Hindalco Industries Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hindalco Industries Bundle

Hindalco Industries leverages a robust product portfolio, from primary aluminum to value-added downstream products, catering to diverse industries. Their pricing strategies are dynamic, reflecting market fluctuations and competitive pressures, while their extensive distribution network ensures widespread availability.

Discover the intricate details of Hindalco's marketing success by exploring their comprehensive Product, Price, Place, and Promotion strategies. This in-depth analysis is perfect for business professionals, students, and consultants seeking actionable insights and strategic advantages.

Save valuable time and gain a competitive edge. Our ready-made, editable Marketing Mix Analysis for Hindalco Industries provides structured thinking, real-world examples, and a clear roadmap for strategic planning and benchmarking.

Product

Hindalco's product strategy hinges on its comprehensive, integrated aluminium value chain. This means they control everything from digging up the raw materials, bauxite, to processing it into alumina, and finally smelting it into aluminium. This end-to-end control is a significant product strength, allowing them to manage quality and costs effectively throughout the entire production process.

This integration ensures a reliable supply of primary aluminium products. Think ingots, billets, and wire rods – all essential building blocks for numerous industries. For instance, in fiscal year 2024, Hindalco's Novelis segment, a major player in downstream aluminium, reported strong performance in its automotive segment, driven by increasing demand for lightweight materials in vehicles.

Hindalco's diverse downstream aluminium products extend far beyond basic metals, encompassing rolled products, extrusions, and foils. These offerings are crucial for industries like construction, automotive, packaging, and consumer durables.

The company is strategically investing in high-precision engineered products, targeting growth sectors such as electric vehicles (EVs) and aerospace. This focus highlights Hindalco's commitment to innovation and capturing value in advanced manufacturing segments.

Hindalco's strong copper business portfolio is anchored by its position as operator of one of Asia's largest custom copper smelters. This robust infrastructure supports a diverse product range, including high-purity copper cathodes and continuous cast rods (CCR), essential for various industrial applications.

The company is strategically enhancing its copper offerings, anticipating increased demand from burgeoning sectors. Notably, Hindalco is investing in expanding its capacity to cater to the electrification wave and the development of high-speed transportation networks, sectors projected for significant growth through 2025.

Focus on High-Value and Specialty s

Hindalco Industries is strategically focusing on high-value and specialty products, a key element of its marketing strategy. This pivot aims to capture higher margins and cater to niche, demanding markets.

The company is actively developing hard alloy products specifically for the defense sector, showcasing its commitment to advanced material solutions. This segment represents a significant growth opportunity, driven by increasing defense spending and technological advancements.

Furthermore, Hindalco is supplying high-performance aluminum and copper for critical Indian Space Research Organisation (ISRO) programs, such as the Chandrayaan and Mangalyaan missions. This underscores the reliability and superior quality of their materials for cutting-edge applications. For instance, in the fiscal year 2023-24, Hindalco's Novelis segment, which includes specialty products, contributed significantly to its overall performance.

Specialty alumina is another key area of focus, with applications in flame retardants, batteries, electronics, ceramics, and catalysts. These diverse applications highlight the versatility and advanced properties of Hindalco's alumina products. The company's investment in research and development for these specialty segments is crucial for maintaining its competitive edge.

- Defense Sector: Development of hard alloy products for specialized defense applications.

- Space Missions: Supply of high-performance aluminum and copper for ISRO's Chandrayaan and Mangalyaan programs.

- Specialty Alumina: Applications in flame retardants, batteries, electronics, ceramics, and catalysts.

- Revenue Contribution: Specialty products, particularly through the Novelis segment, are increasingly contributing to Hindalco's top and bottom lines, with Novelis reporting strong performance in FY24.

Sustainability-Driven Innovation

Hindalco champions sustainability through its product strategy, notably via Novelis, its aluminium recycling arm. In fiscal year 2024, Novelis achieved a significant milestone by processing around 2.3 million tonnes of recycled aluminium, underscoring its commitment to a circular economy and reducing the environmental footprint of its products.

This focus extends to emerging sectors like electric vehicles (EVs). Hindalco is actively developing battery foils and establishing fabrication plants specifically for EV components. These initiatives position the company to offer sustainable material solutions that cater to the growing demand for greener transportation alternatives.

The company’s innovation in sustainability is a key differentiator within its product portfolio:

- Leading Aluminium Recycling: Novelis's processing of approximately 2.3 million tonnes of recycled aluminium in FY24 demonstrates significant capacity and commitment to circularity.

- EV Component Development: Hindalco's work on battery foils and EV fabrication plants directly addresses the market need for sustainable automotive solutions.

- Reduced Environmental Impact: By prioritizing recycled content and developing materials for EVs, Hindalco aims to lower the carbon intensity of its products.

- Future Market Positioning: These sustainable innovations are designed to capture growth in environmentally conscious markets and align with global decarbonization efforts.

Hindalco's product strategy is built on a foundation of integrated value chains for both aluminium and copper, focusing on high-value, specialty, and sustainable offerings. This approach is evident in their advanced materials for defense and space, as well as their significant investments in EV components and recycling through Novelis. The company's commitment to innovation and catering to emerging sectors positions it for continued growth and market leadership.

| Product Category | Key Offerings | Target Sectors | FY24 Data/Highlights |

|---|---|---|---|

| Aluminium (Primary & Downstream) | Ingots, billets, wire rods, rolled products, extrusions, foils, battery foils | Automotive, construction, packaging, consumer durables, EVs, aerospace | Novelis automotive segment strong; ~2.3 million tonnes recycled aluminium processed by Novelis in FY24 |

| Copper | Copper cathodes, continuous cast rods (CCR) | Electrical, infrastructure, transportation, electronics | Capacity expansion to meet electrification demand; increased focus on high-purity products |

| Specialty Products | Hard alloy products, specialty alumina, high-performance alloys | Defense, space (ISRO), batteries, electronics, ceramics, catalysts | Supplied ISRO's Chandrayaan and Mangalyaan missions; R&D focus on advanced material solutions |

What is included in the product

This analysis provides a comprehensive overview of Hindalco Industries' marketing mix, examining their product portfolio, pricing strategies, distribution channels, and promotional activities to understand their market positioning and competitive advantage.

It offers a detailed breakdown of how Hindalco leverages its product innovation, competitive pricing, extensive market reach, and targeted promotions to effectively serve diverse customer segments in the metals and mining industry.

This analysis of Hindalco Industries' 4Ps acts as a pain point reliever by clearly outlining how their product, price, place, and promotion strategies address customer needs and market challenges.

It provides a structured framework to identify and resolve potential marketing friction points, ensuring a cohesive and effective go-to-market approach.

Place

Hindalco's 'place' strategy is built on a vast manufacturing and mining infrastructure. This includes critical bauxite mines and alumina refineries strategically located in Utkal, Renukoot, Muri, and Belagavi, complemented by numerous aluminium smelters throughout India. This integrated network is fundamental to their operational efficiency and supply chain reliability.

This expansive footprint, encompassing captive mines and advanced refining and smelting facilities, allows Hindalco to control its raw material sourcing and production processes. For instance, their Utkal Alumina Refinery in Odisha is a key facility, demonstrating their commitment to a vertically integrated model. This physical presence is a significant advantage in ensuring consistent product availability and managing costs effectively.

Novelis, Hindalco's subsidiary, dramatically extends its global footprint, especially in the flat-rolled aluminum sector. This international presence allows Hindalco to tap into diverse markets, from construction to the booming beverage packaging industry.

With Novelis's operations spanning the globe, Hindalco solidified its position as the world's largest flat-rolled aluminum producer and a leader in aluminum recycling. In fiscal year 2024, Novelis reported net sales of $17.1 billion, underscoring its substantial contribution to Hindalco's global revenue and market share.

Hindalco leverages a robust distribution network to reach its diverse customer base across India and globally. This involves direct engagement with major industrial consumers, ensuring tailored solutions and efficient delivery for large-volume requirements.

Complementing direct sales, Hindalco employs a network of authorized distributors and dealers. This strategy ensures accessibility for smaller businesses and a wider reach for specialized aluminum products, making them readily available in various markets.

Logistics and Supply Chain Optimization

Logistics and supply chain optimization are paramount for Hindalco Industries, ensuring their diverse range of aluminum and copper products reach customers efficiently. The company leverages a multi-modal transportation strategy. For domestic distribution, this includes robust utilization of Indian Railways for bulk cargo and extensive road networks for last-mile delivery, aiming to minimize transit times and costs.

Internationally, Hindalco relies on container shipments, meticulously managed to meet global delivery schedules. This focus on efficient movement of raw materials and finished goods directly impacts cost competitiveness and customer satisfaction.

Hindalco's commitment to optimizing its supply chain is evident in its continuous efforts to integrate technology and improve operational workflows.

- Transportation Modes: Primarily Indian Railways and road networks domestically, supplemented by container shipments for international trade.

- Cost Efficiency: Strategic selection of transport modes to ensure cost-effective delivery of products across various markets.

- Timely Delivery: Emphasis on optimizing transit and handling processes to meet customer deadlines and maintain supply chain reliability.

- Network Reach: Covering both domestic and international markets, requiring a sophisticated and adaptable logistics framework.

Proximity to Key Industrial Hubs and End-Use Markets

Hindalco strategically positions its manufacturing and distribution networks to capitalize on proximity to major industrial centers and rapidly expanding end-use markets. This placement is crucial for efficient logistics and timely delivery to key customers.

The company's focus on high-growth sectors is evident in its recent investments. For instance, the copper inner groove tube plant in Wagodia, Gujarat, is designed to meet the increasing demand from the air conditioning industry. Similarly, battery foil and fabrication plants in Aditya and Chakan are specifically geared towards serving the burgeoning electric vehicle (EV) market.

- Strategic Location: Hindalco's facilities are situated to minimize transportation costs and lead times for critical industrial inputs.

- Market Access: Investments in new plants directly support high-demand sectors like EVs and air conditioning, ensuring Hindalco is at the forefront of these growth areas.

- Capacity Expansion: The establishment of specialized plants, such as the battery foil facility, underscores Hindalco's commitment to meeting the specific needs of emerging industries.

Hindalco's 'place' strategy emphasizes a robust, integrated network of mining, manufacturing, and distribution facilities, both domestically and globally through Novelis. This strategic placement ensures proximity to raw materials and key markets, optimizing logistics and cost efficiency. For example, their Utkal Alumina Refinery in Odisha is a cornerstone of their vertical integration. Novelis, a key part of this strategy, reported net sales of $17.1 billion in fiscal year 2024, highlighting its significant global reach in flat-rolled aluminum.

| Facility Type | Key Locations | Strategic Importance |

|---|---|---|

| Bauxite Mines & Alumina Refineries | Utkal, Renukoot, Muri, Belagavi | Raw material sourcing, vertical integration |

| Aluminum Smelters | Various locations across India | Primary aluminum production |

| Flat-Rolled Aluminum (Novelis) | Global (North America, Europe, Asia) | Market access, largest producer, recycling leader |

| Specialized Plants | Wagodia (Gujarat), Aditya, Chakan | Serving high-growth sectors like EVs and ACs |

What You See Is What You Get

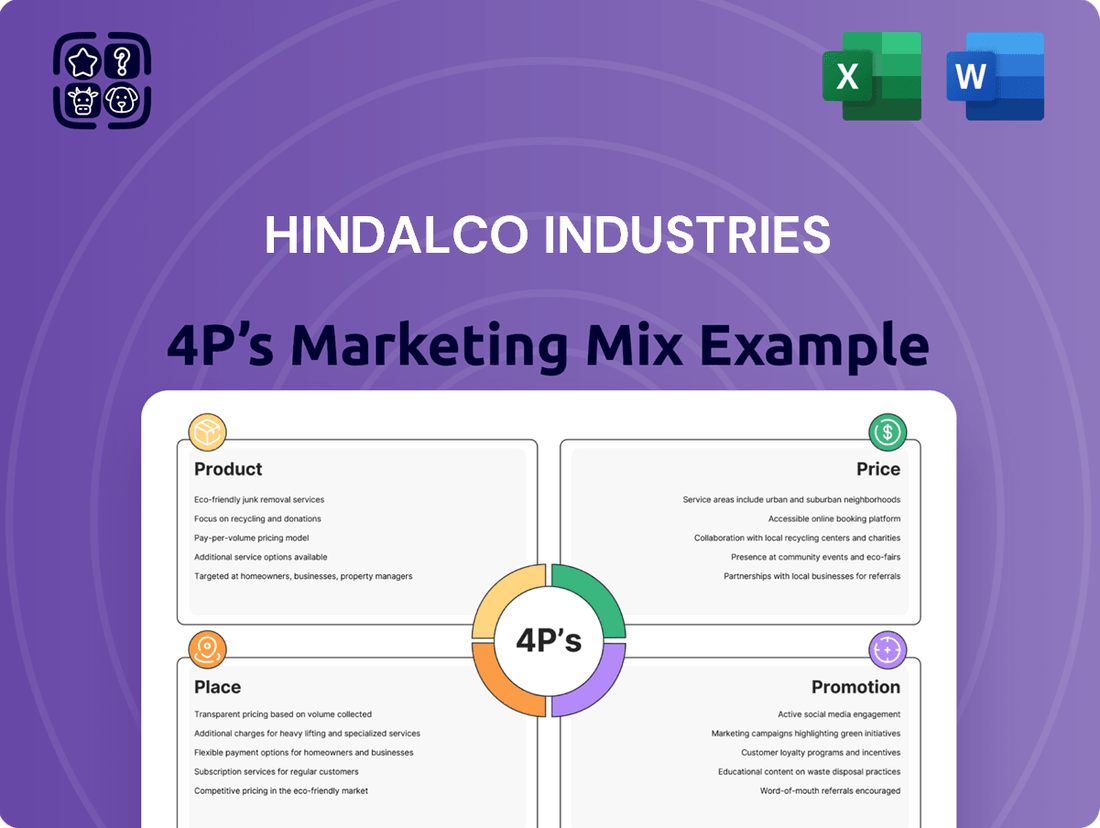

Hindalco Industries 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Hindalco Industries' Product, Price, Place, and Promotion strategies. Understand their market positioning and competitive advantages with this ready-to-use marketing mix breakdown.

Promotion

Hindalco Industries' promotion strategy is predominantly B2B, reflecting its core business as an industrial metals manufacturer. This approach prioritizes direct engagement with industrial clients, aiming to build strong relationships and demonstrate value.

The company actively participates in key industry trade shows and exhibitions, providing a platform to showcase its advanced product capabilities and technical expertise. For instance, Hindalco's presence at events like the Aluminium India Exhibition in 2024 highlights its commitment to reaching its target industrial audience and fostering technical collaborations.

These engagements are crucial for communicating Hindalco's value propositions, which include customized solutions, reliable supply chains, and innovative material science. This B2B focus ensures that promotion efforts are targeted and effective in reaching decision-makers within various industrial sectors.

Hindalco Industries strongly emphasizes its commitment to sustainability, a key aspect of its marketing efforts. This focus is underscored by its recognition as the 'World's Most Sustainable Aluminium Company' by S&P Global for five consecutive years, a testament to its operational excellence and environmental stewardship.

The company actively communicates its progress in critical areas like reducing greenhouse gas emissions, achieving a significant 15% reduction in Scope 1 & 2 emissions intensity between FY20 and FY23. Furthermore, Hindalco highlights its robust waste recycling programs and water conservation initiatives, which have led to a 25% reduction in freshwater withdrawal intensity over the same period.

These sustainability leadership initiatives are not just about environmental responsibility; they are strategically leveraged to enhance Hindalco's brand image, particularly resonating with environmentally conscious investors, customers, and the broader community. This dedication to sustainable practices, including significant community welfare programs, strengthens its appeal and market position.

Hindalco Industries places significant emphasis on investor relations and financial communications as a core component of its promotion strategy, particularly targeting the financial community. This involves a consistent flow of information through regular investor presentations, quarterly earnings calls, and comprehensive annual reports. These communications transparently detail the company's financial performance, highlight strategic investments, and outline future growth trajectories, all designed to foster investor confidence and attract necessary capital for expansion.

Strategic Brand Identity and Corporate Communications

Hindalco Industries strategically cultivates its brand identity and corporate communications to solidify its standing as a premier global player in the non-ferrous metals sector. This proactive approach ensures consistent messaging around its core vision, values, and dedication to pioneering advancements and sustained expansion. The company's commitment to evolving its public image was notably demonstrated with the launch of a refreshed brand identity in March 2025, underscoring its forward-looking strategy.

This emphasis on brand and communication is crucial for stakeholder engagement and market perception. Hindalco's recent financial reports, for instance, highlight increased investment in marketing and communications initiatives, aligning with the brand refresh. This strategic focus aims to resonate with a diverse audience, from individual investors to industry professionals, reinforcing Hindalco's value proposition.

Key aspects of Hindalco's strategic brand identity and corporate communications include:

- Brand Refresh: The unveiling of a new brand identity in March 2025 signals a commitment to modernizing its image and better reflecting its global leadership and innovation.

- Vision and Values Communication: Consistent messaging about Hindalco's long-term vision, ethical values, and commitment to sustainable growth is central to its corporate narrative.

- Innovation and Growth Messaging: The company actively communicates its advancements in technology, product development, and market expansion to reinforce its position as an industry leader.

- Stakeholder Engagement: Through various communication channels, Hindalco aims to foster strong relationships with investors, customers, employees, and the wider community, ensuring transparency and trust.

Showcasing Product Applications and Innovations

Hindalco Industries actively showcases the wide-ranging applications and cutting-edge innovations of its aluminium and copper products. This promotional strategy emphasizes how its materials drive progress in critical industries.

The company highlights its contributions to sectors such as electric vehicle (EV) mobility, renewable energy solutions, and advanced aerospace technologies. For instance, Hindalco's aluminium alloys are integral to lightweighting vehicles, improving EV range and efficiency. In the renewable energy space, its copper and aluminium products are essential components in solar panels and wind turbines, facilitating the transition to cleaner energy sources.

A notable example of Hindalco's innovative applications is its involvement with the Indian Space Research Organisation (ISRO). Hindalco has supplied specialized aluminium alloys that are crucial for the structural integrity and performance of ISRO's rockets and satellites, underscoring the high-performance capabilities of its materials in demanding environments. This showcases the company's ability to meet stringent technical specifications for national strategic projects.

Key areas of product application and innovation include:

- EV Mobility: Lightweight aluminium components for enhanced vehicle range and performance.

- Renewable Energy: Conductors and structural materials for solar and wind power generation.

- Aerospace: High-strength aluminium alloys used in aircraft manufacturing and space missions.

- ISRO Collaboration: Supply of critical aluminium alloys for India's space program, demonstrating advanced material capabilities.

Hindalco Industries leverages a multi-faceted promotion strategy, focusing on B2B engagement, sustainability leadership, and robust investor relations. Its presence at industry events like the Aluminium India Exhibition in 2024 and its recognition as the World's Most Sustainable Aluminium Company for five consecutive years by S&P Global underscore its commitment to showcasing technical prowess and environmental responsibility.

The company actively communicates its sustainability achievements, including a 15% reduction in Scope 1 & 2 emissions intensity between FY20 and FY23 and a 25% reduction in freshwater withdrawal intensity over the same period. This focus on ESG initiatives, coupled with a brand refresh in March 2025, aims to enhance its appeal to environmentally conscious stakeholders and investors.

Hindalco's promotional efforts also highlight the innovative applications of its products in critical sectors such as EV mobility and renewable energy. Its collaboration with ISRO, supplying specialized aluminium alloys for rockets and satellites, exemplifies its capability to meet stringent technical demands and reinforces its position as an industry leader.

Hindalco Industries' promotion strategy is deeply rooted in demonstrating its value proposition through industry engagement, sustainability credentials, and clear financial communication. The company's commitment to innovation, as seen in its product applications for EV and renewable energy sectors, further strengthens its market presence. Its consistent communication with investors, detailing financial performance and strategic growth, is vital for capital attraction and stakeholder confidence.

Price

Hindalco navigates a global commodity market where pricing is heavily dictated by supply-demand forces and international benchmarks like the London Metal Exchange (LME). For instance, LME aluminium prices averaged around $2,200-$2,300 per metric ton in the first half of 2024, a key benchmark Hindalco must consider.

The company's pricing strategy aims for competitiveness, balancing market realities with the need for profitability. This involves closely monitoring LME price movements for aluminium and copper, which can fluctuate significantly. In early 2024, LME copper prices saw volatility, trading in the $8,000-$9,000 per metric ton range, directly impacting Hindalco's copper segment.

Hindalco Industries strategically focuses on cost optimization to bolster its profit margins, a crucial element of its pricing strategy. By leveraging its captive coal mines, the company significantly reduces input costs, a key advantage in the competitive aluminum market.

These efforts in operational efficiency, including advancements in smelting technology and supply chain management, directly translate to lower production costs. For instance, Hindalco's continued investment in energy efficiency initiatives aims to curb power consumption, a major cost driver in aluminum production.

This cost advantage allows Hindalco to offer more competitive pricing for its aluminum products in the global market. In fiscal year 2024, the company reported a notable improvement in its EBITDA margins, partly attributed to these cost-saving measures and favorable commodity prices.

Hindalco Industries adopts a value-based pricing strategy for its downstream and specialty aluminum products. This approach aligns prices with the perceived value and unique benefits these offerings provide to customers, rather than solely on production costs.

Products like battery foils, crucial for electric vehicle batteries, and specialized aerospace alloys are priced higher due to their advanced properties, stringent quality requirements, and the sophisticated manufacturing techniques employed. For instance, Hindalco's focus on high-performance aluminum alloys for the automotive sector, which saw significant growth in 2024, reflects this value-driven pricing.

Impact of Global Economic Conditions and Tariffs

Hindalco's pricing strategy is deeply intertwined with global economic shifts and trade policies. For instance, the imposition of tariffs by various nations can directly impact the cost of raw materials and finished goods, necessitating price adjustments to remain competitive. The company's proactive approach includes hedging a portion of its commodity exposure, a strategy that helps buffer against the sharp price swings often seen in the metals market. This financial maneuver is crucial for maintaining earnings stability, especially when global demand fluctuates or geopolitical tensions escalate.

The impact of tariffs and global economic conditions on Hindalco's pricing is significant. For example, in 2023, global aluminum prices experienced volatility due to factors like energy costs and supply chain disruptions. Hindalco, like its peers, had to navigate these challenges. The company's hedging activities, which are a key part of its risk management, aim to lock in prices for a portion of its output, thereby providing a degree of predictability in its revenue streams amidst these external pressures.

- Geopolitical Impact: Geopolitical events can disrupt supply chains and influence commodity prices, directly affecting Hindalco's input costs and final product pricing.

- Tariff Effects: Trade barriers and tariffs imposed by major economies can increase the cost of exporting Hindalco’s products or importing necessary raw materials, leading to price adjustments.

- Hedging Strategy: Hindalco strategically employs hedging to mitigate the financial risks associated with commodity price volatility, aiming for more stable earnings.

- Economic Sensitivity: The company's pricing is sensitive to global economic growth, as demand for aluminum and copper is closely linked to industrial activity and construction.

Strategic Investments Influencing Future Pricing

Hindalco's strategic capital allocation, including a planned $4-5 billion investment over the next three years, is central to its pricing strategy. These significant investments are geared towards expanding both aluminium and copper production capacities. This focus on growth and efficiency aims to solidify Hindalco's position as a cost leader in the industry.

By enhancing its production capabilities and adopting advanced technologies, Hindalco is building a foundation for sustained competitiveness. This proactive approach to capital expenditure directly influences its ability to manage costs effectively, which in turn supports its long-term pricing power. The company's commitment to these investments signals a strong intent to lead the market and maintain attractive pricing.

- Capacity Expansion: Significant investments are earmarked for increasing output in key segments.

- Technological Advancement: Adoption of new technologies to drive efficiency and cost reduction.

- Cost Leadership: Strategic aim to be a dominant player in terms of production costs.

- Long-Term Pricing Power: Investments are designed to bolster the company's ability to influence market prices over time.

Hindalco's pricing strategy balances benchmark commodity prices with value-added products. For instance, LME aluminium prices hovered around $2,200-$2,300 per metric ton in early-to-mid 2024, influencing its bulk sales. Conversely, specialized products like aerospace alloys command premium pricing due to their advanced properties and stringent quality demands, reflecting Hindalco's dual approach.

Cost optimization is a cornerstone, enabling competitive pricing. With captive coal mines, Hindalco significantly lowers input costs, a crucial advantage. This efficiency, coupled with investments in energy-saving technologies, directly impacts its ability to offer attractive prices, as seen in improved EBITDA margins during fiscal year 2024.

Hindalco's pricing is also shaped by global economic factors and trade policies. Tariffs and currency fluctuations can necessitate adjustments, while hedging strategies help mitigate commodity price volatility. For example, navigating the $8,000-$9,000 per metric ton range for copper in early 2024 required careful price management.

| Product Segment | Benchmark Price (Early-Mid 2024) | Pricing Strategy Element | Key Influencing Factor |

|---|---|---|---|

| Aluminium (Bulk) | LME: ~$2,200-$2,300/ton | Benchmark-based, Cost-competitive | Global Supply/Demand, LME movements |

| Copper (Bulk) | LME: ~$8,000-$9,000/ton | Benchmark-based, Cost-competitive | Global Supply/Demand, LME movements |

| Specialty Aluminium | N/A (Value-driven) | Value-based Premium | Product performance, application, quality |

4P's Marketing Mix Analysis Data Sources

Our Hindalco Industries 4P's analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations, alongside current market data from industry publications and competitor pricing strategies.