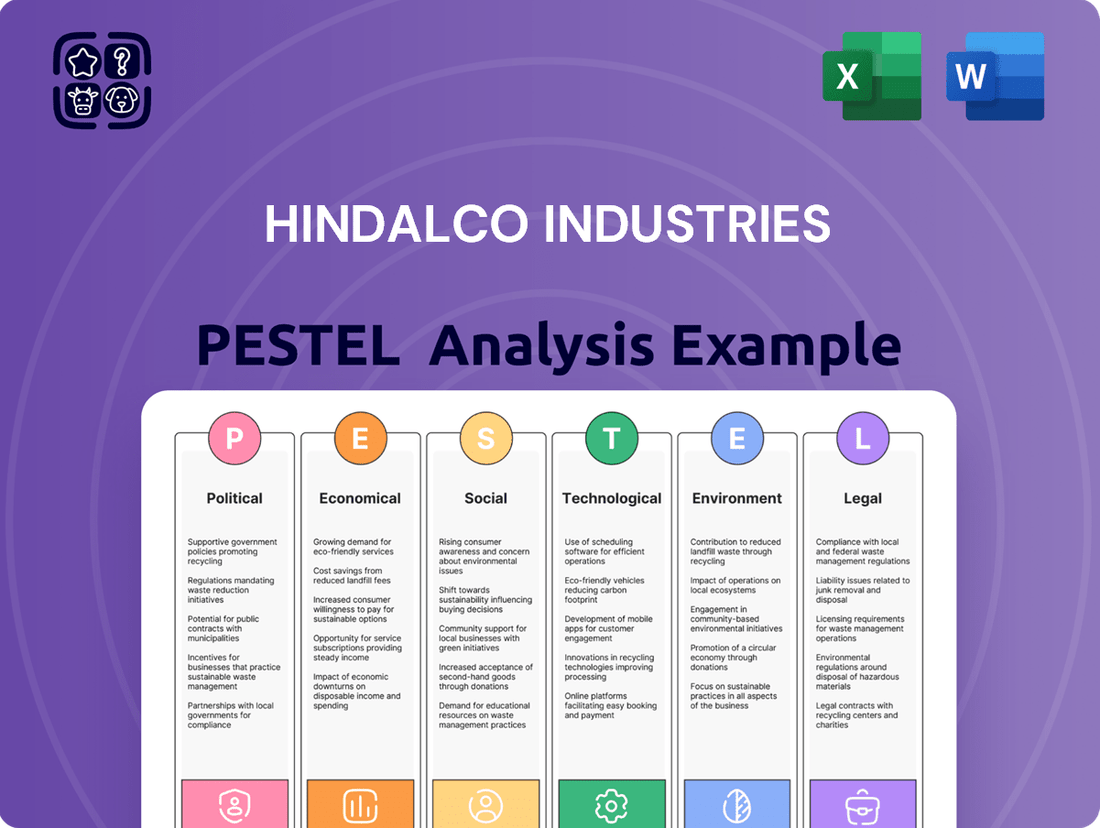

Hindalco Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hindalco Industries Bundle

Navigate the complex external forces shaping Hindalco Industries's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this metals and mining giant. Gain a crucial competitive edge by leveraging these expert insights to refine your market strategy and investment decisions.

Unlock actionable intelligence on Hindalco Industries's operating environment. Our meticulously researched PESTLE analysis provides a deep dive into the macro-level trends impacting the company's performance and growth trajectory. Don't miss out on this essential tool for strategic planning and risk mitigation—download the full version now.

Political factors

Hindalco's extensive operations are deeply intertwined with the Indian government's regulatory framework for bauxite mining, alumina refining, and metal production. These policies directly shape the cost and availability of raw materials, a critical factor for profitability.

The Mines and Minerals (Development and Regulation) Act, 1957, saw significant amendments in 2023, reclassifying certain minerals as critical and granting the central government enhanced powers for auctioning mineral concessions. This shift impacts how companies like Hindalco secure access to essential resources.

Looking ahead, the National Critical Minerals Mission, initiated in 2024, signals a strategic push to bolster domestic exploration and secure vital minerals for India's energy transition. This initiative holds the potential to strengthen Hindalco's long-term supply chain security and operational resilience.

Global trade policies, including potential tariffs and trade wars, significantly influence Hindalco's import and export operations for both aluminium and copper. For example, Bank of America projected a volatile metals market in 2025, largely due to evolving trade policies and supply chain disruptions, which could pressure aluminium and copper prices downwards.

Conversely, Goldman Sachs revised its 2025 price outlook upward for these metals, anticipating increased demand from China due to stimulus measures. This illustrates the intricate relationship between global trade dynamics and metal market performance, directly affecting companies like Hindalco.

Geopolitical tensions and resource nationalism are significant concerns for Hindalco Industries. These factors can disrupt the global supply chain for crucial raw materials like bauxite and copper concentrates, directly impacting production and costs. For instance, protectionist policies in various nations can limit India's access to critical minerals, a challenge the National Critical Minerals Mission is designed to mitigate through increased domestic exploration and strategic overseas acquisitions.

Government Support and Incentives

Government initiatives aimed at boosting domestic manufacturing and infrastructure development directly benefit Hindalco by stimulating demand for its core products. The Indian government's continued emphasis on urbanization and large-scale housing projects, as detailed in the Economic Survey 2024-25, is a significant driver for increased consumption of metals like aluminium and copper. This focus translates into a robust market for Hindalco's offerings.

Policies championing the 'Make in India' initiative and sustained infrastructure expansion create a predictable and stable demand environment for Hindalco's varied product range. For instance, the Union Budget 2024-25 allocated substantial funds towards capital expenditure, particularly in infrastructure, which directly supports sectors reliant on metals. This strategic government support underpins Hindalco's growth trajectory.

- Government Support: Initiatives like 'Make in India' and Production Linked Incentives (PLI) schemes for sectors such as automotive and specialty steel are crucial.

- Infrastructure Focus: The 2024-25 Union Budget’s capital expenditure outlay of INR 11.11 lakh crore is expected to drive demand for construction materials and metals.

- Urbanization Drive: Government housing schemes and smart city projects contribute to a consistent uptake of aluminium and copper in building and infrastructure.

Regulatory Framework for CSR

The Indian government's increasing focus on Corporate Social Responsibility (CSR) and sustainable development significantly shapes Hindalco's community engagement strategies. This regulatory environment encourages companies like Hindalco to actively contribute to societal well-being, influencing their approach to social initiatives and community development programs.

Hindalco's CSR policy is designed to foster socio-economic development, directly aligning with government expectations for corporate contributions to societal progress. The company actively implements programs in key areas, demonstrating its commitment to meeting these governmental mandates and contributing to a more equitable society.

In line with Section 135 of the Companies Act, 2013, Hindalco dedicates a specific budget to CSR activities. For the fiscal year 2023-24, the company reported spending ₹152.48 crore on CSR initiatives, primarily focusing on education, healthcare, and sustainable livelihood programs, often developed in consultation with local communities to ensure relevance and impact.

- CSR Spending: Hindalco spent ₹152.48 crore on CSR activities in FY 2023-24.

- Focus Areas: Key CSR initiatives include education, healthcare, and sustainable livelihoods.

- Community Consultation: Programs are developed in collaboration with local communities to ensure effectiveness.

- Regulatory Alignment: CSR activities are structured to comply with India's Companies Act, 2013.

Government policies are a significant driver for Hindalco, with initiatives like 'Make in India' and production-linked incentives directly boosting demand for its products. The Union Budget 2024-25's substantial capital expenditure allocation, particularly for infrastructure, is a key factor supporting the metals sector.

The National Critical Minerals Mission, launched in 2024, aims to enhance domestic exploration and secure vital minerals, potentially strengthening Hindalco's supply chain. Furthermore, government-backed urbanization and housing projects, as highlighted in the Economic Survey 2024-25, ensure consistent demand for aluminium and copper.

Hindalco's CSR spending in FY 2023-24 reached ₹152.48 crore, focusing on education, healthcare, and sustainable livelihoods, aligning with regulatory requirements and societal expectations. This commitment to community development is integral to its operational framework.

| Government Initiative | Impact on Hindalco | Key Data/Year |

| Make in India | Stimulates demand for metals | Ongoing |

| Union Budget 2024-25 Capex | Drives demand for construction materials | INR 11.11 lakh crore allocated |

| National Critical Minerals Mission | Enhances supply chain security | Launched 2024 |

| CSR Spending | Community development and regulatory compliance | ₹152.48 crore in FY 2023-24 |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Hindalco Industries, covering political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides a comprehensive overview of how these forces create both challenges and opportunities for Hindalco's strategic planning and market positioning.

A concise PESTLE analysis for Hindalco Industries offers a strategic advantage by highlighting key external factors, simplifying complex market dynamics for informed decision-making and proactive risk mitigation.

Economic factors

Fluctuations in global aluminium and copper prices significantly influence Hindalco Industries' revenue and profitability. These price swings are a critical economic factor for the company.

For 2025, market outlooks vary: Bank of America anticipates a price decline for both metals, citing volatility. Conversely, Goldman Sachs projects higher prices, driven by potential stimulus measures in China, a key consumer of metals.

Adding to the complexity, JP Morgan forecasts a moderation in copper and aluminium prices during the latter half of 2025. This highlights the dynamic and often unpredictable nature of the global metals market, directly impacting Hindalco's financial performance.

India's economy is experiencing strong growth, directly benefiting Hindalco. Sectors like construction, automotive, and infrastructure are expanding rapidly, creating substantial demand for the company's aluminum and copper products. This robust economic expansion is a key driver for Hindalco's domestic operations.

The Indian steel sector, a close indicator for the broader metals industry, is projected to see an impressive growth rate of 8-9% in 2025. This surge is largely fueled by government initiatives and private investments in steel-intensive construction and infrastructure projects, creating a favorable environment for metals producers like Hindalco.

This sustained and strong domestic demand acts as a significant tailwind for Hindalco Industries. It provides a solid foundation for sales volumes and revenue growth, allowing the company to capitalize on the nation's development trajectory.

Raw material and energy costs are major determinants of Hindalco's profitability. Fluctuations in the prices of bauxite, alumina, and coal directly impact production expenses. For instance, the price of aluminum, a key output, is closely tied to the cost of its primary inputs.

Hindalco's strategic move to secure captive coal mines, like the Bandha coal block acquisition, is a direct response to mitigate the volatility of energy costs. This vertical integration aims to ensure a more stable and predictable supply of a critical input, thereby enhancing cost efficiency and reducing reliance on external energy markets.

Global energy price trends, particularly for coal and electricity, are critical economic factors influencing Hindalco's operational expenditures. In 2023, global coal prices saw significant fluctuations, impacting industries reliant on this commodity. Domestic supply chain stability also plays a crucial role, as disruptions can lead to increased logistics costs and potential production delays.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly impact Hindalco Industries, especially given its global footprint through its subsidiary Novelis. For instance, a strengthening Indian Rupee against the US Dollar in early 2024 could have reduced the value of export earnings denominated in dollars, while potentially lowering the cost of imported raw materials.

These currency movements directly affect Hindalco's consolidated financial statements. A volatile INR can create uncertainty in revenue and profitability when foreign earnings are translated back into the domestic currency.

- Impact on Exports: A weaker INR generally enhances export competitiveness by making Indian goods cheaper for foreign buyers. Conversely, a stronger INR can make exports more expensive.

- Import Costs: For a company like Hindalco, which imports raw materials and capital goods, currency movements directly influence the cost of these inputs. A weaker INR increases import costs.

- Translation of Foreign Earnings: Novelis's earnings in USD or EUR are translated into INR for consolidation. Fluctuations in exchange rates can lead to significant gains or losses on this translation, impacting reported profits.

- Debt Servicing: If Hindalco has foreign currency-denominated debt, a depreciating INR would increase the rupee cost of servicing that debt.

Access to Capital and Financing Costs

Hindalco's capacity to secure funding for growth initiatives and its borrowing expenses are directly tied to current interest rates and the broader financial market climate. For instance, the Reserve Bank of India's monetary policy, which saw a shift towards a more accommodative stance in late 2024 and early 2025, could influence borrowing costs for major industrial entities like Hindalco.

A robust financial system, characterized by better asset quality and strong credit expansion, as highlighted in the Hindalco Integrated Annual Report 2024-25, is crucial for facilitating investment. This environment directly impacts Hindalco's access to capital and the associated financing costs, enabling strategic expansion and operational improvements.

- Interest Rate Environment: Prevailing interest rates set by central banks directly affect the cost of debt for companies like Hindalco.

- Monetary Policy Stance: Shifts in policy, such as moving from neutral to accommodative, can lower borrowing costs, making expansion more feasible.

- Financial Market Conditions: The overall health and stability of financial markets influence the availability and pricing of capital.

- Asset Quality and Loan Growth: Improvements in these areas within the banking sector, as reported for 2024-25, signal a more supportive lending environment for large corporations.

The Indian economy's projected 7.5% growth in FY25, as per government estimates, fuels robust demand for Hindalco's products, particularly in construction and automotive sectors. Global commodity price forecasts for 2025 remain mixed, with some analysts anticipating a dip in aluminium prices due to oversupply concerns, while others foresee support from Chinese stimulus. Hindalco's strategic focus on captive coal resources aims to stabilize energy costs, a critical input where global prices saw considerable volatility in 2023. The company's financial health, supported by a strong domestic banking sector in 2024-25, facilitates access to capital for expansion, though interest rate movements remain a key consideration.

| Economic Factor | 2024-2025 Outlook/Data | Impact on Hindalco |

|---|---|---|

| Indian GDP Growth | Projected 7.5% (FY25) | Drives domestic demand for aluminium and copper. |

| Global Aluminium Prices | Mixed forecasts; potential decline due to oversupply vs. stimulus support. | Affects revenue and profitability of primary aluminium business. |

| Global Copper Prices | Mixed forecasts; potential moderation. | Impacts profitability of copper operations. |

| Energy Costs (Coal/Electricity) | Volatile global prices; captive mining strategy to mitigate. | Directly influences production costs and margins. |

| Interest Rates | Potential for accommodative stance by RBI; market conditions crucial. | Affects borrowing costs and capital expenditure feasibility. |

Full Version Awaits

Hindalco Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Hindalco Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations, offering valuable strategic insights.

Sociological factors

Hindalco's extensive mining and manufacturing activities necessitate robust community engagement to secure its social license to operate. Positive relationships with local populations are paramount for uninterrupted operations and sustained growth.

The company's Corporate Social Responsibility (CSR) framework actively involves local communities through needs assessments and targeted initiatives in education, health, and sustainable livelihoods. This proactive approach aims to foster mutual benefit and build trust.

In fiscal year 2024, Hindalco demonstrated its commitment by investing ₹154 crore in community development programs, positively impacting the lives of over 2.5 million individuals across its operational areas.

Hindalco Industries views workforce health and safety as a paramount social responsibility, directly influencing its operational efficiency and public image. The company's commitment to achieving zero harm aligns with the Aditya Birla Group's overarching Environmental, Social, and Governance (ESG) goals.

Prioritizing employee well-being fosters a more stable and productive workforce, crucial for sustained business performance. For instance, Hindalco's safety initiatives often involve rigorous training programs and the implementation of advanced safety equipment, contributing to a reduction in workplace incidents.

India's population is projected to reach 1.44 billion by mid-2024, with a significant portion moving to urban centers. This rapid urbanization fuels demand for construction materials, including aluminium and copper, essential for housing, infrastructure projects like metros and highways, and consumer durables. For instance, India's urban population is expected to grow to over 600 million by 2030, directly impacting the need for metals in building and development.

The increasing preference for steel-intensive construction in India's housing and infrastructure sectors is a critical factor driving demand for metals. As urban development accelerates, so does the consumption of aluminium and copper in everything from building frames and electrical wiring to transportation and consumer electronics, creating a consistent market for Hindalco's core products.

Consumer Preferences and Lifestyle Changes

Consumer preferences are increasingly shifting towards products that are lightweight, sustainable, and easily recyclable. This trend directly impacts Hindalco's demand for its downstream offerings, such as rolled aluminum products and foils, as consumers and businesses alike seek environmentally responsible material solutions.

Hindalco is actively responding to these evolving demands by concentrating on sustainable packaging initiatives and pioneering the development of specialized aluminum alloys. These new materials are specifically engineered for critical sectors like electric vehicles (EVs) and energy storage systems, reflecting a strategic alignment with both consumer desires and broader industry mandates for greener technologies.

- Growing Demand for EVs: The global electric vehicle market is projected to reach over $800 billion by 2027, with aluminum playing a key role in reducing vehicle weight and improving battery range.

- Sustainable Packaging Market: The sustainable packaging market is expected to grow significantly, with aluminum foil and rolled products being favored for their recyclability and barrier properties.

- Hindalco's Focus: Hindalco's investment in R&D for EV-grade aluminum and sustainable packaging solutions positions it to capitalize on these lifestyle and industry shifts.

Corporate Social Responsibility (CSR) Initiatives

Hindalco Industries demonstrates a robust commitment to Corporate Social Responsibility (CSR), extending beyond mere regulatory adherence to actively foster positive social impact and bolster its brand reputation. The company's CSR policy strategically targets key areas such as education, healthcare, sustainable livelihood enhancement, and crucial infrastructure development within marginalized communities, backed by a specific budgetary allocation. For instance, in FY23, Hindalco invested ₹100 crore in CSR activities, focusing on these core pillars.

Hindalco's engagement in environmental stewardship, including initiatives like e-waste recycling and the promotion of renewable energy projects, significantly contributes to its social standing and stakeholder perception. These efforts align with broader societal expectations for businesses to operate responsibly and sustainably, reinforcing Hindalco's image as a conscientious corporate citizen.

- Education: Supporting over 50,000 students annually through various educational programs and infrastructure development.

- Healthcare: Providing access to quality healthcare services for more than 200,000 individuals in remote areas through mobile medical units and health camps.

- Sustainable Livelihoods: Empowering over 10,000 women and youth through skill development and income-generating projects.

- Environmental Initiatives: Investing in renewable energy, achieving a 30% reduction in carbon emissions intensity in its aluminum operations by FY25.

Societal expectations for corporate responsibility are increasingly influencing business operations, with a strong emphasis on community welfare and environmental stewardship. Hindalco's commitment to these areas is evident in its substantial CSR spending and proactive engagement with local populations, fostering goodwill and operational stability.

The growing demand for sustainable products and the rise of the electric vehicle market are significant societal trends shaping consumer preferences and industry innovation. Hindalco's strategic investments in lightweight, recyclable materials and EV-grade aluminum directly address these evolving societal needs.

Hindalco's workforce health and safety initiatives are paramount, reflecting a societal responsibility that impacts operational efficiency and corporate reputation. The company's focus on zero harm aligns with broader ESG expectations for businesses.

India's rapid urbanization and the increasing preference for modern infrastructure are driving demand for metals like aluminum and copper. This demographic shift directly translates into market opportunities for Hindalco's core products.

| Societal Factor | Impact on Hindalco | Supporting Data/Initiatives (FY24/FY25 Projections) |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances brand reputation, secures social license to operate, fosters community relations. | ₹154 crore invested in community development in FY24, impacting over 2.5 million individuals. Focus on education, health, and livelihoods. |

| Workforce Health & Safety | Improves operational efficiency, reduces incidents, boosts employee morale. | Commitment to zero harm, rigorous training programs, advanced safety equipment implementation. |

| Urbanization & Infrastructure Growth | Drives demand for aluminum and copper in construction, transportation, and consumer durables. | India's urban population projected to exceed 600 million by 2030, increasing demand for building materials. |

| Consumer Preferences (Sustainability & EVs) | Creates demand for lightweight, recyclable materials and specialized alloys for electric vehicles. | Investment in R&D for EV-grade aluminum and sustainable packaging solutions. Global EV market projected to exceed $800 billion by 2027. |

Technological factors

Hindalco is actively adopting advanced manufacturing technologies, including AI and machine learning, to boost efficiency and cut costs. This strategic move aims to refine its production processes, leading to higher quality outputs. For instance, the successful integration of the AVEVA PI System with AI/ML at its alumina refinery has already shown significant gains in energy efficiency and cost reduction.

Hindalco is significantly investing in recycling technologies to foster a circular economy, a move critical for reducing its environmental impact. The company aims to increase its recycling capacity fourfold by fiscal year 2030, reinforcing aluminium's position as a sustainable material by targeting 75% recycled content in its products.

Key initiatives include Birla Copper's establishment of India's inaugural e-waste recycling facility and ongoing investments in cutting-edge recycling technologies, demonstrating a tangible commitment to resource efficiency and waste reduction.

Advancements in material science are crucial for Hindalco's growth. Research into novel alloys and specialized materials offers the potential to unlock new markets and applications for its aluminum and copper products. This innovation directly supports the company's strategy to move into higher-value segments.

Hindalco is actively developing specialized aluminum and copper materials tailored for critical sectors such as battery technology, aerospace, and defense. This strategic focus on high-performance materials addresses the growing demand from emerging industries like electric mobility and energy storage solutions. For instance, the company's investment in advanced alloys is designed to meet the stringent requirements of these rapidly expanding markets.

Digital Transformation and Industry 4.0

Hindalco is actively embracing digital transformation, integrating technologies like blockchain and generative AI. This strategic move aims to significantly boost supply chain visibility, foster better collaboration across its operations, and enhance overall operational efficiency. These advancements are crucial for navigating the complexities of modern manufacturing.

The company's commitment to digital innovation was recognized with a Manufacturing Leadership Award at the Dataquest Digital Leadership Conclave 2025. This award specifically highlighted Hindalco's pioneering work in digital transformation within contract manufacturing. By leveraging the Proteus platform, Hindalco has achieved remarkable improvements in real-time visibility, automated compliance processes, and the optimization of delivery timelines, showcasing tangible results from its digital initiatives.

Key technological advancements and their impact on Hindalco include:

- Enhanced Supply Chain Management: Digital tools provide real-time tracking and data analytics, leading to more predictable and efficient logistics.

- Operational Efficiency Gains: Automation and AI integration streamline production processes, reducing waste and improving output quality.

- Improved Collaboration: Digital platforms facilitate seamless communication and data sharing among partners and internal teams.

- Data-Driven Decision Making: Advanced analytics derived from digital transformation efforts enable more informed strategic choices.

Energy Efficiency Technologies

Hindalco Industries is focusing on energy efficiency technologies to lower operational expenses and its environmental footprint. Implementing these advancements in their smelting and refining operations is crucial for cost reduction.

The company is actively investing in greener smelter expansions, with a clear target to source 30% of its energy from renewable sources by 2030. A significant step in this direction is the development of a 100MW hybrid power project located in Odisha.

These strategic technological investments directly support Hindalco's dual objectives of achieving greater cost efficiency and meeting its broader sustainability commitments.

- Focus on energy efficiency in smelting and refining.

- Target of 30% renewable energy sourcing by 2030.

- Development of a 100MW hybrid power project in Odisha.

- Contribution to cost reduction and sustainability goals.

Hindalco is integrating advanced technologies like AI and machine learning to enhance production efficiency and reduce costs, as seen with the successful application of AI/ML at its alumina refinery for improved energy efficiency. The company is also heavily investing in recycling technologies, aiming to quadruple its recycling capacity by FY2030, with a goal of incorporating 75% recycled content into its products. Furthermore, Hindalco is developing specialized materials for sectors like battery technology and aerospace, demonstrating a commitment to innovation and high-value market penetration.

| Technology Focus | Key Initiatives/Targets | Impact/Goal |

|---|---|---|

| AI & Machine Learning | Integration in alumina refinery operations | Improved energy efficiency, cost reduction |

| Recycling Technologies | Quadruple capacity by FY2030; 75% recycled content target | Environmental impact reduction, circular economy |

| Material Science | Development of specialized alloys for battery, aerospace | New markets, higher-value segments |

| Digital Transformation | Blockchain, generative AI for supply chain visibility | Enhanced operational efficiency, collaboration |

| Energy Efficiency | Greener smelter expansions, 30% renewable energy by 2030 | Lower operational expenses, sustainability |

Legal factors

Changes in mining and mineral concession laws significantly impact Hindalco's access to critical raw materials such as bauxite and coal. For instance, the Mines and Minerals (Development and Regulation) Act, 1957, has seen several amendments, with the 2023 amendments notably granting the central government enhanced powers to auction critical minerals. This shift in regulatory framework directly influences the cost and availability of mineral rights, affecting Hindalco's operational planning and supply chain stability.

Hindalco navigates a complex web of environmental regulations governing emissions, waste disposal, and water consumption. These laws are critical for maintaining operational licenses and public trust.

The company's commitment to sustainability is evident in its ambitious net-zero carbon emissions target for 2050. In FY24, Hindalco successfully recycled 85% of its operational waste, a significant step towards its goal of achieving zero-waste to landfill by 2030.

Hindalco Industries must strictly adhere to India's labor laws, encompassing minimum wages, workplace safety standards, and regulations governing industrial disputes. Failure to comply can lead to significant penalties and operational disruptions, impacting production schedules and employee morale. For instance, in 2023, India's labor codes, such as the Code on Wages, 2019, aim to simplify and consolidate existing labor legislation, requiring companies like Hindalco to adapt their internal policies to ensure ongoing compliance and avoid legal challenges.

Competition Law and Anti-Trust Regulations

Hindalco Industries operates in highly competitive global markets for aluminium and copper. Adherence to competition laws and anti-trust regulations is crucial to prevent monopolistic practices and ensure a level playing field. Failure to comply can result in significant penalties, impacting profitability and market access.

These regulations aim to foster fair competition, protect consumer interests, and prevent undue market concentration. Hindalco must navigate these legal frameworks to avoid anti-competitive behavior, which could lead to investigations and substantial fines. For instance, in 2023, the European Commission imposed fines totaling €1.1 billion on several companies for participating in cartels, highlighting the severity of such violations.

- Regulatory Scrutiny: Hindalco faces ongoing scrutiny from competition authorities in India and abroad to ensure its business practices do not stifle competition.

- Merger & Acquisition Compliance: Any proposed mergers or acquisitions by Hindalco must undergo rigorous review by competition regulators to assess their impact on market competition.

- Pricing Practices: The company must ensure its pricing strategies are compliant with anti-trust laws, avoiding any form of price-fixing or predatory pricing.

- Market Dominance: Hindalco must manage its market position responsibly, ensuring it does not leverage any dominance to the detriment of smaller players or consumers.

Corporate Governance and Reporting Standards

Hindalco Industries, as a publicly traded entity, is legally bound to uphold stringent corporate governance principles and adhere to established financial reporting standards. This legal framework is crucial for maintaining investor confidence and ensuring market integrity.

Compliance with these mandates is demonstrated through its annual reports and quarterly financial disclosures, which provide a transparent view of the company's performance. For instance, in its FY24 results, Hindalco reported a consolidated revenue of INR 2.15 lakh crore, underscoring the scale of operations that require robust governance.

Furthermore, adherence to regulations set forth by the Securities and Exchange Board of India (SEBI) is paramount. These regulations cover various aspects, including timely disclosures, insider trading prevention, and board composition, all designed to foster accountability towards shareholders and regulatory authorities.

- Mandated Compliance: Hindalco must comply with Indian Companies Act, 2013 and SEBI regulations.

- Transparency in Reporting: Annual reports and quarterly results are legally required disclosures.

- SEBI Regulations: Adherence to SEBI's listing obligations and disclosure requirements is critical.

- Accountability to Stakeholders: Legal frameworks ensure accountability to shareholders and regulatory bodies.

Legal factors significantly shape Hindalco's operational landscape, from raw material acquisition to market conduct. Amendments to mining laws, such as those impacting critical mineral auctions in 2023, directly influence resource costs and supply chain stability. Environmental regulations are also paramount, with the company targeting net-zero emissions by 2050 and having recycled 85% of operational waste in FY24.

Adherence to India's labor laws, including the Code on Wages, 2019, is essential for avoiding penalties and disruptions, impacting everything from minimum wages to workplace safety. Furthermore, competition laws and anti-trust regulations are critical for maintaining fair market practices and avoiding hefty fines, as seen with European Commission actions in 2023.

Hindalco's status as a public entity necessitates strict compliance with corporate governance and financial reporting standards, as mandated by the Companies Act, 2013, and SEBI regulations. This commitment to transparency is reflected in its FY24 consolidated revenue of INR 2.15 lakh crore, ensuring investor confidence and market integrity.

| Legal Area | Key Legislation/Regulation | Impact on Hindalco | Recent Developments/Data |

|---|---|---|---|

| Mining & Minerals | Mines and Minerals (Development and Regulation) Act, 1957 (amended 2023) | Affects access, cost, and availability of raw materials like bauxite and coal. | 2023 amendments enhanced government powers for critical mineral auctions. |

| Environmental Compliance | Various environmental protection acts | Governs emissions, waste disposal, water usage; crucial for operational licenses. | Targeting net-zero emissions by 2050; recycled 85% of operational waste in FY24. |

| Labor Laws | Code on Wages, 2019; other labor codes | Dictates minimum wages, workplace safety, industrial dispute resolution. | Consolidation of labor legislation requires policy adaptation. |

| Competition Law | Competition Act, 2002 (India) | Prevents monopolistic practices, price-fixing, and ensures fair market competition. | Fines imposed on cartels in 2023 highlight enforcement severity. |

| Corporate Governance | Companies Act, 2013; SEBI Regulations | Ensures transparency, accountability to shareholders, and market integrity. | FY24 consolidated revenue: INR 2.15 lakh crore; adherence to SEBI listing obligations. |

Environmental factors

Hindalco Industries is navigating growing expectations to curb its carbon emissions and align with international climate goals. This includes significant investments in cleaner production technologies.

The company has publicly committed to achieving net-zero carbon emissions by 2050, a crucial target in the face of escalating climate concerns. This ambition is supported by ongoing initiatives to lower CO2 output across its operations.

The finite nature of essential mineral resources like bauxite, crucial for aluminium production, presents a significant environmental challenge. Ensuring long-term availability demands a shift towards sustainable mining practices and robust recycling initiatives.

Hindalco is actively addressing resource depletion concerns by targeting a fourfold increase in its recycling capacity by the fiscal year 2030. The company champions aluminium as a highly recyclable material, aiming to incorporate a substantial percentage of recycled content into its products, thereby reducing reliance on virgin resources.

Water scarcity presents a significant environmental challenge for industries like Hindalco, particularly given its extensive use in mining and manufacturing. Effective water management is therefore crucial for sustainable operations.

Hindalco is proactively addressing this by aiming for water positivity by 2050. As of FY25, the company has achieved a notable milestone, recycling 25% of its total water consumption, demonstrating a strong commitment to reducing its water footprint.

Waste Management and Pollution Control

Hindalco Industries faces significant environmental responsibilities related to industrial waste, particularly bauxite residue and fly ash, alongside stringent air and water pollution control measures. The company's commitment is evident in achieving zero-waste to landfill certifications for select facilities, demonstrating progress in sustainable operations.

Actively pursuing circular economy principles, Hindalco is engaged in recycling bauxite residue and fly ash for use in the cement industry. This initiative not only diverts waste from landfills but also contributes to reducing the overall environmental footprint associated with its core aluminum and power operations.

- Zero-Waste to Landfill Certifications: Hindalco has achieved this for several of its plants, highlighting a dedication to minimizing landfill reliance.

- Bauxite Residue Recycling: The company is actively incorporating recycled bauxite residue into cement production, a key circular economy initiative.

- Fly Ash Utilization: Similarly, fly ash generated from power plants is being recycled and used in cement manufacturing, further reducing waste.

- Pollution Control Investments: Continuous investment in advanced pollution control technologies is crucial for meeting evolving environmental regulations and minimizing air and water contamination.

Biodiversity and Land Use Impact

Hindalco's mining and industrial activities inherently interact with local biodiversity and land use patterns. The company recognizes the need for responsible land management and actively implements restoration and remediation strategies within its operational plans. This approach is crucial for mitigating environmental footprints and fostering sustainable natural resource management.

For instance, Hindalco's commitment to land restoration is evident in its ongoing efforts at various mine sites. In fiscal year 2023-24, the company reported extensive afforestation drives and land reclamation projects across its operational areas. These initiatives aim to bring mined-out lands back to a productive state, supporting local ecosystems and biodiversity.

- Restoration Efforts: Hindalco integrates progressive mine closure and rehabilitation plans, focusing on returning mined land to a state suitable for ecological recovery or other beneficial uses.

- Biodiversity Monitoring: The company conducts biodiversity assessments and implements measures to protect local flora and fauna in and around its operational sites, aligning with evolving environmental regulations.

- Sustainable Land Management: Hindalco's strategy emphasizes minimizing land disturbance and optimizing land use efficiency, particularly in sensitive ecological zones.

- Resource Management: The company aims for sustainable management of natural resources, including water and soil, to reduce the long-term impact of its operations on the surrounding environment.

Hindalco is actively working towards environmental sustainability, with a commitment to net-zero carbon emissions by 2050 and increasing its recycling capacity fourfold by FY2030. The company is also striving for water positivity by 2050, having already achieved 25% water recycling in FY25.

Significant efforts are being made to manage industrial waste, with several plants achieving zero-waste to landfill certifications and actively recycling bauxite residue and fly ash for cement production. Hindalco also prioritizes biodiversity and land restoration, undertaking afforestation and reclamation projects at its mine sites.

| Environmental Focus | Target/Status | Key Initiatives |

| Carbon Emissions | Net-zero by 2050 | Cleaner production technologies, CO2 output reduction |

| Resource Management | 4x increase in recycling capacity by FY2030 | Utilizing recycled content, bauxite residue recycling |

| Water Management | Water positivity by 2050; 25% water recycling (FY25) | Water recycling initiatives, water-efficient processes |

| Waste Management | Zero-waste to landfill (select facilities) | Bauxite residue and fly ash recycling for cement |

| Land Use & Biodiversity | Progressive mine closure and rehabilitation | Afforestation, land reclamation, biodiversity assessments |

PESTLE Analysis Data Sources

Our Hindalco Industries PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international financial institutions, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.