Hisun Pharmaceutical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

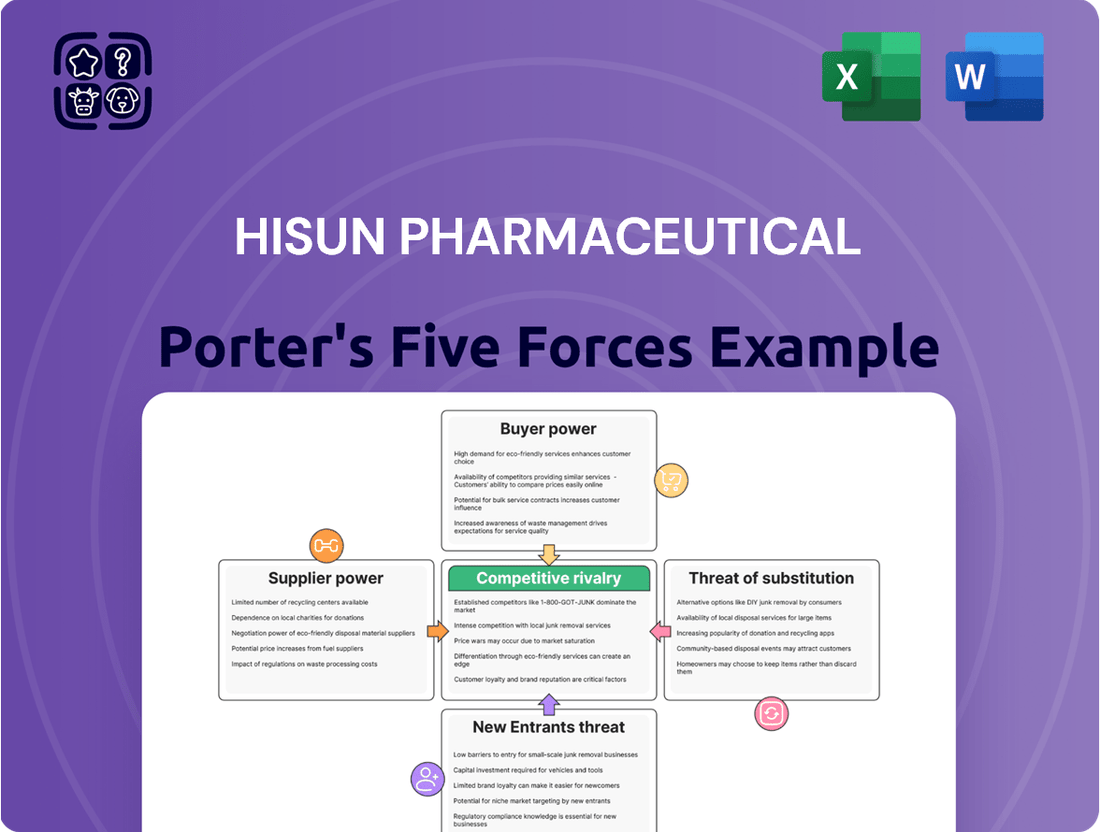

Hisun Pharmaceutical faces significant competitive pressures, with moderate bargaining power from buyers and suppliers impacting its profitability. The threat of new entrants is a constant consideration, while the intensity of rivalry within the pharmaceutical sector remains high.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hisun Pharmaceutical’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The pharmaceutical sector frequently depends on a select group of specialized providers for crucial raw materials, active pharmaceutical ingredients (APIs), and intermediates. When these suppliers are few in number or control proprietary manufacturing methods, their leverage over Hisun Pharmaceutical grows substantially.

In 2023, the global API market was valued at approximately $221.4 billion, with a significant portion concentrated among a few key manufacturers, particularly in China and India. This concentration means Hisun may face limited options for sourcing critical components, potentially driving up costs.

Hisun's capacity to ensure a steady supply of necessary materials at competitive rates hinges on broadening its supplier network and cultivating enduring partnerships. Diversification mitigates the risk of dependency on any single supplier and enhances negotiation strength.

Suppliers providing unique inputs for Hisun Pharmaceutical's advanced drug development, particularly in oncology and biologics, often wield significant bargaining power. For instance, the sourcing of highly specific active pharmaceutical ingredients (APIs) or specialized cell culture media can be concentrated among a few providers.

The substantial costs and time involved in switching suppliers for these critical components, encompassing rigorous re-validation processes and obtaining new regulatory approvals, further strengthen the leverage of incumbent suppliers. This situation underscores the critical need for Hisun to cultivate robust supply chain resilience and strategic supplier relationships, especially as the pharmaceutical industry increasingly relies on complex, proprietary materials.

The threat of forward integration by suppliers poses a significant risk to Hisun Pharmaceutical. If a key supplier, particularly a specialized Active Pharmaceutical Ingredient (API) manufacturer, decides to move downstream and produce finished dosage forms, they could directly compete with Hisun. This would not only reduce Hisun's supplier options but also introduce a new, formidable competitor into their market. For instance, in 2024, the global API market saw continued consolidation, with some larger API producers exploring vertical integration to capture more value.

Supplier's Importance to Hisun's Product Quality and Standards

Hisun Pharmaceutical's commitment to international quality standards means its suppliers are crucial for product integrity. Suppliers meeting stringent global regulations, like Good Manufacturing Practices (GMP), are essential, and their consistent quality can lead to higher pricing power. For instance, in 2023, Hisun reported that a significant portion of its raw material costs were tied to suppliers adhering to these high standards, impacting its cost structure.

- Supplier Reliability: Hisun relies on suppliers for critical raw materials and active pharmaceutical ingredients (APIs) that directly influence product quality and safety.

- Quality Control Costs: Maintaining high quality requires rigorous supplier audits and quality checks, adding to Hisun's operational expenses.

- Regulatory Compliance: Suppliers must consistently meet evolving international regulatory requirements, such as those from the FDA and EMA, to ensure Hisun's products gain and maintain market access.

- Impact on Pricing: Suppliers with a proven track record of quality and compliance can command premium prices, limiting Hisun's ability to negotiate lower costs for essential inputs.

Availability of Substitute Inputs

The bargaining power of suppliers for Hisun Pharmaceutical is influenced by the availability of substitute inputs. If Hisun can readily source alternative raw materials or if there are multiple suppliers for essential components, this reduces the leverage of any single supplier. For instance, in 2024, the pharmaceutical industry saw increased diversification in sourcing for active pharmaceutical ingredients (APIs) due to geopolitical shifts, making it easier for companies like Hisun to switch suppliers for certain basic chemicals.

However, the situation changes dramatically for highly specialized or proprietary ingredients. When Hisun relies on a single supplier for a unique compound or a patented intermediate, that supplier holds considerable power. This is particularly relevant for novel drug development where specific, often patented, raw materials are critical. Hisun's internal research and development efforts play a crucial role here; by developing in-house synthesis methods for certain inputs, Hisun can diminish its dependence on external suppliers, thereby lowering their bargaining power.

- Reduced Supplier Power: Hisun's ability to switch between multiple suppliers for common pharmaceutical intermediates in 2024 helped mitigate supplier price increases.

- Increased Supplier Power: Reliance on a single, patent-protected supplier for a key oncology drug component in early 2025 grants that supplier significant leverage.

- R&D Mitigation: Hisun's investment in developing proprietary synthesis routes for certain APIs aims to reduce reliance on external, high-bargaining-power suppliers.

The bargaining power of suppliers for Hisun Pharmaceutical is a critical factor, particularly concerning specialized raw materials and active pharmaceutical ingredients (APIs). When these inputs are concentrated among a few providers or involve proprietary technology, suppliers can exert significant influence over pricing and availability. For instance, the global API market, valued at approximately $221.4 billion in 2023, shows concentration, meaning Hisun may face limited sourcing options.

Hisun's ability to manage supplier power hinges on diversifying its supplier base and fostering strong relationships. This strategy is essential to mitigate dependency and enhance negotiation capabilities, especially as the industry increasingly relies on complex, proprietary materials. The cost and time associated with switching suppliers for critical components, including re-validation and regulatory approvals, further solidify the leverage of established providers.

The threat of forward integration by suppliers, where they might move into producing finished dosage forms, presents a direct competitive risk. In 2024, consolidation within the API sector saw some manufacturers exploring such vertical integration. Furthermore, suppliers adhering to stringent international quality standards, like GMP, are vital for Hisun's product integrity and can command premium pricing, impacting Hisun's cost structure, as noted in their 2023 reports where a significant portion of raw material costs were tied to such suppliers.

| Factor | Impact on Hisun | Example/Data (2023-2024) |

|---|---|---|

| Supplier Concentration | High bargaining power for few suppliers | Global API market concentration, with key players in China and India. |

| Switching Costs | Increases supplier leverage | Rigorous re-validation and regulatory approval processes for new suppliers. |

| Proprietary Inputs | Significant supplier power | Specialized APIs or cell culture media for novel drug development. |

| Supplier Integration | Potential for direct competition | API manufacturers exploring vertical integration into finished dosage forms (observed in 2024). |

| Quality Standards | Suppliers with high standards can command premium prices | Significant raw material costs linked to GMP-compliant suppliers in 2023. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hisun Pharmaceutical's position in the pharmaceutical industry.

Quickly identify competitive threats and opportunities with a visual breakdown of Hisun Pharmaceutical's market landscape, simplifying strategic planning.

Customers Bargaining Power

Hisun Pharmaceutical's major customers, including large hospital networks, government health agencies, and international distributors, wield significant bargaining power due to their substantial purchasing volumes. These entities can leverage their scale to negotiate lower prices, extended payment terms, and more favorable contract clauses, especially in markets where bulk tenders are the norm.

Customer price sensitivity is a significant factor for Hisun Pharmaceutical, especially given the global healthcare systems' ongoing efforts to manage expenses. In 2024, many developed nations continued to implement stricter drug pricing regulations and reimbursement policies, directly impacting how much customers and payers are willing to spend on pharmaceuticals.

The rise of generic and biosimilar competition further amplifies this price sensitivity. For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) actively negotiates prices for certain drugs, and this trend is mirrored in other major markets. This environment compels Hisun to carefully consider its pricing strategies to remain competitive while ensuring profitability.

Hisun's ability to demonstrate the cost-effectiveness of its therapies is therefore paramount. Products that offer comparable efficacy at a lower price point are more likely to gain traction in budget-constrained healthcare environments. This focus on value is crucial for securing market share against competitors and maintaining strong sales performance.

Customers wield significant influence when readily available substitutes exist. For Hisun Pharmaceutical, this means patients and healthcare providers can opt for generic versions, biosimilars, or entirely different treatments from competing firms. This is particularly true in areas where Hisun operates, as the pharmaceutical landscape is dynamic and competitive.

Hisun's strategy to counter this involves robust product differentiation, especially within its oncology and biologics segments. However, the sheer number of competitors in its key therapeutic areas means customers consistently have choices, underscoring the critical need for Hisun to maintain a pipeline of innovative drugs with demonstrable clinical superiority.

Customer's Access to Information and Market Transparency

Customers now have unprecedented access to information regarding drug pricing and efficacy, significantly increasing market transparency. This allows them to readily compare Hisun Pharmaceutical's products with those of competitors, putting downward pressure on prices and demanding stronger value propositions. For instance, in 2024, the average drug price in the U.S. saw continued scrutiny, with many payers and patient advocacy groups actively publishing comparative cost data.

This heightened transparency forces Hisun to clearly communicate the distinct advantages and cost-effectiveness of its pharmaceutical offerings. Sophisticated procurement processes employed by large healthcare systems and government entities further amplify this customer power. They leverage data analytics to negotiate better terms, making it essential for Hisun to demonstrate superior clinical outcomes alongside competitive pricing.

- Information Access: Patients and payers can easily find and compare drug prices and clinical trial results online.

- Procurement Sophistication: Large buyers utilize advanced analytics to assess and negotiate drug costs.

- Pricing Pressure: Increased transparency directly correlates with greater customer leverage in price negotiations.

- Value Proposition: Hisun must clearly articulate not just efficacy but also cost-effectiveness to retain market share.

Threat of Backward Integration by Customers

While the threat of backward integration by customers is generally low in the pharmaceutical industry due to high regulatory and capital barriers, large healthcare providers or distributors could theoretically explore manufacturing their own generic drugs. This potential, however distant, can still exert subtle pressure on Hisun Pharmaceutical to maintain competitive pricing and demonstrate consistent value. For instance, in 2024, the global generic drugs market was valued at over $400 billion, indicating a significant market that, in theory, could attract such integration efforts if cost efficiencies were substantial enough.

The immense R&D investment and stringent manufacturing compliance required for pharmaceuticals present a formidable deterrent to backward integration for most customers. Hisun Pharmaceutical, like its peers, operates within a highly regulated environment, necessitating specialized expertise and substantial capital expenditure for drug development and production. This complexity significantly raises the barrier to entry for any potential customer seeking to manufacture its own products.

The primary impact of this long-term, high-barrier threat lies in its influence on negotiation dynamics. Customers, even if unable to integrate backward, can leverage the theoretical possibility to push for better terms. This encourages Hisun Pharmaceutical to continuously innovate, optimize its supply chain, and focus on delivering superior product quality and service to solidify its market position and mitigate this potential customer leverage.

Hisun Pharmaceutical faces significant bargaining power from its customers, primarily large hospital networks and government health agencies, due to their substantial purchasing volumes. These entities leverage their scale to negotiate lower prices and more favorable contract terms, a trend amplified by increasing customer price sensitivity and transparency in 2024.

The availability of generic and biosimilar alternatives further empowers customers, forcing Hisun to emphasize cost-effectiveness and superior clinical outcomes. For instance, in 2024, the global generic drugs market exceeded $400 billion, highlighting a competitive landscape where price and value are paramount for market share.

| Customer Segment | Bargaining Power Drivers | Impact on Hisun Pharmaceutical |

|---|---|---|

| Hospital Networks | Bulk purchasing, price sensitivity | Negotiations for lower prices, extended payment terms |

| Government Agencies | Tender processes, cost containment focus | Pressure on pricing, demand for value demonstration |

| International Distributors | Market access, volume commitments | Need for competitive pricing and efficient supply chain |

Same Document Delivered

Hisun Pharmaceutical Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Hisun Pharmaceutical's competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the pharmaceutical industry.

Rivalry Among Competitors

Hisun Pharmaceutical navigates a crowded landscape, competing in key therapeutic areas such as anti-infectives, oncology, cardiovascular, and endocrine disorders. This intense competition involves a multitude of domestic and international pharmaceutical firms, from established global players to agile, specialized local companies.

The sheer volume of competitors significantly escalates price pressures and challenges Hisun's ability to maintain and grow its market share across these diverse segments. For instance, the global oncology market alone was projected to reach over $250 billion by 2024, a testament to the high stakes and numerous participants vying for dominance.

In this environment, Hisun must prioritize differentiation through robust research and development initiatives and unwavering commitment to product quality. Success hinges on its capacity to innovate and deliver superior therapeutic solutions that stand out amidst a sea of comparable offerings.

The global pharmaceutical market is projected to grow, but specific therapeutic areas can become quite saturated. This saturation intensifies competition, pushing companies like Hisun to fight harder for market share through aggressive marketing and pricing strategies. For instance, in 2024, the oncology drug market, while growing, faces intense rivalry from numerous established and emerging players.

When growth slows in certain drug segments, companies often resort to price wars and increased research and development to differentiate themselves. This dynamic means Hisun needs to carefully manage its investments, focusing on promising new areas while protecting its turf in more mature markets. The company's strategy must balance innovation with the defense of existing revenue streams.

Hisun Pharmaceutical's capacity to differentiate its offerings significantly shapes competitive rivalry. By developing drugs with superior efficacy, enhanced safety, novel formulations, or by cultivating robust brand recognition, Hisun can carve out a distinct market position. Strong research and development investment, exemplified by their pipeline advancements, enables the creation of innovative therapies that reduce pressure from direct price competition.

High Exit Barriers for Pharmaceutical Companies

Pharmaceutical companies face substantial exit barriers. These include massive, sunk costs in research and development, specialized manufacturing plants, and rigorous regulatory compliance processes. For instance, the average cost to bring a new drug to market is estimated to be over $2 billion, a figure that discourages companies from exiting even when facing profitability challenges.

These high fixed costs create a strong disincentive to leave the industry. Companies are compelled to continue operating and competing, even in less favorable market conditions, to amortize their investments. This persistence keeps the competitive landscape crowded and the rivalry intense.

- High R&D Investment: Billions are spent on drug discovery and clinical trials.

- Specialized Assets: Manufacturing facilities and intellectual property are difficult to repurpose.

- Regulatory Hurdles: Exiting requires navigating complex de-registration and divestiture processes.

- Human Capital: Highly specialized scientific and medical talent is industry-specific.

Intensity of R&D and Innovation Race

The pharmaceutical industry, and by extension Hisun Pharmaceutical, is characterized by an exceptionally intense R&D and innovation race. This constant pursuit of new treatments and improved therapies is the lifeblood of the sector. Companies are compelled to pour significant resources into research and development to stay ahead.

Hisun Pharmaceutical, like its peers, faces the imperative to continuously invest in R&D. This investment is crucial for discovering novel drugs, enhancing existing formulations, and crucially, mitigating the impact of patent expirations and the subsequent rise of generic competition. A lag in innovation directly translates to diminished market standing and a significant competitive handicap.

- R&D Spending: In 2023, the global pharmaceutical R&D expenditure was estimated to be over $240 billion, highlighting the scale of investment required.

- Patent Cliff Impact: Companies often see significant revenue drops once key patents expire, making the development of new revenue streams through R&D paramount.

- Innovation Cycle: The rapid pace of scientific discovery and the need to address unmet medical needs create a perpetual cycle of innovation and competition.

Competitive rivalry within the pharmaceutical sector is exceptionally fierce, driven by a high number of players and significant R&D investment. Hisun Pharmaceutical operates in therapeutic areas like oncology, where competition is particularly intense, with the global market for these drugs projected to exceed $250 billion by 2024. Companies must differentiate through innovation and quality to gain market share.

The industry faces high exit barriers due to substantial sunk costs in R&D, specialized manufacturing, and regulatory compliance, with the cost to bring a new drug to market estimated over $2 billion. This compels companies to remain competitive even in challenging conditions, perpetuating intense rivalry.

Hisun's success hinges on its ability to innovate and develop superior therapies, as a lag in R&D directly impacts market standing. Global pharmaceutical R&D spending was over $240 billion in 2023, underscoring the continuous investment needed to counter patent expirations and generic competition.

SSubstitutes Threaten

The most potent threat of substitution for Hisun Pharmaceutical stems from generic drugs for its chemical-based medicines and biosimilars for its biological products once their patents expire. These alternatives provide comparable therapeutic benefits but at substantially reduced costs, putting pressure on Hisun to either continuously innovate and differentiate its patented offerings or engage in cost-based competition for drugs that are no longer under patent protection. This dynamic necessitates a robust and ongoing refresh of its drug pipeline.

For certain chronic conditions, patients and healthcare providers are increasingly exploring non-pharmacological interventions and lifestyle modifications as substitutes for traditional drug therapies. For instance, in managing conditions like type 2 diabetes, dietary changes and regular exercise, often supported by digital health platforms, can significantly reduce reliance on medication. This trend highlights the growing importance of demonstrating clear clinical and economic value for Hisun's pharmaceutical products.

Advances in public health and widespread vaccination programs pose a significant threat of substitutes for Hisun Pharmaceutical. For instance, highly effective vaccines for prevalent infectious diseases can directly reduce the need for Hisun's anti-infective treatments, impacting sales volumes. In 2023, global vaccine sales reached over $60 billion, highlighting the market's substantial shift towards prevention.

Technological Advancements in Diagnostics and Medical Devices

Technological advancements in diagnostics and medical devices present a significant threat of substitutes for Hisun Pharmaceutical. New diagnostic tools can identify diseases earlier, potentially shifting treatment paradigms away from traditional drug therapies. For example, advancements in genetic sequencing might offer personalized treatment plans that reduce reliance on broad-spectrum pharmaceuticals.

Medical devices are increasingly offering non-pharmacological alternatives. Consider the management of chronic conditions; implantable devices or advanced wearable sensors could provide therapeutic benefits previously addressed solely by medication. In 2024, the global medical device market was valued at over $600 billion, indicating substantial investment and innovation in this area, which could directly impact drug sales.

- Early Disease Detection: Innovations in AI-powered imaging and liquid biopsies can identify diseases at earlier, more manageable stages, potentially reducing the need for later-stage drug interventions.

- Non-Pharmacological Treatments: Devices for pain management, metabolic control (like advanced insulin pumps), and cardiovascular support are gaining traction, offering alternatives to pain relievers, diabetes medication, and heart drugs.

- Market Growth: The medical device sector's continued growth, projected to reach over $800 billion by 2028, signifies a strong and expanding base of potential substitutes for pharmaceutical products.

Patient Propensity to Substitute Based on Cost or Side Effects

Patients and healthcare providers often look for alternatives if a drug is too expensive or causes unpleasant side effects. This tendency to switch is growing as people have more access to health information and insurance plans often involve co-pays or deductibles. For example, in 2024, the average out-of-pocket cost for prescription drugs in the US continued to be a significant concern for many, with studies indicating that over 25% of patients reported difficulty affording their medications.

Hisun Pharmaceutical needs to make a strong case for its products by highlighting their effectiveness, safety profile, and overall value proposition. This proactive approach is crucial for holding onto market share when cheaper or better-tolerated options might emerge. The company's R&D investments in developing drugs with fewer side effects and improved patient outcomes are therefore directly relevant to mitigating this threat.

- Patient Cost Sensitivity: In 2024, a significant portion of the patient population actively sought lower-cost alternatives, particularly for chronic condition medications where long-term adherence is key.

- Side Effect Management: The increasing availability of patient reviews and comparative drug information online empowers individuals to switch medications based on reported side effect profiles, impacting adherence and market share.

- Information Accessibility: With enhanced digital health literacy, patients are more informed about treatment options, including generic or biosimilar competitors, increasing the threat of substitution.

- Value Demonstration: Hisun's strategy must emphasize not just clinical efficacy but also cost-effectiveness and a superior patient experience to counter the allure of substitutes.

The threat of substitutes for Hisun Pharmaceutical is significant, driven by generics, biosimilars, and non-pharmacological alternatives. Patients' increasing cost sensitivity and access to comparative drug information in 2024, with over 25% of patients struggling to afford medications, further amplifies this risk. Hisun must continually innovate and clearly demonstrate the value of its products to maintain market share against these evolving substitutes.

| Substitute Type | Impact on Hisun | Supporting Data (2024) |

|---|---|---|

| Generic & Biosimilar Drugs | Price erosion, reduced market share for off-patent products | Global generics market projected to reach $300+ billion by 2028 |

| Non-Pharmacological Interventions | Reduced demand for certain drug classes (e.g., diabetes, pain management) | Digital health market valued at over $300 billion in 2024 |

| Medical Devices | Direct competition for therapeutic areas previously dominated by drugs | Medical device market exceeding $600 billion in 2024 |

| Preventative Health (Vaccines) | Decreased need for treatments for preventable diseases | Global vaccine market exceeding $60 billion in 2023 |

Entrants Threaten

The pharmaceutical industry, including companies like Hisun Pharmaceutical, demands substantial upfront investment. Developing a new drug can cost upwards of $2 billion, encompassing extensive research, rigorous clinical trials, and the establishment of advanced manufacturing capabilities. This immense financial barrier significantly limits the number of new companies that can realistically enter the market and compete.

The pharmaceutical sector presents significant barriers to entry due to stringent regulatory requirements. Agencies like China's NMPA, the US FDA, and Europe's EMA mandate extensive and complex approval processes. These hurdles, including rigorous clinical trials and adherence to Good Manufacturing Practices (GMP), demand substantial investment and specialized knowledge, making it difficult for newcomers to compete. Hisun Pharmaceutical's deep experience in navigating these regulatory landscapes provides a crucial competitive edge.

Intellectual property protection, particularly through patents, forms a formidable barrier for new entrants in the pharmaceutical sector. Existing companies like Hisun Pharmaceutical leverage extensive patent portfolios for their innovative drugs, preventing competitors from easily replicating their successful compounds. For instance, the average patent life for a new drug is around 20 years from filing, but effective market exclusivity is often closer to 10-12 years due to development and regulatory timelines. This significant lead time and the high cost of developing new drugs, estimated to be over $2.6 billion per approved drug as of 2023, make it exceptionally challenging for newcomers to establish a competitive footing without their own robust intellectual property.

Access to Distribution Channels and Established Relationships

New companies entering the pharmaceutical market often struggle to build effective distribution networks and secure access to key healthcare stakeholders like hospitals and pharmacies. Hisun Pharmaceutical, however, benefits from its well-developed marketing and sales infrastructure, cultivated over years of operation. These established channels and deep-rooted relationships in both domestic Chinese and international markets present a substantial barrier to entry for newcomers.

Gaining market penetration and building the necessary trust with healthcare providers is a time-consuming and resource-intensive endeavor. For instance, in 2024, the average time for a new pharmaceutical product to achieve significant market share in China, following regulatory approval, was estimated to be between 3 to 5 years, heavily reliant on established distribution partnerships.

- Distribution Network Challenges: New entrants must invest heavily to replicate Hisun's existing reach across diverse geographical regions and healthcare segments.

- Established Relationships: Hisun's long-standing ties with key opinion leaders, hospital administrators, and pharmacy chains provide preferential access and influence that new players lack.

- Market Penetration Costs: The financial outlay required to build brand recognition and secure shelf space or prescription preference is a significant deterrent for emerging companies.

- Time and Resource Investment: Successfully navigating the complex pharmaceutical supply chain and regulatory landscape demands substantial, sustained investment, which many new entrants cannot afford.

Economies of Scale in Production and Purchasing

Hisun Pharmaceutical, as a major player in the industry, leverages significant economies of scale in its production processes, raw material procurement, and research and development efforts. For instance, in 2023, Hisun reported operating revenues of RMB 8.46 billion, reflecting its substantial market presence and the cost efficiencies derived from large-scale operations.

These scale advantages translate into lower per-unit production costs and a greater capacity for investment in innovation compared to smaller, emerging pharmaceutical companies. This cost efficiency is a critical barrier, as new entrants find it challenging to match Hisun's ability to invest in advanced manufacturing technologies and secure bulk discounts on essential raw materials.

Consequently, new companies entering the market face a considerable competitive hurdle in achieving comparable cost efficiencies. This inherent advantage in scale strengthens Hisun's market position by making it more difficult for new, smaller competitors to compete on price and R&D investment.

- Economies of Scale: Hisun benefits from lower unit costs due to high-volume production.

- Procurement Power: Large-scale purchasing of raw materials provides significant cost advantages.

- R&D Investment: Scale allows for greater allocation of resources to research and development.

- Competitive Barrier: New entrants struggle to achieve similar cost efficiencies, creating a disadvantage.

The threat of new entrants for Hisun Pharmaceutical is generally considered low due to significant barriers. These include the immense capital required for drug development, estimated at over $2 billion per drug, and the complex, lengthy regulatory approval processes managed by bodies like the FDA and EMA. Furthermore, intellectual property protection, with patents typically lasting around 20 years from filing, creates a substantial hurdle for newcomers aiming to replicate existing successful products.

| Barrier Type | Description | Impact on New Entrants | Hisun's Advantage |

| Capital Requirements | Drug development costs exceed $2 billion. | High barrier to entry. | Established financial resources. |

| Regulatory Hurdles | Stringent FDA, EMA, NMPA approvals. | Requires extensive expertise and time. | Proven track record in compliance. |

| Intellectual Property | Patents protect innovative drugs. | Prevents easy replication. | Extensive patent portfolio. |

| Distribution & Relationships | Established networks and stakeholder ties. | Difficult and costly to replicate. | Existing market access and influence. |

| Economies of Scale | Lower production costs due to high volume. | Challenging for new entrants to match pricing. | Cost efficiencies from large-scale operations (e.g., 2023 revenue RMB 8.46 billion). |

Porter's Five Forces Analysis Data Sources

Our Hisun Pharmaceutical Porter's Five Forces analysis is built upon a robust foundation of data, including Hisun's annual reports, publicly available financial statements, and industry-specific market research reports from reputable firms.

We also incorporate insights from regulatory filings, news archives, and expert analyses to provide a comprehensive understanding of the competitive landscape impacting Hisun Pharmaceutical.