Hargreaves Lansdown Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Lansdown Bundle

Curious about Hargreaves Lansdown's product portfolio? Our BCG Matrix analysis offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks, revealing their current market standing. To truly understand their strategic positioning and unlock actionable insights for your own investment decisions, dive into the complete report.

The full Hargreaves Lansdown BCG Matrix provides a comprehensive, quadrant-by-quadrant breakdown, complete with data-backed recommendations. Don't miss out on the opportunity to gain a strategic roadmap for smart investment and product decisions. Purchase the full version today and transform your understanding.

Stars

Hargreaves Lansdown stands as the UK's leading provider of Self-Invested Personal Pensions (SIPPs), a position that underscores its significant market dominance in this expanding retirement savings sector.

The SIPP offering has proven instrumental in driving net new client acquisition, notably contributing to the company's growth in the first quarter of fiscal year 2025, demonstrating its appeal to a broad investor base.

This robust market share and consistent client growth trajectory firmly place the SIPP product within the 'Star' category of Hargreaves Lansdown's business portfolio, necessitating ongoing strategic investment to sustain its leading momentum.

The Stocks and Shares ISA is a cornerstone of Hargreaves Lansdown's offering, consistently driving net client growth. Its appeal lies in providing tax-efficient investing within the UK, a significant draw for savers aiming to maximize returns. This product's enduring popularity and its role in attracting new clients firmly place it in the 'Star' category.

Hargreaves Lansdown's Active Savings accounts are a significant growth driver, attracting new clients. These accounts provide a streamlined way for customers to access competitive interest rates from various banks via one platform.

The company is actively expanding its bank partnerships and marketing efforts for Active Savings, signaling a strong belief in its high growth potential. In 2024, Hargreaves Lansdown reported that its Active Savings product saw a substantial increase in balances, contributing significantly to its overall client acquisition strategy.

Ready-Made Investment Portfolios

The introduction of ready-made investment portfolios, including multi-index funds launched in 2024, positions Hargreaves Lansdown in a high-growth segment. These portfolios offer clients a straightforward and cost-effective way to invest, managed by experts.

Their growing appeal signifies a significant market opportunity for Hargreaves Lansdown, aligning with a strategic shift towards simplifying investment for a broader client base.

- Growing Demand: In 2024, the popularity of simplified investment solutions has surged, with ready-made portfolios attracting a substantial number of new clients.

- Cost Efficiency: These expert-managed options are designed to be cost-efficient, appealing to investors seeking value and ease of use.

- Market Growth: The success of these portfolios highlights a high-growth potential area for Hargreaves Lansdown, reflecting evolving investor preferences.

- Strategic Focus: Ready-made portfolios represent a key part of Hargreaves Lansdown's strategy to attract and retain clients by offering accessible investment solutions.

Overseas Share Dealing

Overseas share dealing at Hargreaves Lansdown is emerging as a significant growth area, reflecting a clear shift in client appetite for global investment. In the first quarter of fiscal year 2025, these international transactions accounted for 20.2% of all share deals, a noticeable jump from 18.3% in the same period of fiscal year 2024. This upward trend highlights increasing client engagement with markets beyond domestic borders.

This growing proportion, though still a segment of the larger share dealing picture, indicates that overseas trading is becoming a high-growth niche. It suggests that Hargreaves Lansdown clients are actively seeking diversification and opportunities across different economic landscapes. This segment's expansion is a key indicator of evolving investment strategies among the platform's user base.

- Growing Client Interest: A rise in overseas share dealing volumes points to a strong client demand for international investment options.

- Market Share Growth: Overseas deals constituted 20.2% of total deals in Q1 FY25, up from 18.3% in Q1 FY24.

- High-Growth Niche: The increasing proportion signifies a developing high-growth segment within Hargreaves Lansdown's overall share dealing activity.

- Strategic Importance: This trend suggests a need for continued focus and potential expansion of international trading services.

The SIPP offering is a cornerstone for Hargreaves Lansdown, driving significant client acquisition and demonstrating robust market share in the expanding retirement savings sector. Its consistent performance, contributing to growth in Q1 FY25, firmly places it as a 'Star' product, requiring continued investment to maintain its leading position.

Hargreaves Lansdown's Stocks and Shares ISA is a key driver of net client growth, appealing to UK investors seeking tax-efficient opportunities. This enduring popularity solidifies its 'Star' status within the company's product portfolio.

Active Savings accounts are a notable growth engine, simplifying access to competitive rates from multiple banks. The significant increase in balances reported in 2024 underscores its importance in client acquisition strategy.

Ready-made investment portfolios, including multi-index funds launched in 2024, cater to growing demand for simplified, cost-efficient investing. This segment represents a high-growth opportunity, reflecting evolving investor preferences.

Overseas share dealing is an emerging high-growth niche, with international transactions increasing to 20.2% of all share deals in Q1 FY25, up from 18.3% in Q1 FY24. This highlights a growing client appetite for global diversification.

| Product Category | BCG Matrix Status | Key Performance Indicator (2024/Q1 FY25) | Strategic Implication |

|---|---|---|---|

| SIPPs | Star | Key driver of net new client acquisition in Q1 FY25 | Sustain market leadership with ongoing investment |

| Stocks and Shares ISA | Star | Consistently drives net client growth | Maintain strong market position and client appeal |

| Active Savings | Star | Substantial increase in balances in 2024 | Continue expansion of bank partnerships and marketing |

| Ready-made Portfolios | Star | Growing appeal, significant market opportunity | Focus on simplifying investment for broader client base |

| Overseas Share Dealing | Star (Emerging High-Growth Niche) | 20.2% of deals in Q1 FY25 (vs. 18.3% in Q1 FY24) | Expand and focus on international trading services |

What is included in the product

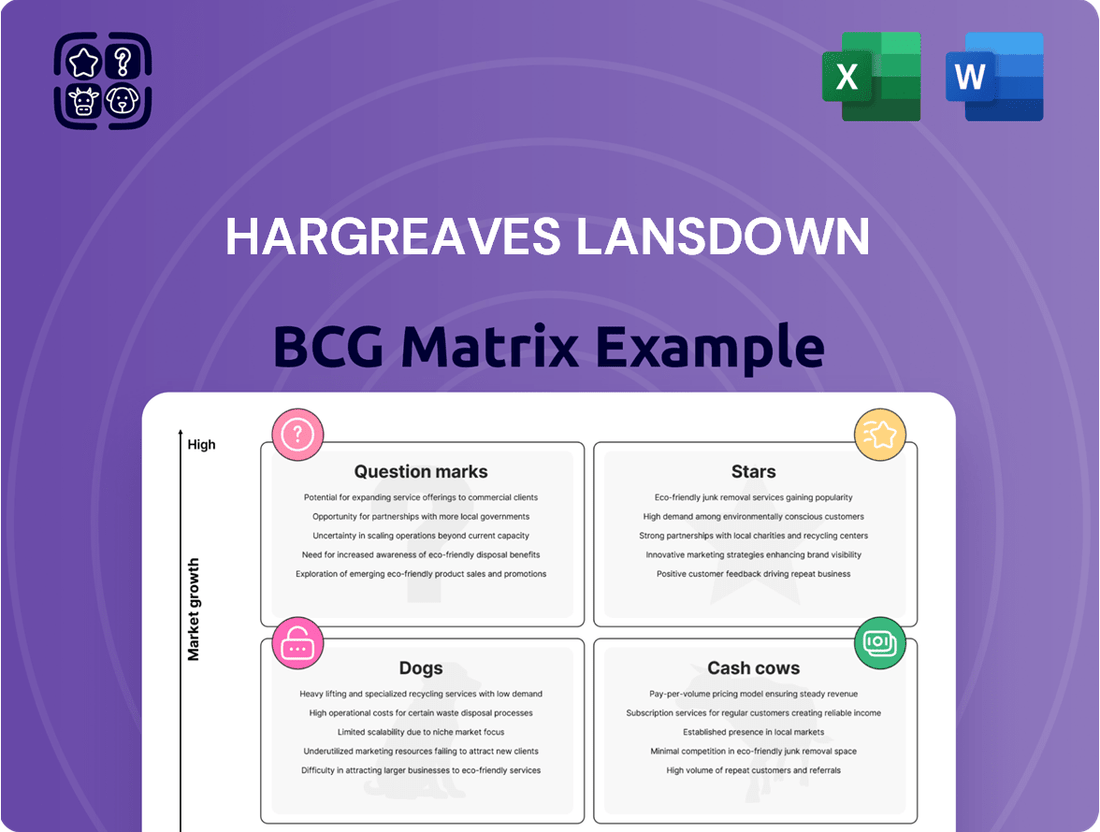

The Hargreaves Lansdown BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs.

The Hargreaves Lansdown BCG Matrix offers a clear, actionable framework to identify underperforming "Dogs" and strategically divest, relieving the pain of wasted resources.

Cash Cows

Hargreaves Lansdown's core platform for funds and shares stands as a formidable Cash Cow, anchoring its position in the UK's direct-to-consumer investment landscape. This foundational offering commands the lion's share of the company's Assets Under Administration (AUA), solidifying its status as the UK's largest investment platform.

The sheer volume of AUA on this platform translates into consistent and significant revenue streams, primarily derived from platform fees and dealing charges. As of the first half of 2024, Hargreaves Lansdown reported £127.4 billion in AUA, with its platform fees alone contributing substantially to its profitability.

Hargreaves Lansdown's established client base and impressive assets under administration (AUA) firmly place it in the Cash Cows category of the BCG Matrix. As of the first quarter of fiscal year 2025, the company served 1.9 million active clients, with AUA reaching a substantial £157.3 billion.

This significant scale translates into a highly stable and predictable revenue stream, primarily generated from recurring management and platform fees. The company’s strong client loyalty is further evidenced by a remarkable 92% client retention rate, underscoring its ability to consistently generate more cash than it requires for ongoing operations and investments.

Hargreaves Lansdown's platform revenue, driven by its substantial Assets Under Administration (AUA), firmly anchors it as a Cash Cow in the BCG Matrix. The sheer volume of AUA directly fuels significant platform fees, demonstrating a strong correlation between client assets and company earnings.

This revenue stream is remarkably resilient, often bolstered by increased dealing volumes and consistently high AUA levels, which effectively cushion the impact of other financial market volatilities. For instance, as of December 31, 2023, Hargreaves Lansdown reported £134.4 billion in AUA, highlighting the immense scale of this revenue-generating engine.

Hargreaves Lansdown (HL) Own-Brand Funds

Hargreaves Lansdown's own-brand funds are a classic example of a cash cow within the company's BCG matrix. Despite a slight dip in revenue margins due to more competitive pricing on newer offerings, these funds maintain a significant average Assets Under Management (AUM) of £9.3 billion as of FY24. This consistent asset base, built on the company's established brand trust and extensive client relationships, generates a steady and reliable stream of income.

These mature funds continue to be a cornerstone of Hargreaves Lansdown's profitability, benefiting from economies of scale and a well-understood operational model. Their low growth, high market share profile aligns perfectly with the characteristics of a cash cow, allowing the company to leverage them for funding other strategic initiatives.

- Significant AUM: £9.3 billion average AUM in FY24.

- Brand Trust: Leverages Hargreaves Lansdown's established reputation.

- Mature Market Position: High market share in a stable, albeit low-growth, segment.

- Consistent Profitability: Provides a reliable cash flow to support the business.

Advisory Services and Research Tools

Hargreaves Lansdown's advisory services and research tools are cornerstones of its client retention strategy, fostering loyalty and deep engagement. These offerings, often lauded for their quality, contribute significantly to the platform's 'Cash Cow' status by ensuring clients remain invested and actively using its services.

While these services themselves may not be direct profit centers, their impact on client stickiness is undeniable. By providing valuable insights and support, Hargreaves Lansdown reduces churn and encourages continued investment through its platform. This indirect revenue generation is crucial for maintaining its dominant market position.

- Award-winning customer service

- High-quality research and investment tools

- Enhanced client loyalty and engagement

- Indirectly drives revenue through platform use

Hargreaves Lansdown's core platform, managing substantial Assets Under Administration (AUA), acts as a significant Cash Cow. This strong market position, evidenced by £157.3 billion in AUA and 1.9 million clients by Q1 FY25, generates consistent revenue through platform fees.

The company's own-brand funds also represent a Cash Cow, maintaining an average AUM of £9.3 billion in FY24. These mature offerings benefit from economies of scale and established brand trust, providing a stable income stream.

The advisory services and research tools, while not direct profit centers, enhance client loyalty and engagement, indirectly supporting the platform's Cash Cow status by reducing churn.

| Business Segment | BCG Category | Key Financial Metric (as of latest available data) | Revenue Driver |

|---|---|---|---|

| Core Investment Platform | Cash Cow | £157.3 billion AUA (Q1 FY25) | Platform fees, dealing charges |

| Own-Brand Funds | Cash Cow | £9.3 billion average AUM (FY24) | Management fees |

| Advisory & Research Services | Cash Cow (Indirect) | High client retention rate (92%) | Increased platform usage, reduced churn |

Preview = Final Product

Hargreaves Lansdown BCG Matrix

The Hargreaves Lansdown BCG Matrix preview you are viewing is the identical, fully unlocked report you will receive upon purchase. This means you can confidently assess its comprehensive analysis and strategic insights, knowing the final document is precisely what you see now, ready for immediate application in your business planning.

Dogs

Legacy products or funds that consistently see more money leaving than coming in are essentially 'Dogs' in the BCG matrix. Think of them as older investment options that just aren't capturing investor interest anymore. For instance, if a particular fund, let's say an older UK equity fund, experienced net outflows of £50 million in 2024 while attracting only £10 million in new investments, it would likely fall into this category. These products might be costly to maintain but aren't generating much in the way of new business or returns.

While Hargreaves Lansdown saw a 6% increase in share dealing volumes in the first half of 2024, certain segments within the platform may still exhibit subdued activity. These could include less commonly traded funds, specific types of bonds, or niche alternative investments that don't attract widespread investor interest.

These less popular asset classes, characterized by low client engagement and infrequent transactions, might be categorized as Dogs in a BCG-like analysis. For instance, if a particular range of structured products or a small selection of overseas equities consistently shows minimal trading activity, it would fit this description.

Such segments can strain resources without contributing significantly to revenue. For example, if the cost of maintaining the trading infrastructure and regulatory oversight for a particular asset class outweighs the brokerage fees generated from its limited use, it represents an inefficient allocation of capital.

Hargreaves Lansdown's significant investment in its digital backbone and automation signals a strategic move away from potentially inefficient manual processes. These legacy operations, often characterized by higher operational costs and limited scalability, could be classified as Dogs within a BCG-like framework.

In 2024, the financial services industry continues to grapple with the costs associated with maintaining outdated systems. For instance, a report from Celent in early 2024 highlighted that financial institutions spend an average of 25% of their IT budget on maintaining legacy systems, which often involve manual workarounds.

These inefficient areas represent a drain on resources, hindering Hargreaves Lansdown's ability to compete effectively in a rapidly evolving digital landscape. Addressing these "Dogs" is crucial for freeing up capital and human resources to invest in growth areas and enhance customer experience.

Certain Low-Margin Offerings in Competitive Areas

Hargreaves Lansdown (HL) faces challenges with certain low-margin offerings in competitive market areas. The company has seen a reduction in revenue margins, partly due to the introduction of new fund ranges with lower charges, reflecting intense competition within the investment platform sector. While not strictly classified as 'Dogs' in the BCG matrix sense, older fund products with higher fees or those that offer little differentiation in crowded segments might be considered underperforming if they don't contribute meaningfully to profit or growth.

These types of offerings can become a drag on overall profitability. For instance, if a significant portion of assets under management is tied up in these lower-margin products, it can impact the average revenue yield for the platform. In 2023, the UK investment platform market continued to see fee compression, with many platforms actively reviewing their charging structures to remain competitive.

- Competitive Pressure: Growth in new, lower-cost fund ranges signals intense competition, impacting revenue margins.

- Underperforming Offerings: Older, higher-cost, or undifferentiated funds may be considered 'Dogs' if they fail to drive profit or growth.

- Profitability Impact: A substantial asset base in low-margin products can reduce the platform's average revenue yield.

- Market Trend: Fee compression remains a significant factor in the UK investment platform market, influencing product viability.

Areas with Below-Target Asset Retention

Hargreaves Lansdown's asset retention rate dipped to 88.6% in Q1 FY25, falling short of their medium to longer-term objectives. This indicates that some client assets are leaving the platform, possibly from segments or investment types that are not meeting client expectations or are outcompeted by other offerings.

These specific outflows can be interpreted as 'Dog' like characteristics within those particular areas of the business. It suggests that these segments may be experiencing slower growth or declining client engagement compared to other parts of Hargreaves Lansdown's operations.

- Asset Retention Rate (Q1 FY25): 88.6%

- Implication: Client assets are being withdrawn from the platform.

- Potential Cause: Segments or investment types not meeting client expectations or competitive offerings.

- BCG Matrix Classification: Indicates 'Dog' like characteristics in specific underlying areas.

Products or segments with low market share and low growth are considered Dogs in the BCG matrix. For Hargreaves Lansdown, this could translate to older, less popular investment funds or specific niche services that are not attracting significant new investment or client engagement. For example, if a particular ethical investment fund launched in 2010 has seen its assets under management stagnate at £20 million since 2020, while the overall market for such funds has grown, it would exhibit 'Dog' characteristics.

These areas often require ongoing resource allocation for maintenance and compliance but generate minimal returns or strategic value. In 2024, the ongoing costs of maintaining legacy IT systems for these less active segments can represent a significant overhead. A study by Gartner in early 2024 indicated that maintaining legacy systems can cost up to five times more than managing modern ones.

These 'Dogs' can hinder overall platform efficiency and profitability by diverting resources from more promising growth areas. For instance, if the operational cost to support a specific type of bond trading platform outweighs the brokerage revenue it generates, it's an inefficient use of capital.

Hargreaves Lansdown's focus on digital transformation and platform enhancements aims to streamline operations and potentially divest or re-evaluate these underperforming segments. The company's reported net new flows in Q1 FY25 were £2.3 billion, but the asset retention rate of 88.6% suggests some areas are experiencing outflows, potentially from these 'Dog' categories.

| BCG Category | Characteristics | Hargreaves Lansdown Example (Illustrative) | Potential Impact | 2024 Context |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Older, underperforming funds; niche services with declining interest | Resource drain, reduced profitability, hinders innovation | High cost of legacy system maintenance; focus on streamlining operations |

| Fund X: £20m AUM, no net inflows since 2020, market growth slow | ||||

| Niche bond trading service: high maintenance cost, low transaction volume |

Question Marks

Hargreaves Lansdown is focusing on AI-driven financial tools for 2025, exploring areas like AI agents to enhance client services. These innovations aim to offer personalized insights and automated financial advice, positioning them as potential future growth drivers.

While these AI initiatives hold significant promise in a dynamic tech environment, they are currently in nascent stages with limited market penetration. Consequently, they represent substantial R&D investments for Hargreaves Lansdown, reflecting their status as potential question marks in the BCG matrix.

Hargreaves Lansdown is set to introduce a new omnichannel advice service in 2024, blending human expertise with digital tools. This move aims to tap into the expanding market for integrated financial guidance, a sector showing significant growth potential.

The success of this new proposition hinges on its ability to attract and retain customers in a competitive landscape. Initial market adoption and profitability remain uncertain, necessitating considerable investment to establish its presence and demonstrate its value proposition.

Hargreaves Lansdown's strategic push into new ESG and thematic investment solutions aligns with a burgeoning market. The company planned to launch 18 new funds by 2024, with a notable emphasis on ESG offerings. This expansion targets a sector that saw global ESG assets reach an estimated $37.7 trillion by the end of 2023, according to the Global Sustainable Investment Alliance.

While these new ESG funds are entering a rapidly expanding market, they are expected to begin with a relatively low market share. The ESG investment market is projected for continued robust growth, with some forecasts suggesting it could reach over $50 trillion by 2025. Capturing a significant portion of this growth will necessitate substantial marketing and educational initiatives from Hargreaves Lansdown.

Enhanced Digital Client Experience Initiatives

Hargreaves Lansdown's focus on enhancing the digital client experience, particularly through its 'digital backbone' development, places these initiatives squarely in the question mark category of the BCG matrix. This involves substantial capital expenditure, with significant investments in technology aimed at leveraging data for new offerings and improved client interaction. For instance, in the fiscal year ending June 2024, the company reported continued investment in its platform and digital capabilities as a key strategic priority.

These broad technology investments are designed to drive future growth and capture greater market share by fundamentally transforming how clients engage with the platform. While the immediate financial outlay is considerable, the potential for high future returns through a superior, data-driven client experience is the underlying rationale. The success of these initiatives hinges on their ability to translate into tangible improvements in client acquisition, retention, and overall satisfaction.

- Digital Backbone Investment: Significant capital is being allocated to build a robust digital infrastructure.

- Data-Driven Insights: The goal is to leverage data analytics to inform new product development and personalize client engagement.

- Client Experience Transformation: These investments aim to create a more intuitive and valuable digital journey for clients.

- Future Growth Potential: While costly now, these initiatives are positioned to drive long-term market share expansion and revenue growth.

Targeted Expansion into Untapped Demographics/Segments

Hargreaves Lansdown's mission to help more people save and invest naturally points towards targeted expansion into untapped demographics. This strategic move aims to capture market share in segments currently underserved by traditional financial services, potentially including younger generations or those with lower financial literacy.

Initiatives focused on financial education and the development of tailored product offerings for specific groups, such as gig economy workers or first-time homebuyers, would align with this strategy. These efforts are characteristic of a 'Question Mark' in the BCG Matrix, signifying high growth potential in new areas but necessitating substantial investment to establish a foothold and build market share.

For instance, Hargreaves Lansdown could target the estimated 14 million adults in the UK who have never invested, as reported by The Investing and Saving Alliance (TISA) in 2024. This represents a significant opportunity for growth.

- Demographic Focus: Targeting younger investors (e.g., Gen Z and Millennials) through digital-first engagement strategies and accessible investment platforms.

- Financial Education Initiatives: Developing comprehensive, easy-to-understand educational content and tools to boost financial literacy across the UK.

- Product Innovation: Creating simplified investment products and services designed to meet the specific needs and risk appetites of underserved segments.

- Partnerships: Collaborating with employers, educational institutions, and community organizations to reach broader audiences and promote financial well-being.

Hargreaves Lansdown's AI-driven financial tools, while promising for future growth, are currently in their early stages with significant R&D investment and uncertain market penetration, placing them as question marks.

The new omnichannel advice service launched in 2024 also falls into this category, requiring substantial investment to gain traction and prove its value in a competitive market.

Similarly, new ESG and thematic investment solutions, despite entering a growing market, are expected to have low initial market share, necessitating considerable marketing efforts to capture growth.

Broad technology investments, including the digital backbone, are capital-intensive but aim for long-term gains through enhanced client experience, with success dependent on tangible improvements in client acquisition and retention.

Targeting underserved demographics, such as the estimated 14 million adults in the UK who have never invested, represents a high-potential but investment-heavy question mark for Hargreaves Lansdown.

BCG Matrix Data Sources

Our Hargreaves Lansdown BCG Matrix leverages comprehensive data, including company financial reports, market share analysis, industry growth rates, and expert analyst forecasts, to accurately position each business unit.