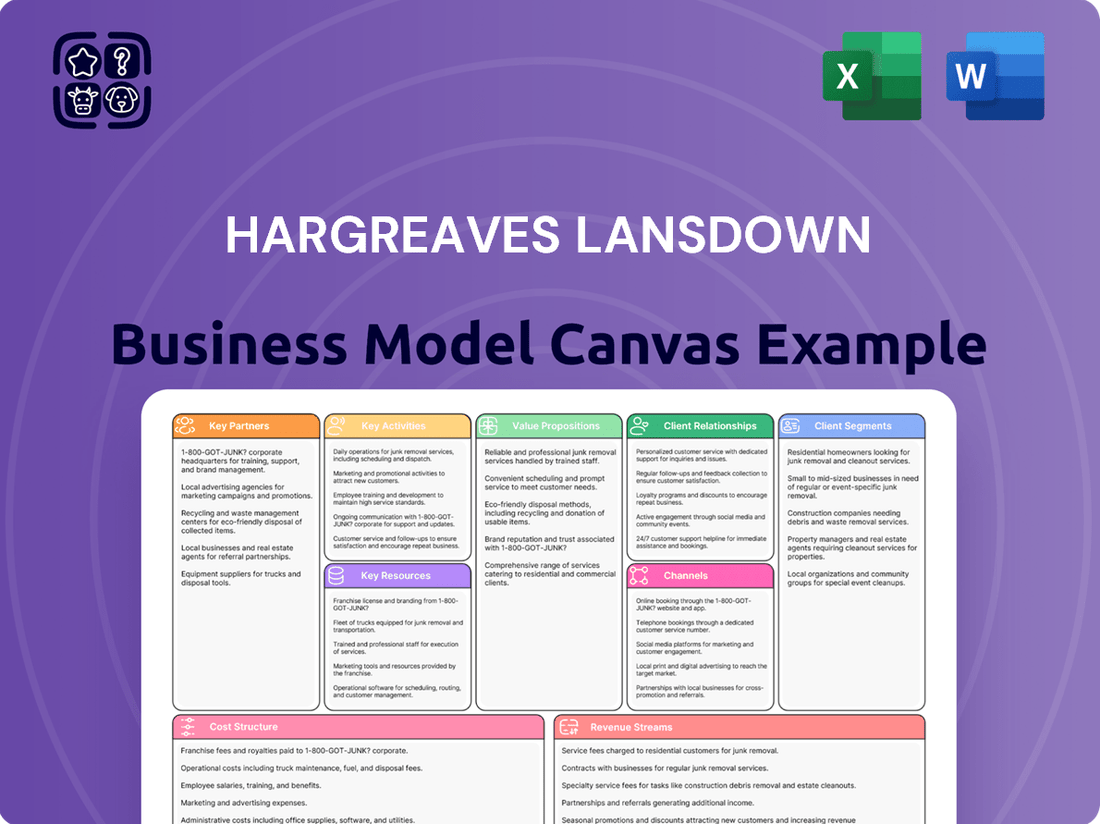

Hargreaves Lansdown Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Lansdown Bundle

Unlock the core of Hargreaves Lansdown's success with its comprehensive Business Model Canvas. This detailed breakdown reveals how they attract and retain clients, manage key resources, and build a robust revenue stream in the competitive financial services sector. Understand their strategic advantages and operational efficiency.

Ready to dissect a market leader? Our full Hargreaves Lansdown Business Model Canvas provides an in-depth look at their customer relationships, cost structure, and key activities. Download it now to gain actionable insights for your own business strategy and competitive analysis.

Partnerships

Hargreaves Lansdown's acquisition by a consortium of CVC Capital Partners, Nordic Capital, and Platinum Ivy (a subsidiary of Abu Dhabi Investment Authority) in March 2025 for £5.4 billion represents a pivotal strategic partnership. This collaboration is designed to propel the company's technology-driven evolution and bolster its client offerings.

The consortium's deep experience within financial services, coupled with their dedication to investing in essential infrastructure, is fundamental to Hargreaves Lansdown's future trajectory, fostering innovation and sustained growth.

Hargreaves Lansdown cultivates vital relationships with numerous fund and investment product providers. These partnerships are the bedrock of their offering, enabling access to a wide spectrum of investment vehicles such as mutual funds, exchange-traded funds (ETFs), and investment trusts. This broad selection empowers clients to diversify their portfolios effectively.

By collaborating with a vast network of asset managers and financial product creators, Hargreaves Lansdown ensures its clients have access to a comprehensive investment universe. This includes everything from individual stocks and bonds to more complex fund structures and pension products. These strategic alliances are crucial for delivering the platform's extensive product proposition.

In 2024, Hargreaves Lansdown continued to leverage these partnerships to provide a diverse investment menu. The platform's success hinges on its ability to aggregate offerings from leading fund houses and product specialists, giving customers a single point of access for their investment needs.

Hargreaves Lansdown’s Active Savings service relies on a robust network of banking partners to offer clients competitive rates and diversification. By collaborating with numerous banks, HL provides a consolidated platform for multi-bank cash ISAs and other savings accounts, granting customers access to a broader spectrum of high-yield options.

This strategic alliance allows Hargreaves Lansdown to present a compelling value proposition, particularly as interest rates fluctuate. For instance, in early 2024, the Bank of England’s base rate remained at 5.25%, prompting consumers to seek higher returns on their savings, a demand HL’s banking partnerships effectively address.

Technology and Software Vendors

Hargreaves Lansdown collaborates with a range of technology and software vendors to ensure its investment platform and digital infrastructure are both powerful and reliable. These relationships are fundamental to the company's ability to offer a cutting-edge digital experience to its clients.

A significant portion of Hargreaves Lansdown's strategic investment is directed towards technology advancements. This includes embracing cloud storage solutions, enhancing data analytics capabilities, and implementing automation to streamline operations and improve client service.

These vendor partnerships are crucial for the continuous modernization and scalability of Hargreaves Lansdown's platform. For instance, in 2024, the company continued to invest heavily in its digital capabilities, aiming to provide seamless access to investment tools and information for its growing customer base.

- Cloud Infrastructure Providers: Essential for hosting and scaling the digital platform, ensuring high availability and performance.

- Data Analytics Software Vendors: Crucial for processing vast amounts of market data and client information to provide personalized insights and improve decision-making.

- Cybersecurity Solution Providers: Vital for protecting client data and financial assets, maintaining trust and regulatory compliance.

- Trading and Portfolio Management Software Developers: Underpin the core functionality of the investment platform, enabling efficient execution and client portfolio management.

Regulatory Bodies and Industry Associations

Hargreaves Lansdown's operations are underpinned by crucial partnerships with regulatory bodies, most notably the Financial Conduct Authority (FCA). These relationships are not merely for compliance but are foundational to maintaining client trust and operational integrity within the UK's financial landscape. By actively engaging with and adhering to the FCA's directives, Hargreaves Lansdown ensures its business practices align with the highest industry standards, safeguarding investor interests.

The company also collaborates with various industry associations, which play a vital role in shaping best practices and advocating for the sector. These affiliations allow Hargreaves Lansdown to stay abreast of evolving market trends and regulatory changes, contributing to a more robust and responsible financial ecosystem. For instance, in 2023, the FCA continued its focus on consumer protection and market integrity, areas directly impacting Hargreaves Lansdown’s key partnerships.

- FCA Compliance: Adherence to FCA regulations is paramount for maintaining Hargreaves Lansdown's license to operate.

- Industry Best Practices: Engagement with industry associations promotes the adoption of high standards in financial advice and platform services.

- Client Trust: Strong regulatory relationships directly translate to enhanced confidence and security for Hargreaves Lansdown's millions of clients.

- Market Stability: Contributing to industry-wide standards helps foster a stable and trustworthy financial market.

Hargreaves Lansdown's key partnerships are crucial for its business model, providing access to a wide array of investment products and banking services. The acquisition by CVC Capital Partners, Nordic Capital, and Platinum Ivy in March 2025 for £5.4 billion is a significant strategic alliance aimed at driving technological advancement and enhancing client offerings.

The company also relies on a broad network of fund providers and asset managers to offer a diverse investment universe, from mutual funds to ETFs. Furthermore, its Active Savings service thrives on partnerships with numerous banks, enabling clients to access competitive rates and a variety of savings accounts. These collaborations are essential for delivering a comprehensive and competitive proposition to Hargreaves Lansdown's client base.

What is included in the product

This Business Model Canvas outlines Hargreaves Lansdown's strategy for providing investment services, focusing on its broad customer base, diverse distribution channels, and compelling value proposition of accessible financial tools and expert advice.

Hargreaves Lansdown's Business Model Canvas provides a structured, one-page snapshot that simplifies the complex process of understanding their client acquisition and service delivery, alleviating the pain point of overwhelming financial product information for investors.

Activities

Hargreaves Lansdown's core activity is the ongoing development and upkeep of its investment platform, focusing on enhancing digital features and user experience. This commitment ensures a robust and intuitive interface for its clients.

Significant investment in 2024 is being channeled into modernizing the technology infrastructure. The aim is to create a leading digital client experience and leverage automation to reduce the cost of serving clients as the business scales.

This strategic technology push is designed to improve system resilience and deliver a state-of-the-art platform. By decoupling costs from client growth, Hargreaves Lansdown can more efficiently manage its operations.

Hargreaves Lansdown actively pursues new clients through targeted marketing and sales initiatives, while also focusing on keeping its current customers happy and engaged. This dual approach is crucial for sustained growth.

The company's commitment to client satisfaction is evident in its daily operations and its continuous refinement of client acquisition strategies. This focus aims to build long-term relationships.

Demonstrating its success, Hargreaves Lansdown welcomed 78,000 net new clients in 2024, underscoring its ability to attract and retain a growing customer base in a competitive market.

Hargreaves Lansdown's core function involves extensive investment research and the creation of accessible content. This includes detailed market analysis, in-depth fund research, and a wide array of educational materials designed to guide retail investors.

The company strives to provide a wealth of data and expert insights, augmented by crucial human support. This dual approach aims to equip clients with the knowledge and confidence needed for sound investment decisions.

In 2024, Hargreaves Lansdown continued to emphasize its role as a trusted source of financial information. Their platform offers tools and insights that help demystify investing for a broad audience.

Customer Service and Support

Hargreaves Lansdown places a strong emphasis on delivering exceptional customer service through multiple avenues, including phone and digital communication. This commitment to client support is a cornerstone of their business model, aiming to foster enduring trust and satisfaction among their customer base.

The company consistently receives positive feedback for its client service, underscoring its dedication to this crucial aspect of its operations. For instance, in the first half of the 2024 financial year, Hargreaves Lansdown reported that 90% of its customer queries were resolved on the first contact, a testament to their efficient support system.

- High-Quality Service Delivery: Offering support via phone, email, and secure messaging to address client needs promptly.

- Client Satisfaction Focus: Prioritizing positive client experiences, which is frequently reflected in customer reviews and satisfaction scores.

- Building Trust: Leveraging excellent service to cultivate and maintain strong, long-term relationships with clients.

- Efficiency Metrics: Aiming for high first-contact resolution rates to enhance customer experience and operational effectiveness.

Compliance and Risk Management

Hargreaves Lansdown’s key activities heavily feature compliance and risk management, ensuring strict adherence to financial regulations like those set by the Financial Conduct Authority (FCA). This involves continuous monitoring of operations, updating policies to meet evolving legal frameworks, and robust reporting to regulatory bodies.

Operational risks, from cybersecurity threats to human error, are meticulously managed through strong internal controls and sophisticated risk assessment frameworks. For instance, in the fiscal year ending June 2023, Hargreaves Lansdown reported significant investment in its digital infrastructure and security measures to safeguard client data and maintain operational resilience.

- Regulatory Adherence: Maintaining FCA authorization and complying with all relevant financial services legislation is paramount.

- Risk Mitigation: Implementing comprehensive strategies to identify, assess, and control operational, financial, and market risks.

- Client Asset Protection: Ensuring the security and integrity of client investments and personal information through stringent controls.

- Adaptability: Proactively responding to changes in the regulatory landscape and market conditions to sustain business operations.

Hargreaves Lansdown's key activities revolve around developing and maintaining its investment platform, with a significant focus in 2024 on modernizing technology for a superior digital client experience and increased operational efficiency. This includes leveraging automation to reduce costs as the client base grows, ensuring system resilience and a state-of-the-art offering.

Delivered as Displayed

Business Model Canvas

The Hargreaves Lansdown Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting of the final deliverable, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive business model, ready for your strategic analysis and planning.

Resources

Hargreaves Lansdown's proprietary technology platform is the engine driving its client-centric digital investment services, offering seamless access to a vast array of financial products. This custom-built infrastructure, encompassing software and digital tools, underpins both its online and mobile offerings, ensuring a robust user experience.

The company is actively investing in a significant technology transformation, aiming to enhance its service proposition and bolster platform resilience. This strategic focus on technology is crucial for maintaining a competitive edge in the evolving digital financial landscape, with the goal of improving client engagement and operational efficiency.

Hargreaves Lansdown's strong brand reputation, cultivated over 40 years, is a cornerstone of its business model, fostering deep client trust in its ability to guide individuals toward their financial goals. This hard-won equity acts as a powerful magnet, drawing in new customers and ensuring loyalty from existing ones.

The company's commitment to service excellence is consistently recognized through numerous industry awards, further reinforcing its image as a reliable and respected financial partner. For instance, in 2023, Hargreaves Lansdown was awarded Best Online Broker by Investors Chronicle, a testament to its ongoing dedication to client satisfaction.

Hargreaves Lansdown's financial capital, comprising shareholder funds and retained earnings, forms a bedrock of its operations. This internal financial strength is augmented by the vast Assets Under Administration (AUA).

As of June 2024, Hargreaves Lansdown managed a significant £155.3 billion in AUA across its 1.88 million active clients. This substantial pool of client assets directly translates into consistent revenue streams for the company through various service fees and commissions.

Skilled Workforce and Expertise

Hargreaves Lansdown's skilled workforce is a cornerstone of its business model, encompassing financial experts, investment analysts, technology professionals, and dedicated customer service teams. This human capital is crucial for developing innovative products and delivering high-quality client support.

The expertise within these teams directly fuels the creation of new investment products and the provision of insightful research, underpinning the company's value proposition. For instance, Hargreaves Lansdown reported a significant increase in active clients, reaching 1.9 million by the end of 2023, a testament to the effectiveness of their client-focused approach driven by a knowledgeable staff.

- Client-Facing Expertise: Financial advisors and customer service representatives possess deep product knowledge and a client-centric approach, fostering trust and long-term relationships.

- Analytical Prowess: Investment analysts provide market insights and research, guiding clients and informing the company's investment strategies.

- Technological Innovation: IT professionals ensure the platform's functionality and security, crucial for a digital-first financial services provider.

- Regulatory Compliance: Expertise in financial regulations ensures adherence to legal frameworks, mitigating risk and maintaining operational integrity.

Data and Client Insights

Hargreaves Lansdown's extensive data on client behavior, investment preferences, and market trends is a core asset. This information allows them to understand what clients want and how they interact with their platform.

This wealth of data is then used to offer personalized insights, helping clients make more informed decisions. It also fuels the development of new products and services, ensuring Hargreaves Lansdown stays competitive and meets evolving client needs.

For instance, in 2024, Hargreaves Lansdown reported a significant increase in digital engagement, with a substantial portion of client interactions occurring through their app and website. This highlights the importance of their data infrastructure.

- Client Behavior Data: Tracks how clients navigate the platform, what they research, and their transaction patterns.

- Investment Preferences: Captures information on asset allocation, fund choices, and risk appetites.

- Market Trends Analysis: Integrates external market data with internal client activity to identify emerging opportunities and risks.

- Personalized Insights: Leverages data to provide tailored recommendations and educational content to individual clients.

Hargreaves Lansdown's key resources are its proprietary technology platform, strong brand reputation, significant financial capital, skilled workforce, and extensive client data. These elements collectively enable the company to deliver its investment services and maintain a competitive edge.

The company's technology platform, continually enhanced through investment, supports its digital offerings and client engagement. Its brand, built over decades, fosters trust and attracts new clients, reinforced by industry accolades.

Financially, Hargreaves Lansdown manages substantial Assets Under Administration (AUA), which generated consistent revenue streams. Its workforce comprises experts in finance, technology, and customer service, driving innovation and client support.

Furthermore, the company leverages client data to personalize services and develop new offerings, as evidenced by increased digital engagement in 2024.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Proprietary Technology Platform | Custom-built software and digital tools for investment services. | Underpins seamless online and mobile access; ongoing transformation enhances services. |

| Brand Reputation | Cultivated over 40 years, fostering deep client trust. | Acts as a powerful client acquisition and retention tool; recognized with awards like Best Online Broker (Investors Chronicle, 2023). |

| Financial Capital / AUA | Shareholder funds, retained earnings, and Assets Under Administration. | Managed £155.3 billion in AUA across 1.88 million active clients as of June 2024. |

| Skilled Workforce | Financial experts, analysts, IT professionals, customer service teams. | Drives product innovation and client support; contributed to reaching 1.9 million active clients by end of 2023. |

| Client Data | Information on client behavior, preferences, and market trends. | Used for personalized insights and product development; significant increase in digital engagement in 2024. |

Value Propositions

Hargreaves Lansdown provides clients with an extensive selection of investment avenues, encompassing stocks, shares, funds, pensions (SIPPs), ISAs, and actively managed savings accounts. This vast array ensures individuals can construct diversified portfolios aligned with their financial objectives throughout their lives.

Clients can access thousands of individual stocks, investment funds, and bonds, offering unparalleled choice. For example, as of early 2024, Hargreaves Lansdown's platform typically lists over 3,000 funds and a substantial universe of global equities, facilitating broad market participation.

Hargreaves Lansdown offers a highly intuitive digital platform, accessible via both its website and a user-friendly mobile app. This design prioritizes ease of use, allowing individuals to effortlessly manage their investments and financial planning. The company actively works to demystify financial jargon, simplifying the process for clients to define and pursue their financial objectives, thereby broadening its appeal across the investor spectrum.

Hargreaves Lansdown offers clients a robust suite of research, analytical tools, and advisory services designed to foster informed investment decisions. This comprehensive support system includes expert market outlooks, curated investment ideas, and extensive educational content, empowering users to confidently navigate financial complexities.

In 2024, Hargreaves Lansdown continued to emphasize its educational resources, with a significant portion of its client base actively engaging with the platform's market insights and analysis. This focus on empowering investors with knowledge is a cornerstone of their value proposition, aiming to demystify investment strategies.

The accessibility of these tools and advisory services directly contributes to clients' ability to effectively manage their portfolios. By providing clear, actionable information, Hargreaves Lansdown helps users make strategic choices, enhancing their long-term financial planning and investment success.

Trusted Brand and Security

Hargreaves Lansdown, as a well-established and regulated UK financial services company, cultivates a strong sense of security and trust among its clients. This is a critical element of its value proposition, reassuring investors who entrust their hard-earned savings to the platform.

The company's long operating history, dating back to 1981, and its unwavering adherence to stringent regulatory standards, such as those set by the Financial Conduct Authority (FCA), provide a solid foundation of confidence. For instance, as of the first half of 2024, Hargreaves Lansdown reported a robust client base, underscoring the trust placed in its services.

This focus on client trust isn't just a talking point; it's a fundamental pillar of their business model, directly impacting client retention and acquisition. Their commitment to transparency and robust security measures further solidifies this reputation, making them a go-to choice for many in the UK market.

- Established Reputation: Operating since 1981, Hargreaves Lansdown has built decades of trust.

- Regulatory Compliance: Adherence to FCA regulations provides a secure environment for investments.

- Client Confidence: A large and growing client base, particularly evident in early 2024 figures, demonstrates significant trust.

- Security Focus: Ongoing investment in platform security reassures clients about the safety of their assets.

Competitive Pricing for Certain Portfolios

Hargreaves Lansdown positions its pricing as competitive, especially for investors managing portfolios up to £50,000. This strategy aims to attract and retain a broad client base by offering cost-effective solutions for common investment needs.

The company further enhances its value proposition through specific product fee structures. For instance, Junior ISAs are offered without platform fees, making them an attractive option for younger investors and their families. Additionally, its Active Savings platform provides competitive rates on cash savings.

- Competitive pricing for portfolios up to £50,000.

- No platform fees for Junior ISAs.

- Competitive rates available through the Active Savings platform.

- Aims to deliver average discounts on top funds, enhancing client value.

Hargreaves Lansdown offers a vast investment universe, including over 3,000 funds and global equities, empowering clients to build diversified portfolios. Its intuitive digital platform simplifies investment management, making financial planning accessible to a wide range of investors.

The company provides robust research, analytical tools, and educational resources, helping clients make informed decisions. In 2024, a significant portion of its client base actively engaged with these insights, underscoring the value placed on demystifying investment strategies.

Trust is a cornerstone, built on a history since 1981 and strict FCA compliance, reassuring clients about asset safety. This focus on security and transparency solidifies its reputation, as evidenced by its substantial client base in early 2024.

Competitive pricing, particularly for portfolios up to £50,000, alongside fee-free Junior ISAs and attractive rates on its Active Savings platform, enhances client value.

| Value Proposition Element | Description | Key Data/Fact (as of early 2024) |

|---|---|---|

| Extensive Investment Choice | Access to a wide array of investment products. | Over 3,000 funds and a broad selection of global equities. |

| User-Friendly Digital Platform | Intuitive website and mobile app for easy investment management. | Emphasis on simplifying financial jargon for broader accessibility. |

| Research & Educational Resources | Tools and insights to support informed investment decisions. | High client engagement with market insights and analysis. |

| Trust & Security | Established reputation and regulatory compliance. | Operating since 1981 with strong FCA adherence; growing client base. |

| Competitive Pricing | Cost-effective solutions, especially for smaller portfolios. | No platform fees for Junior ISAs; competitive rates on Active Savings. |

Customer Relationships

Hargreaves Lansdown's self-service digital platform is the cornerstone of its customer relationships, offering clients unparalleled control and convenience. The intuitive online platform and mobile app empower users to manage investments, access research, and execute trades independently, facilitating a seamless digital experience.

This digital-first approach allows the vast majority of customer interactions to occur online, reflecting a commitment to enhancing user experience and accessibility. In 2024, Hargreaves Lansdown continued to invest in its digital infrastructure, aiming to further streamline the investment journey for its growing client base.

Hargreaves Lansdown offers direct customer support through phone and secure messaging, assisting with inquiries, technical glitches, and account management. This personal interaction adds a crucial human element to their digital platform, giving clients confidence and expert guidance when they need it most.

Many customers have praised Hargreaves Lansdown's customer service, with numerous positive reviews underscoring the quality of assistance provided. For instance, in the first half of the 2024 financial year, Hargreaves Lansdown reported a significant increase in client engagement, with their support channels playing a key role in fostering trust and retention.

Hargreaves Lansdown (HL) leverages data-driven insights to deliver personalized communications, including tailored investment nudges and relevant content. This approach helps guide clients through their investment journey and fosters deeper engagement with the platform. For instance, in the first half of 2024, HL reported a significant increase in client engagement metrics, with personalized content playing a key role in driving activity.

Advisory and Financial Planning Services

Hargreaves Lansdown provides specialized advisory and financial planning services for clients seeking a more personalized approach. These services are designed to assist individuals with intricate financial planning requirements, offering a deeper level of support than their standard platform.

This offering effectively bridges the gap between a direct-to-consumer model and the delivery of comprehensive financial advice. For instance, in the first half of the 2024 financial year, Hargreaves Lansdown reported a significant increase in its advisory client base, demonstrating the growing demand for such tailored services.

- Advisory Services: Offers tailored guidance and support for complex financial planning needs.

- Pension Advisory: Provides specialized advice for pension planning and management.

- Personalized Support: Caters to clients requiring a higher degree of individualized attention.

- Bridging the Gap: Connects direct-to-consumer offerings with comprehensive financial advice solutions.

Educational Content and Webinars

Hargreaves Lansdown actively cultivates client relationships through a robust offering of educational content. This includes in-depth articles, guides, and webinars specifically designed to demystify investing, explain evolving market trends, and offer practical financial planning advice.

By equipping clients with knowledge, Hargreaves Lansdown fosters informed decision-making and cultivates a supportive community centered on shared learning. For instance, in 2024, their platform continued to provide resources that saw significant engagement from users seeking to enhance their financial literacy.

- Educational Content: Comprehensive library covering investing basics to advanced strategies.

- Webinars & Seminars: Live and on-demand sessions with market experts.

- Market Insights: Regular updates and analysis on current economic conditions.

- Financial Planning Tools: Resources to help clients set and achieve financial goals.

Hargreaves Lansdown fosters strong customer relationships through a blend of self-service digital tools and personalized support. Their digital platform, accessible via web and mobile, allows clients to manage investments independently, supported by educational resources and direct assistance channels like phone and secure messaging.

In the first half of the 2024 financial year, Hargreaves Lansdown saw a significant increase in client engagement, highlighting the effectiveness of their approach. The company also offers specialized advisory services for those needing more in-depth financial planning, catering to a growing demand for tailored guidance.

Data-driven personalization further enhances client relationships, with tailored communications and investment nudges guiding users. This focus on education and support, evident in their robust content offerings and positive customer feedback, builds trust and promotes long-term retention.

| Aspect | Description | 2024 Data Point (H1) |

|---|---|---|

| Digital Platform | Self-service for investment management and research | Continued investment in infrastructure |

| Personal Support | Phone and secure messaging for inquiries | Key role in fostering trust and retention |

| Advisory Services | Tailored guidance for complex financial needs | Significant increase in advisory client base |

| Client Engagement | Driven by personalized content and education | Reported significant increase in engagement metrics |

Channels

The Hargreaves Lansdown website is the primary channel for client interaction, investment management, and access to research and tools. It acts as the central hub for all client activities, from account opening to trading and portfolio monitoring, ensuring a seamless user experience.

In 2024, Hargreaves Lansdown reported that its digital platform, the website, facilitated a significant portion of its client transactions and engagement. The company consistently invests in enhancing its website's functionality and user interface, reflecting its commitment to providing a robust and intuitive online investment experience.

Hargreaves Lansdown's dedicated mobile application offers clients seamless, on-the-go access to manage their investments. This channel directly addresses the growing preference for mobile-first financial management, a trend that has accelerated significantly in recent years.

The app has been recognized for its user-friendly design and robust functionality, earning accolades that underscore its effectiveness as a client touchpoint. For instance, in 2023, Hargreaves Lansdown's app was lauded for its innovation and client experience, reflecting its importance in the digital investment landscape.

This mobile channel is crucial for engaging modern investors who expect instant access and intuitive tools to monitor and adjust their portfolios. Its performance is a key indicator of the company's ability to meet the evolving needs of its diverse customer base.

Telephone helplines are a cornerstone of Hargreaves Lansdown's customer engagement, offering direct access to support for a wide range of client needs. This channel is particularly vital for addressing complex queries and delivering the personalized assistance that builds trust.

In 2024, Hargreaves Lansdown continued to emphasize its telephone support, recognizing its importance for clients who prefer direct interaction. The company’s commitment to excellent customer service via phone is often highlighted, contributing to client retention and satisfaction.

Direct Mail and Email Communications

Hargreaves Lansdown leverages direct mail and email as crucial communication channels within its business model. These platforms are utilized for a range of essential client interactions, including the distribution of account statements, vital regulatory updates, and engaging marketing materials designed to inform and attract. In 2024, the company continued to rely on these established methods to maintain client engagement and ensure timely dissemination of critical information.

These channels serve a dual purpose: fulfilling regulatory requirements for communication and proactively engaging clients with personalized investment insights and updates on market developments. This approach helps foster a sense of informed partnership, keeping clients abreast of opportunities and changes relevant to their portfolios. For instance, Hargreaves Lansdown’s email campaigns often highlight new investment products or shifts in market trends.

- Account Statements: Regular delivery of financial performance and holdings.

- Regulatory Updates: Ensuring clients are informed of compliance and legal changes.

- Marketing Materials: Promoting new products, services, and investment opportunities.

- Personalized Insights: Tailored advice and market commentary based on client profiles.

Educational Events and Webinars

Hargreaves Lansdown leverages educational events and webinars to foster client understanding and engagement. These sessions, primarily online following their acquisition by Hargreaves Lansdown, offer valuable insights into investment strategies and market trends.

These educational channels are crucial for reinforcing Hargreaves Lansdown's position as a trusted financial advisor, providing clients with the knowledge to make informed decisions. For instance, in the fiscal year ending June 2023, Hargreaves Lansdown reported a significant increase in client engagement across their digital platforms, including educational content.

- Webinars: Regularly scheduled online sessions covering diverse investment topics, from beginner guides to advanced strategies.

- Client Education: Aimed at empowering clients with financial literacy and confidence in managing their investments.

- Trusted Partner: Reinforces HL's brand as a reliable source of financial guidance and expertise.

Hargreaves Lansdown utilizes its website and mobile app as primary digital channels for client interaction, offering seamless access to investment management, research, and tools. In 2024, the company continued to enhance these platforms, reflecting a strong focus on user experience and digital engagement. These channels are critical for facilitating transactions and providing clients with on-the-go portfolio management capabilities, aligning with the growing trend of mobile-first financial management.

Customer Segments

Self-directed retail investors represent a core customer segment for Hargreaves Lansdown, comprising individuals who actively manage their own investment portfolios. These investors leverage HL's digital platform, research resources, and a broad selection of investment products to make informed, independent decisions, valuing both control and extensive choice. This segment is diverse, ranging from those just beginning their investment journey to seasoned traders.

In 2024, the UK saw continued growth in retail investing, with platforms like Hargreaves Lansdown playing a crucial role. The Financial Conduct Authority (FCA) reported that the number of retail investment accounts remained robust, with millions of individuals actively participating in the market. This sustained engagement underscores the demand for accessible and user-friendly investment tools, a key offering for HL's self-directed clients.

Pension savers and retirees are a core customer group, with many relying on Self-Invested Personal Pensions (SIPPs) and annuities to build and manage their retirement funds. Hargreaves Lansdown (HL) stands out as the UK's largest SIPP provider, demonstrating its significant role in helping individuals accumulate wealth over the long term and generate income during their retirement years.

In 2024, HL continued to serve a vast number of these customers. As of early 2024, HL managed £135.4 billion in assets for its clients, a substantial portion of which is attributed to retirement savings. This figure underscores the trust placed in HL by individuals planning for or already living in retirement.

Tax-Efficient Savers, particularly those utilizing Individual Savings Accounts (ISAs), represent a crucial customer base for Hargreaves Lansdown. This segment prioritizes tax-efficient investment growth, leveraging products like Stocks and Shares ISAs, Lifetime ISAs, and Junior ISAs. In the UK tax year ending April 2024, the ISA allowance was £20,000, a figure many of these savers aim to maximize annually.

Hargreaves Lansdown’s appeal to this group lies in its comprehensive offering of ISA products and its focus on tax-free growth, alongside the potential for government bonuses, especially with Lifetime ISAs. The platform provides the tools and investment options necessary for individuals to effectively manage and grow their savings within these tax-advantaged wrappers.

Cash Savers Seeking Competitive Rates

Hargreaves Lansdown's Active Savings platform directly addresses cash savers who are actively hunting for the best interest rates across various financial institutions. This segment prioritizes maximizing the return on their readily available funds, valuing a streamlined process to compare and select from a diverse range of savings products offered by multiple banks. The platform's appeal lies in its ability to consolidate these options, saving users time and effort in their search for competitive rates.

This offering is designed to attract a broad user base, encompassing both individuals new to Hargreaves Lansdown and its existing clientele. For new customers, Active Savings can serve as an entry point, showcasing the firm's commitment to providing valuable tools for managing finances. Existing clients, on the other hand, benefit from an integrated solution that complements their broader investment portfolios.

Data from 2024 indicates a heightened awareness among consumers regarding interest rates. For instance, the Bank of England's base rate adjustments throughout 2024 have encouraged savers to seek higher yields. The Active Savings platform facilitates this by:

- Offering access to a wide array of savings accounts from different banks, simplifying comparison.

- Providing tools to track and manage savings, ensuring optimized returns.

- Attracting customers who prioritize convenience and competitive rates for their liquid assets.

High Net Worth and Advisory-Seeking Clients

While Hargreaves Lansdown (HL) is largely a direct-to-consumer platform, it also serves a segment of clients with higher net worth who may seek more in-depth financial guidance. These individuals often have more complex financial needs and larger portfolios, making personalized advice valuable.

These clients can utilize HL's advisory services, which offer tailored recommendations and portfolio management. Alternatively, they can leverage the platform's extensive range of investment products, including those suitable for substantial asset allocation, to manage their wealth effectively.

- High Net Worth Segment: Caters to clients with significant investable assets.

- Advisory Services: Offers personalized financial advice and portfolio management.

- Complex Portfolios: Supports clients with intricate financial situations and larger sums.

- Breadth of Investment Options: Provides access to a wide array of investment choices suitable for affluent investors.

Hargreaves Lansdown's customer base is diverse, primarily serving self-directed retail investors who manage their own portfolios. This group ranges from novice investors to experienced traders, all seeking control and choice in their investment decisions.

Pension savers and retirees form another critical segment, with a significant portion utilizing Self-Invested Personal Pensions (SIPPs). As the UK's largest SIPP provider, HL plays a vital role in wealth accumulation and retirement income generation for these individuals.

Tax-efficient savers, particularly ISA users, are key clients who prioritize tax-advantaged growth. Hargreaves Lansdown's comprehensive ISA offerings and focus on tax-free growth appeal strongly to this segment aiming to maximize their annual allowances.

Cash savers are increasingly catered to through the Active Savings platform, which simplifies finding competitive interest rates across multiple banks. This segment values convenience and optimized returns on their liquid assets.

| Customer Segment | Key Characteristics | HL's Offering | 2024 Relevance |

| Self-directed Retail Investors | Independent decision-makers, value control and choice. | Digital platform, research, wide product selection. | Continued robust retail investing activity in the UK. |

| Pension Savers/Retirees | Focus on retirement funds (SIPPs, annuities), income generation. | Largest UK SIPP provider, long-term wealth management. | Managed £135.4 billion in assets as of early 2024. |

| Tax-Efficient Savers (ISAs) | Prioritize tax-free growth, maximize ISA allowances. | Comprehensive ISA products (S&S ISA, LISA, JISA). | ISA allowance remained £20,000 for tax year ending April 2024. |

| Cash Savers | Seek best interest rates, value convenience for liquid assets. | Active Savings platform for comparing bank rates. | Heightened consumer awareness of interest rates in 2024. |

Cost Structure

Hargreaves Lansdown dedicates a substantial portion of its expenses to its technology and platform. This investment is crucial for the ongoing development, upkeep, and modernization of their digital infrastructure, aiming to enhance automation and client experience.

The company's commitment to technology is evident in its financial reporting. For the six months concluding in December 2023, Hargreaves Lansdown saw a significant 40% increase in its technology spending, underscoring the strategic importance of these investments.

Hargreaves Lansdown's significant investment in its people is reflected in its staff and employee-related costs. These expenses encompass salaries, comprehensive benefits packages, and ongoing training for a substantial workforce. This team includes essential roles like customer service representatives, skilled IT professionals, and expert investment analysts, all crucial to the company's operations.

The financial impact of this workforce is substantial, with staff costs showing a notable increase. Specifically, in the latter half of 2023, these costs grew from £86 million to £101 million compared to the same period in the previous year. This rise underscores the company's commitment to attracting and retaining talent in a competitive market.

Hargreaves Lansdown's cost structure heavily features expenditure on marketing and client acquisition. This includes significant investments in advertising, broad digital marketing campaigns, and various initiatives designed to attract new clients and promote its comprehensive range of financial services.

The company actively evolves its client acquisition strategies, consistently investing in marketing to maintain its competitive edge. For the fiscal year ending June 30, 2023, Hargreaves Lansdown reported marketing expenses of £118.1 million, reflecting a strategic commitment to growing its client base and enhancing brand visibility.

Regulatory and Compliance Costs

Hargreaves Lansdown, like all financial services firms, faces significant costs related to regulatory and compliance obligations. These expenses are crucial for maintaining operational integrity and client trust within a heavily regulated industry.

These costs encompass a wide range of activities necessary to adhere to financial regulations, including obtaining and maintaining necessary licenses, ongoing legal counsel for compliance matters, and investing in robust risk management frameworks. For instance, in their 2023 financial year, Hargreaves Lansdown reported operating expenses of £432.8 million, a portion of which is directly attributable to these regulatory and compliance overheads.

- Licensing and Authorization Fees: Costs associated with obtaining and renewing permissions from regulatory bodies like the Financial Conduct Authority (FCA) in the UK.

- Compliance Staff and Systems: Investment in personnel with expertise in financial regulations and the technology infrastructure to ensure adherence.

- Legal and Advisory Services: Expenditure on legal advice and external consultants to navigate complex regulatory landscapes and manage legal risks.

- Reporting and Auditing: Costs incurred for preparing and submitting regulatory reports and undergoing external audits to verify compliance.

Operational and Administrative Overheads

Operational and administrative overheads are the backbone of Hargreaves Lansdown's (HL) daily functioning. These encompass essential business expenses like office rent, utilities, and professional fees, all crucial for smooth operations. HL actively pursues cost discipline to enhance efficiency and boost profitability.

In the financial year 2023, Hargreaves Lansdown reported operating expenses of £373.5 million, demonstrating their commitment to managing these costs effectively. This figure reflects the investment in infrastructure and personnel required to support their extensive client base and platform services.

- Office Rent and Facilities: Costs associated with maintaining physical office spaces in key locations.

- Utilities and Services: Expenses for electricity, internet, and other essential services supporting daily operations.

- Professional Fees: Payments for legal, accounting, and other specialized advisory services.

- Administrative Salaries and Benefits: Compensation for the non-revenue generating staff essential for business management.

Hargreaves Lansdown's cost structure is dominated by its investment in technology and personnel. For the six months ending December 2023, technology spending saw a 40% increase, while staff costs rose from £86 million to £101 million year-on-year in the same period, reflecting a commitment to platform development and talent acquisition.

Marketing and client acquisition also represent a significant expense, with £118.1 million spent in the fiscal year ending June 30, 2023, to drive growth. Furthermore, regulatory and compliance costs are substantial, alongside operational and administrative overheads, which contributed to overall operating expenses of £432.8 million in FY23.

| Cost Category | FY23 (Millions £) | H1 FY24 (Millions £) | Notes |

| Technology | N/A | Significant Increase (40% YoY for H1 FY24) | Platform development and maintenance |

| Staff Costs | N/A | £101 (H1 FY24) vs £86 (H1 FY23) | Salaries, benefits, training |

| Marketing | £118.1 (FY23) | N/A | Client acquisition and brand visibility |

| Operating Expenses (Total) | £432.8 (FY23) | N/A | Includes regulatory, compliance, admin |

Revenue Streams

Hargreaves Lansdown's platform administration fees are a cornerstone of its revenue model, charging clients an annual percentage of their Assets Under Administration (AUA). This recurring income stream provides significant stability and predictability to the company's financials. For instance, in the first half of fiscal year 2024, Hargreaves Lansdown reported £1.4 billion in net revenue, with administration fees being a substantial contributor.

Hargreaves Lansdown generates significant revenue through dealing commissions and transaction fees charged on client trades, especially for stockbroking and share dealing. These fees are structured to reflect the volume of transactions undertaken by each client, meaning more active traders contribute more to this revenue stream.

In the fiscal year 2023, Hargreaves Lansdown reported that its net revenue from stockbroking was £274.5 million, demonstrating the substantial contribution of these transaction-based fees to its overall business. This highlights how increased dealing activity directly translates into higher transactional revenue for the company.

Hargreaves Lansdown generates revenue through the net interest margin on client cash. This occurs when the company earns more interest on client deposits held with financial institutions than it pays out to clients on their uninvested funds.

While this income stream saw a decline in the fiscal year 2024, it continues to be a significant contributor to the company's overall revenue. For instance, in FY24, the net interest income from client cash was £127.7 million, a decrease from £186.9 million in FY23, reflecting changes in interest rate environments.

HL Fund Management Fees

Hargreaves Lansdown generates revenue through management fees on its internally managed funds and multi-manager unit trusts, such as the HL Select funds and its ready-made portfolio options. These fees are a key component of their income, directly tied to the assets under management (AUM) within these specific product lines.

The growth in Assets Under Management (AUM) for these internally managed products, driven by net flows into new HL funds, directly translates to increased revenue from these management fees. For instance, Hargreaves Lansdown reported total AUM of £135.2 billion as of June 30, 2024, with a significant portion attributable to their own managed funds, showcasing the substantial revenue potential from this stream.

- Management Fees: Earned on HL Select funds and multi-manager unit trusts.

- AUM Growth Driver: Net flows into new HL funds boost revenue from these products.

- Revenue Contribution: Fees on internally managed assets are a significant income source.

Advisory and Other Service Fees

Hargreaves Lansdown also generates revenue through advisory and other service fees. This encompasses income derived from providing specialized financial advice, particularly for intricate financial planning scenarios or specific pension-related guidance.

These fees are typically event-driven, meaning they are incurred when a client utilizes these particular advisory services. For instance, a client seeking a detailed retirement income plan or advice on managing a complex pension transfer would likely incur such a fee.

- Advisory Services: Fees for personalized financial planning and pension guidance.

- Event-Driven Fees: Income generated from specific client needs and transactions.

- Revenue Diversification: Supplements income from core investment platform services.

Hargreaves Lansdown's revenue streams are diverse, encompassing platform administration fees, dealing commissions, net interest on client cash, management fees on proprietary funds, and advisory service fees.

Administration fees, calculated as a percentage of Assets Under Administration (AUA), provide a stable, recurring income. Dealing commissions and transaction fees are generated from client trades, with more active traders contributing more revenue. Net interest margin on client cash is earned from the difference between interest earned on deposits and interest paid to clients on uninvested funds.

Management fees are levied on Hargreaves Lansdown's own managed funds, with revenue growing alongside net flows into these products. Advisory fees are generated from personalized financial planning and pension guidance, typically on an event-driven basis, adding another layer of income diversification.

| Revenue Stream | FY23 Revenue (£m) | FY24 Revenue (£m) | Key Driver |

|---|---|---|---|

| Administration Fees | (Included in Net Revenue) | (Included in Net Revenue) | Assets Under Administration (AUA) |

| Dealing Commissions | 274.5 | (Included in Net Revenue) | Client Trading Activity |

| Net Interest on Client Cash | 186.9 | 127.7 | Interest Rate Environment & Client Cash Balances |

| Management Fees (Proprietary Funds) | (Included in Net Revenue) | (Included in Net Revenue) | Assets Under Management (AUM) in HL Funds |

| Advisory & Other Services | (Included in Net Revenue) | (Included in Net Revenue) | Utilization of Advisory Services |

Business Model Canvas Data Sources

The Hargreaves Lansdown Business Model Canvas is built using a combination of internal financial data, extensive market research on investment trends and customer behaviour, and strategic insights derived from competitor analysis and regulatory reports.