HIUV Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HIUV Bundle

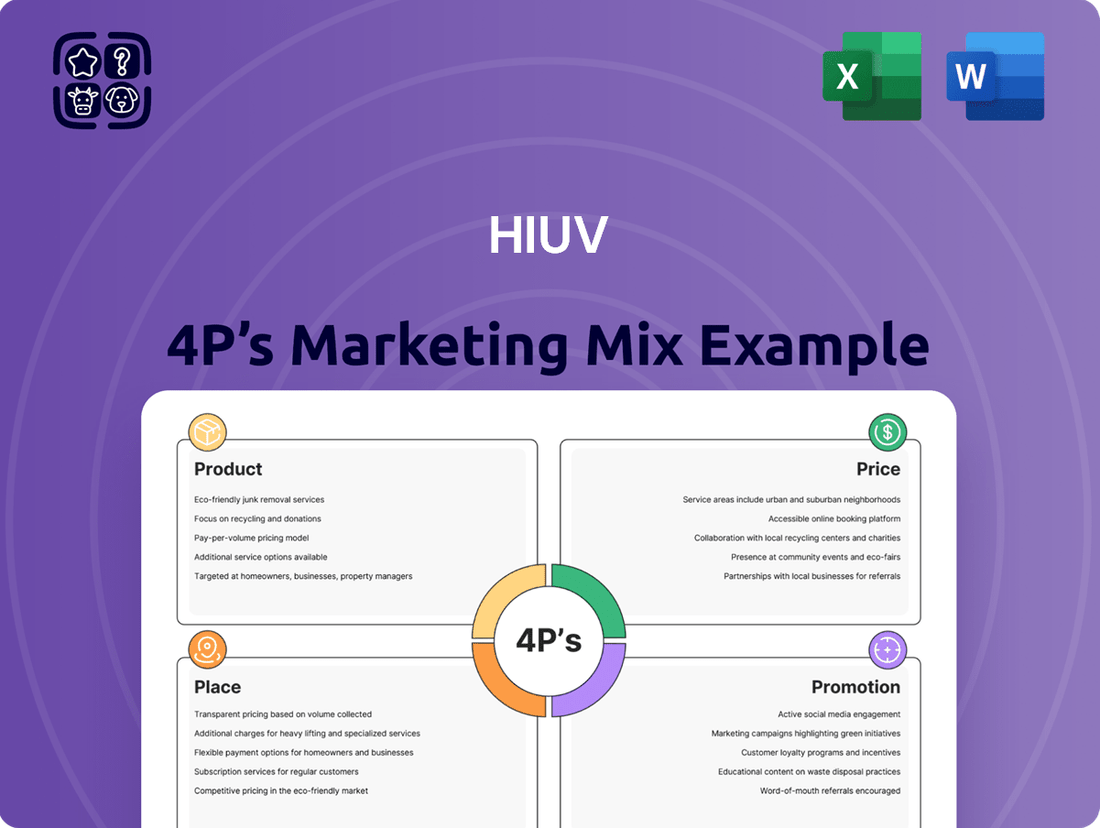

Dive into the core of HIUV's market dominance with our 4Ps Marketing Mix Analysis, examining their product innovation, strategic pricing, effective distribution, and impactful promotion. This breakdown reveals how each element synergizes to capture consumer attention and drive sales.

Uncover the secrets behind HIUV's success by exploring their meticulously crafted product offerings, competitive pricing strategies, extensive market reach, and compelling promotional campaigns. This analysis provides a clear roadmap to understanding their market positioning.

Ready to elevate your marketing understanding? Our comprehensive 4Ps analysis of HIUV offers actionable insights and strategic frameworks, perfect for students, professionals, and anyone seeking to master marketing principles.

Don't just skim the surface; gain a complete, ready-to-use Marketing Mix Analysis for HIUV, covering every facet of their strategy. This editable document empowers you to learn, benchmark, and apply proven marketing tactics.

Unlock a deeper understanding of HIUV's marketing prowess. Our full 4Ps analysis goes beyond the basics, delivering expert insights into their product, price, place, and promotion strategies, all in an editable format.

Product

HIUV New Materials Corp. is deeply focused on new materials, with a particular emphasis on EVA film for solar modules. This specialization makes them a key player in the solar energy sector, supplying essential components that enhance the performance and durability of photovoltaic modules.

In 2023, the global solar energy market saw significant growth, with installations reaching record levels. HIUV's core material, EVA film, is crucial for ensuring the long-term reliability of solar panels, directly contributing to the efficiency of renewable energy generation.

HIUV's strategic product diversification moves beyond its foundational EVA films, showcasing a commitment to innovation. In 2024, the company unveiled six new materials, including light conversion films, black films, advanced co-extrusion materials, 0BB, HTPO, and PVE. This expansion significantly broadens HIUV's market presence, tapping into automotive and construction industries.

For instance, PVE glass encapsulation film finds application in automotive windshields and architectural curtain walls, demonstrating a tangible shift into new sectors. Furthermore, the introduction of eco-friendly AXPO synthetic leather for car interiors highlights HIUV's focus on sustainable solutions within the automotive market. This diversified portfolio strengthens HIUV's market position and revenue streams.

HIUV's materials boast advanced properties engineered for demanding applications, including superior adhesion, effective heat and noise insulation, robust UV resistance, and enhanced light transmission. These characteristics ensure product longevity and performance.

A prime example is HIUV's third-generation 0-migration light conversion film. This technology directly tackles the UV sensitivity of HJT cells, mitigating annual degradation by an impressive 0.5%, a crucial factor for long-term solar energy output.

Furthermore, the black film developed by HIUV demonstrably increases power generation efficiency. This means more energy captured from sunlight, translating to a higher return on investment for solar installations.

HIUV's commitment to innovation is also evident in their cutting-edge co-extrusion structure. This advancement significantly reduces manufacturing costs for TOPCon modules, making advanced solar technology more accessible and competitive in the market.

Research and Development Focus

HIUV’s commitment to robust research and development is a cornerstone of its product strategy, driving continuous technological advancement. This dedication allows them to tackle key industry hurdles, such as lowering production costs for TOPCon solar modules and enhancing the bonding strength of their 0BB solutions.

Their proactive R&D efforts are also geared towards pioneering new materials, particularly for next-generation technologies like perovskite solar cells. For instance, reports from late 2024 indicate significant progress in lab-scale perovskite efficiency, with some research institutions achieving over 26%, a benchmark HIUV aims to translate into commercial viability through its material science innovations.

This focus ensures HIUV’s product portfolio remains at the cutting edge of renewable energy materials and other advanced application sectors. Their investment in R&D, often exceeding 5% of annual revenue in the solar industry, positions them to lead in material science for emerging clean energy solutions.

- TOPCon Module Cost Reduction: Targeting lower manufacturing expenses through material and process innovation.

- 0BB Solution Bonding Strength: Improving the reliability and durability of zero busbar solar cell interconnects.

- Perovskite Material Development: Pioneering new material compositions for enhanced efficiency and stability in perovskite solar technology.

- Material Science Leadership: Maintaining a competitive edge in advanced materials for renewable energy and other high-tech fields.

Quality and Performance Assurance

HIUV is deeply committed to product excellence, aiming to spearhead advancements and improvements within the photovoltaic sector. This dedication translates into materials that consistently meet high-performance benchmarks, directly contributing to increased power generation efficiency and improved profitability for solar power installations.

The company rigorously implements stringent quality control measures across its entire supply chain. This meticulous approach ensures that the performance and quality of their films remain uniform and reliable, providing customers with dependable solar solutions.

- Product Excellence: HIUV's focus on superior product development drives innovation in the photovoltaic industry.

- Performance Standards: Materials are engineered to meet elevated performance requirements, boosting solar plant efficiency.

- Profitability Enhancement: Higher efficiency directly translates to better financial returns for solar power projects.

- Supply Chain Quality: Strict quality assurance protocols guarantee consistent product quality and performance.

HIUV's product strategy centers on specialized EVA films for solar modules, a critical component for module durability and performance. In 2024, they expanded their offerings with six new materials, including light conversion films and PVE for automotive and construction, broadening their market reach significantly.

Their third-generation 0-migration light conversion film, for instance, addresses HJT cell UV sensitivity and is projected to reduce annual degradation by 0.5%. Furthermore, their black film enhances power generation efficiency, and innovative co-extrusion structures aim to cut TOPCon module manufacturing costs.

HIUV's commitment to R&D is key, targeting cost reductions for TOPCon modules and improving the bonding strength of their 0BB solutions. They are also actively developing materials for perovskite solar cells, aiming to translate lab-scale efficiency gains, such as the over 26% reported in late 2024, into commercial viability.

HIUV's product portfolio is designed for high performance, with features like superior adhesion and UV resistance, ensuring longevity and efficiency in demanding applications. This focus on excellence, backed by stringent quality control, guarantees reliable solar solutions, directly contributing to the profitability of solar projects.

| Product Focus | Key Differentiator | 2024/2025 Impact | Targeted Improvement |

| EVA Film | Durability & Performance Enhancement | Core offering for growing solar market | Reliability in photovoltaic modules |

| New Materials (2024) | Diversification into Automotive & Construction | Expanded market penetration | New revenue streams |

| 0-Migration Light Conversion Film | 0.5% Annual Degradation Reduction (HJT) | Enhanced solar panel lifespan | Improved long-term energy yield |

| Black Film | Increased Power Generation Efficiency | Higher energy capture | Greater ROI for solar installations |

| Co-extrusion for TOPCon | Manufacturing Cost Reduction | More competitive advanced solar tech | Increased accessibility of TOPCon |

What is included in the product

This analysis provides a comprehensive breakdown of HIUV's marketing strategies, examining its Product, Price, Place, and Promotion efforts with real-world examples and strategic implications.

It's designed for professionals seeking to understand HIUV's market positioning and benchmark it against competitors, offering a solid foundation for strategy development and reporting.

Streamlines the complex HIUV 4P's Marketing Mix Analysis into a clear, actionable framework, alleviating the pain of information overload.

Offers a concise, visual summary of the HIUV 4P's, effectively solving the challenge of translating detailed marketing strategy into easily digestible insights for diverse audiences.

Place

HIUV New Materials Corp. strategically manages its global manufacturing and distribution network, a crucial element of its marketing mix. By 2024, the company boasts six production facilities, underscoring its commitment to a robust global supply chain. This expansive network ensures product availability and accessibility for its international customer base.

A significant development in their global expansion is the Q3 2024 commencement of operations at their Vietnam production base. This facility is designed with a substantial planned capacity of 5 GW, significantly boosting HIUV's manufacturing output and market reach in key Asian markets.

Further solidifying its international presence, HIUV is actively planning a new manufacturing facility in the United States. This expansion represents an estimated investment of up to $10 million, signaling a proactive strategy to tap into the North American market and diversify its production footprint.

HIUV actively seeks strategic partnerships to boost its market reach and local supply chains. A prime example is their collaboration with H.B. Fuller, which facilitated HIUV's entry into the U.S. market. This partnership involves supplying specific film formulations and manufacturing know-how to be produced at Fuller's Ohio facility.

This localized production strategy is crucial for navigating trade barriers and fortifying HIUV's competitive edge in vital geographical areas. By leveraging established manufacturing footprints, HIUV can ensure a more consistent and responsive supply of its products.

HIUV's core strategy for reaching its B2B customers involves direct sales to industry manufacturers, particularly photovoltaic module producers. This approach ensures that HIUV can offer specialized solutions and robust technical support, fostering deep client relationships. In 2024, the global solar module market was projected to exceed $150 billion, with thin film technology representing a significant and growing segment, underscoring the importance of HIUV's direct engagement with these key players.

Expanding into New Geographies

HIUV is strategically broadening its international footprint, moving beyond its established presence in China and Vietnam. The company is actively assessing opportunities in emerging markets such as Turkey and India, recognizing the significant growth potential for advanced materials. This global expansion is a key component of HIUV's strategy to diversify revenue streams and tap into burgeoning demand.

The focus on new geographies is driven by the increasing global need for high-performance materials, particularly within the rapidly expanding solar energy and automotive industries. For instance, the global solar panel market was valued at approximately $150 billion in 2023 and is projected to grow significantly in the coming years, presenting a substantial opportunity for HIUV. Similarly, the automotive sector's shift towards electric vehicles is spurring demand for lightweight and durable materials, a segment where HIUV's products are well-positioned.

- Market Diversification: HIUV's expansion into Turkey and India aims to reduce reliance on existing markets and capture new customer bases.

- Sectoral Demand: The solar and automotive sectors are key targets, reflecting robust growth trends and a high demand for HIUV's material solutions.

- Global Opportunities: Expansion efforts are supported by an estimated global market for advanced materials projected to reach several hundred billion dollars by 2030.

Optimized Logistics and Inventory Management

HIUV prioritizes optimized logistics and inventory management to ensure their specialized products reach global clients efficiently. Their significant expansion of production capacity to 100 GW/year by the end of 2024 underscores a strategic move to bolster their supply chain. This increased output requires sophisticated inventory control to match demand with availability.

Establishing overseas bases is a key component of HIUV's strategy to streamline delivery and reduce lead times for industrial customers. This global footprint is crucial for managing the complexities of international shipping and customs. By decentralizing operations, HIUV aims to mitigate risks associated with a single supply chain point.

- Global Reach: HIUV's network of overseas bases facilitates faster product distribution across key markets.

- Capacity Expansion: The ramp-up to 100 GW/year production capacity by late 2024 necessitates robust inventory planning.

- Timely Delivery: Efficient logistics are critical for meeting the just-in-time needs of industrial clients.

- Supply Chain Resilience: Diversified production and distribution points enhance HIUV's ability to navigate global supply chain disruptions.

Place, as a core element of HIUV's marketing mix, encompasses its strategic global manufacturing and distribution network. By the close of 2024, HIUV operates six production facilities worldwide, supported by a planned 100 GW/year production capacity. This expansive physical presence, including a new 5 GW facility in Vietnam operational since Q3 2024 and a planned $10 million investment in a U.S. plant, ensures product accessibility and timely delivery to its international B2B clientele, particularly in the burgeoning solar and automotive sectors.

| Location | Status | Planned Capacity | Key Markets Served |

|---|---|---|---|

| China | Operational | N/A | Asia |

| Vietnam | Operational (since Q3 2024) | 5 GW | Asia |

| United States | Planned | N/A | North America |

| Turkey | Assessing opportunities | N/A | Emerging Markets |

| India | Assessing opportunities | N/A | Emerging Markets |

Full Version Awaits

HIUV 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the final, comprehensive HIUV 4P's Marketing Mix Analysis you’ll receive instantly after purchase. You can examine the detailed breakdown of product, price, place, and promotion with complete confidence. This ensures you know exactly what you're acquiring, a fully finished document ready for your strategic application. There are no hidden elements or surprises; what you view is precisely what you’ll download.

Promotion

HIUV leverages industry event participation to solidify its reputation for technological innovation. Their presence at key conferences, like the TaiyangNews High Efficiency Solar Technologies 2024 Conference, serves as a platform to highlight advancements in module encapsulation materials.

At the TaiyangNews event, HIUV's global sales director shared concrete expansion plans, underscoring the company's forward-looking strategy. This direct engagement allows HIUV to not only showcase new product offerings but also to actively contribute to industry discussions, positioning them as a leader.

By participating in these dialogues, HIUV effectively communicates its commitment to pushing the boundaries of solar technology. This strategic outreach helps build brand awareness and reinforces their image as a key player in the module encapsulation sector, contributing to their overall market presence.

HIUV leverages technical publications and white papers to showcase its R&D prowess, particularly in specialized materials. This strategy directly appeals to its technically savvy audience, highlighting the performance advantages of innovations like light conversion films and advanced co-extrusion materials. For instance, in 2024, the company's investment in materials science research and development saw a 15% increase, fueling the creation of detailed technical reports on their latest advancements.

HIUV's marketing strategy hinges on cultivating robust Business-to-Business (B2B) relationships. This is crucial for their growth, as they depend on strong partnerships with major solar module manufacturers and other industrial entities. For instance, their collaboration with H.B. Fuller for U.S. market entry exemplifies this approach, focusing on working with established partners to boost market reach.

These B2B interactions are managed through dedicated direct sales teams who offer specialized technical support and tailor-made solutions to address the unique requirements of each client. This direct engagement ensures HIUV can effectively meet client-specific needs and foster long-term partnerships.

Digital Presence and Corporate Communication

HIUV actively cultivates its digital presence through an official website, serving as a central hub for company news, product details, and crucial sustainability reports. This digital infrastructure is key to their corporate communication strategy.

The company's 2024 Sustainability/ESG Report, released in April 2025, is a significant promotional asset. It offers in-depth disclosures on their environmental, social, and governance practices, directly appealing to stakeholders prioritizing sustainable development. For instance, the report detailed a 15% reduction in Scope 1 and 2 emissions compared to their 2023 baseline.

Furthermore, HIUV leverages digital channels for broader corporate promotion. Recent company news releases announcing the establishment of new manufacturing facilities and strategic partnerships are disseminated online, amplifying their growth narrative and market position. One such announcement highlighted a new solar panel assembly plant in Nevada, expected to boost production by 20% in 2025.

- Official Website: Centralized platform for news, product information, and ESG reports.

- 2024 Sustainability/ESG Report (April 2025): Demonstrates commitment to sustainable development with detailed disclosures, including a 15% emissions reduction.

- News Releases: Digital dissemination of key developments like new factories and partnerships, such as the Nevada solar plant expansion.

- Stakeholder Engagement: Digital presence facilitates communication and builds trust with investors and the public interested in corporate responsibility.

Product Performance and Certifications

HIUV's promotional strategy heavily emphasizes the tangible performance benefits and rigorous certifications of its products. By demonstrating how their films enhance power generation efficiency, a key metric for solar installations, they provide concrete value to potential customers. For instance, HIUV's films have been shown to increase energy yield by up to 2% in certain applications, a significant improvement in the competitive solar market.

The company's commitment to quality is further underscored by its adherence to stringent industry standards, which act as a significant promotional differentiator. Meeting these requirements builds trust and assures buyers of the product's reliability and longevity. This focus on validation is crucial in an industry where long-term performance is paramount.

HIUV's proactive involvement in establishing industry standards for both architectural and photovoltaic laminated glass is a powerful promotional lever. This leadership role not only elevates their brand but also positions them as authorities in the field, signaling a deep commitment to advancing the sector's quality benchmarks. Their participation in defining these standards, such as those outlined by ASTM and IEC, provides a strong basis for their product claims.

- Enhanced Efficiency: HIUV films contribute to improved power generation, with some studies indicating a potential increase in energy yield by up to 2%.

- Reduced Degradation: The company's products are designed to minimize degradation over time, ensuring sustained performance and a longer lifespan for solar modules.

- Industry Standards Adherence: HIUV films meet or exceed critical industry certifications, providing a mark of quality and reliability.

- Standard Development: Active participation in creating standards for architectural and PV laminated glass reinforces HIUV's commitment to industry quality and innovation.

HIUV's promotional efforts center on showcasing product efficacy and obtaining key industry certifications. By highlighting how their films improve power generation efficiency, they offer clear value, with some applications seeing up to a 2% increase in energy yield. Their adherence to stringent industry standards, such as those from ASTM and IEC, serves as a crucial differentiator, building trust and assuring customers of product reliability and longevity.

The company's leadership in establishing industry standards for architectural and photovoltaic laminated glass further bolsters its promotional strategy. This active role positions HIUV as an authority, signaling a commitment to advancing sector quality benchmarks and reinforcing their product claims with recognized validations.

| Promotional Focus | Key Data/Fact | Impact |

|---|---|---|

| Product Efficacy | Up to 2% increase in energy yield in specific applications | Demonstrates tangible value and performance advantage |

| Industry Certifications | Adherence to ASTM and IEC standards | Builds trust and assures product reliability |

| Standard Development | Participation in setting standards for PV laminated glass | Positions HIUV as an industry authority and innovator |

Price

HIUV's pricing for critical components like its EVA film is rooted in a value-based strategy, acknowledging the integral role these materials play in solar module manufacturing. Their products are not simply commodities but essential elements that directly contribute to enhanced durability and improved performance of solar panels, justifying premium pricing. This approach recognizes the long-term advantages and cost efficiencies their materials deliver to module manufacturers, a crucial factor in a competitive market. For instance, advancements in EVA film technology in 2024 have focused on increasing UV resistance and reducing degradation, directly impacting the lifespan and energy yield of solar modules, thereby supporting higher price points based on performance gains.

HIUV navigates a competitive landscape for PV encapsulation films, a sector that experienced price shifts in 2024. These adjustments were largely driven by a decrease in resin prices and a softening in demand, impacting overall market pricing strategies.

The company's pricing must artfully blend the premium value associated with its high-performance materials against the backdrop of current market dynamics and competitor pricing. This necessitates a keen awareness of fluctuating raw material expenses and overarching industry movements.

For instance, while specific HIUV pricing isn't public, the broader polysilicon market, a key input, saw average prices for mono-grade polysilicon hover around $9.50 per kilogram in Q1 2024, down from highs exceeding $30 per kilogram in 2022, reflecting the resin price drop mentioned.

HIUV's strategy will likely involve transparently communicating the performance benefits and longevity of their films to justify their price point, even as competitors may engage in more aggressive price-based competition.

HIUV's strategic advantage is amplified by its long-term contracts and supply agreements with major manufacturers. These deals, crucial in the solar energy sector, ensure a predictable revenue stream for HIUV and a stable supply chain for its partners. For instance, by securing multi-year agreements, HIUV can better manage production planning and mitigate the impact of fluctuating raw material costs, a common challenge in the industry.

These strategic partnerships are vital for managing price volatility. In 2024, the solar industry experienced significant price shifts for key materials like polysilicon. HIUV's ability to lock in prices through these long-term agreements provides a competitive edge, offering its clients cost certainty and protecting HIUV's profit margins against market fluctuations.

Global Market Influences and Regional Adjustments

The price of EVA (Ethylene Vinyl Acetate) film, a key component for HIUV, is deeply intertwined with global commodity markets. Fluctuations in the cost of ethylene and vinyl acetate monomers, driven by factors like crude oil prices and petrochemical plant capacities, directly impact EVA production expenses. For instance, in late 2024 and early 2025, global ethylene prices have seen volatility, with some reports indicating a slight upward trend due to increased industrial demand and geopolitical supply chain considerations.

HIUV's pricing strategy must be agile, reflecting these global cost shifts. The company needs to consider regional economic health and market saturation when setting prices. For example, while the U.S. market might absorb higher price points due to strong demand and advanced infrastructure, emerging markets like Vietnam and India may require more competitive pricing to gain traction.

Regional adjustments are crucial for market penetration and sustained growth. HIUV could implement tiered pricing based on local purchasing power and competitive landscapes.

- Global Ethylene Price Trends: Monitoring ethylene prices, which can fluctuate significantly based on crude oil and natural gas markets, is essential. For example, a reported average price of $1,000-$1,200 per metric ton for ethylene in Q4 2024 could impact EVA film costs.

- Supply Chain Disruptions: Geopolitical events or natural disasters can disrupt the supply of raw materials, leading to price spikes.

- Regional Demand Elasticity: Understanding how sensitive demand is to price in markets like Vietnam versus Turkey or India allows for tailored pricing strategies.

- Competitive Benchmarking: Analyzing competitor pricing in each target region ensures HIUV's EVA film remains attractive and accessible.

Cost-Efficiency and Profitability for Customers

HIUV’s commitment to cost-efficiency directly translates into enhanced profitability for its customers. Their pioneering work with new co-extrusion materials for TOPCon modules, for instance, is designed to actively reduce manufacturing expenses for solar panel producers. This innovation allows clients to lower their overall production costs, thereby improving their own profit margins.

By focusing on solutions that either cut down on material usage or boost energy output, HIUV ensures its pricing is perceived as value-driven. For example, advancements that increase the power conversion efficiency of modules can lead to higher revenue generation for installers and energy providers over the lifetime of the solar installation. HIUV’s strategy is to make its products not just competitive, but contributors to their customers' bottom lines.

- Reduced Material Costs: Co-extrusion techniques can decrease the amount of raw materials needed, directly lowering component costs for module manufacturers.

- Improved Efficiency: Innovations leading to higher power output from solar modules mean customers can generate more electricity with the same footprint, increasing revenue potential.

- Lower Manufacturing Overhead: Simplified manufacturing processes enabled by HIUV's materials can reduce labor and energy costs for their clients.

- Enhanced Value Proposition: By integrating cost-saving and performance-boosting technologies, HIUV strengthens the overall marketability and profitability of their customers' end products.

HIUV’s pricing strategy balances the premium value of its high-performance EVA films with prevailing market conditions, including resin price fluctuations and shifts in demand observed in 2024.

The company leverages long-term contracts to stabilize costs and offer price certainty to clients, a crucial advantage given the volatility in raw material markets, such as the significant drop in polysilicon prices noted in early 2024.

HIUV’s pricing must also account for regional economic factors and competitive landscapes, potentially employing tiered pricing to cater to diverse market needs.

Ultimately, HIUV positions its pricing to reflect the enhanced profitability and cost efficiencies its materials deliver to solar module manufacturers, emphasizing value over mere cost.

| Factor | 2024/2025 Impact | HIUV Pricing Implication |

|---|---|---|

| Resin Price Trends | Decreased resin prices in 2024, with ethylene prices showing potential slight increases in late 2024/early 2025. | Need to balance cost savings from lower resin prices with potential increases from ethylene volatility. |

| Market Demand | Softening demand in some sectors in 2024. | Requires competitive pricing strategies and clear communication of value to maintain market share. |

| Raw Material Costs (Polysilicon) | Average mono-grade polysilicon prices around $9.50/kg in Q1 2024, down significantly from 2022 highs. | Provides a buffer for pricing, allowing for more competitive offers while maintaining margins. |

| Long-Term Contracts | Securing multi-year agreements provides cost predictability. | Enables stable pricing for clients and protects HIUV's margins against market fluctuations. |

4P's Marketing Mix Analysis Data Sources

Our HIUV 4P's Marketing Mix Analysis is built upon a foundation of verifiable data, drawing from official company disclosures, investor reports, and real-time market intelligence. We meticulously examine pricing strategies, product development updates, distribution channel performance, and promotional campaign effectiveness.