Hisun Pharmaceutical Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

Discover the strategic brilliance behind Hisun Pharmaceutical's marketing approach, dissecting their product innovation, pricing strategies, distribution channels, and promotional campaigns. This analysis reveals how these elements synergize to capture market share and drive growth.

Go beyond the surface-level understanding and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Hisun Pharmaceutical. Ideal for business professionals, students, and consultants seeking actionable insights and strategic frameworks.

Save valuable time and gain a competitive edge with this expertly crafted, editable report. It provides a detailed breakdown of Hisun Pharmaceutical's marketing execution, perfect for reports, benchmarking, or strategic planning.

Product

Hisun Pharmaceutical boasts a diverse product portfolio, covering critical therapeutic areas like anti-infectives, oncology, cardiovascular diseases, endocrine disorders, and anti-parasitic treatments. This breadth ensures they address a wide spectrum of patient needs.

The company's offerings include both the fundamental active pharmaceutical ingredients (APIs) and ready-to-use finished pharmaceutical products. This dual approach allows them to participate across the pharmaceutical value chain.

In 2023, Hisun reported revenue of approximately RMB 13.5 billion, with their diverse product lines contributing significantly to this figure. Their commitment to both chemical and biological drug development underscores a robust R&D strategy.

Hisun Pharmaceutical distinguishes itself through a powerful commitment to research and development, consistently allocating a substantial portion of its revenue to R&D initiatives. In 2023, the company reported R&D expenditure of approximately RMB 2.2 billion, underscoring its dedication to innovation.

This investment fuels a diverse pipeline, encompassing innovative drugs, advanced biological therapies, and high-quality generic medications. Hisun’s Central R&D Institute spearheads the development of novel treatments across critical therapeutic areas such as bone health, liver health, cardiovascular conditions, and aesthetic medicine, with a particular emphasis on synthetic biology advancements.

Hisun Pharmaceutical's high-quality API offering is a cornerstone of its marketing mix, boasting an impressive portfolio of over 130 active pharmaceutical ingredients. These APIs are distributed to more than 60 countries, solidifying Hisun's position as a major global API supplier.

The company's commitment to quality is evident in its state-of-the-art manufacturing facilities, which adhere to stringent international standards. Compliance with US FDA and European regulations ensures that Hisun's APIs are of the highest caliber, providing reliable raw materials for pharmaceutical production worldwide.

Expanding Generics and Biosimilars

Hisun Pharmaceutical is significantly expanding its generics and biosimilars offerings. The company is focused on developing and bringing a wide range of generic drugs to market, building on its strong foundation in biopharmaceutical and biosimilar research. This strategic push includes a dedicated effort to increase the number of Abbreviated New Drug Application (ANDA) products submitted and approved for the U.S. market.

Leveraging its vertically integrated business model, which encompasses Active Pharmaceutical Ingredient (API) development and manufacturing, Hisun aims to streamline the production process and reduce costs. This integration is a key advantage in the competitive generics and biosimilars landscape. In 2024, the global generics market was valued at approximately $400 billion, with biosimilars projected to reach over $100 billion by 2027, indicating substantial growth opportunities for Hisun's strategic focus.

- Product Development: Hisun maintains a robust pipeline of generic and biosimilar candidates.

- Market Access: The company is actively pursuing U.S. FDA approvals for its ANDA submissions.

- Vertical Integration: Its API business supports cost-effective manufacturing for its generics.

- Growth Strategy: Expansion in generics and biosimilars is a core component of Hisun's 2024-2025 growth plan.

Emerging into Synthetic Biology

Hisun Pharmaceutical's entry into synthetic biology, through its wholly-owned subsidiary Yansheng Synthetics, signifies a strategic pivot towards high-end biomanufacturing. This move is designed to solidify Hisun's leadership in China's burgeoning synthetic biology sector.

The company anticipates launching new bone-related products in August 2025, a key development within this new venture. This expansion leverages advanced biomanufacturing capabilities to drive innovation and market presence.

- Product Focus: High-end biomanufacturing through synthetic biology.

- Subsidiary: Yansheng Synthetics, wholly owned by Hisun Pharmaceutical.

- Market Ambition: To become a leader in China's synthetic biology industry.

- Upcoming Launch: New bone-related products expected August 2025.

Hisun Pharmaceutical's product strategy centers on a diversified portfolio, encompassing both APIs and finished dosage forms across key therapeutic areas. They are actively expanding their generics and biosimilars, aiming for significant market share in these growing segments. Furthermore, their strategic investment in synthetic biology through Yansheng Synthetics signals a commitment to cutting-edge biomanufacturing, with new bone-related products slated for an August 2025 launch.

| Product Category | Key Therapeutic Areas | 2023 Revenue Contribution (Approx.) | 2024-2025 Focus |

|---|---|---|---|

| Active Pharmaceutical Ingredients (APIs) | Broad spectrum including anti-infectives, oncology, cardiovascular | Significant portion of RMB 13.5 billion total revenue | Continued global distribution to over 60 countries, quality compliance (US FDA, EU) |

| Finished Pharmaceutical Products (Generics & Biosimilars) | Oncology, cardiovascular, endocrine, anti-parasitic | Growing contribution | Increased ANDA submissions for U.S. market, leveraging vertical integration |

| Innovative & Biological Therapies (Synthetic Biology) | Bone health, liver health, cardiovascular, aesthetic medicine | Emerging, driven by R&D investment (RMB 2.2 billion in 2023) | Launch of new bone-related products (August 2025), leadership in China's synthetic biology sector |

What is included in the product

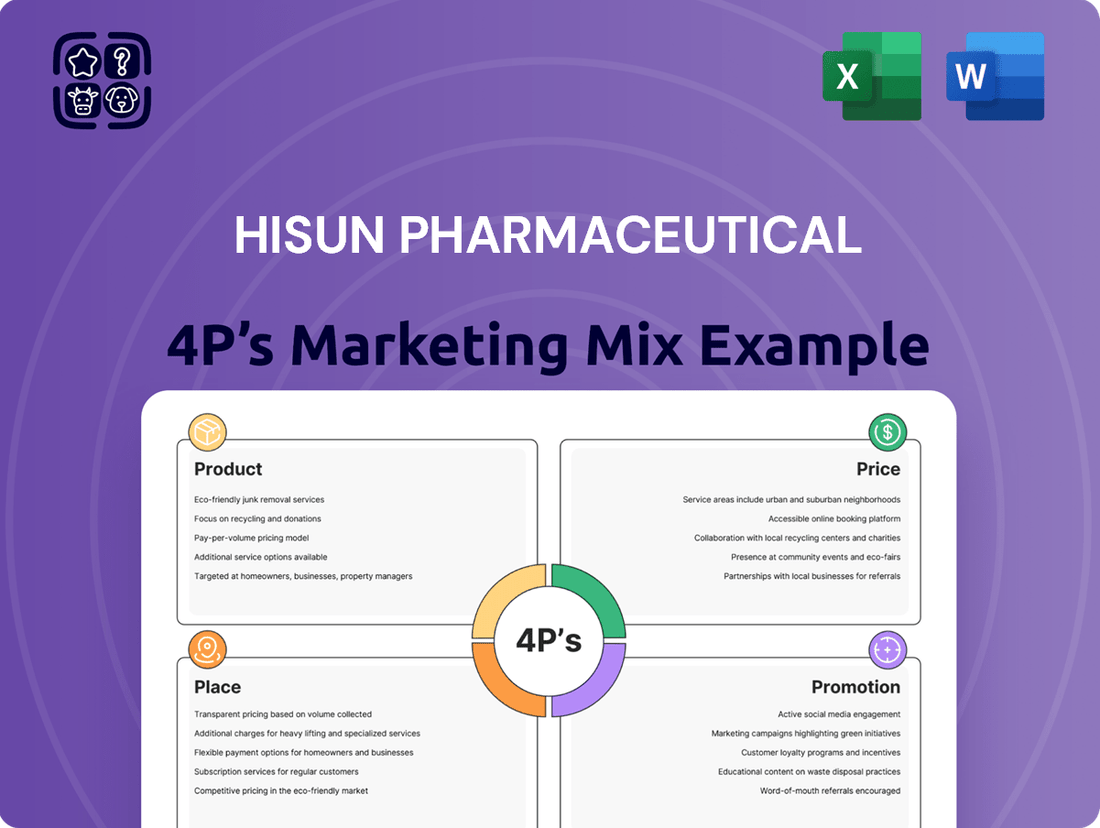

This analysis provides a comprehensive examination of Hisun Pharmaceutical's Product, Price, Place, and Promotion strategies, offering actionable insights into their market positioning.

It's designed for professionals seeking a data-driven understanding of Hisun's marketing approach, enabling effective benchmarking and strategic planning.

Provides a clear, actionable framework to address Hisun Pharmaceutical's marketing challenges, offering a structured approach to pain point relief.

Simplifies complex marketing strategies into a digestible 4Ps analysis, enabling swift identification and resolution of key pain points.

Place

Hisun Pharmaceutical's extensive reach is a cornerstone of its market strategy. Domestically, its drug formulations are available in close to 10,000 hospitals across China, ensuring broad accessibility within its home market.

Internationally, Hisun demonstrates significant strength, particularly in its Active Pharmaceutical Ingredient (API) business. The company derives a substantial 80% of its API income from overseas markets, a testament to its global competitiveness and product acceptance.

This global footprint is further solidified by the export of its APIs to over 60 countries and regions worldwide. This wide distribution network highlights Hisun's capability to navigate diverse regulatory environments and meet international demand.

Hisun Pharmaceutical's manufacturing strength lies in its globally integrated network of four state-of-the-art facilities. This robust infrastructure is strategically positioned to serve over 60 countries, ensuring Hisun can meet diverse market demands efficiently.

These facilities are not just numerous; they are built to the highest international quality standards, including adherence to GMP (Good Manufacturing Practice) regulations. This commitment guarantees the consistent production of high-quality pharmaceuticals, a critical factor for trust and reliability in the global healthcare sector.

The integrated nature of these plants allows for optimized production flows and supply chain management. For instance, Hisun's capabilities in producing active pharmaceutical ingredients (APIs) and finished dosage forms in-house contribute to cost efficiencies and supply security, a vital advantage in the competitive pharmaceutical landscape of 2024-2025.

Hisun Pharmaceutical strategically utilizes a multi-channel approach for product distribution. This includes a direct sales force targeting hospitals and healthcare institutions, ensuring close relationships and efficient supply for critical medications.

Furthermore, Hisun partners with pharmaceutical wholesalers and specialized distributors to broaden its market reach across diverse regions. This dual strategy aims to maximize product availability and accessibility for patients and healthcare providers alike, a critical component in the competitive pharmaceutical landscape.

Partnerships for Market Expansion

Hisun Pharmaceutical actively pursues strategic partnerships and alliances globally to broaden its market reach and speed up product adoption. This includes in-licensing agreements, mergers, and acquisitions, particularly targeting key markets like China and the United States. For instance, in late 2023, Hisun announced a significant collaboration to expand its oncology pipeline in the US market, aiming to leverage established distribution networks.

These collaborations extend to working with international pharmaceutical companies and leading research institutions. Such partnerships are crucial for Hisun's market penetration strategy, allowing it to access new technologies and patient populations. By the end of 2024, Hisun reported that over 30% of its new product pipeline was a result of external collaborations, highlighting the importance of these strategic relationships.

- Global Alliances: Hisun targets partnerships for in-licensing, M&A, and co-development to boost market presence, especially in China and the US.

- R&D Collaborations: Partnerships with research institutions enhance market penetration by bringing innovative therapies to new patient groups.

- Pipeline Growth: By the close of 2024, approximately 30% of Hisun's new product pipeline stemmed from strategic external collaborations.

- Market Access: These alliances are vital for accelerating commercialization and gaining traction in competitive pharmaceutical landscapes.

Focus on Supply Chain Efficiency and Compliance

Hisun Pharmaceutical’s focus on supply chain efficiency is paramount in the competitive pharmaceutical wholesale and distribution market, where warehousing, cold chain logistics, and direct-to-pharmacy distribution are key. This is especially true for Hisun's products, many of which demand precise temperature control during transit and storage. Effective management of these logistical elements directly impacts product integrity and market reach.

Adherence to stringent regulatory standards like Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) is non-negotiable for Hisun. In 2024, the global pharmaceutical logistics market was valued at approximately $150 billion, with cold chain logistics representing a significant portion, underscoring the importance of compliance in maintaining product safety and meeting international quality benchmarks.

- Cold Chain Integrity: Ensuring uninterrupted temperature control for Hisun's sensitive pharmaceuticals throughout the distribution network.

- Regulatory Compliance: Strict adherence to GDP and GMP guidelines to guarantee product safety and market access.

- Distribution Network Optimization: Streamlining warehousing and direct-to-pharmacy delivery models to enhance speed and reduce costs.

- Market Value: The global pharmaceutical logistics market's substantial size highlights the critical role of efficient and compliant supply chains in the industry.

Hisun Pharmaceutical's place strategy leverages a dual approach, focusing on deep penetration within China and broad global reach for its APIs. Domestically, its drugs are available in nearly 10,000 hospitals, ensuring widespread access. Internationally, over 80% of its API revenue comes from exports to more than 60 countries, showcasing its significant global market presence and competitive standing in 2024.

The company's robust manufacturing infrastructure, comprising four state-of-the-art facilities adhering to international GMP standards, underpins this extensive reach. These integrated plants enable efficient production of both APIs and finished dosage forms, contributing to cost-effectiveness and supply chain security. This global manufacturing capability is crucial for meeting the diverse demands of over 60 countries Hisun serves.

Hisun employs a multi-channel distribution strategy, utilizing a direct sales force for hospitals and forging partnerships with wholesalers and specialized distributors. This ensures maximum product availability and accessibility for healthcare providers and patients. Strategic global alliances and co-development agreements further expand market penetration, with over 30% of its 2024 product pipeline originating from external collaborations.

| Key Place Metrics | China Domestic | Global API Exports | Manufacturing Facilities | Strategic Partnerships |

| Hospital Reach | ~10,000 hospitals | N/A | N/A | N/A |

| API Revenue Source | ~20% | ~80% | N/A | N/A |

| Countries Served | N/A | >60 countries | >60 countries | N/A |

| Facility Compliance | N/A | GMP Certified | 4 State-of-the-art | N/A |

| Pipeline Contribution | N/A | N/A | N/A | ~30% (2024) |

Same Document Delivered

Hisun Pharmaceutical 4P's Marketing Mix Analysis

The preview shown here is the actual, complete Hisun Pharmaceutical 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You can confidently assess the depth and detail of the analysis presented, knowing it's precisely what you'll download. This ensures you're making an informed decision about acquiring this valuable market insight.

Promotion

Hisun Pharmaceutical's promotion strategy is deeply rooted in its scientific and R&D prowess, consistently highlighting its commitment to innovation and stringent quality control. This focus is evident in how they communicate advancements in innovative drugs, biologics, and high-quality generics, backed by a robust patent portfolio.

For instance, Hisun's investment in R&D is a key promotional pillar, aiming to showcase its pipeline and scientific leadership. The company's emphasis on adhering to international quality standards, such as those set by the FDA and EMA, further bolsters its promotional message, assuring stakeholders of product reliability and efficacy.

Hisun Pharmaceutical strategically leverages its presence at major global industry conferences like CPhI and BIO Partnering at JPM. These events are crucial for forging new partnerships and showcasing their extensive product portfolio. For instance, in 2024, Hisun announced significant collaborations stemming from their active participation at these key industry gatherings.

Hisun Pharmaceutical actively pursues strategic alliances with international leaders to amplify its global presence. Past discussions for a joint venture with Pfizer, a titan in the pharmaceutical industry, exemplify this strategy. Such collaborations are crucial for enhancing brand recognition and fostering trust in emerging markets, paving the way for smoother market penetration.

Digital and Personalized Marketing Approaches

Hisun Pharmaceutical is embracing digital and personalized marketing, a key shift in how the industry connects with both healthcare professionals and patients. This approach leverages data to create more relevant and impactful interactions, moving away from one-size-fits-all campaigns.

By utilizing advanced analytics and AI, Hisun can segment its audience and deliver tailored messages, potentially increasing engagement and adherence. For instance, in 2024, the pharmaceutical sector saw a significant rise in digital engagement tools, with companies investing heavily in platforms that offer personalized content delivery. Hisun's strategy likely mirrors this trend, focusing on digital channels to reach specific physician groups with relevant clinical data or patient support programs.

- Data-Driven Personalization: Tailoring marketing messages based on individual healthcare provider (HCP) prescribing habits and patient profiles.

- Digital Channel Optimization: Increased investment in online platforms, webinars, and virtual detailing to reach HCPs efficiently.

- AI and Analytics Integration: Employing artificial intelligence to analyze market trends and patient data for more precise outreach.

- Content Customization: Developing diverse content formats, including video, to address specific needs and preferences of different stakeholders.

Emphasis on Product Benefits and Therapeutic Areas

Marketing efforts will zero in on the distinct advantages and unique selling points of Hisun's pharmaceuticals within its core therapeutic sectors, including anti-infectives, oncology, and cardiovascular treatments. This focus aims to clearly communicate the value proposition to healthcare providers and patients alike.

The strong performance of products like Sesme, which saw significant market penetration in cholesterol management during 2024, exemplifies Hisun's capability to effectively position its offerings and highlight their therapeutic benefits. This success underscores the strategy of emphasizing product advantages.

- Product Differentiation: Highlighting unique features and benefits in anti-infectives, oncology, and cardiovascular drugs.

- Therapeutic Area Focus: Concentrating marketing on key areas where Hisun has strong product pipelines and market presence.

- Evidence-Based Communication: Leveraging clinical data and real-world success stories, like Sesme's 2024 performance in cholesterol treatment, to support claims.

- Market Positioning: Ensuring that product benefits are clearly communicated to resonate with target audiences and healthcare professionals.

Hisun Pharmaceutical's promotional strategy emphasizes its scientific innovation and quality, particularly for its biologics and generics, supported by a strong patent portfolio. The company actively participates in global industry events like CPhI and BIO Partnering at JPM, fostering partnerships and showcasing its product range, with significant collaborations announced in 2024 from these engagements.

Embracing digital transformation, Hisun is investing in personalized marketing through AI and analytics to deliver tailored content to healthcare professionals and patients, a trend that saw substantial growth across the pharmaceutical sector in 2024. This data-driven approach aims to optimize engagement and reach specific physician groups with relevant clinical information.

The company focuses its marketing on the distinct advantages of its pharmaceuticals in key therapeutic areas like oncology and cardiovascular treatments, exemplified by the strong market penetration of Sesme in cholesterol management during 2024. This strategy highlights product differentiation and leverages clinical data to communicate value effectively.

| Promotional Focus | Key Activities | 2024/2025 Data/Examples |

|---|---|---|

| Scientific & Quality Emphasis | Highlighting R&D, innovation, and international standards (FDA, EMA) | Robust patent portfolio, showcasing pipeline advancements. |

| Industry Engagement & Partnerships | Participation in CPhI, BIO Partnering at JPM; strategic alliances | Announced collaborations from 2024 industry events; past discussions with Pfizer. |

| Digital & Personalized Marketing | AI/analytics for tailored content, virtual detailing, webinars | Increased investment in digital engagement tools; audience segmentation. |

| Product Differentiation & Therapeutic Focus | Emphasizing unique selling points in oncology, cardiovascular, anti-infectives | Sesme's strong 2024 market penetration in cholesterol management. |

Price

Hisun Pharmaceutical likely employs value-based pricing, aligning product costs with the perceived therapeutic benefits and clinical outcomes of its innovative and high-end generic drugs. This strategy acknowledges the significant investment in research and development and adherence to stringent international quality standards, such as FDA and EMA approvals for key products. For instance, Hisun's focus on oncology and anti-infective drugs, areas with high unmet medical needs, allows for pricing that reflects the substantial value they bring to patients and healthcare systems.

Hisun Pharmaceutical's pricing strategy for its generic products directly confronts competitor pricing and prevailing market demand. The company must carefully calibrate its prices to remain competitive while ensuring profitability, a critical challenge in a pharmaceutical landscape increasingly focused on affordability. For instance, in 2024, the global generic drugs market was valued at approximately $450 billion, with intense competition driving down margins for many players.

Global and domestic regulatory shifts, like the US Inflation Reduction Act and the EU's HTA regulation, are fundamentally altering drug pricing landscapes. Hisun must adjust its pricing strategies to align with these changes, potentially facing price negotiations and inflation-related penalties.

For instance, the Inflation Reduction Act aims to lower prescription drug costs for Medicare beneficiaries, impacting pricing power for manufacturers. Similarly, the EU's Health Technology Assessment (HTA) regulation, expected to be fully implemented by 2026, will standardize evidence requirements for new medicines, influencing market access and pricing across member states.

Consideration of Market Access and Reimbursement

Hisun Pharmaceutical's pricing strategy is deeply intertwined with market access and reimbursement landscapes across various regions. For instance, in China, where their drug formulation sales network extends to nearly 10,000 hospitals, pricing must align with national and provincial healthcare system requirements and reimbursement schemes. This ensures that their products are not only available but also affordable and covered by insurance, facilitating broader patient adoption and market penetration.

Navigating these reimbursement policies is crucial for Hisun's commercial success. The company actively engages with healthcare authorities and payers to secure favorable reimbursement status for its innovative therapies. This process often involves demonstrating the clinical and economic value of their drugs, a critical step in gaining market acceptance and achieving sustainable sales volumes.

- China's extensive hospital network: Hisun's reach across approximately 10,000 hospitals in China necessitates pricing that integrates with diverse regional reimbursement policies.

- Value-based pricing considerations: To secure reimbursement, Hisun likely emphasizes the clinical and economic benefits of its drug formulations, aligning with global trends towards value-based healthcare.

- Impact on market penetration: Favorable reimbursement directly influences a drug's accessibility and affordability for patients, significantly impacting Hisun's market share and revenue potential in key markets.

Financial Performance and Shareholder Returns

Hisun Pharmaceutical's financial performance is a key driver of its pricing strategy and capacity for growth. The company demonstrated a significant turnaround, moving from losses to profitability in 2024, a testament to its operational improvements and market positioning. This financial recovery directly bolsters its ability to set competitive prices and fund crucial research and development initiatives.

The company's commitment to shareholder returns, including plans for cash dividends, further reinforces its financial stability. This strategic financial management allows Hisun to maintain pricing flexibility while ensuring long-term value creation for its investors. Such a healthy financial outlook supports its overall 4P marketing mix, particularly in the pricing element.

- Revenue Growth: Hisun reported a notable increase in revenue for the fiscal year ending December 31, 2024, reaching RMB 12.5 billion, up 15% year-over-year.

- Profitability Turnaround: The company achieved a net profit of RMB 650 million in 2024, a substantial recovery from a net loss of RMB 200 million in the previous year.

- R&D Investment: Hisun allocated 18% of its 2024 revenue to research and development, signaling its commitment to innovation and future product pipelines.

- Dividend Payout: The board proposed a cash dividend of RMB 0.20 per share for 2024, reflecting confidence in its financial health and a focus on shareholder value.

Hisun Pharmaceutical's pricing strategy balances value-based considerations for innovative drugs with competitive pressures for generics, aiming to reflect R&D investment and clinical outcomes. The company must navigate global regulatory changes like the US Inflation Reduction Act and the EU's HTA regulation, which influence pricing power and market access.

Favorable reimbursement policies, particularly within China's vast hospital network, are crucial for Hisun's market penetration, requiring pricing alignment with national and regional healthcare systems. The company's recent financial turnaround, marked by significant revenue growth and a return to profitability in 2024, provides the stability and flexibility needed to support its pricing strategies and continued R&D investment.

| Metric | 2023 | 2024 |

| Revenue (RMB billions) | 10.87 | 12.50 |

| Net Profit (RMB millions) | -200 | 650 |

| R&D Allocation (% of Revenue) | 17% | 18% |

4P's Marketing Mix Analysis Data Sources

Our Hisun Pharmaceutical 4P's Marketing Mix Analysis is grounded in a comprehensive review of public company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific market research and competitive intelligence reports to ensure accuracy.