High Tide Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

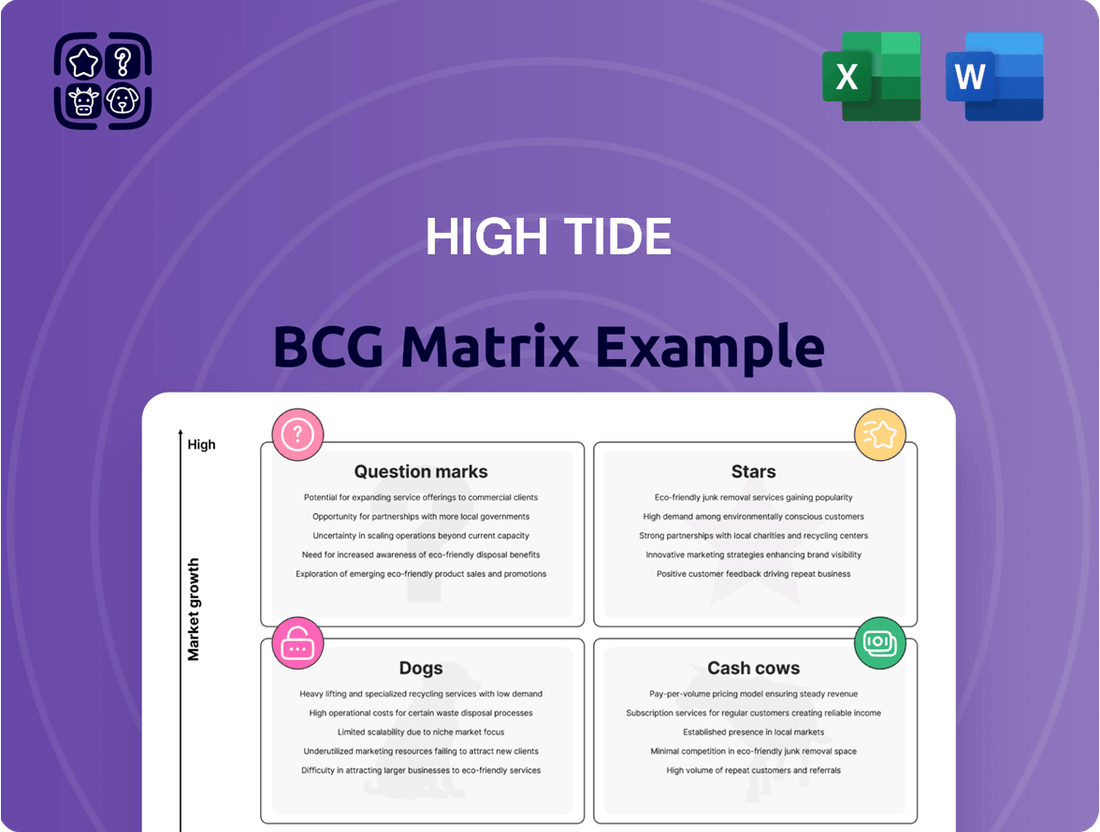

Is your product portfolio a well-oiled machine or a collection of underperformers? The High Tide BCG Matrix offers a crucial glimpse into where your products truly stand – are they the rising Stars, the dependable Cash Cows, the struggling Dogs, or the uncertain Question Marks? This snapshot is just the beginning of understanding your market position and potential.

Don't let guesswork dictate your next strategic move. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

High Tide's Canna Cabana discount club model fits the Star quadrant of the BCG matrix due to its high market share and strong growth potential in the Canadian cannabis retail sector. By early 2025, Canna Cabana captured 12% market share across five provinces.

The brand's aggressive expansion strategy includes opening 20-30 new stores in 2025, further solidifying its market presence. This growth is fueled by its popular Cabana Club loyalty program, which boasts 1.9 million members, demonstrating significant customer engagement and a leading position in a rapidly evolving market.

High Tide's organic store expansion, particularly through its Canna Cabana banner, positions it firmly in the Star category of the BCG Matrix. The company added a remarkable 29 new locations in 2024, a testament to its aggressive growth strategy. This rapid expansion is fueled by internal cash flows, highlighting operational efficiency and strong revenue generation capabilities.

These new stores are not just about increasing footprint; they are actively contributing to High Tide's overall revenue growth, demonstrating successful market penetration. By capturing new market segments and solidifying its presence across Canada, Canna Cabana's expansion is a key driver of High Tide's current success and future potential.

The Cabanalytics Business Data and Insights Platform is a significant growth driver for High Tide, fitting the characteristics of a Star in the BCG Matrix. This segment offers valuable data analytics and advertising revenue, demonstrating substantial upward momentum.

Its revenue trajectory is impressive, with a 26% year-over-year increase in Q2 2025 and an even more robust 49% surge in Q1 2025. These figures highlight the platform's strong market adoption and revenue-generating capabilities.

While Cabanalytics might currently hold a modest market share in the expansive data analytics industry, its rapid expansion within High Tide's diverse portfolio is a key indicator of its potential. This rapid growth suggests it's on track to become a dominant player.

The platform's performance positions it as a potential future leader, contributing significantly to High Tide's overall market standing and profitability. Its strategic importance is underscored by its consistent high growth rates.

ELITE Loyalty Program

The ELITE tier of the Cabana Club loyalty program is a prime example of a high-growth star in the BCG Matrix. By Q2 2025, this paid membership program boasted over 97,000 members, demonstrating its rapid expansion and strong market appeal. The program's growth rate has accelerated, reaching its fastest pace since its launch, indicating a robust and expanding customer base eager for premium benefits.

This significant membership growth, coupled with the paid nature of the ELITE tier, signifies deep customer engagement and a clear willingness to invest in enhanced value. Such a segment, if strategically leveraged and further scaled, has the potential to become a major revenue driver and significantly bolster market share for the company.

- ELITE Tier Membership: Exceeded 97,000 members by Q2 2025.

- Growth Trajectory: Experiencing its fastest growth rate since inception.

- Customer Engagement: Paid membership model highlights strong customer commitment.

- Revenue Potential: Significant opportunity for revenue and market share expansion.

Strategic White Label Cannabis Products

High Tide's strategic push into white label cannabis products, exemplified by brands like Queen of Bud and Cabana Cannabis Co., positions these offerings as potential Stars within its portfolio. This segment is targeted for higher profit margins, reflecting a deliberate move to capitalize on growing consumer demand for branded cannabis goods.

The company is actively expanding its white label range, with new product introductions anticipated for summer 2025. This aggressive product development signals a strong belief in the growth trajectory of this category, aiming to leverage its extensive retail footprint to drive sales and enhance profitability.

By developing proprietary brands, High Tide aims to differentiate itself in a competitive market and capture greater value. This strategy is supported by the increasing consumer preference for curated and trusted cannabis brands, a trend expected to continue through 2025 and beyond.

- High Tide's White Label Strategy: Focus on proprietary brands like Queen of Bud and Cabana Cannabis Co. to capture higher margins.

- Market Growth: Targeting a growing segment of the cannabis market where branded products are increasingly preferred.

- Expansion Plans: New white label product launches are scheduled for summer 2025, indicating continued investment and belief in this category.

- Profitability Focus: The strategy is designed to boost profitability by offering unique, higher-margin products through High Tide's retail network.

High Tide's Canna Cabana discount club model, alongside its Cabanalytics platform and ELITE tier loyalty program, clearly demonstrates characteristics of Stars within the BCG Matrix. These segments exhibit both high market share and strong growth potential, driven by aggressive expansion and increasing customer engagement. The company's strategic focus on proprietary white label brands also positions them as potential Stars, aiming for higher profit margins in a growing market segment.

| Segment | BCG Quadrant | Key Metrics (as of early 2025) | Growth Drivers |

|---|---|---|---|

| Canna Cabana Stores | Star | 12% market share (5 provinces), 1.9 million loyalty members | 20-30 new stores planned for 2025, aggressive organic expansion (29 new stores in 2024) |

| Cabanalytics Platform | Star | 26% YoY revenue increase (Q2 2025), 49% surge (Q1 2025) | Strong market adoption, valuable data analytics and advertising revenue |

| ELITE Tier (Cabana Club) | Star | Over 97,000 members (Q2 2025), fastest growth rate since launch | Paid membership model, deep customer engagement, premium benefits |

| White Label Brands (Queen of Bud, Cabana Cannabis Co.) | Potential Star | New product launches scheduled for summer 2025 | Focus on higher profit margins, growing consumer preference for branded products |

What is included in the product

Detailed analysis of market share vs. growth for each business unit, guiding investment decisions.

A clear visual of your portfolio’s strengths and weaknesses, the High Tide BCG Matrix eliminates the pain of uncertainty.

Cash Cows

High Tide's established Canna Cabana retail footprint, boasting over 200 locations across Canada, functions as a prime Cash Cow within its business portfolio. These mature stores, concentrated in key provinces like Alberta and Ontario, are the primary revenue generators for the company.

These locations consistently deliver robust gross profits and positive free cash flow, indicating strong operational efficiency and market penetration. Unlike newer, growth-oriented ventures, these established Canna Cabana stores require minimal aggressive promotional investment, allowing them to reliably contribute to High Tide's overall financial stability.

For instance, in the first quarter of fiscal year 2024, High Tide reported a significant increase in its Canadian retail cannabis sales, driven by the performance of its Canna Cabana banner.

High Tide's core cannabis and CBD product sales through its extensive retail network stand as a prime example of a Cash Cow within its business portfolio. This segment boasts a high market share due to established consumer loyalty and consistent demand.

In the second quarter of fiscal year 2025, this critical segment delivered impressive results, generating CA$120.051 million in revenue. This figure underscores the stable and significant financial contribution these product sales make to High Tide's overall financial health.

The strength of this Cash Cow lies in its mature market position. It leverages existing consumer preferences and a well-developed sales infrastructure, minimizing the need for extensive new market penetration efforts or significant investment in product innovation.

Proprietary consumption accessory brands, such as Famous Brandz and RGR Canada, are likely High Tide's cash cows. These established brands benefit from long-standing market presence and consistent consumer demand, ensuring a steady generation of revenue. Despite a slight dip in overall accessory revenue in Q2 2025, these mature offerings would continue to be reliable profit drivers for the company.

Consistent Free Cash Flow Generation

High Tide demonstrates strong Cash Cow potential, evident in its consistent free cash flow generation. For fiscal 2024, the company reported $22 million in free cash flow, building on a trend of positive cash generation. This financial strength is further underscored by a $4.9 million free cash flow reported in Q2 2025, showcasing ongoing stability from its core operations, particularly its retail segment.

This reliable cash flow serves as a vital resource, enabling High Tide to effectively fund new growth strategies and manage its existing debt obligations. Such consistent performance is a hallmark of a mature business unit that reliably contributes to the overall financial health of the company.

- Fiscal 2024 Free Cash Flow: $22 million

- Q2 2025 Free Cash Flow: $4.9 million

- Primary Contributor: Retail segment

- Strategic Importance: Funds growth and debt reduction

Cabana Club Base Membership

The Cabana Club base membership, with its substantial 1.9 million members across Canada, functions as a significant Cash Cow for High Tide. This broad, loyal customer base ensures a steady flow of repeat business, a crucial element in maintaining stable revenue streams. While the ELITE tier might be classified as a Star due to its growth potential, the foundational membership provides the consistent sales volume that underpins the company's financial health.

This established membership model reduces the need for extensive marketing spend on acquiring new customers within this segment, as retention is already high. The predictable revenue generated by existing members allows High Tide to allocate resources more effectively to other areas of its business, such as developing its Star products or investing in Question Marks.

- Loyal Customer Base: 1.9 million members in Canada generate consistent sales.

- Stable Revenue Stream: Drives repeat business and customer retention.

- Reduced Acquisition Costs: Focuses on retaining existing members rather than constant new acquisition.

- Foundation for Growth: Provides financial stability to invest in other business segments.

Cash Cows for High Tide represent its mature, high-market-share businesses that generate consistent, strong cash flow with minimal investment. These are the reliable profit engines of the company, funding other strategic initiatives. High Tide's extensive Canna Cabana retail network, proprietary accessory brands, and its large Cabana Club membership base exemplify these Cash Cows, demonstrating stable revenue generation and market dominance.

| Business Unit | Market Share | Cash Flow Generation | Investment Needs | Q2 2025 Revenue |

| Canna Cabana Retail | High | Strong & Consistent | Low | CA$120.051 million |

| Proprietary Accessory Brands (e.g., Famous Brandz) | Established | Reliable Profit Drivers | Low | N/A (Contributes to overall revenue) |

| Cabana Club Membership | Dominant (1.9M members) | Steady Repeat Business | Low | N/A (Drives retail sales) |

What You See Is What You Get

High Tide BCG Matrix

The preview you see is the actual, fully formatted High Tide BCG Matrix document you will receive upon purchase. This means you're getting a complete, professionally designed strategic tool, ready for immediate application in your business planning, without any watermarks or demo content.

Dogs

High Tide's e-commerce operations are currently positioned as a Dog in the BCG Matrix. Sales have been on a downward trend year-over-year, and the segment reported a net loss in the second quarter of 2025. In the fourth quarter of 2024, e-commerce contributed a mere 5.6% to High Tide's overall revenue.

Despite strategic initiatives to grow the Cabana Club membership through e-commerce channels internationally, this segment is characterized by a low market share and limited growth prospects. It is currently a cash consumer without generating substantial returns, reinforcing its Dog classification.

Certain older or less popular consumption accessory lines within High Tide's portfolio might be struggling to connect with today's market demands. These items, despite the company's broad manufacturing and distribution capabilities, are showing a pattern of declining sales. For instance, in the second quarter of 2025, High Tide's overall consumption accessory revenue saw a notable decrease of 12% year-over-year, with specific older lines contributing significantly to this downturn.

Products experiencing sustained revenue drops and diminished consumer interest are prime candidates for placement in this segment of the BCG matrix. This indicates a need for strategic review, potentially leading to divestment or a significant overhaul of these particular product offerings.

Individual Canna Cabana stores in saturated or declining micro-markets face significant headwinds. These locations, characterized by intense local competition and potentially unfavorable demographics, may exhibit low growth potential and a diminished local market share. For instance, a micro-market with multiple dispensaries already established could see individual store performance stagnate.

Legacy Acquired Brands with Limited Integration

Legacy Acquired Brands with Limited Integration, often found in the Dogs quadrant of the BCG matrix, represent past acquisitions that haven't performed as anticipated. These are typically smaller brands or retail locations that were integrated into High Tide’s Canna Cabana ecosystem with minimal success. They contribute little to overall revenue or market share and can even create operational inefficiencies.

Consider High Tide's acquisition history. While specific financial data for these underperforming legacy brands isn't always publicly segmented, the overall strategy aims to streamline operations. For instance, if a previously acquired chain of dispensaries, acquired for $10 million in 2022, consistently shows less than 1% of total group revenue and has not been rebranded under Canna Cabana, it would fit this category. The focus is on divesting or optimizing these assets to free up capital and management attention for more promising ventures.

- Underperforming Assets: Brands or retail units acquired that have not met performance benchmarks or strategic integration goals.

- Minimal Contribution: These entities typically represent a small fraction of total revenue and market share for the parent company.

- Operational Drag: Their existence can tie up resources, including management time and capital, without generating substantial returns.

- Strategic Review: Companies often place these legacy brands under review for potential divestiture or significant restructuring to improve overall portfolio performance.

Wholesale Distribution of Struggling Accessory Brands

Wholesale distribution of struggling accessory brands, characterized by low demand and declining sales within the wholesale segment, would be classified under the Dogs quadrant of the BCG Matrix. This is particularly true if these brands also hold a low market share and exhibit limited future growth potential. The wholesale model itself often operates with thinner profit margins, exacerbating the challenge for underperforming brands.

These brands represent potential cash traps, requiring ongoing investment for minimal returns. For instance, in 2024, a hypothetical accessory distributor might find that its portfolio of niche fashion accessories, distributed primarily through wholesale to independent boutiques, is experiencing a significant downturn. This could be due to changing consumer tastes or increased competition from online direct-to-consumer brands.

- Low Demand and Declining Sales: Brands in this category see a persistent drop in orders from wholesale partners and a general lack of consumer interest.

- Low Market Share: These accessory brands have failed to capture a significant portion of their target market segment.

- Limited Growth Prospects: There is little to no indication that market conditions or consumer preferences will shift to favor these struggling brands in the near future.

- Cash Trap Scenario: Continued investment in marketing, inventory, or sales support for these brands drains resources that could be better allocated to more promising ventures within the portfolio.

Products experiencing sustained revenue drops and diminished consumer interest are prime candidates for placement in this segment of the BCG matrix. This indicates a need for strategic review, potentially leading to divestment or a significant overhaul of these particular product offerings. For instance, in the second quarter of 2025, High Tide's overall consumption accessory revenue saw a notable decrease of 12% year-over-year, with specific older lines contributing significantly to this downturn.

Individual Canna Cabana stores in saturated or declining micro-markets face significant headwinds. These locations, characterized by intense local competition and potentially unfavorable demographics, may exhibit low growth potential and a diminished local market share. For example, a micro-market with multiple dispensaries already established could see individual store performance stagnate.

Legacy Acquired Brands with Limited Integration, often found in the Dogs quadrant of the BCG matrix, represent past acquisitions that haven't performed as anticipated. These are typically smaller brands or retail locations that were integrated into High Tide’s Canna Cabana ecosystem with minimal success. They contribute little to overall revenue or market share and can even create operational inefficiencies.

Wholesale distribution of struggling accessory brands, characterized by low demand and declining sales within the wholesale segment, would be classified under the Dogs quadrant of the BCG Matrix. This is particularly true if these brands also hold a low market share and exhibit limited future growth potential. For example, in 2024, a hypothetical accessory distributor might find that its portfolio of niche fashion accessories, distributed primarily through wholesale to independent boutiques, is experiencing a significant downturn.

| Category | Description | Example | Financial Impact |

| E-commerce Operations | Low market share, limited growth prospects, cash consumer. | Contributed 5.6% to revenue in Q4 2024; reported net loss in Q2 2025. | Negative contribution to profitability. |

| Underperforming Retail Locations | Struggling in saturated or declining micro-markets. | Stores in markets with high dispensary density. | Low revenue generation, potential for closure. |

| Legacy Acquired Brands | Underperforming assets with minimal integration success. | Acquired chain of dispensaries contributing <1% of total revenue. | Operational drag, ties up capital and management time. |

| Struggling Wholesale Brands | Low demand and declining sales in the wholesale segment. | Niche fashion accessories facing changing consumer tastes. | Cash trap, drains resources for minimal returns. |

Question Marks

High Tide's potential entry into the German medical cannabis market positions it as a significant Question Mark within the BCG matrix. Germany's medical cannabis sector shows robust growth, projected to reach €7.7 billion by 2028 according to some analysts, driven by favorable regulatory shifts and expanding patient access. However, High Tide currently holds a minimal market share, necessitating considerable investment and a strategic approach to overcome regulatory hurdles and establish a competitive foothold.

High Tide's strategy to introduce new white label consumption accessory products by summer 2025 positions these offerings in the 'Question Mark' category of the BCG matrix. This means they are entering a high-growth market with significant potential, but currently hold a small or negligible market share.

The success of these innovative accessories hinges on their ability to capture consumer interest and gain traction amidst established competitors. For instance, the global cannabis accessories market, a key segment for such products, was valued at approximately $25 billion in 2023 and is projected to grow at a CAGR of over 12% through 2030, indicating the high growth potential High Tide is targeting.

While the market dynamics are favorable for growth, the nascent stage of these specific white label products means they require substantial investment in marketing and consumer education to build brand awareness and drive adoption. Their current low market share necessitates a focused approach to gain a foothold.

High Tide's recent international expansion of its Cabana Club loyalty program in late 2024 positions it as a Question Mark within the BCG matrix. This initiative targets High Tide's global e-commerce operations, a segment that has shown weaker performance recently. The core idea is to replicate the loyalty model across different markets, aiming for future revenue growth.

However, this international rollout demands substantial capital investment to establish market presence and achieve profitability. For instance, in 2023, High Tide's e-commerce revenue was approximately $45.8 million CAD, a slight decrease from the previous year, highlighting the need for strategic growth drivers like the Cabana Club. Successful execution could transform this segment into a Star, but failure to gain traction could lead to divestment or continued underperformance.

Future U.S. Market Entry Strategy

High Tide's long-term vision includes a significant expansion into the U.S. cannabis market. This strategic move is currently classified as a major Question Mark, heavily dependent on anticipated federal regulatory reforms.

The U.S. cannabis sector presents a substantial growth opportunity, with projections indicating continued expansion in the coming years. For instance, the U.S. legal cannabis market was valued at approximately $30 billion in 2023 and is expected to grow substantially. However, High Tide currently holds a minimal market share in this vast landscape.

Successfully entering and gaining traction in the U.S. will necessitate a meticulously crafted strategy and considerable capital allocation. This investment will be crucial for establishing brand presence, securing distribution channels, and navigating the complex regulatory environment once federal legalization or significant reform occurs.

- U.S. Market Potential: The U.S. cannabis market is projected to reach over $60 billion by 2028, offering immense revenue opportunities.

- Current Market Share: High Tide's current U.S. market share is negligible, highlighting the significant challenge and opportunity.

- Capital Requirements: A robust U.S. market entry strategy will likely demand hundreds of millions in capital for acquisitions, organic growth, and operational setup.

- Regulatory Dependence: Federal reform is the primary catalyst; without it, direct large-scale market entry remains constrained.

Exploration of New Cannabis Product Categories (e.g., Beverages/Edibles if expanded)

Expanding into new cannabis product categories like beverages and edibles, beyond High Tide's current focus on flower and accessories, would position these ventures as Question Marks within the BCG framework. The Canadian cannabis market, for instance, saw significant growth in edibles and beverages, with sales reaching approximately $2.5 billion in 2023, representing a substantial portion of the overall legal market. This presents a high-growth opportunity, but also demands considerable investment to compete with established brands and navigate evolving consumer preferences for novel consumption methods.

Entering these burgeoning segments necessitates strategic investment in product development, marketing, and distribution to carve out market share. For example, the beverage segment alone in Canada experienced a year-over-year growth rate exceeding 50% in 2023, indicating strong consumer adoption. High Tide would need to allocate capital to research and development for unique formulations and branding to stand out in a competitive landscape, making these potential new product lines a classic Question Mark needing careful evaluation and strategic execution.

- High Growth Potential: Categories like cannabis beverages and edibles demonstrate robust market expansion, attracting new consumer demographics.

- Investment Required: Significant capital outlay is needed for product innovation, regulatory compliance, and market penetration.

- Competitive Landscape: Established players and new entrants vie for market share, demanding differentiated offerings and effective marketing strategies.

- Market Evolution: Consumer tastes are shifting towards diverse consumption methods, making these segments attractive but requiring agility to adapt.

Question Marks represent business units or products operating in high-growth markets but currently holding low market share. High Tide's expansion into the German medical cannabis market exemplifies this, where substantial investment is required to build share in a rapidly expanding sector, projected to reach €7.7 billion by 2028. Similarly, their introduction of new white label consumption accessories targets a global market valued at $25 billion in 2023, but requires significant marketing to gain traction. The Cabana Club's international rollout by late 2024 also falls into this category, aiming to drive growth in e-commerce where revenue was $45.8 million CAD in 2023, necessitating capital for market presence.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

| German Medical Cannabis Entry | High (Projected €7.7B by 2028) | Minimal | Substantial (Regulatory, Market Build) | Potential Star if successful |

| New White Label Accessories | High (Global Market $25B in 2023, 12%+ CAGR) | Low | High (Marketing, Consumer Education) | Requires strong product-market fit |

| Cabana Club International Rollout | Moderate to High (E-commerce Growth) | Low (in new markets) | Significant (Market Entry Costs) | Focus on replicating success |

| U.S. Market Expansion | Very High (Projected >$60B by 2028) | Negligible | Very High (Hundreds of Millions) | Dependent on federal reform |

| Beverages & Edibles Expansion (Canada) | High (2023 Canadian Sales ~$2.5B) | Low | High (R&D, Marketing, Distribution) | Addresses shifting consumer preferences |

BCG Matrix Data Sources

This BCG Matrix is built on comprehensive data, incorporating financial statements, market research reports, and competitive analysis to provide actionable insights.