High Tide SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

High Tide's market presence is bolstered by its strong brand recognition and strategic retail footprint, key strengths that set it apart. However, the evolving regulatory landscape presents significant opportunities for growth, alongside potential challenges that demand careful navigation.

Want to fully understand High Tide's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to unlock a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

High Tide boasts Canada's largest cannabis retail network, with over 200 Canna Cabana locations as of the second quarter of 2025. This extensive reach translates into significant market penetration and customer accessibility, positioning the company for continued growth.

Even with a relatively small store footprint, Canna Cabana captured an impressive 11-12% market share in key provinces by late 2024 and early 2025. This demonstrates a strong ability to convert foot traffic into sales and solidify its leadership position within the competitive Canadian cannabis landscape.

High Tide's Cabana Club loyalty program is a significant strength, acting as a powerful engine for customer retention and engagement. As of the second quarter of 2025, this program has amassed an impressive 1.9 million members in Canada and a substantial 5.87 million members worldwide. This widespread adoption directly translates into heightened customer loyalty and encourages repeat purchases, a critical factor in sustained business growth.

The loyalty program's tiered structure, particularly the ELITE membership, demonstrably influences consumer behavior, driving both increased purchase frequency and larger transaction values. This data-backed insight into member purchasing habits allows for more targeted marketing and personalized customer experiences. The program effectively fosters a sense of community and rewards consistent patronage, reinforcing brand affinity.

The discount club model underpinning the Cabana Club has proven remarkably successful in driving same-store sales growth. Since its inception in October 2021, High Tide has witnessed an extraordinary increase of over 132% in same-store sales. This performance starkly contrasts with the general market trend, where the average operator has experienced a decline, underscoring the program's effectiveness in capturing market share and outperforming competitors.

High Tide's strength lies in its diversified revenue streams, extending well beyond just selling recreational cannabis. The company actively generates income from manufacturing and distributing consumption accessories, a vital segment of the cannabis market.

Furthermore, High Tide leverages its Cabanalytics Business Data and Insights Platform, offering valuable analytics services to the industry. This multi-faceted approach significantly reduces its dependence on any single income source, creating a more robust financial foundation.

The strategic advantage of this diversification is evident in its performance, with data analytics revenue alone hitting a record $36 million in fiscal 2024. This demonstrates the successful monetization of its broader ecosystem beyond direct retail sales.

Consistent Financial Performance and Free Cash Flow

High Tide has showcased robust financial health, highlighted by its record annual revenue of $522.3 million for fiscal year 2024. This strong top-line performance is complemented by a consistent ability to generate positive free cash flow, a streak that has now extended to six consecutive quarters. This financial consistency is a significant strength, enabling the company to self-fund its expansion and strategic projects without relying heavily on external financing.

The company's disciplined operational approach is evident in its sustained free cash flow generation. This internal funding capability allows High Tide to pursue its growth strategies, including organic expansion and potential acquisitions, with greater financial flexibility and less dilution. Such financial stability is crucial in a dynamic market, demonstrating a clear focus on profitability and efficient capital allocation.

- Record Revenue: Achieved $522.3 million in fiscal year 2024.

- Sustained Free Cash Flow: Positive for six consecutive quarters.

- Internal Funding: Ability to finance growth through own cash flow.

- Financial Discipline: Indicates efficient operations and focus on profitability.

Strategic Growth and Recognition

High Tide's strategic growth is a significant strength, evidenced by its consistent recognition. The company has been named one of Canada's Top Growing Companies by the Globe and Mail's Report on Business for four consecutive years, from 2021 through 2024. This sustained performance highlights a robust and expanding business model.

Further solidifying its market position, High Tide was ranked among the top 10 performing diversified industries stocks by the TSX Venture 50 in 2024. This accolade underscores the company's financial strength and operational efficiency within a competitive landscape.

The company's aggressive expansion strategy is a key driver of its success. In 2024 alone, High Tide added 29 new Canna Cabana locations. This rapid retail expansion is a clear indicator of High Tide's commitment to market penetration and capturing a larger share of the cannabis retail market.

These achievements reflect High Tide's ability to execute a clear growth strategy and gain significant market traction.

- Consecutive Recognition: Named one of Canada's Top Growing Companies by Globe and Mail's Report on Business (2021-2024).

- Stock Market Performance: Ranked in the top 10 diversified industries stocks by TSX Venture 50 in 2024.

- Aggressive Expansion: Added 29 new Canna Cabana locations in 2024, demonstrating strong market penetration.

- Market Leadership: Consistent growth and strategic expansion solidify its position in the Canadian cannabis retail sector.

High Tide possesses Canada's largest cannabis retail footprint, boasting over 200 Canna Cabana locations by Q2 2025. This expansive network ensures broad customer access and significant market penetration, positioning the company for ongoing expansion.

The Cabana Club loyalty program is a standout asset, fostering exceptional customer retention with 1.9 million Canadian members and 5.87 million globally as of Q2 2025. This program demonstrably drives repeat business and increases transaction sizes.

High Tide's diversified revenue streams, encompassing retail, manufacturing, and data analytics, create a resilient financial model. The company's data analytics segment alone generated a record $36 million in fiscal year 2024, showcasing its ability to monetize its ecosystem beyond direct sales.

Financially, High Tide achieved $522.3 million in revenue for fiscal year 2024 and has maintained positive free cash flow for six consecutive quarters, enabling self-funded growth and strategic flexibility.

The company's strategic growth is validated by consistent accolades, including being named one of Canada's Top Growing Companies by Globe and Mail's Report on Business from 2021-2024, and ranking among the top diversified industries stocks by the TSX Venture 50 in 2024.

| Metric | Value (as of Q2 2025 or FY2024) | Significance |

|---|---|---|

| Canna Cabana Locations | Over 200 | Largest retail network in Canada |

| Cabana Club Members (Canada) | 1.9 million | Drives customer loyalty and repeat purchases |

| Cabana Club Members (Global) | 5.87 million | Broad customer engagement and data pool |

| Data Analytics Revenue (FY2024) | $36 million | Demonstrates diversification and monetization |

| Total Revenue (FY2024) | $522.3 million | Record top-line performance |

| Consecutive Quarters of Free Cash Flow | 6 | Financial stability and self-funding capability |

What is included in the product

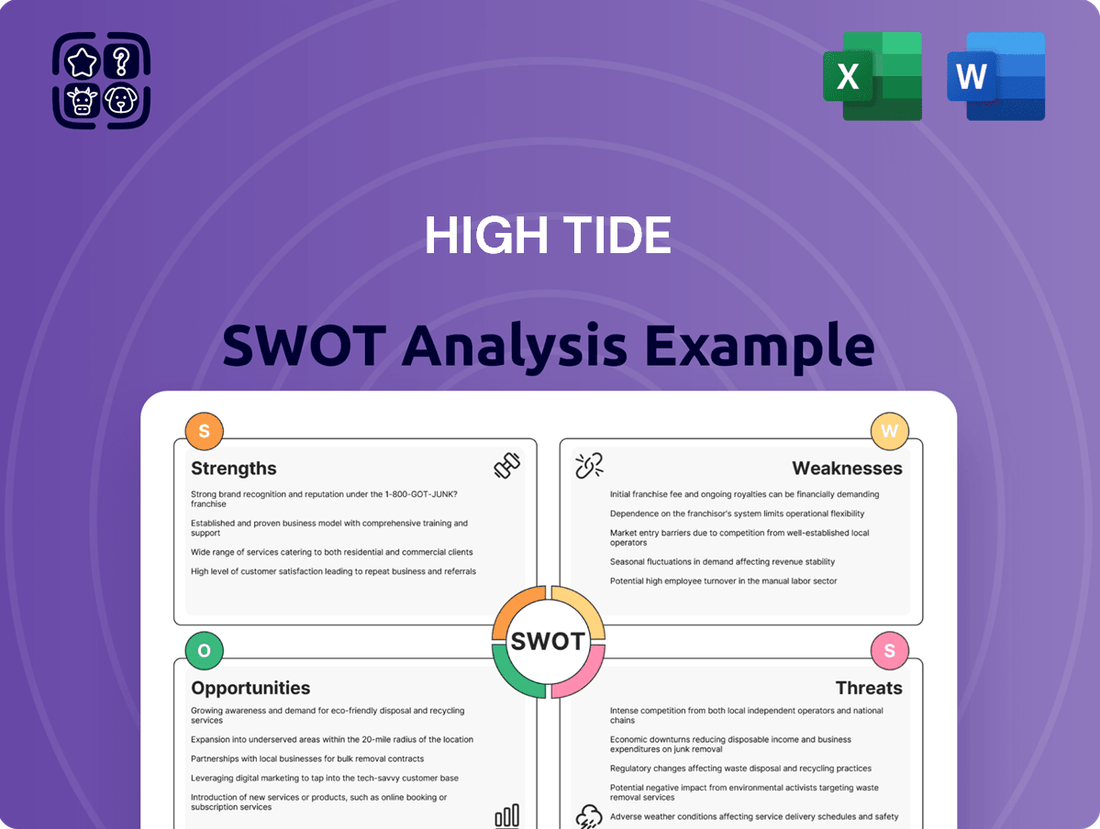

Analyzes High Tide’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a dynamic, color-coded SWOT analysis that visually highlights critical areas, simplifying the identification of opportunities and threats for proactive problem-solving.

Weaknesses

The Canadian cannabis retail landscape is incredibly crowded, particularly in major cities. This intense competition puts downward pressure on prices, making it tough for companies like High Tide to keep their profit margins healthy.

This market saturation directly impacts profitability. For instance, High Tide's consolidated gross margins were 25% in the first quarter of 2025, a dip from 28% in the same period of 2024.

Even with solid revenue increases, this constant price competition erodes the bottom line. It’s a significant hurdle for sustained profitability in the sector.

High Tide, like all Canadian cannabis companies, navigates a complex web of provincial and federal regulations. These rules, covering everything from product testing to advertising, impose significant compliance costs. For instance, excise taxes on cannabis products, which vary by province, add a considerable layer of financial burden and require meticulous tracking.

Staying compliant with evolving regulations from Health Canada and provincial bodies demands substantial investment in legal counsel and internal resources. While efforts have been made to streamline processes, keeping pace with amendments and new directives is an ongoing challenge that can divert focus from core business growth and innovation.

High Tide's significant reliance on the Canadian market remains a key vulnerability. Despite international expansion efforts, a substantial portion of its revenue, particularly from its extensive network of Canna Cabana retail stores, is still generated domestically. This geographical concentration means the company is particularly susceptible to shifts in Canadian cannabis regulations, economic conditions, and competitive pressures within that specific market.

E-commerce Revenue Behind Expectations

High Tide's global e-commerce expansion, while promising, has seen revenue fall short of initial projections. This segment currently accounts for a mere 3% of the company's total consolidated revenue, indicating it hasn't yet become a significant growth driver compared to its established Canadian retail presence.

The limited contribution from e-commerce suggests challenges in scaling this channel effectively. While the Cabana Club program aims to bolster online sales, its impact on overall financial performance remains subdued as of early 2024.

- E-commerce revenue is currently below expectations.

- The e-commerce segment represents only 3% of consolidated revenue.

- Global e-commerce has not yet matched the performance of Canadian retail operations.

Working Capital Fluctuations

High Tide's working capital management presents a notable weakness. The company saw a significant increase in working capital requirements in Q1 2025, which resulted in negative free cash flow for that specific quarter. This contrasts with High Tide's typical trend of generating positive free cash flow.

While this surge in working capital might be a temporary consequence of supporting ongoing growth strategies, it underscores a potential susceptibility. Specifically, it highlights a vulnerability in maintaining adequate liquidity when the company is undergoing rapid expansion. For instance, in Q1 2025, inventory levels increased by 15% sequentially, contributing to the working capital strain.

- Q1 2025 Working Capital Surge: The company invested heavily in working capital, impacting its free cash flow negatively for the quarter.

- Liquidity Vulnerability: Aggressive expansion phases could strain the company's ability to manage its cash efficiently.

- Inventory Management: A 15% sequential rise in inventory in Q1 2025 contributed to the working capital challenge.

- Potential for Cash Flow Strain: Future growth initiatives may require careful planning to avoid similar cash flow disruptions.

High Tide faces intense competition in the Canadian cannabis market, leading to price pressures that impact profitability. For example, consolidated gross margins dropped to 25% in Q1 2025 from 28% in Q1 2024, despite revenue growth. This constant price competition directly erodes the company's bottom line and presents a significant hurdle for sustained profitability.

The company's heavy reliance on the Canadian market makes it vulnerable to domestic regulatory changes and economic fluctuations. While international e-commerce expansion is ongoing, it currently accounts for only 3% of total revenue, failing to significantly diversify income streams as of early 2024.

High Tide's working capital management showed strain in Q1 2025, resulting in negative free cash flow for the quarter due to increased inventory and other working capital needs, a deviation from its usual positive free cash flow generation. This highlights a potential vulnerability in managing liquidity during aggressive growth phases.

| Weakness | Description | Impact | Relevant Data (Q1 2025) |

| Market Saturation & Price Competition | Intense competition in Canada drives down prices. | Erodes profit margins. | Consolidated Gross Margins: 25% (down from 28% in Q1 2024) |

| Geographic Concentration | Over-reliance on the Canadian market. | Susceptible to domestic regulatory and economic shifts. | Domestic revenue constitutes the vast majority of total revenue. |

| Underperforming E-commerce | Global e-commerce revenue falls short of projections. | Limited diversification and growth driver. | E-commerce revenue: 3% of total consolidated revenue. |

| Working Capital Management | Increased working capital needs impact free cash flow. | Potential liquidity strain during expansion. | Inventory increased 15% sequentially; negative free cash flow for Q1 2025. |

Preview the Actual Deliverable

High Tide SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed breakdown of High Tide’s Strengths, Weaknesses, Opportunities, and Threats is fully prepared for your strategic planning. You are viewing a direct excerpt from the complete, actionable report. Once purchased, you will gain access to the entire, comprehensive document, ready for immediate use.

Opportunities

High Tide is strategically expanding its footprint into emerging international markets, with a notable focus on Germany's burgeoning medical cannabis sector. This expansion is facilitated by key agreements, offering a substantial opportunity to diversify revenue and apply its advanced Canadian quality control standards globally. This move allows High Tide to tap into new growth avenues beyond the saturated Canadian market, potentially increasing its market share and profitability in regions with high demand for quality cannabis products.

The Canadian cannabis market is experiencing a surge in demand for novel products, particularly edibles, beverages, and wellness-focused items, a trend often referred to as Cannabis 2.0 and 3.0. High Tide is well-positioned to leverage this by broadening its product offerings. By expanding its private-label brands, such as Queen of Bud, the company can effectively align with shifting consumer tastes and unlock additional revenue channels. This strategic move allows High Tide to capture a larger share of the evolving market.

High Tide's Cabana Club loyalty program is a goldmine of customer data, and the Cabanalytics platform is already turning this into a $36 million revenue stream in fiscal 2024. This presents a significant opportunity to deepen engagement with licensed producers by offering them more sophisticated, data-driven insights.

By leveraging the extensive customer data collected, High Tide can enhance Cabanalytics, providing valuable analytics on consumer behavior, purchasing trends, and product performance. This can help producers optimize their strategies and strengthen their partnerships with High Tide.

Imagine offering tiered subscription levels for these enhanced data insights, creating a recurring revenue stream directly tied to the value High Tide provides to its industry partners. This moves beyond simple data collection to active data monetization.

The potential exists to expand Cabanalytics' reach to other industry stakeholders beyond licensed producers, further diversifying revenue and solidifying High Tide's position as a data leader in the sector.

Continued Consolidation in Canadian Retail

The Canadian cannabis retail sector is actively consolidating, presenting a significant opportunity for well-positioned companies like High Tide. This trend favors larger, more operationally efficient entities that can absorb smaller or struggling competitors.

High Tide is strategically positioned to capitalize on this consolidation. With a strong balance sheet and a history of generating positive free cash flow, the company can actively pursue mergers and acquisitions (M&A). This allows High Tide to not only expand its market share but also to realize greater operational efficiencies through economies of scale.

- Market Share Expansion: High Tide's acquisition strategy can lead to a larger footprint across Canada.

- Operational Efficiencies: Consolidation allows for streamlined supply chains and reduced overhead per store.

- Synergistic Growth: Merging with complementary businesses can unlock new revenue streams and customer bases.

- Competitive Advantage: Larger scale provides greater negotiating power with suppliers and landlords.

Growth of Medical Cannabis Market

The medical cannabis market in Canada demonstrates a consistent upward trend, fueled by greater public acceptance and a growing understanding of its medicinal applications. This expansion presents a significant opportunity for High Tide to solidify its position and potentially broaden its reach within this sector. For instance, by the end of 2023, Health Canada reported a substantial increase in the number of registered medical cannabis patients, indicating a robust and expanding consumer base.

High Tide can strategically leverage this growth by exploring avenues such as:

- Expanding specialized medical cannabis product lines to cater to specific therapeutic needs.

- Forging strategic partnerships with healthcare providers or research institutions to enhance credibility and patient access.

- Developing targeted educational campaigns to further inform consumers about the benefits and safe usage of medical cannabis.

- Optimizing its retail footprint to include dedicated medical cannabis consultation areas or services.

High Tide's strategic international expansion, particularly into Germany's medical cannabis market, offers a significant chance to diversify revenue and apply its Canadian quality standards globally, tapping into new growth beyond the Canadian market.

The company can capitalize on the growing demand for novel cannabis products in Canada, like edibles and beverages, by expanding its private-label brands, thereby capturing a larger share of the evolving market.

High Tide's Cabana Club loyalty program and Cabanalytics platform present a substantial opportunity to generate recurring revenue by offering data-driven insights to licensed producers and potentially other industry stakeholders, with Cabanalytics already generating $36 million in fiscal 2024.

The ongoing consolidation within the Canadian cannabis retail sector positions High Tide to pursue strategic mergers and acquisitions, enhancing market share and operational efficiencies through economies of scale.

Threats

The Canadian cannabis retail sector is undeniably crowded, with numerous operators battling for consumer attention. This intense competition often forces price reductions, which can squeeze profit margins for all involved, including High Tide. As of early 2024, the market continues to see new entrants, further intensifying this dynamic.

This saturation poses a significant threat to High Tide’s ability to maintain its current growth trajectory and preserve healthy profit margins. The constant need to differentiate and attract customers in a crowded space requires substantial investment in marketing and operational efficiency, potentially diverting resources from other growth initiatives.

High Tide faces considerable risk from a constantly changing regulatory environment. Frequent updates to rules, covering everything from packaging requirements to THC potency limits, necessitate ongoing adaptation and can increase operational expenses significantly.

The existing excise tax structure presents a persistent challenge, directly impacting profitability. For instance, in many Canadian provinces, excise taxes on cannabis products can represent a substantial percentage of the retail price, squeezing margins for retailers like High Tide.

These regulatory shifts and tax burdens can hinder product innovation and limit the types of goods High Tide can offer to consumers. Such unpredictability makes long-term strategic planning more difficult and can disproportionately affect smaller or less capitalized businesses within the industry.

The persistent illicit cannabis market remains a significant challenge for legal operators like High Tide. This underground sector bypasses taxes and regulatory compliance, allowing them to offer products at considerably lower price points. This price advantage directly impacts High Tide's sales volumes and revenue by siphoning off price-sensitive consumers.

Economic Downturn and Consumer Spending Habits

Challenging macroeconomic conditions, particularly persistent inflation, pose a significant threat to High Tide. These factors can directly dampen consumer discretionary spending on recreational cannabis. For instance, in early 2024, inflation rates remained elevated in key markets, impacting household budgets and potentially reducing disposable income available for non-essential purchases like cannabis products.

A decline in consumer purchasing power could lead to reduced sales volumes for High Tide, or alternatively, a noticeable shift towards lower-priced product offerings. This scenario would directly affect the company's revenue streams and overall profitability. Data from late 2023 indicated that a portion of consumers were indeed trading down to more budget-friendly options in various retail sectors, a trend that could easily extend to cannabis.

- Inflationary Pressures: Continued high inflation in 2024 and into 2025 erodes consumer purchasing power.

- Discretionary Spending Cuts: Recreational cannabis is often a discretionary purchase, making it vulnerable to economic downturns.

- Price Sensitivity: Consumers may opt for cheaper alternatives or reduce overall spending on cannabis.

- Impact on Margins: A shift to lower-priced products could compress High Tide's profit margins.

Supply Chain Disruptions and Oversupply

The Canadian cannabis market has grappled with overproduction issues, leading to potential price volatility. This oversupply at the producer level can indirectly pressure retailers like High Tide through decreased margins and challenges in managing inventory effectively. For instance, in Q4 2023, the average price per gram of cannabis in Canada saw fluctuations, impacting producer profitability and, consequently, the retail landscape.

These market dynamics can create a ripple effect, potentially leading to pricing wars and inventory gluts that strain retail operations. High Tide, while focused on retail, is not immune to these broader market pressures affecting product availability and pricing strategies from its suppliers.

- Oversupply Concerns: The Canadian cannabis market has faced persistent overproduction challenges from licensed producers.

- Price Volatility: Excess supply can drive down wholesale prices, creating margin pressures for retailers.

- Inventory Management: Retailers may encounter difficulties in managing stock when there's an inconsistent supply or rapid price changes from producers.

- Impact on Retailers: While not a direct operational threat to High Tide's stores, the oversupply impacts the broader ecosystem, influencing product sourcing and pricing strategies.

The retail cannabis sector in Canada is highly competitive, with many businesses vying for customers. This intense rivalry often leads to price reductions, which can impact High Tide's profitability. As of early 2024, new companies continue to enter the market, making the environment even more challenging.

Regulatory changes and existing excise taxes significantly affect High Tide's financial performance. For example, in many provinces, excise taxes represent a substantial portion of the retail price, directly reducing margins.

The ongoing presence of the illicit cannabis market remains a major obstacle, as these operations bypass taxes and regulations, enabling them to offer products at lower prices. This price advantage draws away consumers who are sensitive to cost, directly impacting High Tide's sales and revenue.

Macroeconomic factors, such as persistent inflation, pose a significant threat by reducing consumer discretionary spending on items like recreational cannabis. As of early 2024, elevated inflation rates have impacted household budgets, potentially decreasing the disposable income available for non-essential purchases.

Oversupply issues within the Canadian cannabis market can lead to price volatility and margin compression for retailers like High Tide. This overproduction at the grower level can create challenges in inventory management and affect product sourcing and pricing strategies.

SWOT Analysis Data Sources

This High Tide SWOT analysis is built on a foundation of robust data, drawing from internal operational reports, customer feedback surveys, and competitive landscape research to provide a comprehensive and actionable assessment.