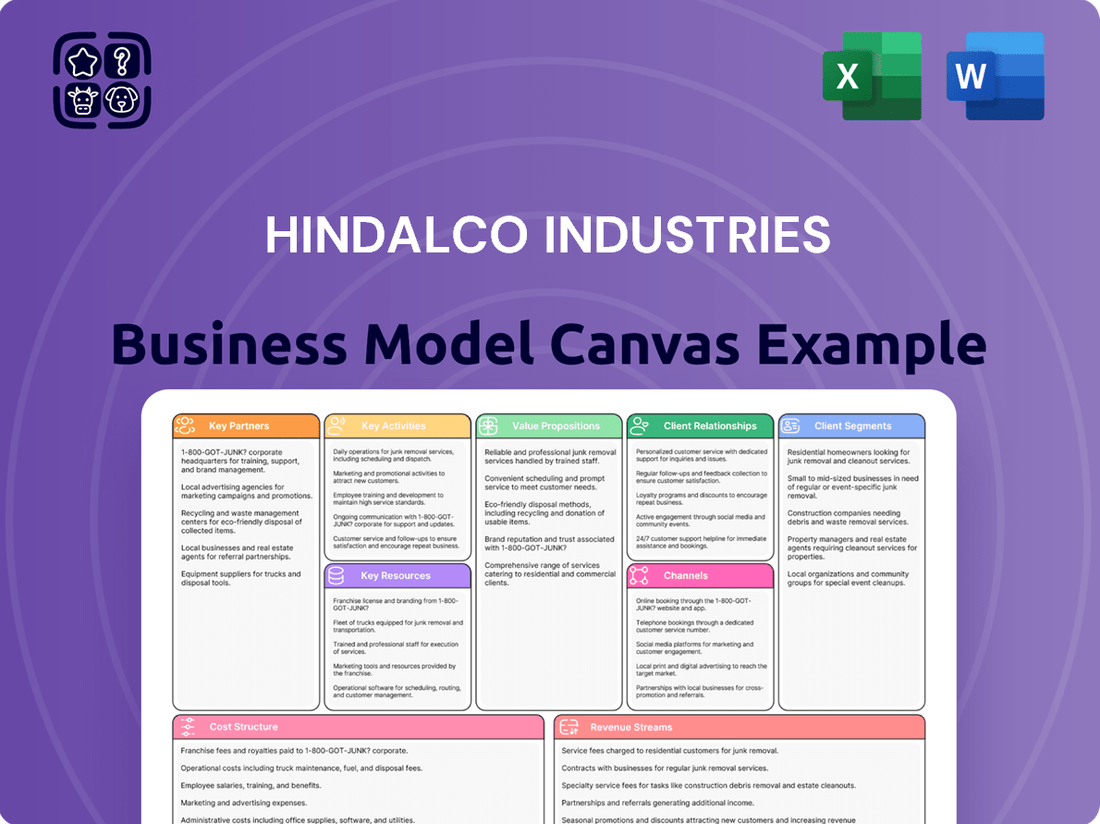

Hindalco Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hindalco Industries Bundle

Unlock the full strategic blueprint behind Hindalco Industries's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hindalco Industries maintains critical relationships with suppliers of bauxite, coal, and copper concentrate, ensuring a steady flow of essential raw materials. These partnerships are fundamental to their operational continuity and competitive pricing.

The strategic acquisition of mines, such as the Meenakshi and Bandha coal blocks, significantly bolsters Hindalco's resource security. This direct control over key inputs enhances operational stability and contributes to improved cost management, a vital aspect of their business model.

Hindalco actively partners with technology providers and research institutions to drive innovation in metal production. These collaborations are vital for developing advanced alloys and refining manufacturing processes, ultimately boosting efficiency and enabling the creation of high-value products.

In 2024, Hindalco continued its focus on R&D, investing significantly to stay at the forefront of metallurgical advancements. This commitment allows them to integrate cutting-edge technologies, such as AI-driven process optimization and advanced material characterization, ensuring a competitive edge in the global market.

Hindalco's logistics and distribution network relies heavily on strategic partnerships to move bauxite, coal, and other raw materials to its processing plants and then deliver finished aluminum and copper products to a global customer base. These collaborations are crucial for maintaining an efficient supply chain, minimizing transit times, and ensuring dependable delivery across various domestic and international markets.

In 2024, Hindalco continued to leverage its extensive network of logistics providers, including road, rail, and sea freight operators. For instance, its strong relationships with Indian Railways were key to transporting bulk raw materials from mines to its smelters, contributing to cost efficiencies. The company’s export operations, particularly for value-added aluminum products, depend on reliable shipping lines and port services to reach customers in North America, Europe, and Asia.

Government and Regulatory Bodies

Hindalco Industries actively partners with government and regulatory bodies, a crucial element for its operational success and expansion. These collaborations are vital for securing essential mining leases and obtaining environmental clearances, which are fundamental to the company's raw material sourcing and sustainable operations.

The company has a history of signing Memoranda of Understanding (MoUs) with various state governments across India. These agreements facilitate new project developments and expansions, underscoring a commitment to working closely with governmental agencies to foster industrial growth. For instance, in 2023, Hindalco continued to engage with state governments on various fronts to support its strategic initiatives.

Key aspects of these partnerships include:

- Securing Mining Leases: Essential for long-term access to bauxite and coal, critical raw materials for aluminum production.

- Environmental Clearances: Obtaining necessary approvals for plant operations and expansions, ensuring compliance with environmental regulations.

- Industrial Development Support: Collaborating on infrastructure development and policy frameworks that encourage manufacturing and economic progress.

- MoUs with State Governments: Formalizing partnerships for new projects and capacity enhancements, ensuring alignment with regional development goals.

Strategic Alliances and Acquisitions

Hindalco Industries actively pursues strategic alliances and acquisitions to bolster its market position and technological capabilities. A prime example is its acquisition of US-based AluChem Companies, Inc., which significantly expanded its global reach and diversified its offerings in high-tech aluminum products. This move, completed in early 2024, underscores Hindalco's commitment to inorganic growth and market penetration.

These strategic partnerships are crucial for market expansion, allowing Hindalco to enter new geographies and customer segments more effectively. They also serve as powerful catalysts for technological advancement, enabling the integration of new processes and product innovations. For instance, the AluChem acquisition brought specialized expertise in refractory materials, a key component in high-temperature industries.

The benefits of these alliances and acquisitions are multifaceted:

- Market Expansion: Gaining access to new geographical markets and customer bases.

- Product Diversification: Broadening the high-tech product portfolio.

- Technological Advancement: Integrating new technologies and expertise.

- Synergistic Growth: Achieving economies of scale and operational efficiencies.

Key partnerships for Hindalco Industries are vital for securing raw materials, driving innovation, and expanding market reach. These collaborations ensure operational stability and foster technological advancement, critical for maintaining a competitive edge.

The company's strategic alliances and acquisitions, like the early 2024 acquisition of US-based AluChem Companies, Inc., are instrumental in diversifying its product portfolio and entering new markets. This inorganic growth strategy allows Hindalco to integrate specialized expertise, such as in refractory materials, enhancing its offerings in high-tech aluminum products.

Hindalco's 2023-2024 financial year saw continued emphasis on these strategic relationships. For example, its robust partnerships with logistics providers, including Indian Railways, were crucial for efficient raw material transport, contributing to cost savings. Similarly, collaborations with technology providers and research institutions in 2024 focused on integrating AI for process optimization, underscoring a commitment to innovation.

| Partnership Type | Key Focus Areas | Impact/Benefit | 2024 Relevance |

|---|---|---|---|

| Raw Material Suppliers | Bauxite, Coal, Copper Concentrate | Operational continuity, competitive pricing | Secured consistent supply for production targets |

| Technology & Research Institutions | Process innovation, advanced alloys | Efficiency gains, high-value product development | Integration of AI-driven process optimization |

| Logistics & Distribution Providers | Transportation of raw materials and finished goods | Efficient supply chain, timely delivery | Leveraged Indian Railways for cost-effective transport |

| Government & Regulatory Bodies | Mining leases, environmental clearances | Operational legality, sustainable expansion | Continued engagement for project facilitation |

| Strategic Alliances & Acquisitions | Market expansion, technological integration | Global reach, product diversification | AluChem acquisition expanded high-tech product offerings |

What is included in the product

This Hindalco Industries Business Model Canvas offers a strategic blueprint detailing its diverse customer segments, from automotive to construction, and its robust value propositions centered on high-quality aluminum and copper products. It outlines key resources like integrated manufacturing facilities and extensive R&D, alongside channels and customer relationships that drive its global market presence.

Hindalco's Business Model Canvas acts as a pain point reliever by streamlining complex supply chains and offering integrated solutions, providing a clear, actionable roadmap for stakeholders.

Activities

Hindalco's integrated mining and refining operations are a cornerstone of its business. This includes extensive bauxite mining, the essential raw material for aluminium production, and subsequent alumina refining. This upstream integration is crucial for maintaining quality control and managing costs throughout the aluminium value chain.

In fiscal year 2024, Hindalco's aluminium business demonstrated strong performance, with its Novelis subsidiary contributing significantly. The company’s focus on operational efficiency in its mining and refining segments directly supports its competitive position in the global aluminium market.

Hindalco's core operations revolve around the large-scale smelting of aluminium and copper, alongside the casting of primary metals. This process is incredibly energy-intensive, demanding meticulous operational precision to yield high-quality metal ingots and copper cathodes.

In fiscal year 2023-24, Hindalco's Novelis segment, a global leader in aluminum rolling and recycling, achieved a record EBITDA of $1.4 billion, underscoring the efficiency and scale of its downstream operations, which are closely linked to the primary smelting activities.

Hindalco Industries is deeply engaged in producing a broad array of downstream aluminum products. This includes crucial items like rolled products for packaging and construction, extrusions for automotive and architectural uses, and foils for food and pharmaceutical applications.

The company also manufactures copper rods and tubes, vital components for electrical and plumbing industries. These downstream activities are central to Hindalco's strategy for adding significant value to its primary metal production.

In fiscal year 2024, Hindalco's Novelis segment, a major player in downstream products, reported strong performance. For the nine months ended December 31, 2023, Novelis achieved an EBITDA of $1.2 billion, showcasing the profitability of its value-added product portfolio.

Research, Development, and Innovation

Hindalco's commitment to research, development, and innovation is central to its strategy. The company actively invests in R&D to create novel aluminum alloys and improve existing product functionalities. This focus is particularly vital for tapping into high-growth markets such as electric vehicles (EVs) and sophisticated packaging solutions, where advanced material properties are in demand.

In 2024, Hindalco continued its drive for innovation, with a significant portion of its capital expenditure allocated to R&D initiatives. The company aims to develop lighter, stronger, and more sustainable aluminum products. This proactive approach ensures Hindalco stays ahead of technological advancements and evolving customer needs.

- Focus on advanced alloys for EV lightweighting

- Development of sustainable and recyclable packaging solutions

- Exploration of new applications in aerospace and defense

- Investment in digital technologies for process optimization

Strategic Capital Expenditure and Expansion

Hindalco is actively investing in substantial capital expenditure for both brownfield and greenfield expansion projects. These initiatives span its aluminium and copper segments within India, as well as its global operations through Novelis. The primary goal is to boost production capacity, improve operational efficiency, and solidify its dominant market position.

These strategic investments are crucial for Hindalco's growth trajectory. For instance, the company has been focusing on expanding its aluminium smelting and refining capacities, alongside downstream value-added products. In its copper division, efforts are directed towards enhancing smelting and refining capabilities to meet growing demand.

- Expansion Projects: Hindalco is undertaking significant capital expenditure for brownfield and greenfield expansions across its aluminium and copper businesses in India, and globally via Novelis.

- Capacity Enhancement: These investments are designed to directly increase production capacity in key segments.

- Efficiency Improvements: A core objective of the capital expenditure is to enhance operational efficiency and reduce costs.

- Market Leadership: The expansion programs aim to strengthen Hindalco's market leadership in both its domestic and international operations.

Hindalco’s key activities encompass integrated mining and refining, large-scale primary metal smelting, and the production of a diverse range of downstream aluminium and copper products. The company also places a strong emphasis on research and development to drive innovation in advanced materials and sustainable solutions, alongside significant capital investments in capacity expansion and operational efficiency across its global footprint.

| Key Activity | Description | Fiscal Year 2024 Impact/Data |

|---|---|---|

| Integrated Mining & Refining | Bauxite mining and alumina refining for aluminium production. | Crucial for cost management and quality control. |

| Primary Metal Smelting | Large-scale smelting of aluminium and copper. | Energy-intensive process requiring operational precision. |

| Downstream Product Manufacturing | Production of rolled products, extrusions, foils, copper rods, and tubes. | Novelis reported $1.2 billion EBITDA for nine months ended Dec 31, 2023, highlighting value addition. |

| Research & Development | Creating novel alloys and improving product functionalities, especially for EVs and packaging. | Significant capital expenditure allocated to R&D for lighter, stronger, and sustainable products. |

| Capacity Expansion | Brownfield and greenfield expansion projects in aluminium and copper segments. | Aims to boost production capacity and solidify market position globally. |

Preview Before You Purchase

Business Model Canvas

The Hindalco Industries Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive snapshot provides a clear overview of Hindalco's strategic framework, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain immediate access to this complete, ready-to-use analysis, ensuring you have the same professional insights as seen in this preview.

Resources

Hindalco Industries benefits immensely from its extensive bauxite and coal reserves, which are foundational to its vertically integrated aluminium business. These resources ensure a stable and cost-effective supply chain, from raw material extraction to finished product.

The company's strategic acquisitions, such as the Meenakshi coal mine and the Bandha coal block, significantly bolster its resource security. For instance, the Meenakshi mine alone is projected to contribute substantially to Hindalco's coal requirements, enhancing its operational resilience and competitive edge in the aluminium market through 2024 and beyond.

Hindalco’s integrated manufacturing facilities are the backbone of its operations, encompassing refineries, smelters, rolling mills, and copper plants. This extensive network, both in India and globally via Novelis, enables massive production volumes.

In fiscal year 2024, Hindalco's India Aluminium business reported a revenue of ₹33,641 crore, a testament to the efficiency of its integrated facilities. Novelis, its global arm, achieved a revenue of $13.2 billion in FY24, highlighting the scale and international reach of these manufacturing assets.

Hindalco Industries heavily relies on its advanced proprietary technology and extensive intellectual property portfolio, spanning mining, refining, and the creation of specialized aluminum alloys and downstream products. This technological prowess is a cornerstone of their competitive advantage, allowing for superior product development and efficient operations.

In 2024, Hindalco's commitment to R&D and innovation is evident in its continuous efforts to develop new materials and processes. For instance, their focus on advanced alloys for automotive and aerospace sectors, like high-strength aluminum for electric vehicles, directly stems from their investment in intellectual property and cutting-edge technology. This allows them to command premium pricing and secure long-term contracts.

Skilled Workforce and Human Capital

Hindalco's skilled workforce is a cornerstone of its operations, providing critical expertise across the entire value chain. This human capital is essential for everything from raw material extraction to the production of advanced aluminum and copper products.

As of March 31, 2024, Hindalco Industries Limited had a significant employee base of 49,909 individuals. This vast team represents a deep reservoir of knowledge and practical experience in mining, metallurgy, engineering, manufacturing, and various support functions.

The company's human capital is structured to support its diverse business segments:

- Mining and Extractive Operations: Skilled personnel manage and operate mining sites, ensuring efficient extraction of bauxite and other raw materials.

- Metallurgical and Manufacturing Expertise: A large contingent of engineers and technicians are involved in smelting, refining, rolling, and producing a wide array of aluminum and copper products.

- Research and Development: Hindalco invests in R&D teams focused on innovation, process improvement, and developing new materials and applications.

- Management and Support Functions: Experienced professionals in finance, marketing, supply chain, and human resources ensure the smooth and strategic running of the organization.

Strong Financial Capital and Balance Sheet

Hindalco Industries benefits significantly from its strong financial capital and robust balance sheet. This healthy financial standing ensures sufficient funds for day-to-day operations, enabling strategic investments in new projects and expansion plans. A well-managed balance sheet is crucial for sustaining growth and navigating market fluctuations.

The company's manageable debt levels are a key strength. As of March 31, 2025, Hindalco reported a net debt to EBITDA ratio of 1.06x. This indicates a solid ability to service its debt obligations, providing financial flexibility for future endeavors.

- Strong Financial Position: A healthy balance sheet and manageable debt are foundational for Hindalco's operations and growth.

- Capital for Investment: The robust financial capital supports ongoing operations and strategic investments.

- Debt Management: A net debt to EBITDA ratio of 1.06x as of March 31, 2025, highlights effective debt management.

- Future Growth: This financial strength positions Hindalco to pursue future growth initiatives and capitalize on opportunities.

Hindalco's key resources include vast mineral reserves, particularly bauxite and coal, which are crucial for its vertically integrated operations. This integration ensures cost efficiency and supply chain stability. The company also possesses extensive manufacturing facilities across India and globally through Novelis. Furthermore, Hindalco leverages proprietary technology and a strong intellectual property portfolio, particularly in advanced aluminum alloys. Its skilled workforce, numbering nearly 50,000 as of March 2024, provides essential expertise across all operational facets.

Hindalco's financial capital is a significant asset, characterized by a robust balance sheet and effective debt management. This financial strength allows for sustained operations and strategic investments, supporting its growth trajectory. The company's net debt to EBITDA ratio stood at 1.06x as of March 31, 2025, underscoring its financial stability.

| Resource Category | Key Components | Significance | Data Point (FY24/FY25) |

|---|---|---|---|

| Mineral Reserves | Bauxite, Coal | Foundation for vertical integration, cost control | Extensive reserves ensuring long-term supply |

| Manufacturing Assets | Refineries, Smelters, Rolling Mills, Copper Plants (India & Novelis) | Large-scale production, global reach | Novelis Revenue: $13.2 billion (FY24) |

| Intellectual Property & Technology | Proprietary processes, advanced alloy development | Competitive advantage, product differentiation | Focus on advanced alloys for automotive/aerospace |

| Human Capital | Skilled workforce | Expertise in mining, metallurgy, manufacturing, R&D | Employees: 49,909 (as of March 31, 2024) |

| Financial Capital | Strong balance sheet, manageable debt | Operational funding, investment capacity, financial flexibility | Net Debt/EBITDA: 1.06x (as of March 31, 2025) |

Value Propositions

Hindalco's integrated value chain, spanning bauxite mining to the production of alumina, aluminium, and downstream products like extrusions and rolled products, provides a significant competitive edge. This end-to-end control allows for enhanced quality assurance and operational efficiencies, contributing to cost leadership.

The company's diversification into copper, through its subsidiary Hindalco Copper, further strengthens its market position. In the fiscal year 2024, Hindalco reported consolidated revenue of ₹2.15 lakh crore, with its Novelis segment contributing ₹1.04 lakh crore, showcasing the scale and breadth of its operations across both aluminium and copper businesses.

Hindalco, through its subsidiary Novelis, stands as a global frontrunner in flat-rolled aluminium products, a position bolstered by its status as the world's largest aluminium recycler.

This dual leadership allows Hindalco to offer compelling sustainable solutions, tapping into a significant market driver for recycled content across various industries.

In fiscal year 2024, Novelis reported a strong performance, with its net sales reaching $17.9 billion, underscoring its significant market presence and operational scale in the flat-rolled products sector.

Hindalco's commitment to sustainability is a cornerstone of its business model, earning it the title of the world's most sustainable aluminum producer for five consecutive years. This dedication is backed by tangible actions in waste recycling, significantly reducing landfill reliance, and robust water conservation programs, which have led to a notable decrease in its water footprint across operations.

The company's strategic focus on increasing renewable energy adoption, aiming for a substantial portion of its energy needs to be met by green sources, further solidifies its environmental stewardship. For instance, by the end of FY24, Hindalco had achieved a significant milestone in renewable energy sourcing, contributing to a lower carbon intensity in its production processes.

High-Quality, Innovative Products for Key Industries

Hindalco Industries delivers premium, cutting-edge aluminium and copper solutions designed to meet the specific demands of critical sectors. Their product range caters to automotive, packaging, construction, and electrical industries, showcasing a commitment to specialized innovation.

This dedication is evident in offerings like lightweight aluminium battery enclosures, crucial for the burgeoning electric vehicle (EV) market, and advanced aerospace-grade alloys. These specialized products underscore Hindalco's focus on high-performance applications, driving value for their customers.

- Automotive Sector: Hindalco's aluminium products contribute to vehicle lightweighting, enhancing fuel efficiency and EV range. In 2023, the automotive segment represented a significant portion of their revenue, driven by increasing demand for sustainable materials.

- Aerospace Industry: The company supplies specialized aluminium alloys meeting stringent aerospace specifications, supporting advancements in aircraft manufacturing.

- Electrical Applications: High-conductivity copper and aluminium products are vital for power transmission and distribution networks, a sector experiencing robust growth.

- Packaging Solutions: Innovative aluminium packaging materials offer superior barrier properties and recyclability, aligning with global sustainability trends.

Cost Competitiveness and Operational Excellence

Hindalco Industries leverages captive raw material sources, such as its own bauxite and coal mines, to significantly reduce input costs. This vertical integration, a key aspect of its cost competitiveness, was further bolstered by strategic acquisitions in 2024, expanding its resource base. For instance, its domestic alumina production capacity reached 2.7 million tonnes per annum, directly contributing to cost control.

Operational excellence is driven by a relentless focus on efficiency and continuous improvement across its manufacturing facilities. In 2024, Hindalco reported a notable improvement in its energy consumption per tonne of aluminum produced, a testament to its ongoing optimization efforts. This focus ensures competitive pricing and healthy margins across its diverse product portfolio, from primary aluminum to value-added downstream products.

- Captive Resources: Secures key raw materials like bauxite and coal, reducing reliance on external markets and price volatility.

- Operational Efficiency: Implemented advanced manufacturing techniques and energy-saving measures, leading to lower production costs.

- Cost Optimization: Ongoing initiatives to streamline processes, reduce waste, and improve productivity across all business segments.

- Competitive Pricing: These efficiencies translate into attractive pricing for customers, enhancing market share.

Hindalco offers a comprehensive suite of aluminium and copper products, catering to diverse industrial needs with a focus on advanced solutions. Their integrated value chain ensures quality and cost-effectiveness, from raw materials to specialized downstream products like automotive components and aerospace alloys.

| Value Proposition | Description | Key Facts/Data (FY24) |

| Integrated Value Chain & Cost Leadership | End-to-end control from mining to finished products, enabling operational efficiencies and cost competitiveness. | Consolidated revenue: ₹2.15 lakh crore. Domestic alumina capacity: 2.7 million tonnes per annum. |

| Global Leadership in Flat-Rolled Products (Novelis) | World's largest aluminium recycler, offering sustainable solutions and high-performance flat-rolled products. | Novelis net sales: $17.9 billion. Largest global producer of beverage can sheet. |

| Sustainability & Environmental Stewardship | Recognized as the world's most sustainable aluminum producer, with strong recycling, water conservation, and renewable energy initiatives. | Awarded most sustainable aluminum producer for five consecutive years. Significant progress in renewable energy sourcing. |

| Specialized & High-Performance Solutions | Tailored products for critical sectors like automotive (EVs), aerospace, packaging, and electrical applications. | Supplies lightweight battery enclosures for EVs and advanced aerospace-grade alloys. |

Customer Relationships

Hindalco Industries prioritizes robust customer connections by offering specialized B2B sales and technical support. This dedicated approach ensures industrial clients receive expert advice and customized solutions for their unique needs, fostering loyalty and repeat business.

In 2023, Hindalco's focus on customer relationships contributed to its strong performance, with its Novelis segment reporting adjusted EBITDA of $1.7 billion, reflecting the value derived from tailored customer solutions and support.

Hindalco Industries cultivates enduring relationships with its major clients, often securing multi-year contracts that guarantee consistent demand for its aluminum and copper products. This strategic approach, exemplified by agreements with automotive manufacturers and construction firms, builds a strong foundation of trust and predictability.

Hindalco actively partners with its customers in developing new products, ensuring their offerings align with changing market demands. This collaborative approach allows for the creation of tailored solutions that precisely address specific industry requirements.

A prime example of this customer-centric innovation is Hindalco's supply of 10,000 aluminum battery enclosures to Mahindra. This significant order directly reflects Hindalco's ability to engineer and deliver specialized components that meet the evolving needs of the automotive sector.

After-Sales Service and Technical Assistance

Hindalco Industries prioritizes robust after-sales service and technical assistance to foster enduring customer relationships, especially critical for its industrial product lines. This commitment ensures customer satisfaction by proactively addressing operational challenges and maximizing product utility.

For instance, Hindalco's dedicated technical teams offer on-site support and troubleshooting, enhancing the performance and longevity of their aluminum and copper products. This focus on customer support is a key differentiator in the competitive metals industry.

- Post-Purchase Support: Hindalco provides comprehensive technical assistance, including installation guidance, operational training, and product maintenance advice to its industrial clients.

- Problem Resolution: Dedicated customer service channels and field engineers are available to promptly address any technical queries or operational issues encountered by customers, ensuring minimal disruption.

- Value-Added Services: Beyond basic support, Hindalco offers value-added services like product customization advice and performance optimization strategies, deepening customer engagement.

- Customer Feedback Integration: Insights gathered from after-sales interactions are systematically fed back into product development and process improvement, demonstrating a commitment to continuous enhancement.

Industry Engagement and Brand Building

Hindalco actively engages in industry associations and trade events, solidifying its market presence and fostering stronger connections with customers. This participation is crucial for brand building and staying abreast of industry trends.

Targeted brand-building initiatives are key to Hindalco's customer relationship strategy. For instance, the Freshwrapp campaign, 'Bacteria Ki Entry Ko Rokey,' directly engaged consumers, highlighting product benefits and enhancing brand recall. This approach aims to build loyalty and differentiate Hindalco's offerings in a competitive market.

- Industry Association Participation: Hindalco's involvement in key industry bodies allows for collaborative problem-solving and advocacy, influencing sector-wide standards and best practices.

- Trade Event Presence: Showcasing innovations and engaging directly with potential clients at trade shows provides valuable feedback and strengthens relationships.

- Consumer Campaigns: Initiatives like the Freshwrapp campaign demonstrate a commitment to consumer engagement, building brand affinity through relatable messaging.

- Brand Reputation: Consistent positive engagement and product quality contribute to a robust brand reputation, a cornerstone of long-term customer relationships.

Hindalco fosters strong customer ties through dedicated B2B sales, technical support, and collaborative product development, ensuring tailored solutions for industrial clients. The company's commitment to after-sales service, including on-site assistance and troubleshooting, further solidifies these relationships, driving customer satisfaction and loyalty.

In 2024, Hindalco's customer-centric approach is evident in its continued focus on building long-term partnerships, often through multi-year contracts with key players in the automotive and construction sectors. This strategy provides a stable demand base for its aluminum and copper products.

Hindalco's proactive engagement in industry events and targeted brand campaigns, like those for its consumer products, also plays a vital role in strengthening its market presence and deepening customer connections.

The company's 2023 financial performance, with Novelis reporting an adjusted EBITDA of $1.7 billion, underscores the value generated by these robust customer relationships and tailored solutions.

| Customer Relationship Aspect | Description | Impact/Example |

|---|---|---|

| B2B Sales & Technical Support | Specialized assistance and expert advice for industrial clients. | Fosters loyalty and repeat business; ensures tailored solutions. |

| After-Sales Service | On-site support, troubleshooting, and product maintenance guidance. | Enhances product performance and longevity, driving satisfaction. |

| Collaborative Product Development | Partnering with customers to align offerings with market demands. | Creation of precisely tailored solutions, like aluminum battery enclosures for Mahindra. |

| Long-Term Contracts | Securing agreements with major clients for consistent demand. | Builds trust and predictability, exemplified by automotive and construction sector partnerships. |

| Industry Engagement & Brand Building | Participation in trade events and consumer campaigns. | Strengthens market presence and brand affinity, as seen with the Freshwrapp campaign. |

Channels

Hindalco Industries heavily relies on its direct sales force to cultivate relationships with major industrial clients and oversee significant accounts. This approach facilitates direct negotiation on pricing and terms, offering crucial technical support and developing customized solutions to meet unique customer needs.

In 2024, Hindalco's direct sales efforts are instrumental in securing large volume orders, particularly within the automotive and construction sectors, which are key growth drivers for the company's aluminum and copper products.

Leveraging Novelis, its global subsidiary, Hindalco Industries taps into an extensive international distribution network, crucial for its flat-rolled aluminium products. This network facilitates worldwide market access and ensures efficient delivery to a diverse client base across automotive, packaging, and aerospace sectors.

In fiscal year 2024, Novelis reported net sales of $17.9 billion, underscoring the significant revenue generated through its robust global distribution channels. This vast reach allows Hindalco to serve customers in over 30 countries, solidifying its position as a key player in the global aluminium market.

For its specialized products, like advanced aerospace alloys or lightweight components for electric vehicle battery enclosures, Hindalco utilizes highly targeted distribution channels. These channels are designed to connect directly with customers who have very specific technical needs and stringent quality requirements.

This direct approach allows for in-depth technical discussions and customized solutions, ensuring that the unique value proposition of these high-margin products is effectively communicated. For instance, Hindalco's Novelis subsidiary, a major player in aluminum solutions for the automotive and aerospace sectors, works closely with key manufacturers, often engaging in joint development programs.

In 2024, the demand for aluminum in the aerospace sector continued to be driven by the need for lighter, more fuel-efficient aircraft. Similarly, the burgeoning EV market presented significant opportunities for specialized aluminum alloys used in battery casings and structural components, with global EV production expected to surpass 15 million units in 2024, creating a substantial market for Hindalco's advanced materials.

Logistics and Supply Chain Infrastructure

Hindalco's extensive logistics and supply chain infrastructure is a cornerstone of its operations, ensuring the smooth flow of materials from sourcing to customer delivery. This network encompasses a vast array of transportation modes and strategically located warehousing facilities to serve a global customer base efficiently. For instance, in the fiscal year 2023-24, Hindalco continued to optimize its logistics, leveraging multimodal transport solutions to reduce transit times and costs for both inbound raw materials like bauxite and outbound aluminum products.

The company's commitment to an efficient supply chain directly impacts its ability to meet market demand promptly. This includes managing the complexities of transporting bulk commodities and specialized finished goods across diverse geographical regions. Hindalco's integrated approach ensures that raw materials reach its numerous production facilities without disruption, and finished products are delivered to customers, whether they are in the automotive, construction, or electrical sectors, in a timely manner.

- Transportation Network: Hindalco utilizes a mix of rail, road, and sea freight to manage its extensive inbound and outbound logistics, aiming for cost-effectiveness and speed.

- Warehousing and Distribution: The company maintains a network of warehouses and distribution centers to ensure product availability and facilitate just-in-time delivery to key markets.

- Supply Chain Optimization: Continuous investment in technology and process improvements helps Hindalco enhance supply chain visibility, reduce lead times, and manage inventory levels effectively.

- Global Reach: This robust infrastructure supports Hindalco's presence in over 90 countries, enabling it to serve a wide spectrum of industrial customers worldwide.

Online Presence and Digital Engagement

Hindalco Industries actively manages its online presence via its corporate website and various digital channels. These platforms are crucial for sharing information about their diverse product portfolio, detailing their commitment to sustainability initiatives, and providing comprehensive investor relations updates. In 2024, the company continued to leverage these digital touchpoints for initial customer and stakeholder engagement, acting as a primary conduit for information dissemination.

- Corporate Website: Hindalco's primary digital hub, offering detailed product information, financial reports, and sustainability disclosures.

- Investor Relations Portal: Dedicated section for shareholders and potential investors, featuring stock performance, annual reports, and investor call transcripts.

- Digital Engagement: Utilization of social media and online news platforms to communicate corporate news, achievements, and industry insights.

- Information Dissemination: Serving as the initial point of contact for stakeholders seeking information about Hindalco's operations and strategic direction.

Hindalco's channels are multifaceted, encompassing a direct sales force for key accounts and an extensive global distribution network via Novelis. Specialized products reach niche markets through targeted channels, often involving joint development with clients. The company also maintains a robust logistics and supply chain infrastructure, complemented by a strong digital presence for information dissemination and initial engagement.

| Channel Type | Description | Key Sectors Served | 2024 Relevance/Data |

|---|---|---|---|

| Direct Sales Force | Builds relationships, negotiates terms, provides technical support for major clients. | Automotive, Construction, Industrial | Secures large volume orders; crucial for custom solutions. |

| Novelis Global Distribution Network | Leverages international reach for flat-rolled aluminium products. | Automotive, Packaging, Aerospace | Novelis net sales: $17.9 billion (FY24); serves over 30 countries. |

| Targeted Distribution Channels | Connects with customers needing specialized, high-quality products. | Aerospace, Electric Vehicles (EVs) | Supports advanced alloys for EV battery enclosures and lightweight aircraft components. |

| Logistics & Supply Chain | Manages inbound raw materials and outbound finished goods efficiently. | All sectors | Optimizes multimodal transport for cost-effectiveness and timely delivery. |

| Digital Channels (Website, Investor Portals) | Primary hub for product info, sustainability, investor relations, and initial engagement. | All Stakeholders | Key for information dissemination and corporate communication in 2024. |

Customer Segments

The automotive industry represents a significant customer segment for Hindalco Industries. They rely on Hindalco's advanced aluminum solutions for vehicle manufacturing, particularly for lightweight body structures that improve fuel efficiency and performance. In 2024, the demand for aluminum in automotive applications continued to rise, driven by stringent emission norms and the accelerating transition to electric vehicles.

Hindalco's aluminum is increasingly being used in battery enclosures for electric vehicles, a critical component for safety and thermal management. This growing application underscores the segment's importance for Hindalco's expansion in the sustainable mobility sector. The global automotive market saw a notable increase in EV production in 2024, directly benefiting suppliers of lightweight materials like Hindalco.

The packaging industry, particularly for beverage cans and food foils, is a significant customer base for Hindalco and its subsidiary Novelis. This sector is increasingly focused on sustainable and recyclable materials, aligning with Hindalco's strategic direction.

In 2024, the global demand for aluminum packaging, driven by its recyclability and lightweight properties, continued to strengthen. Novelis, a key player, reported robust performance in its beverage packaging segment, reflecting this ongoing trend.

Hindalco Industries serves the building and construction sector by providing essential aluminium products like extrusions and rolled sheets. These materials are crucial for architectural features, structural elements, and interior design, highlighting the industry's need for robust and adaptable metal solutions.

In 2023, the Indian construction sector saw significant growth, with the government's focus on infrastructure development driving demand for materials like aluminium. Hindalco's contribution to this sector is substantial, as aluminium's lightweight yet strong properties make it ideal for modern building designs and energy-efficient structures.

Electrical and Electronics Industry

The electrical and electronics industry represents a significant customer segment for Hindalco Industries, primarily through its copper offerings. These materials are fundamental to the sector's infrastructure and product development.

Hindalco's continuous cast copper rods and specialty copper tubes are vital for power transmission and distribution networks, as well as for the internal wiring of electronic devices. The demand from this sector is closely tied to infrastructure spending and the growth of consumer electronics.

- Key Products: Continuous cast copper rods, specialty copper tubes.

- Applications: Power transmission, wiring, electronic components, transformers, and motors.

- Market Drivers: Infrastructure development, renewable energy projects, growth in telecommunications, and consumer electronics demand.

- Hindalco's Role: Providing high-quality copper that meets the stringent specifications required for electrical conductivity and durability.

Aerospace and Defense Sector

Hindalco Industries, via Hindalco-Almex Aerospace Limited (HAAL), is a key supplier to the aerospace and defense sectors. They provide specialized aluminum alloys crucial for building aircraft, defense systems, and components for space exploration. This segment requires materials that meet extremely stringent performance and reliability standards.

The demand for advanced aluminum alloys in these industries is significant. For instance, the global aerospace market was valued at over $800 billion in 2023 and is projected to grow substantially. Hindalco's contribution is vital for manufacturing lightweight yet robust structures in this high-stakes environment.

- High-Performance Materials: Hindalco supplies specialized aluminum alloys like those used in aircraft fuselages and engine components.

- Critical Applications: Their products are essential for defense equipment, including armored vehicles and missile systems.

- Space Missions: Hindalco's alloys are utilized in the construction of satellites and launch vehicles, demanding extreme precision and durability.

- Market Demand: The aerospace and defense sector's continuous need for advanced, lighter materials drives demand for Hindalco's specialized offerings.

Hindalco's diverse customer base spans multiple industries, each with unique demands for its aluminum and copper products. The automotive sector, particularly electric vehicles, relies on lightweight aluminum for improved efficiency and battery components. The packaging industry favors aluminum for its recyclability and durability in beverage cans and food foils.

The building and construction sector utilizes Hindalco's aluminum for architectural elements and structural components, driven by infrastructure development. Furthermore, the electrical and electronics industry depends on Hindalco's copper for power transmission and electronic devices, with demand linked to infrastructure spending and consumer electronics growth.

The aerospace and defense sectors are critical clients, requiring specialized, high-performance aluminum alloys for aircraft, defense systems, and space exploration. This segment demands materials meeting stringent reliability standards, underscoring Hindalco's advanced material capabilities.

| Customer Segment | Key Products/Applications | Market Drivers (2024 Focus) | Hindalco's Value Proposition |

|---|---|---|---|

| Automotive | Lightweight body structures, EV battery enclosures | Emission norms, EV adoption, fuel efficiency | Advanced aluminum alloys for performance and sustainability |

| Packaging | Beverage cans, food foils | Recyclability, sustainability, lightweighting | High-quality, recyclable aluminum solutions |

| Building & Construction | Extrusions, rolled sheets for architecture and structure | Infrastructure development, energy efficiency | Durable, adaptable aluminum for modern construction |

| Electrical & Electronics | Copper rods, tubes for power transmission, wiring | Infrastructure spending, renewable energy, consumer electronics | High-conductivity copper meeting stringent specifications |

| Aerospace & Defense | Specialized aluminum alloys for aircraft, defense systems | Performance, reliability, lightweighting in critical applications | High-performance alloys for extreme environments |

Cost Structure

Raw material procurement represents the most substantial portion of Hindalco's expenses. Key inputs like bauxite, coal, and copper concentrate are vital for its operations.

The cost of these materials is highly sensitive to global market dynamics. For instance, these procurement costs reached a significant peak of 1,593.5 billion in March 2025, highlighting the impact of commodity price volatility on Hindalco's financial performance.

Energy and power expenses are a significant component of Hindalco Industries' cost structure, driven by the energy-intensive nature of aluminium and copper production. In fiscal year 2023, Hindalco reported that its consolidated revenue from operations was INR 215,500 crore, with a substantial portion attributable to energy inputs.

The company's strategic investments in renewable energy sources, such as solar and wind power, are aimed at mitigating these substantial energy costs and enhancing sustainability. This proactive approach is crucial for managing operational expenses in a competitive global market.

Manufacturing and Operational Overheads for Hindalco Industries include the significant costs associated with running its extensive network of aluminum refineries, smelters, and downstream production facilities. These expenses cover everything from direct labor and essential consumables like chemicals and electrodes to ongoing repairs and maintenance crucial for keeping these complex operations running smoothly.

In fiscal year 2024, Hindalco's focus on operational efficiency played a key role in managing these overheads. For instance, the company's Aditya Birla Aluminium segment reported a strong operational performance, with its Utkal Alumina Refinery achieving a capacity utilization of 98% in Q4 FY24, demonstrating effective management of operational inputs and labor.

Capital Expenditure for Growth Projects

Hindalco's commitment to expanding its operational capacity is reflected in its significant capital expenditure plans for growth projects. These investments are crucial for maintaining its competitive edge and capturing future market opportunities.

The company has earmarked substantial funds for both existing and upcoming expansion initiatives. This includes the development of new alumina refineries, which are vital for securing raw material supply, and the establishment of copper recycling plants, aligning with sustainability goals and the circular economy. Furthermore, expansions at existing smelters are underway to boost production volumes.

Specific financial commitments highlight the scale of these ambitions:

- Hindalco plans to invest INR 40,000 crore in India, focusing on enhancing its domestic manufacturing capabilities and expanding its product portfolio.

- Novelis, Hindalco's wholly-owned subsidiary, has outlined a capital expenditure of $6 billion over a three-year period, primarily directed towards increasing its aluminum rolling and recycling capacity, particularly in North America and Europe.

These capital expenditures are strategically designed to support Hindalco's long-term growth trajectory, enabling it to meet growing demand for its products across various sectors, including automotive, construction, and packaging.

Logistics and Distribution Costs

Hindalco's cost structure is significantly influenced by logistics and distribution expenses. These include the substantial costs of transporting raw materials, such as bauxite and coal, to its various manufacturing facilities, as well as the outbound movement of finished goods like aluminum and copper to a diverse customer base across India and global markets. For instance, in the fiscal year 2023-24, freight and forwarding expenses represented a notable portion of their operational expenditures, directly impacting their profitability margins.

Optimizing these logistics is a continuous focus for Hindalco to manage costs effectively. This involves strategic decisions regarding transportation modes, route planning, and warehousing to ensure efficiency.

- Freight and transportation of raw materials to production sites.

- Distribution costs for delivering finished aluminum and copper products to domestic and international customers.

- Warehousing and inventory management linked to the supply chain.

- Costs associated with managing international shipping and customs compliance.

Hindalco's cost structure is dominated by raw material procurement, energy, and manufacturing overheads. In fiscal year 2024, the company focused on operational efficiency to manage these significant expenses, with segments like Aditya Birla Aluminium reporting high capacity utilization.

Capital expenditure, including INR 40,000 crore for domestic expansion and Novelis's $6 billion investment, also forms a key cost driver. Logistics and distribution costs, encompassing freight and warehousing, are continuously optimized to maintain profitability.

| Cost Category | Key Components | Fiscal Year 2023-24 Impact |

|---|---|---|

| Raw Material Procurement | Bauxite, coal, copper concentrate | Significant portion of expenses, sensitive to global prices |

| Energy and Power | Electricity, fuel for production | Substantial due to energy-intensive processes; renewable investments aim to mitigate costs |

| Manufacturing & Operations | Labor, consumables, maintenance | Managed through operational efficiency; Utkal Alumina Refinery achieved 98% capacity utilization in Q4 FY24 |

| Logistics & Distribution | Inbound freight, outbound shipping, warehousing | Notable portion of operational expenditures, subject to ongoing optimization |

Revenue Streams

Hindalco's primary revenue stream is the sale of primary aluminium, a key output from its extensive upstream operations. This involves marketing aluminium ingots and billets, essential raw materials for numerous industrial applications.

In the fiscal year 2023-24, Hindalco reported consolidated revenue of ₹2.15 lakh crore, with its Aluminium business contributing significantly to this figure, underscoring the importance of primary aluminium sales.

Hindalco Industries derives substantial revenue from selling value-added downstream aluminium products. These include critical items like rolled products, extrusions, and foils, vital for industries such as packaging, automotive, and construction.

The downstream segment demonstrated robust revenue expansion in fiscal year 2025, underscoring its growing importance to Hindalco's overall financial performance.

Hindalco's copper division is a significant revenue generator, primarily through the sale of copper cathodes and continuous cast rods. This segment also offers various other value-added copper products, catering to diverse industrial needs.

The company's copper business demonstrated exceptional performance, reaching its highest-ever EBITDA in FY25. This strong financial result underscores the robust demand and efficient operations within this key business segment.

Revenue from Novelis Operations

Novelis, Hindalco's subsidiary, is a significant contributor to its overall revenue through its global operations in flat-rolled aluminum products and recycling. This segment is crucial for Hindalco's financial performance.

For the fiscal year 2025, Novelis reported a substantial revenue of USD 17.1 billion. This figure underscores its importance as a primary revenue generator for the parent company.

- Global Flat-Rolled Products: Novelis is a leading producer of flat-rolled aluminum, serving diverse industries like automotive, aerospace, and packaging.

- Recycling Operations: The company's extensive recycling capabilities contribute significantly to its revenue and sustainability efforts.

- FY25 Revenue: Novelis achieved USD 17.1 billion in revenue in fiscal year 2025, highlighting its market strength.

Sales of Specialty Alumina and By-products

Hindalco Industries diversifies its revenue through the sale of specialty alumina and valuable by-products. A notable example is sulfuric acid, a high-margin by-product generated during the copper smelting process.

The company is strategically expanding its Specialty Alumina business, with ambitious plans to reach a production capacity of 1 million tonnes. This expansion is specifically targeting applications that command higher value and offer greater profitability.

- Specialty Alumina Sales: Targeting 1 million tonnes capacity for high-value applications.

- By-product Revenue: Including sulfuric acid from copper smelting operations.

Hindalco's revenue streams are robust, driven by its integrated operations in aluminium and copper, alongside its global subsidiary, Novelis. The company's strategic focus on value-added products and expanding specialty alumina capacity further bolsters its financial performance.

| Revenue Stream | Key Products/Services | FY25 Contribution (Illustrative) | Notes |

| Primary Aluminium | Ingots, Billets | Significant portion of consolidated revenue | Core upstream business |

| Downstream Aluminium | Rolled products, Extrusions, Foils | Robust growth | Serves packaging, automotive, construction |

| Copper | Cathodes, Continuous Cast Rods | Highest ever EBITDA in FY25 | Includes value-added products |

| Novelis (Global) | Flat-rolled aluminum products, Recycling | USD 17.1 billion revenue | Leading global player |

| Specialty Alumina & By-products | Specialty Alumina, Sulfuric Acid | Targeting 1 million tonnes capacity for specialty alumina | High-margin focus |

Business Model Canvas Data Sources

The Hindalco Industries Business Model Canvas is constructed using a blend of internal financial disclosures, extensive market research reports, and operational data. This ensures a robust foundation for understanding the company's strategic positioning and future growth drivers.