HIUV Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HIUV Bundle

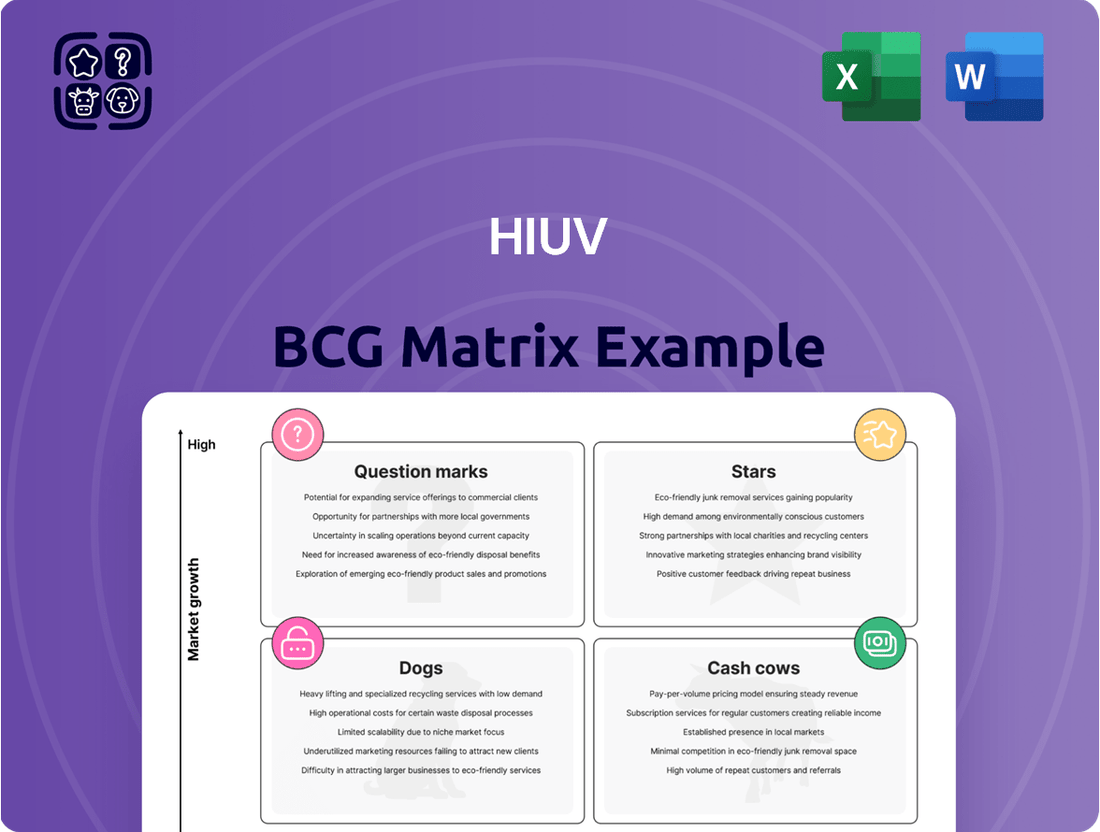

Understanding the BCG Matrix is crucial for any business looking to optimize its product portfolio and resource allocation. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and relative market share, offering a clear visual representation of your business's health.

Imagine knowing exactly which products are driving your growth and which are holding you back. The full BCG Matrix report provides this clarity, offering detailed quadrant placements and actionable insights.

Don't be left guessing about your company's strategic direction. Purchase the full BCG Matrix to gain a comprehensive understanding of your product landscape and unlock smarter investment decisions.

Ready to transform your product strategy? Get the complete BCG Matrix and discover a data-backed roadmap to maximize profitability and minimize risk.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

HIUV's advanced EVA films, specifically designed for TOPCon and HJT solar cells, are positioned as a strong contender in the rapidly expanding solar market. The industry's shift towards these higher efficiency technologies drives significant demand for specialized encapsulants.

These films boast superior UV resistance and anti-potential induced degradation (PID) capabilities, which are critical for ensuring the long-term performance and reliability of advanced solar modules. As solar manufacturers strive for increased power generation and module durability, the need for such high-performance materials continues to grow. For instance, the global solar PV market was valued at approximately $230 billion in 2023 and is projected to reach over $400 billion by 2030, with TOPCon and HJT technologies expected to capture a substantial share of this growth.

Light Conversion Films, developed by HIUV, are a crucial innovation in solar technology, specifically targeting Heterojunction (HJT) solar cells. These films are engineered to combat UV sensitivity and the performance degradation that often plagues advanced solar cell designs. By mitigating these issues, HIUV positions itself as a frontrunner in providing advanced encapsulant solutions for the solar industry.

The primary benefit of Light Conversion Films lies in their ability to enhance the long-term power generation efficiency of solar modules. This is a significant advantage in a market increasingly focused on durability and sustained output. The technology directly tackles a major hurdle in the widespread adoption and reliability of next-generation solar technologies.

A key metric highlighting the impact of these films is their proven ability to reduce annual degradation in HJT cells by approximately 0.5%. This seemingly small reduction translates into substantial improvements in energy yield over the typical 25-30 year lifespan of a solar module. For instance, a 0.5% annual improvement could mean an extra 12.5% to 15% more energy generated over the module's life compared to un-filmed cells.

This performance enhancement makes HIUV's Light Conversion Films a highly compelling offering in the rapidly expanding segment of advanced solar cell technologies. As the solar market continues to grow, with global solar capacity projected to reach over 2,500 GW by 2025, solutions that guarantee higher efficiency and longevity are in high demand.

HIUV's black films are a prime example of a "Star" in the HIUV BCG Matrix for solar modules. These films enhance power generation, adding an estimated 2 million kWh/MW over their 25-year lifespan, a significant performance boost.

The demand for these specialized films is surging as the solar market prioritizes both visual appeal and maximizing energy output. In 2024, the global solar energy market continued its robust growth, with installations reaching record levels, underscoring the need for efficiency-enhancing components like HIUV's black films.

PVE Glass Encapsulation Film for BIPV and Automotive

HIUV's PVE glass encapsulation film is a standout performer, boasting high-strength adhesion along with impressive heat and noise reduction. This innovation is driving HIUV's strategic push into the burgeoning Building-Integrated Photovoltaics (BIPV) and automotive glass markets. The company is leveraging its expertise to meet the unique demands of solar integration in new buildings and the quest for lighter vehicles.

The BIPV sector represents a significant opportunity, with global market projections indicating robust growth. For instance, the BIPV market was valued at approximately USD 18.5 billion in 2023 and is anticipated to reach USD 45 billion by 2030, experiencing a compound annual growth rate (CAGR) of around 13.8%. This expansion underscores the demand for advanced materials like HIUV's PVE film.

- High-Strength Adhesion: Ensures durability and reliable performance in diverse environmental conditions.

- Heat and Noise Reduction: Enhances occupant comfort and energy efficiency in buildings and vehicles.

- BIPV Market Expansion: Targets a high-growth sector with increasing adoption of integrated solar solutions.

- Automotive Glass Applications: Addresses the need for lightweight, functional glass in modern vehicle design.

Next-Generation Co-extrusion Materials

HIUV's introduction of next-generation co-extrusion materials is a strategic play designed to significantly reduce costs for TOPCon solar modules. These innovative materials aim to achieve an 8% cost reduction compared to existing solutions, directly addressing the industry's persistent demand for lower manufacturing expenses. This focus on cost efficiency, without compromising performance, is crucial for gaining a competitive edge in the solar market.

The market for TOPCon solar technology is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond. HIUV's new materials are specifically engineered to integrate seamlessly into these advanced module architectures. By facilitating cost savings, these materials are well-positioned to capitalize on the increasing adoption of TOPCon technology globally.

- Cost Reduction Target: 8% lower cost for TOPCon modules compared to traditional materials.

- Market Focus: Addressing the solar industry's ongoing need for cost efficiency.

- Performance: Designed to maintain high performance standards despite cost reductions.

- Strategic Positioning: Aligned with the growth trajectory of advanced solar module technologies like TOPCon.

HIUV's black films represent a "Star" product within its BCG Matrix for solar applications. These films not only enhance the aesthetic appeal of solar modules but also contribute significantly to power generation, adding an estimated 2 million kWh/MW over a 25-year lifespan. This increased energy yield is a key driver for their strong market position and growing demand, especially as the solar industry, which saw robust installation growth in 2024, continues to prioritize efficiency and visual integration.

| Product | BCG Category | Key Benefit | Market Relevance | Projected Impact |

| HIUV Black Films | Star | Enhanced power generation and aesthetics | Growing demand for efficient and attractive solar modules | 2 million kWh/MW added over 25 years |

What is included in the product

The HIUV BCG Matrix analyzes products based on High Investment, High Uncertainty, and Value.

It guides strategic decisions for investment, divestment, or continued management.

Quickly identify underperforming units for targeted intervention.

Cash Cows

HIUV's standard transparent EVA film is a solid Cash Cow. This product has a strong foothold in the solar encapsulation market, which, while mature, is quite stable. It’s the go-to choice for many because of its great light transmission, strong bonding capabilities, and durability against different weather conditions.

Even though it doesn't see the rapid growth of newer technologies, this EVA film reliably brings in substantial cash. This is thanks to its well-established market position and the company’s efficient manufacturing processes. For instance, the global EVA film market was valued at approximately $1.5 billion in 2023 and is projected to grow at a modest CAGR of around 4% through 2030, highlighting its stable, cash-generating nature.

The white synergistic EVA film functions as a robust cash cow for HIUV, holding a significant market share within its specialized segment of the solar industry. This product is instrumental in solar module designs that require enhanced back reflectivity to boost overall efficiency, a feature driving its consistent demand.

Its widespread adoption underscores its role as a reliable revenue generator, capitalizing on a mature market. For instance, in 2023, the global solar EVA film market reached an estimated USD 2.5 billion, with white EVA films constituting a substantial portion due to their performance benefits in bifacial solar modules.

HIUV's established Polyolefin Elastomer (POE) films are a strong Cash Cow within its BCG matrix. These multi-layer co-extruded films address the increasing market need for enhanced durability and resistance to Potential Induced Degradation (PID) in solar modules. The demand for these high-performance films is growing significantly, with the global solar encapsulation film market projected to reach USD 2.2 billion by 2027, growing at a CAGR of 6.5%.

HIUV's existing market leadership in POE films allows for consistent and predictable cash flow. This mature product line requires minimal additional investment for growth, as it already commands a substantial market share. For instance, the solar industry's expansion, with global solar capacity additions reaching an estimated 400 GW in 2023, directly fuels the demand for HIUV's reliable POE film solutions.

Core PV Module Encapsulation Films

HIUV's core PV module encapsulation films, a range of transparent and white EVA and POE products, represent the company's established revenue generators. These products form the bedrock of HIUV's financial performance, consistently contributing to its earnings.

Despite a challenging global market and fierce competition in 2024, these foundational encapsulation films proved their resilience. They continued to be a vital business segment, underpinning HIUV's profitability and cash flow generation.

- Established Revenue Stream: The established portfolio of EVA and POE encapsulation films consistently generates significant revenue for HIUV.

- Resilience in 2024: These core products demonstrated strong performance, maintaining their importance even amidst intense competition and a complex global economic environment during 2024.

- Profitability Driver: Their reliable earnings generation makes them crucial for HIUV's overall financial health and ability to fund growth initiatives.

- Market Position: The widespread adoption and demand for these established encapsulation solutions solidify HIUV's position in the market.

Mature Product Lines with Optimized Production

Mature product lines, such as HIUV’s established offerings, are characterized by highly refined production methods. This optimization leads to significant economies of scale, directly translating into robust profit margins and a consistent, strong cash flow. In 2024, these mature products are expected to contribute substantially to HIUV's bottom line, requiring very little in terms of marketing spend. Their efficiency allows the company to essentially harvest profits with minimal ongoing investment, bolstering overall financial stability.

- High Profit Margins: Optimized production drives down per-unit costs, maximizing profitability.

- Strong Cash Flow Generation: Consistent sales of mature products provide a reliable income stream.

- Low Investment Needs: Reduced promotional and development expenditures allow for passive profit extraction.

- Contribution to Financial Health: These products are the bedrock of HIUV’s financial strength, funding growth in other areas.

HIUV's transparent and white EVA films, along with its POE films, serve as its primary Cash Cows. These products have a well-established presence in the solar encapsulation market, a segment that, while mature, offers stable demand. Their consistent performance and HIUV's efficient production processes ensure substantial and reliable cash generation.

The global solar encapsulation film market, valued around $2.5 billion in 2023, is projected to grow modestly. HIUV's mature products, benefiting from economies of scale and optimized production, yield high profit margins. For example, the solar industry's significant capacity additions in 2023, estimated at 400 GW, directly support the ongoing demand for these reliable encapsulation solutions.

| Product Category | Market Status | Cash Flow Generation | 2024 Outlook |

|---|---|---|---|

| Transparent EVA Film | Mature, Stable | High & Consistent | Continued strong contribution |

| White EVA Film | Mature, Niche Demand | High & Consistent | Reliable revenue stream |

| POE Films | Growing, High Performance | Strong & Predictable | Benefiting from solar expansion |

What You See Is What You Get

HIUV BCG Matrix

The HIUV BCG Matrix preview you are viewing is precisely the document you will receive immediately after your purchase. This means you're getting the complete, unwatermarked, and professionally formatted analysis, ready for immediate integration into your strategic planning processes without any hidden surprises or demo limitations.

Dogs

Obsolete or low-demand 'other related new materials' represent products that haven't caught on in the market or have been replaced by newer, better technologies. These are typically found in slow-growing sectors where they hold very little market share, meaning they drain resources without bringing in much profit. For instance, think of certain advanced composite materials developed in the early 2010s that were quickly surpassed by lighter, stronger alternatives by 2018, leading to their decline.

These materials often stem from research and development projects that, despite initial promise, never translated into widespread commercial success. For example, a specific type of bio-plastic designed for single-use packaging, which saw limited adoption due to cost and performance issues compared to established petrochemical plastics, might fit here. In 2024, the global market for such niche, underdeveloped materials is often characterized by declining sales volumes and a lack of investment interest.

Standard EVA films in highly commoditized sectors, especially those facing intense competition, can be classified as dogs within the HIUV BCG Matrix. In 2024, the global EVA film market, while robust overall, sees certain standard product lines struggling due to price wars and oversupply. For instance, basic EVA films used in less demanding solar module encapsulation, where differentiation is minimal, often operate on the edge of profitability.

If HIUV possesses a low market share in these specific, commoditized EVA film sub-segments, their contribution might be limited to merely breaking even or even incurring losses. This scenario ties up valuable capital and resources without generating significant returns, hindering the company's overall growth potential. The pressure from numerous smaller manufacturers, often with lower overheads, further exacerbates the challenge in these mature markets.

Underperforming regional product lines, often seen as the 'Dogs' in the BCG matrix, represent offerings that struggle to gain traction in specific geographic markets. These might be due to factors like fierce local competition, regulatory hurdles, or simply a lack of consumer appeal in that particular area.

For instance, a specialty chemical formulation that thrives in North America might be a dog in Southeast Asia if local manufacturers offer similar, cheaper alternatives. In 2024, such a product line might only contribute 2% to the overall regional revenue while demanding 10% of the sales force's attention, yielding minimal profit.

These 'dog' segments are characterized by low sales volume and a small market share within their specific region. The effort required to maintain or grow these product lines often outweighs the meager returns, making them a drain on resources that could be better allocated elsewhere.

Consider a scenario where a company's lubricant product line in a particular European country saw its market share shrink from 8% in 2023 to 5% by mid-2024, facing aggressive pricing from a dominant local competitor. This underperformance necessitates a strategic review, as it represents a significant opportunity cost.

Legacy Products with Declining Demand

Legacy products, particularly those with older solar cell technologies or outdated encapsulant materials, are increasingly being classified as dogs within the BCG matrix. The solar industry is rapidly evolving, with a significant shift towards advancements like PERC (Passivated Emitter and Rear Contact) and TOPCon (Tunnel Oxide Passivated Contact) solar cells. These newer technologies often require different materials, leading to a decline in demand for older formulations. For instance, the market share for traditional polycrystalline silicon cells, while still present, has been steadily eroded by the more efficient monocrystalline silicon cells since the early 2020s.

Maintaining production lines for these legacy items can become financially challenging. As market relevance diminishes, so does profitability, making it difficult to justify the ongoing investment in manufacturing and research and development. The shrinking demand means lower sales volumes, which in turn drives up the per-unit production cost. This creates a negative feedback loop where the product becomes less competitive and even less profitable.

- Declining Market Share: Products based on older solar cell architectures are seeing their market share shrink as newer, more efficient technologies gain traction.

- Technological Obsolescence: The rapid pace of innovation in solar technology, such as the widespread adoption of TOPCon cells, renders older materials and formulations less desirable.

- Cost-Inefficiency: Reduced demand coupled with the need to maintain specialized production lines for legacy products leads to higher per-unit costs, impacting profitability.

- Reduced Investment Appeal: Companies often divest or discontinue dog products as they refocus resources on high-growth potential areas, reflecting a strategic shift away from declining segments.

Inefficiently Produced Niche Materials

Niche materials developed by HIUV could fall into the Dogs category if their production is inefficient. This means that despite a potential market for these specialized items, the internal processes make them too expensive to produce, thus hindering profitability.

These products often face difficulties competing effectively, either on price or on the quality expected by consumers, primarily due to these operational hurdles. The result is a low market share and very little cash coming in for the company.

- High Production Costs: For instance, if a specialized polymer required a complex, multi-stage synthesis process that experienced yield issues, the cost per kilogram could be significantly higher than competitors. In 2024, a company in a similar situation might see production costs for a niche material exceeding market price by 30-40%.

- Low Profit Margins: Inefficient production directly translates to thin or even negative profit margins. If HIUV's niche material had a production cost of $50/kg but could only be sold for $55/kg, its profit margin would be a mere 10%, severely limiting its ability to generate capital.

- Stagnant Market Share: Due to the price disadvantage stemming from inefficient production, these materials struggle to gain traction. A niche material might capture only 2-5% of its potential market if its production costs prevent competitive pricing.

Dogs in the HIUV BCG Matrix represent products with low market share in slow-growing industries. These offerings often struggle with profitability due to factors like obsolescence, high production costs, or intense competition. For example, older solar cell technologies, like polycrystalline silicon, have seen their market share decline significantly as more efficient alternatives such as TOPCon gain prevalence.

In 2024, many standard EVA films in commoditized sectors are considered dogs, especially those facing price wars. If HIUV's market share in these segments is minimal, these products may only break even or incur losses, tying up capital without substantial returns.

Underperforming regional product lines also fit the dog category, such as a specialty chemical formulation in Southeast Asia that faces cheaper local alternatives, contributing only 2% to regional revenue in 2024 while demanding 10% of sales force attention.

Niche materials with inefficient production processes can become dogs if their high costs prevent competitive pricing, leading to low profit margins and stagnant market share, potentially capturing only 2-5% of their market.

| Product Category | Market Growth | Market Share | Profitability | 2024 Example |

|---|---|---|---|---|

| Legacy Solar Cell Materials | Low | Low | Low/Negative | Polycrystalline silicon cell encapsulants facing competition from TOPCon-compatible materials. |

| Commoditized EVA Films | Low | Low | Low/Negative | Standard EVA films in solar encapsulation where price wars are prevalent. |

| Underperforming Regional Products | Low | Low | Low/Negative | A specialty chemical with limited adoption in a specific European market due to local competition. |

| Niche Materials (Inefficient Production) | Low | Low | Low/Negative | A specialized polymer with high production costs (e.g., 30-40% above market price) limiting competitive pricing. |

Question Marks

HIUV's proprietary HTPO material is a key component for perovskite solar cells, engineered to enhance durability by maintaining strong adhesion to perovskite layers and mitigating yellowing, a common degradation issue. This innovation addresses a critical challenge in perovskite technology. The perovskite solar cell market is projected for substantial growth, with some analyses suggesting it could reach tens of billions of dollars by the early 2030s, driven by increasing efficiency and lower manufacturing costs compared to silicon.

Currently, HIUV holds a minimal market share within this emerging perovskite solar cell sector. However, the company's significant investment in HTPO development positions it to capture a substantial portion of this rapidly expanding market. If successful, this strategic investment could elevate HIUV's perovskite business from a question mark to a market-leading Star.

HIUV's PDCLC color-adjustable smart glass films represent a potential star in the BCG matrix, targeting high-growth sectors like automotive and premium construction with their dynamic tinting capabilities. These films tap into strong market trends for energy efficiency and enhanced aesthetics, suggesting significant future demand.

Despite the promising market outlook, PDCLC films are likely still in their early stages of market penetration. Their current market share is probably modest, necessitating considerable investment in brand building and expanding manufacturing capacity to capitalize on the growth potential. For instance, the global smart glass market was valued at approximately $5.3 billion in 2023 and is projected to reach over $11 billion by 2030, indicating the rapid expansion PDCLC can aim for.

HIUV's advanced materials for emerging Building-Integrated Photovoltaics (BIPV) applications, particularly colorful films, fall into the question mark category of the BCG matrix. While the overall BIPV market is experiencing robust growth, projected to reach over $13 billion by 2025 according to some industry forecasts, HIUV's specific penetration in these niche, high-growth segments may still be developing. This presents a strategic opportunity for increased investment to secure a stronger market position.

New Materials for New Energy Vehicle Glass

HIUV's move into eco-friendly surface materials, particularly for new energy vehicle (NEV) glass, positions it in a rapidly expanding sector. This suggests a Stars or Question Marks category within the BCG matrix, given the high growth potential of the EV market and the company's likely nascent position in this specialized niche. The demand for lightweight and energy-efficient automotive components is a strong tailwind for these new materials.

The global automotive glass market was valued at approximately $50 billion in 2023 and is projected to reach over $65 billion by 2028, with NEV glass being a significant growth driver. HIUV's investment in these advanced materials, aiming to capture a share of this burgeoning market, will require substantial capital to build manufacturing capacity and establish distribution networks.

- Market Opportunity: The NEV sector is experiencing robust growth, with global NEV sales projected to exceed 15 million units in 2024, up from approximately 14 million in 2023. This creates a substantial demand for specialized glass materials.

- Investment Needs: Developing and scaling production for advanced materials often requires significant upfront investment in research and development, as well as manufacturing infrastructure, placing these products likely in the Question Marks quadrant initially.

- Competitive Landscape: While the market is growing, HIUV will face established players and new entrants vying for market share in the high-tech automotive glass segment.

- Strategic Importance: This expansion aligns with global sustainability trends and the automotive industry's shift towards electrification, making it a strategically vital area for future growth.

Experimental Material Formulations for Future Solar Technologies

HIUV's exploration into novel materials for next-generation solar cells places these initiatives squarely in the question mark category of the BCG matrix. These advanced formulations, aiming for efficiencies exceeding current commercial limits or incorporating unique functionalities, represent high-growth potential but are currently nascent. For example, research into perovskite-silicon tandem cells, which could theoretically surpass the 30% efficiency barrier, is ongoing. In 2024, the global market for perovskite solar cells, while still emerging, is projected to experience significant growth, driven by ongoing R&D and pilot manufacturing.

- Perovskite-silicon tandem cells are a key focus, targeting efficiencies above 30%.

- These materials currently have no market share, consuming substantial R&D investment.

- The potential for disruptive market entry is high if these experimental formulations prove viable.

- Strategic decisions regarding continued funding or redirection of resources are critical for these long-term bets.

HIUV's advanced materials for Building-Integrated Photovoltaics (BIPV), particularly their colorful films, are positioned as Question Marks. While the broader BIPV market is expanding rapidly, with forecasts suggesting it could exceed $13 billion by 2025, HIUV's specific penetration in these niche, high-growth areas is still developing. This situation calls for increased strategic investment to solidify a more dominant market presence.

HIUV's entry into eco-friendly surface materials for new energy vehicles (NEVs) also falls into the Question Marks category. The NEV market's considerable growth, with global sales anticipated to surpass 15 million units in 2024, creates a significant demand for specialized glass. However, HIUV's position in this high-tech automotive glass segment is likely nascent, requiring substantial investment in manufacturing and distribution to compete effectively.

The company's exploration into novel materials for next-generation solar cells, such as perovskite-silicon tandem cells targeting over 30% efficiency, represents high-potential but currently underdeveloped ventures. These initiatives have no current market share, demanding significant R&D funding, but offer the possibility of disruptive market entry if successful.

| HIUV Product Category | BCG Matrix Position | Market Context | HIUV's Current Standing | Strategic Implication |

|---|---|---|---|---|

| BIPV Colorful Films | Question Mark | BIPV market projected >$13B by 2025; robust growth. | Nascent penetration in niche, high-growth segments. | Requires increased investment for market share growth. |

| NEV Eco-Friendly Surface Materials | Question Mark | NEV market sales >15M units in 2024; strong demand. | Likely nascent position in high-tech automotive glass. | Substantial investment needed for manufacturing and distribution. |

| Next-Gen Solar Cell Materials (e.g., Perovskite-Silicon Tandem) | Question Mark | Emerging market, high R&D focus. | No current market share; high R&D investment. | Potential for disruptive entry if viable; critical funding decisions needed. |

BCG Matrix Data Sources

Our HIUV BCG Matrix leverages comprehensive market data, encompassing sales figures, customer feedback, and competitive landscape analysis to provide a robust strategic overview.