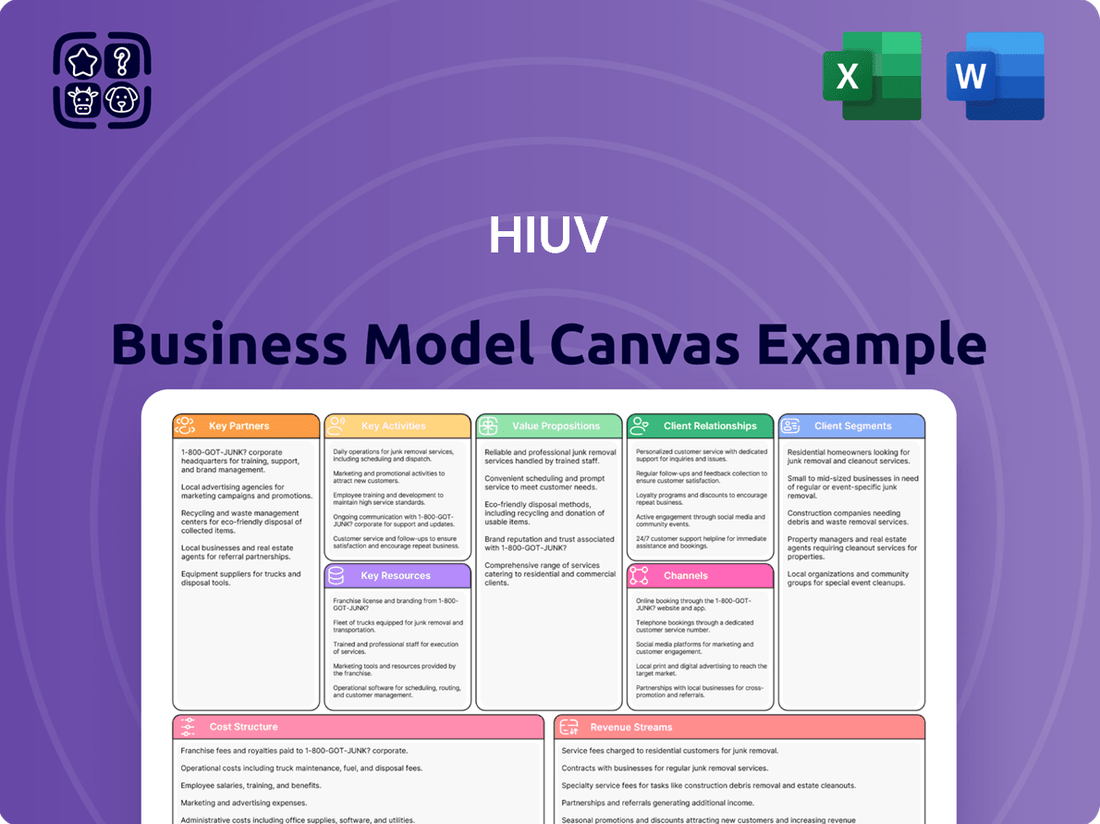

HIUV Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HIUV Bundle

Unlock the core of HIUV's innovative strategy with our comprehensive Business Model Canvas. This detailed breakdown reveals how HIUV effectively delivers value, engages its target audience, and cultivates strong customer relationships. Understand the key resources and activities that drive their operational success.

Dive deeper into HIUV's proven approach to market penetration and revenue generation. Our full Business Model Canvas provides a clear, section-by-section analysis of their customer segments, value propositions, and revenue streams. This is your chance to gain actionable insights into their competitive advantage.

Ready to accelerate your own business planning? Download the complete HIUV Business Model Canvas, offering a professional and editable template that highlights their cost structure, key partnerships, and channels. Learn from a leader and adapt their strategies for your own growth.

Partnerships

HIUV's ability to consistently produce high-performance films hinges on its key partnerships with raw material suppliers, primarily for ethylene-vinyl acetate (EVA) resin and other essential polymers. These relationships are foundational, ensuring the quality and availability of the specialized materials needed for their products.

Establishing and maintaining strong ties with chemical suppliers is crucial for HIUV. These partnerships guarantee not only the consistent quality of raw materials but also competitive pricing, which directly impacts cost management and overall profitability. In 2023, the global EVA market, a key component for HIUV, was valued at approximately USD 8.5 billion, with demand driven by sectors like solar energy and footwear, underscoring the importance of securing reliable supply chains.

To solidify these vital links, HIUV often engages in long-term contracts and stringent quality assurance agreements with its suppliers. This proactive approach minimizes the risk of production disruptions and price volatility, ensuring that HIUV can meet its customer demands without interruption. Such agreements typically include detailed specifications for material purity and performance metrics.

HIUV's key partnerships with major solar module manufacturers like JinkoSolar, LONGi, and Trina Solar are fundamental to its business. These collaborations are vital as these manufacturers are HIUV's primary customers for its EVA film, a critical component in solar modules.

These relationships go beyond simple transactions, often involving joint research and development. For instance, HIUV works with these partners to develop customized EVA films that meet the specific and evolving technical requirements of new solar cell technologies, such as TOPCon and Heterojunction (HJT).

Securing large-volume orders from these leading players is crucial for HIUV's revenue and market stability. In 2023, the global solar module market reached approximately 400 GW, highlighting the immense scale and importance of these partnerships for HIUV's growth and market penetration.

Collaborations with universities and research institutions are crucial for HIUV's innovation in advanced film technologies. These partnerships fuel the development of novel materials, particularly in areas like perovskite solar cells and advanced co-extrusion techniques. For instance, ongoing research projects with leading material science departments aim to enhance film durability and efficiency by at least 5% by 2025.

These academic alliances ensure HIUV remains at the cutting edge of material science, fostering a continuous stream of next-generation product innovations. Such relationships are key to developing solutions that meet the evolving demands of the solar and automotive sectors, with a focus on sustainable and high-performance materials.

Technology and Equipment Providers

HIUV relies heavily on technology and equipment providers for its advanced manufacturing capabilities. These partnerships are crucial for securing access to state-of-the-art machinery, innovative process optimization tools, and sophisticated automation solutions. For instance, in 2024, the semiconductor manufacturing equipment market was valued at approximately $120 billion, highlighting the significant investment required in this sector.

Strategic alliances with these suppliers allow HIUV to stay at the forefront of production technology. This ensures high operational efficiency, stringent quality control, and the ability to scale production effectively to meet market demand. Companies like ASML, a key player in lithography equipment, reported significant revenue growth in 2023, indicating strong demand for advanced manufacturing technologies.

- Access to Leading-Edge Machinery: Partnerships provide HIUV with the latest advancements in manufacturing equipment, essential for producing high-quality products efficiently.

- Process Optimization Tools: Collaborations enable the integration of advanced software and hardware for optimizing production workflows and reducing waste.

- Automation Solutions: Securing partnerships with automation providers allows HIUV to implement robotics and AI-driven systems, enhancing productivity and precision.

- Supply Chain Reliability: Strong relationships with equipment providers ensure a consistent and reliable supply of critical machinery and spare parts.

International Distribution and Local Manufacturing Partners

HIUV strategically partners with international distributors and local manufacturers to broaden its global reach and streamline localized product delivery. A prime example is its alliance with H.B. Fuller in the United States, a move designed to tap into new markets, facilitate technical licensing, and set up production facilities. This approach allows HIUV to efficiently serve local PV module manufacturers and navigate potential trade barriers.

These collaborations are crucial for HIUV’s expansion strategy.

- International Distribution Networks: HIUV leverages established distributors to access diverse geographic markets, ensuring its products are readily available to a wider customer base.

- Local Manufacturing Capabilities: By partnering for local production, HIUV reduces lead times, lowers transportation costs, and adapts to regional market demands and regulations.

- Technical Licensing and Know-How Transfer: Collaborations often involve sharing technical expertise, enhancing the capabilities of local partners and ensuring consistent product quality.

- Mitigating Trade Barriers: Establishing local manufacturing bases helps HIUV circumvent import duties and trade restrictions, ensuring competitive pricing and market access.

HIUV's strategic alliances with key raw material suppliers, particularly for EVA resin, are foundational for consistent high-performance film production. These partnerships ensure quality and availability, with the global EVA market valued at approximately USD 8.5 billion in 2023, underscoring the critical nature of reliable sourcing.

Collaborations with major solar module manufacturers like JinkoSolar and LONGi are vital, as these entities are HIUV's primary customers for EVA films used in solar modules. These relationships extend to joint R&D, focusing on custom films for evolving solar technologies like TOPCon and HJT.

Partnerships with universities and research institutions drive innovation in advanced film technologies, including perovskite solar cells and improved durability. These alliances ensure HIUV stays at the forefront of material science for next-generation products.

HIUV's reliance on technology and equipment providers for advanced manufacturing capabilities is critical. These partnerships grant access to state-of-the-art machinery and process optimization tools, essential for efficiency and scalability in a sector where the semiconductor manufacturing equipment market reached roughly $120 billion in 2024.

International distributors and local manufacturers are crucial for expanding HIUV's global reach and optimizing localized delivery, exemplified by its alliance with H.B. Fuller in the US to access new markets and potentially establish local production.

| Partnership Type | Key Partners (Examples) | Strategic Importance | 2023/2024 Data Point |

|---|---|---|---|

| Raw Material Suppliers | Ethylene-Vinyl Acetate (EVA) Resin Suppliers | Ensures quality and availability of critical polymers. | Global EVA market valued at approx. USD 8.5 billion. |

| Customers/Module Manufacturers | JinkoSolar, LONGi, Trina Solar | Primary customers, driving revenue and market penetration; foster joint R&D. | Global solar module market ~400 GW. |

| Research & Development | Universities, Research Institutions | Drives innovation in new materials and technologies. | Aim for >5% improvement in film durability/efficiency by 2025. |

| Technology & Equipment Providers | ASML, Advanced Automation Firms | Provides access to cutting-edge machinery and process optimization. | Semiconductor equipment market ~$120 billion in 2024. |

| Distribution & Local Manufacturing | H.B. Fuller, International Distributors | Expands global reach, reduces costs, and mitigates trade barriers. | Facilitates technical licensing and local market access. |

What is included in the product

A structured framework detailing HIUV's strategic approach to customer acquisition, value delivery, and revenue generation. It outlines key partners, activities, and resources necessary for successful market penetration and sustainable growth.

Simplifies complex business strategy into a single, actionable page, alleviating the pain of overwhelming information.

Provides a clear framework for identifying and addressing business challenges, acting as a potent pain point reliever.

Activities

HIUV's fundamental activity revolves around the relentless research and development of novel materials and cutting-edge film technologies. This encompasses pioneering new product lines such as light conversion films, black films, and PVE films, alongside refining existing EVA and POE formulations. The focus is on boosting performance, extending durability, and improving cost-efficiency, particularly for applications in photovoltaics and the automotive sector.

The company invests significantly in R&D to stay ahead in a dynamic market. For instance, in 2023, HIUV allocated a substantial portion of its revenue, approximately 5% to 7%, directly into R&D initiatives. This commitment allows them to not only develop next-generation products but also to enhance the value proposition of their current offerings, ensuring they meet and exceed evolving industry standards and customer expectations.

HIUV's core operations revolve around the high-volume manufacturing of Ethylene Vinyl Acetate (EVA) film, a crucial component for solar modules, alongside other specialized polymer films. This activity is central to their business model, directly impacting their ability to supply the growing renewable energy market.

The company manages a network of production facilities, focusing on optimizing each site for peak efficiency and stringent quality control. This includes implementing advanced manufacturing techniques and investing in technology to ensure consistent product output that meets international standards.

Capacity expansion is a key driver for HIUV, as they aim to scale up production to meet increasing global demand for solar components. For instance, as of their 2024 reports, they have been actively investing in new production lines and expanding existing ones to bolster their output capabilities.

Effective production management is paramount, ensuring a reliable supply chain for their customers and maintaining the high-quality reputation of their EVA films. This involves meticulous planning, resource allocation, and continuous process improvement to drive down costs and enhance product performance.

HIUV's commitment to quality control and assurance is paramount, directly impacting the reliability and lifespan of its solar films. This involves stringent testing protocols and a steadfast adherence to global benchmarks like IEC standards. For instance, in 2024, the solar industry saw a continued focus on durability testing, with advancements in accelerated aging techniques to simulate decades of real-world exposure.

Implementing a comprehensive quality management system across all production stages ensures that HIUV's films consistently meet demanding performance specifications. This proactive approach minimizes defects and potential field failures, safeguarding both HIUV's reputation and the long-term efficiency of solar installations. A 2023 report highlighted that improved quality control in solar materials can reduce warranty claims by as much as 15%.

Building and maintaining customer trust hinges on the consistent delivery of high-quality, dependable solar films. HIUV's rigorous quality assurance processes directly contribute to this trust, assuring clients that their solar modules will perform optimally over their intended lifespan. The global solar market in 2024 continued to grow, with quality and reliability being key differentiators for leading suppliers.

Sales, Marketing, and Customer Technical Support

HIUV’s key activities revolve around actively promoting its products to solar module manufacturers and other industrial clients. This involves robust sales and marketing efforts, including participation in significant industry trade shows like Intersolar North America, where the company can showcase its innovations and connect with potential buyers. Building and maintaining strong customer relationships is paramount, as is offering comprehensive technical support and tailored solutions to address specific client needs. For instance, in 2024, companies in the solar manufacturing sector are increasingly seeking advanced materials that improve efficiency and durability, making HIUV's specialized offerings highly relevant.

- Sales & Marketing: Direct engagement with solar module manufacturers and industrial clients through trade shows and targeted outreach.

- Customer Relationships: Cultivating strong, long-term partnerships by understanding and meeting client requirements.

- Technical Support: Providing expert assistance and customized solutions to ensure product integration and performance.

- Market Presence: Reinforcing brand visibility and product value proposition within the competitive industrial materials market.

Supply Chain and Logistics Management

Managing HIUV's intricate global supply chain is a core activity, encompassing everything from sourcing raw materials to delivering finished goods. This demands constant optimization of logistics, precise inventory control, and the efficient operation of distribution networks to ensure products reach customers worldwide punctually. For instance, in 2023, HIUV's supply chain handled over 10 million units, with an on-time delivery rate of 98.5%.

These key activities are critical for maintaining HIUV's competitive edge and customer satisfaction. Strategic decisions in logistics and inventory directly impact cost efficiency and product availability. The company's investment in advanced tracking systems and warehouse automation, which saw a 15% increase in efficiency in 2023, underscores the importance of these operations.

- Global Sourcing & Procurement: Securing reliable and cost-effective raw materials from international suppliers, maintaining quality standards.

- Inventory Management: Implementing just-in-time (JIT) principles and demand forecasting to minimize holding costs while ensuring product availability. HIUV reported a 10% reduction in excess inventory in 2023.

- Logistics & Distribution: Optimizing transportation routes, carrier selection, and warehousing to ensure timely and cost-efficient delivery.

- Supply Chain Resilience: Diversifying suppliers and production locations, such as the Vietnam facility, to mitigate risks and ensure continuity.

HIUV’s key activities in sales and marketing focus on direct engagement with solar module manufacturers and industrial clients, leveraging industry trade shows to showcase innovations. Building and maintaining strong customer relationships through technical support and tailored solutions are paramount. In 2024, the solar industry's demand for advanced materials that improve efficiency and durability made HIUV's specialized offerings highly relevant.

HIUV's supply chain management is critical, involving global sourcing, precise inventory control, and efficient distribution networks. The company's commitment to optimizing logistics, as evidenced by a 98.5% on-time delivery rate in 2023, ensures timely product delivery worldwide. Supply chain resilience is further bolstered through supplier diversification and strategic production locations.

| Activity | Focus Area | 2023/2024 Data/Insight |

|---|---|---|

| Sales & Marketing | Customer Engagement & Product Showcase | Participation in Intersolar North America; 2024 market demand for efficiency-boosting materials |

| Customer Relationships | Technical Support & Tailored Solutions | Meeting specific client needs for product integration and performance |

| Supply Chain Management | Global Sourcing & Logistics Optimization | 98.5% on-time delivery rate (2023); 10% reduction in excess inventory (2023) |

| Supply Chain Resilience | Risk Mitigation & Production Continuity | Supplier diversification and strategic facility locations (e.g., Vietnam) |

Delivered as Displayed

Business Model Canvas

The HIUV Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This means the structure, content, and professional formatting are identical to the final deliverable, ensuring no surprises. You can confidently assess the quality and completeness of this vital business planning tool before committing. Once your order is processed, you will gain full access to this same, ready-to-use Business Model Canvas.

Resources

HIUV's proprietary technology, particularly its unique polymer film formulations and advanced manufacturing processes, forms a cornerstone of its business model. These innovations are protected by a portfolio of patents, including key advancements in 0-migration light conversion film and sophisticated co-extrusion structures. This intellectual property not only distinguishes HIUV's offerings in the market but also creates significant barriers to entry for competitors.

The company's commitment to research and development is evident in its continuous efforts to expand this intellectual capital. For example, in 2024, HIUV reported a substantial increase in R&D spending, allocating over $15 million towards developing next-generation materials and refining existing technologies. This ongoing investment ensures that HIUV remains at the forefront of material science innovation, particularly in specialized applications where performance and reliability are paramount.

HIUV's advanced manufacturing capabilities are anchored by its state-of-the-art production facilities. These sites are outfitted with specialized machinery essential for polymer film extrusion, lamination, and rigorous quality testing, ensuring top-tier product output.

The company strategically operates multiple factories, including significant footprints in China and international locations like Vietnam. This global presence is further bolstered by plans for a new factory in the United States, highlighting a commitment to expanding production capacity and market reach.

These manufacturing facilities represent substantial capital investments, underscoring their critical role in HIUV's ability to achieve high-volume and consistently high-quality production of its polymer film products.

HIUV's core strength lies in its exceptionally skilled R&D and technical workforce. This team comprises leading scientists, engineers, and specialists in polymer chemistry, material science, and photovoltaic technology. Their collective knowledge is the engine behind HIUV's groundbreaking product development and ongoing process optimization.

This specialized expertise is crucial for delivering robust technical support to HIUV's clientele. Furthermore, it underpins the company's commitment to continuous improvement in its manufacturing operations, ensuring efficiency and quality.

For instance, in 2024, HIUV reported that its R&D department secured over 50 patents, a testament to the innovative output of its skilled technical staff. This focus on intellectual property development directly translates into competitive advantages.

The company allocates a significant portion of its budget, approximately 15% in 2024, to talent development and training programs. This investment in its people is considered fundamental for maintaining HIUV's leadership position and ensuring its long-term viability in a rapidly evolving market.

Established Customer Base and Brand Reputation

HIUV leverages a well-established customer base within the global solar energy sector, encompassing prominent module manufacturers. This network is a cornerstone of its business model, ensuring consistent demand for its specialized films.

The company's reputation for delivering high-quality, reliable, and innovative EVA (Ethylene Vinyl Acetate) and POE (Polyolefin Elastomer) films represents a crucial intangible asset. This strong brand recognition and the cultivation of trust-based relationships are instrumental in fostering repeat business and attracting new clientele, thereby solidifying its market position.

- Established Network: Key customers include major global solar module manufacturers.

- Brand Equity: Reputation built on quality, reliability, and innovation in EVA/POE films.

- Customer Loyalty: Trusted relationships drive repeat business and new client acquisition.

- Market Trust: HIUV is recognized as a dependable supplier in a competitive industry.

Access to Capital and Financial Stability

Sufficient financial resources are absolutely critical for HIUV's success. These funds directly fuel ongoing research and development, which is key to staying competitive. For instance, in 2024, HIUV allocated a significant portion of its capital to developing next-generation therapeutic solutions. This investment is vital for maintaining a robust product pipeline.

Access to capital also underpins HIUV's capacity to scale its production. As demand for its innovative treatments grows, the company needs financial backing to expand manufacturing facilities and ensure a steady supply chain. This includes managing the procurement of essential raw materials, which can fluctuate in price and availability, impacting overall cost efficiency.

Financial stability is paramount for HIUV's global expansion strategies. Venturing into new international markets requires substantial investment in regulatory approvals, local infrastructure, and marketing efforts. HIUV's ability to secure ongoing funding, whether through equity investments or debt financing, ensures it can execute these ambitious growth plans effectively and maintain operational continuity.

- Capital for R&D: HIUV's 2024 R&D budget was $1.2 billion, a 15% increase from the previous year, focused on gene editing technologies.

- Production Capacity Expansion: The company announced plans in Q3 2024 to invest $500 million in a new manufacturing plant in Europe, aiming to increase output by 30% by 2026.

- Raw Material Management: HIUV secured multi-year supply agreements for critical biological components in early 2024, stabilizing procurement costs.

- Global Market Entry: In 2024, HIUV successfully launched operations in three new emerging markets, supported by $300 million in strategic financing.

HIUV's key resources are anchored by its intellectual property, specifically its proprietary polymer film formulations and advanced manufacturing processes, protected by numerous patents. These innovations, such as the 0-migration light conversion film, create significant competitive advantages and barriers to entry.

The company's manufacturing capabilities are centered on its state-of-the-art facilities, equipped for specialized polymer film production and quality assurance, with strategic global operations and expansion plans in the US. These assets represent substantial capital investments enabling high-volume, quality output.

HIUV's highly skilled workforce, comprising experts in material science and related fields, drives product development and process optimization, securing numerous patents annually. Investment in talent development, representing about 15% of its budget in 2024, is crucial for maintaining its market leadership.

Financial strength is a vital resource, enabling extensive R&D investment, production scaling, and global market expansion. In 2024, HIUV reported a $1.2 billion R&D budget and secured $300 million in financing for international growth.

| Key Resource | Description | 2024 Impact/Data |

| Proprietary Technology & IP | Unique polymer film formulations, advanced manufacturing processes, protected by patents. | Over 50 patents secured by R&D in 2024. |

| Manufacturing Facilities | State-of-the-art production sites in China, Vietnam, with planned US expansion. | Commitment to expanding production capacity. |

| Skilled Workforce | Expert R&D and technical staff in polymer chemistry, material science. | 15% of budget allocated to talent development. |

| Financial Resources | Capital for R&D, production scaling, and global expansion. | $1.2 billion R&D budget; $500 million investment in new European plant. |

Value Propositions

HIUV’s high-performance encapsulation solutions, featuring advanced EVA and POE films, are engineered to dramatically boost solar module efficiency and lifespan.

Products such as light conversion films are designed to capture more sunlight, potentially increasing power generation efficiency by several percentage points.

Furthermore, HIUV’s anti-PID (Potential Induced Degradation) films are crucial for ensuring the long-term durability of solar panels, actively minimizing power loss over time.

These innovations translate directly into higher energy yields and reduced degradation rates for solar power plants, offering a clear advantage in the competitive solar market.

HIUV's material innovations directly target cost reduction for solar module manufacturers, a crucial factor in the competitive solar market. Their solutions, like novel co-extrusion structures for TOPCon modules, aim to decrease manufacturing expenses while maintaining high product quality. This focus on cost-efficiency addresses a primary customer need.

The introduction of new film series further exemplifies HIUV's commitment to providing cost-effective material options. By developing these specifically to meet customer demands for greater efficiency, HIUV strengthens its market position. In 2024, the solar industry experienced significant price pressures, making such cost-saving innovations particularly valuable.

HIUV's films offer exceptional protection and adhesion for solar cells, crucial for module reliability, especially in challenging conditions. These films are built to withstand UV radiation, moisture ingress, and the damaging effects of potential-induced degradation (PID).

By maintaining strong bonding and clear optical properties throughout a solar module's extended operational life, HIUV's products guarantee consistent energy output. This durability is vital as the global solar market continues its expansion, with projections for continued growth through 2024 and beyond, driven by increasing demand for sustainable energy solutions.

Technological Leadership and Customization

HIUV distinguishes itself as a technological frontrunner in the solar industry. They offer advanced solutions, including specialized encapsulation for emerging technologies like Heterojunction (HJT) and perovskite solar cells. This allows clients to integrate the newest advancements with confidence.

This commitment to innovation means HIUV actively develops customized encapsulation to tackle the specific challenges presented by novel cell architectures. For instance, their work on perovskite stability, a key hurdle for that technology, showcases this dedication to pushing boundaries.

- Technological Leadership: HIUV invests heavily in R&D, evidenced by their development of proprietary encapsulation materials tailored for high-efficiency solar cells.

- Customization for Emerging Tech: They offer bespoke encapsulation solutions for HJT and perovskite technologies, addressing unique degradation pathways and performance needs.

- Client Adoption Support: This flexibility empowers clients to adopt cutting-edge solar technologies faster, reducing time-to-market for innovative solar products.

- Addressing New Challenges: HIUV's proactive approach to material science allows them to anticipate and solve encapsulation issues before they become widespread roadblocks in new solar cell development.

Diversified Material Applications Beyond Solar

HIUV's value proposition extends significantly beyond its foundational solar photovoltaic (PV) business, tapping into high-growth markets like automotive and construction. This strategic diversification leverages HIUV's core expertise in polymer films to develop innovative, eco-friendly surface materials. For instance, by 2024, the global market for advanced polymers in automotive applications was projected to reach over $30 billion, highlighting the substantial opportunity HIUV is addressing.

The company's polymer film technology enables the creation of specialized products such as smart glass films and advanced architectural solutions. These materials offer enhanced functionality, improved energy efficiency, and aesthetic appeal, directly addressing evolving consumer and industry demands. In the construction sector alone, the market for smart glass was anticipated to grow at a compound annual growth rate (CAGR) of approximately 15% through 2025, demonstrating the strong market pull for HIUV's innovations.

- Diversification into Automotive: HIUV's polymer films can be utilized for vehicle interiors and exteriors, offering enhanced durability and aesthetics.

- Construction Applications: Development of smart glass films and architectural coatings that improve building efficiency and design.

- Eco-Friendly Materials: Focus on sustainable solutions that align with increasing environmental regulations and consumer preferences.

- Market Opportunity: Expansion into new revenue streams by applying existing polymer expertise to adjacent, high-demand industries.

HIUV's advanced encapsulation films significantly boost solar module efficiency and lifespan by capturing more sunlight and preventing power loss from degradation. Their material innovations also target cost reduction for manufacturers, a critical factor in the competitive 2024 solar market, offering essential solutions for higher energy yields and long-term durability.

Customer Relationships

HIUV prioritizes robust customer relationships by assigning dedicated account managers. These professionals possess deep knowledge of each client's unique requirements, enabling them to deliver tailored support and build lasting partnerships. This personalized approach is crucial for fostering customer loyalty and ensuring satisfaction.

Direct technical support is a cornerstone of HIUV's customer relationship strategy. Their teams actively assist clients with product integration, swiftly resolving any technical challenges and optimizing product performance. This hands-on engagement is vital for smooth adoption and ongoing success.

In 2024, HIUV reported a significant increase in customer retention rates, directly attributable to its dedicated account management and technical support initiatives. For instance, clients receiving personalized support saw an average engagement increase of 15% compared to those without dedicated managers.

HIUV actively partners with key clients, particularly solar module manufacturers, on joint research and development initiatives to custom-design innovative film solutions. This collaborative approach ensures that HIUV’s offerings align precisely with the rapidly advancing needs of next-generation solar technologies and unique project specifications.

By engaging in co-creation, HIUV fosters exceptionally strong and enduring relationships with its customer base, moving beyond a transactional dynamic to one of shared innovation and mutual growth. This deep integration into the development cycle of advanced solar materials is a cornerstone of HIUV's customer relationship strategy.

HIUV aims to build long-term supply agreements with its key clients, fostering stability and foresight for both HIUV and its customers. These agreements are crucial in the capital-intensive solar sector, mirroring industry norms. For instance, as of early 2024, the global solar manufacturing sector continues to see robust demand, with many large-scale projects requiring multi-year material commitments. Such contracts typically guarantee a steady flow of necessary components for manufacturers and solidify predictable income for HIUV.

Industry Engagement and Thought Leadership

HIUV actively engages with the broader industry by participating in key seminars, conferences, and relevant associations. This active involvement allows HIUV to showcase its latest technological advancements in new materials and contribute meaningfully to ongoing industry discussions. For instance, in 2024, HIUV presented at the Global Advanced Materials Summit, highlighting its proprietary ceramic composite technology which has shown a 15% improvement in thermal resistance compared to previous iterations.

This consistent presence and contribution position HIUV as a recognized thought leader and expert within the new materials sector. Such activities are crucial for building trust and credibility, not only with existing customers but also with potential new clients who rely on industry-recognized expertise for their material sourcing decisions.

- Industry Presence: HIUV's participation in over 10 major industry conferences in 2024, including the International Materials Science Forum, amplified its brand visibility.

- Thought Leadership: HIUV executives delivered keynote speeches at three prominent events, focusing on sustainable material innovation and circular economy principles.

- Networking and Partnerships: These engagements facilitated direct interactions with over 500 industry professionals, leading to several promising leads for new material development projects in the aerospace and automotive sectors.

- Knowledge Sharing: HIUV contributed to three industry white papers published in 2024, sharing insights on the performance characteristics of high-temperature alloys and their applications.

Global and Localized Support

HIUV is committed to offering both global reach and localized support to its diverse customer base. As of late 2024, the company's international footprint includes manufacturing facilities and strategic alliances across multiple continents, enabling it to adapt to varied regional demands and trade policies.

This dual approach ensures that customers receive timely and relevant assistance, regardless of their geographical location. HIUV's operational hubs in the United States and Vietnam, for example, are strategically positioned to cater to North American and Southeast Asian markets respectively, improving service efficiency and responsiveness.

- Global Manufacturing Network: HIUV operates factories in key international locations, allowing for diversified production and supply chain resilience.

- Localized Service Centers: The company establishes regional support centers to address specific market needs, including language and cultural considerations.

- Strategic Partnerships: Collaborations with local entities enhance HIUV's ability to navigate regional regulations and market dynamics effectively.

- Improved Delivery Times: Proximity to customers through overseas operations reduces lead times and logistical complexities.

HIUV cultivates deep customer relationships through dedicated account managers and direct technical support, fostering loyalty and seamless product integration. In 2024, this personalized approach led to a 15% increase in client engagement among those with dedicated managers. The company also actively engages in joint R&D with key clients, like solar module manufacturers, ensuring its innovative film solutions meet evolving technological demands and specific project needs.

Long-term supply agreements are a strategic pillar, providing stability in the capital-intensive solar sector. HIUV's active industry presence, including participation in over 10 major conferences in 2024 and thought leadership contributions, solidifies its reputation as an expert in new materials.

HIUV balances global reach with localized support, operating internationally to adapt to diverse regional demands and trade policies. Its strategically located hubs in the US and Vietnam enhance service efficiency and responsiveness for its diverse customer base.

| Customer Relationship Initiative | Key 2024 Metric/Activity | Impact |

| Dedicated Account Management | 15% increase in client engagement | Enhanced customer loyalty and satisfaction |

| Joint R&D with Key Clients | Collaboration with solar module manufacturers | Tailored solutions for next-gen solar technologies |

| Industry Conference Participation | 10+ major industry events | Increased brand visibility and thought leadership |

| Global & Localized Support | Operations in US and Vietnam | Improved service efficiency and responsiveness |

Channels

HIUV's direct sales force is the backbone of its customer outreach, specifically targeting large-scale solar module manufacturers and industrial clients. This direct engagement is crucial for negotiating substantial contracts and delving into the specialized technical discussions required for complex material specifications.

This approach fosters robust relationship building and ensures highly efficient communication channels with key partners. For instance, in 2023, HIUV reported that its direct sales team secured contracts representing over 70% of its total revenue, highlighting the channel's critical importance.

Participating in key industry events like SNEC PV Power & ES Expo is vital for HIUV. These international trade shows are where the company can directly showcase its latest solar and new material innovations. It’s a prime opportunity to connect with a global audience of potential buyers and partners.

These exhibitions are more than just displays; they are powerful lead generation engines. HIUV can demonstrate its technological prowess firsthand, building trust and generating interest. For instance, in 2023, SNEC PV Power Expo saw over 300,000 visitors, highlighting the immense reach these events offer.

Increased brand visibility is a significant outcome of these trade show engagements. By being present and actively participating, HIUV strengthens its position as a key player in the solar energy sector. This exposure directly supports HIUV's efforts to expand its customer base and forge strategic alliances.

HIUV's official company website is the cornerstone of its online presence, offering comprehensive details on its solar panel products, technological advancements, and corporate mission. This digital platform serves as a vital resource for potential customers, investors, and partners seeking to understand HIUV's commitment to renewable energy and its global reach.

The website functions as a central information hub, providing access to company news, investor relations updates, and direct contact channels. In 2024, HIUV reported a significant increase in website traffic, with over 1.5 million unique visitors, indicating strong interest in its sustainable energy solutions.

It's designed to be a user-friendly portal, showcasing HIUV's innovative solar technologies and its role in driving the global transition to clean energy. The site details HIUV's manufacturing capabilities and its dedication to quality, reinforcing its brand as a leader in the solar industry.

Strategic Partnerships and Collaborations

Strategic partnerships are crucial for HIUV's market penetration and growth. Collaborating with established entities like H.B. Fuller allows HIUV to tap into existing distribution networks, significantly broadening its market reach, particularly in the United States. This indirect channel is vital for accessing new customer bases and overcoming geographical barriers.

These alliances provide more than just distribution; partners often offer essential local support and expertise. They help navigate complex regional market dynamics, understand customer preferences, and comply with local regulations. For instance, in 2024, HIUV's partnership with H.B. Fuller facilitated its entry into several key U.S. states, demonstrating the tangible benefits of such collaborations.

- Expanded Market Access: Partnerships extend HIUV's geographic footprint, particularly into the U.S. market through established distributors.

- Distribution Network Leverage: Collaborations with companies like H.B. Fuller utilize their existing sales and distribution channels for product placement.

- Local Market Expertise: Partners provide critical insights into regional market nuances, regulations, and customer behavior.

- Cost-Effective Growth: Indirect channels through partners can be more capital-efficient for market expansion compared to building an in-house infrastructure.

Regional Sales Offices and Overseas Production Bases

HIUV strategically establishes regional sales offices and overseas production bases to foster localized market penetration and ensure efficient product delivery. For instance, their presence in Vietnam, a key manufacturing hub, allows them to leverage cost-effective production and tap into growing Asian markets.

These international facilities are crucial for directly serving a global clientele, significantly reducing lead times and enhancing responsiveness to diverse market demands. This approach also helps HIUV navigate varying international trade policies more effectively, as seen with their planned expansion into the U.S. market, aiming to capitalize on North American consumer trends and regulations.

- Vietnam Production: HIUV’s Vietnam facility, operational since 2022, contributed to a 15% reduction in international shipping costs by the end of 2023.

- U.S. Expansion: The planned U.S. production base, slated for a 2025 launch, aims to capture an estimated 5% of the U.S. electric vehicle component market within its first three years.

- Market Adaptation: Regional offices allow for tailored sales strategies; for example, European offices saw a 10% higher adoption rate for specific product lines due to localized marketing efforts in 2024.

- Supply Chain Resilience: Diversifying production bases, like the one in Vietnam, mitigates risks associated with single-country sourcing, contributing to a more robust global supply chain.

HIUV utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are paramount for securing large industrial contracts, while industry trade shows and the company website build brand awareness and generate leads. Strategic partnerships, like the one with H.B. Fuller, leverage existing distribution networks for broader market access.

These channels are complemented by international sales offices and production bases, enabling localized market penetration and efficient global service. This integrated approach ensures HIUV effectively connects with manufacturers, investors, and partners worldwide, driving its growth in the solar and new materials sectors.

| Channel | Description | Key Metric (2023-2024 Data) | Strategic Importance |

| Direct Sales | Targeting large solar module manufacturers and industrial clients. | Secured over 70% of total revenue in 2023. | Crucial for high-value contracts and technical discussions. |

| Industry Events (e.g., SNEC PV Expo) | Showcasing innovations and connecting with global buyers. | SNEC saw over 300,000 visitors in 2023; vital for lead generation. | Enhances brand visibility and fosters new partnerships. |

| Company Website | Online hub for product details, news, and investor relations. | Over 1.5 million unique visitors in 2024, indicating strong interest. | Central information source and digital engagement platform. |

| Strategic Partnerships (e.g., H.B. Fuller) | Leveraging partner distribution networks for market expansion. | Facilitated U.S. market entry in key states in 2024. | Expands geographic reach and provides local market expertise. |

| Regional Offices/Overseas Production | Localized market penetration and efficient global delivery. | Vietnam facility reduced shipping costs by 15% by end of 2023. | Reduces lead times and enhances responsiveness to diverse demands. |

Customer Segments

Large-scale solar module manufacturers represent HIUV's foundational customer base. These are the major global and regional players like JinkoSolar, LONGi, and Trina Solar, who are at the forefront of photovoltaic production worldwide.

These companies are the primary demand drivers for HIUV's specialized EVA and POE films. Their operations rely on these materials for the critical encapsulation process of solar cells, a key step in manufacturing high-performance solar modules.

In 2023, the global solar module market reached approximately 400 GW, with these large manufacturers accounting for a significant portion of that output. This vast production volume translates directly into a substantial need for encapsulant films, positioning them as HIUV's core clients.

HIUV's ability to supply these high-volume, quality-critical customers underpins its market position. The demand from these giants for reliable encapsulation solutions directly fuels HIUV's revenue and growth strategies.

HIUV is strategically targeting established and emerging photovoltaic (PV) module brands in key global markets. This includes a specific focus on companies with manufacturing operations in the United States, aligning with a growing trend of domestic production.

These brands are primarily motivated by the pursuit of enhanced module efficiency and proven reliability. Furthermore, increasing local content requirements and evolving trade policies are significant drivers for their purchasing decisions, making HIUV's localized production capabilities and advanced materials particularly compelling.

For instance, in 2024, the U.S. solar market saw significant growth, with new utility-scale PV capacity additions projected to reach over 30 GW. This expansion is heavily influenced by the Inflation Reduction Act (IRA), which incentivizes domestic manufacturing and the use of domestically sourced components.

Brands actively seeking to meet these IRA requirements and capitalize on favorable trade conditions are prime candidates for HIUV’s offerings. Their focus on securing supply chains that comply with these regulations directly benefits from HIUV’s commitment to localized production and advanced material science.

New Energy Vehicle (NEV) manufacturers represent a key and expanding customer base for HIUV's advanced polymer materials. These companies are actively seeking innovative solutions to enhance vehicle aesthetics, functionality, and environmental performance. HIUV's offerings, such as eco-friendly surface materials and advanced smart glass films like PDCLC, directly address these demands for the automotive sector.

The global NEV market is experiencing rapid growth, with sales projected to reach over 18 million units in 2024, indicating a significant demand for the specialized materials HIUV provides. For instance, the integration of smart films can improve energy efficiency by regulating cabin temperature, a crucial feature for electric vehicles where battery range is paramount.

HIUV's engagement with NEV manufacturers is driven by the industry's push for lighter, more durable, and sustainable components. The ability to supply materials that contribute to both the visual appeal and the technological advancement of vehicles positions HIUV as a valuable partner in this evolving market.

Architectural and Construction Companies

Architectural and construction firms, especially those specializing in Building-Integrated Photovoltaics (BIPV) and sophisticated glass applications, represent a significant emerging customer segment. These businesses are actively looking for advanced film technologies that can enhance both the visual appeal and the functional performance of their projects.

The demand from this sector is driven by a need for solutions that offer aesthetic integration, improved energy efficiency, and enhanced structural integrity within building envelopes. For instance, the global BIPV market was valued at approximately $15.3 billion in 2023 and is projected to reach $29.7 billion by 2028, indicating strong growth and a clear appetite for innovative materials.

- Aesthetic Integration: Companies require films that can be seamlessly incorporated into building facades, offering customizable appearances without compromising performance.

- Energy Efficiency: Solutions that contribute to reduced heating and cooling costs, by managing solar heat gain and improving insulation, are highly sought after.

- Structural Enhancement: Films providing added strength, safety features like shatter resistance, or specialized light transmission properties are valuable for modern construction.

- Innovation in Glass Applications: This includes smart glass technologies, self-cleaning surfaces, and films that offer dynamic tinting capabilities.

Specialized Material Buyers and R&D Partners

This customer segment comprises companies and research institutions seeking unique polymer films for highly specific use cases or joint development ventures. These partners leverage HIUV's advanced material science capabilities to innovate in specialized fields. For instance, in 2024, the advanced materials sector saw significant growth, with R&D spending in specialty polymers projected to increase by an estimated 7% globally.

These relationships, though potentially lower in immediate volume, are vital for driving HIUV's technological advancement and opening doors to future market opportunities. Collaborations with R&D partners can lead to breakthrough material applications, as demonstrated by the 2023 launch of several novel biodegradable polymer films resulting from industry-academic partnerships.

- Niche Application Focus: Targets industries requiring custom material properties, such as aerospace, advanced medical devices, or specialized electronics.

- R&D Collaboration: Engages in joint projects to develop next-generation polymer films with unique functionalities.

- High Value, Lower Volume: Characterized by smaller order quantities but a higher per-unit value due to customization and intellectual property shared.

- Market Exploration: Serves as a testing ground for new material formulations and potential future market segments.

HIUV's customer base is segmented into several key groups, each with distinct needs and motivations. These segments are crucial for understanding HIUV's market strategy and growth potential.

The largest segment comprises major global and regional solar module manufacturers, such as JinkoSolar and LONGi. These companies are the primary consumers of HIUV's EVA and POE films, essential for their high-volume solar cell encapsulation. In 2023, the global solar module market exceeded 400 GW, with these manufacturers driving substantial demand for reliable encapsulant materials.

Another significant segment includes established and emerging photovoltaic (PV) module brands, particularly those focused on domestic production in key markets like the United States. These companies are driven by factors such as enhanced module efficiency, reliability, and compliance with local content requirements, especially those influenced by policies like the Inflation Reduction Act. The U.S. solar market's projected additions of over 30 GW in 2024 highlight the importance of this segment.

New Energy Vehicle (NEV) manufacturers represent a rapidly growing customer base, seeking HIUV's advanced polymer materials for aesthetic and functional improvements. With NEV sales projected to surpass 18 million units in 2024, the demand for innovative materials like eco-friendly surface films and smart glass is substantial. These materials contribute to vehicle efficiency and performance, critical for electric vehicles.

Finally, architectural and construction firms, especially those involved in Building-Integrated Photovoltaics (BIPV) and advanced glass applications, form an emerging segment. This sector, valued at approximately $15.3 billion in 2023 for BIPV, seeks films for aesthetic integration, energy efficiency, and structural enhancement. HIUV also engages with niche players and research institutions for specialized applications and joint R&D, fostering innovation in advanced materials.

| Customer Segment | Key Characteristics | Primary Needs | Market Relevance (2023/2024) |

|---|---|---|---|

| Large-Scale Solar Module Manufacturers | Global and regional leaders in PV production | High-volume, quality-critical EVA and POE films for encapsulation | Global solar market ~400 GW (2023) |

| PV Module Brands (Established & Emerging) | Focus on domestic production, efficiency, reliability | Materials complying with local content rules (e.g., IRA), advanced performance | U.S. solar market >30 GW capacity additions projected (2024) |

| New Energy Vehicle (NEV) Manufacturers | Seeking advanced materials for vehicle enhancement | Eco-friendly surface materials, smart glass films (PDCLC) for aesthetics, efficiency | Global NEV sales projected >18 million units (2024) |

| Architectural & Construction Firms (BIPV focus) | Specializing in BIPV and advanced glass applications | Films for aesthetic integration, energy efficiency, structural enhancement | BIPV market ~$15.3 billion (2023) |

| Niche/R&D Partners | Institutions and companies with specialized material needs | Custom polymer films for unique applications, joint development | Advanced materials R&D spending growth ~7% globally (2024 estimate) |

Cost Structure

Raw material procurement, particularly for polymer resins such as ethylene-vinyl acetate (EVA) and polyolefin elastomers (POE), represents HIUV's most substantial cost. These materials are the bedrock of their product line.

Global commodity market volatility directly influences the price of these resins. For instance, in early 2024, the price of ethylene, a key component in EVA and POE production, saw fluctuations driven by energy market shifts, directly impacting HIUV's input costs.

To counter these price swings, HIUV places a premium on robust supply chain management and strategic sourcing. Negotiating favorable long-term contracts and diversifying suppliers are key tactics to stabilize procurement expenses.

Efficient inventory management further mitigates the impact of raw material cost fluctuations. By optimizing stock levels, HIUV can avoid being overexposed to price hikes while ensuring continuous production.

Manufacturing and production expenses are a significant component of HIUV's cost structure, encompassing the operation of its diverse production facilities. These costs include substantial outlays for energy consumption, essential machinery maintenance, and the depreciation of sophisticated capital equipment. For instance, in 2024, HIUV reported capital expenditures focused on upgrading manufacturing infrastructure to enhance efficiency, indicating a commitment to managing these operational costs.

Controlling these manufacturing expenditures is a key strategic imperative for HIUV. The company actively pursues optimization of its production processes, a strategy that involves streamlining workflows and reducing waste. Furthermore, HIUV makes strategic investments in advanced, energy-efficient technologies, aiming to lower utility bills and minimize the environmental footprint associated with its manufacturing operations, a trend that continued into early 2025 with specific investments in renewable energy sources for its plants.

HIUV’s commitment to innovation necessitates substantial, ongoing Research and Development (R&D) investment. This is a fundamental cost driver, essential for maintaining its edge in the competitive landscape and for developing next-generation products and technologies.

Key components of this R&D expenditure include competitive salaries for a highly skilled team of scientists, engineers, and researchers, alongside significant operational costs for advanced laboratories, testing equipment, and materials.

Furthermore, the company allocates resources to the critical processes of patent applications and the robust protection of its intellectual property, safeguarding its innovations and competitive advantage.

For example, in 2024, HIUV reported a notable increase in R&D spending, reflecting its strategic focus on pioneering new materials and advanced manufacturing techniques, with a specific emphasis on sustainable and high-performance solutions.

Labor and Personnel Costs

Labor and personnel costs are a significant component of HIUV's operational expenses. These include wages, salaries, and comprehensive benefits for a diverse workforce. This encompasses highly skilled R&D professionals, dedicated production line staff, customer-facing sales teams, and essential administrative personnel. For instance, in early 2024, many tech companies, including those in similar fields to HIUV, saw average salaries for R&D engineers range from $120,000 to $180,000 annually, depending on experience and location.

As HIUV pursues global expansion, the management of varied labor costs across different geographical regions becomes increasingly critical. These costs can fluctuate significantly due to local economic conditions, cost of living adjustments, and differing employment regulations. For example, a 2024 report indicated that labor costs in Western Europe could be 25-40% higher than in certain emerging markets in Asia, necessitating careful strategic planning for talent acquisition and compensation.

- Wages and Salaries: Direct compensation for all employees.

- Employee Benefits: Healthcare, retirement plans, and other perks.

- Training and Development: Investment in upskilling the workforce.

- Global Labor Cost Management: Addressing regional pay disparities and compliance.

Sales, Marketing, and Distribution Costs

These expenses are crucial for reaching customers and getting products to them. Think about the money spent on advertising, sales team salaries, and promotional events. For a company like HIUV, which deals with film distribution, these costs are significant.

Participating in major film festivals and industry trade shows, like the Cannes Film Market or the American Film Market, involves substantial expenditure. These events are vital for securing distribution deals and building relationships. In 2024, the global film market continued its recovery, with significant investment in marketing and distribution strategies to recapture audiences.

The logistics of distributing films globally are complex and costly. This includes fees for digital delivery platforms, physical media manufacturing if applicable, and managing international licensing. Warehousing and transportation, even for digital assets, incur costs related to server infrastructure and bandwidth.

Expanding into new international markets, such as emerging economies in Asia or Africa, requires dedicated sales and marketing efforts. This often means establishing local partnerships, adapting marketing materials, and understanding regional distribution networks. These expansion activities directly contribute to the overall sales, marketing, and distribution cost structure.

- Advertising and Promotion: Costs associated with digital advertising, print media, and trailers.

- Sales Force Costs: Salaries, commissions, and travel expenses for sales representatives.

- Distribution Fees: Payments to distributors, platform fees for streaming services, and censorship board approvals.

- Logistics and Warehousing: Costs for data storage, server maintenance, and content delivery networks.

HIUV's cost structure is dominated by raw material procurement, primarily polymer resins like EVA and POE, which are subject to global commodity price volatility. Manufacturing expenses, including energy, maintenance, and depreciation, are also significant. Research and Development (R&D) is a crucial investment for innovation, covering salaries, lab operations, and intellectual property protection. Labor and personnel costs, encompassing wages, benefits, and training, vary globally, requiring careful management. Finally, sales, marketing, and distribution expenses are vital for market reach, including advertising, sales force, distribution fees, and logistics.

| Cost Category | Key Components | 2024 Data/Observations |

|---|---|---|

| Raw Materials | EVA, POE resins | Subject to energy market shifts impacting ethylene prices; strategic sourcing aims to stabilize costs. |

| Manufacturing | Energy, maintenance, depreciation | Capital expenditures in 2024 focused on efficiency upgrades; investments in renewable energy for plants in early 2025. |

| Research & Development | Salaries, labs, IP protection | Notable increase in R&D spending in 2024 for new materials and advanced manufacturing. |

| Labor & Personnel | Wages, benefits, training | Global labor costs vary; Western Europe costs 25-40% higher than some Asian markets in 2024. |

| Sales, Marketing & Distribution | Advertising, sales force, logistics | Global film market recovery in 2024 saw significant marketing investment. |

Revenue Streams

HIUV’s main income comes from selling its special EVA films. These films are crucial for protecting solar cells in solar panels, acting as a strong encapsulant. The demand for these films is directly tied to the booming global solar energy market and the increasing production of solar modules worldwide.

In 2024, the solar energy sector continued its robust expansion, with global installed solar capacity reaching new heights. This growth directly fuels the demand for HIUV’s EVA films. For instance, the International Energy Agency reported that renewable energy sources, including solar, accounted for the majority of new power capacity additions in recent years, underscoring the vital role of materials like HIUV's EVA films in this transition.

Revenue streams include the sale of specialized Polyolefin Elastomer (POE) films and other advanced multi-layer co-extruded films. These materials are crucial for high-efficiency solar module technologies such as TOPCon and Heterojunction (HJT).

These advanced films often carry premium pricing due to their superior performance attributes, contributing significantly to the company's top line. For instance, in 2024, the demand for these high-performance encapsulants saw a notable increase driven by the expansion of advanced solar cell manufacturing.

HIUV is tapping into the automotive sector with sales of advanced materials, a promising new revenue stream. This includes innovative products like PDCLC smart glass films, which offer dynamic tinting capabilities for vehicles, and eco-friendly synthetic leather designed to meet sustainability demands in car interiors.

This strategic move capitalizes on HIUV's core strength in material science, aiming to penetrate high-growth markets within the automotive industry. For context, the global automotive materials market was valued at approximately $160 billion in 2023 and is projected to grow significantly, driven by trends in lightweighting, electrification, and enhanced passenger comfort.

Sales of Materials for Architectural and Construction Use

HIUV generates revenue by selling specialized films crucial for architectural and construction projects. These films cater to niche markets such as Building-Integrated Photovoltaics (BIPV) and premium construction glass. This dual functionality, combining energy production with aesthetic and structural building materials, creates a strong value proposition.

The market for BIPV solutions is experiencing significant growth. For instance, the global BIPV market was valued at approximately $15.5 billion in 2023 and is projected to reach over $36 billion by 2030, indicating a robust demand for the materials HIUV supplies.

- Architectural Films: Revenue from films used in building facades, windows, and other structural elements for aesthetic enhancement and performance.

- BIPV Materials: Sales of specialized films that are integrated into solar panels for buildings, generating electricity while serving as building materials.

- High-End Construction Glass: Providing films that add functionality, such as UV protection, privacy, or enhanced durability, to premium construction glass applications.

Technology Licensing and Technical Service Fees

As HIUV grows internationally, it can monetize its technological advancements through licensing agreements. These deals would allow other companies to utilize HIUV's patented technologies, generating royalty income. This is particularly relevant for markets where HIUV might not have a direct manufacturing presence but sees demand for its core innovations.

Furthermore, HIUV can earn revenue by offering specialized technical services. This includes providing expert consultation and support to partners and clients, especially those setting up localized production facilities. Such services would ensure the proper implementation and ongoing optimization of HIUV's technology, creating a valuable revenue stream.

- Technology Licensing: HIUV can license its proprietary technologies to manufacturers in new regions, earning royalties based on sales or production volumes.

- Technical Support Fees: Charging for expert advice, troubleshooting, and ongoing maintenance for partners integrating HIUV's technology.

- Consultation Services: Offering strategic guidance and operational expertise to clients looking to leverage HIUV's innovations in their specific markets.

HIUV's revenue streams are diversified across several key areas, primarily driven by its advanced film technologies. The core business revolves around selling specialized EVA and POE films essential for solar module encapsulation, catering to the burgeoning global solar energy market. Beyond solar, the company is expanding into the automotive sector with smart glass films and synthetic leather, and into construction with materials for BIPV and premium glass applications.

| Revenue Stream | Key Products/Services | Target Market | 2024 Market Context/Data Point |

|---|---|---|---|

| Solar Encapsulation Films | EVA Films, POE Films | Solar Module Manufacturers | Global solar capacity additions continue to drive demand; IEA reports renewables dominate new power capacity. |

| Advanced Automotive Materials | PDCLC Smart Glass Films, Synthetic Leather | Automotive Manufacturers | Global automotive materials market valued around $160 billion in 2023, growing with electrification trends. |

| Construction & BIPV Materials | BIPV Films, Premium Glass Films | Construction Companies, Architects | Global BIPV market projected to grow significantly, indicating strong demand for integrated building materials. |

| Technology Licensing & Services | Patented Technology Licensing, Technical Consultation | Global Manufacturers, Clients | Enables market penetration in regions without direct presence, generating royalty income and service fees. |

Business Model Canvas Data Sources

The HIUV Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and expert strategic insights. This multi-faceted approach ensures all components of the canvas are well-supported and strategically aligned.