Hisun Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

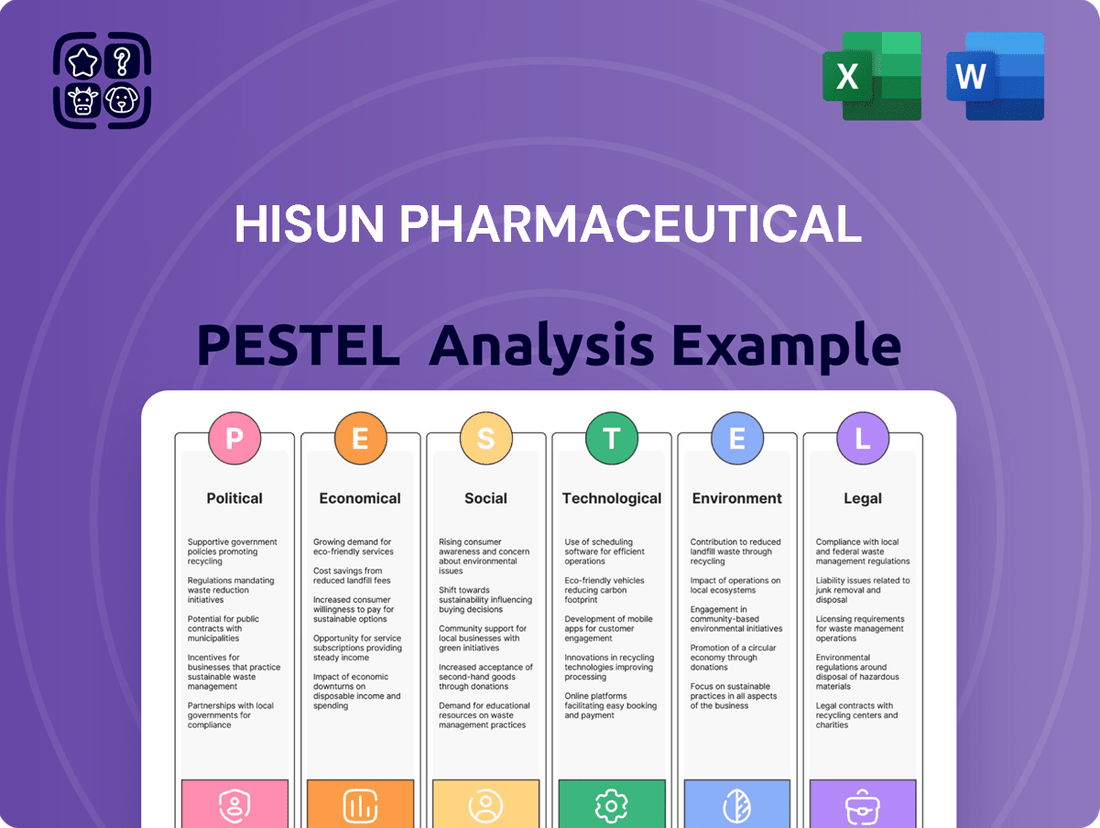

Navigate the complex external forces shaping Hisun Pharmaceutical's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social attitudes, technological advancements, stringent environmental regulations, and legal frameworks are impacting its operations and strategic decisions. Gain a critical edge by leveraging these expert-level insights to refine your market approach and anticipate future challenges. Download the full version now for actionable intelligence.

Political factors

Government healthcare reforms in China, including the National Centralized Drug Procurement (NCDP) program, directly impact Hisun Pharmaceutical's pricing power and market access. These initiatives, aimed at reducing healthcare costs for citizens, have led to significant price reductions for many drugs, putting pressure on Hisun's profitability.

For instance, in 2023, Hisun reported that several of its key products were included in the NCDP, leading to substantial price cuts. This trend is expected to continue, forcing Hisun to focus on high-volume sales and cost-efficiency to maintain market share and profitability in the domestic market.

Geopolitical shifts and evolving trade pacts between China and key global players directly influence Hisun Pharmaceutical's international reach. For instance, the United States' imposition of tariffs on Chinese goods, which saw an average tariff rate of 19.3% on Chinese imports in 2023, can increase Hisun's costs for exported APIs and finished drugs, potentially impacting its competitiveness in those markets.

Trade barriers or increased scrutiny on Chinese pharmaceutical firms, such as those seen in certain European Union member states regarding supply chain transparency, can hinder Hisun's market penetration and disrupt the import of vital raw materials. This necessitates a proactive strategy to diversify sourcing and market access, ensuring supply chain resilience amidst a fluctuating global trade landscape.

Changes in drug approval processes by China's NMPA, the US FDA, and Europe's EMA significantly impact Hisun Pharmaceutical's time-to-market for new drugs and the maintenance of existing product registrations. For instance, in 2024, the NMPA continued to emphasize expedited pathways for innovative therapies, a trend Hisun can leverage, while the FDA's evolving requirements for real-world evidence in 2025 could necessitate adaptive R&D strategies.

Streamlined regulatory pathways, such as accelerated approval programs, can reduce the time to market, a critical factor for Hisun's revenue generation. Conversely, stricter data requirements or enhanced post-market surveillance, like those being considered by the EMA for certain drug classes in 2025, demand robust compliance and data management capabilities from Hisun.

Adherence to international quality standards, including Good Manufacturing Practices (GMP), remains paramount for Hisun's global market access. In 2024, the FDA's increased scrutiny on foreign manufacturing sites, with a notable rise in warning letters issued to overseas facilities, underscores the importance of Hisun maintaining its compliance to avoid market access disruptions.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws in China and Hisun's key international markets are paramount for safeguarding its significant research and development investments and its unique drug formulations. China's IP landscape is continually evolving, with recent efforts focused on strengthening patent protection and enforcement. For instance, the average duration of patent examination in China has been significantly reduced, aiming to expedite the process for innovators. This evolution directly impacts Hisun's competitive edge and its strategic decisions regarding investment in new drug discovery.

Evolving IP policies, including changes to patent duration, the effectiveness of enforcement mechanisms, and the implementation of robust anti-counterfeiting measures, critically shape Hisun Pharmaceutical's ability to maintain market exclusivity for its innovative products. Stronger IP protection fosters a more conducive environment for innovation, encouraging companies like Hisun to allocate resources towards the development of novel therapies. The World Intellectual Property Organization (WIPO) reported in 2024 that China continues to be a leading contributor to international patent filings, underscoring the growing emphasis on IP rights within the country.

- Patent Protection: China's revised Patent Law, effective from June 1, 2021, introduced longer patent terms for pharmaceuticals, offering up to five years of supplementary protection for innovative drugs, which is crucial for Hisun's R&D recovery.

- Enforcement Measures: Increased penalties for patent infringement, including higher statutory damages, are being implemented, strengthening the deterrent effect against counterfeiting and unauthorized use of Hisun's intellectual assets.

- International Alignment: Hisun's international markets, particularly the US and EU, maintain robust IP frameworks, requiring Hisun to navigate and adhere to diverse but generally strong protection standards to secure its global market position.

Geopolitical Stability

Global geopolitical stability significantly impacts Hisun Pharmaceutical's supply chain. For instance, disruptions in regions like Eastern Europe, which experienced heightened tensions in early 2024, can affect the availability and cost of specialized pharmaceutical ingredients. Hisun's ability to source materials and distribute finished goods globally, including to markets like the United States and European Union, is directly tied to the absence of major international conflicts or trade disputes. The company's operational continuity and market supply depend on proactively assessing and mitigating these geopolitical risks.

Government healthcare policies in China, such as the National Centralized Drug Procurement (NCDP), directly influence Hisun's pricing and market access, leading to significant price reductions on key products in 2023. Geopolitical shifts and trade pacts, including US tariffs averaging 19.3% on Chinese imports in 2023, impact Hisun's export costs and competitiveness. Evolving drug approval processes by regulatory bodies like the NMPA, FDA, and EMA in 2024-2025 necessitate adaptive R&D and compliance strategies for Hisun.

| Factor | Impact on Hisun Pharmaceutical | 2023-2025 Data/Trend |

| Healthcare Reforms (China) | Price pressure, market access challenges | NCDP inclusion led to price cuts; ongoing cost reduction focus. |

| Geopolitical Tensions/Trade Wars | Increased import/export costs, supply chain risks | US tariffs averaged 19.3% on Chinese goods in 2023; potential disruptions to raw material sourcing. |

| Regulatory Approval Processes | Time-to-market, R&D strategy adaptation | NMPA expedited pathways for innovation (2024); FDA evolving real-world evidence requirements (2025). |

| Intellectual Property (IP) Laws | Protection of R&D, market exclusivity | China's Patent Law (2021) offers supplementary protection; WIPO reported China's strong international patent filings in 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hisun Pharmaceutical, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to inform strategic decision-making.

Provides a concise version of Hisun Pharmaceutical's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Global healthcare expenditure is on a steady upward trajectory, projected to reach $11.6 trillion by 2025, according to Deloitte. This significant increase, fueled by rising incomes in emerging markets and broader access to health insurance, creates a substantial market opportunity for Hisun Pharmaceutical. The growing demand spans various therapeutic areas, directly benefiting companies like Hisun with established portfolios in oncology and cardiovascular treatments.

This expansion in healthcare spending directly translates into increased demand for pharmaceutical products. As more people gain access to healthcare services, the need for innovative and affordable medicines grows, aligning with Hisun's strategic focus. Companies capable of delivering high-quality, cost-effective solutions are poised to capitalize on this expanding global market.

Fluctuations in the global prices of active pharmaceutical ingredients (APIs) and other essential raw materials significantly impact Hisun Pharmaceutical's production costs. For instance, the price of key APIs can be influenced by factors like supply chain disruptions, which were evident in 2021-2022 due to global logistics challenges, and energy costs. These shifts directly affect Hisun's profitability and its ability to maintain competitive pricing for its finished products.

Effective supply chain management and diversifying sourcing strategies are therefore critical for Hisun to mitigate the financial risks tied to material price volatility. Companies that can accurately forecast these price movements and adapt their procurement strategies, perhaps by entering into longer-term contracts or exploring alternative suppliers, are better positioned to maintain stable margins and operational efficiency in the dynamic pharmaceutical market.

Currency exchange rate fluctuations significantly impact Hisun Pharmaceutical, given its dual domestic and international market presence. For instance, if the Chinese Yuan strengthens against the US Dollar, Hisun's exports priced in Yuan become more expensive for American buyers, potentially dampening sales volume. Conversely, a weaker Yuan could increase the cost of essential imported raw materials, impacting production expenses.

The financial health of Hisun is directly tied to these currency movements. In 2024, the Yuan experienced periods of volatility against major currencies. A sustained appreciation of the Yuan could reduce the value of international earnings when converted back into the local currency. This necessitates robust foreign exchange risk management, potentially through financial hedging instruments or by strategically diversifying its revenue streams across different currency zones to mitigate adverse impacts.

Economic Growth in Key Markets

The economic performance in China, Hisun's home market, is a critical driver. For instance, China's GDP growth was projected to be around 5.0% in 2024, indicating continued expansion that supports healthcare investment.

Internationally, Hisun's sales are tied to the economic health of regions like North America and Europe. The US economy, for example, showed resilience with GDP growth estimated at 2.1% for 2024, bolstering consumer spending on healthcare.

- China's GDP growth: Projected at 5.0% for 2024, supporting domestic pharmaceutical demand.

- US GDP growth: Estimated at 2.1% for 2024, influencing international market performance.

- Impact of growth: Strong economic expansion generally correlates with increased healthcare expenditure and pharmaceutical sales for Hisun.

Inflationary Pressures

Rising inflation presents a significant challenge for Hisun Pharmaceutical, potentially increasing operational costs across the board. For instance, in 2024, global inflation rates remained elevated, impacting raw material sourcing and energy prices, which are critical for pharmaceutical manufacturing. These escalating expenses can directly squeeze profit margins if Hisun cannot offset them through other means.

To counter these pressures, Hisun must implement robust cost management strategies. This could involve optimizing supply chains, investing in energy-efficient technologies, and exploring more localized sourcing options. The company’s ability to adapt its pricing models strategically will also be crucial in maintaining profitability amidst persistent inflation.

- Increased Cost of Goods Sold: Higher prices for active pharmaceutical ingredients (APIs), excipients, and packaging materials directly impact Hisun's COGS.

- Elevated Operating Expenses: Rising labor wages, energy costs for facilities, and increased logistics expenses contribute to higher overhead.

- Potential Margin Erosion: If price increases cannot fully compensate for cost hikes, profit margins are likely to shrink.

- Need for Strategic Pricing: Adapting product pricing to reflect increased costs while remaining competitive is a key challenge.

Global economic growth directly influences healthcare spending, with a projected 5.0% GDP growth for China in 2024 and an estimated 2.1% for the US. This expansion bolsters demand for pharmaceutical products, benefiting Hisun's sales. However, rising inflation, with persistent elevated global rates in 2024, increases operational costs for raw materials and energy, potentially impacting Hisun's profit margins. Currency fluctuations also play a role; for example, a stronger Yuan in 2024 could make Hisun's exports more expensive internationally.

| Economic Factor | 2024 Projection/Estimate | Impact on Hisun Pharmaceutical |

|---|---|---|

| Global Healthcare Expenditure | Projected to reach $11.6 trillion by 2025 | Increases market opportunity and demand for Hisun's products. |

| China GDP Growth | Projected at 5.0% for 2024 | Supports domestic pharmaceutical demand and investment. |

| US GDP Growth | Estimated at 2.1% for 2024 | Influences international market performance and consumer spending on healthcare. |

| Global Inflation | Remained elevated in 2024 | Increases production costs (APIs, energy) and operating expenses, potentially squeezing margins. |

| Currency Exchange Rates (e.g., CNY/USD) | Experienced volatility in 2024 | Affects export competitiveness and the cost of imported raw materials. |

Full Version Awaits

Hisun Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Hisun Pharmaceutical.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Hisun Pharmaceutical.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Hisun Pharmaceutical's strategic landscape.

Sociological factors

The global population is getting older, and this trend is a big deal for companies like Hisun Pharmaceutical. As people age, they tend to develop more chronic and age-related illnesses. Think about things like heart disease, diabetes, and different types of cancer – these are all areas Hisun focuses on.

This aging demographic means there's a steady and increasing need for medicines and treatments to manage these conditions. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.5 billion globally, more than double the 2020 figure. This growth directly translates into a larger market for Hisun's established and pipeline drugs.

Hisun's existing product range, which includes treatments for cardiovascular diseases and oncology, is already a good fit for the healthcare demands of an older population. The company's strategic focus on these therapeutic areas positions it well to capitalize on the sustained demand driven by this significant demographic shift.

Growing public consciousness regarding health, wellness, and preventative measures is a significant sociological driver. This heightened awareness translates directly into increased demand for early disease detection, cutting-edge medical treatments, and solutions for managing lifestyle-related illnesses. For Hisun Pharmaceutical, this means a broader market for their current and pipeline products, as individuals are more proactive about seeking medical care and adhering to prescribed therapies.

The increasing prevalence of lifestyle diseases like diabetes, obesity, and certain cancers, driven by evolving dietary patterns and sedentary lifestyles, is creating a significant and growing market for Hisun's specialized pharmaceuticals. For instance, the International Diabetes Federation reported over 537 million adults living with diabetes globally in 2021, a figure projected to reach 643 million by 2030, highlighting the immense need for effective treatments.

Pharmaceutical companies, including Hisun, are strategically positioned to develop and market innovative therapies for these widespread health challenges. This societal health trend translates directly into a substantial business opportunity for Hisun, as demand for treatments addressing these chronic conditions continues to rise.

Access to Healthcare and Affordability

Societal expectations for universal, affordable healthcare significantly shape government policies. This includes regulations on drug pricing, reimbursement frameworks, and the development of healthcare infrastructure. For Hisun Pharmaceutical, offering accessible and cost-effective solutions is paramount for market entry and gaining public trust, especially in emerging markets.

The global average out-of-pocket healthcare expenditure was around 14% in 2023, highlighting the pressure on affordability. Hisun's strategy must navigate this by balancing the costs of research and development with the need for accessible medicines. This societal consideration directly impacts market penetration and long-term public acceptance, particularly for chronic disease treatments.

- Innovation vs. Affordability: Societal pressure demands that pharmaceutical companies like Hisun find ways to make groundbreaking treatments affordable, a challenge evident in ongoing debates about drug price controls.

- Developing Economies: In regions where per capita income is lower, like many parts of Africa and Asia, Hisun's ability to offer low-cost generics and essential medicines is critical for market access and public health impact.

- Government Policy Influence: Policies such as price caps or mandatory generic substitution, seen in countries like India and Brazil, directly affect Hisun's revenue streams and market positioning.

Public Trust in Pharmaceuticals

Public trust is a cornerstone for pharmaceutical companies like Hisun. Concerns about drug safety, efficacy, and how companies market their products significantly impact brand image and how readily patients adhere to treatment. For instance, a 2024 survey indicated that only 45% of consumers felt confident in the pharmaceutical industry's ethical practices, a figure Hisun must actively address.

Societal expectations are also evolving. Increased demand for transparency in drug pricing and a focus on corporate social responsibility can sway consumer decisions and attract greater regulatory attention. Hisun's commitment to these areas, demonstrated through initiatives like their 2025 patient assistance programs, directly influences public perception.

- Public Perception: Surveys in late 2024 showed a general public skepticism towards the pharmaceutical industry's pricing strategies, with over 60% of respondents expressing concern.

- Ethical Scrutiny: Regulatory bodies, including the FDA, have increased their oversight of marketing claims and clinical trial data, putting pressure on companies to maintain impeccable ethical standards.

- Brand Reputation: Hisun's proactive engagement in community health initiatives and transparent reporting on drug development milestones are crucial for building and maintaining public trust.

The aging global population is a significant sociological factor, driving increased demand for Hisun Pharmaceutical's treatments for chronic and age-related diseases. By 2050, the number of individuals aged 65 and over is projected to reach 1.5 billion, more than doubling the 2020 figure, creating a sustained market for Hisun's oncology and cardiovascular drugs.

Growing public awareness of health and wellness fuels demand for preventative measures and advanced medical treatments, benefiting Hisun as people become more proactive about their health. The rising incidence of lifestyle diseases, such as diabetes, with over 537 million adults affected globally in 2021, presents a substantial opportunity for Hisun's specialized pharmaceuticals.

Societal expectations for accessible and affordable healthcare influence government policies on drug pricing and reimbursement. Hisun must balance R&D costs with affordability, especially as global out-of-pocket healthcare expenditure averaged around 14% in 2023, impacting market penetration and public trust.

Public trust is paramount, with a 2024 survey revealing only 45% confidence in the pharmaceutical industry's ethics. Hisun's commitment to transparency and corporate social responsibility, exemplified by its 2025 patient assistance programs, is crucial for building and maintaining public perception and brand reputation.

| Sociological Factor | Impact on Hisun Pharmaceutical | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Aging Population | Increased demand for chronic disease treatments | Global population aged 65+ projected to reach 1.5 billion by 2050 (vs. ~700 million in 2020) |

| Health Consciousness & Lifestyle Diseases | Broader market for preventative and treatment solutions | Diabetes prevalence expected to reach 643 million by 2030 (from 537 million in 2021) |

| Affordability Expectations | Pressure on pricing strategies and market access | Global out-of-pocket healthcare expenditure ~14% (2023) |

| Public Trust & Ethics | Need for transparency and ethical practices | ~45% consumer confidence in pharma ethics (2024 survey) |

Technological factors

The pharmaceutical industry is experiencing a revolution driven by rapid advancements in biotechnology, such as gene editing and cell therapies. Hisun Pharmaceutical, with its dual focus on chemical and biological drugs, is well-positioned to leverage these innovations. For instance, the global biologics market was valued at approximately $420 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity for companies like Hisun.

Investing in research and development for novel biologics and biosimilars is paramount for Hisun to maintain its competitive edge and address critical unmet medical needs across various therapeutic areas. The company's commitment to R&D in these advanced areas is key to unlocking new frontiers in drug discovery and development, potentially leading to breakthrough treatments.

Hisun Pharmaceutical is actively embracing digital transformation, integrating artificial intelligence (AI), big data analytics, and automation across its R&D and manufacturing operations. This strategic move is designed to accelerate the lengthy drug discovery process and streamline clinical trials. For instance, AI-driven platforms are showing promise in identifying novel drug candidates, potentially reducing discovery timelines by years.

The implementation of advanced automation in manufacturing is crucial for enhancing Hisun's production efficiency and ensuring stringent quality control. By leveraging these technologies, the company aims to optimize yields, minimize errors, and maintain consistent product quality, which is paramount in the highly regulated pharmaceutical sector. This digital shift is key to Hisun's strategy for innovation and operational excellence.

Technological advancements in drug delivery are revolutionizing patient care. Innovations like sustained-release formulations, which reduce the frequency of dosing, and targeted therapies, delivering medication directly to affected cells, are significantly boosting treatment effectiveness and patient adherence. For instance, the global drug delivery market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating strong demand for these sophisticated systems.

Hisun Pharmaceutical's strategic adoption of these cutting-edge delivery technologies presents a clear path to enhanced competitiveness. By integrating advanced methods such as liposomal encapsulation or nanoparticle-based delivery, Hisun can improve the therapeutic profile of its existing drug pipeline, potentially increasing market share and opening doors to new therapeutic areas. This focus on delivery innovation not only optimizes drug performance but also creates new revenue streams by offering differentiated products.

Emergence of Personalized Medicine

The pharmaceutical landscape is increasingly shaped by the emergence of personalized medicine, a trend fueled by rapid advancements in genomics and diagnostics. This allows for treatments to be precisely tailored to an individual's unique genetic makeup and health profile, moving away from one-size-fits-all approaches. For companies like Hisun Pharmaceutical, this necessitates a significant evolution in their research and development strategies, focusing on the creation of targeted therapies and the crucial companion diagnostics needed to identify suitable patient populations. By 2024, the global personalized medicine market was valued at approximately $500 billion, with projections indicating substantial growth, underscoring the strategic importance of this shift.

Hisun's R&D capabilities must therefore adapt to this paradigm shift, prioritizing precision medicine. This means investing in areas like gene sequencing, biomarker identification, and the development of therapies designed for specific genetic mutations or patient subgroups. Such a focus aims to deliver treatments that are not only more effective but also significantly safer by minimizing off-target effects. For instance, advancements in liquid biopsy technology are enabling earlier and more accurate cancer detection, a key component of personalized oncology, a sector Hisun is actively involved in.

- Genomic Data Integration: Hisun needs to enhance its ability to analyze and integrate vast amounts of genomic data into its drug discovery pipelines.

- Targeted Therapy Development: The company should prioritize the development of therapies that act on specific molecular targets identified through personalized diagnostics.

- Companion Diagnostics: Investing in or partnering for the development of companion diagnostics is crucial to ensure the effective and safe use of targeted therapies.

- Biomarker Research: Continued investment in identifying and validating predictive biomarkers will be key to stratifying patient populations for clinical trials and treatment.

Supply Chain Digitization and Traceability

Hisun Pharmaceutical is actively integrating digital technologies like blockchain and the Internet of Things (IoT) to bolster its supply chain. This move significantly boosts transparency and traceability, crucial for pharmaceutical integrity.

These advanced systems are instrumental in combating counterfeit drugs and ensuring that products maintain their quality from the initial sourcing of raw materials all the way to the end consumer. This digital transformation also streamlines logistics, making operations smoother and more reliable.

By embracing digitization, Hisun is enhancing its operational resilience and strengthening its ability to meet stringent regulatory requirements across its international markets. For example, by 2024, the global pharmaceutical supply chain market was projected to reach over $20 billion, highlighting the increasing investment in these digital solutions.

Key benefits for Hisun include:

- Enhanced product traceability: Real-time tracking of goods from origin to destination.

- Counterfeit prevention: Blockchain technology provides an immutable record, making it harder to introduce fake products.

- Improved operational efficiency: IoT sensors and data analytics optimize inventory management and logistics.

- Strengthened regulatory compliance: Digital records simplify audits and adherence to global pharmaceutical standards.

Hisun Pharmaceutical's technological trajectory is marked by a strong embrace of AI and big data, aiming to accelerate drug discovery and streamline clinical trials. For instance, AI platforms are reducing discovery timelines, a critical advantage in the fast-paced pharmaceutical sector. The company's investment in advanced automation for manufacturing also enhances efficiency and ensures stringent quality control, vital for meeting global regulatory standards.

Legal factors

Hisun Pharmaceutical operates under a rigorous and constantly changing landscape of drug regulations. Authorities such as China's National Medical Products Administration (NMPA), the U.S. Food and Drug Administration (FDA), and the European Medicines Agency (EMA) set strict standards that Hisun must meet. These regulations cover everything from the initial stages of drug development and the execution of clinical trials to the quality of manufacturing processes, accurate product labeling, and ongoing post-market monitoring.

Failure to comply with these demanding requirements can result in serious consequences. These can include substantial fines, the forced withdrawal of products from the market, and lasting damage to the company's reputation. Consequently, maintaining a strong and proactive regulatory affairs department is absolutely vital for Hisun's continued success and market access.

Intellectual property rights, especially patents, are the bedrock of Hisun Pharmaceutical's innovation strategy. These protections are vital for recouping substantial research and development expenditures and ensuring a period of market exclusivity for novel drug discoveries. For instance, in 2023, Hisun continued to invest heavily in R&D, with a significant portion allocated to patent filings and maintenance, aiming to secure its pipeline of oncology and anti-infective drugs.

The company faces ongoing legal hurdles in managing its patent portfolio. This includes navigating the intricate landscape of global patent laws, actively defending against potential infringement claims, and engaging in litigation when necessary to protect its innovations. Successfully enforcing these rights worldwide is paramount for maintaining Hisun's competitive edge in the pharmaceutical market.

Hisun Pharmaceutical must navigate a complex web of anti-monopoly and fair competition laws, both domestically in China and in the international markets it serves. These regulations are designed to prevent practices like price-fixing, bid-rigging, and market allocation, all of which could stifle competition and harm consumers. For instance, China's Anti-Monopoly Law, enacted in 2008 and significantly amended in 2022, imposes strict penalties for violations, including substantial fines and operational restrictions.

Compliance is not merely a legal obligation but a strategic imperative for Hisun. As the company aims for global expansion and increased market penetration, adhering to these fair competition principles becomes even more critical. Failure to comply can lead to severe financial penalties, reputational damage, and protracted legal battles, as demonstrated by numerous cases in the pharmaceutical sector worldwide where companies have faced billions in fines for anti-competitive behavior.

Data Privacy and Cybersecurity Regulations

Hisun Pharmaceutical operates within a complex legal landscape concerning data privacy and cybersecurity. China's Personal Information Protection Law (PIPL), enacted in 2021, imposes strict rules on how companies collect, process, and store personal information, impacting Hisun's digital R&D and patient data management. Failure to comply can result in significant penalties, with PIPL fines potentially reaching up to 50 million yuan or 5% of annual turnover.

Furthermore, as Hisun engages in international markets and collaborations, adherence to global standards like the European Union's General Data Protection Regulation (GDPR) becomes critical. GDPR, with its broad extraterritorial reach, mandates robust data protection measures and breach notification protocols. A 2024 report indicated that data privacy fines globally are on the rise, underscoring the financial and reputational risks associated with non-compliance.

- PIPL Fines: Up to 50 million yuan or 5% of annual turnover for violations.

- GDPR Impact: Affects Hisun's international data handling and requires stringent protection.

- Cybersecurity Imperative: Essential for safeguarding sensitive patient and research data from breaches.

- Reputational Risk: Non-compliance can severely damage Hisun's standing and trust.

Environmental, Health, and Safety (EHS) Regulations

Hisun Pharmaceutical's manufacturing facilities must adhere to stringent Environmental, Health, and Safety (EHS) regulations. These cover critical areas such as waste disposal, air and water emissions, and ensuring a safe working environment for all employees. For instance, China's Ministry of Ecology and Environment has progressively tightened emission standards for pharmaceutical manufacturing, with new regulations impacting volatile organic compounds (VOCs) and wastewater discharge becoming more rigorous in recent years, a trend expected to continue through 2025.

Failure to comply with these EHS laws can lead to severe consequences, including substantial financial penalties, temporary or permanent closure of production lines, and significant damage to Hisun's reputation. In 2023, environmental fines in China's pharmaceutical sector saw an increase, with many companies facing penalties for non-compliance with wastewater treatment standards.

To navigate this complex regulatory landscape and maintain operational continuity, Hisun must consistently invest in advanced, eco-friendly manufacturing technologies and robust safety management systems. This proactive approach not only ensures legal adherence but also supports the company's commitment to sustainable operations and corporate social responsibility.

Key EHS compliance areas for Hisun include:

- Waste Management: Proper handling and disposal of chemical and pharmaceutical waste according to national and local environmental protection laws.

- Emissions Control: Meeting strict limits on air pollutants and greenhouse gases emitted from manufacturing processes.

- Water Usage and Discharge: Complying with regulations on water conservation and the quality of wastewater discharged from facilities.

- Workplace Safety: Implementing comprehensive safety protocols and training to prevent accidents and protect employee health in manufacturing and R&D environments.

Hisun Pharmaceutical is subject to evolving legal frameworks governing drug development, manufacturing, and marketing. Compliance with regulations from bodies like the NMPA, FDA, and EMA is crucial, with penalties for non-adherence including fines and product recalls. In 2024, regulatory scrutiny on drug pricing and marketing practices intensified globally, impacting pharmaceutical companies' revenue streams and operational strategies.

Intellectual property law is paramount, with patent protection safeguarding Hisun's R&D investments. The company actively manages its patent portfolio, facing challenges in global patent enforcement and potential infringement disputes. As of early 2025, the pharmaceutical industry continues to see significant patent litigation, highlighting the importance of robust IP strategies.

Antitrust and fair competition laws, such as China's amended Anti-Monopoly Law (2022), dictate Hisun's market conduct. Violations can lead to substantial fines and operational restrictions. The company must ensure its pricing strategies and business practices do not create monopolies or hinder fair competition, a key focus for regulators in 2024.

Data privacy regulations, including China's PIPL and the EU's GDPR, impose strict requirements on handling personal and health data. Non-compliance can result in severe penalties, with PIPL fines potentially reaching 5% of annual turnover. In 2024, data breach incidents and subsequent fines underscored the critical need for robust cybersecurity measures.

Environmental, Health, and Safety (EHS) regulations are integral to Hisun's manufacturing operations. China's environmental standards, particularly for emissions and wastewater, have tightened, with continued emphasis expected through 2025. Companies failing to meet these standards, as seen with increased environmental fines in the sector in 2023, face operational disruptions and reputational damage.

| Legal Area | Key Regulations/Considerations | Impact on Hisun | 2024/2025 Trend |

|---|---|---|---|

| Drug Regulation | NMPA, FDA, EMA standards | Compliance essential for market access; penalties for non-adherence | Increased scrutiny on pricing and marketing |

| Intellectual Property | Patent laws, global enforcement | Protects R&D investment; litigation risks | Continued patent litigation in pharma |

| Competition Law | Anti-Monopoly Law (China) | Prevents price-fixing, market allocation; fines for violations | Regulatory focus on fair market practices |

| Data Privacy | PIPL, GDPR | Strict data handling rules; significant fines for breaches | Rising data breach incidents and fines |

| EHS | Emissions, waste, safety standards | Operational compliance; penalties for violations | Tightening environmental standards |

Environmental factors

Growing global awareness of industrial environmental impact is pushing companies like Hisun Pharmaceutical to prioritize sustainable manufacturing. This means actively working to lower energy use, cut down on waste, and make better use of raw materials in their production lines. For instance, by 2024, many pharmaceutical companies reported a 10-15% increase in investment towards greener manufacturing technologies.

Adopting eco-friendly approaches, such as investing in renewable energy sources for their facilities or implementing advanced waste recycling programs, allows Hisun to reduce its environmental footprint. This proactive stance is crucial not only for corporate social responsibility but also for staying ahead of increasingly stringent environmental regulations worldwide.

The proper disposal and management of pharmaceutical waste, encompassing chemical by-products, expired medications, and hazardous manufacturing materials, present considerable environmental hurdles. Hisun Pharmaceutical faces the imperative to comply with rigorous regulations governing waste treatment and disposal to avert pollution and safeguard ecological systems.

In 2024, the global pharmaceutical waste market was valued at approximately $10 billion, with stringent environmental regulations being a key driver. Hisun must invest in advanced waste management systems and foster responsible disposal practices to demonstrate robust environmental stewardship.

Climate change poses a significant threat to Hisun Pharmaceutical's global supply chain. Increasingly frequent extreme weather events, such as floods and droughts, can directly impact the availability and quality of raw materials sourced from various regions. For instance, in 2024, several key agricultural regions supplying active pharmaceutical ingredients (APIs) experienced severe weather, leading to an estimated 15% increase in raw material costs for some companies in the sector.

To counter these disruptions, Hisun must actively assess and build resilience into its supply chain. Diversifying suppliers across different geographical locations and optimizing logistics to mitigate transit risks are crucial steps. By proactively identifying and addressing climate-related vulnerabilities, Hisun can ensure business continuity and maintain a stable supply of essential medicines for patients worldwide.

Water Scarcity and Pollution Concerns

Pharmaceutical manufacturing, including Hisun's operations, is notoriously water-intensive. This makes water scarcity and pollution critical environmental considerations. For instance, China, where Hisun is headquartered, faces significant water stress in many regions, impacting industrial water availability. In 2023, reports indicated that several major industrial hubs experienced water shortages, necessitating stricter industrial water usage regulations.

Hisun must therefore prioritize efficient water management. This includes investing in advanced water recycling technologies and robust wastewater treatment systems to minimize its operational water footprint. Effective wastewater treatment is crucial not only for regulatory compliance but also to prevent the contamination of local water sources, which can have severe ecological and public health consequences. For example, by 2024, many pharmaceutical companies globally are aiming to reduce their water intensity by 10-15% compared to 2020 benchmarks.

Responsible water stewardship is becoming a key factor in ensuring long-term operational sustainability and maintaining positive community relations. Companies demonstrating strong environmental performance, particularly in water management, often enjoy enhanced brand reputation and social license to operate. By 2025, investors are increasingly scrutinizing environmental, social, and governance (ESG) factors, with water management being a prominent area of focus.

- Water Intensity: Pharmaceutical production can require substantial water volumes for cleaning, cooling, and as a solvent.

- Wastewater Treatment: Proper treatment is essential to remove active pharmaceutical ingredients (APIs) and other chemical contaminants before discharge.

- Regulatory Landscape: Increasing environmental regulations globally mandate stricter controls on water usage and discharge quality.

- Reputational Risk: Poor water management can lead to fines, operational disruptions, and damage to corporate reputation.

ESG Investor Scrutiny and Reporting

Investor focus on Environmental, Social, and Governance (ESG) factors significantly impacts Hisun Pharmaceutical, driving increased scrutiny of its environmental footprint. Stakeholders now expect detailed and transparent reporting on key areas like carbon emissions, water usage, and waste management. For instance, by the end of 2024, Hisun aims to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 15% compared to its 2022 baseline, a target aligned with global sustainability benchmarks.

This heightened ESG awareness translates into tangible expectations for Hisun's operational practices. The company is under pressure to demonstrate robust environmental stewardship, including efficient resource utilization and adherence to stringent pollution control standards. Meeting these expectations is not just about compliance; it's about building trust.

Strong ESG performance is increasingly linked to financial outcomes. Hisun's commitment to sustainability can bolster investor confidence, potentially attracting new capital and improving its access to finance. Companies with superior ESG ratings, such as those recognized by MSCI in their 2024 reviews, often experience lower costs of capital and enhanced market valuations. Hisun's proactive approach to environmental reporting, including its 2025 sustainability report detailing progress on waste reduction initiatives, aims to solidify its reputation as a responsible industry leader.

- Increased Scrutiny: Investors are closely examining Hisun's environmental performance, particularly concerning emissions and waste.

- Reporting Expectations: Transparent reporting on carbon emissions, water usage, and sustainable practices is now a standard stakeholder demand.

- Capital Attraction: Companies with strong ESG credentials, like Hisun's reported 10% reduction in hazardous waste in 2024, are better positioned to attract investment.

- Reputational Enhancement: Demonstrating environmental responsibility improves Hisun's standing as a responsible corporate citizen in the pharmaceutical sector.

Hisun Pharmaceutical must navigate increasingly stringent environmental regulations worldwide, impacting everything from waste disposal to water usage. The company's commitment to sustainable manufacturing, including reducing energy consumption and waste, is crucial for compliance and corporate social responsibility. In 2024, the global pharmaceutical waste market reached approximately $10 billion, highlighting the significant financial implications of effective waste management.

Climate change presents a tangible threat to Hisun's supply chain, with extreme weather events in 2024 impacting raw material availability and causing an estimated 15% cost increase for some pharmaceutical ingredients. To mitigate these risks, Hisun is focusing on supply chain resilience, including diversifying suppliers and optimizing logistics to ensure a stable supply of essential medicines.

Water scarcity and pollution are critical environmental concerns for Hisun, particularly given China's water stress. The company is investing in advanced water recycling and wastewater treatment technologies to minimize its operational water footprint and prevent local water source contamination. By 2024, many pharmaceutical firms aim for a 10-15% reduction in water intensity compared to 2020 benchmarks.

Investor focus on ESG factors, especially environmental performance, is intensifying. Hisun's goal to reduce Scope 1 and Scope 2 greenhouse gas emissions by 15% by the end of 2024 demonstrates its commitment to sustainability. Strong ESG performance, evidenced by a reported 10% reduction in hazardous waste in 2024, is vital for attracting investment and enhancing corporate reputation.

| Environmental Factor | Impact on Hisun Pharmaceutical | 2024/2025 Data/Trends |

|---|---|---|

| Sustainable Manufacturing | Need to lower energy use, cut waste, and improve raw material efficiency. | Pharmaceutical companies investing 10-15% more in greener technologies. |

| Waste Management | Proper disposal of chemical by-products, expired meds, and hazardous materials. | Global pharmaceutical waste market valued at ~$10 billion; focus on compliance. |

| Climate Change & Supply Chain | Extreme weather affecting raw material availability and quality. | Estimated 15% raw material cost increase due to severe weather impacting API sources. |

| Water Intensity & Pollution | High water usage in production; need for efficient water management. | Aim to reduce water intensity by 10-15% by 2024; China faces water stress. |

| ESG Investor Scrutiny | Demand for transparent reporting on emissions, water, and waste. | Targeting 15% GHG emission reduction (Scope 1 & 2) by end of 2024; 10% hazardous waste reduction in 2024. |

PESTLE Analysis Data Sources

Our Hisun Pharmaceutical PESTLE analysis is built upon a robust foundation of data sourced from official government publications, international financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical industry.