Hindalco Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hindalco Industries Bundle

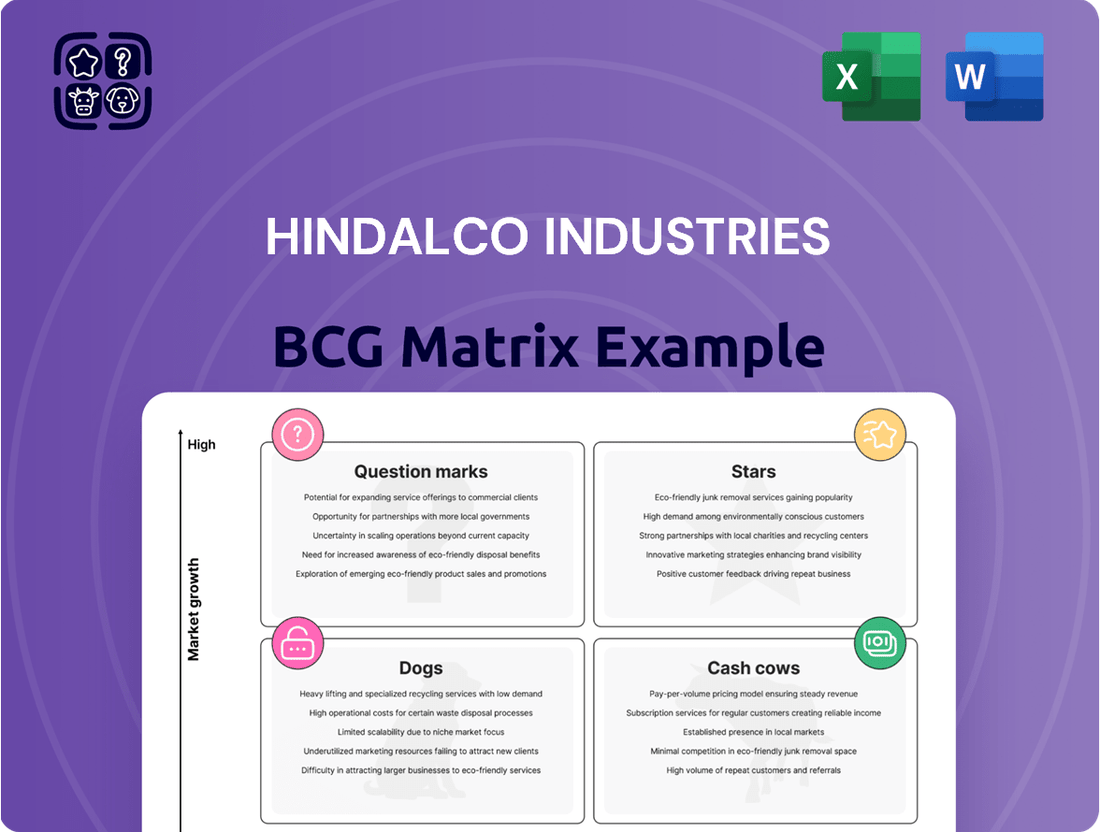

Explore the strategic positioning of Hindalco Industries' diverse product portfolio within the BCG Matrix. Understand which segments are driving growth and which require careful management. This glimpse offers a strategic overview, but for a comprehensive understanding and actionable insights, the full report is essential.

Uncover the hidden potential and challenges within Hindalco's business units through a detailed BCG Matrix analysis. Identify your Stars, Cash Cows, Dogs, and Question Marks to optimize resource allocation. Purchase the complete matrix for a data-driven roadmap to maximize profitability and market share.

Gain a competitive edge by understanding Hindalco Industries' market performance at a glance. This preview highlights key areas, but the full BCG Matrix provides the in-depth analysis and strategic recommendations needed to navigate the complexities of the metals and mining sector. Invest in clarity and drive informed decisions.

Stars

Hindalco is significantly boosting its downstream aluminium capacity, aiming for 600 kilotons per annum (ktpa) from its current 400 ktpa. This expansion includes the anticipated ramp-up of its Flat Rolled Products (FRP-2) facility by June 2025.

India's aluminium market is on a strong growth trajectory, fueled by increasing demand from key sectors like construction, automotive, and electrical industries. This creates a fertile ground for Hindalco's focus on value-added downstream products.

By concentrating on these value-added segments, Hindalco is strategically positioning itself to capitalize on the expanding market opportunities and meet the growing demand for specialized aluminium solutions.

Hindalco is significantly expanding its Specialty Alumina business, aiming for a 1 million tonne capacity. This move focuses on high-margin, value-added products for advanced applications.

The acquisition of US-based AluChem Companies Inc. for $125 million in 2024 is a key part of this strategy. It bolsters Hindalco's presence in the high-growth specialty materials sector, crucial for electric vehicles, semiconductors, and advanced ceramics.

Hindalco is strategically positioned to capitalize on the surging demand for aluminium in India's burgeoning electric vehicle (EV) and renewable energy sectors. The automotive industry, especially EV manufacturers, is increasingly adopting aluminium for its lightweight properties, which directly translate to improved energy efficiency and extended range, crucial factors for EV adoption. In 2023, the Indian automotive sector was a significant consumer of aluminium, and this trend is expected to accelerate with the government's push for EV manufacturing and adoption.

The renewable energy domain, particularly solar power projects and wind farms, represents another substantial growth avenue for aluminium. These sectors require vast quantities of aluminium for components like solar panel frames and wind turbine nacelles. Hindalco's proactive approach, including its focus on developing specialized aluminium products like battery enclosures for EVs, underscores its commitment to these high-growth markets and its potential to significantly increase its market share in these critical industries.

Novelis's Beverage Packaging Segment

Novelis, a key subsidiary of Hindalco Industries, has demonstrated exceptional strength in its beverage packaging segment. This division has consistently achieved record shipment volumes, underscoring its significant market presence. Despite facing some broader industry challenges, the demand for Novelis's beverage packaging remains exceptionally strong, pointing to a dominant position in a rapidly expanding consumer market.

The beverage packaging segment is a vital contributor to Novelis's overall financial health and growth trajectory. In fiscal year 2024, Novelis reported a notable increase in beverage can shipments, driven by sustained consumer demand for aluminum packaging solutions. This segment's performance is a testament to its strategic importance within Hindalco's diversified portfolio.

- Record Beverage Packaging Shipments: Novelis consistently breaks its own shipment records for beverage packaging.

- Robust Demand Despite Headwinds: The segment shows resilience, maintaining strong demand even when other parts of Novelis face challenges.

- Key Growth Driver: Beverage packaging is identified as a primary engine for Novelis's continued success and profitability.

- Market Share in Growing Sector: The segment holds a significant share in the expanding market for aluminum beverage containers.

Copper Downstream Products (e.g., Copper Rods, Inner Grooved Tubes)

Copper downstream products, such as copper rods and inner grooved tubes, represent a vital segment for Hindalco Industries within the BCG matrix. These products are crucial for sectors experiencing robust expansion.

India's copper market is on a significant upward trajectory, with projections indicating demand could double by 2030. This surge is fueled by increased investments in infrastructure development, the growing automotive sector, and the accelerating adoption of clean energy technologies.

Hindalco is strategically positioned to capitalize on this demand. The company is actively expanding its copper smelter capacity and has commissioned a new 25 KT copper inner grooved tube plant. This expansion directly addresses the rising need for specialized, value-added copper components essential for these burgeoning industries.

- Market Growth: India's copper demand expected to double by 2030.

- Key Drivers: Infrastructure, transportation, and clean energy transitions.

- Hindalco's Expansion: Increasing smelter capacity and new inner grooved tube plant (25 KT).

- Value Addition: Catering to demand for specialized copper products in high-growth sectors.

Hindalco's downstream aluminium expansion, targeting 600 ktpa with its FRP-2 facility by June 2025, positions it strongly in a growing Indian market. The Specialty Alumina business, aiming for 1 million tonne capacity, bolstered by the 2024 acquisition of AluChem for $125 million, focuses on high-margin products for EVs and advanced sectors. The company is also a key player in the burgeoning EV and renewable energy markets, supplying essential aluminium components.

Novelis, a Hindalco subsidiary, shows exceptional strength in its beverage packaging segment, consistently achieving record shipments and demonstrating robust demand despite broader industry headwinds. This segment is a primary growth driver for Novelis and holds a significant share in the expanding aluminum beverage container market.

Hindalco's copper downstream products, like rods and inner grooved tubes, are vital for India's expanding market, which is projected to double demand by 2030. Driven by infrastructure, automotive, and clean energy, Hindalco's increased smelter capacity and new 25 KT copper inner grooved tube plant directly address this rising need for specialized copper components.

| Business Segment | Key Strengths/Focus | Growth Drivers | Recent Developments/Data | BCG Category |

| Downstream Aluminium | Capacity expansion (600 ktpa target), value-added products | Construction, automotive, electrical industries | FRP-2 facility ramp-up by June 2025 | Star |

| Specialty Alumina | High-margin products, advanced applications | EVs, semiconductors, advanced ceramics | 1 million tonne capacity target, $125M AluChem acquisition (2024) | Star |

| Novelis - Beverage Packaging | Market leadership, consistent record shipments | Strong consumer demand for aluminum packaging | Notable increase in beverage can shipments (FY24) | Star |

| Copper Downstream | Specialized components (rods, tubes) | Infrastructure, automotive, clean energy | 25 KT copper inner grooved tube plant commissioned; India copper demand to double by 2030 | Star |

What is included in the product

Hindalco's BCG Matrix analysis highlights strategic investments in its growing aluminum business (Stars) and stable copper operations (Cash Cows).

A clear BCG Matrix visually identifies Hindalco's Stars and Cash Cows, alleviating the pain of resource allocation uncertainty.

This matrix offers a focused view, relieving the pain of complex strategic decision-making by categorizing Hindalco's businesses.

Cash Cows

Hindalco's primary aluminium production in India, a segment where it holds around 40% market share, functions as a classic Cash Cow. This business benefits from integrated operations, spanning from mining to smelting, which enhances cost efficiency and secures its supply chain. The segment consistently generates robust cash flow, even amidst market volatility, due to its commanding market presence and operational strengths.

Novelis, Hindalco's global aluminium rolling and recycling arm, stands as a formidable Cash Cow. In fiscal year 2024, it was the primary revenue driver, accounting for a substantial 61% of Hindalco's total revenues and contributing 56% to its EBITDA. This dominance highlights its consistent and significant cash-generating capacity.

Despite facing some headwinds from fluctuating scrap spreads and shifts in its product mix, which have impacted near-term margins, Novelis's core strengths remain robust. Its undisputed global leadership in aluminium rolling and its position as the world's largest aluminium recycler provide a stable and deep well of cash generation for the parent company.

The sheer scale of Novelis's operations in a mature yet vital global market allows it to consistently produce significant cash flows. This financial muscle is crucial, enabling Hindalco to strategically deploy these funds to support growth initiatives in other business segments or for broader corporate development.

Hindalco Industries commands a substantial position in India's copper sector, particularly with its significant capacities for copper cathodes and continuous cast rods (CCR). This segment is a bedrock for the company, consistently demonstrating robust financial results.

The copper business has been a reliable engine for Hindalco, marked by record shipment volumes and impressive EBITDA growth. For instance, in the fiscal year 2024, Hindalco reported a notable increase in its copper segment's performance, contributing significantly to the company's overall profitability.

While the global copper market is experiencing healthy expansion, Hindalco's well-entrenched market share and unwavering operational efficiency in these foundational copper products solidify their status as prime cash cows for the organization.

Captive Bauxite and Coal Mining Operations

Hindalco's captive bauxite and coal mining operations are solid Cash Cows. These operations provide essential raw materials, ensuring a stable supply for its aluminum production. For instance, in FY24, Hindalco's captive mines contributed significantly to its bauxite and coal needs, bolstering cost competitiveness.

The strategic advantage of these captive sources, including the Bandha coal block acquisition, directly translates into cost efficiencies and operational stability. This control over key inputs is vital for maintaining profitability in Hindalco's energy-intensive aluminum business, a segment that consistently generates strong cash flows.

- Raw Material Security: Hindalco secures a substantial portion of its bauxite and coal requirements through captive mining.

- Cost Efficiency: Captive operations reduce reliance on external suppliers, leading to lower input costs and improved margins.

- Operational Stability: Guaranteed access to raw materials ensures uninterrupted production and consistent output for its aluminum segment.

- Profitability Driver: The cost advantages from captive mining directly contribute to the strong profitability of Hindalco's aluminum business.

Captive Power Generation Facilities

Hindalco Industries' captive power generation facilities are strong cash cows. The company operates four captive power plants and three co-generation plants, securing a stable and economical power source for its energy-demanding aluminium and copper smelting. This internal power generation capability is crucial for maintaining low operating expenses and shielding the company from fluctuating external energy costs, thereby ensuring steady cash generation from its primary metal businesses.

These facilities are vital for Hindalco’s operational efficiency and cost management. By controlling its power supply, Hindalco mitigates risks associated with grid availability and pricing, which is particularly important for its large-scale smelting operations. This strategic advantage translates directly into more predictable and robust cash flows.

- Operational Scale: Four captive power plants and three co-generation plants.

- Cost Advantage: Ensures a cost-effective power supply, reducing operational expenses.

- Risk Mitigation: Insulates the company from external energy price volatility.

- Cash Flow Stability: Contributes to consistent cash flow from core metal production.

Hindalco's Indian primary aluminium business, a segment with approximately 40% market share, is a classic Cash Cow. Its integrated operations, from mining to smelting, enhance cost efficiency and supply chain security, consistently generating robust cash flow despite market fluctuations.

Novelis, Hindalco's global arm, is a significant Cash Cow, driving 61% of total revenue and 56% of EBITDA in FY24. Its global leadership in aluminium rolling and recycling ensures a stable, deep well of cash generation.

Hindalco's copper business, particularly copper cathodes and CCR, is a reliable Cash Cow. Record shipments and impressive EBITDA growth in FY24 highlight its consistent contribution to overall profitability, supported by a healthy global copper market expansion.

Captive bauxite and coal mining operations are strong Cash Cows, securing essential raw materials and bolstering cost competitiveness. The Bandha coal block acquisition further enhances these cost efficiencies, ensuring stable cash generation for the aluminum segment.

Hindalco's captive power generation facilities, including four power plants and three co-generation plants, are vital Cash Cows. They ensure a stable, economical power supply for its energy-intensive operations, reducing costs and stabilizing cash flows.

| Segment | FY24 Revenue Contribution | FY24 EBITDA Contribution | Key Strength |

|---|---|---|---|

| Indian Aluminium | Significant | Strong | Market leadership, integrated operations |

| Novelis | 61% | 56% | Global leadership, recycling scale |

| Copper | Substantial | Robust | Record volumes, operational efficiency |

| Captive Mining | Cost advantage | Profitability driver | Raw material security, cost control |

| Captive Power | Cost advantage | Cash flow stability | Economical supply, risk mitigation |

Full Transparency, Always

Hindalco Industries BCG Matrix

The Hindalco Industries BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professionally designed, analysis-ready document for immediate strategic application.

Dogs

Legacy, low-value commodity aluminium products within Hindalco Industries' portfolio represent areas where the company might have a less dominant market position or where the products themselves are highly undifferentiated. These are typically found in mature, low-growth markets where competition is fierce and pricing power is limited. For instance, basic aluminium ingots sold into segments with abundant global supply could fall into this category, potentially yielding lower profit margins compared to Hindalco's more specialized offerings.

In 2023, Hindalco's overall revenue reached approximately INR 2.15 lakh crore (roughly $26 billion USD), with its aluminium business contributing significantly. However, within this vast business, a small fraction of sales from these legacy commodity products might be characterized by thin profit margins, possibly in the low single digits, and minimal contribution to the company's overall volume growth. These products often require substantial capital investment for production but offer limited returns, potentially tying up resources that could be better allocated to higher-margin, value-added segments.

Older production lines or manufacturing processes within Hindalco's diverse portfolio that have become technologically inefficient or highly cost-ineffective compared to modern alternatives could be categorized as Dogs. These operations would likely consume disproportionate resources for maintenance and energy, yielding low returns. For instance, while Hindalco has invested heavily in advanced aluminum smelting technologies, some legacy facilities might still operate with older, less efficient methods, impacting overall profitability.

Niche products within stagnant industrial applications, where Hindalco Industries struggles to gain traction or innovate, represent the 'Dogs' in its BCG Matrix. These offerings are characterized by low growth potential and minimal contribution to the company's overall financial performance.

For instance, if Hindalco has legacy products serving industries experiencing structural decline, such as certain types of specialized industrial coatings or components for outdated machinery, these could be categorized as Dogs. The company’s FY24 performance, with a focus on high-demand sectors, likely sidelines investments in these underperforming areas, making divestment or a strategic pivot a more logical approach to resource allocation.

Underperforming Small, Non-Strategic Acquisitions

Underperforming small, non-strategic acquisitions for Hindalco Industries, if any exist, would fall into the Dogs category of the BCG Matrix. These are typically businesses with low market share in low-growth markets. For instance, if Hindalco acquired a small, niche aluminum extrusion unit in a mature, slow-growing European market that hasn't shown significant profitability or integration benefits, it could be considered a Dog. Such an acquisition might have been made for tangential reasons but has failed to contribute meaningfully to the overall business strategy or financial performance.

These units often require significant management oversight and capital investment relative to their returns. In 2023, for example, companies across various sectors saw a trend of divesting non-core assets to streamline operations. If Hindalco has similar underperforming, small acquisitions that are not central to its primary aluminum and copper businesses, they would represent potential Dogs. These could be legacy businesses acquired years ago that no longer align with current strategic priorities or market dynamics.

The key characteristic is their inability to generate substantial cash flow or growth, acting more as a drain on resources.

- Low Market Share in Low-Growth Markets

- Failure to Integrate or Deliver Synergies

- Drain on Management Attention and Resources

- Potential for Divestment to Free Up Capital

Products with Declining Demand Due to Substitutes

Products facing severe and irreversible decline due to superior or cheaper substitutes, where Hindalco has not adapted, would be classified as Dogs. These products typically have a low market share and operate in a shrinking market, making profitability difficult to sustain.

For Hindalco, this could potentially include legacy aluminum products that have been largely superseded by advanced composites or specialized alloys in certain high-performance applications. For instance, while aluminum remains crucial, the automotive sector's increasing reliance on lighter, stronger materials like carbon fiber or advanced high-strength steels in specific components could impact demand for certain standard aluminum grades. Hindalco's financial reports for the fiscal year ending March 31, 2024, show a focus on value-added products and downstream integration, suggesting a proactive strategy to mitigate such risks.

- Legacy Aluminum Products: Standard aluminum extrusions or sheets facing competition from advanced materials in niche automotive or aerospace applications.

- Commodity Alumina: While alumina is a key input, if its production costs remain high relative to market prices and without significant downstream integration into higher-margin products, it could exhibit Dog-like characteristics in a volatile commodity market.

- Older Generation Aluminum Alloys: Alloys designed for specific, now-obsolete industrial applications that have been replaced by more efficient or cost-effective alternatives.

Dogs in Hindalco's portfolio are products with low market share in slow-growing or declining industries. These often represent legacy offerings or underperforming acquisitions that consume resources without generating significant returns. For instance, certain older aluminum alloys or commodity alumina production with high costs relative to market prices could be classified as Dogs if they fail to adapt to evolving market demands or competitive pressures.

Hindalco's strategy, as seen in its FY24 performance, emphasizes value-added products and downstream integration, suggesting a deliberate move away from or divestment of such Dog-like segments. The company's overall revenue of approximately INR 2.15 lakh crore in 2023 indicates a large, diversified business, but identifying and managing these low-performing units is crucial for optimizing resource allocation and enhancing overall profitability.

These segments often struggle with profitability due to intense competition, lack of differentiation, or obsolescence, potentially yielding profit margins in the low single digits. Their continued operation might tie up capital that could be better invested in higher-growth, higher-margin areas within Hindalco's more strategic business units.

The key is their inability to generate substantial cash flow or growth, acting more as a drain on resources and management attention.

| Category | Description | Hindalco Example (Potential) | Market Growth | Market Share | Profitability |

|---|---|---|---|---|---|

| Dogs | Low market share in low-growth markets. | Legacy aluminum alloys for obsolete applications. | Low / Declining | Low | Low / Negative |

| Dogs | Products facing obsolescence due to superior substitutes. | Standard aluminum sheets in niche automotive segments replaced by composites. | Low / Declining | Low | Low |

| Dogs | Underperforming, non-strategic acquisitions. | Small, niche aluminum extrusion unit in a mature, slow-growing market. | Low | Low | Low / Negative |

Question Marks

Hindalco is strategically positioning itself for future growth by investing in new high-precision engineered products aimed at burgeoning sectors such as semiconductors and advanced electronics. This move signals a commitment to diversifying its portfolio beyond traditional aluminum and copper offerings. These emerging markets represent significant long-term potential, driven by global technological advancements and increasing demand for specialized components.

While these sectors offer substantial growth prospects, Hindalco's current market share within these highly specialized and competitive niches is expected to be minimal as it initiates its entry. Establishing a foothold will necessitate considerable investment in research and development, advanced manufacturing capabilities, and building robust supply chains to meet stringent quality and performance standards demanded by these industries.

The aerospace industry's demand for advanced aluminum alloys, offering superior strength-to-weight ratios and high-temperature performance, presents a significant growth opportunity for Hindalco. While Hindalco has the capabilities, its current share in the global aerospace supply chain is estimated to be nascent, likely below 5% as of 2024.

Breaking into this sector requires substantial investment in research and development, alongside rigorous certification processes to meet stringent aerospace standards. For instance, achieving AS9100 certification, a key requirement, can take several years and significant financial commitment.

Hindalco's greenfield copper recycling plant in Gujarat, a significant INR 2,700 crore investment for 50,000 tonnes per annum (ktpa) capacity, represents a strategic move into a burgeoning, sustainable sector.

Currently, this venture is in its nascent phase, akin to a 'Question Mark' in the BCG matrix, as it requires substantial effort to build market presence and achieve optimal operational performance.

The success of this plant hinges on its ability to capture market share and demonstrate strong operational efficiencies, which will determine its future trajectory towards becoming a 'Star' performer within Hindalco's portfolio.

Aditya Alumina Refinery Expansion (New Capacity)

The Aditya Alumina Refinery expansion, with a planned capacity of 850 kilotons per annum (ktpa), signifies a substantial investment of INR 7,500-8,000 crores by Hindalco Industries. This project, slated for a December 2027 commencement, positions itself as a potential high-growth area within Hindalco's portfolio.

Currently, this new capacity is in its nascent stages, meaning its market share contribution is minimal. As such, it fits the profile of a 'Question Mark' in the BCG matrix.

- Projected Capacity: 850 ktpa

- Estimated Investment: INR 7,500-8,000 crores

- Expected Start Date: December 2027

- BCG Matrix Classification: Question Mark

International Expansion Initiatives (e.g., AluChem integration)

Hindalco's acquisition of US-based AluChem Companies, Inc. in 2023 marked a significant step into the high-tech alumina sector, particularly in North America. This move diversifies its product portfolio and geographical reach, aiming to capitalize on growing demand for specialized alumina products used in advanced applications.

The integration of AluChem presents a classic 'Question Mark' scenario within Hindalco's business portfolio. While the strategic intent is clear – to establish a stronger foothold in new, lucrative markets and niche segments – the success hinges on effective operational integration, scaling production, and achieving projected market share gains. The company will need to carefully manage the investment and execution required to transform this acquisition into a star performer.

- Strategic Rationale: AluChem acquisition expands Hindalco's global presence in high-value alumina markets, particularly in North America, a region with robust demand for specialized alumina products.

- Market Position: The move positions Hindalco to compete in growing niche segments, leveraging AluChem's existing technological capabilities and customer base.

- Investment Focus: As a 'Question Mark,' AluChem requires significant strategic investment and diligent management to overcome integration challenges and achieve its full market potential.

- Future Outlook: Successful scaling and market penetration will be critical for transitioning AluChem from a 'Question Mark' to a potential 'Star' in Hindalco's future BCG matrix analysis.

Hindalco's greenfield copper recycling plant in Gujarat, a significant INR 2,700 crore investment for 50,000 tonnes per annum (ktpa) capacity, represents a strategic move into a burgeoning, sustainable sector. Currently, this venture is in its nascent phase, akin to a 'Question Mark' in the BCG matrix, as it requires substantial effort to build market presence and achieve optimal operational performance. The success of this plant hinges on its ability to capture market share and demonstrate strong operational efficiencies, which will determine its future trajectory towards becoming a 'Star' performer within Hindalco's portfolio.

The Aditya Alumina Refinery expansion, with a planned capacity of 850 kilotons per annum (ktpa), signifies a substantial investment of INR 7,500-8,000 crores by Hindalco Industries. This project, slated for a December 2027 commencement, positions itself as a potential high-growth area within Hindalco's portfolio. Currently, this new capacity is in its nascent stages, meaning its market share contribution is minimal. As such, it fits the profile of a 'Question Mark' in the BCG matrix.

Hindalco's acquisition of US-based AluChem Companies, Inc. in 2023 marked a significant step into the high-tech alumina sector, particularly in North America. The integration of AluChem presents a classic 'Question Mark' scenario within Hindalco's business portfolio. While the strategic intent is clear – to establish a stronger foothold in new, lucrative markets and niche segments – the success hinges on effective operational integration, scaling production, and achieving projected market share gains.

| Business Unit | Investment | Capacity/Scale | Market Position | BCG Classification |

| Gujarat Copper Recycling Plant | INR 2,700 crore | 50,000 tonnes per annum (ktpa) | Nascent | Question Mark |

| Aditya Alumina Refinery Expansion | INR 7,500-8,000 crores | 850 ktpa | Nascent | Question Mark |

| AluChem Companies, Inc. (Acquisition) | Undisclosed (2023) | High-tech Alumina (North America) | Nascent (post-acquisition) | Question Mark |

BCG Matrix Data Sources

Our Hindalco Industries BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.