Hargreaves Lansdown Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Lansdown Bundle

Hargreaves Lansdown navigates a dynamic financial services landscape, where the bargaining power of buyers, the intensity of rivalry, and the threat of new entrants significantly shape its competitive environment. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Hargreaves Lansdown’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hargreaves Lansdown's reliance on a diverse set of fund managers means that while no single provider dominates, a concentration of popular or high-performing funds can still grant certain providers significant bargaining power. This leverage can influence fee structures and product terms, impacting Hargreaves Lansdown's profitability and client offering.

Hargreaves Lansdown's reliance on technology and infrastructure providers is significant. These companies underpin its direct-to-consumer investment platform, ensuring everything from trading execution to data security functions smoothly. Given the specialized nature of these services, the costs and complexities involved in switching providers can be substantial for Hargreaves Lansdown.

This high switching cost can amplify the bargaining power of established technology suppliers. For instance, the ongoing investment in cybersecurity and cloud infrastructure, crucial for a financial services firm, often involves long-term contracts with specialized vendors. In 2024, the increasing demand for robust data protection and scalable cloud solutions further strengthens the position of key infrastructure partners.

Hargreaves Lansdown relies heavily on data and research providers, forming a crucial part of its operational backbone. These partnerships are essential for delivering the comprehensive analysis and advisory services that are central to Hargreaves Lansdown's value proposition.

The bargaining power of these suppliers stems from the potential uniqueness or proprietary nature of the data and research they offer. If certain critical datasets or analytical tools are only available from a limited number of sources, Hargreaves Lansdown may face higher costs or less favorable terms.

For instance, in 2024, the market for financial data terminals and specialized research reports saw continued consolidation. Companies providing real-time market data feeds or unique quantitative research models can command significant leverage, as switching costs can be substantial for a platform like Hargreaves Lansdown that integrates these services deeply.

Regulatory and Compliance Services

Hargreaves Lansdown operates in a tightly regulated financial environment, making its reliance on specialized regulatory and compliance services significant. These services are crucial for navigating complex rules set by bodies like the Financial Conduct Authority (FCA), ensuring the company’s operations remain lawful and secure.

The expertise demanded by these compliance functions, coupled with the critical nature of adhering to financial legislation, can grant these suppliers a moderate degree of bargaining power. This is particularly true for niche compliance consultants or specialized legal firms that possess in-depth knowledge of financial regulations.

- Regulatory Dependence: Hargreaves Lansdown’s need for expert legal and compliance advice to meet FCA mandates is a key factor.

- Supplier Expertise: The specialized knowledge of regulatory consultants and auditors can influence their bargaining leverage.

- Market Concentration: A limited number of highly qualified providers in this niche could further enhance supplier power.

Talent Pool and Human Capital

The financial services sector, especially wealth management, relies heavily on specialized skills in technology, financial advising, and client support. A constrained talent market can significantly amplify the bargaining power of employees. This means Hargreaves Lansdown may face increased wage pressures and higher recruitment expenses.

For instance, in 2024, the UK financial services sector continued to grapple with a shortage of skilled IT professionals, with demand outstripping supply by an estimated 20%. This scarcity directly impacts companies like Hargreaves Lansdown, forcing them to compete more aggressively for top talent, potentially driving up compensation packages and retention costs.

- Talent Demand: High demand for tech and advisory roles in wealth management.

- Supply Constraints: Shortages in specialized skills, particularly in IT, noted in 2024 UK financial services.

- Impact on Costs: Increased bargaining power for employees leads to higher wages and recruitment expenses for Hargreaves Lansdown.

While Hargreaves Lansdown utilizes numerous fund managers, a concentration of popular funds can still give certain providers leverage over fees and product terms. This can impact profitability and the client experience.

The company's dependence on technology and infrastructure providers, crucial for its platform, means high switching costs can strengthen supplier bargaining power. In 2024, the demand for robust data protection and cloud solutions amplified this for key partners.

Data and research providers are vital for Hargreaves Lansdown's advisory services. Unique or proprietary data sources can increase supplier leverage, especially as market data consolidation continued in 2024, raising costs for integrated services.

Specialized regulatory and compliance service providers hold moderate bargaining power due to the critical need for expertise in a tightly regulated environment. Niche consultants with deep financial regulation knowledge are particularly influential.

| Supplier Category | Key Dependencies for Hargreaves Lansdown | Factors Influencing Bargaining Power | 2024 Context/Data Point |

|---|---|---|---|

| Fund Managers | Access to diverse investment products | Concentration of popular/high-performing funds | No specific data available for 2024 concentration impact |

| Technology & Infrastructure | Platform operation, trading, data security | High switching costs, specialized services | Increased demand for cloud/cybersecurity |

| Data & Research Providers | Comprehensive analysis and advisory | Uniqueness/proprietary nature of data | Market consolidation in financial data terminals |

| Regulatory & Compliance Services | Adherence to FCA mandates, legal advice | Expertise in financial legislation | Continued need for specialized compliance consultants |

What is included in the product

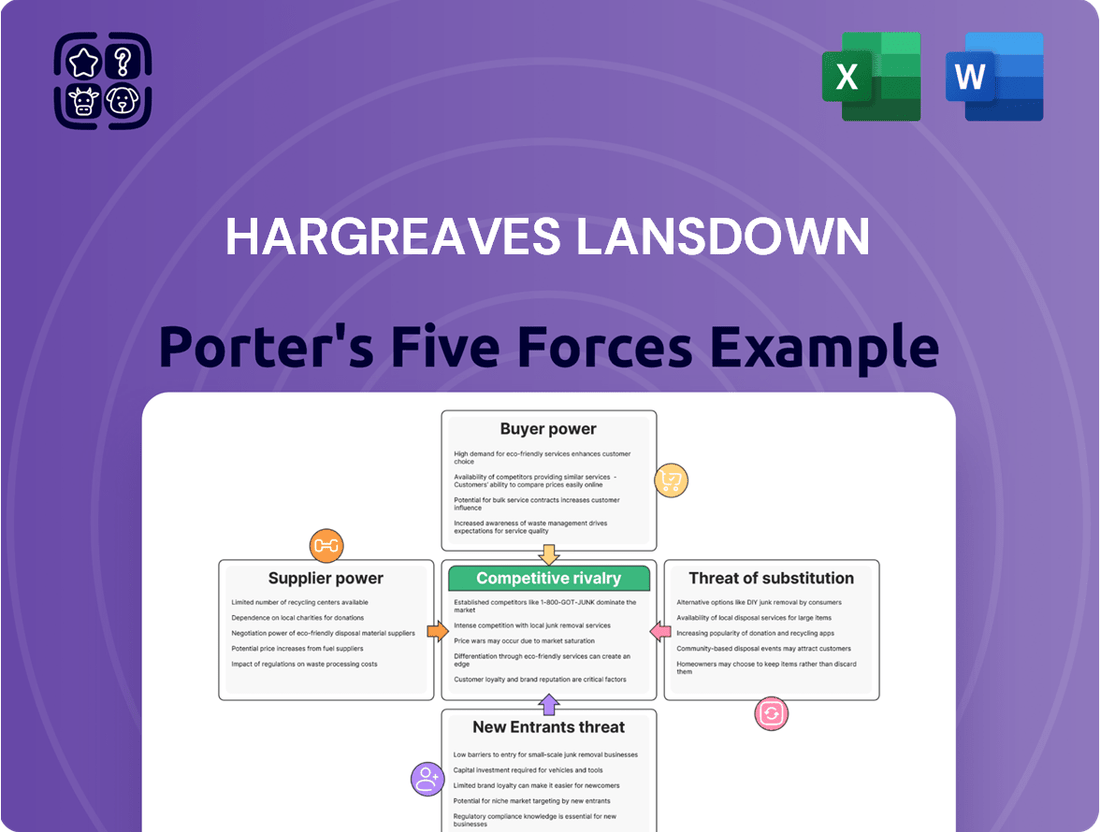

This analysis dissects the competitive forces impacting Hargreaves Lansdown, including buyer and supplier power, threat of new entrants and substitutes, and existing rivalry, to understand its strategic positioning and profitability.

Hargreaves Lansdown's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding strategic pressures.

Customers Bargaining Power

Hargreaves Lansdown's position as the UK's largest direct-to-consumer investment platform, boasting nearly 1.9 million clients and £155.3 billion in assets under administration as of June 30, 2024, indicates a strong customer base. While individual clients may have minimal direct bargaining power due to their small scale relative to the platform's total assets, the sheer volume of customers can translate into collective influence.

The UK investment platform market is highly competitive, featuring numerous alternatives such as Interactive Investor, AJ Bell, Vanguard Investor, and emerging commission-free trading apps. This abundance of choice directly impacts Hargreaves Lansdown's customer bargaining power.

While transferring assets like ISAs and SIPPs involves some administrative steps, the process is becoming increasingly streamlined. Competitors often offer attractive fee structures and enhanced features, making it easier for customers to switch and thereby increasing their leverage.

For example, in 2024, many platforms continued to compete on fees, with some offering tiered pricing or flat fees that can be more appealing to certain investor segments than Hargreaves Lansdown's potentially higher charges for smaller account balances.

Clients, particularly those with smaller investment pots, are becoming more aware of and sensitive to the fees they pay. This heightened awareness means they are actively comparing costs across different platforms.

Hargreaves Lansdown's fee structure, while designed to be competitive, can sometimes become a point of contention for larger portfolios. For instance, while a 0.45% platform fee applies to most of their funds, this can add up for substantial investments, potentially pushing clients to seek out providers with lower percentage-based charges.

This price sensitivity directly translates into pressure on Hargreaves Lansdown to either maintain or reduce its fees. The availability of lower-cost alternatives means clients have a real option to switch, forcing the company to remain competitive in its pricing strategy to retain its customer base.

Access to Information and Digital Tools

Retail investors now possess an unprecedented amount of information and digital tools at their fingertips. This access allows them to thoroughly research investment options, compare platform fees and services, and understand market trends, significantly leveling the playing field.

The ease with which investors can access data, such as real-time stock prices and analyst reports, diminishes information asymmetry. For instance, platforms like Hargreaves Lansdown themselves provide extensive research and educational content, which paradoxically empowers their users to become more discerning.

This enhanced knowledge directly translates into increased bargaining power for customers. They can readily identify platforms offering superior value, lower costs, or better user experiences, forcing companies to compete more aggressively on these fronts.

- Informed Decisions: Investors can now easily compare fees, performance, and services across multiple financial platforms.

- Reduced Information Asymmetry: The widespread availability of financial data and research empowers individuals to understand their investment options better.

- Platform Choice: Customers can switch providers if they find better deals or services elsewhere, increasing competitive pressure.

- Digital Tool Impact: Online tools and apps facilitate this comparison and decision-making process, amplifying customer influence.

Demand for Value-Added Services and Personalization

Clients are no longer satisfied with just basic investment execution; they expect more. This includes access to in-depth research, personalized financial advice, and tailored portfolio management. Hargreaves Lansdown's strength lies in offering these enhanced services, which helps it stand out. However, if competitors begin offering comparable value at a more attractive price point, it can elevate customer expectations and, consequently, their bargaining power.

The demand for value-added services is a significant driver in the financial services sector. For instance, in 2024, a significant portion of investors, particularly those with larger portfolios, indicated a preference for advisory services alongside their investment platforms. This trend suggests that firms failing to integrate such offerings may face increased pressure from clients seeking holistic financial solutions.

- Client Expectation Shift: Investors now seek more than just trading capabilities, demanding research, advice, and personalization.

- Competitive Differentiation: Hargreaves Lansdown leverages these services to differentiate itself.

- Price Sensitivity: Competitors offering similar value at lower costs can amplify customer bargaining power.

- Market Trend: In 2024, a notable trend showed investors, especially those with substantial assets, prioritizing platforms offering integrated advisory services.

The bargaining power of customers for Hargreaves Lansdown is moderate, influenced by the platform's scale and the increasing availability of competitive alternatives. While its vast client base of nearly 1.9 million as of June 2024 provides some collective leverage, individual clients typically have limited direct power. The ease of switching, driven by streamlined processes and competitive fee structures from rivals like Interactive Investor and AJ Bell, empowers customers to seek better value, thereby increasing their bargaining influence.

| Factor | Hargreaves Lansdown Position | Impact on Customer Bargaining Power |

|---|---|---|

| Customer Base Size | Nearly 1.9 million clients (June 2024) | Moderate collective influence, low individual influence |

| Market Competition | Highly competitive UK investment platform market | Increases customer choice and leverage |

| Ease of Switching | Streamlining of ISA/SIPP transfers | Empowers customers to switch for better fees/features |

| Price Sensitivity | Growing awareness of fees, especially for smaller accounts | Pressures HL to maintain competitive pricing |

| Information Access | Extensive client research and educational tools | Reduces information asymmetry, enhances customer discernment |

Same Document Delivered

Hargreaves Lansdown Porter's Five Forces Analysis

This preview showcases the complete Hargreaves Lansdown Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the investment platform industry. The document you see here is precisely the same professionally researched and formatted analysis you will receive immediately upon purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The UK's direct-to-consumer investment platform landscape is intensely crowded, with a significant number of firms vying for market share. This high level of competition stems from both long-standing institutions and emerging disruptors.

Key players alongside Hargreaves Lansdown include Interactive Investor, which saw its revenue grow by 10% in 2023 to £330 million, and AJ Bell, reporting a 22% increase in its customer base to over 500,000 in the same year. Vanguard Investor and Fidelity Personal Investing also represent substantial competition.

Furthermore, the rise of commission-free trading apps like Freetrade and Trading 212 has intensified rivalry by attracting a younger demographic with lower cost structures. This dynamic forces established platforms to continually innovate and refine their offerings to retain and attract customers.

Hargreaves Lansdown faces significant pricing pressure from a crowded market. The rise of commission-free trading platforms, like Trading 212 and Freetrade, has intensified competition, forcing established players to re-evaluate their fee structures.

This competitive landscape directly impacts Hargreaves Lansdown's revenue streams, particularly for clients with smaller investment portfolios where fees can represent a more substantial portion of returns. For instance, in 2024, many neo-brokers continued to offer zero commission on trades, a stark contrast to the tiered service fees that Hargreaves Lansdown traditionally charges.

The competitive landscape for Hargreaves Lansdown is marked by relentless innovation, particularly in digital tools and user experience. Competitors are actively developing and deploying new features, intuitive interfaces, and advanced digital solutions like robo-advisors and AI-powered analytics. For instance, many platforms are enhancing their mobile app functionalities, a trend that saw significant user engagement in 2024 as more investors preferred on-the-go access to their portfolios.

To sustain its market position, Hargreaves Lansdown faces the imperative to continuously invest in its technological infrastructure and service enhancements. This proactive approach is crucial to prevent client attrition to platforms offering superior technological capabilities or a more user-friendly experience. The ongoing digital transformation across the financial services sector means that staying ahead of the curve in technology is not just an advantage, but a necessity for market leadership.

Differentiation and Value Proposition

Hargreaves Lansdown (HL) stands out with its extensive research, broad investment selection, and excellent customer support. However, the competitive landscape is dynamic, with rivals actively pursuing differentiation through specialized products, unique pricing structures, or advanced digital platforms. This necessitates that HL consistently enhances its core value proposition to maintain its market position.

Competitors are increasingly focusing on areas like:

- Niche Investment Offerings: Some platforms are carving out spaces by focusing on specific asset classes or ethical investing, attracting a dedicated client base.

- Fee Model Innovation: Competitors are experimenting with various fee structures, including flat fees or performance-based charges, to appeal to different investor segments.

- Digital Experience Enhancement: Investment in user-friendly apps, AI-powered advice, and seamless digital onboarding is becoming a key differentiator.

In 2024, the UK investment platform market saw continued growth, with firms like AJ Bell and Interactive Investor actively investing in technology and customer acquisition. HL's ability to adapt its offering, perhaps by further integrating personalized digital tools or expanding its range of ESG-focused funds, will be crucial in fending off these intensifying competitive pressures.

Regulatory Landscape and Consolidation

The financial services sector, including platforms like Hargreaves Lansdown, is navigating a significantly evolving regulatory landscape. New rules, such as the UK's Consumer Duty introduced in 2023, mandate that firms deliver fair value and demonstrate better customer outcomes, increasing operational costs and the need for robust compliance frameworks across the board.

This heightened regulatory scrutiny, coupled with substantial private equity interest in wealth management, is fueling a wave of consolidation. For instance, in 2023 and early 2024, several smaller platforms have been acquired, aiming to achieve economies of scale and meet regulatory demands more effectively. This trend also sees the rise of vertically integrated firms that combine financial advice with their own proprietary investment platforms, directly intensifying competition for established players.

- Regulatory Impact: The Consumer Duty, implemented in July 2023, requires firms to prove they are delivering good outcomes for retail customers, impacting product design, pricing, and customer support.

- Consolidation Drivers: Increased compliance costs and the pursuit of scale are prompting mergers and acquisitions, with private equity actively seeking opportunities in the UK wealth management sector.

- Vertical Integration: The emergence of advice firms building or acquiring their own platform capabilities creates new competitive dynamics, challenging independent platforms by offering a bundled service.

- Market Shift: These forces collectively are reshaping the competitive environment, pushing all participants to innovate and demonstrate superior value propositions to retain and attract clients.

The competitive rivalry within the UK direct-to-consumer investment platform market is intense, driven by numerous established players and agile newcomers. Hargreaves Lansdown faces significant pressure from platforms like Interactive Investor, which reported a 10% revenue increase to £330 million in 2023, and AJ Bell, which saw its customer base grow by 22% to over 500,000 in the same year.

SSubstitutes Threaten

Individuals might bypass investment platforms like Hargreaves Lansdown entirely by directly acquiring physical assets such as real estate or gold. For instance, the UK property market saw average house prices reach approximately £291,000 in early 2024, a tangible asset alternative.

While direct ownership offers a different kind of control, it often comes with significant drawbacks compared to platform-managed investments. These include lower liquidity, as selling physical assets can be a lengthy process, and a lack of the robust regulatory protections afforded by regulated investment platforms.

Furthermore, the ease of access and diversification potential offered by platforms like Hargreaves Lansdown, which in 2023 managed £135.4 billion in assets, are difficult to replicate with direct physical asset holdings. The operational complexities and costs associated with managing a portfolio of diverse physical assets can also be substantial for individual investors.

Traditional financial advisors and wealth managers represent a significant substitute threat to Hargreaves Lansdown's core business. High-net-worth individuals or those requiring highly personalized, comprehensive financial planning often gravitate towards these services. These traditional models offer bespoke advice and tailored portfolio management, which can be perceived as superior to the more standardized, direct-to-consumer approach, even if it comes with a higher fee structure.

For individuals prioritizing saving over investing, alternative products like high-interest savings accounts or fixed-term deposits pose a significant threat. These options are particularly appealing for short-term goals or building emergency funds, directly competing with investment platforms. Hargreaves Lansdown acknowledges this by offering its own Active Savings account to capture this segment of the market.

Peer-to-Peer Lending and Crowdfunding Platforms

Peer-to-peer lending and crowdfunding platforms present a significant threat of substitutes for traditional financial services, including those offered by Hargreaves Lansdown. These platforms allow individuals to directly invest in businesses or lend money, bypassing established financial intermediaries. For example, by mid-2024, the peer-to-peer lending market in the UK had facilitated billions of pounds in loans, offering investors potentially higher yields than traditional savings accounts, albeit with increased credit risk.

These alternatives appeal to a segment of investors seeking different risk-return profiles and a more direct engagement with their investments. Crowdfunding, in particular, has seen substantial growth, with platforms enabling small businesses to raise capital from a large number of individuals. This disintermediation means that capital that might have flowed through traditional channels, like Hargreaves Lansdown's investment services, can now be directed to these alternative platforms.

- Alternative Investment Channels: Peer-to-peer lending and crowdfunding offer direct investment routes, bypassing traditional platforms.

- Risk-Return Trade-off: These platforms often provide higher potential returns but come with elevated risks and less regulatory oversight compared to established financial institutions.

- Market Growth: The UK peer-to-peer lending sector alone facilitated over £10 billion in loans by early 2024, demonstrating a significant shift in capital allocation.

- Investor Diversification: They cater to investors looking for diversification beyond traditional stocks and bonds, accepting a different risk appetite.

Do-It-Yourself (DIY) Investing without a Platform

The threat of substitutes for a platform like Hargreaves Lansdown, particularly from DIY investing without a platform, is relatively low for the average investor. While sophisticated investors might bypass platforms to buy individual stocks or bonds directly, this approach demands significant expertise and time commitment. For instance, in 2024, the UK's Financial Conduct Authority reported that while direct share ownership exists, the vast majority of retail investment activity is facilitated through regulated platforms, highlighting the convenience and accessibility these offer.

These sophisticated investors, though a niche, do represent a substitute. They might use a direct-dealing broker, potentially saving on platform fees but accepting a higher administrative burden and increased personal responsibility for research and compliance. This segment is likely to be small, as the complexity of managing a diversified portfolio directly, including tax implications and rebalancing, is substantial for most individuals.

The appeal of DIY investing without a platform is primarily cost savings and control. However, this often comes at the expense of user-friendly tools, research resources, and consolidated reporting that platforms like Hargreaves Lansdown provide. For example, in 2023, Hargreaves Lansdown reported over £130 billion in assets under administration, indicating a strong preference among a broad investor base for the integrated services offered by such platforms.

- DIY investing requires significant financial knowledge and time commitment.

- Sophisticated investors may opt for direct dealing to avoid platform fees.

- Platforms offer convenience, research tools, and consolidated reporting, which DIY investors often lack.

- The majority of retail investors utilize platforms due to their accessibility and integrated services.

The threat of substitutes for Hargreaves Lansdown is multifaceted, encompassing direct physical asset ownership, traditional financial advisors, and alternative savings products. While direct ownership of assets like property, with UK average prices around £291,000 in early 2024, offers tangible control, it lacks the liquidity and regulatory safeguards of platform investments. Similarly, personalized advice from wealth managers, though costly, appeals to those seeking bespoke financial planning, a service that Hargreaves Lansdown's more standardized approach may not fully replicate.

Furthermore, the rise of peer-to-peer lending and crowdfunding platforms presents a significant alternative. These channels, which facilitated over £10 billion in loans in the UK's P2P market by early 2024, offer potentially higher yields but also carry increased risk and less regulatory oversight. This disintermediation allows capital to bypass traditional platforms, catering to investors with different risk appetites and a desire for direct engagement.

Even simple savings accounts, especially those offering competitive interest rates, act as substitutes, particularly for individuals focused on short-term goals or emergency funds. Hargreaves Lansdown's own Active Savings account is a strategic move to capture this market segment. The overall landscape suggests that while platforms offer convenience and diversification, investors have a growing array of choices catering to varying needs, risk tolerances, and desired levels of direct involvement.

| Substitute Type | Key Characteristics | Example/Data Point (Early 2024) | Pros for Investor | Cons for Investor |

|---|---|---|---|---|

| Physical Assets | Direct ownership of tangible goods | UK Average House Price: ~£291,000 | Tangible control, potential for capital appreciation | Low liquidity, significant transaction costs, less regulatory protection |

| Traditional Advisors | Bespoke financial planning and portfolio management | N/A (Service-based) | Personalized advice, comprehensive planning | Higher fees, potentially less accessible for smaller portfolios |

| Alternative Lending/Crowdfunding | Direct investment in businesses or loans | UK P2P Lending Market: >£10 billion facilitated | Potentially higher yields, direct engagement | Increased credit risk, less regulatory oversight |

| High-Interest Savings Accounts | Low-risk deposit accounts with interest | N/A (Variable rates) | High liquidity, capital preservation, simplicity | Lower returns compared to investments, inflation risk |

Entrants Threaten

High capital requirements present a significant barrier for new entrants looking to establish a direct-to-consumer investment platform. Building a robust technological infrastructure, ensuring stringent regulatory compliance, and executing effective marketing campaigns to attract a sizable client base and assets under administration demand substantial upfront investment. For instance, launching a new investment platform in the UK typically requires millions of pounds to cover licensing, platform development, cybersecurity, and initial marketing efforts.

The UK's financial services industry, overseen by the Financial Conduct Authority (FCA), presents significant regulatory hurdles for new entrants. These include demanding stipulations for consumer protection, robust data security measures, and operational resilience, all of which necessitate considerable investment in compliance infrastructure and expertise.

Obtaining the necessary licenses and maintaining ongoing adherence to these regulations incurs substantial costs and consumes significant time. For instance, the FCA's Consumer Duty, implemented in 2023, places a heightened focus on delivering good outcomes for retail customers, adding another layer of complexity and resource requirement for any firm seeking to enter the market.

Hargreaves Lansdown has cultivated a formidable brand, recognized as the UK's largest investment platform. This extensive brand recognition, built over four decades, fosters significant trust among its vast customer base.

New entrants face a substantial hurdle in replicating Hargreaves Lansdown's established reputation and the deep-seated trust it commands. Building this level of credibility in a competitive market takes considerable time and investment, making it difficult for newcomers to quickly attract and retain clients.

Economies of Scale and Network Effects

Existing players like Hargreaves Lansdown leverage significant economies of scale, driving down per-unit costs in technology development, marketing campaigns, and overall operations. For instance, in 2024, Hargreaves Lansdown reported £135.4 billion in assets under administration, a testament to their operational capacity and reach. This scale makes it incredibly challenging for newcomers to match their cost efficiencies.

Furthermore, powerful network effects create a substantial barrier. A large and active client base, like Hargreaves Lansdown's, attracts a wider array of financial product providers and services. This broad offering, in turn, draws in more customers, creating a virtuous cycle that new entrants struggle to replicate, especially in terms of competitive pricing and product diversity.

- Economies of Scale: Lower operational costs per customer due to large asset bases.

- Network Effects: More clients attract more product providers, enhancing the platform's value.

- Cost Advantage: New entrants face higher initial costs to achieve comparable scale and breadth of offering.

- Client Inertia: Existing customers are less likely to switch due to the convenience and comprehensive nature of established platforms.

Talent Acquisition and Retention

New entrants often struggle to attract and retain skilled professionals in specialized fields like financial technology, regulatory compliance, and investment research. The cost of recruiting and onboarding experienced talent can be substantial, creating a barrier for those without established brand recognition or extensive resources.

Hargreaves Lansdown, for instance, benefits from its established reputation and existing workforce, which can make it easier to secure top talent. In 2024, the UK financial services sector continued to face a competitive landscape for skilled individuals, with reports indicating high demand for data scientists and cybersecurity experts, roles crucial for both new and existing players.

- High Demand for Specialized Skills: The financial industry, particularly in areas like AI and blockchain, sees intense competition for talent.

- Cost of Recruitment: For new entrants, the expense associated with attracting and securing experienced professionals can be a significant deterrent.

- Established Firm Advantage: Companies like Hargreaves Lansdown leverage their brand and existing employee base to enhance recruitment efforts.

- Talent Retention Challenges: Keeping skilled employees engaged and preventing them from moving to competitors is an ongoing concern across the sector.

The threat of new entrants for Hargreaves Lansdown is moderate, primarily due to substantial barriers like high capital requirements and stringent regulatory hurdles in the UK financial services sector. Building a competitive platform requires millions in investment for technology, compliance, and marketing, making it difficult for newcomers to quickly gain traction against established players.

Hargreaves Lansdown's strong brand reputation, cultivated over decades, and significant economies of scale, evidenced by £135.4 billion in assets under administration in 2024, create formidable competitive advantages. These factors, coupled with network effects and client inertia, make it challenging for new entrants to replicate their market position and cost efficiencies.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for technology, compliance, and marketing. | Significant deterrent, requiring substantial funding. | Launching a UK investment platform can cost millions. |

| Regulation | Strict FCA rules on consumer protection, data security, and operational resilience. | Increases complexity, cost, and time to market. | FCA's Consumer Duty (2023) adds compliance burden. |

| Brand Reputation & Trust | Hargreaves Lansdown is the UK's largest investment platform with established trust. | Difficult for newcomers to build comparable credibility quickly. | Decades of operation have built strong customer loyalty. |

| Economies of Scale | Lower per-unit costs due to large asset base. | New entrants struggle to match cost efficiencies. | £135.4 billion in assets under administration (2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hargreaves Lansdown leverages data from financial statements, investor presentations, and regulatory filings to understand the competitive landscape. We also incorporate insights from industry research reports and market analysis platforms to assess factors like threat of new entrants and bargaining power of buyers.