Hargreaves Lansdown PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Lansdown Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hargreaves Lansdown's future. Our expertly crafted PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now and gain a decisive competitive advantage.

Political factors

The UK government's approach to financial services regulation significantly shapes Hargreaves Lansdown's operating environment. For instance, the Financial Conduct Authority (FCA) sets the rules, and in 2024, they continued to focus on consumer protection, particularly concerning investment advice and product transparency. Increased regulatory scrutiny, while adding compliance burdens, also builds investor confidence, a crucial element for a platform like Hargreaves Lansdown.

Changes in government policy, such as potential reforms to pension allowances or capital gains tax announced in the 2024/2025 fiscal year, can directly influence investment behaviour and product demand. A stable and predictable regulatory landscape, as generally aimed for by the current government, provides Hargreaves Lansdown with the certainty needed for strategic planning and investment in new services.

Changes in capital gains tax, dividend tax, and inheritance tax significantly impact investor decisions and the appeal of products like those offered by Hargreaves Lansdown. For instance, the UK's capital gains tax allowance was reduced from £6,000 to £3,000 for the 2024-2025 tax year, potentially increasing the tax burden on investors and influencing their trading activity.

Favorable tax environments, such as those with lower rates or higher allowances, tend to stimulate investment, directly boosting the volume of assets Hargreaves Lansdown administers. Conversely, increased taxation can dampen investor enthusiasm, leading to a potential slowdown in asset growth and a shift towards tax-efficient investment wrappers.

The UK's political landscape significantly influences investor sentiment, a key driver for Hargreaves Lansdown. A stable government and predictable policy environment encourage long-term investment, directly benefiting platforms that manage client assets.

Conversely, political instability, such as unexpected election outcomes or rapid policy changes, can create market volatility. For instance, the period leading up to the 2019 general election saw some market uncertainty, which can dampen client activity and new investment inflows on platforms like Hargreaves Lansdown.

The government's approach to financial regulation and taxation is also paramount. Changes in capital gains tax or stamp duty, for example, directly affect investment returns and the attractiveness of various financial products offered by Hargreaves Lansdown, impacting client decisions and asset values.

Brexit and Trade Agreements

Brexit and its ongoing impact on trade agreements continue to shape the UK's economic landscape, which in turn influences investor confidence and the performance of assets listed on UK exchanges. While Hargreaves Lansdown's core client base is domestic, shifts in international trade dynamics can ripple through the broader market, affecting investment opportunities and overall portfolio performance.

The UK's ability to forge new trade deals post-Brexit influences economic growth prospects. For instance, the UK's trade agreement with the EU, the EU-UK Trade and Cooperation Agreement, came into effect on January 1, 2021, establishing new rules for trade, travel, and business. Any future adjustments or new agreements could further alter the economic environment Hargreaves Lansdown operates within.

- Trade Deal Impact: The effectiveness of post-Brexit trade deals in boosting UK exports and imports is a key indicator of economic health.

- Investor Sentiment: Uncertainty or positive developments surrounding trade negotiations can significantly sway investor sentiment towards UK assets.

- Financial Services: While direct equivalence for financial services remains a complex issue, any changes in this area could impact cross-border operations for UK financial firms.

Consumer Protection Legislation

New and evolving consumer protection laws, like the Financial Conduct Authority's (FCA) Consumer Duty, are significantly raising the bar for how financial firms interact with their customers. This means Hargreaves Lansdown, a prominent investment platform, must constantly refine its services, communication strategies, and product designs to align with these stricter mandates. The core of this is ensuring fair value and fostering genuine understanding among its retail investor base, a crucial element in maintaining trust and compliance.

For Hargreaves Lansdown, adapting to these regulatory shifts is not just about avoiding penalties; it's about building a more robust and customer-centric business model. For instance, the FCA's Consumer Duty, implemented in 2023, requires firms to demonstrate how they deliver good outcomes for retail customers across four key areas: products and services, price and value, consumer understanding, and consumer support. This proactive approach to consumer protection can differentiate Hargreaves Lansdown in a competitive market.

- FCA Consumer Duty Focus: Mandates higher standards for fair value, clear communication, and customer support.

- Impact on Hargreaves Lansdown: Requires continuous adaptation of services, product offerings, and client communications.

- Regulatory Landscape: Ongoing scrutiny of financial advice and platform services by bodies like the FCA.

The political environment in the UK profoundly impacts Hargreaves Lansdown, particularly through regulatory frameworks and fiscal policies. The Financial Conduct Authority (FCA) continues to be a key influence, with its 2024 focus on consumer protection and product transparency directly shaping platform operations. Changes in tax policies, such as the reduction in the capital gains tax allowance to £3,000 for the 2024-2025 tax year, directly affect investor behaviour and the volume of assets managed by Hargreaves Lansdown.

Government stability and predictable policy are crucial for investor confidence, which in turn drives asset growth on platforms like Hargreaves Lansdown. Conversely, political uncertainty can lead to market volatility, potentially dampening client activity. The ongoing evolution of post-Brexit trade agreements also influences the broader economic landscape, indirectly affecting investor sentiment and asset performance.

The FCA's Consumer Duty, implemented in 2023, mandates higher standards for customer outcomes, requiring Hargreaves Lansdown to continually adapt its services and communication. This regulatory push for fair value and consumer understanding is a critical factor for the company's strategy and market positioning.

| Regulatory Focus Area | Key Policy/Regulation | Impact on Hargreaves Lansdown | Relevant Year(s) |

|---|---|---|---|

| Consumer Protection | FCA Consumer Duty | Requires enhanced customer support, fair value, and clear communication. | 2023 onwards |

| Taxation | Capital Gains Tax Allowance Reduction | Potentially increases tax burden on investors, influencing trading activity. | 2024-2025 |

| Market Stability | Government Policy Predictability | Stable policies foster investor confidence and asset growth. | Ongoing |

What is included in the product

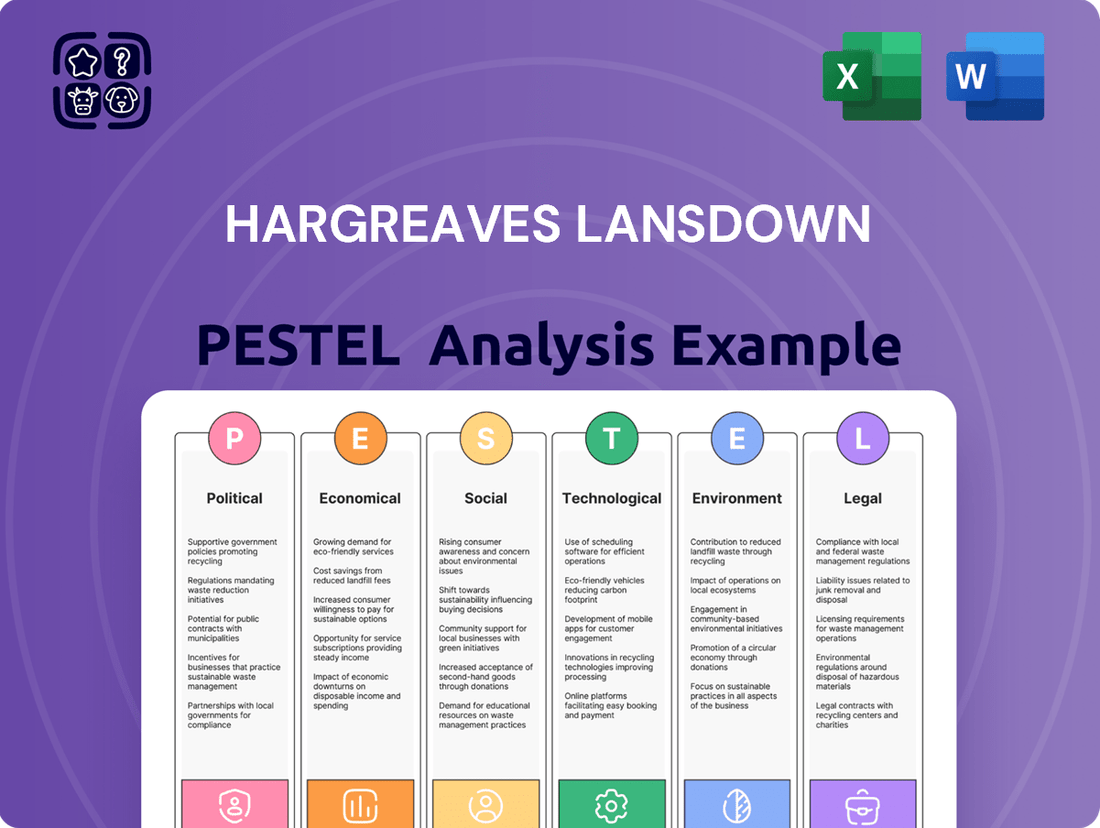

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Hargreaves Lansdown, offering a comprehensive understanding of its external operating landscape.

It provides actionable insights into how these macro-environmental forces create both strategic opportunities and potential threats for the company's future growth and stability.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE data into actionable insights for Hargreaves Lansdown's strategic discussions.

Economic factors

Fluctuations in the Bank of England's base rate significantly affect Hargreaves Lansdown's clients. For instance, the base rate stood at 5.25% in early 2024, a notable increase from previous years, influencing the appeal of cash savings versus equities.

High inflation, which averaged around 4.6% in the UK for the year ending March 2024, erodes the real value of investments. This trend often pushes clients towards assets with potentially higher returns, impacting demand for growth-focused funds and wealth management services offered by Hargreaves Lansdown.

A robust UK economy, as anticipated for late 2024 and into 2025, typically fuels job creation and boosts disposable incomes. This environment directly translates to enhanced consumer wealth, encouraging more people to consider investing their savings, which benefits platforms like Hargreaves Lansdown.

For instance, the UK's GDP growth, projected to be around 1.5% in 2024 by the Bank of England, supports this trend. Higher consumer confidence, often correlating with economic stability, leads to increased inflows into investment platforms and a greater willingness to engage with financial services.

Conversely, economic contractions, such as the slight recession experienced in late 2023, can dampen investor sentiment. During such periods, individuals may reduce savings, draw down existing investments, and postpone new client acquisition, directly impacting Hargreaves Lansdown's revenue from fees and asset management.

Periods of heightened market volatility, such as those experienced in late 2023 and early 2024 due to geopolitical tensions and inflation concerns, can significantly impact investor behavior. This often leads to a cautious stance, with investors potentially reducing trading frequency or reallocating funds to safer investments. For Hargreaves Lansdown, this translates to a direct effect on revenue streams derived from transaction fees and asset under management growth.

Investor confidence is a critical barometer for Hargreaves Lansdown's success. For instance, during periods of economic uncertainty, like the initial reaction to the 2024 inflation data, a noticeable dip in retail investor sentiment was observed across the UK market. This directly influences the company’s ability to attract new clients and retain existing ones, as confidence underpins willingness to engage with investment products.

Competition in the Investment Platform Market

Hargreaves Lansdown operates within a fiercely competitive investment platform landscape, facing rivals from traditional financial institutions and agile fintech startups. This intense rivalry pressures platforms to lower fees, constantly enhance their product suites and user interfaces, and significantly invest in marketing to acquire and retain customers. For instance, as of early 2024, the UK investment platform market has seen significant consolidation and new entrants, with firms like AJ Bell and Interactive Investor vying for market share alongside Hargreaves Lansdown.

The drive for innovation is paramount, as platforms must continually adapt to evolving client expectations and technological advancements. This includes offering a wider range of investment options, improved digital tools, and personalized advice. The ongoing digital transformation in financial services means that user experience and platform accessibility are key differentiators.

- Market Share Dynamics: While Hargreaves Lansdown has historically held a dominant position, competitors are actively gaining ground. For example, in 2023, reports indicated that while HL remained a leader, platforms like AJ Bell saw substantial growth in their customer numbers and assets under management.

- Fee Compression: Increased competition has led to a downward trend in platform fees across the industry, forcing all players to re-evaluate their pricing structures to remain competitive.

- Fintech Disruption: The rise of robo-advisors and digital-first investment apps presents a significant challenge, offering lower-cost alternatives and streamlined user experiences that appeal to a younger demographic.

- Product Diversification: Platforms are expanding their offerings beyond traditional stocks and funds to include ESG-focused investments, fractional shares, and alternative assets to attract a broader client base.

Employment Rates and Wage Growth

High employment rates and sustained wage growth are crucial for financial services firms like Hargreaves Lansdown. When more people are employed and earning more, they have greater disposable income, which can be channeled into savings and investments. This directly expands the potential customer base for wealth management platforms, increasing the demand for investment products and advisory services. For instance, in the UK, the employment rate remained robust, with the Office for National Statistics reporting it at 74.4% for the three months to April 2024. Wage growth also showed resilience, with average weekly earnings increasing by 6.0% year-on-year in the same period, providing individuals with more financial capacity.

Conversely, economic downturns characterized by rising unemployment or stagnant wages can significantly dampen investment activity. A shrinking job market and reduced earning potential mean fewer individuals have the surplus funds to invest, and existing clients may reduce their contributions or even withdraw funds to cover essential expenses. This contraction in available capital directly impacts the growth and profitability of investment platforms. For example, a significant rise in unemployment, say above 5%, could signal a period where discretionary spending, including investing, is curtailed by a larger segment of the population.

- UK Employment Rate: 74.4% (three months to April 2024).

- UK Average Weekly Earnings Growth: 6.0% year-on-year (three months to April 2024).

- Impact on Investment: Higher employment and wages boost disposable income, expanding the investor pool for Hargreaves Lansdown.

- Economic Sensitivity: Rising unemployment or wage stagnation can reduce investment capacity and client contributions.

The Bank of England's base rate, at 5.25% in early 2024, influences client decisions between cash savings and equities, impacting Hargreaves Lansdown's product appeal.

UK inflation averaged 4.6% for the year ending March 2024, diminishing investment value and potentially driving clients towards higher-return assets, affecting demand for Hargreaves Lansdown's growth-focused services.

Projected UK GDP growth of around 1.5% for 2024, coupled with robust employment (74.4% in early 2024) and wage growth (6.0% year-on-year), supports increased disposable income and investor activity, benefiting platforms like Hargreaves Lansdown.

| Economic Factor | Data Point (Early 2024 / Year Ending March 2024) | Impact on Hargreaves Lansdown |

| Bank of England Base Rate | 5.25% | Affects client asset allocation decisions. |

| UK Inflation Rate | 4.6% (Year ending March 2024) | Erodes real investment value, influencing demand for growth assets. |

| UK GDP Growth Projection | ~1.5% (2024) | Indicates economic expansion, potentially boosting investment. |

| UK Employment Rate | 74.4% (Three months to April 2024) | High employment supports disposable income for investment. |

| UK Average Weekly Earnings Growth | 6.0% (Year-on-year, three months to April 2024) | Increased earnings enhance capacity for savings and investment. |

Full Version Awaits

Hargreaves Lansdown PESTLE Analysis

The preview shown here is the exact Hargreaves Lansdown PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hargreaves Lansdown, providing valuable insights for strategic planning and decision-making.

Sociological factors

The UK's aging population, with over 11 million people aged 65 and over in 2023 according to the Office for National Statistics, presents a substantial growth avenue for Hargreaves Lansdown. As individuals near or enter retirement, the demand for sophisticated pension management and drawdown strategies intensifies, directly benefiting platforms offering such services.

This demographic shift underscores the need for Hargreaves Lansdown to refine its product suite and advisory capabilities to address the complexities of long-term wealth accumulation and the crucial aspect of intergenerational wealth transfer. By 2030, the proportion of the UK population aged 65+ is projected to increase further, highlighting the sustained relevance of these financial planning needs.

The drive for enhanced financial literacy is a significant tailwind for Hargreaves Lansdown. As more individuals seek to manage their own investments, the demand for user-friendly platforms and educational resources surges. This trend is evidenced by the increasing number of people engaging with online financial advice and tools, a demographic Hargreaves Lansdown is well-positioned to serve.

Hargreaves Lansdown’s success hinges on its ability to cater to this growing segment of self-directed investors. By offering accessible investment tools, comprehensive research, and educational content, the company empowers both novice and seasoned investors. For instance, the UK’s Financial Conduct Authority reported in 2024 that 57% of adults felt confident managing their finances, a figure that underscores the market's readiness for direct investment platforms.

Societal views on personal finance are changing, with a growing emphasis on individuals taking charge of their long-term financial well-being, including retirement planning and wealth accumulation. This trend is evident in increasing engagement with investment platforms, particularly among younger demographics seeking to build financial resilience.

Hargreaves Lansdown can leverage this by highlighting the compounding power of early investment and simplifying access to diverse investment products. For instance, the UK's Financial Conduct Authority reported that in 2023, over 1.2 million new investment accounts were opened, indicating a strong appetite for personal investing.

Demand for Ethical and Sustainable Investing (ESG)

Societal expectations are increasingly pushing for investments that consider environmental, social, and governance (ESG) factors. This means companies like Hargreaves Lansdown need to offer more products that meet these ethical demands. For instance, a significant portion of UK investors now consider ESG when making decisions, with surveys in late 2024 indicating over 60% of retail investors actively seeking out sustainable options.

Hargreaves Lansdown is responding by expanding its range of ESG-screened funds and improving the clarity of information available to clients. This allows individuals to align their financial goals with their personal values, a trend that gained considerable momentum through 2024 and is projected to continue growing. The firm’s platform is enhancing tools to help investors easily identify and select funds based on specific ESG criteria.

- Growing Investor Interest: Over 60% of UK retail investors considered ESG factors in their investment choices by late 2024.

- Demand for Transparency: Clients expect clear data on fund ESG performance and holdings.

- Product Expansion: Hargreaves Lansdown is increasing its offering of ESG-focused investment funds.

- Values-Based Investing: The trend reflects a broader shift towards aligning personal values with financial decisions.

Digital Adoption and Lifestyle Integration

The widespread digital adoption means clients, regardless of age, expect investment platforms that are intuitive and prioritize mobile access. Hargreaves Lansdown must ensure its services fit seamlessly into users' daily digital routines, offering easy access for financial management on the go.

For instance, in the UK, as of early 2024, over 90% of adults use the internet, with mobile devices being the primary access point for many. This trend underscores the necessity for platforms like Hargreaves Lansdown to offer a superior mobile experience, reflecting a broader shift in consumer behaviour towards digital-first interactions.

- Mobile-First Design: Prioritizing mobile app functionality and user experience is critical for client engagement.

- Seamless Integration: Platforms need to integrate with other digital financial tools and services for a holistic user experience.

- Digital Convenience: Offering features like instant account opening, easy fund transfers, and accessible customer support via digital channels is paramount.

- Data Security: Maintaining robust cybersecurity measures is essential to build and retain client trust in a digital environment.

The increasing emphasis on financial literacy and self-directed investing, with 57% of UK adults feeling confident managing their finances in 2024, presents a significant opportunity for Hargreaves Lansdown to provide accessible tools and education. This societal shift towards greater personal financial responsibility is further evidenced by over 1.2 million new investment accounts opened in the UK in 2023, indicating a strong appetite for direct investment platforms.

Societal values are increasingly incorporating Environmental, Social, and Governance (ESG) considerations into investment decisions, with over 60% of UK retail investors considering ESG factors by late 2024. Hargreaves Lansdown is responding by expanding its ESG-focused fund offerings and enhancing platform transparency to meet this demand for values-based investing.

The widespread adoption of digital technology, with over 90% of UK adults using the internet in early 2024 and mobile devices being the primary access point, necessitates intuitive and mobile-first investment platforms. Hargreaves Lansdown must ensure its services offer seamless digital integration and convenience to cater to evolving consumer behaviour.

Technological factors

Hargreaves Lansdown is leveraging advancements in artificial intelligence and automation to refine its client services. The integration of AI and machine learning is key to enhancing advisory capabilities, offering more personalized investment recommendations, and streamlining customer support operations.

These technological shifts promise to boost efficiency across the board, delivering richer insights to clients and enabling the scaling of personalized wealth management services. This focus on AI positions Hargreaves Lansdown to gain a significant competitive advantage in the evolving financial landscape.

Cybersecurity is a critical technological factor for Hargreaves Lansdown, a company entrusted with vast amounts of sensitive client financial data and assets. In 2024, the financial services sector continued to face escalating cyber threats, from sophisticated phishing attacks to ransomware. Hargreaves Lansdown's commitment to investing in advanced security protocols, such as multi-factor authentication and continuous threat monitoring, is non-negotiable to safeguard client information and maintain operational integrity.

The regulatory landscape surrounding data protection, particularly with GDPR and similar frameworks, places immense responsibility on financial institutions. Failure to comply can result in substantial fines and reputational damage. For instance, in the UK, the Information Commissioner's Office (ICO) has the power to levy significant penalties for data breaches. Therefore, Hargreaves Lansdown’s ongoing efforts to bolster its data protection measures are essential for both legal compliance and preserving client trust in the face of evolving technological risks.

Hargreaves Lansdown's platform innovation is key to staying ahead. In 2024, the company continued to invest in its digital offerings, focusing on enhancing user experience and introducing new features. This commitment to a seamless and intuitive interface is vital for attracting and keeping clients in a competitive online investment landscape.

The firm's ability to provide advanced tools and research capabilities directly impacts its market differentiation. By offering a user-friendly platform that caters to both novice and experienced investors, Hargreaves Lansdown aims to meet the ever-increasing expectations of its customer base. This focus on UX is a significant technological factor in its ongoing success.

Integration with Open Banking and Open Finance

The ongoing shift towards Open Banking, and the subsequent evolution into Open Finance, offers significant strategic avenues for Hargreaves Lansdown. By embracing these frameworks, the company can seamlessly connect with a broader ecosystem of financial service providers. This integration allows for a more comprehensive and consolidated view of client finances, moving beyond just investment portfolios.

This enhanced data aggregation can unlock innovative service offerings. For instance, Hargreaves Lansdown could develop tools that provide clients with a holistic financial picture, incorporating savings, loans, and other financial products alongside their investments. Such a move could significantly deepen client engagement and loyalty by offering greater convenience and actionable insights.

The potential benefits are substantial. In the UK, Open Banking has already seen increased adoption, with millions of consumers and businesses actively using open banking-enabled services. For example, by the end of 2023, over 10 million UK consumers and SMEs were estimated to be using Open Banking. This trend is expected to accelerate with Open Finance, which promises to extend data sharing to a wider range of financial products, including pensions and insurance.

- Holistic Financial View: Integration allows clients to see all their financial assets and liabilities in one place, improving financial management.

- New Service Development: Opportunities exist to create value-added services like personalized financial planning tools and automated savings solutions.

- Enhanced Data Insights: Access to broader financial data enables more sophisticated, data-driven advice and product recommendations.

- Increased Customer Engagement: A more integrated and personalized experience can lead to higher customer retention and satisfaction.

Cloud Computing and Scalability

Hargreaves Lansdown's adoption of cloud computing is a significant technological enabler. This allows for robust scalability, meaning the platform can easily handle a growing user base and increased transaction activity without performance degradation. For instance, during peak market events in 2024, the ability to scale resources rapidly ensured uninterrupted service for their clients.

The flexibility offered by cloud infrastructure is crucial for Hargreaves Lansdown's agility. It facilitates the swift deployment of new features and updates, keeping their digital offerings competitive. This also underpins the resilience of their services, ensuring high availability and minimizing downtime, which is paramount for client trust in financial services.

Key benefits realized include:

- Enhanced Platform Scalability: Ability to manage millions of client accounts and transactions efficiently.

- Improved Service Resilience: Ensuring high uptime, critical for financial transactions.

- Faster Feature Deployment: Accelerating innovation and response to market changes.

- Cost Optimization: Leveraging pay-as-you-go cloud models for efficient resource utilization.

Hargreaves Lansdown's technological strategy centers on AI for personalized client experiences and operational efficiency. By integrating machine learning, they aim to enhance advisory services and streamline customer support, positioning themselves for growth in wealth management.

Legal factors

Hargreaves Lansdown operates under the stringent oversight of the Financial Conduct Authority (FCA), a key legal factor impacting its operations. The FCA mandates strict rules covering client money protection, capital adequacy, and the fair treatment of customers, ensuring a secure and ethical environment for investors. For instance, FCA rules often dictate specific capital requirements, which Hargreaves Lansdown must maintain to demonstrate financial resilience. Failure to comply can result in significant penalties and even the revocation of operating licenses, making adherence a critical business imperative.

Hargreaves Lansdown operates under stringent data protection laws like the UK GDPR and the Data Protection Act 2018. These regulations dictate the meticulous handling of client personal and financial data, from collection to storage and processing. Failure to comply can result in substantial penalties; for instance, the Information Commissioner's Office (ICO) can issue fines up to £17.5 million or 4% of global annual turnover for serious breaches.

The Financial Conduct Authority's (FCA) Consumer Duty, implemented in July 2023, significantly elevates the expected standard of care for financial firms like Hargreaves Lansdown. This means the company must proactively ensure its products, services, communications, and customer support deliver genuinely good outcomes for its retail clients.

Hargreaves Lansdown needs to demonstrate that it provides fair value across its offerings, aligning with the reasonable foreseeable needs of its defined target market. For instance, the firm's fees and charges must be justifiable in relation to the benefits provided, a key aspect of the Duty's fair value outcome.

Failure to meet these stringent requirements could lead to regulatory scrutiny and potential penalties. The FCA's focus on consumer protection underscores the critical importance of transparency and customer-centricity in Hargreaves Lansdown's operational framework, particularly as it navigates the evolving financial landscape through 2024 and into 2025.

Anti-Money Laundering (AML) and KYC Regulations

Hargreaves Lansdown operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, a critical aspect of its legal environment. These rules are designed to combat financial crime, ensuring the integrity of the financial system. For instance, in the UK, the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 mandate rigorous customer due diligence.

To comply, Hargreaves Lansdown must maintain robust processes for verifying client identities, meticulously monitoring all transactions for any unusual patterns, and promptly reporting suspicious activities to the relevant authorities. This commitment to compliance necessitates continuous investment in advanced technology and comprehensive staff training programs. The Financial Conduct Authority (FCA) oversees these compliance efforts in the UK, with firms facing significant penalties for non-adherence.

Key compliance obligations include:

- Customer Due Diligence (CDD): Verifying the identity of all clients, including beneficial ownership.

- Transaction Monitoring: Implementing systems to detect and flag potentially illicit financial activities.

- Suspicious Activity Reporting (SAR): Establishing clear channels for reporting suspected money laundering or terrorist financing to the National Crime Agency (NCA).

- Record Keeping: Maintaining detailed records of customer identification and transaction data for a specified period.

Advertising and Marketing Regulations

Hargreaves Lansdown operates under stringent advertising and marketing regulations for financial products, demanding clear, fair, and non-misleading communications. The Financial Conduct Authority (FCA) sets these standards, and compliance is paramount to prevent misrepresentation claims and uphold the company's reputation for trust. For instance, in 2024, the FCA continued its focus on consumer protection in financial promotions, with increased scrutiny on digital advertising and social media campaigns. Failure to adhere can result in significant fines and reputational damage.

Key aspects of these regulations for Hargreaves Lansdown include:

- Clarity and Fairness: Ensuring all promotional materials clearly explain the risks and benefits of financial products without ambiguity.

- Accuracy: Verifying that all claims made in advertising and marketing are factually correct and supported by evidence.

- FCA Compliance: Adhering to specific FCA rules, such as those outlined in the Financial Promotions regime, to maintain authorization.

- Client Communications: Extending these principles to all client-facing communications, including emails, website content, and customer service interactions.

Hargreaves Lansdown's operations are heavily influenced by evolving legal frameworks, particularly the FCA's Consumer Duty implemented in July 2023. This regulatory shift mandates a proactive approach to ensuring positive client outcomes, with a focus on fair value for products and services. The FCA's ongoing scrutiny of financial promotions, especially in digital channels, means Hargreaves Lansdown must maintain clear, accurate, and non-misleading communications to avoid penalties and reputational damage. Furthermore, robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, such as the UK's Money Laundering Regulations 2017, require continuous investment in compliance processes to prevent financial crime.

Environmental factors

Investor demand for Environmental, Social, and Governance (ESG) investments continues to surge. In 2024, a significant portion of new fund inflows are directed towards sustainable and ESG-focused strategies. For instance, global sustainable fund assets reached an estimated $3.7 trillion by the end of 2023, with projections indicating further growth in 2024 and 2025.

Hargreaves Lansdown, like other financial platforms, is feeling this pressure. Clients increasingly expect access to a wider range of sustainable funds and clear, actionable data on the environmental impact of their investments. This shift necessitates a robust expansion of their ESG product shelf and enhanced transparency in reporting to align with evolving client preferences and regulatory expectations.

Hargreaves Lansdown, like many financial institutions, faces growing pressure to disclose climate-related financial risks and opportunities. This is driven by evolving regulations and stakeholder expectations, heavily influenced by frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). For instance, in 2024, the UK's Financial Conduct Authority (FCA) mandated climate-related disclosures for listed companies, impacting many of Hargreaves Lansdown's clients and the broader market it operates within.

While Hargreaves Lansdown is primarily an investment platform, it's not immune to these environmental factors. The company may need to report on its own operational carbon footprint, a trend seen across the financial sector. Furthermore, a significant aspect of its response involves facilitating clients' access to robust Environmental, Social, and Governance (ESG) data. This allows investors to make more informed decisions aligned with sustainability goals, a demand that saw ESG fund inflows reach record levels in 2024.

Hargreaves Lansdown, like any modern business, contributes to an operational carbon footprint through its office spaces, energy usage, and the broader supply chain that supports its operations. This footprint is a key area of focus as environmental consciousness grows.

Stakeholders, including investors and customers, increasingly demand transparency and action regarding environmental impact. For Hargreaves Lansdown, this translates to a need to not only measure but also actively reduce its emissions, aligning with global sustainability targets and demonstrating corporate responsibility.

While specific figures for Hargreaves Lansdown's 2024/2025 operational carbon footprint are not yet publicly detailed, the financial services sector as a whole is under pressure to decarbonize. For instance, many UK financial institutions have committed to net-zero targets, reflecting a sector-wide shift towards environmental accountability.

Reputation and Brand Image Linked to Sustainability

Hargreaves Lansdown's reputation is significantly shaped by its environmental sustainability efforts. A strong commitment to eco-friendly practices can attract environmentally conscious clients and investors, setting the company apart in a competitive financial services landscape.

In 2024, a significant portion of investors, estimated at over 60% by various surveys, consider a company's environmental, social, and governance (ESG) performance when making investment decisions. This trend underscores the importance of sustainability for Hargreaves Lansdown's brand image and client acquisition.

Hargreaves Lansdown's proactive approach to sustainability can translate into tangible benefits:

- Enhanced Brand Loyalty: Demonstrating genuine commitment to environmental causes fosters trust and loyalty among customers.

- Attracting Talent: A strong sustainability ethos makes the company more attractive to potential employees who prioritize working for responsible organizations.

- Investor Confidence: Investors increasingly view sustainable companies as less risky and better positioned for long-term growth, potentially boosting Hargreaves Lansdown's valuation.

- Market Differentiation: Sustainability leadership can serve as a key differentiator, helping Hargreaves Lansdown stand out from competitors.

Physical Risks from Climate Change

Physical risks stemming from climate change, such as increasingly frequent extreme weather events and growing resource scarcity, can indirectly affect Hargreaves Lansdown by impacting the performance of the diverse range of assets held by its clients. For instance, the intensification of storms and floods in 2024, causing billions in damages globally, could negatively influence sectors like agriculture, real estate, and infrastructure, all of which are represented on investment platforms.

Hargreaves Lansdown, as a digital investment platform, needs to proactively consider how these physical climate risks are evaluated and communicated to its user base. This involves integrating climate risk assessments into its investment research and advisory services, ensuring clients are aware of potential portfolio vulnerabilities. For example, a report by the World Economic Forum in early 2025 highlighted that 50% of global GDP is highly or very highly dependent on nature and its services, underscoring the broad economic impact of environmental degradation.

- Extreme weather events: Increased frequency and severity of events like hurricanes, floods, and wildfires can disrupt supply chains and damage physical assets, impacting company valuations.

- Resource scarcity: Depletion of critical resources such as water and certain minerals can lead to increased operational costs and reduced production for businesses.

- Impact on asset performance: These physical risks can translate into lower returns or increased volatility for investment portfolios that are heavily exposed to vulnerable sectors or geographies.

- Disclosure and communication: Platforms like Hargreaves Lansdown face a growing need to transparently disclose how climate-related physical risks are factored into their investment recommendations and research.

The demand for sustainable investments continues to climb, with ESG funds seeing substantial inflows in 2024, exceeding previous years. This trend means Hargreaves Lansdown must expand its offering of environmentally conscious funds and provide clearer data on their impact. For instance, global sustainable fund assets were projected to grow significantly beyond the $3.7 trillion mark seen by the end of 2023.

Regulatory bodies are also pushing for greater transparency on climate-related financial risks. In 2024, the UK's FCA mandated climate disclosures for listed companies, directly impacting the market Hargreaves Lansdown operates within and requiring more detailed reporting from its clients.

Physical climate risks, such as more frequent extreme weather, pose a threat to investment portfolios. A World Economic Forum report in early 2025 indicated that half of global GDP is highly dependent on nature, highlighting the broad economic impact of environmental degradation on various sectors represented on investment platforms.

| Factor | Impact on Hargreaves Lansdown | 2024/2025 Data/Trend |

|---|---|---|

| ESG Investment Demand | Increased client demand for sustainable funds and ESG data. | Continued strong inflows into ESG funds, with over 60% of investors considering ESG performance in 2024. |

| Climate Risk Disclosure | Pressure to report on climate-related financial risks and opportunities. | FCA mandates for climate disclosures for listed companies in 2024. |

| Physical Climate Risks | Potential impact on asset performance due to extreme weather and resource scarcity. | 50% of global GDP dependent on nature (WEF early 2025 report), increasing portfolio vulnerability. |

PESTLE Analysis Data Sources

Our Hargreaves Lansdown PESTLE analysis is meticulously constructed using a blend of publicly available government data, reputable financial news outlets, and expert industry analysis. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the financial services sector.