Hexagon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexagon Bundle

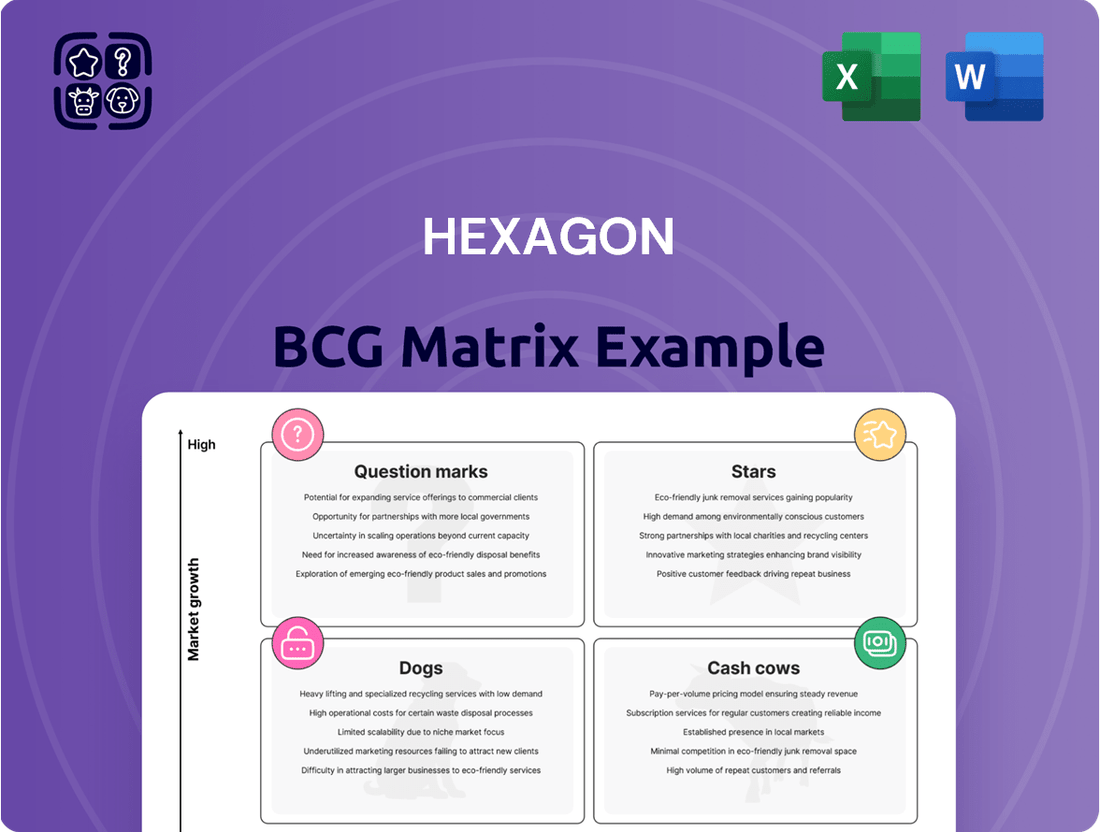

The BCG Matrix is your compass for navigating the complex world of product portfolio management. It visually categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing their market share and growth potential.

This foundational understanding is crucial for making informed decisions about resource allocation and strategic investments. Don't settle for a glimpse; unlock the full power of the BCG Matrix to gain a comprehensive strategic roadmap.

Purchase the complete BCG Matrix report today and transform your insights into actionable strategies, ensuring your business thrives by optimizing its product portfolio for maximum impact and profitability.

Stars

Hexagon's digital twin solutions represent a significant growth opportunity, aligning perfectly with the booming digital twin market. This sector is expected to surge from an estimated €16.55 billion in 2024 to a substantial €242.11 billion by 2032, a compound annual growth rate of 39.8%.

By enabling clients to build and maintain digital replicas of products, physical locations, and operational workflows, Hexagon is strategically positioned to capitalize on this expansion. The company's offerings are vital for advancing automation and enhancing decision-making capabilities across diverse industrial sectors.

Hexagon's strategic emphasis on AI-powered analytics and robotics is a key driver for industry transformation, paving the way for more autonomous operations. This focus is underscored by the company's Q1 2025 launch of a dedicated Robotics division, specifically targeting advancements in humanoid robotics, a sector poised for significant growth.

These forward-looking investments are crucial for Hexagon to solidify its competitive position and capitalize on the escalating market demand for sophisticated, automated solutions. For instance, the global robotics market was valued at approximately $50 billion in 2023 and is projected to reach over $150 billion by 2030, highlighting the immense potential in this space.

Hexagon's acquisition of Apei in June 2025 is a strategic move to bolster its reality capture and positioning offerings. This acquisition directly addresses the escalating demand for high-resolution aerial data, a critical component for industries relying on precise geospatial intelligence.

The integration of Apei enhances Hexagon's ability to provide comprehensive geospatial solutions, aligning with the growth trajectory of the reality capture market. This segment is experiencing robust expansion, fueled by the increasing need for accurate spatial data in fields like urban planning, infrastructure management, and environmental monitoring.

Geomagic Software Suite

The acquisition of 3D Systems' Geomagic software suite in April 2025 significantly bolsters Hexagon's Manufacturing Intelligence division. This move enhances Hexagon's offerings in 3D metrology and reengineering, crucial for advanced manufacturing processes.

Geomagic software is instrumental in generating precise 3D models from laser scan data. This capability is increasingly vital for manufacturers focused on rigorous quality control and innovative product development cycles.

- Enhanced 3D Metrology: Geomagic's advanced surfacing and meshing tools integrate seamlessly with Hexagon's existing metrology hardware, creating a more comprehensive solution.

- Reengineering Capabilities: The software empowers reverse engineering, allowing companies to recreate or improve existing parts using scan data, a key driver in product lifecycle management.

- Market Growth: The 3D scanning market, a primary application for Geomagic, was projected to reach over $10 billion globally by 2024, highlighting the strategic importance of this acquisition for Hexagon.

Septentrio GNSS Technologies

Hexagon's acquisition of Septentrio NV, finalized in March 2025, positions Septentrio as a key player within Hexagon's Autonomous Solutions division. This integration is a strategic move to capitalize on the rapidly expanding market for mission-critical navigation and autonomy. The demand for precise positioning is particularly strong in sectors like agriculture and mining, where operational efficiency and safety are paramount.

Septentrio's advanced GNSS receivers and solutions are designed for challenging environments. For instance, their technology offers centimeter-level accuracy, crucial for autonomous vehicles and precision farming equipment. This acquisition directly addresses Hexagon's goal of enhancing its portfolio in areas requiring highly reliable and accurate location data, a trend expected to see significant growth through 2025 and beyond.

- Market Integration: Septentrio NV, a leader in GNSS, now part of Hexagon's Autonomous Solutions division following a March 2025 acquisition.

- Growth Focus: Strategic alignment with the high-growth market for mission-critical navigation and autonomy applications.

- Industry Impact: Essential for sectors like agriculture and mining, demanding precise and reliable positioning.

- Technological Edge: Septentrio's advanced GNSS technology provides centimeter-level accuracy, vital for autonomous operations.

Stars in the Hexagon BCG Matrix represent high-growth, high-market-share business segments. These are typically areas where Hexagon has a strong competitive advantage and is investing heavily to maintain leadership. The company's focus on digital twins, robotics, and advanced reality capture solutions aligns with this category. These segments are crucial for Hexagon's future growth and innovation.

Hexagon's strategic acquisitions and product launches in 2025, particularly in areas like AI-powered robotics and enhanced reality capture, underscore its commitment to nurturing its Star segments. These investments are designed to capitalize on rapidly expanding markets, ensuring Hexagon remains at the forefront of technological advancement. The company is actively building capabilities to address the increasing demand for sophisticated, automated, and data-driven solutions across various industries.

The company's proactive approach to integrating new technologies and businesses, such as the acquisition of Apei and 3D Systems' Geomagic, solidifies its position in high-growth markets. By strengthening its offerings in digital twins, autonomous solutions, and manufacturing intelligence, Hexagon is strategically positioning itself to dominate these emerging and rapidly evolving sectors. This focus on innovation and market leadership is key to its long-term success.

| Business Segment | Market Growth Potential | Hexagon's Market Share | Strategic Focus |

| Digital Twin Solutions | Very High (39.8% CAGR projected 2024-2032) | Strong | Investment in AI analytics, automation |

| Robotics (Humanoid) | Very High (Global market projected >$150B by 2030) | Emerging/Growing | Dedicated Robotics division launch (Q1 2025) |

| Reality Capture & Geospatial Intelligence | High (Driven by demand for precise spatial data) | Strong | Acquisition of Apei (June 2025) for aerial data |

| 3D Metrology & Reengineering | High (3D scanning market >$10B globally by 2024) | Strong | Acquisition of Geomagic (April 2025) |

| Autonomous Solutions (GNSS) | High (Critical for agriculture, mining, etc.) | Strong | Acquisition of Septentrio NV (March 2025) for precision positioning |

What is included in the product

The Hexagon BCG Matrix visually maps business units by market growth and share, offering strategic direction for investment.

Quickly visualize your portfolio's health, identifying areas needing investment or divestment.

Cash Cows

Hexagon's recurring revenue from software and services is a significant strength, acting as a cash cow. This segment grew by 10% in the first quarter of 2025, now representing 43.1% of the company's total sales. This consistent and expanding income source offers predictability, smoothing out revenue fluctuations and providing a robust financial base.

The Asset Lifecycle Intelligence (ALI) division is a prime example of a cash cow within the Hexagon BCG Matrix. Its consistent performance, evidenced by a robust 10% organic growth in Q4 2024, is largely fueled by recurring software sales.

This strong growth stems from ALI's core function: enabling customers to effectively plan, operate, and maintain their assets. The division benefits significantly from its high market share and a deeply entrenched, loyal customer base, which translates into predictable and stable cash flows.

The Safety, Infrastructure & Geospatial (SIG) division of Hexagon stands as a prime example of a Cash Cow within its BCG matrix. This division is a global powerhouse in public safety solutions, reaching over 1 billion individuals worldwide.

In the fourth quarter of 2024, SIG demonstrated robust performance with 11% organic growth. This growth was fueled by substantial demand for its public safety software, solidifying its position in a mature, high-market-share segment that reliably generates significant cash flow for the company.

Established Metrology and Measurement Technologies

Hexagon's established metrology and measurement technologies represent a significant cash cow within its portfolio, leveraging its strong position in industrial metrology. The company commands an impressive 12-15% market share in this sector, a testament to its long-standing expertise and innovation, such as the Leica Absolute Tracker ATS800.

These mature product lines, despite not seeing explosive growth, are characterized by their high market penetration and steady, reliable demand across diverse industrial applications. This consistent demand translates into substantial and predictable cash flow for Hexagon, underpinning its financial stability.

- Market Dominance: Hexagon holds a 12-15% share in the industrial metrology market.

- Key Innovation: Products like the Leica Absolute Tracker ATS800 exemplify their technological leadership.

- Stable Demand: Mature product lines ensure consistent revenue streams from established industrial uses.

- Cash Flow Generation: These offerings are vital contributors to Hexagon's overall profitability.

Global Presence and Diversified Industries

Hexagon’s extensive global footprint, operating in 50 countries, underpins its status as a cash cow. This widespread presence across diverse sectors like manufacturing, construction, agriculture, and public safety creates a robust and stable revenue stream. By not being overly dependent on any single market or industry, Hexagon ensures a consistent generation of cash, a hallmark of a strong cash cow.

The company's diversified industry exposure is a key factor. For instance, in 2024, Hexagon reported significant contributions from its manufacturing intelligence division, driven by demand for advanced automation solutions. Simultaneously, its geosystems segment saw continued growth, fueled by infrastructure development projects globally. This balance across different economic cycles and industry trends solidifies its cash-generating capabilities.

- Global Reach: Operations in 50 countries.

- Industry Diversification: Serves manufacturing, construction, agriculture, public safety, and more.

- Revenue Stability: Reduced reliance on single markets or sectors ensures consistent cash flow.

- Market Position: Strong presence in mature and emerging economies provides a broad customer base.

Cash cows are business units with high market share in mature industries, generating more cash than they consume. Hexagon's recurring revenue from software and services, particularly within its Asset Lifecycle Intelligence (ALI) and Safety, Infrastructure & Geospatial (SIG) divisions, exemplifies this. These segments benefit from strong customer loyalty and established market positions, ensuring predictable and stable cash flows that support other business units.

| Division | Market Share | Growth (Q4 2024) | Key Drivers |

|---|---|---|---|

| Asset Lifecycle Intelligence (ALI) | High | 10% organic | Recurring software sales, loyal customer base |

| Safety, Infrastructure & Geospatial (SIG) | High | 11% organic | Public safety software demand, global reach |

| Industrial Metrology | 12-15% | Stable | Established industrial applications, consistent demand |

Full Transparency, Always

Hexagon BCG Matrix

The Hexagon BCG Matrix document you are currently previewing is the precise, fully formatted report you will receive immediately after your purchase. This means no watermarks, no sample data, and no hidden surprises – just a comprehensive, ready-to-deploy strategic tool designed to illuminate your business portfolio's performance.

Dogs

Hexagon's sensor division is showing signs of distress, with a notable 28% decrease in sales volumes recorded in March 2025. This downturn directly impacted their short-term EBIT1 margins, signaling potential trouble ahead for this product category.

While sensors represent a foundational element of Hexagon's business, this sharp decline, if it persists without a strategic intervention, positions them as a potential 'dog' in the BCG matrix. Such products typically consume resources without generating adequate returns, posing a risk to overall profitability.

Hexagon's exposure to cyclical markets such as construction and automotive has presented headwinds, affecting its sales trajectory and organic growth. For instance, the global construction market experienced a slowdown, with some regions seeing contraction in 2023, impacting demand for Hexagon's solutions in this sector.

The automotive industry also faced its own set of challenges, including supply chain disruptions and fluctuating consumer demand throughout 2023 and into early 2024. If Hexagon cannot adapt or maintain its market share in these volatile segments, particularly with ongoing weakness in areas like European construction, its offerings within these sectors risk being categorized as dogs.

Before Hexagon's strategic shift to SaaS, its legacy on-premise software solutions likely fell into the 'dog' category of the BCG matrix. These older products, such as certain versions of their manufacturing ERP or CAD software, faced declining market share and low growth potential as the industry gravitated towards cloud-based offerings. For example, while specific revenue figures for these legacy products are not publicly itemized, the overall trend in the industrial software market shows a significant move away from perpetual licenses towards subscription models, indicating reduced demand for on-premise solutions.

Products with Low Organic Growth

Products with low organic growth, often categorized as dogs in the Hexagon BCG Matrix, represent a challenge for companies. Hexagon's overall organic revenue growth was 0% in Q1 2025, and flat for the full year 2024. This stagnation highlights specific areas needing attention.

Within Hexagon's portfolio, products or solutions experiencing consistently zero or negative organic growth, particularly those with a smaller market share in mature markets, fit the dog profile. These offerings may require strategic evaluation for divestment or turnaround efforts.

- Stagnant Growth: Hexagon's 0% organic revenue growth in Q1 2025 and flat growth for the entirety of 2024 points to a broad challenge.

- Identifying Dogs: Products with persistent zero or negative organic growth, especially in mature markets where their market share is already low, are prime candidates for the dog category.

- Market Position: These underperforming products typically operate in markets that are not expanding rapidly, further limiting their potential for organic expansion.

- Strategic Implications: Companies must analyze these dog products to determine if they can be revitalized or if they represent a drag on overall performance.

Divisions with Margin Pressure and Lower Volumes

Divisions experiencing margin pressure and declining volumes are prime candidates for the "Dogs" quadrant in the BCG Matrix. For instance, if a company sees its adjusted operating margin fall to 26.1% in Q1 2025 from 29.0% in Q1 2024, this indicates a significant profitability squeeze. This dip, often driven by reduced sales in high-margin product segments, signals potential competitive challenges or market saturation.

When these negative trends persist, these underperforming divisions risk becoming Dogs. This classification means they consume resources without generating substantial returns, potentially hindering overall company growth. It's crucial to monitor key financial indicators to identify these areas early.

- Margin Erosion: Adjusted operating margin dropped from 29.0% (Q1 2024) to 26.1% (Q1 2025).

- Volume Decline: Lower sales volumes, especially in high-margin sensor products, contributed to the margin dip.

- Competitive Pressure: Persistent declines suggest these divisions may be facing intense competition or market shifts.

- Resource Drain: If unaddressed, these areas can become resource sinks with limited future growth potential.

Products classified as "Dogs" in the BCG matrix are those with low market share and low market growth. Hexagon's sensor division, experiencing a 28% sales volume decrease in March 2025 and facing headwinds in cyclical markets like construction and automotive, exhibits characteristics of a dog. The company's overall flat organic revenue growth for 2024 and 0% in Q1 2025 further underscore the challenges in identifying high-growth areas within its portfolio.

These underperforming segments, such as legacy on-premise software solutions that have seen declining demand, consume resources without generating significant returns. For instance, the shift towards SaaS models in industrial software indicates a reduced market for older, on-premise offerings. Persistent margin pressure, like the drop in adjusted operating margin from 29.0% in Q1 2024 to 26.1% in Q1 2025, coupled with declining volumes, solidifies the dog classification for these product lines.

| Product Category | Market Growth | Market Share | Hexagon's Performance Indicator | BCG Classification |

| Sensors | Low (cyclical markets) | Low-to-Medium (declining) | -28% sales volume (March 2025), margin pressure | Dog |

| Legacy On-Premise Software | Low (market shifting to SaaS) | Low (declining) | Reduced demand, lower growth potential | Dog |

| Overall Organic Growth | N/A | N/A | 0% (Q1 2025), Flat (2024) | Indicative of Dog-like segments |

Question Marks

Hexagon's strategic move into humanoid robotics, launched in Q1 2025, positions it within a high-growth, emerging market. While the long-term potential is substantial, the immediate market share and profitability of this new division are expected to be low, classifying it as a classic question mark.

Significant investment will be crucial for Hexagon to carve out market leadership in this nascent field. For instance, the global humanoid robot market is projected to reach USD 15.7 billion by 2030, growing at a CAGR of 35.5% from 2023, according to some industry analyses, highlighting the scale of the opportunity and the necessary capital commitment.

Hexagon's push into new AI-enhanced analytics applications, like predictive maintenance for the aerospace industry or personalized healthcare diagnostics, could be considered question marks. These areas offer significant future growth but are currently nascent for Hexagon, requiring considerable R&D investment to gain traction and market share.

For instance, while Hexagon is a leader in manufacturing analytics, its foray into AI-powered drug discovery platforms represents a new frontier. This segment, though potentially lucrative, demands substantial capital to build out specialized AI models and secure early adopters, mirroring the characteristics of a question mark in the BCG matrix.

Hexagon's January 2025 acquisition of CAD Service, a specialist in advanced visualization, signals a strategic move to unify CAD, BIM, and Reality Capture data. This integration aims to unlock new revenue streams by offering more immersive and data-rich visualization experiences for users across various industries.

While the potential is significant, the market's full embrace of these advanced visualization tools is still in its nascent stages. This positions the CAD Service acquisition as a question mark within Hexagon's portfolio, requiring substantial investment in marketing and seamless integration to drive widespread adoption and revenue generation.

Products within Geosystems Facing Challenging Conditions

Products within Hexagon's Geosystems division, particularly those launched in 2024, likely fall into the question mark category of the BCG matrix. These are businesses with low relative market share in high-growth markets, facing challenging conditions. While new product introductions in 2024 aimed to bolster performance, the division's overall performance in Q2 2025 indicated headwinds, suggesting these newer offerings are still in their early stages of market penetration.

The Geosystems segment, despite facing difficulties in Q2 2025, saw its performance partially mitigated by the introduction of several new products during 2024. These specific products, especially those targeting rapidly expanding market segments where Hexagon is either a newer entrant or contending with established competitors, are prime candidates for the question mark classification. This means they require significant investment to grow their market share, despite operating in promising growth areas.

- Geosystems Division Performance: Experienced challenging conditions in Q2 2025.

- Mitigating Factors: New product launches in 2024 helped to offset declines.

- Question Mark Characteristics: Products in high-growth markets with low relative market share.

- Strategic Imperative: These products require investment to build market share against strong competition.

New Product Launches in Manufacturing Intelligence

Hexagon's Manufacturing Intelligence division is strategically positioning itself for future expansion through new product introductions slated for 2025. These innovative solutions are targeting burgeoning market segments, but their current market penetration and customer adoption rates place them in the question mark category of the BCG matrix.

Significant investment will be crucial to nurture these nascent offerings, aiming to secure substantial market share and validate their long-term potential. Hexagon's commitment to these question mark products reflects a forward-looking strategy to capitalize on emerging trends in manufacturing technology.

- Targeted Growth Segments: Hexagon is focusing its 2025 new product launches on high-growth areas within manufacturing intelligence, such as AI-driven quality control and advanced simulation software.

- Early Market Stage: These products are in the initial phases of market entry, meaning their success is not yet guaranteed and requires careful management and strategic marketing.

- Investment Requirements: Capturing market share for these question mark products will necessitate substantial financial backing for research and development, sales, and marketing efforts.

- Potential for High Returns: If successful, these early-stage products have the potential to become future stars for Hexagon, driving significant revenue growth.

Question marks represent business units or products operating in high-growth markets but possessing a low relative market share. These are typically new ventures or recently introduced products that require substantial investment to develop their market position and potential.

Hexagon's foray into AI-driven predictive maintenance for the aerospace sector, launched in late 2024, exemplifies a question mark. While the aerospace analytics market is projected to grow significantly, Hexagon's current market share in this specific niche is minimal, necessitating considerable investment to gain traction against established players.

The company's new humanoid robotics division, established in Q1 2025, also falls into this category. The global humanoid robot market is anticipated to reach USD 15.7 billion by 2030, but Hexagon's nascent presence means it holds a low market share, demanding significant capital for research, development, and market penetration.

These question marks, while demanding, hold the promise of becoming future stars if strategic investments are made effectively to increase market share and capitalize on market growth.

| Business Unit/Product | Market Growth Rate | Relative Market Share | Strategic Implication |

|---|---|---|---|

| Humanoid Robotics (launched Q1 2025) | High (Projected 35.5% CAGR to 2030) | Low | Requires significant investment to build market share. |

| AI Predictive Maintenance (Aerospace, launched late 2024) | High | Low | Needs substantial capital for R&D and market penetration. |

| Advanced Visualization (CAD Service acquisition) | Moderate to High | Low | Investment needed for marketing and integration to drive adoption. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry trend analysis to provide a clear strategic overview.