High Tide PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

Discover the critical external factors shaping High Tide's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities. This in-depth report is your key to unlocking strategic advantages in a dynamic market. Don't get left behind—download the full analysis now and gain the foresight you need to make informed decisions.

Political factors

The cannabis sector in Canada navigates a complex web of federal and provincial regulations, which are not static but rather undergo regular reviews and modifications. High Tide Inc., like other players, must remain agile, adapting to evolving rules concerning licensing, permissible product types, and operational protocols to ensure compliance and capitalize on emerging market prospects. For instance, recent regulatory adjustments in 2024 have simplified some procedures for licensed entities, impacting areas such as product packaging and the amount of cannabis micro-cultivators and processors can hold on-site.

Government taxation policies, particularly excise duties on cannabis products, directly influence High Tide's pricing strategies and overall profitability. For instance, if an excise tax is set at 20% of the wholesale price, it adds a significant cost layer that must be passed on to consumers, impacting demand.

Discussions and potential reductions in the excise duty burden on cannabis producers, as seen in some Canadian provinces moving towards more moderate rates in 2024, can foster more competitive pricing across the legal market. This could stimulate higher sales volumes for retailers like High Tide, improving their financial performance.

Such shifts in fiscal policy are vital for the sustained financial health and growth of companies operating within the legal cannabis sector. For example, a reduction in federal excise tax from $1 per gram to $0.50 per gram could free up significant capital for businesses to reinvest in operations or offer more attractive pricing. This is a key consideration for High Tide as it navigates the evolving regulatory landscape.

The pace at which High Tide can secure new retail licenses and approvals for its Canna Cabana locations is a critical driver of its expansion plans. This process directly influences how quickly the company can grow its footprint across Canada.

High Tide's aggressive growth targets, with plans to open 20-30 new Canna Cabana stores in 2025, underscore the significance of a streamlined licensing environment. A favorable regulatory landscape is essential for achieving this ambitious expansion.

The company's ongoing rapid store openings rely on the consistency and predictability of provincial licensing procedures. Any slowdown or unpredictability in these processes could directly impede High Tide's ability to execute its growth strategy.

International Market Opportunities

High Tide, while rooted in Canada, is actively pursuing international expansion, with a keen eye on markets like Germany. Political shifts and evolving regulations in countries such as Germany are crucial. For instance, Germany's recent move towards decriminalization of cannabis, effective April 1, 2024, signifies a potentially significant opening for cannabis-related businesses. This political development could pave the way for High Tide to explore wholesale distribution of its accessories, and potentially, cannabis products if regulations align.

These international political factors directly impact High Tide's growth trajectory. Favorable legislative changes in Europe, for example, could unlock new revenue streams. As of early 2024, several European nations were reviewing their cannabis policies, creating a dynamic landscape for market entry.

- German Market Entry: High Tide is targeting Germany's medical cannabis market, a sector experiencing significant regulatory evolution.

- Policy Impact: Political decisions in countries like Germany directly influence opportunities for wholesale distribution of High Tide's accessory brands.

- Trade Agreements: International trade agreements can further facilitate the movement of High Tide's products across borders, boosting global reach.

- Regulatory Landscape: The evolving legal frameworks for cannabis in various jurisdictions present both opportunities and challenges for international expansion.

Government Stance on Illicit Market Combat

Government initiatives to combat the illicit cannabis market directly influence the playing field for legal retailers like High Tide. Policies designed to steer consumers away from unregulated sources and towards licensed dispensaries are crucial for boosting legal sales and enhancing the market share of compliant businesses. For instance, increased enforcement actions against unlicensed operators, coupled with public awareness campaigns highlighting the safety and quality assurances of legal products, can significantly shift consumer behavior.

High Tide stands to gain substantially from a government stance that actively seeks to dismantle the illicit market. This approach not only legitimizes the industry but also creates a more predictable and competitive environment for businesses that adhere to regulations. As of early 2024, many jurisdictions are intensifying efforts to curb illegal sales, recognizing the tax revenue and consumer protection benefits of a regulated market.

- Increased Enforcement: Governments are allocating more resources to police illicit cannabis operations, leading to seizures and closures.

- Public Education Campaigns: Initiatives are underway to inform consumers about the risks associated with illicit products and the benefits of purchasing from licensed retailers.

- Tax Revenue Generation: A stronger legal market contributes directly to government coffers, incentivizing further support for regulated sales.

- Consumer Trust: Policies promoting transparency and product testing in the legal market build consumer confidence, drawing them away from the black market.

Government licensing and regulatory frameworks significantly shape High Tide's operational landscape, impacting everything from store openings to product offerings. For instance, recent 2024 adjustments in Canadian provinces have aimed to streamline certain licensing processes, potentially accelerating High Tide's expansion plans. Taxation policies, particularly excise duties, directly affect High Tide's pricing and profitability, with potential reductions in 2024 offering a boost to competitive pricing and sales volumes.

International political developments, such as Germany's April 2024 cannabis decriminalization, present new avenues for High Tide's global growth, particularly in accessory distribution. Government efforts to combat the illicit market are also critical, as increased enforcement and public education campaigns in 2024 encourage consumers to shift towards legal, regulated channels, benefiting compliant retailers like High Tide.

What is included in the product

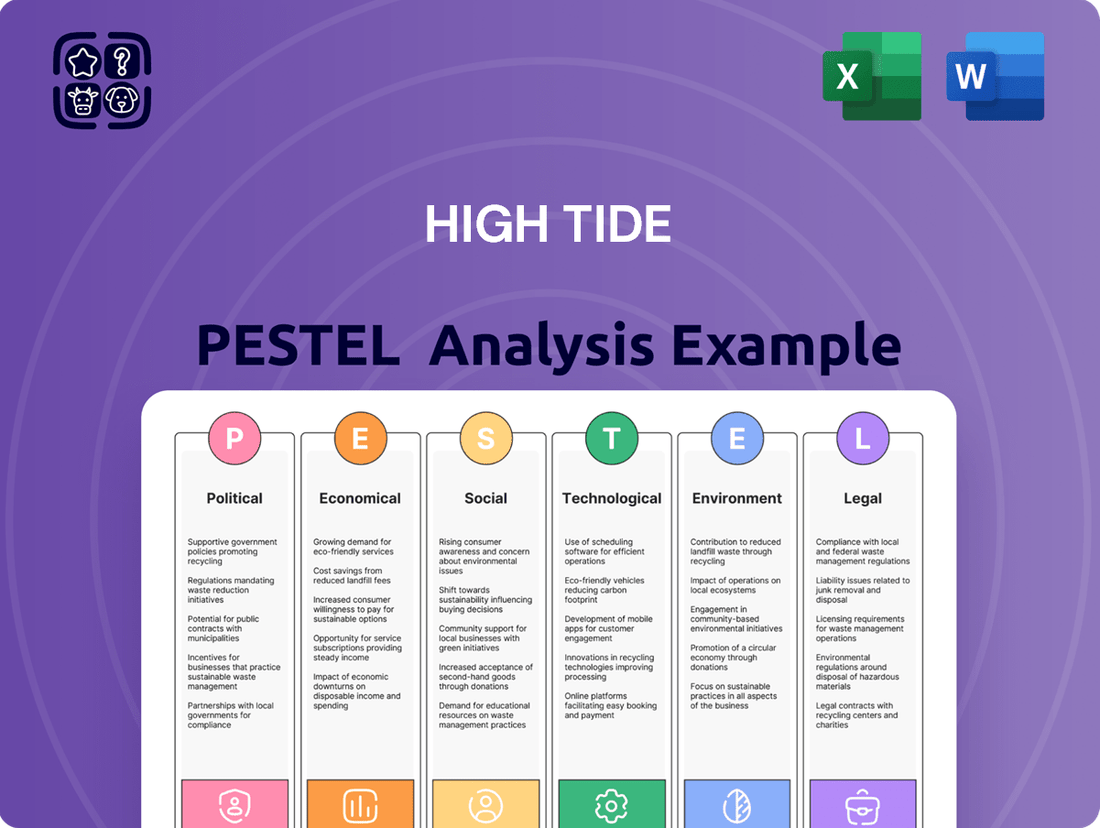

This High Tide PESTLE analysis examines how external macro-environmental factors influence the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities stemming from these critical global trends.

Provides a clear, actionable summary of external factors impacting your business, simplifying complex information to alleviate the stress of overwhelming data during strategic planning.

Economic factors

Consumer spending, a critical driver for recreational cannabis, is directly tied to overall economic health. Inflation rates, which saw a notable 3.3% annual increase in the US as of May 2024, can erode disposable income, potentially impacting discretionary purchases like cannabis products.

High Tide's ability to maintain revenue growth, even in typically slower periods, demonstrates a degree of resilience. For instance, the company reported a 4.4% year-over-year increase in revenue for its fiscal 2024 first quarter, reaching $59.1 million. However, persistent economic pressures like elevated inflation and potential interest rate hikes could still dampen consumer purchasing power in the near future.

The Canadian cannabis retail landscape is fiercely competitive, driving down prices and squeezing profit margins for businesses like High Tide. This intense rivalry forces retailers to constantly adjust their strategies to stay afloat.

High Tide's Cabana Club, a discount membership program, plays a crucial role in securing its market position and drawing in customers. It’s a smart move in a market where value is key.

However, the battle isn't just against other major retail chains; the persistent presence of the illicit cannabis market continues to exert pressure. This means High Tide must be particularly sharp with its pricing to effectively compete.

The Canadian legal cannabis market is definitely maturing. While growth rates have slowed from the initial boom, the sector is still expanding. For instance, Canadian cannabis sales reached an estimated CAD 4.4 billion in 2023, a notable increase from previous years, although the pace of that increase is more moderate.

High Tide Inc. demonstrates resilience in this evolving environment. The company reported revenue of CAD 247.6 million for the fiscal year ending September 30, 2023, showcasing its ability to grow even as the market normalizes. This performance suggests effective strategies are in place to capture value and build a loyal customer base.

High Tide's approach, focusing on customer retention through its loyalty program and strategic retail expansion, appears well-suited for a more mature market. The company's ability to gain market share amidst this maturation points to strong operational execution and a deep understanding of consumer preferences in the current landscape.

Access to Capital and Financing Costs

Access to capital is a significant economic factor for High Tide's growth strategies, impacting both organic store expansion and potential acquisitions. The cost of this capital, influenced by interest rates and market conditions, directly affects the feasibility and profitability of these initiatives. For instance, as of early 2024, the Bank of Canada's policy interest rate remained elevated, increasing borrowing costs for many businesses, though potential easing was being discussed.

High Tide's emphasis on generating positive free cash flow, a key metric in its 2024 performance, is strategically important. This internal generation of funds reduces the company's need to seek external financing, thereby lowering its reliance on debt. A strong balance sheet further enhances this financial flexibility, making it easier to secure favorable terms should external capital be required.

The company's ability to self-fund growth is a competitive advantage. In the cannabis retail sector, where capital intensity can be high, this financial discipline allows for more strategic decision-making.

- Cost of Capital: Fluctuations in interest rates, like the Bank of Canada's key lending rate, directly impact borrowing costs for expansion and acquisitions.

- Free Cash Flow Generation: High Tide's focus on positive free cash flow in 2024 provides internal funding for growth, reducing reliance on external debt.

- Balance Sheet Strength: A robust balance sheet improves access to capital and provides financial flexibility for future opportunities.

- Reduced Debt Dependence: By funding growth internally, High Tide mitigates the risks associated with high leverage, particularly in a dynamic market.

Black Market Influence

The black market remains a persistent economic hurdle, siphoning potential revenue away from legitimate businesses like High Tide. This illicit trade often thrives on lower prices and less regulatory oversight, presenting a constant challenge to market share. Estimates suggest that illicit markets can account for a significant percentage of total economic activity in certain sectors, though precise figures are difficult to ascertain.

High Tide actively works to counter this by focusing on customer acquisition from the unregulated sector. Their approach centers on providing a compelling value proposition that extends beyond just price. By offering competitively priced, high-quality, and legally compliant products, coupled with a robust loyalty program, High Tide aims to draw consumers who might otherwise engage with the black market.

- Economic Diversion: The black market diverts an estimated 10-20% of potential consumer spending in some regulated industries, impacting tax revenues and legitimate business growth.

- High Tide's Strategy: Competitive pricing and loyalty programs are key tools to attract consumers from illicit channels.

- Value Proposition: Offering regulated, quality products and a superior retail experience differentiates High Tide from black market alternatives.

- Consumer Attraction: The goal is to incentivize a shift towards legal, safer, and more reliable purchasing options.

Economic conditions significantly influence consumer spending on recreational cannabis, a key revenue driver for High Tide. Inflation, which saw the US annual rate at 3.3% in May 2024, can reduce disposable income, impacting discretionary purchases. High Tide's revenue growth, like the 4.4% year-over-year increase to $59.1 million in Q1 fiscal 2024, shows resilience, but ongoing economic pressures could still affect consumer purchasing power.

The Canadian cannabis market, with estimated sales of CAD 4.4 billion in 2023, is maturing, leading to increased competition and price pressures. High Tide's revenue of CAD 247.6 million for fiscal 2023 demonstrates its ability to adapt and grow in this environment. The company's strategies, including its Cabana Club discount program, are designed to retain customers and maintain market share against both legal competitors and the persistent illicit market.

Access to capital is crucial for High Tide's expansion plans, with borrowing costs influenced by interest rates, such as the elevated Bank of Canada policy rate in early 2024. The company's focus on generating positive free cash flow in 2024 is a strategic advantage, reducing its reliance on external financing and strengthening its balance sheet, which enhances financial flexibility for future growth opportunities and acquisitions.

| Economic Factor | Impact on High Tide | Supporting Data/Context |

| Consumer Spending Power | Directly affects demand for cannabis products. | US inflation at 3.3% (May 2024) can reduce disposable income. |

| Market Competition | Drives down prices and squeezes margins. | Canadian cannabis sales reached CAD 4.4 billion in 2023. |

| Cost of Capital | Influences expansion and acquisition feasibility. | Bank of Canada policy rate remained elevated in early 2024. |

| Free Cash Flow | Provides internal funding for growth, reducing debt reliance. | High Tide focused on positive free cash flow in 2024. |

Preview Before You Purchase

High Tide PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive High Tide PESTLE Analysis breaks down Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. Understand the external forces shaping High Tide's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed examination of each PESTLE category relevant to High Tide.

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase, providing actionable insights from the PESTLE framework.

Sociological factors

Societal views on cannabis are rapidly changing, leading to broader acceptance. This shift means more people, from young adults to older demographics, are open to exploring legal cannabis products. In 2024, surveys indicated a significant portion of the adult population now views cannabis use as acceptable, a stark contrast to previous decades.

High Tide is well-positioned to capitalize on this evolving landscape. As the stigma around cannabis diminishes, the company sees its potential customer base grow. This includes professionals and seniors, segments that were previously hesitant but are now increasingly comfortable engaging with legal dispensaries and related products.

This increasing social acceptance directly translates into market opportunities for High Tide. The destigmatization fuels demand, allowing the company to expand its reach and product offerings to a wider audience. Data from early 2025 suggests a continued upward trend in consumer confidence regarding cannabis purchases.

Shifting age demographics significantly impact cannabis consumption patterns. For instance, in 2024, a notable segment of consumers aged 55 and older showed increasing interest in edibles and low-dose tinctures, driven by a desire for discreet and manageable relief. This contrasts with younger demographics, who often favor vaporizers and high-potency concentrates. High Tide's adaptable product lines, including its diverse range of Canna Cabana accessories and NuEra vaporizers, are well-positioned to meet these evolving generational demands.

Consumers are increasingly prioritizing health and wellness, which directly impacts the demand for cannabis and CBD products. This heightened awareness means people are actively seeking out items they believe can contribute to their well-being. For instance, the global CBD market was valued at approximately $5.0 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over $100 billion by 2029, showcasing a massive consumer interest in these areas.

High Tide is well-positioned to capitalize on this trend. Through its extensive retail network, which includes brands like Canna Cabana, and its own line of proprietary accessory brands, the company can offer products specifically tailored to this wellness-focused consumer. Think of items like CBD oils, tinctures, and other accessories designed to enhance a healthy lifestyle, directly meeting this growing market need.

Consumer Preferences for Product Formats

Consumer preferences for cannabis products are a dynamic landscape, with shifts favoring convenience and discretion. While dried flower remains a staple, the demand for formats like edibles, vapes, and concentrates has seen significant growth. This evolution is driven by a desire for ease of use and controlled dosing.

High Tide Inc. is well-positioned to navigate these changing tastes. Their extensive accessory offerings cater to all consumption methods, from traditional smoking to advanced vaping technology. Furthermore, the company's expansion into white-label products allows for direct responses to emerging consumer trends, ensuring a diverse product portfolio that aligns with current market demands.

- Vape Market Growth: The global cannabis vape market was valued at approximately $10 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for this format.

- Edibles Popularity: Edibles represent a significant and growing segment, with many consumers seeking non-inhalation options for a more controlled experience.

- Accessory Sales: High Tide reported strong growth in its accessories segment, directly correlating with the diverse consumption preferences of its customer base. For instance, accessories sales in Q4 2023 reached $37.1 million, up 7% year-over-year.

- White-Label Expansion: The strategic push into white-label products allows High Tide to quickly introduce new formats and brands that directly address evolving consumer preferences, such as ready-to-use vape pens or precisely dosed edibles.

Importance of Loyalty Programs and Customer Experience

Consumer loyalty is paramount in the cannabis retail sector, and companies like High Tide are leveraging this through well-structured programs. Their Cabana Club and ELITE memberships are designed to foster repeat business and build lasting customer relationships in a crowded marketplace. This focus on rewarding loyal customers directly impacts revenue streams and market share.

The success of these initiatives is evident in High Tide's membership growth. As of early 2024, High Tide reported a significant increase in its loyalty program members, demonstrating a strong consumer appetite for such benefits. This growth isn't just about numbers; it reflects an enhanced customer experience, driving engagement and ultimately, sales.

- Cabana Club and ELITE memberships are key drivers of customer retention for High Tide.

- Loyalty programs contribute directly to increased customer lifetime value.

- High Tide has seen substantial growth in its membership base, indicating program effectiveness.

- Enhanced customer experience through loyalty programs boosts repeat purchases.

Shifting demographics, particularly the increasing acceptance and engagement of older adults with cannabis, present a significant growth avenue. This trend is supported by data showing a growing interest in discreet, wellness-oriented products among seniors. High Tide's diverse product and accessory lines are strategically positioned to cater to these evolving generational preferences.

The growing emphasis on health and wellness is a powerful sociological driver, pushing consumers towards cannabis and CBD products perceived to enhance well-being. The substantial growth projected for the global CBD market underscores this consumer shift. High Tide's retail footprint and proprietary brands enable them to effectively serve this health-conscious demographic with tailored offerings.

Consumer demand for convenience and discretion continues to shape the cannabis market, favoring formats like edibles and vapes over traditional flower. High Tide's comprehensive accessory portfolio and strategic expansion into white-label products allow them to swiftly adapt to these evolving consumer tastes, ensuring a relevant and diverse product selection.

Customer loyalty programs are crucial for retention in the competitive cannabis retail space. High Tide's Cabana Club and ELITE memberships are designed to cultivate repeat business and enhance customer lifetime value. The substantial growth in their membership base as of early 2024 highlights the effectiveness of these programs in driving engagement and sales.

Technological factors

High Tide is significantly boosting its direct-to-consumer sales by enhancing its e-commerce capabilities, particularly for its accessories division. This strategic focus on digital platforms is a key technological driver for the company's growth.

The company is actively expanding its digital footprint, integrating online ordering systems and robust loyalty programs. This integration is vital for creating a seamless customer experience that bridges its physical and online retail operations.

High Tide's investment in data analytics tools is crucial for understanding customer behavior and optimizing operations. For instance, in Q1 2024, e-commerce revenue represented a substantial portion of overall sales, demonstrating the effectiveness of these digital strategies.

By leveraging these technological advancements, High Tide aims to improve customer engagement and operational efficiency. This digital-first approach is essential for staying competitive in the evolving retail landscape, with projections indicating continued growth in online sales through 2025.

High Tide is increasingly integrating retail automation, notably through its Fastendr kiosk systems, to optimize in-store processes. This technology is designed to significantly improve customer throughput and manage queues more effectively, particularly during peak periods. By automating certain transactions and information delivery, these kiosks also aim to reduce the reliance on manual labor, thereby lowering operational expenses.

The implementation of these in-store technologies directly contributes to enhanced operational efficiency for High Tide. For instance, kiosks can handle routine sales, loyalty program sign-ups, and product information, freeing up staff for more complex customer interactions. This modernization of the physical retail environment is crucial for maintaining a competitive edge and improving the overall customer journey.

High Tide is leveraging data analytics and artificial intelligence to gain deeper insights into consumer behavior. This is crucial for optimizing inventory and tailoring marketing efforts, as seen in the cannabis industry's increasing reliance on data for personalized promotions.

By analyzing vast datasets, High Tide can refine its product selection and improve sales forecasts, leading to better resource allocation. For instance, in 2024, businesses that effectively utilized AI for demand forecasting saw an average reduction of 15% in stockouts and a 10% increase in sales conversion rates.

This technology-driven approach directly impacts profitability by identifying cost-saving opportunities and enhancing operational efficiency. The global AI market, projected to reach over $1.8 trillion by 2030, underscores the significant competitive advantage derived from advanced analytics.

Product Innovation and Manufacturing Technologies

Technological advancements in cannabis cultivation, processing, and product manufacturing are continuously shaping the industry. These innovations allow for the creation of new and enhanced products, such as higher potency extracts, unique edibles, and more sophisticated consumption devices. For High Tide, leveraging these evolving technologies is key to expanding its product offerings and staying ahead of competitors. For instance, advancements in CO2 extraction technology have become more efficient, allowing for purer and more potent cannabis concentrates, a growing market segment. In 2023, the global cannabis extracts market was valued at approximately $15.5 billion and is projected to grow significantly, offering substantial opportunities for companies like High Tide to innovate.

High Tide's manufacturing capabilities can directly benefit from these technological leaps. By integrating cutting-edge processing techniques, the company can improve the quality and consistency of its existing products while also developing novel items to meet diverse consumer demands. This includes exploring new methods for terpene preservation, which enhances the aroma and flavor profiles of cannabis products. The demand for premium, technologically advanced cannabis products is on the rise, with consumers increasingly seeking out products with specific cannabinoid and terpene profiles, driving innovation in manufacturing processes to meet these precise requirements.

- Efficient Extraction Technologies: Investments in advanced extraction methods like subcritical and supercritical CO2 extraction can yield higher quality and more potent cannabis oils, increasing product value and market appeal.

- Product Development Innovations: Technologies enabling precise dosing in edibles and the development of novel delivery systems, such as advanced vaporization technologies, cater to growing consumer preferences for convenience and controlled experiences.

- Manufacturing Automation: Implementing automation in production lines can improve efficiency, reduce costs, and ensure consistent product quality, crucial for scaling operations and maintaining a competitive edge in a rapidly evolving market.

- Quality Control Advancements: Sophisticated analytical instruments and methodologies for testing cannabinoid profiles, terpene content, and purity are essential for building consumer trust and meeting stringent regulatory standards.

Supply Chain Optimization Technologies

Technology is revolutionizing High Tide's cannabis supply chain. Innovations in seed-to-sale tracking are crucial for ensuring product integrity and regulatory compliance. For instance, the global cannabis market was valued at over $40 billion in 2023 and is projected to grow significantly, making efficient supply chain management paramount.

Blockchain and automation are key drivers for enhancing transparency and traceability. These technologies allow for meticulous tracking of cannabis products from cultivation to the end consumer, reducing the risk of counterfeiting and improving recall management. By 2025, the adoption of these advanced technologies is expected to significantly reduce operational costs for cannabis businesses.

Key technological factors impacting High Tide's supply chain include:

- Seed-to-Sale Tracking Systems: Implementing robust systems to monitor every stage of the product lifecycle, ensuring compliance with regulations like those in Canada, where High Tide operates.

- Blockchain Integration: Enhancing security and transparency in transactions and product movement, which is increasingly important in regulated markets.

- Logistics and Distribution Automation: Utilizing software and hardware to streamline warehousing, inventory management, and transportation, thereby improving delivery times and reducing errors.

- Data Analytics: Leveraging data to forecast demand, optimize inventory levels, and identify inefficiencies within the supply chain.

High Tide is enhancing its e-commerce and digital presence, integrating online ordering and loyalty programs to create a seamless customer experience. The company's investment in data analytics tools is crucial for understanding consumer behavior and optimizing operations, with e-commerce revenue showing substantial growth in early 2024.

Retail automation, particularly through Fastendr kiosks, is being implemented to improve in-store processes, customer throughput, and reduce operational expenses by automating transactions and information delivery.

Leveraging AI and data analytics provides deeper insights into consumer behavior, aiding in inventory optimization and personalized marketing. Businesses effectively using AI for demand forecasting saw an average 15% reduction in stockouts and a 10% increase in sales conversion rates in 2024.

Technological advancements in cultivation and processing are enabling the creation of new products, with efficient extraction methods like CO2 extraction yielding higher quality concentrates. The global cannabis extracts market was valued at approximately $15.5 billion in 2023, highlighting significant innovation opportunities.

Legal factors

High Tide's success hinges on strict adherence to the federal Cannabis Act and the diverse provincial regulations governing cannabis sales and operations. These legal frameworks are dynamic, with recent amendments in 2024, for instance, simplifying some compliance burdens for licensed producers and retailers, affecting packaging and possession limits. Navigating these evolving rules, such as specific provincial excise tax rates that can vary significantly, is crucial for High Tide to maintain its operational licenses and avoid penalties.

In Canada, the cannabis industry operates under strict advertising and marketing regulations, significantly impacting how companies like High Tide can reach consumers. These rules, implemented to protect public health and safety, limit promotional activities, requiring a careful approach to brand building and customer engagement. For instance, advertising is generally prohibited on television, radio, and in print media, forcing companies to rely on digital channels and in-store promotions.

High Tide must navigate these restrictions by focusing on compliant marketing strategies. This includes utilizing social media platforms in accordance with evolving guidelines, developing educational content about their products, and enhancing the in-store experience to drive brand loyalty. As of early 2024, the landscape continues to adapt, with ongoing discussions around further refinement of these advertising rules, which could present new opportunities or challenges for High Tide's marketing efforts.

Health Canada mandates rigorous product safety, quality control, and testing for all legal cannabis. High Tide's adherence to these stringent standards is crucial for building consumer confidence and preventing regulatory fines. For example, in 2023, Health Canada reported over 500 inspections of licensed cannabis producers, highlighting the active enforcement of these regulations.

Intellectual Property Protection

Protecting intellectual property, such as High Tide's unique accessory designs and established brand names, is fundamental to maintaining its edge in the market. This legal protection is key to preventing competitors from replicating successful products and diluting brand value.

The legal landscape surrounding trademarks and patents provides the essential framework for safeguarding High Tide's innovations. For instance, in 2024, High Tide continued to leverage its registered trademarks for brands like "Canna-Fit" and "Elevate," ensuring brand recognition and preventing unauthorized use. These legal protections are critical for securing its market position and fostering continued investment in research and development.

- Brand Protection: High Tide's registered trademarks for its core product lines are legally protected, preventing market confusion and safeguarding brand equity.

- Design Patents: The company has pursued design patents for innovative accessory features, offering exclusive rights to its unique product aesthetics.

- Global IP Strategy: High Tide maintains an active intellectual property strategy across key international markets to protect its innovations and brand presence globally.

- Enforcement: Legal actions are taken to enforce intellectual property rights against infringements, preserving High Tide's competitive advantage.

Labor Laws and Workplace Safety

High Tide Inc. must navigate a complex web of labor laws and workplace safety regulations, which are particularly intricate within the cannabis sector. Compliance ensures a secure and equitable environment for its workforce across all Canadian provinces where it operates, from retail outlets to production facilities.

These legal frameworks are not static; they demand constant vigilance and adaptation. For instance, provincial occupational health and safety acts, such as Ontario's Occupational Health and Safety Act, set stringent standards for hazard identification, worker training, and the implementation of safety protocols in environments where cannabis is handled and processed. Failure to adhere can result in significant penalties and operational disruptions.

Key considerations for High Tide include:

- Adherence to provincial minimum wage laws and employment standards: As of early 2024, minimum wages vary significantly across Canada, impacting payroll costs and employee compensation strategies.

- Implementation of robust workplace safety programs: This includes specific protocols for handling cannabis products, machinery operation in manufacturing, and emergency preparedness, aligning with guidelines from provincial bodies like WorkSafeBC or the Workplace Safety and Insurance Board (WSIB) in Ontario.

- Compliance with cannabis-specific regulations on employee impairment: Laws may dictate testing protocols and policies to ensure employee safety and operational integrity in a regulated industry.

- Managing employee relations and collective bargaining: Understanding labor relations legislation is crucial for fostering positive employee relationships and managing potential unionization efforts, which can influence operational flexibility and costs.

High Tide Inc.'s operations are deeply intertwined with Canada's evolving legal landscape for cannabis, encompassing federal and provincial statutes. Recent legislative changes in 2024 have aimed to streamline some aspects of compliance, impacting areas like packaging and possession limits, but the core requirement for strict adherence to the Cannabis Act and provincial regulations remains. For instance, varying provincial excise tax rates, such as the 15% PST in British Columbia versus Ontario's 13% HST on cannabis products, directly influence High Tide's profitability and pricing strategies across its retail network.

The company faces stringent advertising and marketing restrictions, a key legal factor shaping its consumer outreach. These regulations, designed to protect public health, prohibit most traditional advertising channels, pushing High Tide to focus on compliant digital marketing and in-store experiences. As of early 2024, discussions about potential refinements to these rules continue, suggesting a dynamic environment for brand promotion.

Health Canada's rigorous product safety and quality control mandates, evidenced by over 500 inspections of licensed producers in 2023, underscore the critical importance of High Tide's compliance. Protecting its intellectual property, including trademarks like Canna-Fit and Elevate, through patents and trademarks is also vital for maintaining its competitive edge and brand value in the market.

Labor laws and workplace safety are significant legal considerations for High Tide, particularly within the unique context of the cannabis industry. Adhering to provincial occupational health and safety acts, such as Ontario's, is essential for preventing penalties and operational disruptions. This includes compliance with minimum wage laws, which vary significantly by province as of early 2024, impacting payroll costs and employee compensation.

Environmental factors

Consumers and regulators are increasingly prioritizing environmental sustainability, which directly influences how cannabis businesses like High Tide operate. This growing awareness means High Tide will likely face more pressure to implement eco-friendly practices across its retail footprint and possibly in the production of its accessories, such as minimizing energy usage.

For instance, in 2024, the global cannabis market is seeing a significant push for greener cultivation methods, with some regions mandating reduced water and energy consumption. High Tide's commitment to sustainability could translate to adopting energy-efficient lighting in stores and exploring recycled materials for product packaging, aligning with broader industry trends.

Environmental regulations around cannabis waste and packaging are tightening globally. For instance, in Canada, provinces are increasingly focused on sustainable packaging mandates, pushing companies like High Tide to explore compostable or recyclable materials. This trend is expected to accelerate through 2024 and 2025, potentially increasing operational costs but also offering opportunities for brand differentiation through eco-conscious practices.

High Tide must actively adapt its packaging strategies to meet these evolving standards, focusing on reducing material usage and sourcing environmentally sound alternatives. Proactive adoption of responsible waste disposal methods not only ensures compliance but also aligns with growing consumer demand for sustainable businesses, a factor that could influence market share in the coming years.

Cannabis cultivation can be energy-intensive, impacting a company's carbon footprint. While High Tide operates mainly in retail, its manufacturing partners for accessories, like pipes and bongs, and its broader supply chain must consider energy efficiency. For example, in 2024, the U.S. cannabis industry's energy use was estimated to be significant, with some reports highlighting the substantial electricity required for indoor grows, often leading to higher carbon emissions.

Addressing this involves optimizing manufacturing processes and encouraging supply chain partners to adopt renewable energy sources and energy-efficient technologies. High Tide's commitment to sustainability would involve assessing the environmental impact of its product sourcing and exploring partnerships with suppliers who prioritize carbon footprint reduction. The global push for net-zero emissions by 2050, as seen in many countries and exemplified by initiatives like the EU's Green Deal, will increasingly influence all industries, including cannabis retail and its associated supply chains.

Water Usage in Cultivation (Indirect Impact)

While High Tide Inc. doesn't directly engage in cultivation, its reliance on a supply chain that does means it's indirectly impacted by water usage in agriculture. This is becoming a significant concern as water scarcity grows. For instance, in 2024, regions vital for agricultural production are facing increased water stress, with some areas reporting up to a 20% reduction in available water resources compared to historical averages. High Tide's commitment to environmental, social, and governance (ESG) principles necessitates a close look at its partners' water management practices.

Promoting sustainable water management among High Tide's cultivation partners is crucial for the company's overall environmental footprint and brand reputation. This can involve encouraging practices like efficient irrigation systems, water recycling, and drought-resistant crop selection. The agricultural sector, a major consumer of global freshwater resources, is under immense pressure to adopt more sustainable methods. Reports from 2025 indicate that water-efficient farming techniques could reduce agricultural water consumption by as much as 30% in key growing regions, a target that could benefit High Tide's supply chain significantly.

- Supply Chain Vulnerability: Increased water scrutiny on cultivation partners can lead to operational disruptions or increased costs for High Tide if partners fail to meet evolving water usage standards.

- Reputational Risk: Association with partners exhibiting poor water management practices can negatively impact High Tide's brand image among environmentally conscious consumers and investors.

- Operational Efficiency: Encouraging water-saving technologies among suppliers can lead to more resilient and cost-effective supply chains, especially in water-stressed regions.

Climate Change Adaptation and Resilience

Climate change presents a significant environmental factor for High Tide, impacting its supply chain and overall business resilience. Extreme weather events, such as droughts or floods, can disrupt cannabis cultivation, affecting the availability and quality of raw materials. For instance, in 2024, parts of Canada experienced unseasonably dry conditions, raising concerns about crop yields for agricultural products, which could indirectly affect the sourcing of certain cannabis-related goods or packaging materials.

High Tide's ability to navigate these environmental shifts hinges on its supply chain's adaptability. Ensuring diverse sourcing regions and robust logistics can mitigate the risks associated with localized climate impacts. The company's reliance on a stable supply of cannabis products means that climate-induced agricultural challenges in key growing areas could translate into higher input costs or supply shortages. By 2025, projections indicate a continued increase in the frequency and intensity of extreme weather, underscoring the need for proactive adaptation strategies within High Tide's operational framework.

Considerations for High Tide’s climate adaptation include:

- Supply Chain Diversification: Establishing relationships with growers in multiple geographic regions to reduce reliance on any single climate-vulnerable area.

- Logistics Resilience: Developing contingency plans for transportation and distribution networks to account for weather-related disruptions.

- Sustainable Sourcing Practices: Partnering with suppliers who employ climate-resilient farming techniques and environmental stewardship.

- Inventory Management: Maintaining adequate buffer stock for key products to absorb short-term supply chain interruptions.

Growing environmental consciousness is pushing businesses toward sustainability, affecting High Tide's operations and supply chain. Regulations are tightening on waste and packaging, pushing companies like High Tide to adopt eco-friendly materials and practices, a trend expected to grow through 2024 and 2025.

Climate change poses risks to High Tide's supply chain through extreme weather events, impacting crop yields and material availability. Adapting involves diversifying sourcing and building resilient logistics, especially as climate impacts intensify through 2025.

Water scarcity is another key concern, impacting cultivation partners. High Tide's ESG commitments necessitate monitoring suppliers' water management, encouraging efficient practices to ensure supply chain resilience and brand reputation.

| Environmental Factor | Impact on High Tide | Examples/Data (2024-2025) | Mitigation Strategies |

|---|---|---|---|

| Sustainability Demands | Increased pressure for eco-friendly operations and products. | Global push for greener cannabis cultivation methods (2024); tightening packaging regulations in Canada. | Adopt energy-efficient lighting; explore recycled packaging materials. |

| Climate Change | Supply chain disruptions due to extreme weather. | Unseasonably dry conditions in parts of Canada impacting crop yields (2024); projections of increased extreme weather events through 2025. | Diversify supply chain regions; enhance logistics resilience. |

| Water Scarcity | Potential impact on cultivation partners' yields and costs. | Regions facing up to 20% reduction in water resources (2024); water-efficient farming potentially reducing consumption by 30% (2025 projections). | Encourage efficient irrigation and water recycling among suppliers. |

PESTLE Analysis Data Sources

Our High Tide PESTLE Analysis is built on verified data from leading economic indicators, governmental policy updates, and reputable market research firms. We ensure each factor is grounded in current, fact-based insights to provide a comprehensive understanding of the macro-environment.