Hisun Pharmaceutical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisun Pharmaceutical Bundle

Uncover Hisun Pharmaceutical's strategic positioning with our comprehensive BCG Matrix analysis. See which of their products are poised for growth, which are generating consistent revenue, and which may require a closer look.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Hisun Pharmaceutical.

Stars

Hisun Pharmaceutical's venture into synthetic biology through its subsidiary, Yansheng Synthetics, is a significant move. This new entity boasts a pipeline of 24 projects, signaling a robust commitment to innovation in biomanufacturing. The company is strategically positioning itself to capitalize on the growing demand for advanced biopharmaceutical products.

The launch of three bone-related products in August 2025 is a key milestone, highlighting Hisun's focus on high-value offerings. This leverages their deep expertise in microbial fermentation, a core competency that underpins their synthetic biology ambitions. The biotechnology sector experienced substantial growth, with global market size reaching over $150 billion in 2024, indicating a fertile ground for these new products.

Hisun Pharmaceutical stands as a leading force in China's anti-tumor drug market, boasting an impressive portfolio where 20 distinct products each generate over 100 million yuan in sales. This strong performance underscores their established presence and market penetration in a critical therapeutic area.

The global oncology market is experiencing robust growth, fueled by a rising incidence of cancer diagnoses and continuous breakthroughs in treatment methodologies. This trend highlights the significant demand and opportunity within the sector for companies like Hisun.

Hisun's unwavering commitment to research and development in oncology, coupled with the successful registration of new cancer therapies in China, strategically positions them for sustained market leadership and accelerated growth. Their pipeline development is a key indicator of future success.

Hisun Pharmaceutical boasts a robust biologics division, notably being the first to introduce a bio-better version of Enbrel in China. The company currently has several biosimilar products progressing through late-stage clinical development, indicating a strategic focus on this growing market segment.

The global biosimilar market is projected for substantial expansion, driven by the demand for more cost-effective alternatives to expensive biologic drugs. This trend positions Hisun's upcoming biosimilar launches for significant market penetration and competitive advantage in key therapeutic areas.

Key Innovative Drugs from R&D Pipeline

Hisun Pharmaceutical's R&D pipeline is a critical driver of its future growth, with a focus on innovative drugs that address significant unmet medical needs. The company actively participates in national key R&D projects, fostering both independent and collaborative research efforts. This dedication to innovation is designed to yield products with substantial market potential.

Key innovative drugs emerging from Hisun's R&D efforts are positioned as potential stars within its portfolio. These candidates, often targeting complex diseases or offering superior efficacy and safety profiles compared to current treatments, represent significant growth opportunities. For instance, in 2024, Hisun reported progress in several late-stage clinical trials for oncology and autoimmune disease treatments, indicating strong potential for market disruption.

- Oncology Pipeline: Hisun is advancing several novel targeted therapies and immunotherapies for various cancers, with clinical trial data in 2024 showing promising response rates.

- Autoimmune Disease Treatments: The company has made strides in developing new biologic drugs for conditions like rheumatoid arthritis and lupus, aiming for improved patient outcomes.

- Global Collaboration: Hisun continues to forge strategic partnerships with international pharmaceutical companies to accelerate the development and commercialization of its innovative drug candidates.

International Expansion of Finished Products

Hisun Pharmaceutical is making a concerted effort to grow its finished drug product business internationally, especially in the United States and other key global markets. This expansion includes a strong focus on generic medications, and the company is actively pursuing collaborations and partnerships worldwide to bolster its reach.

The worldwide pharmaceutical sector, particularly in rapidly developing economies, presents substantial avenues for expansion. Hisun's strategy to introduce a diverse range of generic and specialized medicines into these markets positions them as potential future stars within the BCG matrix.

- Global Pharmaceutical Market Growth: The global pharmaceutical market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.2 trillion by 2028, indicating a significant opportunity for companies like Hisun.

- US Market Penetration: The US generics market alone is a substantial segment, with sales estimated to be over $100 billion annually, offering a prime target for Hisun's finished product expansion.

- Emerging Market Potential: Emerging markets are expected to drive a significant portion of future pharmaceutical growth, with some estimates suggesting they could account for nearly 30% of global sales by 2027.

Hisun Pharmaceutical's innovative drug candidates, particularly in oncology and autoimmune diseases, are poised to become stars. These products, showing promising clinical trial data from 2024, target unmet medical needs and represent significant future growth opportunities. Their advancement through late-stage development signals strong market potential.

| Product Category | Key Developments (2024) | Market Potential |

|---|---|---|

| Oncology Therapies | Progress in late-stage clinical trials for novel targeted therapies and immunotherapies. Promising response rates reported. | High, given the global oncology market's projected growth to over $400 billion by 2027. |

| Autoimmune Disease Treatments | Advancement in developing new biologic drugs for conditions like rheumatoid arthritis. Focus on improved patient outcomes. | Substantial, as the biologics market continues its upward trajectory, driven by demand for advanced treatments. |

| Global Expansion of Finished Products | Focus on generic and specialized medicines in the US and other key international markets. | Significant, targeting the US generics market (over $100 billion annually) and emerging markets. |

What is included in the product

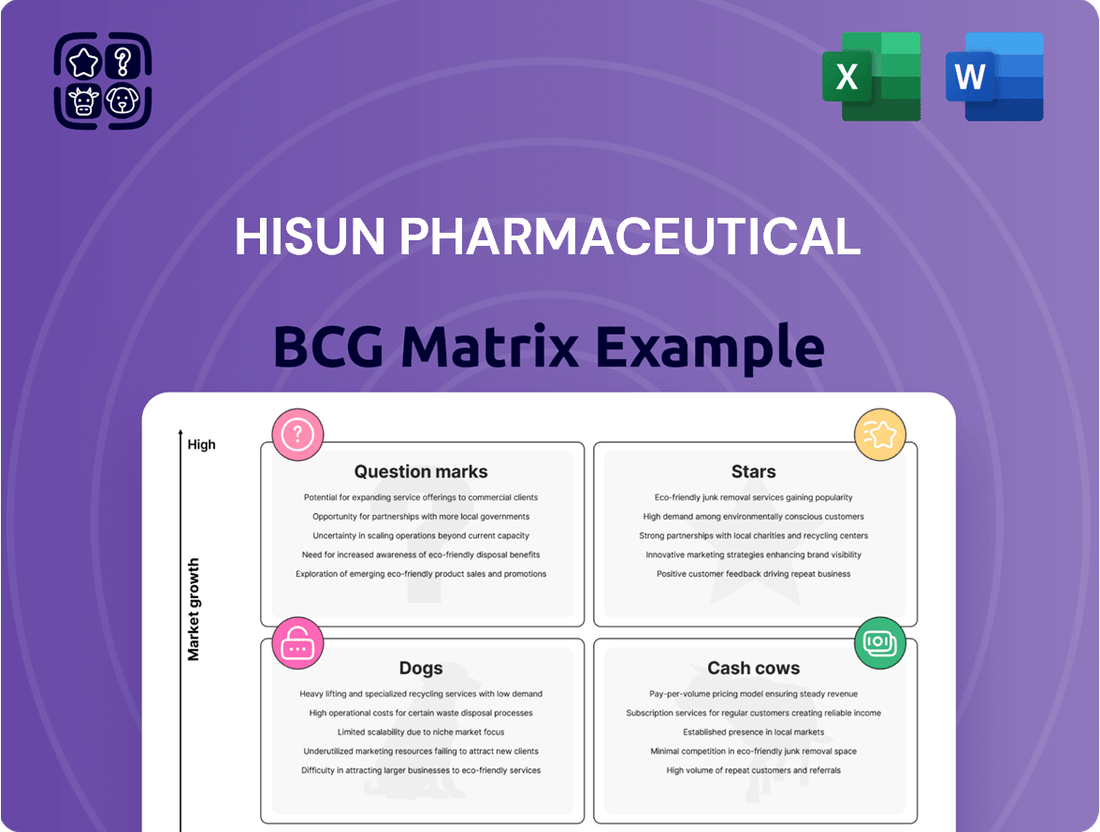

Hisun Pharmaceutical's BCG Matrix offers a strategic overview of its product portfolio, guiding investment and divestment decisions.

It categorizes products into Stars, Cash Cows, Question Marks, and Dogs, highlighting growth potential and market share.

Hisun Pharmaceutical's BCG Matrix offers a clear, one-page overview, pinpointing each business unit's strategic position to alleviate portfolio management pain points.

Cash Cows

Hisun Pharmaceutical's Active Pharmaceutical Ingredient (API) division is a strong Cash Cow. As one of China's leading API manufacturers, Hisun exports over 130 products to more than 60 nations, with 80% of its API revenue originating from international sales. This demonstrates a well-established global reach and a significant market share.

The API market is mature, but Hisun's extensive product range and commitment to global quality standards, such as those required by the FDA and EMA, translate into reliable and substantial cash flows. This segment acts as a bedrock for the company, consistently generating revenue due to the essential nature of APIs in pharmaceutical production worldwide.

Hisun Pharmaceutical holds a commanding position in China's anti-infective drug market, boasting significant market share. This segment, though mature, benefits from persistent demand for treatments against a spectrum of infections, ensuring reliable revenue streams.

The company’s strong foothold and diverse product offerings in anti-infectives are expected to yield stable profits and robust cash flow. This is particularly true as these established products typically require less intensive marketing expenditure to maintain their market presence.

Hisun Pharmaceutical's established generic drug portfolio in China functions as a classic cash cow. This segment boasts a wide array of products with a robust sales network reaching approximately 10,000 hospitals across the nation.

While the Chinese generic drug market is well-developed, Hisun's deep distribution channels and significant market penetration for these generics ensure consistent and considerable cash flow. These mature products benefit from steady demand and reduced research and development expenses compared to newer, innovative medications.

Cardiovascular Drugs

Hisun Pharmaceutical's cardiovascular drugs are a cornerstone of its portfolio, addressing widespread chronic health issues. This segment benefits from a large and consistently growing market, as cardiovascular diseases remain a significant global health concern. For instance, in 2024, the global cardiovascular drugs market was valued at approximately $150 billion, with projections indicating continued steady growth.

These established products generate reliable revenue streams for Hisun, acting as significant cash cows. Their consistent sales performance means they require minimal reinvestment for aggressive expansion, instead contributing stable cash flow to support other areas of the business. This stability is crucial for funding research and development in emerging therapeutic areas.

- Stable Market: The cardiovascular drug market is large and consistently growing, providing a reliable revenue base.

- Consistent Cash Flow: Established cardiovascular products generate predictable income for Hisun.

- Lower Investment Needs: Unlike high-growth products, these cash cows require less aggressive investment to maintain their market position.

- Support for Innovation: The cash generated helps fund research and development in other, potentially higher-growth, areas of Hisun's business.

Certain Endocrine Disorder Treatments

Hisun Pharmaceutical's portfolio includes treatments for endocrine disorders, which can function as cash cows. These products cater to chronic conditions, ensuring a steady demand and recurring revenue streams.

While precise market share figures for Hisun's specific endocrine disorder treatments aren't publicly detailed, the general market for diabetes management, a key endocrine disorder, demonstrates strong stability. For instance, the global diabetes care market was valued at approximately $72.5 billion in 2023 and is projected to reach $100.9 billion by 2030, indicating a consistent need for these long-term therapies.

- Consistent Demand: Endocrine disorders often require lifelong management, creating a predictable revenue base.

- Established Market: Products for conditions like diabetes have well-defined patient populations and established treatment protocols.

- Low Growth, High Share: These treatments typically operate in mature markets with moderate growth but hold significant market share for Hisun.

- Profit Generation: The stable demand and established position allow these products to generate substantial profits with relatively lower investment needs.

Hisun Pharmaceutical's established generic drug portfolio in China serves as a prime example of a cash cow. With a robust sales network reaching approximately 10,000 hospitals nationwide, these mature products benefit from steady demand and reduced R&D expenses.

The company's cardiovascular drugs also function as significant cash cows, addressing widespread chronic health issues. In 2024, the global cardiovascular drugs market was valued at around $150 billion, highlighting a stable and growing demand that Hisun's established products reliably tap into.

Furthermore, Hisun's API division, a leading player in China, exports over 130 products to more than 60 countries. This global reach in a mature market ensures consistent and substantial cash flows, with 80% of API revenue coming from international sales.

Hisun's anti-infective drug segment, holding a significant market share in China, also contributes to its cash cow status. Persistent demand for these treatments ensures reliable revenue streams with minimal need for aggressive marketing expenditure.

| Product Segment | Market Characteristic | Hisun's Position | Cash Flow Generation |

| Generic Drugs (China) | Mature, High Volume | Extensive Distribution (10,000+ hospitals) | Stable, Predictable |

| Cardiovascular Drugs | Growing, Chronic Conditions | Established Products | Consistent, Supports R&D |

| Active Pharmaceutical Ingredients (APIs) | Mature, Global Demand | Leading Chinese Manufacturer, Global Reach | Substantial, International Revenue |

| Anti-infectives (China) | Persistent Demand | Significant Market Share | Reliable Revenue, Low Marketing Costs |

What You’re Viewing Is Included

Hisun Pharmaceutical BCG Matrix

The Hisun Pharmaceutical BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use document for strategic decision-making. You can confidently use this preview as a direct representation of the comprehensive analysis that will be delivered to you, enabling immediate application in your business planning.

Dogs

Hisun Pharmaceutical's overall revenue saw a dip of 5.7% in fiscal year 2024 when compared to fiscal year 2023. Projections for the next two years suggest a modest growth of only 1.9%, a figure notably lagging behind the broader industry's expansion. This performance points to certain product lines or business areas within Hisun experiencing a downturn in sales and a shrinking presence in their respective markets.

These underperforming products, especially those situated in markets with minimal growth potential, are classified as dogs in the BCG matrix. Their contribution to the company's negative revenue trend is significant, highlighting areas that require careful strategic consideration for potential divestment or repositioning.

Older, undifferentiated generic products in highly competitive markets represent a significant challenge for Hisun Pharmaceutical. In 2024, the generic drug market continued to be fiercely contested, with numerous players vying for market share. Products within Hisun's portfolio that fall into this category are likely experiencing declining sales volumes and pressure on profit margins due to intense price competition and the availability of lower-cost alternatives from other manufacturers.

These specific generic drugs, lacking unique selling propositions or significant cost advantages, often find themselves in a precarious position. They may only manage to break even or generate very minimal cash flow for the company. For instance, if a particular older generic antibiotic from Hisun faces competition from ten other manufacturers offering similar products at lower price points, its contribution to overall profitability would be negligible, potentially even negative if manufacturing costs exceed revenue.

Hisun Pharmaceutical's research and development efforts, while robust, have encountered setbacks. Several promising R&D projects have stalled, failing to progress to commercialization due to efficacy issues or market unviability. For instance, a late-stage oncology drug candidate in 2023, which had shown early promise, was discontinued after failing to meet primary endpoints in Phase III trials, representing a significant write-off.

Furthermore, some products that did launch have seen minimal market adoption, leading to stagnation. These underperforming assets tie up capital without yielding substantial returns. An example is a cardiovascular drug launched in 2022, which, despite initial expectations, captured less than 1% of its target market by the end of 2023, effectively becoming a cash trap with ongoing, low-level production costs.

Non-Core or Divested Business Units

Hisun Pharmaceutical might classify certain divested or soon-to-be-divested business units as dogs within its BCG matrix. These are typically operations that have historically yielded low returns and operate within slow-growth market segments. For example, if Hisun divested a legacy generics division in 2023 that had seen declining sales due to intense competition and limited innovation, this would fit the dog profile.

Such units, often characterized by mature or declining product lifecycles and high operational costs relative to revenue, are divested to free up capital and management focus for more promising areas. In 2024, Hisun continued its strategic portfolio optimization, which could involve shedding businesses that no longer align with its core strengths in innovative drug development and biologics.

Consider a hypothetical scenario where a former subsidiary focused on specific over-the-counter (OTC) products, which faced significant market saturation and minimal revenue growth, was sold. This unit, generating perhaps less than 5% of Hisun's total revenue in its final years and operating in a market with sub-2% annual growth, would be a clear candidate for the dog quadrant.

- Divested Legacy Products: Business units focused on older, off-patent drugs with declining market share.

- Low-Growth Segments: Operations in therapeutic areas experiencing minimal innovation or market expansion.

- Underperforming Subsidiaries: Companies or divisions consistently failing to meet profitability targets or contributing minimally to overall revenue.

- Non-Core Asset Sales: Business lines that do not align with Hisun's strategic focus on innovative pharmaceuticals and biologics.

Products Impacted by Stricter Regulations or Changing Treatment Paradigms

Pharmaceutical products can transition into the 'dog' category within a BCG matrix when advancements in medical science introduce superior alternatives or when regulatory shifts diminish their market viability. For Hisun Pharmaceutical, this could apply to older medications facing declining demand due to the emergence of more effective or safer treatments, or those encountering stricter regulatory hurdles that impact profitability.

Consider a scenario where Hisun has an established antibiotic that, while once a market leader, now faces competition from newer, broad-spectrum agents with improved resistance profiles. If regulatory bodies in key markets, such as the FDA or EMA, begin to impose more stringent post-market surveillance requirements or label changes that limit its use, this product could see its market share erode significantly, pushing it into the dog quadrant.

For instance, if a particular generic drug in Hisun's portfolio, previously a cash cow, is now subject to increased pricing pressure from government health programs or if its manufacturing process faces new environmental compliance costs, its profitability could plummet. This would be especially true if its sales volume in 2024 dropped by, say, 15% year-over-year due to these factors, indicating a clear decline in its market position and growth potential.

- Declining Market Share: Products facing obsolescence due to new therapeutic paradigms.

- Regulatory Hurdles: Drugs impacted by stricter approval processes or post-market requirements.

- Reduced Profitability: Medications where increased compliance costs outweigh revenue.

- Lowered Demand: Older treatments superseded by more effective or safer alternatives, impacting 2024 sales.

Dogs in Hisun Pharmaceutical's portfolio represent products with low market share in low-growth industries. These are often older, undifferentiated generics facing intense price competition, leading to minimal or even negative cash flow. For example, a legacy antibiotic facing numerous competitors in 2024 might only break even.

Hisun's overall revenue decline of 5.7% in 2024, with projected modest growth of 1.9%, highlights the impact of these underperforming assets. Stalled R&D projects, like an oncology drug discontinued in Phase III trials in 2023, also contribute to this category by tying up capital without returns.

These dogs may include divested business units, such as a legacy generics division sold in 2023, or non-core assets that do not align with Hisun's strategic focus on innovation. A cardiovascular drug launched in 2022 that captured less than 1% of its market by the end of 2023 exemplifies a cash trap.

Products can become dogs due to new therapeutic alternatives or regulatory shifts, impacting their market viability. An established antibiotic facing newer, more effective agents, or one subject to stricter post-market surveillance, could see its market share erode, pushing it into the dog quadrant.

Question Marks

Hisun Pharmaceutical's Yansheng Synthetics subsidiary is poised to launch three novel bone-related products in August 2025, tapping into the burgeoning synthetic biology market. These products are entering a high-growth sector, but their initial market share is yet to be determined, placing them in a critical early stage of development.

The success of these synthetic biology offerings hinges on substantial investment to build market presence and encourage adoption. Without strong market uptake, they risk becoming Dogs in the BCG matrix, despite their innovative origins and the overall sector's potential for rapid expansion, which saw global synthetic biology market revenue reach an estimated USD 11.5 billion in 2023.

Hisun Pharmaceutical's early to mid-stage clinical pipeline, a key component of its BCG matrix analysis, showcases a significant commitment to innovation across diverse therapeutic areas, notably in oncology and biologics. These products, while holding considerable future growth potential, currently represent nascent market positions due to their ongoing clinical trial phases.

The investment required for these pipeline assets is substantial, with clinical trials representing a significant expenditure. For instance, in 2024, Hisun continued to allocate considerable resources towards advancing its investigational drugs through Phase I, II, and III trials, underscoring the high-risk, high-reward nature of these ventures.

Hisun Pharmaceutical is actively pursuing a pipeline of biosimilar products beyond those in late-stage clinical trials. These early-stage candidates represent significant future growth opportunities, though they also carry substantial development risks.

The biosimilar market is indeed expanding, with global revenues projected to reach over $100 billion by 2029. However, the success of any single biosimilar hinges on factors like the existing competitive landscape, the speed and outcome of regulatory reviews, and how readily physicians and patients adopt the new product.

For Hisun, these early-stage biosimilars are classic examples of "question marks" in a BCG matrix. They require significant investment to advance through development and regulatory hurdles, with uncertain market penetration and revenue generation in the near term. Their potential for high future growth is tempered by the inherent risks associated with bringing novel biologics to market.

Products in Emerging Therapeutic Areas with High R&D Investment

Hisun Pharmaceutical actively invests in emerging therapeutic areas with substantial research and development (R&D) expenditure. Products in these nascent, high-growth sectors, where Hisun's current market presence is minimal but R&D funding is significant, represent potential future stars. These ventures demand considerable capital to establish market share and validate their efficacy and commercial viability.

For instance, Hisun's commitment to oncology R&D saw a notable increase, with R&D expenses reaching approximately RMB 2.0 billion in 2023, a significant portion allocated to novel cancer therapies. This strategic focus on areas like CAR-T cell therapy and targeted oncology drugs, though currently representing a smaller portion of their overall revenue, positions them for future growth.

- Oncology: Hisun is channeling substantial R&D resources into innovative cancer treatments, including immuno-oncology and targeted therapies.

- Autoimmune Diseases: Significant investment is being made in developing novel biologics and small molecule drugs for conditions like rheumatoid arthritis and lupus.

- Rare Diseases: The company is exploring treatments for rare genetic disorders, recognizing the unmet medical needs and potential for specialized market penetration.

- Neurology: Hisun is also increasing its R&D focus on neurodegenerative diseases, such as Alzheimer's and Parkinson's, areas with high unmet demand.

Expansion into New Geographic Markets for Specific Products

Hisun Pharmaceutical's specific finished products entering new geographic markets like the US, where it has minimal existing share, would be classified as Question Marks in the BCG Matrix. This expansion hinges on successful strategic partnerships and alliances to navigate these unfamiliar territories.

The success of these Question Mark products in new markets such as the US is heavily reliant on robust market entry strategies. Hisun must carefully consider the competitive landscape and the significant regulatory hurdles present in these regions. For instance, the US pharmaceutical market is highly competitive, with major players and stringent FDA approval processes.

- Market Entry Strategy: Hisun's approach to introducing products in new territories like the US will be crucial.

- Competitive Dynamics: Understanding and outmaneuvering established competitors is key.

- Regulatory Hurdles: Navigating complex approval processes in markets like the US is a significant challenge.

- Strategic Alliances: Partnerships will be vital for gaining market access and expertise.

Hisun Pharmaceutical's pipeline of early-stage biosimilars and novel therapies in emerging areas like oncology and autoimmune diseases are prime examples of Question Marks in the BCG matrix. These ventures require significant investment to progress through development and regulatory stages, with uncertain near-term revenue potential but high future growth prospects.

The company's strategic focus on R&D, with 2023 R&D expenses around RMB 2.0 billion, highlights this commitment to developing these high-potential but uncertain products. For instance, advancements in their CAR-T cell therapy programs, while costly, aim to capture future market share in a rapidly evolving oncology landscape.

Expansion into new geographic markets, such as the US, for existing or new products also positions them as Question Marks. Navigating these competitive and regulatory-intensive environments demands substantial strategic investment and partnerships to gain traction.

Hisun's investment in synthetic biology, with new bone-related products slated for August 2025, further illustrates this. While the sector is growing, with global revenue estimated at USD 11.5 billion in 2023, these specific offerings are in their infancy, requiring significant capital to establish market presence.

BCG Matrix Data Sources

Our Hisun Pharmaceutical BCG Matrix is built upon comprehensive market data, including financial disclosures, industry growth forecasts, and competitor analysis to provide strategic insights.