Hargreaves Lansdown Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Lansdown Bundle

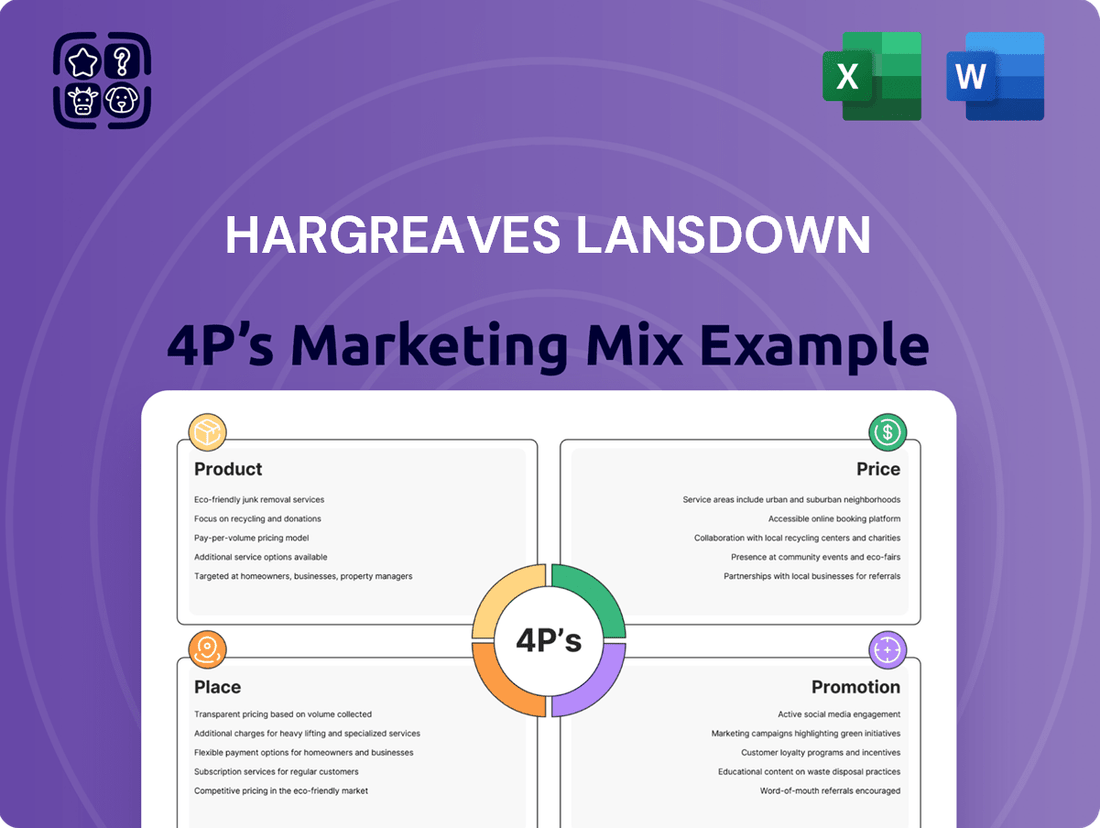

Hargreaves Lansdown excels by offering a comprehensive suite of investment products, competitive pricing structures, and accessible digital platforms. Their strategic use of online channels and targeted promotions ensures they reach and retain a broad customer base.

Unlock the secrets behind Hargreaves Lansdown's marketing success with our in-depth 4Ps analysis. Discover their product innovation, pricing strategies, distribution channels, and promotional activities in a professionally written, editable report.

Product

Hargreaves Lansdown's Comprehensive Investment Platform is a direct-to-consumer offering that puts a wide array of financial products at individual investors' fingertips. This platform serves as a central hub for personal finance management, featuring diverse investment accounts designed for various savings objectives and tax advantages.

The platform's core is its user-centric design, empowering individuals to actively manage their investment choices. As of early 2024, Hargreaves Lansdown reported a significant client base, with over 1.8 million clients, underscoring the platform's widespread adoption and trust among retail investors.

Hargreaves Lansdown offers an extensive selection of investment options, catering to a broad spectrum of investor needs. Clients can access individual stocks and shares, alongside a substantial range of funds, including both actively managed and passive strategies. This includes their own Hargreaves Lansdown multi-manager funds, designed to offer diversification and professional management.

The platform further broadens its appeal by providing access to investment trusts, exchange-traded funds (ETFs), gilts, and bonds. This comprehensive suite of products empowers investors to construct well-diversified portfolios aligned with their specific risk tolerance and financial goals, a key element in managing market volatility, especially as the FTSE 100 saw fluctuations throughout 2024.

Hargreaves Lansdown offers a comprehensive range of tax-efficient savings accounts, including Stocks and Shares ISAs, Self-Invested Personal Pensions (SIPPs), Lifetime ISAs, and Junior ISAs. These products are central to their marketing strategy, helping clients grow their wealth by reducing tax burdens on investments and savings.

The appeal of these tax-efficient wrappers is significant, with Hargreaves Lansdown reporting a substantial increase in ISA subscriptions in the 2023-2024 tax year, exceeding £7 billion. This demonstrates the strong client demand for tax-advantaged investment vehicles.

The popularity of specific offerings like their ready-made pension solutions and cash ISA options directly fuels client acquisition and retention. For instance, in the first half of the 2024 financial year, Hargreaves Lansdown saw a net increase of 28,000 clients, many drawn by the benefits of these tax-efficient accounts.

Active Savings and Cash Solutions

Hargreaves Lansdown's Active Savings service represents a significant expansion beyond traditional investment products, offering clients a streamlined way to manage their cash. This platform aggregates competitive interest rates from various partner banks, providing a flexible and FSCS-protected avenue for cash management that complements investment portfolios. It underscores Hargreaves Lansdown's commitment to being a one-stop shop for diverse financial needs.

The Active Savings solution is particularly relevant in the current economic climate. As of late 2024, the Bank of England base rate remained elevated, leading to increased competition among savings providers. Hargreaves Lansdown leverages this by offering access to rates that can exceed 5% AER on various savings products through its platform, providing tangible benefits to clients seeking better returns on their readily accessible funds.

- Diversified Cash Access: Clients can choose from a range of savings accounts from different banks, all accessible through a single Hargreaves Lansdown interface.

- Competitive Rates: The service actively seeks out and presents savings accounts offering attractive interest rates, often exceeding those found directly with individual banks.

- FSCS Protection: Funds held in partner banks are covered by the Financial Services Compensation Scheme, providing a safety net up to £85,000 per eligible person, per eligible institution.

- Integrated Financial Management: Active Savings allows clients to view and manage their cash alongside their investments, offering a holistic overview of their financial holdings.

Research, Tools, and Advisory Services

Hargreaves Lansdown's product offering, encompassing research, tools, and advisory services, is central to its value proposition for investors. This segment is designed to equip clients with the necessary knowledge and resources to make well-informed investment decisions, thereby fostering confidence and improving potential returns. The breadth of information available caters to a wide range of investor expertise, from beginners seeking foundational understanding to seasoned individuals requiring sophisticated analytical support.

The platform offers a wealth of market insights, highlighting potential investment opportunities across various asset classes. Furthermore, Hargreaves Lansdown provides guidance on effective portfolio management, assisting clients in constructing and maintaining diversified portfolios aligned with their financial goals. This comprehensive support system is a key differentiator, aiming to demystify investing and empower clients to navigate financial markets more effectively.

For instance, as of early 2024, Hargreaves Lansdown reported a significant increase in client engagement with its research tools, indicating a strong demand for such resources. The company actively promotes educational content, including webinars and articles, to enhance financial literacy. This commitment to client education and robust support underpins their strategy to improve investment outcomes for their diverse client base.

Key aspects of their product offering include:

- Extensive Market Research: Providing up-to-date analysis and commentary on global markets and economic trends.

- Advanced Investment Tools: Offering tools for portfolio analysis, stock screening, and fund comparison.

- Personalized Advisory Services: Guidance from financial experts on investment strategies and portfolio construction.

- Educational Resources: A library of articles, guides, and webinars designed to improve financial knowledge.

Hargreaves Lansdown's product strategy centers on providing a comprehensive and user-friendly investment platform, offering a vast array of investment choices from stocks and funds to ETFs and bonds. This includes tax-efficient wrappers like ISAs and SIPPs, which saw over £7 billion in ISA subscriptions in the 2023-2024 tax year. The recent addition of Active Savings further broadens their offering, aggregating competitive interest rates from partner banks, with access to rates potentially exceeding 5% AER in late 2024.

The platform's product depth is complemented by robust research, analytical tools, and educational resources designed to empower investors of all levels. This commitment to client support, evidenced by increased engagement with research tools in early 2024, aims to foster informed decision-making and enhance investment outcomes.

| Product Category | Key Features | 2023-2024 Data/Context |

|---|---|---|

| Investment Platform | Wide range of investments (stocks, funds, ETFs, bonds) | Over 1.8 million clients by early 2024 |

| Tax-Efficient Accounts | ISAs, SIPPs, Lifetime ISAs, Junior ISAs | £7 billion+ in ISA subscriptions (2023-2024 tax year) |

| Active Savings | Aggregated savings accounts from partner banks | Access to rates potentially exceeding 5% AER (late 2024) |

| Research & Tools | Market analysis, portfolio tools, educational content | Increased client engagement with research tools (early 2024) |

What is included in the product

This analysis provides a comprehensive, brand-specific deep dive into Hargreaves Lansdown's marketing mix, dissecting its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

Simplifies the complex 4Ps of Hargreaves Lansdown's marketing strategy into actionable insights, alleviating the pain of understanding their approach.

Provides a clear, concise overview of Hargreaves Lansdown's 4Ps, resolving the difficulty in identifying key marketing drivers.

Place

Hargreaves Lansdown's core offering is its direct-to-consumer digital platform, accessible via its website and mobile apps. This digital-first strategy ensures clients, numbering close to 1.9 million as of early 2024, have convenient and instant access to investment tools and account management.

The company's commitment to a superior digital experience is evident in its ongoing investments in technology. This focus allows Hargreaves Lansdown to continually refine its online services, meeting the evolving needs of its digitally-savvy customer base and maintaining a competitive edge in the fintech landscape.

The Hargreaves Lansdown mobile app acts as a powerful, portable investment hub, allowing users to research, trade, and manage their portfolios directly from their smartphones. This innovation has been recognized with awards, highlighting its user-centric design and functionality. In 2024, mobile trading continues to surge, with a significant percentage of Hargreaves Lansdown’s trades executed via their app, demonstrating its critical role in client engagement and accessibility.

Hargreaves Lansdown offers a robust mix of customer service channels, blending digital convenience with traditional support. While its platform is largely self-service, clients can readily access assistance via phone and email. This dual approach ensures accessibility for all users, catering to diverse preferences and needs.

The company prioritizes exceptional client service, even when experiencing high volumes of inquiries. For instance, during the busy tax year-end periods, Hargreaves Lansdown typically scales its support teams to manage the increased demand. This commitment to service underpins client trust and retention, a key element of its marketing strategy.

UK Market Focus

Hargreaves Lansdown’s market focus is unequivocally the United Kingdom, reflecting its origins and primary operational base. This strategic concentration allows the company to deeply understand and cater to the specific needs and regulatory environment of UK investors. For example, to open an account, individuals must be at least 18 years old and a UK tax resident, a straightforward requirement that streamlines their onboarding process within the domestic market.

This geographical specialization is crucial for compliance with UK financial regulations, such as those set by the Financial Conduct Authority (FCA). By concentrating its efforts, Hargreaves Lansdown can develop highly relevant product suites and marketing campaigns that resonate with the UK consumer. In 2024, the company continued to serve a substantial UK client base, with reports indicating millions of active clients across the nation.

The company’s product development and service offerings are therefore finely tuned to the UK’s investment landscape, including its tax wrappers like ISAs and pensions. This deep penetration into the domestic market means Hargreaves Lansdown is well-positioned to leverage trends and opportunities specific to the UK economy. Their client acquisition strategy in 2024 heavily relied on digital channels and educational content aimed at the UK public.

- Primary Market: United Kingdom.

- Client Profile: UK residents, aged 18+, meeting UK tax residency requirements.

- Regulatory Alignment: Focused on compliance with UK financial regulations (e.g., FCA).

- Market Penetration: Millions of active UK clients as of recent reports.

Strategic Acquisition Influence on Future Distribution

The planned acquisition of Hargreaves Lansdown by a private equity consortium, anticipated to conclude in Q1 2025, marks a significant shift in its distribution strategy. This move, resulting in the company’s delisting from the London Stock Exchange, signals a potential recalibration of how its services reach customers.

New ownership has pledged substantial investment in technology, a move that could directly impact Hargreaves Lansdown's distribution channels. This focus on a technology-led transformation aims to enhance the platform's reach and efficiency.

- Technology Investment: The new owners are committed to investing in a technology-led transformation, potentially upgrading digital platforms and customer interfaces to improve accessibility and user experience.

- Distribution Evolution: This technological advancement is expected to refine and expand Hargreaves Lansdown's distribution capabilities, possibly through new digital partnerships or enhanced direct-to-consumer channels.

- Market Position: By leveraging technology, the company aims to strengthen its competitive position in the evolving financial services landscape, ensuring its proposition remains attractive and accessible to a broader audience.

Hargreaves Lansdown's Place within the marketing mix is defined by its digital-first distribution strategy, leveraging its intuitive online platform and mobile app to reach its UK customer base. This digital accessibility is crucial, with millions of active clients as of early 2024 relying on these channels for investment management.

The company's physical presence is minimal, emphasizing a direct-to-consumer online model. This approach is further supported by a robust customer service infrastructure accessible via phone and email, ensuring a blend of digital convenience and traditional support.

Following its planned acquisition in Q1 2025, Hargreaves Lansdown is set for a distribution evolution driven by significant technology investments. This strategic shift aims to enhance platform reach and efficiency, potentially through new digital avenues.

| Distribution Channel | Key Features | Client Reach (Early 2024) | Post-Acquisition Focus (2025) |

|---|---|---|---|

| Digital Platform (Website & App) | 24/7 Access, Trading, Account Management | Approx. 1.9 million clients | Enhanced user experience, increased efficiency |

| Customer Service (Phone & Email) | Support for diverse client needs | Integral to client retention | Continued support alongside digital enhancements |

| Potential New Digital Channels | To be determined by technology investment | N/A | Expansion of market reach and accessibility |

Same Document Delivered

Hargreaves Lansdown 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Hargreaves Lansdown's 4P's marketing mix is fully complete and ready for your immediate use.

Promotion

Hargreaves Lansdown excels with a powerful digital footprint, anchored by its comprehensive website. This platform serves as a hub for extensive investor education, offering everything from market analysis to detailed investment strategy guides.

Their content marketing approach is a cornerstone of their promotion strategy. By providing free, downloadable resources, Hargreaves Lansdown solidifies its reputation as a trusted source of financial knowledge, attracting and retaining clients by empowering them with information.

In the fiscal year ending June 2023, Hargreaves Lansdown reported a significant increase in active clients, reaching 1.8 million, a testament to the effectiveness of their digital engagement and content offerings in attracting and retaining a broad investor base.

Hargreaves Lansdown actively cultivates its public relations by consistently engaging with financial news outlets. This proactive approach involves issuing regular trading updates and comprehensive financial results announcements, ensuring a steady flow of information to both the financial community and the general public.

These communications are crucial for maintaining visibility and fostering transparency. They serve to highlight key company performance metrics, such as client growth figures, and detail ongoing strategic initiatives, thereby reinforcing Hargreaves Lansdown's established market position.

For instance, in their interim results for the six months ended 31 December 2023, Hargreaves Lansdown reported a 3% rise in revenue to £302.1 million and a 4% increase in pre-tax profit to £131.9 million, demonstrating solid operational performance that is regularly communicated to stakeholders.

Hargreaves Lansdown heavily promotes its dedication to outstanding client service, aiming for a superior client experience. This commitment is a cornerstone of their promotional strategy, designed to resonate with a broad range of financially literate individuals and professionals.

Evidence of this focus includes ongoing initiatives to boost service Net Promoter Scores (NPS) and ensure consistently responsive customer support. For instance, Hargreaves Lansdown reported an NPS of +40 in their most recent client satisfaction surveys, indicating strong customer loyalty and advocacy.

By prioritizing service quality, Hargreaves Lansdown seeks to cultivate and sustain trust, a critical element and a significant differentiator within the competitive financial services landscape. This emphasis on client relationships is key to their long-term growth and market position.

Brand Reputation and Trust Building

Hargreaves Lansdown heavily leverages its established brand reputation and the trust it has cultivated over decades. As the UK's largest investment platform, with nearly 1.9 million clients as of early 2024, it highlights its long history and reliability. This strong brand equity is crucial for attracting new investors and retaining existing ones in a crowded financial services landscape.

The company's marketing consistently reinforces its position as a trusted and secure platform. By emphasizing its over 40 years of experience, Hargreaves Lansdown aims to provide clients with confidence in their investment decisions. This focus on trust is particularly important when dealing with personal finances and long-term wealth building.

- Over 40 years of operation

- Nearly 1.9 million clients (early 2024)

- UK's largest investment platform

- Emphasis on reliability and security

Targeted Campaigns for Specific Products

Hargreaves Lansdown actively deploys targeted campaigns to spotlight specific financial products. For instance, their promotions for Cash ISAs and ready-made pensions frequently align with the tax year end, aiming to boost customer contributions during this critical period.

These focused marketing efforts underscore the advantages and growing appeal of particular Hargreaves Lansdown services. By emphasizing these benefits, the company successfully attracts new clients and expands its business, as seen in their consistent net new client growth.

- Product Focus: Campaigns often center on products like Cash ISAs and pensions.

- Timing: Promotions frequently coincide with tax year deadlines to maximize inflows.

- Objective: To highlight product benefits and drive net new client acquisition.

- Contextual Relevance: Campaigns are often linked to current economic conditions or tax advantages.

Hargreaves Lansdown's promotional strategy is multifaceted, leveraging digital channels, content marketing, and public relations to build trust and attract clients. Their consistent communication of financial performance, such as the 3% revenue rise to £302.1 million in H1 2024, reinforces their market standing.

The company emphasizes client service, evidenced by a reported Net Promoter Score (NPS) of +40, highlighting strong customer loyalty. This focus on positive client experiences is a key differentiator in their promotional efforts.

Furthermore, Hargreaves Lansdown capitalizes on its established brand as the UK's largest investment platform, serving nearly 1.9 million clients by early 2024. This extensive reach and over 40 years of operation are consistently promoted to underscore reliability and security.

Targeted campaigns, like those for Cash ISAs around the tax year end, showcase specific product benefits and drive client acquisition. These focused efforts contribute to their consistent net new client growth.

| Promotional Aspect | Key Activities/Focus | Supporting Data (as of early 2024/H1 2024) |

|---|---|---|

| Digital & Content Marketing | Comprehensive website, investor education, market analysis | 1.8 million active clients (FY23), consistent net new client growth |

| Public Relations | Engaging with financial news, trading updates, financial results | H1 2024: Revenue £302.1m (+3%), Pre-tax profit £131.9m (+4%) |

| Client Service Emphasis | Focus on superior client experience, responsive support | Net Promoter Score (NPS) of +40 |

| Brand & Trust Building | Leveraging 40+ years of operation, UK's largest platform status | Nearly 1.9 million clients |

| Product-Specific Campaigns | Promoting ISAs, pensions, aligning with tax deadlines | Objective: Drive contributions and net new client acquisition |

Price

Hargreaves Lansdown utilizes a tiered annual platform fee, a key element of its pricing strategy. This fee is a percentage of the total investment value. For instance, the fee for funds typically begins at 0.45% for smaller investment amounts.

The percentage decreases as the portfolio grows, demonstrating a customer-centric approach. Notably, there is no platform fee applied to investment values exceeding £2 million, making it more attractive for high-net-worth individuals.

Hargreaves Lansdown structures its dealing charges for shares, investment trusts, and ETFs based on trading frequency. For instance, in 2024, clients executing 0-9 trades per month might face a fee of £11.95 per trade, while those making 10 or more trades could see this reduced to £5.95 per trade, reflecting a tiered pricing model designed to reward active investors.

A key differentiator for Hargreaves Lansdown is its absence of dealing fees for trading funds. This policy encourages investment in a broader range of investment vehicles beyond individual equities and ETFs, potentially making it a more attractive platform for investors with a diversified portfolio strategy, particularly those focused on mutual funds.

Hargreaves Lansdown's pricing strategy for specific holdings, such as UK and overseas shares, investment trusts, and ETFs, eliminates account opening and maintenance fees. This is a significant draw for investors who concentrate on direct equity investments, as their primary cost consideration shifts to transaction charges rather than recurring holding expenses.

Interest Retention on Cash Balances

Hargreaves Lansdown, like many investment platforms, does not levy direct platform fees for holding cash. Instead, it strategically retains a portion of the interest generated on client cash balances deposited on its platform. This practice is a key revenue stream for the company, especially relevant in a period of rising interest rates.

The specific percentage of interest Hargreaves Lansdown retains on client cash can vary. This fluctuation is directly tied to prevailing market interest rates, meaning higher base rates generally lead to greater retained interest income for the platform. For example, with the Bank of England base rate increasing significantly through 2022 and 2023, the potential for retained interest revenue has grown.

- Interest Retention: Hargreaves Lansdown earns revenue by retaining a portion of interest on client cash balances, rather than charging explicit platform fees for cash holding.

- Revenue Stream: This practice forms a notable part of the company's income, particularly benefiting from higher market interest rates.

- Rate Sensitivity: The amount retained is dynamic and directly influenced by changes in benchmark interest rates, such as the Bank of England base rate.

- Industry Practice: Retaining interest on client cash is a common and accepted model across the investment platform industry.

Promotional Discounts and Special Offers

Hargreaves Lansdown frequently uses promotional discounts to draw in new customers. For instance, they've offered a significant 40% reduction on platform fees for new Stocks and Shares ISAs and SIPPs. This offer typically requires a minimum funding amount and is available for a limited time, making it a compelling incentive for those looking to start investing.

These special offers are strategically timed to boost client acquisition and encourage substantial initial deposits. By making the platform more affordable, especially during key investment periods, Hargreaves Lansdown aims to enhance its competitive edge in the market.

- Promotional Discounts: Offers like 40% off platform fees for new ISAs/SIPPs.

- New Client Acquisition: Designed to attract individuals opening their first investment accounts.

- Minimum Funding Requirement: Often tied to a minimum initial investment amount.

- Limited-Time Offers: Creates urgency and encourages prompt decision-making.

Hargreaves Lansdown's pricing reflects a tiered structure, aiming to balance cost for different investor levels. The platform fee, a percentage of assets under management, decreases with larger portfolios, notably dropping to zero for holdings over £2 million. This tiered approach is further complemented by variable dealing charges for shares, investment trusts, and ETFs, which are reduced for more frequent traders, such as £5.95 per trade for those making 10+ trades monthly in 2024, compared to £11.95 for fewer trades.

A significant advantage is the absence of dealing fees for funds, encouraging broader investment diversification. Furthermore, Hargreaves Lansdown forgoes account opening and maintenance fees on specific holdings like UK and overseas shares, shifting the cost focus to transaction charges. The company also generates revenue by retaining a portion of the interest earned on client cash balances, a practice particularly lucrative in periods of rising interest rates, as seen with the Bank of England base rate increases through 2022-2023.

To attract new clients, promotional discounts are frequently employed, such as a 40% reduction on platform fees for new Stocks and Shares ISAs and SIPPs, often with a minimum funding requirement and limited-time availability. These incentives are strategically used to boost client acquisition and encourage substantial initial deposits, enhancing the platform's competitive appeal.

| Service | Pricing Structure | Example/Data Point (2024/2025) |

|---|---|---|

| Platform Fee | Tiered percentage of AUM | Starts at 0.45% for funds; 0% for portfolios > £2 million |

| Share Dealing | Frequency-based charges | £11.95 (0-9 trades/month), £5.95 (10+ trades/month) |

| Fund Dealing | No dealing fees | Encourages investment in funds |

| Cash Interest | Retained portion of interest | Revenue stream sensitive to base rates |

| Promotions | New client acquisition offers | 40% off platform fees for ISAs/SIPPs |

4P's Marketing Mix Analysis Data Sources

Our Hargreaves Lansdown 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company information. We utilize annual reports, investor relations materials, their official website, and industry-specific financial publications to capture their strategic decisions.