Hexagon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexagon Bundle

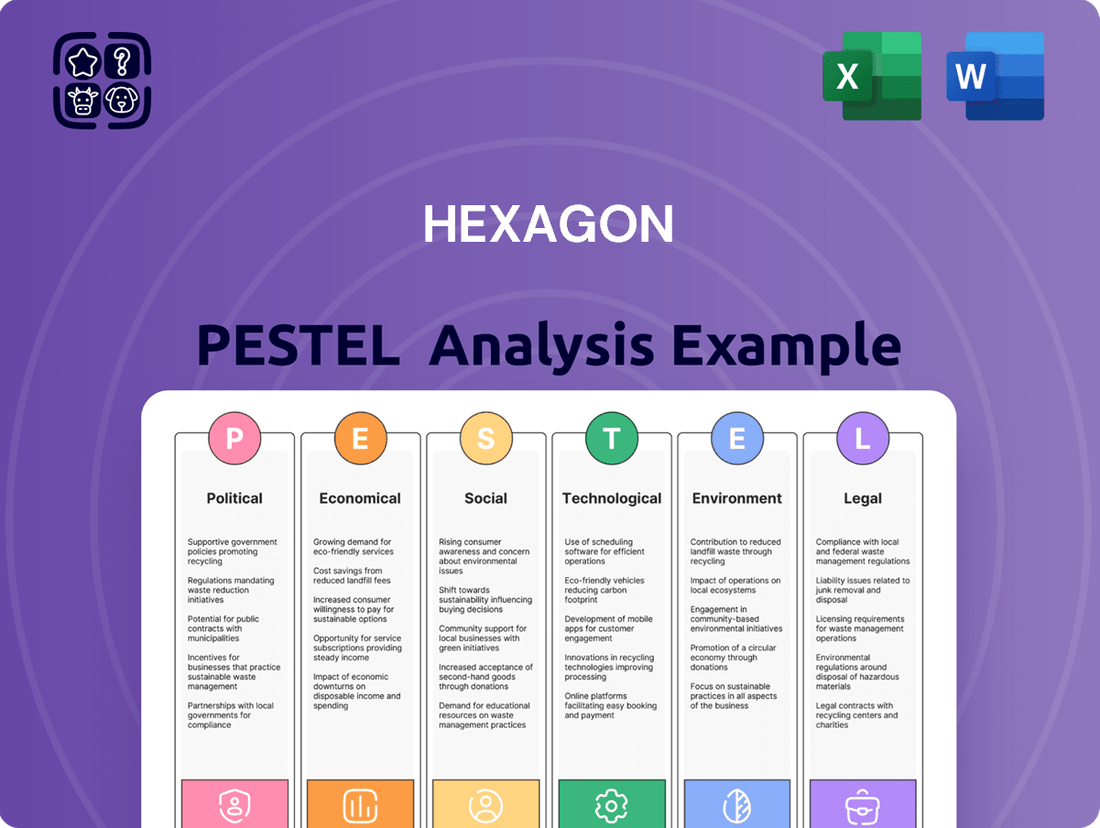

Unlock the critical external factors shaping Hexagon's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they present both opportunities and challenges. Equip yourself with the strategic foresight needed to navigate this dynamic landscape. Download the full, actionable report now and gain a decisive competitive advantage.

Political factors

Governments worldwide are actively pushing digital transformation, a trend that directly supports Hexagon's digital reality solutions. For instance, the European Union's Digital Decade policy aims to have 75% of businesses using cloud, big data, or AI services by 2030, creating a fertile ground for Hexagon's offerings.

Policies promoting smart cities, robust digital infrastructure, and the adoption of Industry 4.0 principles foster a market environment ripe for Hexagon's technologies. Many nations, including the United States with its Bipartisan Infrastructure Law, are investing billions in digital infrastructure upgrades, potentially opening doors for public sector contracts.

Incentives for automation and data-driven decision-making are also on the rise. South Korea, for example, has a national strategy to boost AI adoption across industries, recognizing its potential to enhance productivity and innovation, aligning perfectly with Hexagon's mission.

Hexagon's extensive global footprint, spanning 50 countries, makes it highly sensitive to evolving trade relations and geopolitical stability. For instance, the ongoing trade disputes between major economies in 2024 could lead to increased tariffs on components or finished goods, directly impacting Hexagon's manufacturing costs and pricing strategies. The World Bank's projections for global trade growth in 2024, while showing some recovery, remain subject to these geopolitical uncertainties.

Shifts in trade agreements, such as potential renegotiations or the imposition of new protectionist measures, pose a significant risk to Hexagon's intricate supply chains and access to key markets. A rise in protectionism could necessitate costly adjustments to sourcing and distribution networks, potentially affecting Hexagon's competitive edge. Geopolitical tensions in regions where Hexagon operates can also dampen investment climates and reduce demand for its advanced technology solutions, particularly in sectors sensitive to economic stability.

Hexagon's autonomous technology solutions, a significant part of its business, face a complex web of regulations that differ by nation. These rules, addressing safety, accountability, and how data is handled, impact everything from self-driving cars to industrial robots. For instance, the European Union's AI Act, expected to be fully implemented by mid-2025, categorizes AI systems based on risk, with higher-risk applications like those in autonomous vehicles facing stricter requirements, potentially impacting Hexagon's development timelines and compliance costs.

The varying speed and direction of these regulatory changes present both challenges and potential advantages for Hexagon's global growth strategy. While some regions are actively promoting autonomous tech with clear guidelines, others are more cautious, leading to fragmented market access. For example, the US has seen a patchwork of state-level regulations for autonomous vehicles, contrasting with a more unified federal approach in some European countries, creating a need for adaptable compliance strategies.

Data Privacy and Security Laws

Hexagon's core business, centered on digital twins and extensive data management, makes compliance with data privacy and cybersecurity legislation paramount. Regulations such as the General Data Protection Regulation (GDPR) and similar frameworks enacted globally directly impact how Hexagon collects, processes, and stores sensitive information. Failure to adhere can lead to significant financial penalties and reputational damage.

The increasing focus on data protection is evident in the growing number of data breach notifications and regulatory fines. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. In 2023, regulators worldwide issued billions in fines for privacy violations, highlighting the critical need for robust compliance strategies.

- Global Data Protection Landscape: Over 120 countries now have data protection laws, with many mirroring GDPR principles, increasing compliance complexity for multinational corporations like Hexagon.

- Cybersecurity Investments: Companies are significantly increasing cybersecurity budgets; the global cybersecurity market was projected to reach over $200 billion in 2024, indicating the perceived threat and investment in protective measures.

- Trust and Reputation: Demonstrating strong data governance and security practices is essential for building and maintaining customer trust, a key differentiator in the digital twin and data analytics market.

Government Spending on Infrastructure and Public Safety

Government investments in infrastructure and public safety are crucial drivers for Hexagon's business. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, is expected to boost spending on roads, bridges, and public transit through 2026, directly increasing demand for Hexagon's geospatial planning and management tools. Similarly, increased public safety spending, such as the projected 5% growth in the global public safety market by 2025, signals a growing need for Hexagon's integrated software solutions in areas like emergency response and law enforcement.

These government initiatives create substantial growth opportunities. For example, smart city projects, often funded by government grants and stimulus packages, rely heavily on the type of location intelligence and data management that Hexagon provides. In 2024, many countries are continuing to prioritize digital transformation in public services, which translates to increased adoption of advanced geospatial technologies.

- Infrastructure Investment: Government spending on infrastructure projects, like those outlined in national development plans, directly fuels demand for Hexagon's surveying, mapping, and asset management software.

- Public Safety Funding: Increased budgets for emergency services, policing, and disaster management create opportunities for Hexagon's public safety and security solutions.

- Urban Planning Initiatives: Government focus on urban development and smart city projects necessitates the use of geospatial data and analytics, aligning with Hexagon's core offerings.

Government policies championing digital transformation and smart city initiatives directly benefit Hexagon. For instance, the EU's Digital Decade aims for 75% of businesses to use cloud, big data, or AI by 2030, creating a strong market for Hexagon's solutions. Similarly, U.S. infrastructure spending, exceeding $1.2 trillion, boosts demand for Hexagon's geospatial tools.

Trade relations and geopolitical stability significantly influence Hexagon's global operations. Trade disputes in 2024 could lead to tariffs, impacting manufacturing costs, while protectionist measures might disrupt supply chains. The World Bank noted ongoing geopolitical uncertainties affecting global trade growth projections for 2024.

Regulations surrounding autonomous technologies and data privacy present both challenges and opportunities. The EU's AI Act, with stricter rules for high-risk AI by mid-2025, could affect Hexagon's development. Data protection laws like GDPR, with potential fines up to 4% of global turnover, underscore the critical need for robust compliance, as billions in fines were issued globally in 2023.

| Policy Area | Impact on Hexagon | Example/Data Point (2024-2025) |

|---|---|---|

| Digital Transformation & Smart Cities | Increased demand for geospatial and data management solutions | EU's Digital Decade: 75% of businesses using cloud/AI by 2030; US infrastructure spending over $1.2T |

| Trade & Geopolitics | Potential impact on supply chains, costs, and market access | Ongoing trade disputes affecting component tariffs; World Bank projections for global trade growth subject to uncertainty |

| Autonomous Tech Regulation | Compliance costs and market access variations | EU AI Act (mid-2025 implementation) with stricter rules for autonomous vehicles |

| Data Privacy & Cybersecurity | Critical need for robust compliance and security investments | GDPR fines up to 4% of global turnover; over 120 countries with data protection laws; global cybersecurity market projected over $200B in 2024 |

What is included in the product

The Hexagon PESTLE Analysis provides a comprehensive examination of how external macro-environmental factors influence the Hexagon across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The Hexagon PESTLE Analysis provides a structured framework that simplifies complex external factors, alleviating the pain of information overload and enabling more focused strategic decision-making.

Economic factors

Hexagon's performance is intrinsically linked to the health of the global economy and the appetite for industrial investment. When economies are robust, industries are more inclined to invest in advanced technologies that boost productivity, directly benefiting Hexagon's sales. For instance, a strong global GDP growth forecast, such as the projected 2.7% for 2025 by the IMF, generally signals increased capital expenditure across key sectors.

Conversely, economic slowdowns or periods of uncertainty can significantly curb customer spending on capital goods. Sectors like manufacturing, construction, and automotive, which are major consumers of Hexagon's solutions, tend to reduce their investment in new equipment and technologies during downturns. This caution directly impacts Hexagon's revenue streams and its potential for organic growth, highlighting the sensitivity of its business to macroeconomic conditions.

Currency exchange rate fluctuations present a significant challenge for Hexagon, a multinational corporation with a global footprint. For instance, if the US dollar strengthens significantly against the Euro, Hexagon's reported revenues from European sales would translate to fewer dollars, impacting its overall financial performance. This volatility directly influences Hexagon's profitability and the price competitiveness of its offerings in various international markets.

Rising inflation, a persistent concern throughout 2024 and into early 2025, directly impacts Hexagon's operational costs. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable uptick, meaning raw materials and components are more expensive. This squeeze on input costs puts pressure on Hexagon's gross margins if these increases cannot be fully passed on to customers.

Supply chain disruptions, exacerbated by geopolitical events and lingering pandemic effects, continue to inflate logistics expenses for Hexagon. Shipping costs, particularly for ocean freight, remained elevated in late 2024, contributing to longer lead times and increased inventory holding costs. These challenges can delay product delivery, potentially impacting customer satisfaction and revenue realization.

Interest Rate Environment and Access to Capital

The prevailing interest rate environment significantly impacts Hexagon's financial flexibility and its customers' investment capacity. As of mid-2024, central banks in major economies like the US and Europe have maintained relatively high benchmark rates, reflecting ongoing efforts to curb inflation. For instance, the US Federal Reserve's target range for the federal funds rate remained at 5.25%-5.50% through early 2024, a level not seen in decades.

This higher cost of capital directly affects Hexagon's borrowing expenses for strategic initiatives such as mergers, acquisitions, and research and development. Furthermore, elevated interest rates can deter Hexagon's clients, particularly those undertaking large-scale digital transformation projects, from financing these ventures. The increased cost of debt may lead to deferred or scaled-back investments by customers, potentially slowing Hexagon's revenue growth in these segments.

The outlook for interest rates in late 2024 and into 2025 suggests a cautious approach from central banks. While inflation has shown signs of moderating, underlying economic pressures might prevent rapid rate reductions. This persistent higher-rate environment necessitates careful financial planning for Hexagon, focusing on efficient capital allocation and potentially exploring alternative financing structures.

- Borrowing Costs: Higher interest rates increase the cost of debt for Hexagon's capital expenditures and acquisitions.

- Customer Investment: Elevated rates can make financing large digital transformation projects more expensive for Hexagon's clients, potentially delaying adoption.

- Credit Conditions: Tightening credit markets associated with higher rates could limit access to capital for both Hexagon and its customers.

- Market Outlook: Continued elevated rates through 2024-2025 require strategic financial management to mitigate impacts on growth.

Industry-Specific Market Conditions

Hexagon's diverse portfolio means it navigates a complex web of industry-specific economic realities. For instance, while the automotive sector grappled with supply chain disruptions and fluctuating demand throughout 2024, impacting sales for related manufacturing solutions, the industrial automation market demonstrated robust expansion. This growth, driven by increased investment in efficiency and smart factory technologies, presented significant opportunities for Hexagon's automation and software divisions.

The construction industry, another key area for Hexagon, also experienced varied economic conditions. Factors like rising material costs and interest rate sensitivity influenced project starts and investment levels. However, the ongoing need for infrastructure upgrades and digital transformation in construction provided a counterbalancing demand for Hexagon's surveying and design technologies. Adapting to these sector-specific economic cycles is paramount for Hexagon's strategic resource allocation and market positioning.

- Automotive Sector Challenges: Faced supply chain issues and demand volatility in 2024, impacting related Hexagon offerings.

- Industrial Automation Growth: Experienced strong expansion in 2024, fueled by smart factory investments, benefiting Hexagon's automation and software segments.

- Construction Industry Dynamics: Navigated rising material costs and interest rate impacts, offset by infrastructure investment demand for Hexagon's surveying and design tools.

- Strategic Adaptation: Understanding and responding to these varied sector-specific economic trends is vital for Hexagon's planning.

Economic factors significantly influence Hexagon's performance, with global GDP growth directly correlating to industrial investment. For example, the IMF projected 2.7% global GDP growth for 2025, signaling potential for increased capital expenditure. Conversely, economic downturns and uncertainty can dampen customer spending on capital goods, impacting Hexagon's revenue, particularly in manufacturing and construction sectors.

Currency fluctuations pose a challenge for Hexagon's global operations. A stronger US dollar, for instance, can reduce the value of revenues earned in other currencies. Inflation also directly impacts Hexagon's costs, as seen with rising producer prices for manufactured goods in 2024, squeezing profit margins if these costs cannot be fully passed on.

Elevated interest rates, maintained by central banks through early 2024, increase Hexagon's borrowing costs for strategic investments and can deter customers from financing large projects. For example, the US Federal Reserve's rate held between 5.25%-5.50% through early 2024. This persistent higher-rate environment necessitates careful financial management and strategic capital allocation.

| Economic Factor | Impact on Hexagon | 2024/2025 Data Point |

|---|---|---|

| Global GDP Growth | Influences industrial investment and capital expenditure. | IMF projected 2.7% global GDP growth for 2025. |

| Currency Exchange Rates | Affects reported revenues from international sales. | USD strengthened against EUR in late 2024, impacting Eurozone revenue translation. |

| Inflation | Increases operational costs and impacts profit margins. | Producer Price Index for manufactured goods saw notable upticks in 2024. |

| Interest Rates | Raises borrowing costs and affects customer financing capacity. | US Federal Reserve target rate range 5.25%-5.50% through early 2024. |

Preview Before You Purchase

Hexagon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hexagon PESTLE Analysis provides a detailed breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting a business. It's designed for strategic planning and market assessment.

Sociological factors

The increasing integration of digital reality and autonomous systems by companies like Hexagon demands a workforce proficient in managing these advanced technologies. For instance, the global augmented reality (AR) and virtual reality (VR) market, which Hexagon heavily influences, was projected to reach over $30 billion in 2024, highlighting the need for specialized skills.

Societal shifts in education and digital literacy directly impact Hexagon's innovation pipeline and its clients' adoption rates. A 2024 report indicated that less than 40% of the global workforce felt adequately prepared for the digital transformation, underscoring a significant skill gap that Hexagon must consider.

To bridge these emerging skill gaps, Hexagon's strategy likely involves robust training programs and strategic alliances with educational institutions. This proactive approach ensures both Hexagon's internal capabilities and its customers' readiness to leverage cutting-edge digital solutions.

Public perception of automation and AI is a key driver for Hexagon's growth. Surveys in late 2024 indicated that while a majority of consumers are optimistic about AI's potential benefits, concerns about job security remain significant, with roughly 45% expressing worry about AI replacing human workers.

Societal anxieties surrounding job displacement and the ethical deployment of AI directly shape regulatory landscapes and consumer demand for Hexagon's offerings. For instance, the EU's AI Act, finalized in early 2025, introduces stringent guidelines that Hexagon must navigate, potentially impacting market entry timelines for certain AI-driven solutions.

Hexagon's strategic emphasis on technologies that demonstrably boost productivity and enhance workplace safety is crucial for building positive societal acceptance. By highlighting how its solutions augment human capabilities rather than solely replace them, Hexagon can mitigate apprehension and foster trust among its target markets.

Global urbanization continues at a rapid pace, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This trend intensifies the demand for sophisticated urban planning, resilient infrastructure, and enhanced public safety. Hexagon's expertise in geospatial data and digital twin creation offers powerful tools to address these growing urban challenges.

Smart city initiatives are directly leveraging these technologies to optimize traffic flow, manage resources like water and energy more effectively, and improve the overall quality of life for citizens. For instance, cities are increasingly adopting sensor networks and data analytics, areas where Hexagon's solutions provide foundational capabilities for creating interconnected and responsive urban environments.

Demand for Sustainable Practices and ESG Reporting

Societal expectations are increasingly pushing businesses toward sustainability, and this trend significantly impacts Hexagon. Consumers and stakeholders alike are demanding that companies adopt environmentally friendly practices and be transparent about their social and governance performance through ESG reporting. For Hexagon, this means not only aligning its own operations with ESG principles but also recognizing how its technology can help its customers achieve their sustainability objectives.

Hexagon's commitment to ESG can be a powerful differentiator. A strong ESG profile can boost its reputation, making it more appealing to environmentally conscious investors and top talent. For instance, by 2024, over 90% of S&P 500 companies were expected to be reporting on ESG metrics, highlighting the widespread adoption of these standards.

- Growing consumer demand for sustainable products and services.

- Increasing regulatory pressure for ESG disclosures.

- Investor focus on ESG performance for long-term value.

- Hexagon's role in enabling customer sustainability through its solutions.

Changing Consumer Expectations and Digital Experiences

Even though Hexagon mainly operates in business-to-business sectors, evolving consumer demands for smooth digital interactions and personalized services can indirectly shape industrial needs. For example, the growing interest in digital twins and highly customized manufactured goods mirrors a wider societal trend toward digital engagement and bespoke solutions.

This shift is evident in the increasing adoption of e-commerce platforms by industrial buyers, seeking efficiency and transparency similar to their B2C experiences. By mid-2024, a significant portion of B2B purchasing decisions were influenced by digital touchpoints, with many buyers expecting online self-service options.

- Digital Transformation in B2B: Studies in 2024 indicated that over 70% of B2B buyers prefer to research and purchase online, reflecting a strong demand for digital experiences.

- Personalization Demand: The desire for customized products, a trend amplified by consumer markets, is now pushing industrial manufacturers to leverage digital tools for greater product variability and tailored solutions.

- Impact on Industrial Software: Hexagon's software solutions, which enable digital twins and advanced customization, are therefore well-positioned to meet these evolving, digitally-driven expectations in industrial sectors.

Societal trends increasingly prioritize digital fluency and the ethical application of advanced technologies. With the global AR/VR market projected to exceed $30 billion in 2024, Hexagon must address a workforce skill gap, as less than 40% of workers felt ready for digital transformation in 2024.

Public sentiment towards automation and AI reveals a duality: optimism about benefits coexists with concerns about job security, with approximately 45% of consumers worried about AI-driven job displacement in late 2024 surveys. This anxiety influences regulatory frameworks, such as the EU's AI Act finalized in early 2025, which Hexagon must navigate.

The growing demand for sustainability is a significant societal factor, driving companies to adopt eco-friendly practices and transparent ESG reporting, a trend mirrored by over 90% of S&P 500 companies expected to report on ESG metrics by 2024.

Technological factors

Hexagon's strategic advantage is deeply rooted in its digital reality solutions, where advancements in digital twin and artificial intelligence (AI) are paramount. These technologies are not just features but the very foundation of their business, enabling sophisticated data capture, analysis, and visualization.

The continuous evolution of AI, machine learning, and 3D modeling directly impacts Hexagon's ability to innovate and stay ahead. For instance, AI's role in predictive maintenance within industrial settings, a key area for Hexagon, is expected to grow significantly. The global AI market, projected to reach hundreds of billions of dollars by 2025, underscores the immense potential these advancements hold for companies like Hexagon.

Hexagon's core strength is its ability to seamlessly integrate advanced sensors, intelligent software, and increasingly autonomous systems. This fusion is crucial for delivering powerful, real-time solutions across its diverse customer base.

The accelerating convergence of these technologies, fueled by the expansion of the Internet of Things (IoT), the rollout of 5G networks, and the rise of edge computing, allows Hexagon to offer more sophisticated capabilities. For instance, in manufacturing, this integration enables enhanced quality control and predictive maintenance, improving operational efficiency.

This technological synergy directly translates into tangible benefits for industries like construction and agriculture. In construction, it facilitates more precise surveying and project management, while in agriculture, it supports precision farming techniques, leading to better resource utilization and yield optimization. Hexagon's investment in R&D for these integrated solutions is expected to continue driving growth, with the company reporting significant revenue from its software-intensive businesses.

Hexagon AB is at the forefront of geospatial and positioning technologies, a sector experiencing rapid innovation. Advancements in satellite technology, LiDAR, and drone deployment are significantly broadening the utility of Hexagon's offerings in areas like mapping, surveying, and location-based intelligence. These technological leaps are directly translating into more precise, faster, and comprehensive data acquisition for their clients.

For instance, the global drone services market, a key area for Hexagon's geospatial solutions, was valued at approximately $2.4 billion in 2023 and is projected to reach $10.1 billion by 2030, growing at a compound annual growth rate of over 22%. This robust growth underscores the increasing demand for the very capabilities Hexagon is enhancing through its technological development.

Growth of Industrial Automation and Robotics

The industrial automation and robotics sector is booming, with global markets projected to reach significant figures. For instance, the industrial robotics market alone was valued at approximately $50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2030, driven by demand for enhanced efficiency and precision in manufacturing.

Hexagon's strategic positioning in this space is robust. Their manufacturing intelligence solutions and advancements in autonomous systems directly cater to this growing demand. By enabling businesses to automate intricate production lines and optimize operational output, Hexagon is well-placed to capitalize on this technological shift.

Key aspects of this trend include:

- Increased adoption of collaborative robots (cobots) in diverse industries Cobots are becoming more prevalent, working alongside humans to boost productivity.

- AI and machine learning integration in automated systems AI is powering smarter, more adaptable automation solutions.

- Growth in smart factory initiatives Businesses are investing in connected, data-driven manufacturing environments.

- Demand for predictive maintenance Automation helps anticipate and prevent equipment failures, reducing downtime.

Cybersecurity and Data Integrity for Digital Solutions

As Hexagon's digital solutions, from industrial automation to geospatial intelligence, become increasingly interconnected and data-heavy, the imperative for strong cybersecurity and data integrity escalates. Protecting sensitive industrial operational data and detailed geospatial information from unauthorized access or breaches is paramount for maintaining customer confidence and ensuring the dependable performance of their digital twin technologies.

The increasing reliance on data-driven insights and interconnected systems means that any compromise in cybersecurity can have far-reaching consequences, impacting operational continuity and the accuracy of critical decision-making processes for Hexagon's clients. For instance, a report from Cybersecurity Ventures in 2023 projected that cybercrime costs would reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks associated with data vulnerabilities across all industries, including those Hexagon serves.

- Data Breach Impact: A significant data breach could erode customer trust, leading to contract cancellations and damage to Hexagon's reputation in sectors where data security is a primary concern.

- Regulatory Compliance: Adherence to evolving data protection regulations, such as GDPR and CCPA, necessitates continuous investment in cybersecurity measures to avoid hefty fines and legal repercussions.

- Digital Twin Reliability: Ensuring the integrity of data feeding into digital twins is crucial; any corruption or unauthorized alteration could lead to flawed simulations and incorrect operational adjustments for clients.

- Industry Standards: Meeting stringent industry-specific cybersecurity standards, particularly in sectors like defense and critical infrastructure, is a prerequisite for market access and competitive advantage.

Technological factors are central to Hexagon's strategy, particularly advancements in AI, machine learning, and 3D modeling, which are crucial for their digital reality solutions. The company leverages these technologies for sophisticated data analysis and visualization, directly impacting its innovation capabilities. The global AI market's substantial growth, projected to reach hundreds of billions by 2025, highlights the immense potential these technologies offer.

Legal factors

Hexagon's core business thrives on its advanced proprietary sensors, sophisticated software, and cutting-edge autonomous technologies. These innovations are the bedrock of its competitive edge, making robust intellectual property (IP) protection paramount.

Effective patent protection is crucial for Hexagon to prevent competitors from replicating its unique technologies and to secure its market position. For instance, in 2023, Hexagon continued to invest significantly in R&D, with a substantial portion allocated to developing and patenting new solutions, reflecting the critical role of IP in its strategy.

The increasing use of autonomous systems, like those Hexagon develops, brings significant product liability and safety concerns. Navigating these evolving legal landscapes is crucial. For instance, in 2024, the US Department of Transportation continued to refine guidelines for automated driving systems, emphasizing safety performance standards and data reporting requirements for manufacturers.

Hexagon must ensure its autonomous solutions comply with a patchwork of international and national regulations that assign responsibility for accidents or malfunctions. Failure to do so can lead to substantial financial penalties and reputational damage. By 2025, many jurisdictions are expected to have more solidified legal frameworks specifically addressing AI and autonomous vehicle liability, potentially increasing the compliance burden.

Hexagon's global operations, particularly its work with digital twins and extensive data processing, necessitate strict adherence to a patchwork of international data governance and cross-border data flow regulations. Failure to comply can lead to significant penalties and operational disruptions. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, continues to set a high bar for data privacy, impacting how Hexagon collects, stores, and transfers customer data. As of 2024, companies operating across multiple jurisdictions are increasingly facing scrutiny over data localization requirements, such as those being implemented or considered in countries like India and China, which can complicate global data strategies.

Anti-Trust and Competition Laws

Hexagon's global operations necessitate strict adherence to anti-trust and competition laws across numerous countries. As a significant player in its markets, the company's growth strategies, including mergers and acquisitions, are scrutinized to prevent monopolistic practices and ensure a level playing field. For instance, the European Commission actively reviews significant mergers to safeguard competition, and Hexagon must navigate these regulatory landscapes diligently.

Failure to comply can result in substantial fines and operational disruptions. In 2023, the U.S. Department of Justice and Federal Trade Commission collectively issued over $3 billion in penalties for antitrust violations, highlighting the financial and reputational risks involved. Hexagon's commitment to fair competition is therefore crucial for its sustained market access and business integrity.

Key considerations for Hexagon include:

- Merger Control: Ensuring all acquisitions meet regulatory thresholds and approval requirements in relevant jurisdictions.

- Abuse of Dominance: Avoiding practices that unfairly leverage its market position to disadvantage competitors.

- Cartel Prevention: Implementing robust internal controls to prevent price-fixing or market-sharing agreements.

- Regulatory Scrutiny: Proactively engaging with competition authorities to ensure transparency and compliance.

Software Licensing and Compliance

Hexagon's vast software portfolio necessitates rigorous adherence to licensing agreements and software regulations. This involves meticulous tracking of software usage to prevent unauthorized access and piracy, which directly impacts revenue and incurs significant legal penalties. For instance, in 2024, software piracy costs the global economy an estimated $60 billion annually, a figure Hexagon must actively mitigate.

Adapting to the dynamic landscape of software legislation is crucial for maintaining compliance and safeguarding Hexagon's financial health. Evolving data privacy laws, such as GDPR and CCPA, continue to shape how software is developed, deployed, and managed, potentially requiring costly updates and operational adjustments. Failure to comply can lead to substantial fines, with GDPR penalties reaching up to 4% of annual global turnover.

- Software Licensing Management: Ensuring all Hexagon software deployments are covered by appropriate licenses to avoid legal repercussions and financial penalties.

- Compliance with Data Privacy Laws: Adhering to regulations like GDPR and CCPA in software development and data handling practices.

- Piracy Prevention: Implementing robust measures to deter and detect software piracy, protecting intellectual property and revenue streams.

- Regulatory Monitoring: Staying abreast of changes in software-related laws and adapting Hexagon's practices accordingly to maintain legal standing.

Legal factors are paramount for Hexagon, particularly concerning intellectual property and product liability. The company's reliance on proprietary sensor and autonomous technologies necessitates robust patent protection to prevent infringement and maintain its competitive edge. For example, in 2023, Hexagon continued its significant investment in R&D, a portion of which was dedicated to patenting new innovations.

The increasing adoption of autonomous systems, central to Hexagon's offerings, brings heightened product liability and safety concerns. Navigating evolving regulations, such as the US Department of Transportation's refined guidelines for automated driving systems in 2024, is critical for compliance and risk mitigation. By 2025, many regions are expected to solidify legal frameworks for AI and autonomous vehicle liability, potentially increasing compliance demands.

Hexagon's global data processing activities, including digital twin development, require strict adherence to international data governance and cross-border data flow regulations. Compliance with frameworks like GDPR, which sets high data privacy standards, remains essential. As of 2024, companies like Hexagon face increasing scrutiny over data localization requirements in countries such as India and China, complicating global data strategies.

Furthermore, Hexagon must navigate complex anti-trust and competition laws across its operating regions. Its growth strategies, including mergers and acquisitions, are subject to regulatory review to prevent monopolistic practices. In 2023, U.S. antitrust enforcement resulted in over $3 billion in penalties, underscoring the financial risks of non-compliance.

Environmental factors

The increasing global focus on sustainability and climate change is a significant factor for Hexagon. This trend creates opportunities for Hexagon's technology to aid clients in reducing their environmental impact, such as through smarter resource use and enhanced energy efficiency. For instance, Hexagon's digital reality solutions can optimize construction processes, potentially cutting material waste by up to 20% in large-scale projects.

Growing concerns about resource scarcity are driving a shift towards circular economy principles, impacting how companies like Hexagon design, produce, and manage their products. This means a greater emphasis on solutions that maximize resource efficiency, minimize waste, and incorporate recycling, making them more attractive to environmentally conscious customers and regulators.

For instance, the global demand for critical raw materials, essential for many advanced technologies, continues to rise. Projections suggest that the demand for metals like lithium and cobalt, crucial for batteries, could increase by over 500% by 2050, highlighting the urgency of circular solutions. Hexagon's focus on digital transformation and data analytics can play a pivotal role in optimizing resource use throughout product lifecycles, from design to end-of-life management, potentially reducing reliance on virgin materials.

Hexagon must navigate a complex web of environmental regulations across its global manufacturing sites and product lifecycles. These rules, covering emissions, waste disposal, and hazardous material usage, directly influence operational expenses and necessitate adjustments in product development. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation impacts the materials Hexagon can use in its products sold within the EU.

Demand for Green Technologies and Solutions

The global market for green technologies is experiencing robust growth, fueled by escalating environmental awareness and supportive government policies. This trend presents a significant opportunity for companies like Hexagon, whose digital reality solutions can enhance efficiency and sustainability across various sectors. For instance, by optimizing resource management in agriculture or streamlining construction processes, Hexagon's offerings directly align with the growing demand for eco-friendly solutions.

The increasing focus on sustainability is translating into substantial market expansion. The global green technology and sustainability market was valued at approximately $11.5 billion in 2023 and is projected to reach over $30 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 15%. This surge is driven by a confluence of factors, including stricter environmental regulations and a growing consumer preference for sustainable products and services.

- Market Growth: The green technology market is projected to grow at a CAGR of approximately 15% from 2023 to 2030.

- Key Drivers: Environmental concerns, regulatory incentives, and increasing consumer demand for sustainable solutions are primary growth drivers.

- Hexagon's Relevance: Hexagon's digital reality solutions can capitalize on this trend by enabling more efficient and sustainable operations in key industries.

- Industry Impact: Sectors such as agriculture, construction, and energy are actively seeking and adopting green technologies to reduce their environmental footprint.

Impact of Extreme Weather and Natural Disasters

The increasing frequency and intensity of extreme weather events present a significant challenge for Hexagon's global operations and supply chains. For instance, the economic impact of natural disasters in 2023 alone was estimated to be over $250 billion globally, affecting infrastructure and logistics. This can disrupt production, increase transportation costs, and potentially impact customer access to Hexagon's products and services.

Conversely, Hexagon is well-positioned to capitalize on the growing need for disaster response and resilience planning. Their geospatial technology and public safety solutions are vital for accurate risk assessment, real-time monitoring during emergencies, and developing effective mitigation strategies. The global market for disaster management solutions is projected to reach over $120 billion by 2028, indicating substantial growth opportunities for Hexagon.

- Increased operational risk: Extreme weather events can damage facilities and disrupt critical infrastructure, leading to production downtime and increased insurance premiums.

- Supply chain vulnerabilities: Floods, storms, and wildfires can impede transportation routes, causing delays and shortages of essential components.

- Market opportunities in resilience: Demand for Hexagon's geospatial data, analytics, and public safety software is rising for climate adaptation and disaster preparedness.

- Growing investment in climate resilience: Governments and private sectors are allocating more resources to infrastructure upgrades and early warning systems, directly benefiting Hexagon's offerings.

The increasing global focus on sustainability and climate change is a significant factor for Hexagon. This trend creates opportunities for Hexagon's technology to aid clients in reducing their environmental impact, such as through smarter resource use and enhanced energy efficiency. For instance, Hexagon's digital reality solutions can optimize construction processes, potentially cutting material waste by up to 20% in large-scale projects.

Growing concerns about resource scarcity are driving a shift towards circular economy principles, impacting how companies like Hexagon design, produce, and manage their products. This means a greater emphasis on solutions that maximize resource efficiency, minimize waste, and incorporate recycling, making them more attractive to environmentally conscious customers and regulators.

Hexagon must navigate a complex web of environmental regulations across its global manufacturing sites and product lifecycles. These rules, covering emissions, waste disposal, and hazardous material usage, directly influence operational expenses and necessitate adjustments in product development. For instance, the European Union's REACH regulation impacts the materials Hexagon can use in its products sold within the EU.

The increasing frequency and intensity of extreme weather events present a significant challenge for Hexagon's global operations and supply chains. For instance, the economic impact of natural disasters in 2023 alone was estimated to be over $250 billion globally, affecting infrastructure and logistics. This can disrupt production, increase transportation costs, and potentially impact customer access to Hexagon's products and services.

| Environmental Factor | Description | Hexagon's Relevance/Impact | Data/Example |

|---|---|---|---|

| Climate Change & Sustainability | Growing global awareness and action on environmental protection. | Opportunity for Hexagon's solutions to improve efficiency and reduce impact. | Global green technology market projected to exceed $30 billion by 2030 (15% CAGR). |

| Resource Scarcity | Increasing demand and potential shortages of raw materials. | Drives demand for Hexagon's circular economy and efficiency solutions. | Lithium and cobalt demand could rise over 500% by 2050. |

| Environmental Regulations | Stricter laws on emissions, waste, and hazardous materials. | Influences operational costs and product development for Hexagon. | EU REACH regulation impacts material choices. |

| Extreme Weather Events | Increased frequency and intensity of natural disasters. | Disrupts operations and supply chains; creates demand for resilience solutions. | Global economic impact of natural disasters in 2023 exceeded $250 billion. |

PESTLE Analysis Data Sources

Our Hexagon PESTLE Analysis is meticulously crafted using data from reputable sources like the World Bank, International Monetary Fund (IMF), and leading market research firms. We incorporate official government publications, industry-specific reports, and academic studies to ensure comprehensive and accurate insights.