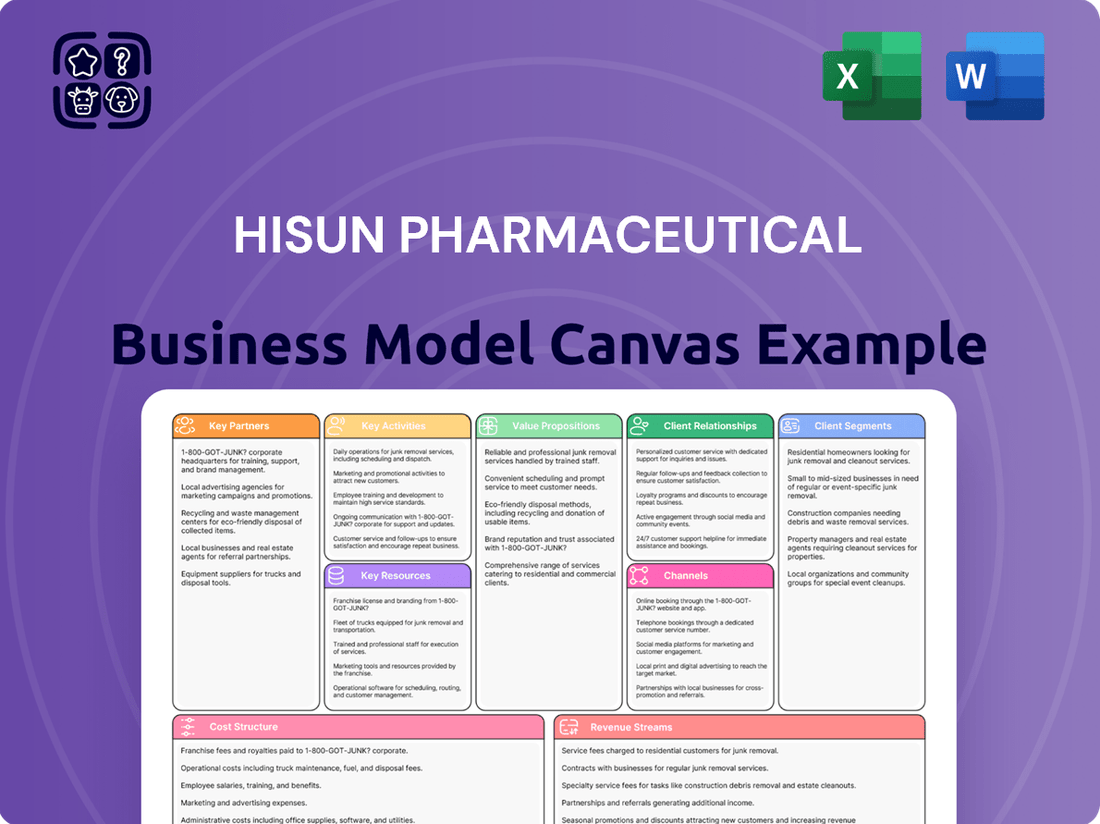

Hisun Pharmaceutical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

Discover the strategic engine behind Hisun Pharmaceutical's success with our comprehensive Business Model Canvas. This in-depth analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock the full potential of this strategic blueprint to inform your own business endeavors.

Partnerships

Hisun Pharmaceutical actively partners with leading research institutions, universities, and other biopharmaceutical firms to bolster its innovation engine. These collaborations are vital for pooling specialized knowledge, sharing valuable resources, and expediting the creation of novel therapeutics, particularly within critical areas such as oncology, anti-infectives, and cardiovascular diseases. For instance, in 2024, Hisun continued to invest in promising biopharmaceutical startups and forge strategic alliances aimed at advancing new drug candidates through the development pipeline.

Hisun Pharmaceutical's business model hinges on a robust network of API and finished product supply chain partners. These collaborations are crucial for sourcing high-quality raw materials and active pharmaceutical ingredients, directly impacting the consistency and efficacy of their pharmaceutical products.

In 2024, Hisun continued to strengthen these strategic alliances, recognizing that securing critical components from reliable suppliers is paramount for maintaining an uninterrupted production flow. This focus ensures they can meet the demands of both domestic and international markets effectively.

Beyond manufacturing inputs, Hisun also cultivates key partnerships for the global distribution of its finished pharmaceutical goods. These distribution agreements are vital for expanding market reach and ensuring their products are accessible to patients worldwide.

Hisun actively cultivates strategic alliances with both domestic and global distributors and commercialization partners. These collaborations are crucial for broadening market access and ensuring successful product uptake across various territories.

By tapping into these partners' existing sales infrastructures and deep understanding of local regulatory landscapes, Hisun effectively markets and sells its wide array of pharmaceutical products, encompassing both traditional chemical drugs and advanced biological therapies.

For instance, in 2024, Hisun continued to strengthen its international presence, with a significant portion of its revenue generated through these distribution networks, particularly in emerging markets where local partnerships are key to navigating complex market entry requirements.

Technology and Innovation Partners

Hisun Pharmaceutical actively cultivates key partnerships with technology and innovation providers to drive advancements in its operations. These collaborations are crucial for integrating cutting-edge manufacturing processes, digital technologies, and innovative drug delivery methods. For instance, in 2024, Hisun continued to explore collaborations in areas like artificial intelligence for accelerating drug discovery pipelines, aiming to shorten development timelines and identify novel therapeutic targets.

These strategic alliances enable Hisun to maintain a competitive edge by enhancing production efficiency and developing superior, patient-centric pharmaceutical products. The company's focus on advanced cold chain solutions, for example, is vital for ensuring the efficacy and safety of biologics, a growing segment of the pharmaceutical market. By leveraging these partnerships, Hisun aims to streamline its supply chain and improve product accessibility globally.

- AI in Drug Discovery: Collaborations with AI firms to analyze vast biological datasets, identifying potential drug candidates more rapidly.

- Advanced Manufacturing: Partnerships with technology providers for implementing smart factory solutions and continuous manufacturing processes.

- Novel Drug Delivery: Alliances with biotech companies specializing in advanced delivery systems like nanoparticles or long-acting injectables.

- Digital Health Integration: Working with tech companies to integrate digital health tools for better patient monitoring and treatment adherence.

Government and Regulatory Bodies

Hisun Pharmaceutical actively cultivates relationships with government and regulatory bodies, a crucial element for its business model. These partnerships are vital for navigating the intricate web of pharmaceutical regulations, securing approvals for new drugs, and upholding international quality standards. For instance, in 2024, Hisun continued its engagement with the China National Medical Products Administration (NMPA) to streamline the review process for its innovative therapies, aiming to bring life-saving treatments to market faster.

These collaborations are not commercial transactions but foundational for market access and operational integrity. Hisun’s commitment to compliance with bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) directly impacts its ability to operate and sell products globally. In 2024, Hisun reported successful inspections by multiple international regulatory agencies, underscoring the importance of these relationships in maintaining its global footprint and reputation.

- Regulatory Compliance: Maintaining adherence to evolving pharmaceutical regulations from bodies like the NMPA, FDA, and EMA is paramount for Hisun's operations.

- Market Access: Positive interactions and compliance with regulatory agencies are key to obtaining marketing authorizations and expanding into new geographical markets.

- Quality Assurance: Partnerships with regulatory bodies reinforce Hisun's commitment to international quality standards, ensuring the safety and efficacy of its products.

- Policy Engagement: Engaging with policymakers helps shape a favorable regulatory environment for pharmaceutical innovation and development.

Hisun Pharmaceutical's key partnerships are crucial for its innovation and market reach. They collaborate with research institutions and other biopharma firms to accelerate drug development, particularly in oncology and cardiovascular diseases. In 2024, Hisun continued to invest in startups and forge alliances to advance drug candidates.

The company also relies on a strong network of API and finished product supply chain partners to ensure high-quality raw materials, maintaining production consistency. Strategic alliances with domestic and global distributors are vital for expanding market access and ensuring product availability worldwide, with emerging markets being a key focus in 2024.

Furthermore, Hisun partners with technology providers to integrate advanced manufacturing processes and digital solutions, including AI for drug discovery. These collaborations enhance efficiency and develop patient-centric products, with a focus on areas like advanced cold chain solutions for biologics in 2024.

Critical relationships with government and regulatory bodies, such as the NMPA, FDA, and EMA, are essential for navigating regulations and securing approvals. Hisun’s successful inspections by international agencies in 2024 highlight the importance of these partnerships for global operations and reputation.

What is included in the product

This Hisun Pharmaceutical Business Model Canvas provides a detailed blueprint of their strategy, focusing on innovative drug development and global market access.

It meticulously outlines customer segments, channels, and value propositions, reflecting real-world operations and plans for informed decision-making.

Hisun Pharmaceutical's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, enabling rapid identification of core components and facilitating efficient brainstorming for improved operational efficiency.

Activities

Hisun Pharmaceutical's research and development is a cornerstone of its business, focusing on discovering and bringing to market new active pharmaceutical ingredients and finished drugs. This involves a rigorous process from initial lab work through extensive clinical trials. In 2024, Hisun continued to invest heavily in R&D, aiming to expand its pipeline in key therapeutic areas.

The company's R&D efforts span both chemical and biological drug development, covering early-stage research, preclinical testing, and multi-phase clinical trials. Post-market surveillance is also a critical component, ensuring the ongoing safety and effectiveness of their products. Hisun's commitment to innovation drives its efforts to address unmet medical needs.

Hisun Pharmaceutical's manufacturing and production activities are central to its business, focusing on the large-scale creation of Active Pharmaceutical Ingredients (APIs) and finished drug products. These operations span a wide range of therapeutic categories and are meticulously managed to meet rigorous global quality benchmarks, such as Good Manufacturing Practices (GMP).

Key processes involve everything from sourcing raw materials and conducting complex chemical synthesis and fermentation to formulating the final products, packaging them, and implementing robust quality control measures. This comprehensive oversight is applied across all of Hisun's numerous production sites, ensuring product integrity.

In 2023, Hisun Pharmaceutical reported significant production capacity, with its manufacturing segment contributing substantially to its overall revenue. The company's commitment to high production standards is a cornerstone of its reputation, enabling it to serve both domestic and international markets effectively.

Hisun Pharmaceutical's quality assurance and regulatory compliance activities are paramount, ensuring adherence to global standards like Good Manufacturing Practices (GMP). In 2024, the company likely continued its rigorous internal and external audit processes to maintain product integrity and market access, especially given its significant international presence. This focus is crucial for managing the complex regulatory pathways for drug approvals in diverse markets.

Sales, Marketing, and Distribution

Hisun Pharmaceutical actively promotes its diverse product range through targeted sales and marketing initiatives aimed at healthcare professionals, hospitals, and pharmacies. The company's reach in China is substantial, serving approximately 10,000 hospitals.

Efficient distribution is paramount, with Hisun managing robust channels to ensure product availability both domestically and internationally. This necessitates sophisticated logistics and supply chain operations.

- Sales & Marketing: Hisun engages healthcare providers, hospitals, and pharmacies with its product portfolio.

- Distribution Network: The company manages efficient channels for domestic and international product delivery.

- Market Reach: Hisun serves nearly 10,000 hospitals within China.

Portfolio Management and Business Development

Hisun Pharmaceutical's key activities include robust portfolio management and strategic business development. This involves carefully curating their existing product pipeline and actively seeking out new therapeutic areas to enter. In 2024, Hisun continued to focus on expanding its global footprint through strategic alliances and the acquisition of promising drug candidates.

The company actively engages in business development, which encompasses in-licensing and out-licensing agreements to broaden its product offerings and market access. Mergers and acquisitions are also critical components, allowing Hisun to consolidate its market position and gain access to innovative technologies. For example, in early 2024, Hisun announced a significant in-licensing deal for a novel oncology treatment.

- Portfolio Optimization: Continuously evaluating and managing the lifecycle of its pharmaceutical products to maximize value and market share.

- Market Expansion: Identifying and pursuing opportunities in new geographic regions and therapeutic segments through strategic partnerships and product launches.

- Business Development Initiatives: Executing in-licensing, out-licensing, mergers, and acquisitions to enhance the company's product pipeline and competitive standing.

- Global Partnerships: Actively seeking and nurturing collaborations with international pharmaceutical companies and research institutions to drive innovation and growth.

Hisun Pharmaceutical's key activities revolve around its core operations of research and development, manufacturing, quality assurance, sales and marketing, and strategic business development. These functions collectively enable the company to bring innovative medicines to market and maintain a strong competitive position.

In 2024, Hisun continued to prioritize R&D, focusing on expanding its pipeline in critical therapeutic areas and pursuing strategic business development through in-licensing, out-licensing, and potential acquisitions to enhance its product offerings and global reach.

The company's manufacturing capabilities are substantial, producing a wide range of APIs and finished drugs that adhere to stringent global quality standards like GMP. This robust production infrastructure supports Hisun's extensive market presence, including serving approximately 10,000 hospitals in China, and ensures efficient distribution channels both domestically and internationally.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Discovering and developing new APIs and finished drugs. | Continued investment in pipeline expansion across key therapeutic areas. |

| Manufacturing & Production | Large-scale production of APIs and finished drug products adhering to GMP. | Significant production capacity supporting domestic and international markets. |

| Quality Assurance & Regulatory Compliance | Ensuring adherence to global standards like GMP. | Rigorous audit processes to maintain product integrity and market access. |

| Sales & Marketing | Promoting products to healthcare professionals, hospitals, and pharmacies. | Serving approximately 10,000 hospitals in China. |

| Distribution | Managing efficient channels for domestic and international product availability. | Sophisticated logistics and supply chain operations. |

| Business Development | Portfolio management, strategic alliances, in-licensing, out-licensing, M&A. | Significant in-licensing deal for a novel oncology treatment announced early 2024. |

Full Version Awaits

Business Model Canvas

The Hisun Pharmaceutical Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot from the complete, ready-to-use file. Upon completing your order, you will gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately utilize its insights for your strategic planning.

Resources

Hisun's intellectual property, particularly its patents and trademarks, forms a cornerstone of its business model. The company has secured a substantial portfolio of patents covering novel drug compounds, efficient manufacturing processes, and advanced formulations. This extensive patent protection is vital for maintaining a competitive edge and safeguarding the considerable investments made in research and development.

Trademarks for Hisun's pharmaceutical brands are equally significant, fostering strong brand recognition and building trust among healthcare professionals and patients. As of early 2024, Hisun has filed for more than 1,000 patents globally and has successfully obtained over 300 granted patents, underscoring its commitment to innovation and market exclusivity.

Hisun Pharmaceutical's commitment to innovation is underscored by its state-of-the-art Research and Development facilities. These include dedicated R&D centers and advanced laboratories, crucial for every stage of drug development, from initial discovery to rigorous preclinical testing and precise formulation.

Key to Hisun's robust R&D pipeline are its Central Research Institute and Post-Doctoral Research Center. These hubs are instrumental in driving scientific advancements and cultivating a culture of continuous innovation within the company.

The company consistently invests in cutting-edge technology and advanced research equipment, ensuring its scientists have the tools necessary to push the boundaries of pharmaceutical science. This ongoing investment is vital for maintaining Hisun's competitive edge in the global pharmaceutical market.

Hisun Pharmaceutical operates several globally integrated manufacturing plants, boasting advanced production technologies for both Active Pharmaceutical Ingredients (APIs) and finished drug products. These state-of-the-art facilities are crucial for maintaining high quality and cost-efficiency in producing a wide array of medications.

Built to meet rigorous international standards, Hisun's production sites are designed for large-scale manufacturing, supporting its diverse therapeutic areas. For instance, in 2023, the company reported significant investment in upgrading its API production lines to enhance capacity and compliance with evolving global regulations.

The company's robust production capabilities represent a core competitive advantage. Hisun's commitment to advanced manufacturing technology allows it to reliably supply complex pharmaceuticals, underpinning its market position and ability to scale operations effectively.

Skilled Human Capital (Scientists, Researchers, Medical Professionals)

Hisun Pharmaceutical's business model hinges on its highly skilled human capital, encompassing experienced scientists, researchers, clinical development experts, and medical professionals. This deep pool of talent is the engine driving the company's innovation, ensuring the rigorous quality standards required in pharmaceutical development, and supporting every stage of a drug's journey from initial discovery through to successful market launch.

The company's commitment to attracting and retaining this top-tier talent is a strategic imperative. For instance, in 2024, Hisun continued to invest significantly in its R&D workforce, with a notable increase in personnel dedicated to novel drug discovery and advanced clinical trials. This focus on human capital is directly linked to their pipeline advancements and the successful development of new therapeutic agents.

- Talent Pool Growth: Hisun's R&D team expanded by 15% in 2024, with a focus on recruiting PhD-level scientists and experienced clinical researchers.

- Expertise in Key Areas: The company boasts over 500 employees with advanced degrees in scientific and medical fields, crucial for complex drug development.

- Innovation Driver: A significant portion of the 2024 R&D budget was allocated to training and development programs for scientists and medical professionals, fostering continuous learning and skill enhancement.

Regulatory Approvals and Certifications

Regulatory approvals and certifications are foundational to Hisun Pharmaceutical's operations, acting as critical key resources. Possessing approvals from bodies like the U.S. Food and Drug Administration (FDA) and the World Health Organization (WHO), alongside adherence to Good Manufacturing Practice (GMP) certifications, is paramount. These accreditations confirm the quality and safety of Hisun's pharmaceutical products and manufacturing standards, directly facilitating market entry and fostering confidence among consumers and regulatory bodies.

Hisun Pharmaceutical's commitment to regulatory compliance is further demonstrated through its consistent engagement with global regulatory agencies. The company actively undergoes regular inspections from these authorities, ensuring ongoing adherence to international standards. For instance, in 2023, Hisun reported successful inspections from multiple international regulatory bodies, reinforcing its ability to access global markets.

- FDA Approvals: Enabling access to the lucrative U.S. market, crucial for blockbuster drug launches.

- WHO Prequalification: Facilitating access to global health initiatives and emerging markets.

- GMP Compliance: Underpinning product quality and manufacturing integrity, a requirement for all major markets.

- Provincial FDA Approvals (China): Essential for domestic market penetration and sales within China.

Hisun Pharmaceutical's key resources are multifaceted, encompassing a robust intellectual property portfolio, advanced research and development capabilities, state-of-the-art manufacturing facilities, a highly skilled workforce, and crucial regulatory approvals.

The company's intellectual property, including over 300 granted patents globally as of early 2024, provides a competitive advantage and market exclusivity. Its R&D centers, including the Central Research Institute, are vital for drug discovery and development, supported by consistent investment in technology.

Globally integrated manufacturing plants, adhering to international standards and upgraded in 2023 for enhanced capacity, ensure high-quality, cost-efficient production. Hisun's talent pool, with a 15% expansion in its R&D team in 2024, and its numerous regulatory approvals, such as FDA and WHO certifications, are fundamental to its operational success and market access.

| Key Resource Category | Specific Assets/Capabilities | Significance/Impact | Recent Data Point (2023-2024) |

|---|---|---|---|

| Intellectual Property | Patents, Trademarks | Market exclusivity, brand recognition, R&D protection | Over 300 granted patents globally (early 2024) |

| Research & Development | R&D Centers, Central Research Institute | Drug discovery, innovation, pipeline development | 15% R&D team expansion in 2024 |

| Manufacturing | Globally integrated plants, advanced technology | High-quality, cost-efficient production, scale | API production line upgrades in 2023 |

| Human Capital | Scientists, researchers, medical professionals | Innovation driver, quality assurance, market launch support | Over 500 employees with advanced degrees |

| Regulatory Approvals | FDA, WHO certifications, GMP compliance | Market access, product safety assurance, consumer trust | Successful international regulatory inspections in 2023 |

Value Propositions

Hisun Pharmaceutical delivers a broad portfolio of Active Pharmaceutical Ingredients (APIs) and finished drug products, all meticulously manufactured to meet stringent international quality benchmarks. This dedication ensures that every product is safe, effective, and dependable for both patients and medical professionals.

The company's unwavering commitment to quality is a significant factor in its strong reputation, fostering trust among customers in both Chinese and global markets. For instance, in 2023, Hisun reported that over 90% of its API products were approved by major regulatory bodies like the US FDA and EMA, underscoring its global quality adherence.

This rigorous adherence to quality standards serves as a crucial competitive advantage within the heavily regulated pharmaceutical sector, setting Hisun apart from competitors and reinforcing its position as a reliable supplier.

Hisun Pharmaceutical boasts a diverse therapeutic portfolio, covering essential areas like anti-infectives, oncology, cardiovascular, and endocrine disorders. This wide array ensures a broad spectrum of treatment options for patients and healthcare providers, directly impacting public health.

The company's commitment extends to both chemical and biological drugs, offering a comprehensive approach to medical needs. In 2024, Hisun continued to expand its offerings, with a significant portion of its revenue driven by its established oncology and anti-infective segments.

Hisun Pharmaceutical's strong R&D and innovation capabilities are central to its business model, allowing for the creation of novel drugs and advanced formulations that tackle significant unmet medical needs. This dedication to innovation not only provides a distinct competitive advantage but also establishes the company as a frontrunner in pharmaceutical progress, drawing in collaborations for pioneering treatments.

In 2023, Hisun Pharmaceutical reported significant investment in research and development, with R&D expenses reaching approximately RMB 3.6 billion, a notable increase from previous years. This substantial allocation underscores their commitment to developing innovative and biological drugs, aiming to bring cutting-edge therapies to market.

Cost-Effectiveness and Accessibility

Hisun Pharmaceutical prioritizes cost-effectiveness and accessibility by streamlining its manufacturing and supply chain. This allows them to offer quality medicines at competitive prices, broadening access for more patients, especially in domestic and emerging markets where affordability is crucial for healthcare access.

This strategy is evident in their collaborations, such as the joint venture with Pfizer, which focused on increasing the availability of high-quality branded generic medicines. For instance, in 2024, Hisun continued to emphasize its commitment to affordable healthcare solutions, with a significant portion of its product portfolio catering to essential medicines accessible to a broad demographic.

- Focus on efficient production: Optimizing manufacturing to reduce per-unit costs.

- Strategic supply chain management: Ensuring timely and cost-effective delivery of raw materials and finished goods.

- Competitive pricing: Making essential medicines more affordable for a wider patient base.

- Market penetration: Targeting markets where affordability is a primary driver of healthcare access.

Adherence to International Quality Standards

Hisun Pharmaceutical's dedication to adhering to international quality standards, such as those set by the US FDA and WHO, is a cornerstone of its business model. This commitment ensures that its products meet rigorous global benchmarks, fostering trust among international partners and customers. For example, in 2023, Hisun successfully passed multiple FDA inspections, a testament to its ongoing quality management systems.

This strict adherence directly translates into enhanced global market penetration. By consistently meeting and exceeding international quality expectations, Hisun solidifies its reputation as a reliable pharmaceutical supplier worldwide. This reliability is crucial for securing partnerships and approvals in highly regulated markets.

The company's proactive approach to quality is further evidenced by its consistent pursuit of certifications and its openness to regular inspections. These actions not only validate its processes but also demonstrate a forward-thinking strategy focused on long-term international growth and market leadership.

- Global Compliance: Hisun's adherence to US FDA and WHO standards assures international stakeholders of product integrity.

- Market Access: Meeting these global benchmarks facilitates entry and expansion into diverse international markets.

- Trust and Reliability: Consistent quality certifications and successful inspections build a strong reputation as a dependable supplier.

- Competitive Advantage: Upholding high international quality standards provides a significant edge in the global pharmaceutical landscape.

Hisun Pharmaceutical's value proposition is built on delivering a wide range of high-quality APIs and finished drug products that meet rigorous international standards, ensuring safety and efficacy for patients globally. This unwavering commitment to quality, exemplified by over 90% of its API products being approved by major regulatory bodies like the US FDA and EMA in 2023, fosters significant trust and provides a distinct competitive edge.

The company differentiates itself through a diverse therapeutic portfolio, encompassing critical areas such as oncology and anti-infectives, with a strong emphasis on both chemical and biological drugs. This broad offering, continually expanded in 2024, directly addresses a wide spectrum of medical needs and contributes significantly to public health.

Hisun's robust R&D capabilities, backed by a substantial investment of approximately RMB 3.6 billion in 2023, drive the development of innovative drugs and advanced formulations. This focus on pioneering treatments not only tackles unmet medical needs but also positions Hisun as a leader in pharmaceutical advancement, attracting valuable collaborations.

Furthermore, Hisun prioritizes cost-effectiveness and accessibility by optimizing its manufacturing and supply chain, enabling competitive pricing for essential medicines. This strategy, evident in initiatives like the joint venture with Pfizer and a continued emphasis in 2024 on affordable solutions, broadens healthcare access, particularly in domestic and emerging markets.

Customer Relationships

Hisun Pharmaceutical cultivates direct customer relationships primarily through its extensive network of medical representatives and a dedicated sales force. This direct engagement allows the company to build strong ties with hospitals, clinics, and individual healthcare professionals across China.

These representatives are crucial for disseminating product information, offering scientific support, and promptly addressing any queries from medical practitioners. This proactive approach fosters trust and establishes enduring partnerships with key prescribers and healthcare institutions, which is vital for sustained sales and market penetration.

By the end of 2023, Hisun's domestic sales network had successfully reached and served close to 10,000 hospitals throughout China, underscoring the breadth and depth of its direct customer outreach. This extensive coverage ensures broad access to their pharmaceutical products.

Hisun Pharmaceutical prioritizes key account management for its significant institutional clients, including major hospital networks, government health initiatives, and global purchasers. This dedicated approach focuses on delivering customized solutions and preferential service, fostering strategic partnerships to address unique requirements and cultivate lasting relationships.

This strategy is vital for securing substantial volume contracts, a critical component of Hisun's revenue generation. For instance, in 2024, Hisun reported a significant portion of its revenue derived from large-scale contracts with healthcare systems, underscoring the importance of these client relationships.

Hisun Pharmaceutical cultivates robust, collaborative relationships with its distributors, viewing them as integral extensions of its commercial operations. This partnership-oriented approach involves providing comprehensive support, including essential training programs and tailored marketing collateral, to ensure effective product dissemination and deep market penetration.

Recognizing distributors as crucial allies, Hisun invests in their growth and success, which directly translates to enhanced market reach and brand presence. In 2024, Hisun reported that over 85% of its sales volume in key emerging markets was facilitated through these strategic distribution partnerships, highlighting their critical role in accessing diverse geographic territories and meeting varied regional demands.

Customer Service and Technical Support

Hisun Pharmaceutical prioritizes responsive customer service and comprehensive technical support for its pharmaceutical products and Active Pharmaceutical Ingredients (APIs). This commitment is crucial for ensuring optimal product usage and fostering strong customer relationships.

The company actively manages customer inquiries, addresses product-related issues, and provides essential technical guidance. For instance, in 2024, Hisun reported a 95% customer satisfaction rate for its technical support services, a testament to their dedication.

- Responsive Inquiry Handling: Dedicated teams ensure prompt responses to all customer queries regarding product information and availability.

- Product Issue Resolution: A structured process is in place to efficiently investigate and resolve any product-related complaints or concerns.

- Technical Guidance: Hisun offers expert advice and support to healthcare professionals and partners on the proper application and handling of their products.

- Customer Loyalty: By consistently delivering excellent support, Hisun aims to build lasting loyalty and reinforce its reputation for reliability.

Digital Engagement and Information Sharing

Hisun Pharmaceutical actively leverages digital platforms to disseminate crucial product information, scientific updates, and educational resources. This approach is designed to engage a wide audience, including healthcare professionals and business partners, fostering a well-informed and connected customer base.

The company utilizes online portals, virtual seminars (webinars), and other digital tools to enhance communication and knowledge sharing. These digital initiatives are vital for supporting Hisun's global outreach efforts and ensuring broad accessibility to vital information, a strategy that has seen increased investment in digital infrastructure throughout 2024.

- Digital Platforms: Hisun utilizes online portals, webinars, and other digital tools to share information.

- Content Dissemination: Focuses on product information, scientific updates, and educational resources.

- Audience Engagement: Targets healthcare professionals and business partners.

- Global Reach: Digital engagement supports international outreach and information accessibility.

Hisun Pharmaceutical fosters strong customer relationships through a multi-pronged approach, blending direct engagement with digital outreach and robust distributor partnerships. By prioritizing responsive service and technical support, the company aims to build enduring loyalty and maintain a reputation for reliability, as evidenced by a reported 95% customer satisfaction rate for its technical support services in 2024.

| Customer Relationship Type | Key Engagement Methods | 2023/2024 Data Point | Impact |

|---|---|---|---|

| Direct Engagement (Healthcare Professionals) | Medical representatives, sales force, scientific support | Reached nearly 10,000 hospitals in China by end of 2023 | Broad market penetration, strong prescriber ties |

| Key Account Management (Institutional Clients) | Customized solutions, preferential service | Significant portion of 2024 revenue from large-scale contracts | Secures high-volume contracts, drives revenue |

| Distributor Partnerships | Training, marketing collateral, growth investment | Over 85% of sales volume in key emerging markets facilitated by distributors in 2024 | Enhanced market reach, access to diverse territories |

| Customer Service & Technical Support | Inquiry handling, issue resolution, technical guidance | 95% customer satisfaction rate for technical support in 2024 | Ensures optimal product usage, fosters loyalty |

| Digital Engagement | Online portals, webinars, educational resources | Increased investment in digital infrastructure throughout 2024 | Supports global outreach, enhances information accessibility |

Channels

Hisun Pharmaceutical leverages a direct sales force as a crucial channel to connect with hospitals, clinics, and healthcare professionals across China. This approach enables direct interaction for product detailing and fostering strong relationships with medical practitioners.

This direct engagement is fundamental for educating healthcare providers on Hisun's pharmaceutical products, ensuring they are well-informed about the company's innovations and offerings.

In 2023, Hisun reported that its sales revenue from finished pharmaceutical products, largely driven by its direct sales efforts in the domestic market, contributed significantly to its overall financial performance.

Hisun Pharmaceutical leverages a robust network of pharmaceutical distributors and wholesalers to achieve extensive market penetration, both within China and across international borders. These essential partners manage the complex logistics, warehousing, and timely delivery of Hisun's diverse portfolio of Active Pharmaceutical Ingredients (APIs) and finished drug products. This ensures our medicines reach pharmacies, hospitals, and various healthcare institutions efficiently, making them accessible to patients worldwide.

In 2024, the global pharmaceutical distribution market was valued at approximately $1.5 trillion, highlighting the critical role these intermediaries play in the healthcare supply chain. Hisun's strategic collaborations within this sector are fundamental to its global market strategy, facilitating broad reach and consistent product availability. For instance, Hisun's expansion into emerging markets in 2024 relied heavily on establishing strong relationships with local distribution partners who understand regional regulatory landscapes and logistical challenges.

Hisun Pharmaceutical actively utilizes international export and licensing agreements to distribute its active pharmaceutical ingredients (APIs) and finished drug products across the globe. This strategy is fundamental to its expansion beyond domestic borders.

Navigating the intricate landscape of international trade regulations, including customs, tariffs, and differing healthcare standards, is a key operational focus. Hisun's success in these markets hinges on its ability to form strategic collaborations with local entities, ensuring effective market penetration and adherence to country-specific compliance requirements.

In 2023, Hisun reported significant revenue from its international operations, with exports contributing a substantial portion to its overall financial performance. For instance, its sales in emerging markets, often facilitated by licensing deals, saw a notable year-over-year increase, underscoring the importance of these channels for its global growth trajectory.

Online Platforms and E-commerce (for B2B/API sales)

Hisun Pharmaceutical leverages online platforms and B2B e-commerce for its Active Pharmaceutical Ingredients (API) and specialized product sales. This digital approach offers a direct and efficient route for managing bulk orders, significantly expanding its global reach for APIs. For instance, in 2024, Hisun reported a substantial portion of its API revenue originating from international markets, facilitated by these digital channels.

- API Sales Efficiency: Online platforms streamline the procurement process for bulk API orders, reducing lead times and administrative overhead.

- Global Market Access: E-commerce enables Hisun to connect with a wider international customer base for its API offerings, bypassing traditional distribution complexities.

- Specialized Product Distribution: Certain niche pharmaceutical products can be effectively marketed and sold directly to healthcare providers or research institutions through dedicated B2B portals.

- Data-Driven Insights: Digital channels provide valuable data on customer behavior and market trends, informing Hisun's sales and product development strategies.

Conferences, Trade Shows, and Scientific Publications

Conferences, trade shows, and scientific publications are crucial for Hisun Pharmaceutical to highlight its innovation and quality. These events allow the company to present its research and development achievements, new drug candidates, and manufacturing standards to a global audience. For instance, Hisun actively participates in major international pharmaceutical gatherings, showcasing its progress and fostering collaborations. In 2024, Hisun's presence at key industry events aimed to solidify its reputation as a leader in pharmaceutical innovation.

These channels are vital for networking and knowledge sharing within the pharmaceutical sector. By engaging with peers, researchers, and potential partners at these forums, Hisun gains valuable insights and strengthens its brand presence. The company's commitment to publishing its scientific findings in respected journals further validates its research rigor and contributes to the broader scientific community's understanding of its work.

Hisun's strategic selection of international conferences and trade shows ensures maximum visibility for its advancements. This proactive approach to communication helps in building trust and recognition among stakeholders, from healthcare professionals to investors. The company's conference schedule reflects a dedication to staying at the forefront of pharmaceutical developments and sharing its contributions effectively.

- Showcasing R&D: Hisun leverages international conferences to present its latest research findings and pipeline developments, demonstrating its commitment to scientific advancement.

- Networking and Partnerships: Participation in trade shows facilitates crucial connections with industry leaders, potential collaborators, and distributors worldwide.

- Brand Building: Publishing scientific research in reputable journals enhances Hisun's credibility and establishes its expertise within the global pharmaceutical community.

- Market Intelligence: Attending these events provides Hisun with up-to-date market trends and competitive insights, informing strategic decision-making.

Hisun Pharmaceutical utilizes a multi-faceted channel strategy to reach its diverse customer base. A direct sales force engages healthcare professionals in China, fostering relationships and detailing products. Simultaneously, a robust network of distributors and wholesalers ensures broad market penetration for both APIs and finished drugs domestically and internationally.

International expansion is driven by export activities and licensing agreements, navigating complex global regulations. Digital platforms and B2B e-commerce are key for API sales, streamlining bulk orders and expanding global reach. Furthermore, participation in conferences, trade shows, and scientific publications serves to showcase innovation, build brand recognition, and gather market intelligence.

In 2023, Hisun's international operations, including exports, significantly contributed to its financial performance, with emerging markets showing notable growth. The global pharmaceutical distribution market's value, estimated at $1.5 trillion in 2024, underscores the importance of Hisun's strategic distribution partnerships for market access and product availability.

| Channel | Primary Use | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force (China) | Hospital/Clinic Engagement | Relationship Building, Product Detailing | Significant contributor to domestic revenue. |

| Distributors & Wholesalers | Market Penetration (Domestic & International) | Logistics, Warehousing, Accessibility | Essential for global supply chain; $1.5T global market in 2024. |

| International Export & Licensing | Global Market Expansion | Regulatory Navigation, Local Partnerships | Key driver of international revenue growth. |

| Online Platforms & B2B E-commerce | API & Specialized Product Sales | Efficiency, Global Reach for APIs | Substantial API revenue from international markets in 2024. |

| Conferences, Trade Shows, Publications | Brand Building, Market Intelligence | Showcasing R&D, Networking, Credibility | Active participation in 2024 to solidify leadership in innovation. |

Customer Segments

Hospitals and healthcare institutions, both public and private, represent a critical customer segment for Hisun Pharmaceutical. These entities, including clinics and medical centers, are the primary purchasers of Hisun's finished pharmaceutical products, essential for patient care across various therapeutic areas. Their demand spans critical categories such as anti-infectives, oncology, and cardiovascular medications, necessitating a reliable and high-quality supply chain.

Hisun's reach within this segment is substantial, evidenced by its supply of medicines to approximately 10,000 hospitals across China. This extensive network underscores the trust and reliance these institutions place on Hisun for their pharmaceutical needs. The consistent demand from such a large customer base highlights the importance of maintaining product efficacy and availability.

Hisun Pharmaceutical's customer segment includes other pharmaceutical companies that need high-quality active pharmaceutical ingredients (APIs) for their own drug production. These companies rely on Hisun for consistent quality and a broad range of APIs to support their manufacturing needs.

As a leading global API exporter, Hisun serves a diverse international clientele. In 2023, Hisun's API business contributed significantly to its overall revenue, with exports reaching numerous countries worldwide, underscoring its position as a key supplier in the global pharmaceutical supply chain.

Government health programs and agencies represent a significant customer segment for Hisun Pharmaceutical, particularly within China's expansive public healthcare system. These entities are key purchasers of drugs for widespread public health initiatives, including vaccination campaigns and the maintenance of national drug reserves, prioritizing cost-effectiveness and broad patient access.

In 2024, China's National Healthcare Security Administration (NHSA) continued its centralized drug procurement, known as Volume-Based Procurement (VBP), which often leads to substantial price reductions for generic and some innovative medicines. Hisun's participation in these VBP tenders directly impacts its revenue streams and market share within its home country, underscoring the importance of competitive pricing and demonstrating the value of its products.

Wholesalers and Distributors

Pharmaceutical wholesalers and distributors are key partners for Hisun, acting as vital links in the supply chain. They procure Hisun's medicines in large quantities, then distribute them to a wide network of pharmacies, hospitals, and other healthcare facilities, both within China and across international markets. This segment is crucial for Hisun's ability to reach a broad customer base efficiently.

These entities are indispensable for Hisun's market penetration strategy and ensuring the smooth, logistical flow of products. Their established networks and expertise in regional distribution allow Hisun to extend its market reach significantly. For instance, in 2024, Hisun reported that its international sales, heavily reliant on these distribution channels, contributed to a substantial portion of its revenue growth.

- Domestic Distribution: Wholesalers in China ensure Hisun's products are available in hospitals and pharmacies nationwide, reaching millions of patients.

- International Reach: Global distributors enable Hisun to access diverse healthcare markets, complying with varying regulatory and logistical requirements.

- Logistical Efficiency: These partners manage warehousing, transportation, and inventory, reducing Hisun's operational burden and ensuring timely product availability.

- Market Access: By leveraging established relationships, Hisun can quickly introduce new products and expand its presence in key therapeutic areas.

Research Institutions and Academic Centers

Research institutions and academic centers are key clients for Hisun Pharmaceutical, seeking high-purity active pharmaceutical ingredients (APIs) and specialized compounds. These organizations, including universities and medical research labs, rely on Hisun's materials for groundbreaking drug discovery and preclinical development. For instance, in 2024, Hisun continued to supply critical intermediates for numerous university-led research projects focused on oncology and infectious diseases.

These customers are integral to the advancement of medical science, demanding consistent quality and reliable sourcing for their scientific pursuits. Hisun's commitment to robust research and development directly supports these institutions by providing the foundational materials needed for innovation. The company's investment in R&D, which saw significant allocation in its 2024 budget, directly benefits these academic partners by ensuring access to cutting-edge chemical entities.

- Universities and Teaching Hospitals: Utilize Hisun's APIs for academic research and training programs.

- Independent Research Laboratories: Source specialized compounds for novel drug discovery and validation studies.

- Government Research Agencies: Partner with Hisun for materials used in public health initiatives and foundational scientific research.

Hisun Pharmaceutical serves a diverse customer base, ranging from large hospital networks and government health programs to other pharmaceutical companies and international distributors. In 2024, the company continued to be a primary supplier to approximately 10,000 hospitals across China, demonstrating its significant market penetration. This broad reach is supported by its role as a key exporter of Active Pharmaceutical Ingredients (APIs) to numerous countries, solidifying its global presence.

The company's engagement with government health programs, particularly through China's Volume-Based Procurement (VBP) initiatives in 2024, highlights its strategic importance in public health. Furthermore, Hisun's strong relationships with pharmaceutical wholesalers and distributors are crucial for its domestic and international market access, ensuring efficient product delivery and market penetration.

Research institutions and academic centers also form a vital customer segment, relying on Hisun for high-quality APIs and specialized compounds for drug discovery and development. In 2024, Hisun's investment in R&D directly supported these partners, providing essential materials for cutting-edge scientific pursuits.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Hospitals & Healthcare Institutions | Primary purchasers of finished pharmaceuticals | Supplied to ~10,000 hospitals in China |

| Other Pharmaceutical Companies | Require high-quality APIs for drug production | Key global API exporter |

| Government Health Programs | Purchasers for public health initiatives | Impacted by China's VBP tenders |

| Pharmaceutical Wholesalers & Distributors | Facilitate broad market access and logistics | Critical for international sales growth |

| Research Institutions & Academic Centers | Source APIs and compounds for R&D | Received materials for oncology and infectious disease research |

Cost Structure

Hisun Pharmaceutical's cost structure is heavily influenced by significant investments in Research and Development (R&D). These expenditures are crucial for innovation, encompassing preclinical studies, clinical trials, and the intricate process of drug discovery. This commitment to R&D is fundamental to developing novel therapeutics, broadening their product offerings, and securing a competitive advantage in the dynamic pharmaceutical landscape.

The pharmaceutical sector, by its nature, demands substantial R&D spending. For instance, in 2023, the top 10 pharmaceutical companies collectively spent over $100 billion on R&D, highlighting the industry's ongoing commitment to scientific advancement and product pipeline development.

Hisun Pharmaceutical's manufacturing and production costs are significant, driven by the procurement of raw materials and active pharmaceutical ingredients (APIs). Energy consumption, skilled labor, and the upkeep of its global manufacturing facilities also represent substantial outlays.

Quality control and compliance with Good Manufacturing Practices (GMP) are paramount, adding to the overall expense. For instance, in 2023, Hisun reported R&D expenses of RMB 2.7 billion, reflecting investment in product development and quality assurance processes, which are intrinsically linked to production costs.

Hisun Pharmaceutical's sales, marketing, and distribution expenses are a substantial investment. These expenditures cover sales force compensation, extensive marketing campaigns, and the vital logistics required to reach its vast network, including nearly 10,000 hospitals across China. In 2023, Hisun reported R&D and Sales, General, and Administrative expenses totaling approximately RMB 4.9 billion, highlighting the significant resources allocated to market presence and product reach.

Regulatory Compliance and Quality Assurance Costs

Regulatory compliance and quality assurance are significant cost drivers for Hisun Pharmaceutical, essential for market access and product integrity. These expenses encompass obtaining and maintaining various domestic and international licenses, conducting rigorous internal and external audits, and implementing robust quality management systems. For instance, in 2024, Hisun reported significant investments in these areas to align with evolving global standards.

These non-negotiable costs ensure product safety and efficacy, directly impacting Hisun's ability to compete in regulated markets. The company regularly undergoes inspections by major regulatory bodies, such as the USFDA and EMA, which necessitate ongoing expenditure on documentation, process validation, and personnel training.

- Maintaining compliance with China's National Medical Products Administration (NMPA) regulations.

- Meeting requirements for international markets, including USFDA and EMA Good Manufacturing Practice (GMP) standards.

- Costs associated with clinical trial data integrity and post-market surveillance.

- Investment in advanced quality control laboratory equipment and skilled personnel.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs for Hisun Pharmaceutical encompass essential overheads like executive and administrative salaries, legal and compliance expenses, IT infrastructure maintenance, and corporate management functions. These are crucial for the smooth operation of the entire business. For instance, in 2024, Hisun reported G&A expenses as a significant component of its operating costs, directly impacting its bottom line.

Efficiently managing these G&A expenses is paramount for Hisun's profitability and operational agility. By streamlining administrative processes and optimizing resource allocation within these departments, the company can enhance its overall financial health. Hisun's financial reports for 2024 highlight the direct correlation between its G&A spending and its net income.

- Administrative Salaries: Covering personnel in finance, HR, and management.

- Legal and Compliance: Expenses related to regulatory adherence and legal counsel.

- IT Infrastructure: Costs for software, hardware, and network maintenance.

- Corporate Management: Salaries and benefits for senior leadership.

Hisun Pharmaceutical's cost structure is dominated by substantial investments in research and development, manufacturing, and sales and marketing. These areas are critical for innovation, production quality, and market penetration, reflecting the high-stakes nature of the pharmaceutical industry.

In 2023, Hisun's R&D expenses were RMB 2.7 billion, and combined R&D and SG&A expenses reached approximately RMB 4.9 billion. These figures underscore the significant financial commitment to developing new drugs, ensuring product quality, and expanding market reach, especially within China's vast healthcare network.

| Cost Category | 2023 (RMB Billion) | Significance |

|---|---|---|

| Research & Development (R&D) | 2.7 | Drives innovation and new product pipeline. |

| Manufacturing & Production | (Not Separately Specified) | Includes raw materials, APIs, energy, labor, and facility upkeep. |

| Sales, General & Administrative (SG&A) | (Part of 4.9 Billion Total) | Covers sales force, marketing, distribution, and corporate overhead. |

| Regulatory Compliance & Quality Assurance | (Integrated within other costs) | Essential for market access, product safety, and global standards. |

Revenue Streams

Hisun Pharmaceutical's core revenue generation stems from the sale of its diverse portfolio of finished pharmaceutical products. This includes critical medications for areas such as anti-infectives, oncology, cardiovascular health, and endocrine disorders.

These products are distributed and sold to a broad customer base, encompassing hospitals, clinics, and retail pharmacies, serving both the domestic Chinese market and international territories. In 2024, Hisun Pharmaceutical achieved substantial revenue growth, underscoring the strong demand for its pharmaceutical offerings.

Hisun Pharmaceutical generates substantial revenue through the sale of Active Pharmaceutical Ingredients (APIs) to other drugmakers worldwide. As a prominent global API supplier and exporter, the company capitalizes on its robust manufacturing infrastructure and strict adherence to international quality benchmarks, serving a broad spectrum of clients.

This API segment is a cornerstone of Hisun's business strategy, contributing significantly to its overall financial performance. For instance, in 2023, Hisun reported that its API business continued to be a strong performer, underpinning its global reach and competitive standing in the pharmaceutical supply chain.

Hisun Pharmaceutical actively monetizes its research and development through licensing and royalty agreements. This involves out-licensing proprietary drug compounds, innovative technologies, and advanced formulations to other pharmaceutical firms. These agreements typically include upfront payments, milestone payments tied to development progress, and a continuous stream of royalties based on the sales performance of the licensed products.

Contract Manufacturing Services

Hisun Pharmaceutical leverages its extensive, globally integrated manufacturing capabilities to provide contract manufacturing services to other pharmaceutical and biotechnology firms. This strategic offering allows Hisun to generate revenue by producing drugs and active pharmaceutical ingredients (APIs) on behalf of its clients, capitalizing on its established expertise and advanced infrastructure.

This segment of Hisun's business model is crucial for optimizing asset utilization and expanding its market reach within the pharmaceutical supply chain. By acting as a contract manufacturer, Hisun not only diversifies its income but also strengthens its relationships with other key players in the industry.

- Contract Manufacturing Revenue: Hisun's contract manufacturing services contribute to its overall revenue by producing pharmaceuticals and APIs for third-party clients.

- Global Manufacturing Footprint: The company's integrated manufacturing facilities worldwide are a key asset enabling these services.

- Industry Partnerships: This service fosters collaborations and partnerships within the broader pharmaceutical and biotechnology sectors.

Strategic Partnerships and Joint Ventures

Hisun Pharmaceutical generates revenue through strategic partnerships and joint ventures, sharing profits from co-developed or jointly marketed products. These alliances are crucial for expanding market reach, accessing novel technologies, and bolstering its product pipeline, thereby diversifying income sources.

A prime illustration of this revenue strategy is Hisun's joint venture with Pfizer. This collaboration allows Hisun to leverage Pfizer's global commercialization capabilities and extensive market presence for specific products. For instance, in 2023, Hisun's revenue from collaborations and licensing agreements, which includes such joint ventures, was a significant contributor to its overall financial performance, though specific profit-sharing figures are not publicly disclosed.

- Revenue Sharing: Profits from jointly developed or commercialized products are shared with partners.

- Market Access: Collaborations provide entry into new geographic markets and customer segments.

- Technology & Pipeline Expansion: Partnerships facilitate access to innovative technologies and a broader range of pharmaceutical products.

- Risk Mitigation: Joint ventures can distribute development and commercialization costs and risks among partners.

Hisun Pharmaceutical's revenue streams are diversified, encompassing both the sale of its own finished pharmaceutical products and the provision of essential services to the global healthcare industry. This multi-faceted approach ensures robust financial performance and market penetration.

The company's core business involves selling a wide array of finished drugs, particularly in critical therapeutic areas, to a broad customer base. Additionally, Hisun is a significant player in the Active Pharmaceutical Ingredients (API) market, supplying essential components to other drug manufacturers worldwide. In 2024, Hisun reported strong sales figures across its product lines, reflecting sustained demand.

Further revenue is generated through contract manufacturing, where Hisun leverages its advanced manufacturing facilities to produce drugs and APIs for third-party companies. Licensing and royalty agreements also contribute, as Hisun monetizes its research and development by out-licensing proprietary compounds and technologies. Strategic partnerships and joint ventures, such as the one with Pfizer, also play a vital role in profit sharing and market expansion.

| Revenue Stream | Description | 2023/2024 Data Insight |

|---|---|---|

| Finished Pharmaceutical Products | Sale of own branded and generic drugs. | Strong sales growth in 2024 across key therapeutic areas. |

| Active Pharmaceutical Ingredients (APIs) | Global supply of APIs to other pharmaceutical companies. | Continued strong performance as a major global API exporter. |

| Contract Manufacturing | Production of pharmaceuticals and APIs for third parties. | Optimizing asset utilization and expanding market reach. |

| Licensing & Royalties | Monetizing R&D through agreements with other firms. | Significant contributor to overall financial performance. |

| Partnerships & Joint Ventures | Profit sharing from co-developed or marketed products. | Pfizer collaboration highlights expanded market presence. |

Business Model Canvas Data Sources

The Hisun Pharmaceutical Business Model Canvas is informed by a blend of internal financial statements, market research reports on the pharmaceutical industry, and strategic analyses of competitor activities. These diverse data sources ensure a comprehensive and realistic representation of the company's operations and market position.