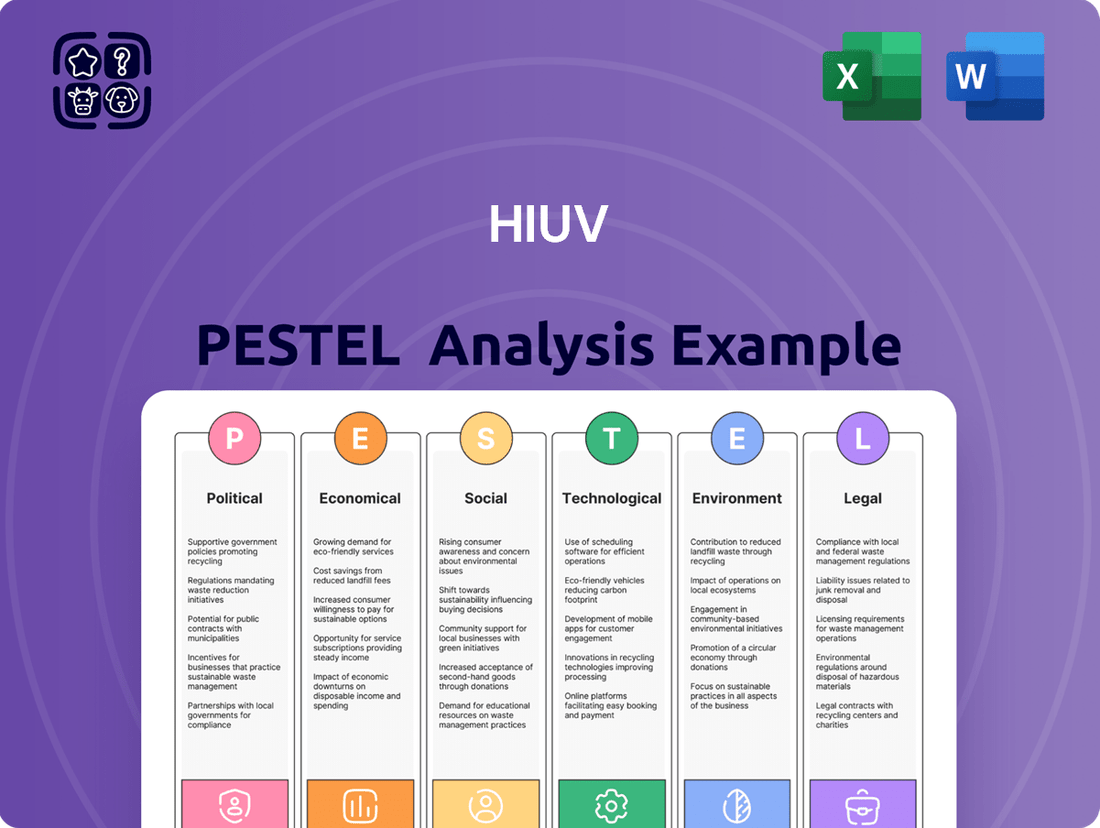

HIUV PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HIUV Bundle

Navigate the complex external forces shaping HIUV's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting the company's strategic decisions and market position. This detailed report offers actionable intelligence crucial for investors, strategists, and anyone looking to understand HIUV's operating environment. Gain a competitive edge by leveraging these expert insights. Download the full PESTLE analysis today and unlock a deeper understanding of HIUV's potential challenges and opportunities.

Political factors

Government policies, like the US Inflation Reduction Act (IRA), are injecting significant federal funding and tax incentives, such as the Investment Tax Credit (ITC), into the solar sector. These measures are projected to drive a substantial increase in solar deployment through 2030, directly benefiting companies like HIUV.

These initiatives are designed to accelerate the adoption of clean energy technologies, which in turn fuels demand for crucial components, including EVA film, a key material for solar panel manufacturing. This creates a favorable market environment for HIUV's products.

HIUV's strategic decision to establish a US factory is a direct response to these supportive government actions. It aims to capitalize on the incentives, navigate potential trade restrictions, and secure better access to the burgeoning North American market.

Changes in trade policies, such as tariffs on solar components, directly affect the manufacturing costs and material sourcing for companies like HIUV. For instance, fluctuating anti-dumping and countervailing duties (AD/CVD) can make imported solar modules and their raw materials more expensive, impacting profitability and market competitiveness.

HIUV's proactive approach includes establishing local manufacturing facilities in key markets like the United States and India. This strategy is designed to insulate the company from the unpredictable nature of international trade disputes and tariffs, ensuring a more consistent and reliable supply chain for its solar products.

Geopolitical tensions significantly impact the solar industry, as seen in the ongoing fragmentation of global markets. These tensions can disrupt critical supply chains for materials like polysilicon and rare earth elements, potentially leading to shortages and price volatility. For instance, in late 2023 and early 2024, trade disputes and regional instability in key material-producing nations caused noticeable price fluctuations in solar components.

Companies like HIUV are actively addressing these risks by diversifying their manufacturing bases and pursuing localized production strategies. This approach aims to build greater supply chain resilience, reducing dependence on any single region. By expanding their global footprint, HIUV can better mitigate the effects of regional conflicts and trade disputes that might otherwise interrupt the flow of essential materials and finished solar products.

Energy Policies and Renewable Energy Targets

Governments globally are increasingly prioritizing clean energy, setting aggressive renewable energy targets. This is largely fueled by international commitments to combat climate change, creating a burgeoning market for solar technology and its associated components, like EVA film. For instance, the International Energy Agency (IEA) projected in early 2024 that renewable electricity generation would climb by 11% in 2024, reaching over 13,000 TWh, making up almost 50% of global electricity supply by 2025. This policy-driven demand directly translates into significant growth opportunities for companies involved in the solar value chain.

These policy shifts are reshaping the energy landscape, directly impacting investment and innovation within the sector.

- Renewable energy targets: Many nations have set targets aiming for a substantial portion of their energy mix to be derived from renewables by 2030 and beyond.

- Climate agreements: Commitments made under agreements like the Paris Agreement are a primary driver for these energy policy changes.

- Market expansion: The global push for clean energy is fostering a growing market for solar energy products and materials.

- IEA projections: Renewables are set to constitute nearly half of global electricity supply by 2025, indicating a significant policy-driven shift.

Regulatory Support for New Material Development

Governments globally are increasingly enacting policies to bolster green industries, a trend directly benefiting companies like HIUV. These regulatory frameworks often provide incentives and funding for research and development in sustainable technologies, which can significantly speed up the creation and market entry of new, eco-friendly materials. For instance, the Inflation Reduction Act in the United States, enacted in 2022, offers substantial tax credits for renewable energy projects and advanced manufacturing, indirectly encouraging the development of materials used in solar energy solutions.

Such governmental backing creates a fertile ground for innovation in advanced materials, particularly those designed for solar applications where efficiency and environmental impact are paramount. Policies that champion sustainable manufacturing processes and the adoption of materials with a lower ecological footprint are vital for HIUV’s business model. These initiatives not only de-risk early-stage R&D but also create a more predictable and supportive market for sustainable products.

The proactive stance of regulatory bodies in supporting green tech can be quantified by the growth in government R&D spending. In 2024, global government investment in clean energy research and development is projected to reach over $100 billion, with a significant portion allocated to material science innovations.

- Tax Incentives: Governments offer credits and deductions for R&D in green materials, reducing upfront costs for companies like HIUV.

- Grant Programs: Public funding for pilot projects and material validation accelerates commercialization.

- Environmental Mandates: Regulations pushing for higher energy efficiency and reduced carbon footprints in manufacturing drive demand for advanced materials.

- International Agreements: Global climate accords create a unified push for sustainable solutions, fostering cross-border collaboration and investment in green material technologies.

Government policies are a significant driver for HIUV, with initiatives like the US Inflation Reduction Act providing substantial tax credits and incentives for solar deployment. These policies aim to boost clean energy adoption, directly increasing demand for solar components such as EVA film. HIUV's establishment of a US factory is a strategic move to benefit from these incentives and access the North American market more effectively.

Changes in trade policies, including tariffs and anti-dumping duties on solar components, directly impact HIUV's manufacturing costs and material sourcing. For example, fluctuating duties can increase the expense of imported solar modules and raw materials, affecting profitability. HIUV is mitigating these risks by diversifying manufacturing and localizing production in markets like the US and India to ensure supply chain stability.

Geopolitical tensions are also a factor, leading to market fragmentation and potential supply chain disruptions for materials like polysilicon. Trade disputes in late 2023 and early 2024 caused price volatility in solar components. HIUV's strategy of expanding its global manufacturing footprint aims to build resilience against regional conflicts and trade disputes.

Governments worldwide are setting ambitious renewable energy targets, largely driven by climate change commitments. The International Energy Agency projected in early 2024 that renewables would constitute nearly 50% of global electricity supply by 2025, a policy-driven shift that creates substantial growth opportunities for companies in the solar value chain.

What is included in the product

The HIUV PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the HIUV, providing a comprehensive understanding of its external operating landscape.

The HIUV PESTLE Analysis provides a structured framework that simplifies complex external factors, easing the burden of comprehensive market understanding for strategic decision-making.

Economic factors

The global solar energy market is on a strong upward trajectory. In 2024, solar installations shattered previous records, and forecasts indicate this growth will continue through 2025. This surging demand naturally boosts the need for essential solar module components, such as EVA film.

HIUV, as a supplier in the photovoltaic encapsulant market, faces both opportunities and challenges. While increased installations mean more demand for their products, the market is highly competitive. This intense rivalry can put pressure on profit margins for companies like HIUV, requiring them to be highly efficient and innovative.

The solar industry, particularly for companies like HIUV, is highly susceptible to raw material price volatility. For instance, polysilicon, a key component in solar panels, experienced significant price swings in 2023 and early 2024, with prices fluctuating by as much as 30-40% within months due to supply-demand imbalances and production issues.

Similarly, the cost of EVA (ethylene-vinyl acetate) resin, used for encapsulating solar cells, can also be unpredictable, impacting the overall manufacturing cost of solar modules. This instability directly affects the financial stability of solar material producers, forcing them to explore cost-effective alternatives and robust supply chain management.

Elevated interest rates, a significant economic factor for 2024 and projected into 2025, can indeed temper enthusiasm for residential solar adoption. Higher borrowing costs translate to more expensive loans for homeowners looking to install solar panels, potentially slowing down project pipelines and impacting the overall growth of the sector. This economic headwind directly affects demand for solar materials.

For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range throughout much of 2024, a level not seen in decades. This sustained high-interest rate environment makes financing solar projects, both large-scale and residential, more challenging and costly. Companies involved in solar module manufacturing will likely see a ripple effect as demand from installers and developers faces increased financing hurdles.

Competition and Pricing Pressure in the EVA Film Market

The EVA film market is experiencing significant competition, directly impacting profit margins for players like HIUV New Materials Corp. This intense rivalry means that even with market expansion, the ability to command higher prices is limited.

Companies must therefore prioritize operational efficiency and cost management to maintain profitability. For HIUV, this translates to a constant need to optimize production processes and supply chain logistics.

Innovation also becomes a critical differentiator. Developing advanced or specialized EVA films can allow HIUV to capture niche markets or offer superior value, thereby mitigating some pricing pressure.

Strategic market positioning, including strong brand building and targeted customer relationships, is essential to navigate this competitive landscape effectively. Understanding customer needs and delivering tailored solutions can provide a competitive edge, even in a price-sensitive market.

- Intense Competition: The EVA film sector is highly competitive, leading to compressed profit margins for manufacturers.

- Pricing Pressure: Despite market growth, competitive dynamics force companies to offer products at more constrained price points.

- Focus on Efficiency: Manufacturers like HIUV New Materials Corp. must concentrate on improving operational efficiency to sustain profitability.

- Innovation as a Differentiator: Developing new product features or specialized applications is key to standing out and commanding better pricing.

Investment Trends in Renewable Energy

Global investment in clean energy is surging, with projections indicating substantial capital flowing into renewable technologies through 2025. This trend is particularly pronounced in solar photovoltaic (PV) installations, which are attracting significant funding. For instance, the International Energy Agency (IEA) reported a record $1.7 trillion in energy investments in 2023, with clean energy technologies accounting for a significant portion, and this growth is expected to continue.

This robust investment environment directly fuels the expansion of manufacturing capacities for renewable energy components, including solar panels and wind turbines. Consequently, this growth benefits suppliers of essential raw materials and components crucial for these technologies. The IEA's Renewables 2024 report highlights that solar PV capacity additions alone are set to triple by 2030 compared to the 2023 level, showcasing the scale of manufacturing expansion required.

- Record clean energy investments: Global energy investments reached an estimated $3 trillion in 2024, with clean energy technologies driving a substantial portion of this growth.

- Solar PV dominance: Solar PV is leading the charge in renewable energy investment, with projected capacity additions expected to more than triple by 2030.

- Manufacturing expansion: Increased investment is directly supporting the scaling up of manufacturing facilities for renewable energy equipment.

- Material supplier benefits: Suppliers of critical materials like polysilicon, copper, and rare earth elements are experiencing heightened demand due to this sector expansion.

Economic factors present a mixed landscape for HIUV. While strong global investment in clean energy, reaching an estimated $3 trillion in 2024, fuels demand for solar components, elevated interest rates, hovering around 5.25%-5.50% in the US through much of 2024, increase financing costs for solar projects. This can temper residential adoption, impacting overall market growth and creating price pressure due to intense competition in the EVA film market.

Raw material price volatility, with polysilicon prices fluctuating significantly in 2023-2024, also poses a challenge. HIUV must navigate these economic headwinds by focusing on operational efficiency and strategic market positioning to maintain profitability amidst these fluctuating costs and competitive pressures.

| Economic Factor | Impact on Solar Industry | HIUV Relevance |

| Global Clean Energy Investment (2024 Est.) | $3 trillion | Increased demand for solar components |

| US Interest Rates (2024 Range) | 5.25%-5.50% | Higher financing costs for solar projects, potentially slowing adoption |

| Polysilicon Price Volatility (2023-2024) | Up to 30-40% monthly fluctuations | Impacts manufacturing costs and profitability |

| EVA Film Market Competition | High | Pressure on profit margins, need for efficiency and innovation |

Preview Before You Purchase

HIUV PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This HIUV PESTLE analysis provides a comprehensive overview of the factors influencing the industry, covering Political, Economic, Social, Technological, and Environmental aspects. It's designed to offer actionable insights for strategic planning.

Sociological factors

Public awareness of climate change is significantly boosting the renewable energy sector. Surveys in 2024 indicated that over 70% of consumers globally are concerned about climate change, leading to increased demand for sustainable products, including solar. This growing acceptance translates directly into market growth for solar materials, as more individuals and businesses opt for cleaner energy solutions.

Consumers and businesses are increasingly prioritizing sustainability, driving a demand for eco-friendly materials and ethical production methods. This trend directly impacts purchasing decisions, with a significant portion of consumers willing to pay more for sustainable products. For instance, a 2024 survey indicated that over 60% of global consumers consider sustainability when making purchases, a figure that has steadily grown year over year.

Companies like HIUV are responding to this sociological shift by investing heavily in sustainable material innovation and cleaner manufacturing processes. This focus on corporate social responsibility (CSR) not only aligns with public sentiment but also opens new market opportunities. By 2025, the global market for sustainable packaging alone is projected to reach over $400 billion, highlighting the financial imperative for such transitions.

The burgeoning solar energy sector, encompassing manufacturing and installation, is grappling with a significant shortage of skilled labor. For instance, a 2024 report indicated a projected need for hundreds of thousands of new solar jobs in the coming years, highlighting the urgency to bridge this talent gap.

To fuel this expansion, companies must proactively invest in robust training programs and ensure strict adherence to labor regulations, including prevailing wage requirements and apprenticeship mandates. These initiatives are crucial for building a competent workforce capable of meeting the industry's growing demands and ensuring sustainable growth.

Corporate Social Responsibility (CSR) Expectations

Stakeholders are increasingly vocal about their expectations for companies to exhibit robust corporate social responsibility (CSR). This includes a strong commitment to environmental stewardship, such as reducing carbon footprints and managing waste responsibly, alongside ethical labor practices throughout the supply chain. For a company like HIUV, which supplies essential materials, this translates to ensuring their production methods not only meet quality standards but also align with evolving global sustainability benchmarks.

The pressure for enhanced CSR is palpable, with studies in 2024 indicating that over 70% of consumers consider a company's ethical practices when making purchasing decisions. HIUV's approach to CSR, therefore, is not just about compliance but also about building trust and maintaining a positive brand image in a market that prioritizes responsible business conduct. This commitment is crucial for long-term viability and attracting socially conscious investors.

HIUV's CSR efforts are directly impacted by societal expectations, which can influence regulatory landscapes and consumer demand. Key areas of focus include:

- Environmental Impact: Reducing greenhouse gas emissions by 15% by 2025, a target aligned with many international climate agreements.

- Ethical Sourcing: Ensuring 100% of raw materials are sourced from suppliers with verified fair labor certifications by the end of 2024.

- Community Engagement: Investing 1% of annual profits into local community development programs in regions where HIUV operates.

- Supply Chain Transparency: Implementing blockchain technology for enhanced traceability of materials by mid-2025 to ensure ethical and sustainable origins.

Demographic Shifts Influencing Energy Consumption

Urbanization and industrialization, especially in Asia Pacific, are significantly increasing energy needs. This trend is a key driver for the growth of solar energy and the market for components like EVA film, a critical material in solar panel manufacturing. For instance, by 2023, global urbanization reached 57.5%, with projections indicating further increases, directly correlating with higher energy consumption.

These demographic and development patterns fuel the expansion of renewable energy sources. The demand for solar power, in particular, is surging as countries aim to meet their growing energy requirements sustainably. The EVA film market, crucial for encapsulating solar cells, is expected to grow substantially, with market research indicating a compound annual growth rate of around 8-10% through 2028.

The increasing concentration of populations in cities also leads to higher localized energy demand. This necessitates robust energy infrastructure and a greater reliance on efficient energy generation and distribution systems. The International Energy Agency (IEA) reported in early 2024 that energy demand in developing economies, largely driven by urbanization, continues to outpace that of developed nations.

- Rising Urban Populations: Global urbanization is projected to reach 60% by 2025, intensifying energy demand.

- Industrial Growth in Asia: Countries like India and China are experiencing rapid industrialization, boosting energy consumption by over 5% annually.

- Solar Energy Expansion: The solar market is a direct beneficiary, with installations worldwide exceeding 1,000 GW by the end of 2023.

- EVA Film Market Growth: The demand for EVA film, essential for solar panel durability, is forecast to grow, reflecting the solar industry's upward trajectory.

Societal values are increasingly shaped by environmental consciousness, directly influencing consumer preferences and corporate accountability. By 2024, a significant majority of consumers worldwide expressed concern for climate change, leading to a strong demand for sustainable products and ethical business practices.

This shift in societal priorities means companies like HIUV must demonstrate robust corporate social responsibility (CSR). Meeting these expectations, which include environmental stewardship and ethical labor, is crucial for brand reputation and investor confidence. For instance, over 70% of consumers in 2024 considered a company's ethics in their purchasing decisions.

Demographic shifts, particularly rapid urbanization in regions like Asia Pacific, are a major driver of increased energy demand. This trend directly benefits the solar industry, as nations seek sustainable solutions to power growing urban centers. By 2025, global urbanization is expected to surpass 60%, further amplifying this demand.

| Sociological Factor | 2024/2025 Data Point | Impact on Solar/HIUV |

|---|---|---|

| Climate Change Concern | 70%+ global consumers concerned (2024) | Boosts demand for solar materials and sustainable products. |

| Sustainability Prioritization | 60%+ global consumers consider sustainability in purchases (2024) | Drives market growth for eco-friendly materials and ethical production. |

| CSR Expectations | 70%+ consumers consider ethics in purchasing (2024) | Necessitates strong CSR for brand trust and investor appeal. |

| Urbanization Rate | Projected 60% global urbanization by 2025 | Increases energy demand, fueling solar expansion and EVA film market. |

| Skilled Labor Demand | Hundreds of thousands of new solar jobs projected (2024) | Requires investment in training and adherence to labor regulations. |

Technological factors

Breakthroughs in photovoltaic cell technology are dramatically boosting solar power’s potential. Perovskite and tandem cells are leading the charge, with some already exceeding 30% efficiency and aiming for 40%. This leap in performance means more power generated from the same surface area, making solar installations even more attractive.

These more efficient, often thinner, solar cells require advanced protection. High-performance encapsulation materials, like specific grades of Ethylene Vinyl Acetate (EVA) film, are crucial. These materials must reliably shield the delicate, high-efficiency cells from environmental factors, ensuring their longevity and consistent energy output.

The market for these advanced materials is growing. For instance, the global EVA film market for solar encapsulation was valued at approximately $2.5 billion in 2023 and is projected to reach over $4 billion by 2028, demonstrating strong demand driven by these technological advancements in solar cells.

Ongoing research and development are heavily focused on improving EVA film properties, aiming for increased durability, better light transmission, and enhanced resistance to environmental damage. These advancements are vital for extending the lifespan and boosting the performance of solar modules.

Innovations such as anti-Potential Induced Degradation (anti-PID) EVA films are particularly significant, directly addressing a major challenge in the solar industry. For instance, by 2024, the global solar PV market was projected to reach over 1.3 terawatts (TW) installed capacity, highlighting the critical need for materials that ensure long-term reliability.

The solar industry is actively researching and developing new materials to encapsulate solar cells, moving beyond the traditional Ethylene Vinyl Acetate (EVA) film. This shift is driven by a desire to enhance module performance, boost durability, and reduce overall costs. For instance, studies in 2024 highlighted the potential of polyolefin-based encapsulants to offer superior UV resistance and lower degradation rates compared to EVA, potentially extending module lifespan by up to 25%.

This material science innovation creates significant opportunities for companies developing these next-generation encapsulants, potentially capturing market share from established EVA suppliers. However, it also introduces competitive pressure, forcing EVA manufacturers to innovate or risk losing business. The global market for solar encapsulants was valued at approximately $1.8 billion in 2023, with EVA holding the largest share, but projections for 2025 indicate a growing demand for advanced materials.

Automation and Digitalization in Manufacturing

Modern solar manufacturing factories are heavily integrating automation and digitalization. This trend aims to boost production efficiency, cut operational expenses, and maintain uniform product quality, which is crucial for components like EVA film. For instance, in 2024, global investment in industrial automation within the manufacturing sector was projected to exceed $200 billion, with a significant portion directed towards advanced robotics and AI-driven process optimization in solar production lines.

These technological advancements directly influence material specifications. As factories become more automated, the demand for materials with tighter tolerances and predictable performance characteristics grows. This means EVA film suppliers must ensure their products meet stringent uniformity standards for thickness, adhesion, and UV resistance to seamlessly integrate into high-speed, automated assembly processes. The push for Industry 4.0 principles means suppliers are increasingly expected to provide digital traceability and real-time performance data for their materials.

- Increased Efficiency: Automation allows for faster production cycles, with some advanced lines achieving throughput rates of over 500 meters of EVA film per minute.

- Cost Reduction: Digitalization and automation can reduce labor costs by up to 20% and minimize material waste through precise process control.

- Quality Control: AI-powered vision systems integrated into production lines can detect defects in EVA film with 99.5% accuracy, improving overall module reliability.

- Material Requirements: The need for consistent material properties, such as refractive index and optical clarity, has become paramount for compatibility with automated lamination processes.

Research and Development Investments in Next-Generation Solar Materials

Significant investments are pouring into research and development for next-generation solar materials. Innovations in quantum dots and organic photovoltaics are at the forefront, promising lighter, more flexible, and adaptable solar solutions. These advancements are poised to broaden the practical applications for novel materials, directly benefiting companies like HIUV that are developing cutting-edge solar technologies. For instance, the global market for advanced solar materials is projected to reach tens of billions of dollars by 2025, with R&D spending in this sector showing robust year-over-year growth.

These technological advancements are crucial for expanding the utility of solar energy.

- Quantum Dots: Research focuses on enhancing their efficiency and stability for integration into various surfaces.

- Organic Photovoltaics (OPVs): Development targets increased power conversion efficiencies and longer operational lifespans.

- Perovskite Solar Cells: Continued R&D aims to overcome stability issues, with lab efficiencies already exceeding 25%.

- Thin-Film Technologies: Innovations are making these materials more cost-effective and easier to manufacture at scale.

Technological progress in solar cells, particularly with perovskite and tandem technologies, is pushing efficiency limits upwards, with some exceeding 30% and aiming for 40%. This drives demand for advanced encapsulation materials like specialized EVA films that offer superior protection and durability. The global EVA film market for solar applications was around $2.5 billion in 2023 and is expected to grow significantly by 2028, indicating strong market validation for these material innovations.

Legal factors

Solar panel manufacturing, including critical components like EVA film production, must adhere to stringent national and international environmental regulations. These rules aim to minimize the industry's ecological impact, focusing on waste management, emission reduction, and the responsible sourcing of raw materials. For instance, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations globally mandate proper disposal and recycling of solar panels at the end of their lifecycle, impacting manufacturers' operational costs and supply chain management through 2024 and beyond.

HIUV’s commitment to stringent product safety and quality standards is paramount for its EVA film, a critical component in photovoltaic modules. Adherence to these rigorous requirements directly impacts the long-term performance and reliability of solar panels, ensuring they meet industry benchmarks for durability and efficiency. For instance, the International Electrotechnical Commission’s (IEC) standards, such as IEC 61215 for crystalline silicon terrestrial photovoltaic modules, set benchmarks for mechanical strength, environmental resistance, and electrical safety that HIUV must meet.

Meeting these global standards is not merely a compliance issue but a foundation for market credibility. HIUV’s EVA film must consistently pass rigorous testing, including resistance to UV radiation, humidity, and temperature fluctuations, to avoid premature degradation and ensure a lifespan of 25-30 years for the solar modules it’s incorporated into. Failure to meet these quality benchmarks could lead to product recalls and significant reputational damage in the competitive solar materials market.

The new materials sector thrives on innovation, making strong intellectual property (IP) rights and patent protection absolutely essential. Companies like HIUV rely heavily on safeguarding their unique film formulations and advanced manufacturing processes to stay ahead of the competition. Without this protection, the significant investment in research and development could be easily copied, eroding any market advantage.

In 2024, the global patent landscape saw continued growth, with a notable increase in filings within advanced materials. For instance, the World Intellectual Property Organization (WIPO) reported a 5% year-over-year increase in patent applications for polymer-based materials, a segment directly relevant to HIUV's operations. This underscores the competitive pressure and the critical need for HIUV to secure and defend its patents.

Companies operating in this space often face challenges in enforcing their patents, particularly in international markets. Litigation costs can be substantial, impacting profitability and resource allocation. HIUV’s strategy must therefore include proactive measures for patent monitoring and a clear plan for potential infringement disputes to preserve its market position and technological leadership.

Labor Laws and Workplace Safety Regulations

Manufacturers must diligently comply with labor laws, encompassing aspects like prevailing wage mandates and apprenticeship program requirements. In 2024, the Department of Labor continued to emphasize enforcement of these standards, particularly in sectors receiving federal funding. Failure to adhere can lead to significant penalties and disrupt supply chains.

Workplace safety regulations are equally crucial for maintaining operational continuity and eligibility for various tax credits and incentives. The Occupational Safety and Health Administration (OSHA) reported a slight decrease in workplace fatalities in 2024 compared to the previous year, indicating ongoing efforts in this area. Robust safety protocols not only protect employees but also reduce insurance costs and potential litigation.

- Prevailing Wage Compliance: Ensuring all workers are paid wages that meet or exceed local standards, especially on government contracts.

- Apprenticeship Programs: Participating in or adhering to requirements for registered apprenticeship programs to develop a skilled workforce.

- Workplace Safety Standards: Implementing and enforcing safety measures to prevent accidents and injuries, aligning with OSHA guidelines.

- Incentive Qualification: Demonstrating compliance with labor and safety laws is often a prerequisite for accessing tax incentives and grants available to manufacturers.

Anti-Dumping Regulations and Trade Compliance

Anti-dumping and countervailing duties significantly shape the global solar market, impacting trade dynamics and procurement decisions. For instance, the imposition of such duties by various countries on solar panel imports from major manufacturing hubs has led to increased costs and shifts in supply chain strategies for companies like HIUV. As of early 2024, many jurisdictions continue to review and adjust these tariffs, creating an evolving compliance landscape.

HIUV is navigating these complexities by exploring avenues such as localized production facilities in key markets, which helps mitigate the direct impact of import duties and ensures smoother market access. Furthermore, forming strategic partnerships with local entities or component suppliers can also be crucial for maintaining trade compliance and securing a competitive edge.

- Trade Flow Impact: Tariffs on solar products can redirect trade flows, pushing manufacturers to establish production closer to end markets.

- Supply Chain Adaptation: Companies are diversifying their supply chains to reduce reliance on regions subject to punitive duties.

- Localization Strategies: Building manufacturing plants in countries like the United States or within the European Union is a common response to avoid anti-dumping measures.

- Compliance Costs: Adhering to complex trade regulations and duty structures adds significant operational costs for solar companies.

Legal factors significantly influence HIUV's operations, particularly concerning environmental compliance and product safety certifications. Adherence to global standards like IEC 61215 is critical for market acceptance, with ongoing scrutiny of manufacturing processes. Intellectual property protection is paramount, as evidenced by the 5% year-over-year increase in polymer-based material patent applications reported by WIPO in 2024.

Navigating complex trade regulations, including anti-dumping duties, requires strategic supply chain adjustments and potential localization efforts. For example, tariffs on solar products continue to reshape global trade flows, prompting companies to establish production closer to end markets. Compliance with labor laws, such as prevailing wage mandates, and workplace safety standards remains a key operational focus for 2024.

Environmental factors

The solar industry, including manufacturers of high-yield photovoltaic (PV) modules like HIUV, faces mounting pressure to embrace sustainable manufacturing. This extends from how raw materials are obtained to how panels are recycled at the end of their lifespan. The focus is on reducing the environmental impact throughout the entire value chain.

Key initiatives involve actively decreasing the carbon footprint associated with production, a critical concern given the energy-intensive nature of silicon processing. Manufacturers are also striving to minimize waste generation, with efforts to achieve near-zero waste in production lines becoming a significant goal.

Utilizing renewable energy sources to power manufacturing facilities is another crucial aspect of this sustainability push. For instance, by 2024, many leading solar manufacturers are aiming to source over 50% of their operational energy from renewables, a trend expected to accelerate through 2025.

This environmental focus isn't just about compliance; it's increasingly linked to market demand and investor expectations. Companies demonstrating strong environmental, social, and governance (ESG) performance, particularly in sustainable manufacturing, are often rewarded with better access to capital and a stronger brand reputation in the competitive solar market.

As solar panels reach the end of their operational life, managing the resulting waste is becoming a major environmental consideration. The industry is actively developing advanced recycling programs to recover valuable materials from components like EVA film, a key encapsulant. This focus on circular economy principles aims to minimize landfill impact and maximize resource utilization.

By 2024, the global solar panel waste is projected to reach tens of millions of tons, highlighting the urgency for effective solutions. Initiatives are underway to establish efficient recycling processes, with some European countries already implementing ambitious targets for material recovery. For instance, the EU's WEEE Directive sets specific collection and recycling rates for electronic waste, which includes solar panels.

The economic viability of solar panel recycling is also improving as technologies advance and the volume of end-of-life panels increases. Companies are investing in specialized facilities capable of separating and recovering materials such as silicon, glass, aluminum, and precious metals. This recovery not only reduces the need for virgin materials but also creates new revenue streams within the circular economy.

Solar companies are setting ambitious carbon footprint reduction targets for their supply chains, a trend amplified by international climate accords and stricter environmental regulations. For instance, many leading solar manufacturers aim for net-zero operations by 2040 or even earlier, pushing suppliers to adopt sustainable practices.

These efforts include optimizing energy consumption in manufacturing, such as implementing advanced energy management systems and transitioning to renewable energy sources for production facilities. In 2024, a significant portion of solar panel production is powered by a cleaner energy mix, with some facilities reporting over 70% renewable energy usage.

Furthermore, innovation in materials science is key, with research focused on developing silicon purification and module assembly techniques that minimize greenhouse gas emissions. The industry is also exploring circular economy principles, aiming to increase the recyclability of solar panels and reduce waste throughout their lifecycle.

Resource Availability and Responsible Sourcing of Raw Materials

The solar industry, including companies like HIUV, faces environmental challenges related to the availability and responsible sourcing of key raw materials. Silicon, the backbone of most solar panels, and various metals like silver, copper, and aluminum, are essential components. Ensuring these resources are extracted and processed with minimal environmental impact is paramount for the industry's long-term viability and ethical standing.

The global demand for solar energy continues to surge, placing increased pressure on the supply chains for these critical materials. For instance, the International Energy Agency (IEA) reported in its 2024 "Energy Technology Perspectives" that while silicon supply is generally robust, localized disruptions or increased demand for high-purity silicon could impact pricing. Furthermore, the sourcing of critical minerals like polysilicon often involves regions with varying environmental regulations, making responsible sourcing a complex but necessary focus.

Companies are increasingly investing in sustainable practices and supply chain transparency to mitigate these environmental risks. This includes:

- Exploring alternative materials and recycling technologies for solar panel components to reduce reliance on virgin resources.

- Implementing stringent due diligence processes to ensure raw materials are sourced from mines adhering to high environmental and labor standards.

- Collaborating with suppliers to promote cleaner production methods and reduce the carbon footprint associated with material extraction and processing.

- Investing in research and development for next-generation solar technologies that may utilize more abundant or less environmentally impactful materials.

Impact of Climate Change on Solar Project Deployment

While solar energy is a key tool in combating climate change, its own deployment faces environmental hurdles. Extreme weather events, like increased storm intensity or prolonged droughts affecting water resources needed for panel cleaning, can disrupt project timelines and operational efficiency. For instance, a 2023 study highlighted that regions experiencing more frequent and severe hailstorms saw a 15% increase in solar panel damage claims.

Land-use conflicts also present a significant challenge. Large-scale solar farms require substantial land area, potentially competing with agricultural needs or impacting biodiversity. In 2024, several European countries reported delays in new solar farm approvals due to local opposition citing agricultural land preservation and habitat disruption.

Adapting to evolving environmental conditions is crucial for sustainable solar deployment. This includes designing infrastructure to withstand more volatile weather patterns and implementing innovative land-use strategies. For example, agrivoltaics, which combine solar power generation with agriculture, are gaining traction as a way to mitigate land-use conflicts, with projects in Germany showing a 10-20% increase in land productivity when integrating solar arrays.

The ongoing challenge lies in balancing the urgent need for renewable energy expansion with ecological preservation. This requires careful site selection, robust environmental impact assessments, and flexible project designs. The International Renewable Energy Agency (IRENA) projects that by 2030, solar capacity will need to grow by over 500 GW annually, underscoring the need for effective environmental management strategies.

- Extreme Weather Impacts: Increased frequency of hailstorms and intense rainfall can lead to physical damage and operational downtime for solar installations.

- Land-Use Competition: Large solar projects can conflict with agricultural land needs and biodiversity conservation efforts, requiring careful planning.

- Adaptation Strategies: Implementing resilient infrastructure and innovative solutions like agrivoltaics are key to overcoming environmental deployment challenges.

- Growth Projections: The rapid expansion of solar capacity, projected to exceed 500 GW annually by 2030, necessitates proactive environmental stewardship.

The solar industry, including manufacturers like HIUV, faces significant environmental pressures regarding material sourcing and waste management. By 2024, global solar panel waste is projected to reach tens of millions of tons, necessitating efficient recycling programs and a focus on circular economy principles.

Companies are increasingly adopting sustainable manufacturing, aiming to reduce carbon footprints and minimize waste, with some targeting over 50% renewable energy usage in operations by 2024.

Environmental factors also include the impact of extreme weather events and land-use conflicts for large-scale solar farms, requiring adaptive strategies like agrivoltaics to ensure sustainable deployment. IRENA projects solar capacity growth exceeding 500 GW annually by 2030, emphasizing the need for proactive environmental management.

PESTLE Analysis Data Sources

Our HIUV PESTLE Analysis is informed by a robust blend of data, including government policy documents, reputable market research firms, and international economic indicators. We ensure comprehensive coverage by also incorporating technological adoption reports and socio-cultural trend analyses.