High Tide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

High Tide Bundle

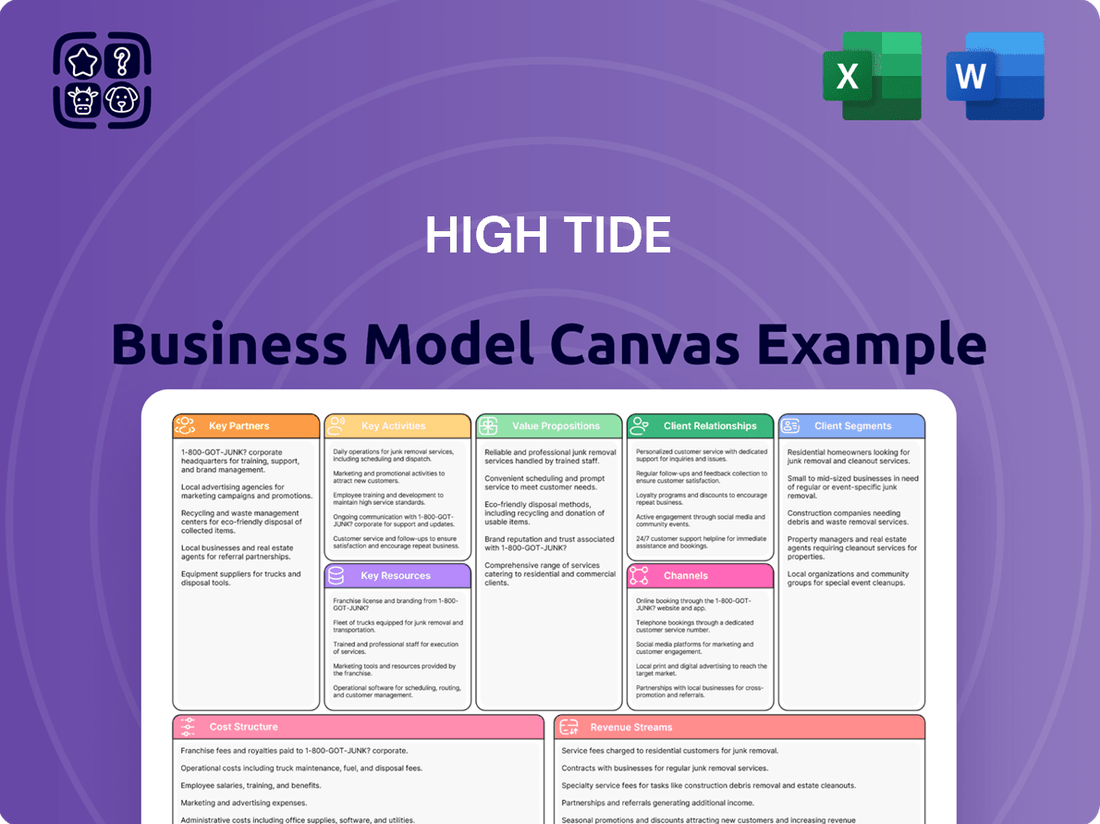

Curious about High Tide's innovative approach? This Business Model Canvas offers a peek into their customer relationships, key resources, and revenue streams. Discover the strategic framework that underpins their growth and market position.

Unlock the full strategic blueprint behind High Tide's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

High Tide cultivates robust relationships with a wide array of Licensed Producers (LPs) across Canada. These partnerships are the bedrock of its retail strategy, ensuring a steady and varied inventory of cannabis products for its Canna Cabana stores. For instance, in the fiscal year 2023, High Tide reported over $265 million in revenue, a significant portion of which is directly tied to the quality and availability of products sourced from these LPs.

These collaborations are not merely transactional; they enable High Tide to offer a diverse product mix, from flower to edibles and concentrates, catering to a broad customer base. The ability to secure premium products from numerous LPs allows High Tide to maintain a competitive edge and meet the evolving preferences of Canadian cannabis consumers.

High Tide's strategy hinges on strong alliances with real estate landlords and commercial developers. These partnerships are the bedrock for their ambitious plan to establish over 300 Canna Cabana stores throughout Canada. By securing prime locations in bustling commercial hubs, they ensure maximum visibility and customer access, a critical factor in their retail expansion.

These collaborations directly enable the swift establishment of new Canna Cabana outlets, fueling High Tide's pursuit of market leadership in the Canadian cannabis retail sector. As of early 2024, High Tide reported operating 132 stores, demonstrating the ongoing importance of these land-based relationships to their growth trajectory.

High Tide actively partners with technology providers to integrate cutting-edge retail solutions, such as their proprietary Fastendr™ kiosks. This collaboration directly enhances the customer shopping experience by offering seamless and efficient interactions within their stores.

These strategic technology partnerships are crucial for streamlining in-store operations and boosting overall efficiency. By leveraging advanced technological integrations, High Tide solidifies its commitment to a modern, cohesive retail environment.

Technology integration serves as a cornerstone for High Tide's competitive differentiation in the market. For example, the implementation of Fastendr™ allows for quicker transactions and personalized customer engagement, setting them apart from competitors.

Wholesale and Logistics Partners

High Tide leverages a network of wholesale and logistics partners to extend the reach of its proprietary consumption accessories and CBD products. These collaborations are crucial for distributing its diverse brand portfolio beyond its owned retail locations, as evidenced by its Valiant™ wholesale solutions. In 2024, High Tide continued to focus on expanding its wholesale network, aiming to diversify revenue streams and capture a larger market share.

- Valiant™ Wholesale Solutions: This division acts as a key channel, facilitating the distribution of High Tide's owned brands and third-party products to a wide array of independent retailers.

- Logistics Network: Efficient warehousing and transportation are managed through strategic partnerships, ensuring timely delivery of products across various markets.

- Market Expansion: These partnerships enable High Tide to tap into new geographic regions and customer segments that may not be directly served by its physical stores, thereby increasing overall sales volume and brand visibility.

International Market Entrants (e.g., German Medical Cannabis)

High Tide is actively forging key partnerships to expand into lucrative international markets, with a particular focus on the burgeoning German medical cannabis sector. These collaborations are crucial for diversifying revenue and building a robust global footprint.

A prime example is High Tide's strategic engagement with German entities, including initial acquisition discussions and partnership endeavors, such as with Purecan GmbH. This move is designed to leverage local expertise and regulatory understanding to facilitate market entry and operational setup.

These international ventures are not merely opportunistic; they are integral to High Tide's overarching strategy for sustained, long-term growth and market leadership. By establishing a presence in markets like Germany, High Tide aims to capture significant market share and build a diversified international revenue base.

- German Medical Cannabis Market Growth: The German medical cannabis market is projected to reach approximately €1.2 billion by 2025, indicating substantial growth potential for High Tide.

- Purecan GmbH Partnership: High Tide's engagement with Purecan GmbH signifies a direct pathway into the German market, focusing on distribution and brand presence.

- Diversification Strategy: Entry into international markets like Germany is a key component of High Tide's strategy to reduce reliance on any single market and enhance overall financial resilience.

- Global Expansion Ambitions: These partnerships underscore High Tide's commitment to becoming a significant international player in the cannabis industry.

High Tide's key partnerships are fundamental to its operational success and expansion strategy. These include strong alliances with Licensed Producers (LPs) for product sourcing, ensuring a diverse inventory for its Canna Cabana stores. As of early 2024, High Tide operated 132 stores, highlighting the crucial role of real estate partnerships in its ambitious growth plans for over 300 locations across Canada.

Furthermore, strategic technology collaborations, such as with the development of its proprietary Fastendr™ kiosks, enhance customer experience and operational efficiency. The company also leverages wholesale and logistics partners to distribute its branded products, including Valiant™ solutions, to a broader market. High Tide's international expansion, particularly into the German medical cannabis sector, relies on partnerships to navigate new regulatory landscapes and establish market presence.

| Partnership Type | Key Collaborators | Strategic Importance | Recent Data/Facts |

|---|---|---|---|

| Licensed Producers (LPs) | Various Canadian LPs | Inventory sourcing, product diversity | Fiscal year 2023 revenue over $265 million |

| Real Estate/Developers | Landlords, commercial developers | Retail location acquisition, store expansion | 132 stores operated as of early 2024 |

| Technology Providers | Internal tech teams, external partners | In-store experience, operational efficiency | Development of Fastendr™ kiosks |

| Wholesale/Logistics | Distributors, logistics firms | Product distribution, market reach | Expansion of Valiant™ wholesale solutions |

| International Market Entry | German entities (e.g., Purecan GmbH) | Market access, regulatory navigation | German medical cannabis market projected at €1.2 billion by 2025 |

What is included in the product

A fully developed, actionable business model canvas populated with High Tide's specific strategic elements, customer insights, and operational details.

This canvas provides a clear, narrative-driven overview of High Tide's business, suitable for strategic planning and stakeholder communication.

The High Tide Business Model Canvas simplifies complex business strategy, alleviating the pain of over-analysis and unstructured planning.

Activities

Managing the extensive Canna Cabana retail network is a primary activity for High Tide, covering staffing, inventory control, and strict adherence to cannabis regulations. This operational focus is crucial for driving revenue and ensuring a consistent customer experience across all locations.

Optimizing store layouts and deploying efficient point-of-sale systems are key components of High Tide's retail strategy. These efforts aim to enhance customer flow and streamline transactions, directly impacting sales performance and operational efficiency.

In 2024, High Tide continued to expand its retail footprint, aiming to solidify its position as a leading cannabis retailer in Canada. The company's commitment to operational excellence in its physical stores remains a significant driver of its overall financial results.

High Tide's key activities center on procuring a broad spectrum of recreational cannabis products from licensed producers. This meticulous sourcing ensures they can meet the varied tastes of their customer base. For instance, in 2024, High Tide continued to expand its product selection, adding new cultivars and brands to its shelves.

Effective inventory management across their retail stores and e-commerce platforms is paramount. This process guarantees product availability and maintains freshness, crucial for customer satisfaction. Efficient inventory control also directly supports their discount club model by enabling competitive pricing strategies.

By strategically procuring products, High Tide can offer attractive pricing through its membership programs. This approach is vital for attracting and retaining customers in a competitive market. Their focus on smart purchasing allows them to pass savings onto their loyal members.

High Tide's manufacturing and distribution of consumption accessories is a cornerstone of its strategy, extending beyond its retail footprint. This vertical integration allows the company to capture higher margins and maintain stringent quality control across its product lines.

Through its proprietary brands, High Tide designs, manufactures, and distributes a diverse array of cannabis accessories. This includes popular names such as Queen of Bud™, Valiant™, and the artist-driven Famous Brandz™ collection, showcasing a commitment to innovation and brand development.

In 2023, High Tide reported significant growth in its accessories segment, contributing to an overall revenue increase. The company's strategic focus on expanding its manufacturing capabilities and global distribution network for these accessories is expected to continue driving profitability.

E-commerce Platform Management

High Tide's e-commerce platforms are central to its operations, managing a global network for consumption accessories and CBD products. This digital presence extends High Tide's reach significantly beyond its brick-and-mortar locations.

Key platforms include Grasscity.com, Smoke Cartel, Daily High Club, and Blessed CBD. Managing these diverse online storefronts is a critical function, ensuring a seamless customer experience across different markets.

While the e-commerce segment represented a smaller portion of High Tide's overall revenue in recent periods, its strategic importance cannot be overstated. For instance, in the first quarter of fiscal year 2024, High Tide reported significant growth in its e-commerce sales, with Grasscity.com seeing a substantial increase in orders.

- Global E-commerce Operations: Overseeing and maintaining a suite of international e-commerce websites.

- Brand Portfolio Management: Managing distinct online platforms such as Grasscity.com, Smoke Cartel, Daily High Club, and Blessed CBD.

- Revenue Diversification: E-commerce contributes to revenue streams beyond physical retail, offering a broader product selection.

- Market Reach Expansion: Utilizing online channels to connect with a global customer base for accessories and CBD products.

Customer Loyalty Program Management

High Tide's customer loyalty program management, particularly the Cabana Club and ELITE programs, is a core activity. This focuses on keeping customers coming back and actively involved with the brand. It’s about making sure members feel valued and get the most out of their participation.

Analyzing data from loyalty members is crucial for tailoring promotions and offers. This personalization helps create a stronger connection with customers. The programs are constantly being improved to offer even more benefits and keep them appealing.

The loyalty program is a significant differentiator for High Tide. It’s not just about rewards; it’s a powerful tool for understanding consumer behavior. This deep dive into customer preferences allows for more effective business strategies.

- Program Development and Oversight: Actively designing, implementing, and managing the Cabana Club and ELITE loyalty programs.

- Data Analysis for Personalization: Utilizing member data to create targeted marketing campaigns and personalized experiences.

- Continuous Program Evolution: Regularly updating and enhancing loyalty program benefits and features to maximize customer value.

- Competitive Advantage: Leveraging the loyalty program as a key differentiator in the market and a source of valuable consumer insights.

High Tide's key activities encompass managing its extensive Canna Cabana retail network, which involves inventory control and strict adherence to cannabis regulations. This operational focus is vital for revenue generation and consistent customer experience. Additionally, the company focuses on procuring a broad spectrum of recreational cannabis products from licensed producers to meet diverse customer preferences. High Tide also manufactures and distributes its own consumption accessories through proprietary brands, enhancing margins and quality control. Managing its global e-commerce platforms, including Grasscity.com and Smoke Cartel, is critical for expanding market reach beyond physical stores. Finally, the company actively manages its customer loyalty programs, the Cabana Club and ELITE, to foster repeat business and gather valuable consumer insights.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Retail Operations Management | Managing Canna Cabana stores, including staffing, inventory, and regulatory compliance. | Continued expansion of retail footprint; commitment to operational excellence. |

| Product Sourcing | Procuring recreational cannabis products from licensed producers. | Expansion of product selection with new cultivars and brands. |

| Accessories Manufacturing & Distribution | Designing, manufacturing, and distributing cannabis accessories via proprietary brands. | Focus on expanding manufacturing capabilities and global distribution networks. |

| E-commerce Platform Management | Overseeing global e-commerce sites like Grasscity.com and Smoke Cartel. | Reported significant growth in e-commerce sales, with Grasscity.com seeing a substantial increase in orders in Q1 FY2024. |

| Loyalty Program Management | Developing and managing customer loyalty programs (Cabana Club, ELITE). | Utilizing member data for targeted marketing and personalized experiences. |

What You See Is What You Get

Business Model Canvas

The High Tide Business Model Canvas preview you're viewing is not a sample; it is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are precisely as you see them, ensuring no discrepancies or surprises after your transaction. You'll gain immediate access to this complete, professional document, ready for your immediate use and customization.

Resources

High Tide's extensive retail store network, boasting over 200 Canna Cabana locations across Canada, is a foundational element of its business model. This vast physical presence offers unparalleled accessibility to a broad customer base, directly contributing to its status as Canada's largest cannabis retailer.

The sheer scale of this network is a significant competitive advantage, underpinning a substantial portion of High Tide's market share and revenue generation. This physical footprint is not static; a strategic objective for continued expansion targets reaching over 300 locations, further solidifying its retail dominance.

High Tide strategically leverages its ownership of proprietary consumption accessory brands, including Queen of Bud™, Valiant™, and Famous Brandz™. This diverse portfolio, supported by associated intellectual property, is a cornerstone of their business model.

By controlling these brands, High Tide unlocks the ability to achieve higher profit margins. This is accomplished through direct manufacturing and wholesale distribution, allowing them to capture more value across the supply chain.

These internally developed brands act as a significant differentiator in the competitive accessories market. They enable High Tide to offer a unique product selection that stands apart from competitors relying on third-party brands.

The intellectual property associated with these brands creates a robust competitive moat. This IP protects their market position and provides a sustainable advantage in the accessories sector.

The Cabana Club loyalty program is a cornerstone of High Tide's operations, boasting over 5.87 million global members. This extensive network represents a significant intangible asset, providing a direct channel to a massive customer base.

The data meticulously gathered from these millions of members offers unparalleled insights into consumer behavior, preferences, and emerging market trends. This granular understanding allows High Tide to anticipate and respond effectively to customer needs.

Leveraging this wealth of data, High Tide refines its inventory management, tailors marketing campaigns, and optimizes pricing strategies. This data-driven approach cultivates robust customer relationships and drives operational efficiency.

Global E-commerce Platforms

High Tide operates a crucial suite of international e-commerce platforms, including well-established names like Grasscity.com, Smoke Cartel, and Blessed CBD. These digital assets are fundamental to extending the company's market presence far beyond its Canadian base. They are the primary conduits for global sales of consumption accessories and CBD products, forming a vital, diversified revenue stream.

These platforms are not just sales channels; they represent a strategic foundation for High Tide's ongoing international growth ambitions. Their established online presence and customer bases in various global markets provide a significant advantage. Furthermore, their positioning is particularly astute in anticipation of potential federal reforms concerning cannabis-related products in the United States, opening up new avenues for expansion.

- Global Reach: Platforms like Grasscity.com and Smoke Cartel provide immediate access to consumers in numerous countries, bypassing traditional retail barriers.

- Revenue Diversification: These e-commerce sites generate sales from a wide array of consumption accessories and CBD products, reducing reliance on any single market or product category.

- Scalability: The digital nature of these platforms allows for relatively easy scaling of operations to meet growing international demand.

- Market Intelligence: User data and sales trends from these platforms offer valuable insights into global consumer preferences and market opportunities.

Human Capital and Retail Expertise

High Tide's human capital is anchored by its knowledgeable and well-trained retail staff, a vital asset for delivering exceptional customer experiences. This team's expertise in product knowledge and customer engagement directly impacts sales conversion and customer loyalty, critical elements in the competitive cannabis retail landscape.

Experienced management forms another cornerstone of High Tide's human capital, bringing deep expertise in retail operations, supply chain optimization, and brand development. For instance, in 2024, High Tide continued to invest in its leadership team, attracting talent with proven track records in scaling retail businesses. This collective management acumen is indispensable for navigating the complexities of High Tide's integrated business model, from cultivation to retail.

- Skilled Retail Workforce: Employees trained in cannabis product knowledge and customer service.

- Experienced Management: Leadership with deep understanding of retail, supply chain, and brand building.

- Brand Development Expertise: Staff capable of effectively communicating and enhancing the High Tide brand.

- Operational Efficiency: Human capital focused on ensuring smooth and efficient store and supply chain operations.

High Tide's key resources include its extensive retail footprint, proprietary accessory brands, a robust loyalty program, international e-commerce platforms, and experienced human capital. These elements combine to create a powerful and integrated business model, driving both revenue and market share.

The company’s owned brands like Valiant™ and Famous Brandz™ are crucial for margin enhancement and differentiation. Furthermore, the Cabana Club loyalty program, with over 5.87 million members, provides invaluable customer data for personalized marketing and operational improvements.

Internationally, platforms like Grasscity.com and Smoke Cartel are vital for global accessory sales and future growth, especially in anticipation of US market changes. Their skilled retail staff and experienced management team are instrumental in executing the company's strategy and ensuring operational excellence.

| Key Resource | Description | Impact | Data Point (as of latest available) |

| Retail Network | Over 200 Canna Cabana stores across Canada, with plans to expand. | Market dominance, customer accessibility, revenue generation. | Targeting over 300 locations by end of fiscal 2024. |

| Proprietary Brands | Consumption accessory brands including Queen of Bud™, Valiant™, Famous Brandz™. | Higher profit margins, product differentiation, competitive moat via IP. | Contributes significantly to accessories segment revenue. |

| Cabana Club Loyalty Program | Loyalty program with extensive global membership. | Customer data insights, direct marketing channel, customer retention. | Over 5.87 million global members. |

| International E-commerce | Platforms like Grasscity.com, Smoke Cartel, Blessed CBD. | Global sales reach, revenue diversification, market intelligence. | Key for accessories and CBD product sales worldwide. |

| Human Capital | Knowledgeable retail staff and experienced management. | Customer experience, operational efficiency, strategic execution. | Management team with proven track records in retail scaling. |

Value Propositions

High Tide's Cabana Club discount model offers a powerful value proposition by making cannabis and accessories more affordable for members. This strategy is designed to attract customers and encourage them to shop more often, fostering a loyal customer base and increasing overall accessibility to quality products.

This approach has demonstrably paid off, with High Tide reporting that its Cabana Club members exhibit significantly higher average transaction values and visit frequency compared to non-members. For instance, in Q3 2024, High Tide observed that Cabana Club members spent approximately 30% more per visit than non-members, highlighting the model's effectiveness in driving revenue.

By offering competitive pricing through this membership-based model, High Tide differentiates itself in a crowded market. This focus on value not only boosts same-store sales, outperforming competitors who may not have similar loyalty programs, but also cultivates a community around its brands.

Customers can explore a vast and carefully chosen array of recreational cannabis products, from flower to edibles, alongside a comprehensive selection of consumption accessories like pipes, bongs, and vaporizers. This extensive product offering ensures that diverse consumer preferences are met, creating a convenient one-stop-shop experience.

High Tide’s integrated model, exemplified by its flagship Canna Cabana stores, allows customers to easily find both their preferred cannabis strains and the essential accessories needed for consumption, all under one roof. This convenience is a key driver of customer loyalty and increased basket size.

For instance, in the first quarter of 2024, High Tide reported that its retail cannabis sales grew by 22% year-over-year, indicating strong customer demand for its broad product selection. This growth underscores the effectiveness of offering a wide variety of cannabis and accessories.

High Tide's retail network, boasting over 200 Canna Cabana locations strategically spread across Canada, offers unparalleled convenience. This extensive footprint ensures customers can easily find legal cannabis products and accessories in their communities.

The company's deliberate expansion into high-traffic urban and suburban areas further solidifies its commitment to accessibility. This widespread physical presence isn't just about convenience; it's a key driver of market penetration and brand visibility for High Tide.

Enhanced Shopping Experience with Retail Innovation

High Tide is dedicated to enriching the customer journey through continuous retail innovation. A prime example is the integration of Fastendr™ self-serve kiosks, which streamline the browsing, ordering, and pickup phases. This technology fosters a more personalized and efficient interaction for shoppers.

These advancements create a sophisticated and fluid retail atmosphere, directly enhancing the overall shopping experience. For instance, High Tide reported that its same-store sales grew by 3.3% in the fiscal year ending September 30, 2023, reflecting a positive customer response to these modernizing efforts.

- Streamlined Transactions: Fastendr™ kiosks reduce wait times and offer a quick, self-directed purchasing path.

- Personalized Engagement: These technologies allow for tailored product recommendations and order customization.

- Modern Convenience: High Tide's investment in digital solutions caters to evolving consumer preferences for speed and ease.

- Improved In-Store Flow: Kiosks help manage customer traffic, leading to a more pleasant environment.

Trusted Brand Portfolio and Quality Assurance

High Tide leverages a robust portfolio of trusted brands, prominently featuring its in-house accessory lines such as Queen of Bud™ and Valiant™. This strategy ensures a consistent level of quality across all offerings, from cannabis products to essential accessories. For instance, in fiscal year 2024, High Tide continued to expand its proprietary product lines, contributing to a stronger brand identity and customer loyalty.

This unwavering commitment to quality across both cannabis and accessories cultivates significant consumer trust. It positions High Tide as a dependable retailer, assuring customers that they are purchasing reliable and high-standard products. This trust directly translates into repeat business and a strengthened market position.

- Diverse Brand Portfolio: Includes proprietary accessory brands like Queen of Bud™ and Valiant™.

- Quality Assurance: Focus on high standards for both cannabis and accessories.

- Consumer Trust: Builds confidence through reliable product offerings.

- Brand Reinforcement: Enhances High Tide's reputation as a trusted source.

High Tide's value proposition centers on affordability through its Cabana Club, a wide selection of cannabis and accessories, convenient accessibility via its extensive retail network, and a commitment to innovation and quality brands.

The Cabana Club membership drives customer loyalty by offering discounts, leading to higher transaction values and visit frequency. In Q3 2024, Cabana Club members spent about 30% more per visit than non-members.

High Tide's extensive network of over 200 Canna Cabana stores across Canada ensures customers can easily access both cannabis products and accessories. This broad reach, particularly in urban and suburban areas, enhances market penetration.

The company enhances the customer experience with innovations like Fastendr™ self-serve kiosks, improving transaction speed and personalization. This focus on modern convenience contributed to a 3.3% increase in same-store sales for the fiscal year ending September 30, 2023.

High Tide also offers a strong portfolio of trusted brands, including its proprietary accessory lines like Queen of Bud™ and Valiant™, reinforcing consumer trust through consistent quality.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Affordability & Loyalty | Cabana Club membership provides discounts, increasing customer spending and visits. | Cabana Club members spent ~30% more per visit in Q3 2024. |

| Product Assortment | Comprehensive selection of cannabis products and consumption accessories. | Retail cannabis sales grew 22% YoY in Q1 2024. |

| Accessibility & Convenience | Extensive retail footprint with over 200 Canna Cabana locations. | Strategic expansion into high-traffic urban and suburban areas. |

| Retail Innovation | Streamlined shopping experience through technologies like Fastendr™ kiosks. | Same-store sales grew 3.3% in FY2023, reflecting positive customer response to modernization. |

| Brand Quality & Trust | Portfolio includes trusted proprietary accessory brands like Queen of Bud™ and Valiant™. | Continued expansion of proprietary product lines in FY2024 to build brand identity. |

Customer Relationships

High Tide fosters robust customer loyalty via its tiered Cabana Club program, featuring the exclusive ELITE tier. This structure provides members with special discounts, tailored promotions, and a community atmosphere, encouraging repeat business and deepening engagement.

The program's success is evident in its significant growth, particularly in ELITE memberships, which saw a substantial increase in 2024, indicating strong customer appreciation for the added benefits and recognition.

High Tide's Canna Cabana stores excel with personalized in-store service, where knowledgeable staff offer expert advice. This direct human interaction is crucial for building trust and guiding customers through product choices and usage. For example, in 2024, High Tide reported a significant increase in customer satisfaction scores directly attributed to the quality of in-store consultations.

High Tide actively engages with its customer base through robust e-commerce platforms and various digital channels. This online presence is crucial for providing timely customer support, detailed product information, and fostering a sense of community. In 2024, High Tide's digital strategy focused on enhancing user experience, leading to a notable increase in online customer interactions and positive feedback on their responsiveness.

Community Building and Educational Initiatives

High Tide actively cultivates a strong community around its brands, recognizing the power of connection in the cannabis space. This is achieved through various initiatives designed to engage consumers beyond simple transactions.

The company prioritizes educational content, empowering consumers with knowledge about cannabis products and responsible use. This commitment to education not only builds trust but also fosters a more informed and loyal customer base. For instance, High Tide's retail locations often serve as hubs for such information sharing.

Furthermore, High Tide leverages its loyalty programs to create a sense of belonging and reward repeat customers. These programs offer exclusive benefits and access, encouraging ongoing engagement and strengthening the customer's connection to the brand. This community-building approach is vital for long-term customer retention and brand advocacy.

In 2024, High Tide continued to invest in these customer relationship strategies. While specific community engagement metrics for 2024 are proprietary, the company’s consistent focus on loyalty programs and educational outreach demonstrates a clear commitment to fostering deep customer relationships. This aligns with industry trends showing that personalized experiences and community building significantly boost customer lifetime value.

- Community Focus: Initiatives aim to create a sense of belonging among cannabis consumers.

- Educational Content: Providing information empowers consumers and builds brand trust.

- Loyalty Programs: Rewarding repeat customers enhances engagement and brand affinity.

- Brand Stickiness: Fostering community strengthens customer loyalty and reduces churn.

Feedback Mechanisms and Continuous Improvement

High Tide actively gathers customer feedback through various channels to refine its product lines and service delivery. This proactive approach ensures the company stays aligned with evolving consumer demands, fostering stronger customer connections and encouraging repeat business.

The company leverages data from its Cabana Club loyalty program, which boasts over 1.5 million members as of early 2024, to pinpoint areas for enhancement. This rich dataset allows High Tide to make data-driven decisions, directly impacting customer satisfaction and loyalty.

- Customer Feedback Integration: High Tide systematically collects and analyzes customer input to drive product and service innovation, ensuring offerings remain relevant and competitive.

- Cabana Club Data Utilization: Insights from the Cabana Club program, with its significant membership base, are crucial for identifying customer preferences and optimizing the overall experience.

- Continuous Improvement Cycle: The feedback loop is integral to High Tide's strategy, facilitating ongoing enhancements that meet and anticipate customer needs, thereby strengthening relationships.

- Loyalty and Retention: By actively listening and responding to customers, High Tide aims to cultivate deep loyalty and ensure long-term customer retention, a key driver of sustainable growth.

High Tide's customer relationships are built on a foundation of community, education, and personalized engagement, amplified by their Cabana Club loyalty program. By actively listening to feedback and leveraging data from their substantial membership base, they foster brand loyalty and drive continuous improvement.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (2024 Focus) |

|---|---|---|

| Loyalty Program | Cabana Club (tiered, ELITE tier) | Over 1.5 million members (early 2024); significant ELITE tier growth indicating strong appreciation for benefits. |

| Personalized Service | Knowledgeable in-store staff, expert advice | Increased customer satisfaction scores attributed to in-store consultations. |

| Digital Engagement | E-commerce platforms, digital channels | Enhanced user experience led to notable increase in online customer interactions and positive feedback. |

| Community Building | Educational content, fostering belonging | Consistent focus on initiatives to build deep customer relationships and brand advocacy. |

| Feedback Integration | Customer feedback channels, data utilization | Systematic collection and analysis of input to refine products and services, driving customer satisfaction and retention. |

Channels

High Tide's primary distribution channel is its expansive network of over 200 Canna Cabana physical retail stores located throughout Canada. These locations are the backbone of their direct-to-consumer strategy, offering a tangible point of sale for recreational cannabis products and a wide array of consumption accessories. This significant physical presence is a key driver of their market penetration and revenue.

High Tide leverages a strong portfolio of global e-commerce platforms, including Grasscity.com, Smoke Cartel, and Daily High Club, to reach a worldwide customer base for consumption accessories and CBD products. These digital storefronts are crucial for international market penetration and serve consumers who prefer the convenience of online shopping, effectively complementing its brick-and-mortar operations.

In 2024, High Tide reported a significant portion of its revenue generated through these online channels, demonstrating their vital role in the company's diversified sales strategy. For instance, Grasscity.com alone experienced substantial traffic growth throughout the year, attracting customers from over 100 countries.

High Tide utilizes its wholesale distribution network, notably through its Valiant™ subsidiary, to extend the reach of its owned accessory brands to a broader retail and distributor base. This business-to-business channel significantly amplifies market penetration and revenue streams, complementing direct-to-consumer sales.

For fiscal year 2024, High Tide reported that its wholesale segment played a crucial role in its overall financial performance, contributing to a substantial portion of its gross revenue. This strategic B2B approach allows for efficient scaling of proprietary product sales, leveraging established retail partnerships.

The integration of wholesale distribution within High Tide's business model is designed to optimize inventory management and supply chain efficiency for its manufactured accessories. This synergy allows the company to capture market share across diverse retail environments, driving consistent sales growth.

Digital Marketing and Social Media

High Tide leverages a robust digital marketing and social media strategy to connect with its customer base. This approach is vital for promoting its diverse product offerings and engaging with the cannabis enthusiast community. They utilize targeted advertising campaigns across various platforms to reach specific demographics, aiming to drive both in-store foot traffic and online sales.

Content marketing plays a significant role, with High Tide creating informative and engaging material to build brand loyalty and educate consumers. Direct communication channels, such as email newsletters and social media messaging, are employed to foster relationships and announce new products or promotions. In 2024, High Tide continued to invest in its online presence, recognizing digital channels as a primary driver for brand visibility and customer acquisition in the competitive cannabis retail landscape.

- Digital Reach: High Tide's digital marketing efforts are designed to extend its reach beyond physical locations, tapping into a broader customer base online.

- Customer Engagement: Social media platforms are actively used for community building, responding to customer inquiries, and generating buzz around new product launches.

- Sales Drivers: Targeted online advertising and content marketing campaigns are key components in driving traffic to both High Tide's e-commerce website and its network of physical retail stores.

- Brand Building: Consistent digital communication and valuable content contribute to building a strong brand identity and fostering customer loyalty within the cannabis market.

Investor Relations and Corporate Communications

Investor relations and corporate communications are critical channels, even though they don't directly generate sales. They are essential for building trust and attracting capital by keeping financial stakeholders, analysts, and the investment community informed about the company's performance and strategic direction.

High Tide Inc. actively engages its investors through its investor relations portal, providing regular financial reports and updates on its strategic initiatives. For instance, in fiscal year 2023, the company reported a significant reduction in its adjusted EBITDA loss compared to the previous year, demonstrating progress towards profitability. This transparency is key to maintaining investor confidence and facilitating future capital raises.

Key aspects of this channel include:

- Financial Transparency: Regularly publishing financial statements and performance metrics.

- Strategic Communication: Articulating the company's long-term vision and growth strategies.

- Stakeholder Engagement: Hosting investor calls and providing timely responses to inquiries.

- Market Perception: Shaping how the company is viewed by analysts and the broader financial market.

High Tide's channels are a multi-faceted approach to reaching customers and stakeholders. The core is its extensive Canna Cabana retail network, offering direct consumer interaction. This is powerfully supplemented by global e-commerce platforms like Grasscity.com, broadening its international footprint for accessories and CBD. The company also utilizes a robust wholesale distribution network, primarily through Valiant™, to expand its proprietary accessory brands into diverse markets.

Digital marketing and social media are crucial for engagement and brand building, driving both online and in-store traffic. Investor relations and corporate communications form another vital channel, ensuring transparency and building confidence with the financial community.

In fiscal year 2024, High Tide's online channels, particularly Grasscity.com, showed significant growth, attracting customers from over 100 countries. The wholesale segment also played a critical role in contributing to gross revenue, highlighting the effectiveness of its B2B strategy for scaling proprietary products.

These integrated channels allow High Tide to cater to a wide range of consumer preferences, from in-person shopping to global online purchasing, while simultaneously building brand equity and securing financial support.

| Channel Type | Key Platforms/Activities | Customer Segment | Fiscal 2024 Highlight |

|---|---|---|---|

| Physical Retail | Canna Cabana Stores (>200) | Canadian Consumers (Recreational Cannabis) | Core revenue driver and brand presence |

| E-commerce | Grasscity.com, Smoke Cartel, Daily High Club | Global Consumers (Accessories, CBD) | Significant traffic growth, international reach |

| Wholesale Distribution | Valiant™ Subsidiary | Retailers, Distributors (Accessory Brands) | Crucial for proprietary product scaling and revenue contribution |

| Digital Marketing & Social Media | Targeted Ads, Content Marketing, Email | Cannabis Enthusiasts, Broad Consumer Base | Key for brand visibility and customer acquisition |

| Investor Relations | Financial Reports, Investor Calls | Investors, Financial Analysts | Maintained investor confidence through transparency |

Customer Segments

The core customer base for High Tide comprises adults aged 19 and over in Canada who are looking for cannabis for recreational use. This group prioritizes having legal and easy access to a variety of cannabis products and accessories. In 2023, the Canadian legal cannabis market was valued at approximately $4.5 billion, showcasing the significant size of this consumer segment.

High Tide's business model, particularly its extensive network of retail stores and its loyalty program, is designed to appeal directly to these consumers. They are attracted to the convenience of purchasing from a well-established retailer and the value offered through discounts. The company's strategy aims to capture a substantial share of this expanding market by offering a comprehensive selection and a rewarding shopping experience.

Cannabis enthusiasts and connoisseurs represent a key demographic for High Tide, seeking premium flower, craft concentrates, and unique consumption devices. This group, often more experienced, values product quality, variety, and expert guidance. For instance, in 2024, the Canadian cannabis market continued to see demand for high-potency products, with consumers actively seeking out strains with THC content exceeding 20%, a trend High Tide aims to satisfy through its curated selection.

Value-conscious shoppers are a core customer segment for High Tide, drawn to competitive pricing and a clear emphasis on getting the most for their money. This group actively seeks out deals and discounts, making High Tide's Cabana Club loyalty program particularly appealing. The program's structure, offering savings and rewards, directly addresses their desire for value.

High Tide's discount strategy has proven effective in attracting and retaining these price-sensitive customers, contributing to market share growth. For instance, in the first quarter of 2024, High Tide reported a significant increase in revenue, partly attributed to the success of their loyalty programs in driving customer engagement and repeat purchases among value-seeking consumers.

International E-commerce Consumers (Accessories & CBD)

Globally, consumers interested in cannabis consumption accessories and hemp-derived CBD products represent a crucial customer segment for High Tide, primarily engaged through its international e-commerce operations. This segment is separate from the Canadian recreational cannabis market and offers substantial growth potential, particularly in regions with evolving cannabis legislation.

High Tide's international e-commerce platforms cater to a diverse global audience seeking specialized accessories and CBD items. This reach is vital for expanding market share beyond domestic borders, tapping into varying regulatory landscapes and consumer preferences worldwide.

- Global Reach: High Tide's international e-commerce sites serve customers across numerous countries, facilitating access to accessories and CBD products where regulations permit.

- Market Diversification: This segment allows High Tide to diversify its revenue streams and reduce reliance on any single market, especially important as cannabis regulations continue to shift internationally.

- Growth Opportunity: The international market for cannabis accessories and CBD is experiencing significant expansion, driven by increasing consumer acceptance and evolving legal frameworks. For example, the global CBD market was projected to reach tens of billions of dollars by 2025, with accessories forming a substantial part of the overall ecosystem.

- Product Specialization: Consumers in this segment often seek specific, high-quality accessories and a wide variety of CBD formulations, a demand High Tide aims to meet through its extensive product offerings.

Wholesale Business Partners

High Tide's wholesale business partners, primarily other retailers and distributors, are crucial for its Valiant™ distribution arm. These partners buy consumption accessories in large quantities, helping High Tide expand the market presence of its in-house brands. This B2B channel is key to diversifying revenue and reaching a broader customer base.

These partners rely on High Tide for consistent product availability and high-quality merchandise. For example, in the first quarter of fiscal year 2024, High Tide reported a significant increase in its wholesale segment's revenue, demonstrating the growing importance of these relationships.

- Retailers and Distributors: These are the primary customers for Valiant™, purchasing bulk accessories.

- Brand Expansion: Wholesale partners are instrumental in extending the reach of High Tide's proprietary brands.

- Revenue Diversification: This segment provides a stable income stream separate from direct-to-consumer sales.

- Reliability and Quality: Partners prioritize a dependable supply chain and consistently good products.

High Tide's customer segments are diverse, encompassing recreational cannabis consumers in Canada seeking legal access and variety, and cannabis enthusiasts valuing premium products and expert advice.

Value-conscious shoppers are drawn to competitive pricing and loyalty programs, while international customers engage through e-commerce for accessories and CBD products.

Wholesale partners, including retailers and distributors, are critical for expanding the reach of High Tide's in-house brands through bulk accessory purchases.

| Customer Segment | Description | Key Motivations | 2024 Data/Trends |

|---|---|---|---|

| Recreational Consumers (Canada) | Adults 19+ seeking legal cannabis. | Convenience, variety, legal access. | Canadian legal cannabis market valued at ~$4.5 billion in 2023; continued growth expected. |

| Cannabis Enthusiasts | Seekers of premium flower, concentrates, and unique devices. | Product quality, variety, expert guidance. | Demand for high-potency products (THC > 20%) remains strong. |

| Value-Conscious Shoppers | Prioritize competitive pricing and discounts. | Deals, loyalty rewards, savings. | Loyalty programs drive engagement; Q1 2024 revenue increase linked to program success. |

| International E-commerce | Global consumers of accessories and CBD. | Specialized accessories, CBD variety, global access. | Global CBD market projected for significant growth; accessories form a key part. |

| Wholesale Partners | Retailers and distributors buying accessories in bulk. | Consistent availability, quality merchandise, brand expansion. | Wholesale segment revenue saw significant increase in Q1 2024. |

Cost Structure

High Tide's Cost of Goods Sold (COGS) is significantly influenced by the direct expenses of acquiring cannabis products from licensed cultivators and the manufacturing costs for its in-house consumption accessories. These are the core costs directly tied to the products it sells.

For example, in the fiscal year 2023, High Tide reported that its cost of sales, which largely represents COGS, was approximately CAD 236.2 million. This figure highlights the substantial investment in inventory and production necessary to support its retail and manufacturing operations.

Optimizing the supply chain and procurement processes are absolutely vital for High Tide to keep its COGS in check and ensure robust gross margins. This involves careful negotiation with suppliers for raw materials and efficient production management.

The cost structure also encompasses the direct expenses related to raw materials and the labor involved in manufacturing their unique accessories, like the Elevate accessories brand. These elements directly impact the profitability of each item sold.

Operating High Tide's extensive network of physical retail locations comes with considerable fixed and variable expenses. These include the costs of rent for prime locations, essential utilities, local property taxes, ongoing maintenance, and importantly, store staff wages and benefits.

Given High Tide's ambitious strategy for retail growth, these operational costs represent a substantial portion of the company's overall expenditure. For instance, in the fiscal year ending September 30, 2023, High Tide reported total operating expenses of $170.7 million CAD, with a significant portion attributable to its growing retail footprint.

Effectively managing these expenditures is paramount to achieving and sustaining profitability, especially considering that newly opened stores typically require a period to ramp up sales and reach their full earning potential. This necessitates careful budgeting and cost control measures across all retail outlets.

High Tide dedicates significant resources to marketing and advertising, crucial for bolstering its retail presence, exemplified by Canna Cabana. These investments are strategically channeled into digital marketing campaigns, point-of-sale promotions within its stores, and the development of customer loyalty programs, all designed to attract new patrons and foster repeat business. For instance, in fiscal year 2024, High Tide reported a notable increase in marketing spend to support the expansion of its Canna Cabana locations and the launch of new e-commerce initiatives.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at High Tide encompass essential corporate overhead. This includes salaries for administrative personnel, crucial legal and compliance expenditures, and fees for professional services. These are the foundational costs enabling the company's overall operation and governance, ensuring smooth sailing.

High Tide actively focuses on optimizing its G&A cost structure. The goal is to ensure these necessary operational expenses directly support and contribute to revenue growth and bolster overall profitability. In 2023, High Tide reported a significant increase in revenue, underscoring the importance of an efficient G&A framework.

- Salaries for administrative staff

- Legal and compliance costs

- Professional fees (e.g., accounting, consulting)

- Other corporate functions supporting governance

Capital Expenditures for Store Expansion and Technology

Capital expenditures are a major part of High Tide's growth strategy, specifically for expanding its Canna Cabana retail chain and enhancing its technological infrastructure. These investments are essential for opening new locations, which are a key driver of revenue growth. For instance, High Tide has been actively pursuing expansion, aiming to increase its store count significantly.

Beyond new store openings, existing locations often require renovations to maintain a competitive and appealing customer experience. Furthermore, High Tide is investing in retail technology, such as its proprietary Fastendr™ kiosks, to streamline the customer purchasing process and improve operational efficiency. These technology investments are crucial for staying ahead in the evolving retail landscape.

While these capital expenditures are vital for High Tide's expansion and technological advancement, they represent a substantial cash outflow. The company's strategy to fund a significant portion of this growth is through its internally generated cash flows. This approach aims to balance aggressive expansion with financial prudence, relying on operational profits to fuel future development rather than solely external financing.

- Expansion Investments: Capital expenditures are primarily directed towards opening new Canna Cabana stores.

- Renovation Needs: Funds are also allocated for updating and improving existing retail locations.

- Technology Integration: Significant investment in retail technology like Fastendr™ kiosks is a key focus.

- Funding Strategy: High Tide plans to finance a substantial part of these capital expenditures using internally generated cash flows.

High Tide's cost structure is multifaceted, encompassing direct costs of goods sold, operational expenses for its retail network, marketing investments, general administrative overhead, and significant capital expenditures for growth.

In fiscal year 2023, High Tide's cost of sales was CAD 236.2 million, reflecting the direct costs of acquiring cannabis products and manufacturing accessories. Operating expenses for the same period totaled CAD 170.7 million, a substantial figure driven by the expansion of its retail footprint, particularly Canna Cabana locations.

The company also invests heavily in marketing to drive brand awareness and customer acquisition, with a notable increase in spending in fiscal year 2024 to support new e-commerce initiatives and store expansion.

General and Administrative costs, including salaries, legal, and professional fees, are managed to support revenue growth, while capital expenditures are primarily focused on opening new Canna Cabana stores and integrating technologies like Fastendr™ kiosks, largely funded by internal cash flow.

| Cost Category | Description | Fiscal Year 2023 (CAD) |

|---|---|---|

| Cost of Sales (COGS) | Direct costs of acquiring cannabis products and manufacturing accessories. | 236.2 million |

| Operating Expenses | Costs associated with running the retail network (rent, utilities, staff wages, etc.). | 170.7 million |

| Marketing & Advertising | Investments in digital marketing, promotions, and loyalty programs. | [Data not explicitly provided for FY23, but noted increase in FY24] |

| General & Administrative (G&A) | Corporate overhead including salaries, legal, and professional fees. | [Data not explicitly provided as a single line item for FY23] |

| Capital Expenditures | Investments in new store openings, renovations, and technology. | [Data not explicitly provided as a single line item for FY23, but noted focus on expansion] |

Revenue Streams

High Tide's core revenue driver is the direct sale of recreational cannabis through its Canna Cabana retail locations nationwide. This segment represents the largest chunk of the company's income, fueled by its significant number of stores and a loyalty program that incentivizes repeat purchases.

In the fiscal year ending September 30, 2023, High Tide reported a substantial 19.4% increase in cannabis sales revenue, reaching $207.9 million. This growth underscores the effectiveness of their direct-to-consumer strategy in capturing market share and customer spending.

The company's discount club model, a key differentiator, plays a crucial role in driving these sales by offering competitive pricing and exclusive member benefits. This approach has proven successful in attracting and retaining a loyal customer base within the highly competitive Canadian cannabis market.

As of the first quarter of fiscal 2024, High Tide continued to demonstrate strong performance in this area, with retail sales contributing significantly to its overall financial results, reflecting ongoing consumer demand for their curated product selection and accessible pricing.

High Tide generates revenue by selling cannabis consumption accessories directly to consumers. This includes sales from its numerous Canna Cabana retail locations across Canada and through its international e-commerce sites like Grasscity.com and Smoke Cartel.

This dual approach, combining brick-and-mortar retail with online sales, allows High Tide to reach a broad customer base. In the first quarter of fiscal 2024, High Tide reported a 10% increase in its accessories segment revenue, demonstrating the strength of this direct-to-consumer strategy.

High Tide generates significant revenue through the wholesale of its owned brands of cannabis accessories, like Valiant™. This business-to-business model allows them to supply their products to a broader network of retailers and distributors, effectively extending their market presence.

This wholesale channel is crucial for High Tide as it typically offers more attractive profit margins compared to direct-to-consumer sales, enhancing overall profitability. For instance, in the fiscal year 2023, wholesale operations contributed a substantial portion to their revenue growth, demonstrating the channel's importance.

By leveraging wholesale, High Tide can reach a wider customer base without the need for extensive individual retail storefronts. This strategy is key to scaling their accessory business efficiently and capturing a larger share of the burgeoning cannabis accessory market.

Cabanalytics Data and Advertising Revenue

High Tide generates revenue through its Cabanalytics Business Data and Insights Platform, offering valuable market data and analytics. This platform provides key performance indicators and industry trends to businesses, fostering informed decision-making.

Advertising on High Tide's platforms also contributes significantly to its revenue. This includes digital advertising opportunities across various touchpoints, reaching a targeted audience.

- Data and Insights Platform: High Tide monetizes its proprietary data and analytics services, offering subscription-based access to market intelligence.

- Advertising Revenue: The company leverages its digital presence and user base to generate income through various advertising formats.

- Growing Segment: This combined revenue stream is characterized by its high-margin potential and its role in diversifying High Tide's overall income sources.

- Market Position: As of early 2024, the demand for granular data in sectors served by High Tide continues to rise, supporting the growth of this revenue stream.

Loyalty Program Memberships (ELITE) and Related Services

High Tide generates revenue through paid ELITE memberships within its Cabana Club loyalty program. This subscription-based model offers premium benefits to its most engaged customers, creating a direct revenue stream beyond just driving sales.

The ELITE tier is structured to encourage increased customer spending and foster deeper brand loyalty. For instance, in Q1 2024, High Tide reported a 25% increase in same-store sales, partly attributed to the success of its loyalty initiatives like the Cabana Club, which aims to convert casual shoppers into repeat, high-value customers.

- Direct Subscription Revenue: ELITE memberships provide a predictable, recurring income source.

- Enhanced Customer Lifetime Value: The program incentivizes higher spending and repeat purchases.

- Data & Insights: ELITE members offer valuable data for targeted marketing and product development.

- Brand Advocacy: Loyal members are more likely to become brand advocates, driving organic growth.

High Tide's revenue streams are diversified, with its primary income originating from the direct sale of recreational cannabis across its extensive Canna Cabana retail network. Complementing this is the robust sale of cannabis consumption accessories, both through its physical stores and international e-commerce platforms like Grasscity.com, with its accessories segment revenue seeing a 10% increase in Q1 2024.

Further bolstering its income, High Tide engages in the wholesale distribution of its proprietary accessory brands, such as Valiant™, a B2B approach that typically yields higher profit margins. The company also generates revenue from its Cabanalytics Business Data and Insights Platform, offering valuable market intelligence, and through advertising opportunities across its digital properties.

Additionally, High Tide leverages a paid ELITE membership tier within its Cabana Club loyalty program, creating a direct subscription revenue stream and fostering deeper customer engagement and loyalty, which contributed to a 25% increase in same-store sales in Q1 2024.

| Revenue Stream | Description | Key Performance Indicator/Fact |

| Cannabis Sales | Direct sale of recreational cannabis through Canna Cabana stores. | 19.4% increase in cannabis sales revenue in FY2023, reaching $207.9 million. |

| Accessories Sales (DTC & E-commerce) | Sale of cannabis consumption accessories via retail and online. | 10% increase in accessories segment revenue in Q1 2024. |

| Accessories Sales (Wholesale) | B2B distribution of owned accessory brands. | Contributed substantially to revenue growth in FY2023, offering higher profit margins. |

| Data & Insights Platform / Advertising | Monetization of market data and digital advertising. | High-margin potential and diversification of income sources. |

| ELITE Memberships | Subscription revenue from premium loyalty program tier. | Contributed to a 25% increase in same-store sales in Q1 2024. |

Business Model Canvas Data Sources

The High Tide Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and detailed financial projections. These diverse data sources ensure each component of the canvas accurately reflects our strategic direction and market realities.