Hindalco Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hindalco Industries Bundle

Hindalco Industries operates in a dynamic market shaped by intense competition and fluctuating raw material prices, impacting its profitability. Understanding the bargaining power of its suppliers and buyers is crucial for navigating this landscape effectively.

The threat of new entrants and the availability of substitutes pose significant challenges to Hindalco's market share and pricing strategies. A comprehensive analysis reveals the true intensity of these forces.

Ready to move beyond the basics? Get a full strategic breakdown of Hindalco Industries’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Hindalco's strategic backward integration into bauxite mining and captive coal mines directly curtails the bargaining power of its raw material suppliers. By securing its own sources for bauxite and coal, Hindalco lessens its reliance on external vendors, thereby strengthening its negotiating position. This integration offers a significant cost advantage and ensures supply chain stability, directly impacting the leverage suppliers can exert.

Despite significant vertical integration, Indian aluminum producers like Hindalco Industries continue to depend on imported bauxite and alumina. This reliance exposes them to global price volatility and potential supply chain interruptions, granting international suppliers a degree of bargaining power. For instance, in 2023, global alumina prices saw fluctuations due to geopolitical events and production issues in key exporting nations, directly impacting Indian manufacturers' input costs.

India's significant reliance on imported copper concentrates, with forecasts suggesting this trend will persist through 2047, directly translates to substantial bargaining power for international suppliers. This dependence means that companies like Hindalco Industries, a major player in the Indian metals sector, have limited options when negotiating prices and terms for essential raw materials.

In 2023, India imported approximately 1.5 million tonnes of copper concentrates, underscoring the critical nature of these imports for domestic smelting operations. This high import volume grants overseas suppliers considerable leverage, as disruptions or unfavorable pricing from these sources can significantly impact Hindalco's production costs and profitability.

Energy and Fuel Suppliers

The bargaining power of energy and fuel suppliers for Hindalco Industries presents a mixed picture. While Hindalco possesses captive coal mines, which significantly reduces its reliance on external coal, its substantial electricity needs for smelting operations remain a key area of dependence. Fluctuations in global energy prices, particularly for natural gas and imported coal if needed, can still influence input costs and provide leverage to suppliers. For instance, in 2023, global energy markets experienced volatility, impacting the cost of power generation for many industrial players.

Hindalco's strategic shift towards renewable energy sources is a proactive measure to counter this supplier power. The company has been investing in solar power projects and aims to increase its renewable energy mix. This diversification helps to insulate it from the price volatility of traditional fuels and reduces dependence on a concentrated group of energy providers. By securing more of its energy needs through self-generation or long-term power purchase agreements with renewable developers, Hindalco can diminish the bargaining leverage of conventional energy suppliers.

- Hindalco's captive coal mines offer a degree of insulation from external coal supplier power.

- Significant electricity consumption for smelting operations creates dependence on power suppliers.

- Investments in renewable energy, such as solar projects, aim to reduce reliance on traditional fuel suppliers.

- Volatility in global energy prices in 2023 highlighted the potential leverage of energy suppliers.

Technology and Specialized Equipment Suppliers

For its advanced manufacturing processes and expansion initiatives, Hindalco Industries depends on suppliers of specialized technology and equipment. The distinctiveness of certain technologies and the specialized knowledge needed can give these suppliers moderate bargaining power, particularly when it comes to cutting-edge solutions.

These specialized suppliers often hold patents or proprietary knowledge, limiting the number of alternative providers. This exclusivity allows them to command higher prices and favorable contract terms, impacting Hindalco's input costs.

- Specialized Technology Dependence: Hindalco's reliance on specific advanced machinery for its sophisticated aluminum and copper production processes means fewer suppliers can meet these stringent technical requirements.

- Moderate Supplier Power: While not absolute, the specialized nature of the equipment grants these technology providers a degree of leverage, influencing pricing and delivery schedules for critical components.

- Innovation Drive: Suppliers of state-of-the-art manufacturing equipment are key to Hindalco's continuous improvement and capacity expansion, making their offerings valuable and somewhat indispensable.

Hindalco's captive coal mines significantly reduce its reliance on external coal suppliers, thereby lowering their bargaining power. However, the company's substantial electricity consumption for smelting operations creates a dependence on power suppliers, whose leverage is influenced by energy market volatility. For example, global energy prices saw notable fluctuations in 2023, impacting electricity costs for industrial users.

What is included in the product

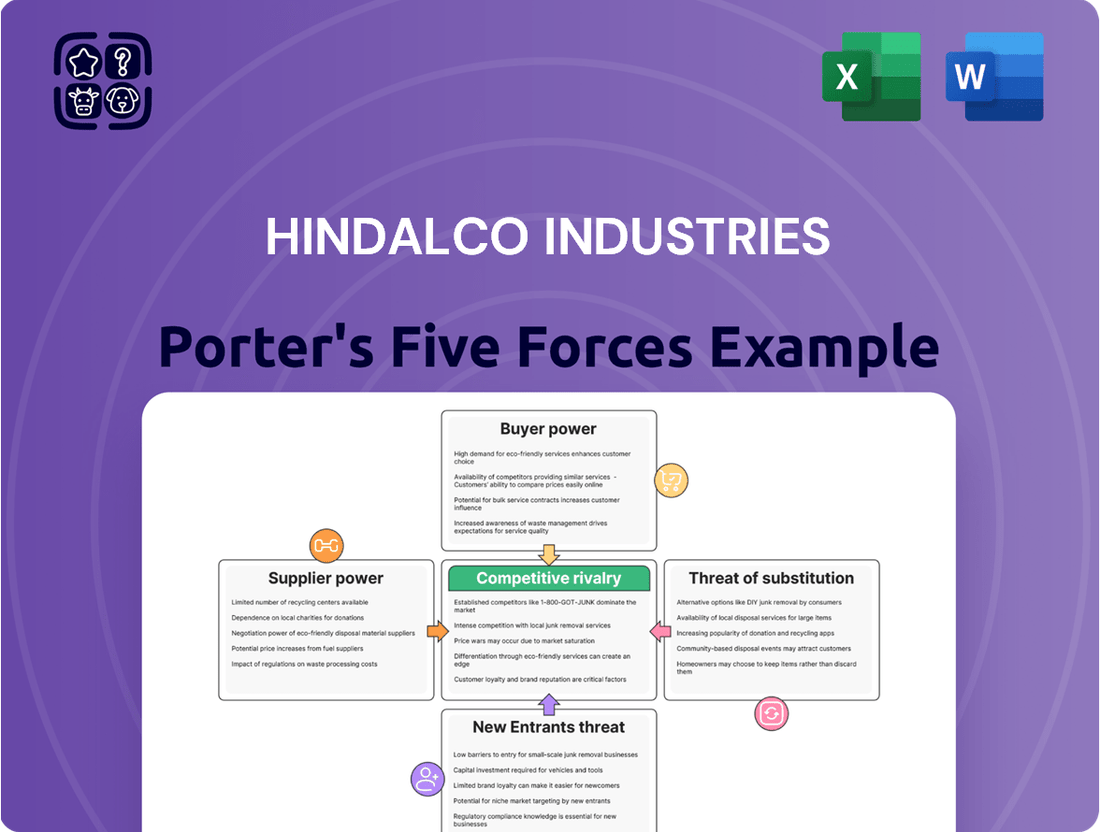

This analysis of Hindalco Industries examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the presence of substitutes within the aluminum and copper sectors.

Effortlessly assess Hindalco's competitive landscape by visualizing the impact of each force with a dynamic, interactive dashboard.

Gain immediate insights into Hindalco's strategic positioning by pinpointing key areas of pressure and opportunity across all five forces.

Customers Bargaining Power

Hindalco's diverse end-use industries, spanning electricals, transportation, construction, consumer durables, and packaging, significantly dilute customer bargaining power. This broad market exposure means that no single industry segment dominates demand, preventing any one group of customers from exerting substantial pressure on pricing or terms. For instance, in the fiscal year ending March 31, 2024, Hindalco's consolidated revenue was INR 225,585 crore, with sales distributed across these varied sectors, demonstrating the reduced reliance on any single customer base.

Hindalco's emphasis on value-added products, such as specialized rolled products, extrusions, and foils, directly addresses niche customer requirements. This focus fosters deeper customer loyalty and can reduce the impact of price-based competition, as clients value the tailored solutions.

For instance, in the automotive sector, where Hindalco supplies high-strength aluminum alloys for lightweighting, customers demanding specific performance characteristics have limited alternatives, thereby diminishing their bargaining power. This is evident as the automotive segment, a key consumer of value-added products, saw significant growth for Hindalco in recent fiscal periods, reflecting sustained demand for these specialized offerings.

Hindalco, primarily through its Novelis subsidiary, faces considerable bargaining power from large customers in the automotive and beverage can industries. These major buyers, often requiring substantial volumes of flat-rolled aluminum products, can leverage their purchasing scale to negotiate more favorable pricing and supply agreements. For instance, in 2023, Novelis reported that its automotive segment accounted for a significant portion of its sales, highlighting the importance of these relationships and the potential for customer influence.

Commodity Market Price Influence

As a major producer of primary aluminium and copper, Hindalco Industries is significantly exposed to global commodity market price fluctuations. Customers, particularly large industrial buyers, closely track these benchmarks. For instance, the LME Aluminium price, a key indicator, averaged around $2,200 per tonne in the first half of 2024, a figure that directly informs customer negotiation leverage.

When global supply outstrips demand, leading to falling commodity prices, customers are empowered to push for lower prices from Hindalco. This dynamic can compress profit margins for the company. The average aluminium price in 2023 was approximately $2,240 per tonne, a slight decrease from 2022, illustrating this sensitivity.

- Global Commodity Price Sensitivity: Hindalco's aluminium and copper prices are directly tied to international benchmarks like the London Metal Exchange (LME).

- Customer Negotiation Leverage: In periods of oversupply or declining global prices, customers gain significant power to demand price reductions.

- Margin Impact: Falling commodity prices can put downward pressure on Hindalco's sales realization and profit margins.

- 2024 Price Trends: The LME Aluminium price hovered around $2,200/tonne in H1 2024, reflecting ongoing market dynamics that influence customer bargaining power.

Sustainability and ESG Preferences

Customers increasingly factor sustainability into their buying choices, impacting demand for materials. Hindalco's commitment to ESG principles, including its significant investments in renewable energy and circular economy initiatives, positions it favorably. For instance, in FY23, Hindalco reported a 27% reduction in its specific carbon emissions intensity compared to FY20, showcasing tangible progress in its green agenda. This focus on environmentally responsible production can mitigate the bargaining power of customers who prioritize such attributes, as they have fewer readily available alternatives with comparable credentials.

Hindalco's robust sustainability reporting and certifications further strengthen its appeal to environmentally conscious buyers. The company's emphasis on recycling, with a substantial portion of its aluminum production utilizing recycled content, directly addresses a key customer concern. This proactive approach to sustainability not only meets evolving market demands but also creates a differentiation point, potentially softening price sensitivity and reducing the leverage customers hold when negotiating terms.

- Growing Consumer Demand for Green Products: A significant portion of consumers now actively seek out products with a lower environmental impact, influencing their purchasing decisions.

- Hindalco's ESG Advantage: The company's strong sustainability track record, including a 27% reduction in specific carbon emissions intensity by FY23 (vs. FY20), provides a competitive edge.

- Recycling as a Lever: Hindalco's substantial use of recycled materials in its production process caters to customer preferences for circular economy solutions.

- Mitigating Customer Power: By offering demonstrably sustainable and recycled products, Hindalco can reduce the bargaining power of customers who prioritize environmental responsibility.

While Hindalco's broad customer base across diverse industries generally limits individual customer bargaining power, significant leverage exists with large-volume buyers, particularly in sectors like automotive and beverage cans, often through its Novelis subsidiary. These major clients can negotiate favorable terms due to their substantial purchasing scale, as evidenced by Novelis's automotive segment forming a considerable part of its sales in 2023.

Global commodity price volatility, directly influenced by benchmarks like the LME Aluminium price which averaged around $2,200 per tonne in the first half of 2024, empowers industrial customers. When global supply exceeds demand, customers can more effectively push for price reductions, impacting Hindalco's realization and margins, as seen with the average aluminium price of approximately $2,240 per tonne in 2023.

Hindalco's commitment to sustainability, including a 27% reduction in specific carbon emissions intensity by FY23 (vs. FY20) and substantial use of recycled materials, appeals to environmentally conscious customers. This focus on ESG principles and circular economy initiatives differentiates Hindalco, potentially reducing the bargaining power of customers prioritizing these attributes by offering fewer comparable alternatives.

| Customer Segment | Key Bargaining Factors | Hindalco's Mitigating Strategies | Impact on Bargaining Power |

|---|---|---|---|

| Large Industrial Buyers (Automotive, Beverage Cans) | High volume purchases, price sensitivity | Value-added products, long-term contracts, sustainability focus | Moderate to High |

| General Industrial Customers | Price sensitivity to commodity markets | Diversified product portfolio, consistent supply | Moderate |

| Environmentally Conscious Buyers | Demand for ESG compliance, recycled content | Strong ESG reporting, significant recycling initiatives | Low to Moderate |

What You See Is What You Get

Hindalco Industries Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Hindalco Industries, detailing the competitive landscape and strategic positioning within the aluminum and copper sectors. The analysis you see here is the exact, professionally formatted document you will receive immediately after purchase, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

Hindalco faces significant competition in India from established domestic giants like Vedanta Limited, National Aluminium Company (NALCO), and Hindustan Copper Limited. These players are deeply integrated, operating across the entire value chain from raw material extraction to the production of finished aluminium and copper products.

The rivalry among these major Indian companies is fierce, as they all vie for market share in both domestic and international markets. This competition intensifies due to their integrated operations, allowing them to control costs and offer competitive pricing across various product segments.

For instance, Vedanta Limited, a diversified natural resources company, has substantial operations in both aluminium and copper, directly challenging Hindalco's market position. Similarly, NALCO, a Navratna PSU, is a significant player in the aluminium sector, and Hindustan Copper Limited is a key entity in the copper industry, further contributing to the competitive landscape.

Hindalco, primarily through its subsidiary Novelis, competes globally in the flat-rolled aluminium products market. This means they're up against major international players, making the landscape quite crowded.

Global market conditions significantly influence this rivalry. For instance, a slowdown in demand from a major region or an oversupply of aluminium can lead to heightened competition and put downward pressure on prices, impacting profitability for all involved.

Hindalco faces intense rivalry from competitors who also boast integrated business models, mirroring its own operations from mining to finished products. This integration allows rivals to achieve significant cost efficiencies and offer competitive pricing, making the market a battleground for operational excellence and raw material access.

For instance, companies like Vedanta Resources and National Aluminium Company (NALCO) also operate with substantial upstream integration, securing their supply chains and controlling costs. This shared characteristic intensifies competition beyond mere product price, focusing on who can best manage their entire value chain and ensure raw material security, a critical factor in the volatile metals market.

Capacity Expansion and Investment

Competitive rivalry within the metals and mining sector, particularly for companies like Hindalco Industries, is intense due to significant capacity expansion efforts. Competitors are channeling substantial capital into upgrading technology and increasing production volumes to secure greater market share in both domestic and international arenas.

Hindalco is a prime example of this trend, having announced considerable investments to boost its aluminium and copper capacities. For instance, in fiscal year 2024, Hindalco's subsidiary, Novelis, continued its strategic capital expenditure, including projects aimed at expanding its recycling and automotive sheet production capabilities in North America and Asia. This proactive expansion by Hindalco signals a dynamic competitive landscape where staying ahead requires continuous investment in growth and efficiency.

- Capacity Expansion: Hindalco is actively investing in expanding its aluminium and copper production capacities to meet growing demand.

- Technological Advancements: Competitors are also focusing on technological upgrades to improve efficiency and product quality, intensifying rivalry.

- Market Share Goals: These investments are driven by the objective to capture a larger share of the expanding Indian and global metals markets.

- Hindalco's Investments: Hindalco's own significant capital expenditure plans underscore the aggressive competitive environment.

Focus on Value-Added Products and Sustainability

Competitive rivalry within the aluminum industry, including players like Hindalco, is increasingly centered on offering value-added products and demonstrating a commitment to sustainability. Companies are investing in advanced manufacturing to create specialized aluminum alloys and solutions tailored to specific customer needs, moving beyond basic commodity production.

This focus on differentiation allows firms to capture higher margins and build stronger customer loyalty. For instance, Hindalco has been actively developing high-strength aluminum alloys for the automotive sector, which requires lighter materials for improved fuel efficiency. In 2024, the global demand for specialized aluminum products continued to grow, driven by sectors like aerospace, electric vehicles, and renewable energy infrastructure.

- Product Differentiation: Companies are investing in research and development to create specialized aluminum alloys and downstream products.

- Sustainability Focus: Emphasis on eco-friendly production processes, recycling, and reducing carbon footprint is a key competitive factor.

- ESG Performance: Strong Environmental, Social, and Governance (ESG) ratings are becoming crucial for attracting investment and customer preference.

- Market Leadership: Firms aim for market leadership by offering innovative solutions and superior ESG credentials.

Hindalco faces intense rivalry from both domestic players like Vedanta and NALCO, and global giants, particularly in the flat-rolled products segment through its subsidiary Novelis. This competition is fueled by significant capacity expansions and a drive for technological advancement across the industry.

In 2024, the metals market saw substantial investment in new production capabilities, with Hindalco itself earmarking considerable capital for growth. For example, Hindalco's 2024 fiscal year included continued strategic capital expenditure for Novelis, focusing on enhancing recycling and automotive sheet production in key global markets.

This competitive environment is increasingly shaped by product differentiation and a strong emphasis on sustainability, with companies like Hindalco developing specialized alloys for sectors such as electric vehicles. Strong ESG performance is also becoming a critical differentiator, influencing customer preference and investment decisions.

| Key Competitors (India) | Key Competitors (Global - Novelis) | Competitive Focus Areas |

|---|---|---|

| Vedanta Limited | Alcoa Corporation | Capacity Expansion |

| National Aluminium Company (NALCO) | Kaiser Aluminum Corporation | Technological Advancements |

| Hindustan Copper Limited | Constellium SE | Product Differentiation |

| Arconic Corporation | Sustainability & ESG |

SSubstitutes Threaten

A significant threat to Hindalco Industries arises from the substitution of aluminum for copper, especially in electrical wiring. This is largely due to the substantial price difference between the two metals, making aluminum a more cost-effective option for many applications. For instance, as of early 2024, the price of copper has been trading significantly higher than aluminum, creating a strong incentive for manufacturers to switch.

This substitution trend is expected to accelerate as copper prices are projected to continue their upward trajectory. This potential rise in copper costs could further erode its competitiveness against aluminum, thereby impacting Hindalco's copper segment. The demand for copper in sectors like electric vehicles and renewable energy infrastructure, while positive for the metal, also contributes to price pressures that favor aluminum substitution.

While aluminum and copper are staples in construction and automotive sectors, the threat of substitutes is real. Steel, for instance, continues to be a dominant alternative, especially in structural applications where its strength-to-cost ratio is highly competitive. In 2024, global steel production was projected to reach over 1.9 billion metric tons, highlighting its significant presence.

Plastics and advanced composites are also increasingly encroaching on traditional metal applications. These materials offer advantages like lighter weight, corrosion resistance, and ease of manufacturing, which are particularly attractive in the automotive industry for fuel efficiency gains. For example, the average percentage of plastic in a vehicle has been steadily rising, with some estimates suggesting it now accounts for around 10% of a car's weight.

Innovations that improve the performance or reduce the cost of these substitutes directly challenge Hindalco's market position. If plastics or composites can achieve comparable strength or conductivity at a lower price point, or offer unique benefits like integrated functionalities, they could capture market share from aluminum and copper in specific segments.

The growing focus on a circular economy presents a significant threat from recycled materials and scrap. Recycled aluminum and copper can directly substitute primary production, potentially reducing demand for newly mined resources. For instance, India's substantial imports of aluminum scrap, valued in the billions of dollars annually, highlight the scale of this substitution threat. As the recycling industry expands, it could directly impact the market share and pricing power of primary metal producers like Hindalco.

Technological Advancements in Material Science

Technological advancements in material science present a potential long-term threat to Hindalco. Ongoing research could yield new materials that rival or even surpass aluminum and copper in performance for various applications, impacting demand for traditional metals.

For instance, breakthroughs in composite materials or advanced polymers might offer lighter, stronger, or more cost-effective alternatives in sectors like automotive and aerospace, where aluminum is a key component. In 2024, global investment in R&D for advanced materials is projected to exceed $100 billion, highlighting the pace of innovation.

- Emerging Composites: Development of high-strength, low-weight composite materials could displace aluminum in structural applications.

- Advanced Polymers: Innovations in polymer science may offer cost-effective and versatile substitutes for copper in electrical and plumbing sectors.

- Nanomaterials: Nanotechnology could lead to materials with novel properties, potentially disrupting existing metal markets.

- Sustainability Focus: The drive for sustainable solutions may accelerate the adoption of materials with lower environmental footprints than traditional metals.

Shift to Lighter Materials in Transportation

The transportation industry, especially with the increasing adoption of electric vehicles, is actively seeking lighter materials to boost energy efficiency. While this trend favors aluminum, the emergence of ultra-lightweight composites or other advanced materials presents a potential threat of substitution for Hindalco Industries.

For instance, by 2024, the automotive industry saw significant R&D investment in alternative lightweight materials. The cost-effectiveness and performance characteristics of these emerging substitutes will be crucial in determining their market penetration against aluminum.

- Increasing demand for energy efficiency in EVs drives material innovation.

- Advanced composites and other novel materials pose a direct substitution threat.

- Future material cost and performance will dictate the competitive landscape.

The threat of substitutes for Hindalco Industries is multifaceted, encompassing both established alternatives and emerging materials. While aluminum offers a compelling cost advantage over copper in many electrical applications, the broader market sees steel as a persistent substitute in construction due to its strength and established infrastructure. Furthermore, advancements in plastics and composites are increasingly offering lighter, corrosion-resistant alternatives, particularly in the automotive sector, challenging traditional metal usage.

The increasing focus on sustainability and circular economy principles also fuels the threat from recycled materials, which can directly compete with primary metal production. Technological innovation in material science, such as nanomaterials and advanced polymers, represents a potential long-term disruption, offering novel properties that could displace aluminum and copper in various applications.

| Substitute Material | Key Applications | Competitive Advantage | Hindalco's Exposure |

|---|---|---|---|

| Copper | Electrical wiring, plumbing | Higher conductivity, established infrastructure | Direct competition, price sensitivity |

| Steel | Construction, automotive frames | High tensile strength, lower cost for structural use | Substitution in construction and automotive |

| Plastics & Composites | Automotive parts, consumer goods | Lightweight, corrosion resistance, design flexibility | Displacement in automotive and consumer sectors |

| Recycled Metals | Various industrial applications | Lower environmental impact, potentially lower cost | Reduced demand for primary production |

Entrants Threaten

The threat of new entrants in Hindalco Industries' primary aluminium and copper manufacturing sectors is significantly mitigated by the colossal capital investment required. Establishing integrated operations, from mining bauxite and copper ore to refining and smelting, necessitates billions of dollars. For instance, setting up a greenfield aluminium smelter alone can cost upwards of $2 billion, a substantial hurdle for most aspiring competitors.

Established players like Hindalco Industries possess deeply integrated value chains, from mining bauxite to producing finished aluminum products. This integration, coupled with significant economies of scale achieved through massive production volumes, allows them to operate at a much lower cost per unit. For instance, Hindalco's extensive operational footprint and captive power plants in 2024 significantly reduce its energy costs, a major component in aluminum production.

New entrants would face immense capital expenditure requirements to replicate such an integrated setup and achieve comparable economies of scale. Building new mines, smelters, and rolling facilities, while simultaneously securing reliable and cost-effective raw material supplies, presents a formidable barrier. The sheer financial commitment and time needed to reach operational efficiency levels comparable to Hindalco would deter most potential new competitors.

The metals industry, including Hindalco Industries, faces significant regulatory hurdles. Obtaining environmental clearances for mining and manufacturing operations is a complex and time-consuming process, acting as a substantial barrier for potential new entrants. For instance, in 2024, the Indian government continued to emphasize stricter environmental compliance for industrial projects, requiring extensive impact assessments and public consultations.

Access to Raw Materials and Technology

Securing consistent access to high-quality bauxite and copper ore reserves, along with proprietary smelting and refining technologies, is a significant hurdle for new entrants. Hindalco, for instance, benefits from its integrated operations and established relationships with suppliers, which can be difficult for newcomers to replicate.

Existing players often possess long-term agreements or even captive mines for essential raw materials like bauxite. This creates a substantial barrier, as new companies struggle to establish a reliable and cost-effective supply chain, a challenge exacerbated by the capital-intensive nature of mining and processing.

- Hindalco's integrated model, from mining to finished products, provides a competitive edge in raw material sourcing.

- New entrants face significant upfront investment requirements for securing mining rights and developing processing facilities.

- Proprietary technologies in smelting and refining, often developed over years, represent another barrier to entry.

- The global demand for aluminum and copper, driven by sectors like automotive and construction, intensifies competition for limited high-grade ore reserves.

Brand Loyalty and Distribution Networks

Hindalco, like many established players in the metals and aluminum sector, benefits from decades of investment in brand building and distribution infrastructure. This translates into significant customer loyalty, making it difficult for newcomers to gain traction. For instance, in fiscal year 2024, Hindalco reported consolidated revenues of approximately INR 207,792 crore, underscoring its substantial market presence built over time.

New entrants would need to overcome the immense hurdle of replicating Hindalco's widespread and efficient distribution channels, which are crucial for reaching diverse industrial clients across India and globally. Establishing these networks requires substantial capital investment and time, creating a significant barrier to entry.

- Brand Recognition: Hindalco's long-standing reputation for quality and reliability fosters strong customer loyalty, a difficult asset for new entrants to replicate.

- Distribution Reach: Decades of investment have created an extensive network of warehouses, logistics, and sales channels, providing a competitive advantage.

- Customer Relationships: Established relationships with key industrial buyers, cultivated over many years, present a significant barrier to new competitors seeking market share.

The threat of new entrants for Hindalco Industries is generally low due to the substantial capital required to establish operations, particularly in integrated aluminum and copper production. Hindalco's extensive, vertically integrated value chain, from mining to finished products, along with significant economies of scale and established brand loyalty, creates formidable barriers for newcomers. Regulatory requirements and the need for proprietary technology further solidify Hindalco's position, making it challenging for new players to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Setting up integrated mining, smelting, and refining facilities demands billions of dollars. A new greenfield aluminum smelter can cost over $2 billion. | Extremely High Barrier |

| Economies of Scale & Integration | Hindalco's massive production volumes and captive power plants (e.g., reducing energy costs significantly in 2024) allow for lower per-unit costs. | High Barrier |

| Raw Material Access | Securing access to high-grade bauxite and copper ore, often through captive mines or long-term agreements, is difficult for new firms. | High Barrier |

| Technology & Expertise | Proprietary smelting and refining technologies developed over years are not easily replicated. | Moderate to High Barrier |

| Brand & Distribution | Hindalco's established brand reputation and extensive distribution network (supporting its INR 207,792 crore consolidated revenue in FY24) foster customer loyalty. | High Barrier |

| Regulatory Hurdles | Stringent environmental clearances and compliance, emphasized by government policies in 2024, add complexity and time to new project setups. | Moderate to High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hindalco Industries leverages data from annual reports, investor presentations, and financial statements to understand internal capabilities and strategic positioning. We also incorporate industry reports from reputable sources like CRU Group and Wood Mackenzie, alongside macroeconomic data, to assess external competitive pressures and market dynamics.