developing new industrial communication protocols, enhancing integration capabilities across various platforms, and bolstering cybersecurity features, which are critical for maintaining a competitive edge and attracting new clients.

The company’s commitment to delivering cutting-edge solutions, such as those that seamlessly support emerging technologies like 5G and Time-Sensitive Networking (TSN), is vital for sustained differentiation. These advanced capabilities allow HMS Networks to stay ahead in a dynamic and rapidly evolving industrial technology landscape.

Exit Barriers

High exit barriers in the industrial communication sector, stemming from substantial investments in research and development, specialized manufacturing, and strong customer ties, compel existing players to remain and compete vigorously. These factors mean companies find it exceedingly difficult and costly to leave the market.

The specialized nature of assets, such as proprietary hardware and software for industrial automation and control systems, makes them ill-suited for repurposing in other industries. This lack of flexibility locks companies into the sector, even during periods of low profitability.

For instance, the average R&D spending for leading industrial communication companies exceeded 15% of revenue in 2024, a significant commitment that is hard to recoup upon exiting. Companies like Siemens and Rockwell Automation have invested billions in their integrated industrial solutions, creating dedicated production lines and extensive service networks.

- Significant R&D Investment: Companies in this space often invest heavily, with some reporting R&D expenditure as high as 18% of sales in 2024, making it costly to abandon.

- Specialized Assets: Manufacturing facilities and equipment are highly specific to industrial communication technologies, limiting resale value or alternative use.

- Established Customer Relationships: Long-term contracts and deep integration with client operations, particularly in critical infrastructure, create switching costs for customers and lock-in for suppliers.

- Brand Reputation and Expertise: The need for specialized technical support and a proven track record in industrial environments means that exiting players cannot easily transfer their accumulated knowledge and brand equity.

Market Share and Strategic Objectives

HMS Networks occupies a significant space in the industrial networking sector, with its yearly assessments highlighting sustained growth and the ongoing prevalence of Industrial Ethernet. For instance, in 2023, the company reported a revenue of SEK 22,003 million, underscoring its robust market presence.

The competitive landscape is characterized by rivals actively pursuing market share via aggressive pricing strategies, the introduction of innovative products, and the formation of key alliances. This dynamic is evident as companies like Moxa and Hirschmann, major players in industrial communication, continually invest in R&D to differentiate their offerings.

- Competitive Intensity: Rivalry is high as established firms and emerging players vie for dominance in the growing industrial network market.

- Innovation Drive: Competitors are pushing boundaries with new product launches, such as advanced IIoT gateways and cybersecurity solutions, to capture market share.

- Ecosystem Expansion: Key players aim to broaden their reach by offering integrated solutions and expanding their partner ecosystems, creating a competitive advantage.

- Market Share Focus: Companies are strategically focused on increasing their share of the Industrial Ethernet market, which is projected for significant growth in the coming years.

The competitive rivalry within the industrial communication and IIoT market is intense, driven by a large number of diverse players, including giants like Siemens and Rockwell Automation, alongside specialized firms. This crowded field means companies must constantly innovate and differentiate to capture market share.

The robust growth of the industrial communication and IIoT sectors, with the IIoT platform market projected to exceed $50 billion in 2024, provides ample opportunity, yet fierce competition persists as companies introduce new products and expand their partner ecosystems.

HMS Networks faces rivals who are actively engaged in aggressive pricing, product innovation, and strategic alliances. For instance, in 2024, R&D spending for leading industrial communication companies averaged over 15% of revenue, highlighting the significant investment required to stay competitive.

High exit barriers, due to substantial R&D investments, specialized assets, and established customer relationships, compel existing players to remain and compete vigorously, ensuring sustained rivalry for market dominance.

| Key Competitor Aspects | Description | Example Fact (2024/2025 Data) |

| Market Landscape | Crowded with large conglomerates and specialized niche providers. | IIoT platform market projected over $50 billion in 2024. |

| Rivalry Tactics | Aggressive pricing, innovation, and ecosystem expansion. | Leading firms' R&D spending averaged >15% of revenue in 2024. |

| Exit Barriers | High due to R&D, specialized assets, and customer lock-in. | Billions invested by companies like Siemens in integrated solutions. |

| HMS Networks' Position | Strong through diverse brands (Anybus, IXXAT, eWON) and innovation. | Reported SEK 22,003 million in revenue for 2023. |

SSubstitutes Threaten

While Industrial Ethernet has become the dominant force in factory automation, traditional wired communication protocols like PROFIBUS continue to represent a significant threat of substitutes. As of 2024, PROFIBUS still accounts for a substantial portion of newly installed nodes in many factory automation projects, particularly in regions and industries with long-established infrastructure.

These legacy systems are often favored in existing industrial environments where the cost of replacing extensive cabling and control systems with newer Ethernet-based solutions is prohibitive. The inherent reliability and familiarity of these older protocols, coupled with their proven track record, make them a viable alternative for businesses prioritizing stability over the cutting edge.

The persistence of these traditional wired solutions means that companies offering Industrial Ethernet technologies must contend with a market segment that is slower to adopt new standards. This gradual shift underscores the continued relevance of older fieldbus technologies as practical substitutes, especially for applications where the benefits of Industrial Ethernet might not immediately outweigh the transition costs.

Large industrial organizations and system integrators may choose to develop their own communication solutions, specifically designed for their unique operational needs. This backward integration serves as a significant substitute for relying on third-party providers. Companies possessing robust research and development capabilities are well-positioned to pursue this strategy, particularly when their requirements are highly specialized. The ongoing trend of IT/OT convergence further supports and enables such in-house development efforts.

The growing adoption of advanced wireless technologies like 5G and Wi-Fi 6 directly challenges HMS's existing wireless solutions. For instance, 5G’s widespread deployment, projected to reach over 2 billion subscriptions globally by 2025, offers high bandwidth and low latency, potentially replacing proprietary industrial wireless systems.

Specialized industrial wireless standards, such as IO-Link Wireless, are also gaining traction, providing flexible and scalable network options that can serve as substitutes for traditional wired or less adaptable wireless implementations. This shift is driven by the increasing demand for agile manufacturing environments.

As these alternative technologies mature and become more cost-effective, they can erode the market share of established wireless providers by offering comparable or superior functionality. The ability of these new standards to support a vast number of connected devices, a key tenet of Industry 4.0, further amplifies their substitution threat.

Non-digital or Manual Processes

In certain industrial settings, especially smaller operations or those with less complex needs, manual processes or simpler communication methods can act as substitutes for advanced IIoT (Industrial Internet of Things) solutions. This often occurs where the investment in full automation doesn't yet present a clear cost advantage. For example, a small manufacturing plant might rely on manual inventory tracking and paper-based production logs instead of connected sensors and real-time data platforms.

However, the accelerating adoption of Industry 4.0 principles is steadily eroding the competitive edge of these less-automated alternatives. By 2024, many industries are seeing significant productivity gains and cost reductions from IIoT integration, making purely manual systems increasingly inefficient. This shift is driven by the need for greater agility, predictive maintenance capabilities, and enhanced supply chain visibility.

The viability of non-digital or manual processes as substitutes is particularly challenged in sectors focused on efficiency and data-driven decision-making. Consider the logistics industry: while manual route planning was once standard, real-time traffic data and AI-powered optimization through IIoT platforms are now the norm for major players, offering substantial fuel savings and delivery time improvements.

- Cost-Benefit Analysis: Manual processes remain a substitute only where the ROI for IIoT is not yet compelling, a threshold that is rapidly rising.

- Industry 4.0 Impact: The widespread adoption of Industry 4.0 technologies is significantly reducing the attractiveness and feasibility of manual or less sophisticated alternatives.

- Efficiency Gap: Businesses relying on manual systems face growing disadvantages in areas like operational efficiency, predictive maintenance, and real-time data analytics compared to IIoT-enabled competitors.

- Market Trends: Global IIoT spending was projected to reach over $300 billion in 2024, highlighting the strong market preference for automated and connected solutions.

Cloud-native Platforms and Software-Defined Solutions

The increasing migration to cloud-native platforms and software-defined solutions presents a significant threat of substitutes for traditional hardware-centric industrial communication systems. These flexible and scalable cloud-based offerings, including virtual PLCs and software-defined automation, can fulfill many communication needs previously requiring dedicated physical modules. For instance, as of early 2024, the global industrial automation market is seeing substantial growth in software-defined networking (SDN) and edge computing, components crucial for these substitute solutions.

This shift is further amplified by the ongoing convergence of Information Technology (IT) and Operational Technology (OT). This integration allows software-driven alternatives to seamlessly operate within industrial environments, diminishing the perceived necessity of specialized hardware. By 2024, many industrial sectors are actively investing in IT/OT integration projects, with cybersecurity and data management being key drivers, further paving the way for software-based communication architectures.

- Cloud-native platforms offer greater scalability and flexibility compared to fixed hardware solutions.

- Virtual PLCs and software-defined automation can reduce the reliance on specialized industrial communication hardware.

- The IT/OT convergence facilitates the adoption of software-driven communication alternatives in industrial settings.

- Market analysis for 2024 indicates a growing demand for adaptable, software-centric industrial control systems.

The threat of substitutes for traditional industrial communication systems is significant, driven by advancements in alternative technologies. Legacy wired protocols like PROFIBUS continue to hold ground due to installation costs in existing infrastructure, especially in 2024. However, newer wireless solutions and software-defined platforms are increasingly offering comparable or superior functionality, forcing established players to adapt. The growing adoption of Industry 4.0 principles also pushes businesses away from less automated, manual processes.

The market for industrial communication is experiencing a dynamic shift. While older technologies persist, the rapid evolution of alternatives presents a compelling case for change. The following table illustrates the competitive landscape of substitutes:

| Substitute Technology | Key Advantages | Market Penetration (Indicative 2024) | Threat Level |

|---|---|---|---|

| Legacy Wired Protocols (e.g., PROFIBUS) | Proven reliability, familiarity, lower initial cost for upgrades in existing systems | Significant in established factories, ~30-40% of new nodes in certain sectors | Medium to High (especially in retrofits) |

| Advanced Wireless (5G, Wi-Fi 6, IO-Link Wireless) | Flexibility, mobility, high bandwidth, low latency, scalability | Growing rapidly, 5G subscriptions expected to exceed 2 billion globally by 2025 | High |

| Cloud-Native & Software-Defined Solutions | Scalability, flexibility, reduced hardware dependence, virtualized functions | Increasing adoption, significant growth in SDN and edge computing | High |

| Manual/Less Automated Processes | Simplicity, low upfront investment for very small operations | Declining, primarily in niche or small-scale applications | Low to Medium (eroding rapidly with Industry 4.0) |

Entrants Threaten

Entering the industrial communication and IIoT market demands significant capital, especially for research and development in both hardware and specialized software. For example, companies like Siemens and Rockwell Automation invest billions annually in R&D to maintain their competitive edge, creating a substantial hurdle for newcomers. Developing advanced solutions that can handle diverse industrial protocols, such as those used in manufacturing and energy sectors, requires immense financial backing and technical expertise, effectively deterring many potential entrants.

The industrial automation sector, where companies like HMS Networks operate, requires a deep well of specialized technical knowledge. This includes understanding various communication protocols, adhering to strict industrial standards, and mastering complex cybersecurity measures. Newcomers often struggle to match this existing expertise, which is a significant hurdle.

Established companies, including HMS Networks, have cultivated substantial intellectual property and patent portfolios. These assets represent years of research and development, making it incredibly difficult for new entrants to replicate their innovations or compete on a level playing field without infringing on existing patents. For instance, HMS Networks holds numerous patents related to industrial communication technologies, a key differentiator.

The industrial products sector is heavily burdened by complex regulatory compliance and the need for global certifications. Adherence to stringent safety, performance, and interoperability standards is paramount, making entry a formidable challenge.

Navigating these intricate regulatory landscapes, which often vary by region, and securing the necessary certifications is a lengthy and expensive undertaking. For instance, obtaining FDA approval for medical devices can take years and cost millions, a significant barrier for newcomers.

This substantial regulatory hurdle effectively deters new companies from entering the market. The sheer investment in time and resources required to meet these demands creates a formidable moat for established players.

Established Customer Relationships and Brand Loyalty

HMS Networks benefits significantly from deeply entrenched customer relationships and strong brand loyalty within the industrial automation sector. These long-standing connections, fostered by reliable product performance and extensive global support, create a substantial barrier for any new competitor aiming to enter the market.

New entrants must overcome the significant hurdle of displacing existing, trusted suppliers. Industrial clients often prioritize proven track records and stability, making them hesitant to switch from vendors with whom they have built trust over time. This loyalty is a critical defense for HMS Networks.

- Brand Reputation: HMS Networks is recognized for its robust and dependable industrial communication solutions.

- Customer Loyalty: Existing clients often demonstrate a high degree of loyalty due to consistent performance and support.

- Switching Costs: The cost and complexity of integrating new technology can deter customers from switching suppliers.

- Risk Aversion: Industrial clients tend to be risk-averse, favoring established vendors with a history of successful deployments.

Economies of Scale and Distribution Channels

Existing players in the industry often enjoy significant economies of scale, which new entrants struggle to match. This scale advantage translates into lower per-unit costs for manufacturing, purchasing raw materials, and research and development. For instance, a major competitor might have production facilities operating at 90% capacity, whereas a new entrant might only achieve 50% capacity, leading to substantially higher costs per unit.

Established distribution channels represent another formidable barrier. Companies like HMS, with its extensive network of over 20 sales offices and a broad base of distributors, have already built strong relationships and efficient logistics. Replicating this reach and market penetration requires substantial investment and time, creating a significant hurdle for newcomers seeking to get their products to market effectively.

The difficulty in quickly replicating established distribution networks and achieving comparable economies of scale creates a substantial cost and market access disadvantage for potential new entrants. This can make it challenging for them to compete on price or even to gain visibility in a crowded marketplace. For example, a new entrant might face higher shipping costs per unit due to a less optimized supply chain compared to an incumbent with widespread warehousing.

- Economies of Scale: Incumbents benefit from lower per-unit costs in production, procurement, and R&D due to higher output volumes.

- Distribution Channels: Established companies possess extensive sales networks and distributor relationships that are costly and time-consuming to replicate.

- Market Access: New entrants face challenges in gaining broad market penetration and visibility compared to firms with existing market presence.

- Cost Disadvantage: The inability to achieve similar scale and distribution efficiency places new entrants at a significant cost disadvantage.

The threat of new entrants in the industrial communication and IIoT market is moderate. Significant capital investment is required for R&D, with companies like Siemens investing billions annually. Deep technical expertise in protocols, standards, and cybersecurity is essential, making it difficult for newcomers to compete with established players like HMS Networks, who possess extensive patent portfolios and strong brand loyalty.

Regulatory compliance and global certifications add another layer of difficulty, demanding substantial time and financial resources. Established players benefit from economies of scale and entrenched distribution channels, creating cost and market access disadvantages for new entrants. For example, in 2023, the global industrial automation market was valued at over $160 billion, indicating the scale of investment needed to gain a foothold.

| Barrier Type | Description | Example Impact (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High R&D and operational costs. | Companies like ABB reported R&D expenses of approximately $1.5 billion in 2023. |

| Technical Expertise | Need for specialized knowledge in protocols and cybersecurity. | A successful cybersecurity breach in an industrial setting can cost millions in recovery and lost production. |

| Intellectual Property | Patents held by incumbents. | HMS Networks holds numerous patents protecting its core communication technologies. |

| Regulatory Hurdles | Complex certifications and compliance standards. | Obtaining CE marking for industrial equipment can take months and incur thousands in testing fees. |

| Distribution Channels | Established networks are costly to replicate. | HMS Networks has a global presence with over 20 sales offices and numerous distributors. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, financial statements, and regulatory filings. We supplement this with insights from reputable industry research firms and market intelligence platforms to ensure a comprehensive understanding of competitive dynamics.