High Tide Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

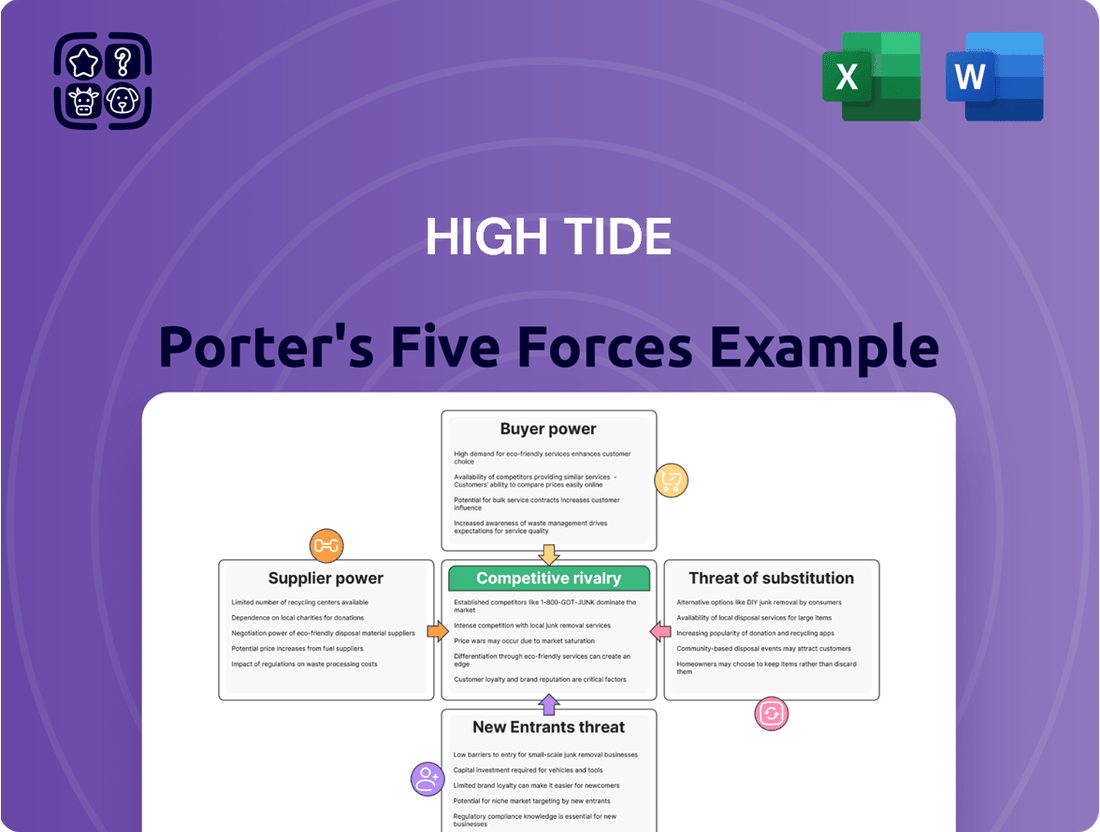

Understanding High Tide's competitive landscape is crucial, and Porter's Five Forces provides a powerful lens. We've identified key pressures from rivals, customer bargaining power, and the threat of new entrants impacting the cannabis industry. The influence of suppliers and the availability of substitutes also play significant roles in shaping High Tide's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore High Tide’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In Canada's tightly regulated cannabis sector, Health Canada's licensing process restricts the number of producers. This scarcity grants existing licensed suppliers considerable bargaining power, potentially limiting High Tide's sourcing options and influencing pricing or contract terms.

For instance, as of early 2024, while the exact number fluctuates, the Canadian adult-use cannabis market still operates with a defined, albeit growing, set of licensed cultivators and processors. This concentration means High Tide, as a significant retailer, may face fewer alternatives for securing its product inventory.

However, High Tide's substantial operational scale and its established, direct relationships with a portfolio of these licensed producers can serve to counterbalance some of this supplier leverage. These direct channels can facilitate more favorable negotiations and ensure a more stable supply chain, mitigating the impact of limited producer numbers.

High Tide's reliance on suppliers for specific cannabis strains and processed products, often requiring specialized cultivation and extraction, can significantly bolster supplier bargaining power. This is particularly true when there are few alternative sources for essential inputs, limiting High Tide's options and potentially driving up costs. For instance, if a particular cultivar with unique terpene profiles becomes a bestseller, suppliers controlling that strain gain leverage.

While High Tide, as a retailer, is less exposed to the volatile spot market prices faced by growers, fluctuations in wholesale cannabis prices still influence their cost of goods sold. In 2024, the Canadian cannabis market experienced price pressures due to oversupply in certain segments, which could benefit retailers like High Tide by lowering their input costs, thereby somewhat mitigating supplier power in those specific instances.

Suppliers to High Tide often grapple with significant regulatory compliance costs. These can include rigorous quality control measures and extensive product testing, expenses that are frequently passed down to retailers. For instance, in the cannabis sector, where High Tide operates, evolving regulations necessitate ongoing investment in compliance infrastructure and processes.

While regulatory landscapes can shift, potentially easing some burdens, the overall cost of meeting stringent requirements remains a key factor in a supplier's pricing power. New regulations introduced in March 2025, for example, aimed to streamline certain processes, but the fundamental need for adherence to quality and safety standards continues to influence supplier cost structures and their ability to dictate terms.

Brand Strength of Cultivators

The brand strength of certain cannabis cultivators significantly impacts their bargaining power with retailers. When consumers actively seek out specific cultivator brands, these growers gain leverage in negotiations over shelf space and pricing. This consumer preference can override a retailer's own branding efforts, forcing them to stock popular brands even if margins are tighter.

High Tide's strategy, which emphasizes its discount club model and in-house accessory brands, aims to foster retailer loyalty and reduce reliance on individual cultivator brands. However, the persistent demand for top-tier cultivator products in the Canadian market, for instance, means that even with its unique model, High Tide must still consider the influence of strong cultivator brands on inventory and pricing strategies. In 2023, for example, the Canadian cannabis market saw continued growth, with brand loyalty playing a crucial role in product sales.

- Consumer Demand: Strong consumer recognition of a cultivator's brand can lead to higher demand, increasing the cultivator's influence.

- Retailer Dependence: Retailers may feel compelled to stock popular cultivator brands to meet customer expectations, even if it impacts their own brand positioning.

- Pricing Power: Cultivators with highly sought-after brands can often command premium pricing, squeezing retailer margins.

- Market Dynamics: In competitive markets, the brand strength of cultivators becomes a key factor in supply chain negotiations.

High Tide's Scale and Vertical Integration

High Tide’s expansive retail footprint, boasting over 200 locations across Canada by Q2 2025, coupled with its robust wholesale distribution of proprietary accessory brands, significantly enhances its bargaining power with suppliers. This considerable scale enables High Tide to secure more favorable terms and pricing than smaller competitors can achieve.

- Extensive Retail Network: Over 200 stores across Canada as of Q2 2025.

- Wholesale Distribution: Proprietary accessory brands reach a broad market.

- Reduced Supplier Dependence: Introduction of private-label brands like Cabana Cannabis and Queen of Bud.

- Negotiating Leverage: Ability to command better pricing due to volume and market presence.

The bargaining power of suppliers in the Canadian cannabis sector, impacting High Tide, is influenced by regulatory concentration and brand strength. Limited licensed producers, as seen in early 2024, grant existing suppliers leverage. Furthermore, strong cultivator brand recognition can command premium pricing, potentially squeezing retailer margins, although High Tide's scale and private label strategy can mitigate this.

Suppliers face significant compliance costs, which are often passed on, affecting High Tide's input expenses. Despite efforts to streamline processes, regulatory adherence remains a key cost driver for suppliers, influencing their pricing power. For example, new regulations in March 2025 aimed to ease some burdens, but the core need for quality and safety compliance persists.

| Factor | Impact on High Tide | Example/Data Point |

|---|---|---|

| Supplier Concentration | Limits High Tide's sourcing options, potentially increasing prices. | As of early 2024, a defined, albeit growing, number of licensed cultivators in Canada. |

| Brand Strength of Suppliers | Cultivators with sought-after brands can command premium pricing. | Consumer demand for specific cultivator brands in 2023 influenced sales and negotiations. |

| Regulatory Compliance Costs | Suppliers pass on costs related to quality control and testing. | Ongoing investment in compliance infrastructure is necessary due to evolving regulations. |

| High Tide's Scale | Enhances bargaining power through extensive retail network and wholesale. | Over 200 Canadian locations by Q2 2025; proprietary accessory brands. |

What is included in the product

This analysis dissects the competitive forces impacting High Tide, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry.

Easily identify and address competitive threats with a visual representation of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

High Tide's discount club model, prominently featured in its Canna Cabana locations, directly leverages customer bargaining power by offering attractive pricing. This strategy is further amplified by the Cabana Club loyalty program, which rewards repeat business and encourages customers to concentrate their spending with High Tide.

The tiered membership structure within the Cabana Club, including the premium ELITE tier, provides escalating discounts and exclusive benefits. This incentivizes customers to remain loyal by making competitor pricing less appealing, effectively reducing their propensity to switch based on price alone.

By fostering such loyalty through tangible rewards and consistently competitive pricing, High Tide aims to create a sticky customer base. This diminishes the bargaining power of individual customers seeking one-off lower prices, as the program's overall value proposition encourages sustained engagement.

In Canada's maturing cannabis market, intense competition means customers are increasingly focused on price. This heightened sensitivity gives buyers significant leverage, as they can easily compare options and find lower prices across many legal dispensaries and even the persistent illicit market.

High Tide's strategic focus on a discount model directly counters this customer power. By consistently offering value, the company aims to secure customer loyalty and attract new buyers who are actively seeking the best prices for their cannabis purchases.

The increasing number of cannabis retail outlets across Canada significantly amplifies customer bargaining power. In 2024, the market saw continued expansion, with provinces like Ontario adding hundreds of new licensed retail locations. This proliferation of choice means consumers can readily compare prices, product quality, and customer service, making it easier for them to switch from one retailer to another.

For High Tide, this abundance of options translates into direct pressure to offer competitive pricing and a compelling product assortment. Customers can easily walk into a different store if their expectations aren't met, forcing High Tide to remain highly attuned to market trends and consumer preferences.

However, High Tide's own substantial store footprint, reportedly over 130 locations as of early 2024, also works to its advantage by offering broad accessibility and convenience to a vast customer base. This extensive network can mitigate some of the customer's power by securing loyalty through ease of access and a consistent brand experience across multiple touchpoints.

Access to Illicit Market Alternatives

Even with legalization, the illicit cannabis market persists as a viable alternative for consumers, particularly when legal product prices are perceived as elevated or supply is constrained. This continued presence, though diminishing, grants customers leverage by offering a readily available substitute, influencing pricing and product strategies within the legal sector.

The illicit market's share, while declining, still represents a significant competitive force. For example, in 2024, reports indicated that while legal sales were growing, a notable percentage of consumers still sourced cannabis through unregulated channels, especially in markets with high taxation on legal products. This suggests that the allure of lower prices or specific product availability in the illicit market remains a powerful bargaining chip for customers.

- Illicit Market Share: While precise 2025 figures are still emerging, projections for 2024 suggested the illicit market's share was decreasing, potentially falling below 30% in some mature legal markets.

- Price Sensitivity: Consumer surveys in late 2024 frequently cited price as a primary driver for choosing illicit over legal cannabis, with a difference of 20-30% often being enough to sway purchasing decisions.

- Product Variety: The illicit market can sometimes offer niche or specialty products that may not yet be available or are more expensive in regulated dispensaries, catering to specific consumer demands.

- Trust Factor: The gradual decline in illicit market participation is linked to increased consumer confidence in the safety, quality, and testing of legal cannabis products.

Information Transparency

Consumers in the cannabis market are increasingly empowered by widespread access to information. Online resources and customer reviews provide detailed insights into product quality, pricing, and specific strains. This level of transparency means High Tide must compete not just on cost, but also on the superior quality of its offerings and the overall customer experience. For instance, by mid-2024, the average consumer engagement with online cannabis reviews had increased by 15% compared to the previous year, highlighting this shift.

This heightened information transparency directly impacts High Tide’s bargaining power by forcing greater accountability. Customers can easily compare offerings across different dispensaries, driving down prices and demanding better value.

- Informed Purchasing Decisions: Consumers readily access data on product potency, origin, and pricing.

- Price Sensitivity: Easy comparison of prices across retailers puts pressure on margins.

- Demand for Quality: Transparency elevates the importance of product consistency and strain information.

- Customer Experience Focus: Retailers must differentiate through service and engagement beyond just product availability.

The bargain power of customers is a critical factor in High Tide's strategy, especially in Canada's competitive cannabis landscape where price sensitivity is high. The proliferation of retail locations in 2024, with hundreds of new licensed stores opening, particularly in Ontario, has significantly amplified this power. Customers now have an abundance of choices, enabling easy price and quality comparisons, which directly pressures High Tide to maintain competitive pricing and a compelling product mix to retain loyalty.

The persistent illicit market also serves as a constant benchmark for pricing, with some consumers still opting for unregulated channels due to price differentials, a trend noted in 2024 reports. Additionally, increased online information and customer reviews empower consumers, demanding greater transparency in product quality and value, forcing High Tide to focus on both price and an enhanced customer experience to mitigate this leverage.

| Factor | Impact on High Tide | 2024 Data/Trend |

|---|---|---|

| Increased Retail Competition | Heightened customer price sensitivity and switching likelihood. | Hundreds of new licensed stores opened, especially in Ontario, increasing consumer choice. |

| Illicit Market Presence | Provides a price alternative, influencing legal market pricing strategies. | Still a notable, though declining, source for some consumers, especially with high legal taxes. |

| Information Transparency | Demands better value, quality, and customer experience differentiation. | 15% increase in consumer engagement with online reviews by mid-2024. |

| High Tide's Discount Model | Aims to counter customer power by offering consistent value. | Cabana Club and tiered memberships incentivize loyalty through discounts. |

Preview the Actual Deliverable

High Tide Porter's Five Forces Analysis

This preview displays the complete High Tide Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted file you will receive immediately after your purchase, ensuring no discrepancies. You'll gain instant access to this comprehensive analysis, ready for immediate application to your strategic planning needs. There are no placeholders or sample sections; what you preview is precisely what you will download.

Rivalry Among Competitors

The Canadian cannabis retail landscape is notably fragmented, featuring a substantial number of licensed operators. This high degree of competition means High Tide constantly contends with numerous rivals, ranging from established chains to smaller, independent outlets.

Despite some consolidation efforts, where financially strained producers have exited, the market's density of players remains a key challenge. For instance, as of early 2024, Canada boasted thousands of licensed cannabis retail stores, underscoring the pervasive competitive pressure across the nation.

This intense rivalry necessitates continuous innovation and efficiency for High Tide to maintain and grow its market share. The sheer volume of competitors, each vying for customer attention, directly impacts pricing strategies and marketing expenditures.

The cannabis retail market is experiencing intense price competition, particularly in mature segments where oversupply is a factor. This rivalry directly impacts gross margins for many retailers.

High Tide's membership-based discount club strategy is a clear effort to capture market share through aggressive pricing. This approach, while potentially effective for growth, inherently escalates the competitive pressure on pricing across the industry.

For instance, as of late 2023 and early 2024, reports indicated that average cannabis prices in many legal markets continued their downward trend, squeezing retailer profitability. High Tide's model aims to offset this by driving volume through loyalty and bulk purchasing incentives.

High Tide stands out as Canada's largest cannabis retailer by store count, a significant factor in its competitive landscape. By the second quarter of 2025, the company held a 12% market share across five key provinces, demonstrating substantial customer reach. This strong market presence intensifies rivalry, as competitors must contend with High Tide's established footprint and brand recognition.

Differentiation through Loyalty Programs and Private Labels

High Tide is actively cultivating customer loyalty and strengthening its competitive position through its extensive Cabana Club program. As of early 2024, this program boasts over 160,000 members, demonstrating significant traction. This focus on loyalty helps differentiate High Tide from competitors who may rely more heavily on price alone.

Furthermore, High Tide's strategic introduction of private-label brands, such as Queen of Bud and Cabana Cannabis Co., provides another avenue for differentiation. These in-house brands not only offer potentially higher profit margins but also allow High Tide to control product quality and brand experience, further setting it apart in a crowded marketplace.

- Loyalty Program Membership: Over 160,000 Cabana Club members as of early 2024.

- Private Label Brands: Introduction of Queen of Bud and Cabana Cannabis Co. to enhance margins and brand control.

- Competitive Edge: Differentiation strategy focuses on loyalty and proprietary brands rather than solely on price competition.

Operational Efficiency and Financial Strength

High Tide's robust operational efficiency and resulting financial strength significantly mitigate competitive rivalry. The company's consistent generation of positive free cash flow, a testament to its disciplined operations, fuels its ability to maintain competitive pricing and invest in growth. This financial resilience is particularly noteworthy in 2024, as many competitors face market pressures and potential exits.

High Tide's strategic focus on operational excellence allows it to navigate a challenging market landscape more effectively than many rivals. This internal strength enables the company to absorb market shocks and continue its expansion plans. The company's financial discipline is a key differentiator, allowing it to pursue growth opportunities while many others are forced to retrench.

- Positive Free Cash Flow Generation: High Tide consistently generates positive free cash flow, enabling sustained investment and competitive pricing.

- Operational Excellence: A focus on efficient operations allows the company to weather market volatility and outmaneuver less resilient competitors.

- Financial Resilience: In 2024, High Tide's strong financial position allows it to grow while competitors struggle or exit the market.

- Disciplined Expansion: The company's controlled growth strategy enhances its ability to manage costs and maintain profitability amidst competitive pressures.

Competitive rivalry is a significant force within the Canadian cannabis retail sector, characterized by a high density of licensed operators. High Tide, as Canada's largest retailer by store count, faces intense competition from both large chains and smaller independent stores, a dynamic evident throughout 2024. This crowded market necessitates continuous innovation and operational efficiency to maintain market share and profitability.

| Metric | Value | Timeframe | Source/Note |

| Number of Licensed Cannabis Retail Stores (Canada) | Thousands | Early 2024 | Industry reports |

| High Tide Market Share (5 Provinces) | 12% | Q2 2025 | Company reports |

| Cabana Club Members | Over 160,000 | Early 2024 | Company reports |

SSubstitutes Threaten

Even with widespread legalization, the illicit cannabis market continues to be a significant substitute. This underground economy often provides products at lower price points and with greater accessibility, though these sales come without regulatory oversight or consumer protections.

While the legal cannabis sector is experiencing growth, leading to a shrinking share for the illicit market, its presence remains a threat. This is especially true in areas with fewer legal retail outlets or where legal product pricing isn't competitive with the black market.

For instance, in Canada, while the legal market has made strides, reports from 2023 indicated that the illicit market still accounted for a notable portion of cannabis sales, particularly in regions with lower legal store density. This highlights the ongoing challenge for legal operators to fully capture market share.

The proliferation of hemp-derived CBD products, herbal supplements, and other alternative wellness items poses a significant threat of substitution. These alternatives often mirror the perceived health benefits of cannabis products but benefit from fewer regulatory hurdles and broader accessibility. For instance, the global CBD market was valued at approximately USD 5.04 billion in 2023 and is projected to grow significantly, indicating a strong consumer shift towards these less restricted options.

Traditional recreational substances like alcohol and tobacco remain significant substitutes for cannabis. In 2024, the global alcohol market was valued at over $1.5 trillion, and the tobacco industry, despite ongoing declines, still represents a substantial consumer spend. These established markets offer consumers familiar experiences and social rituals that compete directly with cannabis for discretionary income and leisure time.

Home Cultivation

The threat of home cultivation presents a significant substitute for High Tide's retail cannabis operations. In Canada, adults are legally allowed to grow up to four cannabis plants for personal use. This provision directly impacts the demand for commercially sold cannabis.

This home-grown option offers a low-cost alternative, appealing to consumers who prioritize cost savings or wish to manage their own cultivation. It bypasses the retail supply chain entirely, reducing convenience but significantly cutting expenses for the end-user.

- Legal Framework: Canadian adults can cultivate up to four cannabis plants per household for personal consumption.

- Cost Advantage: Home cultivation is a substantially cheaper alternative to purchasing from licensed retailers.

- Consumer Control: This option allows individuals to manage their supply and the quality of their cannabis.

Evolving Product Forms and Market Innovation

The threat of substitutes for High Tide is amplified by the rapid evolution of cannabis product forms. We're seeing a significant diversification beyond traditional flower, with edibles, beverages, topicals, and concentrates gaining substantial market share. This trend, often referred to as Cannabis 2.0 and 3.0, introduces new ways for consumers to experience cannabis, directly substituting older methods of consumption.

For High Tide, this necessitates a continuous adaptation of its product portfolio. Staying competitive means not only offering a wide range of existing products but also actively innovating and integrating these newer, substitute product categories. For instance, the global cannabis edibles market alone was projected to reach over $15 billion by 2025, highlighting the growing consumer demand for these alternatives.

- Diversification: Cannabis products are expanding into edibles, beverages, topicals, and concentrates, creating new consumption avenues.

- Cannabis 2.0/3.0: These advancements introduce innovative product formats that can directly substitute traditional flower.

- Consumer Preference: High Tide must align its offerings with shifting consumer tastes towards these novel product categories.

- Competitive Landscape: Failure to adapt to these substitutes could cede market share to competitors who embrace the evolving product landscape.

The threat of substitutes for High Tide is multifaceted, encompassing both illicit markets and alternative wellness products. While legal cannabis gains ground, the illicit market, particularly in regions with fewer legal options, remains a persistent competitor due to lower prices and greater accessibility. Similarly, the growing market for hemp-derived CBD and other herbal supplements presents a significant substitution threat, offering perceived benefits with fewer regulatory burdens.

Established recreational substances like alcohol and tobacco continue to compete for consumer spending and leisure time, representing significant substitute markets. For instance, the global alcohol market exceeded $1.5 trillion in 2024. Furthermore, the legal allowance for home cultivation in Canada provides a direct, low-cost substitute for retail cannabis purchases, impacting demand for commercially sold products.

The evolving cannabis product landscape, with a surge in edibles, beverages, and concentrates, also acts as a substitute for traditional flower consumption, demanding constant adaptation from retailers like High Tide. The global cannabis edibles market, projected to exceed $15 billion by 2025, exemplifies this shift.

| Substitute Category | Key Characteristics | Market Relevance/Data Point |

|---|---|---|

| Illicit Cannabis Market | Lower prices, greater accessibility, no regulation | Significant share in areas with low legal store density (e.g., Canada 2023 data) |

| Hemp-Derived CBD & Supplements | Perceived wellness benefits, fewer regulations | Global CBD market valued at ~$5.04 billion in 2023 |

| Alcohol & Tobacco | Established markets, social rituals | Global alcohol market >$1.5 trillion (2024); Tobacco still a substantial consumer spend |

| Home Cultivation (Canada) | Low cost, consumer control | Legal allowance of up to 4 plants per household |

| Cannabis Product Diversification | Edibles, beverages, topicals, concentrates | Cannabis edibles market projected to exceed $15 billion by 2025 |

Entrants Threaten

The Canadian cannabis industry presents substantial hurdles for newcomers due to stringent regulations. Health Canada mandates rigorous licensing for every stage, from growing and processing to selling cannabis products. This complex web of compliance and oversight significantly deters potential entrants.

The application process alone is notoriously intricate, demanding extensive documentation and adherence to strict operational standards. For instance, obtaining a cultivation license can take many months, and often years, with no guarantee of approval. This lengthy and demanding procedure acts as a powerful deterrent, protecting established players like High Tide.

The capital-intensive nature of the cannabis retail industry presents a significant barrier to new entrants. Establishing a widespread network of stores, like High Tide's, demands considerable upfront investment in leasehold improvements, sophisticated point-of-sale systems, and substantial inventory. For instance, the average cost to build out a cannabis dispensary can range from $200,000 to $1 million or more, depending on size and location.

Furthermore, federal prohibition in many jurisdictions severely restricts access to traditional banking and financing avenues for cannabis businesses. This limited access to capital forces new players to rely on private equity or more expensive debt, thereby increasing the financial hurdle for market entry.

The Canadian cannabis market has faced significant over-licensing, leading to saturation in many regions. This has triggered a wave of consolidation, with smaller, less efficient companies being acquired or exiting the market entirely. For instance, by early 2024, numerous craft producers and smaller retailers struggled to compete, with some reporting declining revenues and increased debt loads.

This maturing landscape presents a formidable barrier for new entrants. Established players, such as High Tide, possess considerable advantages, including economies of scale in purchasing and distribution, as well as substantial existing customer loyalty. High Tide, for example, reported over 130 retail locations across Canada by mid-2024, a network that provides significant market penetration and brand recognition that is difficult for newcomers to replicate.

Brand Loyalty and Established Retail Networks

High Tide's established brand loyalty and extensive retail footprint present a significant barrier to new entrants. For instance, their Cabana Club loyalty program boasts a substantial membership, creating a sticky customer base that new competitors must work hard to attract. Building comparable brand recognition and a vast, efficient retail network requires immense capital and time investment, making it a daunting challenge for newcomers aiming to compete directly.

The costs associated with replicating High Tide's market presence are considerable:

- Brand Building: Significant marketing and advertising spend is necessary to achieve brand awareness comparable to High Tide's established position.

- Retail Network Development: Establishing a widespread and strategically located retail presence, as High Tide has done, demands substantial real estate acquisition and operational setup costs.

- Customer Acquisition Costs: New entrants face high costs to acquire customers who are already loyal to existing brands and programs like High Tide's Cabana Club.

- Loyalty Program Investment: Creating and maintaining a compelling loyalty program that rivals existing offerings requires ongoing investment in technology, rewards, and customer engagement.

Competitive Pricing and Operational Efficiency

High Tide's established discount club model, exemplified by its extensive network of stores and focus on operational efficiency, positions it to offer highly competitive pricing. This focus on cost control and generating positive free cash flow, a key metric for financial health, means new entrants will find it challenging to match High Tide's price points.

New cannabis retailers entering the market would need to invest significantly in building comparable economies of scale and developing efficient supply chains to compete on price. Without these advantages, they risk being undercut by High Tide's existing cost structures.

- Discount Club Model: High Tide's strategy leverages membership programs to drive customer loyalty and volume, enabling lower per-unit costs.

- Operational Efficiency Focus: A core element of High Tide's business is minimizing operational expenses to translate into better pricing for consumers.

- Positive Free Cash Flow: In 2023, High Tide reported positive free cash flow, demonstrating its ability to generate cash after operational and capital expenditures, which supports its pricing flexibility.

- Economies of Scale: As one of Canada's largest cannabis retailers, High Tide benefits from significant purchasing power and distribution efficiencies that smaller competitors cannot easily replicate.

The threat of new entrants into the Canadian cannabis market, while present, is significantly mitigated by a confluence of regulatory, capital, and competitive factors. High Tide, as a prominent player, benefits from these existing barriers.

Strict licensing and lengthy approval processes, often taking years, create a substantial time and resource commitment for any new operator. Furthermore, the capital required to establish a retail presence, estimated between $200,000 to over $1 million per dispensary, combined with limited access to traditional financing due to federal prohibition, elevates the financial hurdle considerably.

The market's maturation, marked by consolidation and the exit of weaker players by early 2024, means newcomers face established brands with significant economies of scale and customer loyalty. High Tide's extensive retail footprint, exceeding 130 locations by mid-2024, and its successful Cabana Club loyalty program, illustrate these entrenched advantages.

| Barrier Type | Description | Impact on New Entrants | High Tide's Advantage |

|---|---|---|---|

| Regulatory Complexity | Rigorous licensing and compliance with Health Canada mandates. | Significant time, cost, and uncertainty. | Established compliance infrastructure and expertise. |

| Capital Intensity | High upfront investment for retail build-out and operations. | Requires substantial funding, difficult to secure due to financing limitations. | Proven ability to raise capital and manage large-scale operations. |

| Market Saturation & Consolidation | Over-licensing leading to intense competition and market exits. | Difficult to gain market share against established, efficient players. | Economies of scale in purchasing and distribution, strong brand recognition. |

| Brand Loyalty & Customer Acquisition | Existing customer bases are difficult to dislodge. | High customer acquisition costs and need for significant marketing. | Loyalty programs (e.g., Cabana Club) foster repeat business and brand stickiness. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for High Tide leverages data from company annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.

We also incorporate insights from regulatory filings, news articles, and financial databases to provide a comprehensive view of the competitive landscape impacting High Tide.