Hexagon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexagon Bundle

Unlock the full strategic blueprint behind Hexagon's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Hexagon's technology alliance partners are crucial for embedding cutting-edge capabilities into its digital reality solutions. These collaborations with cloud providers like AWS and Azure, AI/ML specialists, and connectivity firms ensure Hexagon leverages foundational technologies to boost performance and reach. For instance, in 2024, Hexagon continued to deepen its integration with major cloud infrastructure providers, enabling more scalable and robust data processing for its customers.

Hexagon's ecosystem thrives on industry-specific integrators and value-added resellers. These partners are vital for tailoring Hexagon's advanced technology to the unique demands of sectors like automotive manufacturing and infrastructure development.

In 2024, Hexagon continued to expand its global partner network, with a particular focus on regions experiencing rapid industrial growth. For instance, the company announced new collaborations in Southeast Asia, aiming to bring its digital reality solutions to a burgeoning manufacturing base.

These specialized partners are instrumental in driving market penetration by providing localized expertise for implementation, training, and ongoing support, ensuring customers can fully leverage Hexagon's capabilities for enhanced productivity and efficiency.

Hexagon AB actively collaborates with leading universities and research institutions globally to fuel its innovation pipeline. These partnerships are critical for exploring fundamental research in areas like advanced sensor technology and data analytics, ensuring Hexagon stays at the forefront of technological advancement.

For instance, Hexagon's ongoing engagement with institutions such as the Technical University of Munich and the Royal Institute of Technology in Stockholm directly contributes to developing next-generation software for its metrology and manufacturing intelligence solutions. These collaborations also serve as a vital channel for talent acquisition, bringing in highly skilled graduates.

Hardware Component Suppliers

Hexagon's reliance on advanced technology necessitates strong ties with hardware component suppliers. These partnerships are crucial for securing a consistent flow of specialized sensors, measurement units, and other essential components that underpin Hexagon's autonomous and integrated solutions. For instance, in 2024, the global market for industrial sensors was projected to reach over $60 billion, highlighting the scale and importance of these upstream relationships.

These collaborations are not just about procurement; they often involve co-development and early access to new technologies. This ensures Hexagon remains at the forefront of innovation in areas like metrology and geospatial data acquisition. Reliable sourcing directly impacts product quality and the ability to meet market demand, making these partnerships a cornerstone of Hexagon's operational strategy.

- Sensor Manufacturers: Securing access to leading-edge optical, lidar, and inertial sensors.

- Semiconductor Providers: Ensuring a steady supply of high-performance chips for embedded systems.

- Precision Component Fabricators: Partnering for the specialized mechanical and electronic parts required for measurement devices.

- Connectivity Module Suppliers: Collaborating for reliable wireless and cellular communication hardware.

Strategic Industry Alliances

Hexagon actively cultivates strategic alliances with leading companies in complementary sectors. For instance, in 2024, Hexagon announced a significant collaboration with a major cloud infrastructure provider, aiming to enhance the scalability and accessibility of its digital reality solutions. This type of partnership allows Hexagon to tap into new customer bases and integrate its offerings more seamlessly into existing enterprise workflows.

These alliances are crucial for co-developing innovative solutions and establishing industry benchmarks. By combining Hexagon's expertise in digital reality with the specialized knowledge of its partners, the company can create more robust and comprehensive offerings. For example, a partnership in the construction technology space in late 2023 focused on integrating BIM (Building Information Modeling) data with IoT sensors for real-time project monitoring, demonstrating the value of these cross-industry collaborations.

- Co-development of integrated solutions: Partnerships enable the creation of end-to-end digital workflows, such as those seen in the manufacturing sector where Hexagon collaborates with automation specialists.

- Market expansion and reach: Alliances with companies possessing strong distribution networks or established client relationships in adjacent markets, like surveying or infrastructure management, significantly broaden Hexagon's market penetration.

- Industry standard setting: Collaborating with key players helps define and advance industry standards for data interoperability and digital twin technologies, reinforcing Hexagon's leadership position.

- Leveraging complementary strengths: By pooling resources and expertise, Hexagon and its partners can offer greater value than they could individually, addressing complex customer needs more effectively.

Hexagon's strategic partnerships are vital for expanding its technological capabilities and market reach. Collaborations with cloud providers, AI specialists, and connectivity firms ensure its digital reality solutions are built on robust foundational technologies.

These alliances are critical for co-developing integrated solutions and setting industry standards, allowing Hexagon to address complex customer needs more effectively by leveraging complementary strengths.

In 2024, Hexagon continued to strengthen its ties with universities and research institutions, fueling innovation in areas like advanced sensor technology and data analytics, while also securing a pipeline of skilled talent.

Key partnerships with sensor manufacturers, semiconductor providers, and precision component fabricators are essential for maintaining a consistent supply of high-quality components, directly impacting product reliability and market responsiveness.

What is included in the product

A structured framework that visually maps a business's core components, including customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how a company creates, delivers, and captures value, facilitating strategic planning and innovation.

Eliminates the frustration of disjointed strategy by visually mapping all key business elements in one place.

Reduces the pain of unclear value propositions by forcing concise articulation of what makes your offering unique.

Activities

Hexagon's core strength lies in its relentless pursuit of innovation through extensive research and development in digital reality. This encompasses advancements in sensor technology, sophisticated software engineering, and the integration of autonomous systems. The company's commitment to R&D is a strategic imperative, driving the creation of novel products and the refinement of existing offerings, ensuring Hexagon remains at the forefront of the industry.

Significant investment in R&D fuels Hexagon's ability to weave together disparate technologies into comprehensive digital reality solutions. This integrated approach is crucial for maintaining a competitive advantage and effectively responding to the dynamic demands of the market. For instance, Hexagon's 2023 annual report highlighted substantial R&D expenditures, demonstrating their dedication to pushing the boundaries of what's possible in digital reality.

Hexagon's core activities revolve around developing sophisticated software and platform solutions that power its digital twin technology. This involves creating robust, scalable platforms designed for the seamless creation and management of digital twins, integrating various data streams.

Key efforts include designing intuitive user interfaces and building advanced analytical tools. Hexagon also focuses on ensuring interoperability, allowing its software to connect and communicate effectively with a wide array of data sources and existing systems, making the software the unifying element for its hardware and services.

In 2024, Hexagon continued to invest heavily in its software capabilities. For instance, its Geosystems division reported significant progress in its cloud-based software offerings, which are crucial for managing large-scale geospatial data used in digital twins. This strategic focus on software development underpins Hexagon's ability to deliver integrated solutions across its various business segments.

Hexagon's core activity revolves around the design and manufacturing of advanced sensors, precision measurement tools, and other sophisticated hardware. This crucial stage involves rigorous quality control, meticulous supply chain oversight, and continuous optimization of production lines to ensure the delivery of dependable and accurate physical products that form the backbone of their integrated solutions.

In 2024, Hexagon continued to invest heavily in its manufacturing capabilities, aiming to enhance efficiency and reduce lead times for its diverse product portfolio. The company's commitment to producing high-quality hardware is directly linked to the performance and reliability of its broader software and service offerings, underscoring the importance of this foundational activity.

Global Sales, Marketing, and Distribution

Hexagon's global sales, marketing, and distribution are central to its operations, focusing on promoting its broad range of solutions to customers worldwide across many industries. This involves a multi-pronged approach including direct sales teams, nurturing relationships with channel partners, executing targeted digital marketing campaigns, and actively participating in key industry trade shows and events.

These activities are crucial for building brand recognition and driving customer acquisition. For instance, Hexagon's robust digital presence and strategic partnerships are designed to reach a diverse clientele, from manufacturing giants to individual professionals. In 2023, Hexagon reported a significant portion of its revenue stemming from its software and services segments, underscoring the importance of effective go-to-market strategies.

- Direct Sales Force: Employing specialized sales teams to engage directly with key accounts and enterprise clients, offering tailored solutions and in-depth product expertise.

- Channel Partner Network: Collaborating with a global network of resellers, distributors, and system integrators to extend market reach and provide localized support.

- Digital Marketing: Leveraging online channels, including search engine optimization, content marketing, social media, and targeted advertising, to generate leads and build brand awareness.

- Industry Engagement: Participating in major international trade fairs, conferences, and webinars to showcase new technologies, connect with potential customers, and stay abreast of market trends.

Professional Services and Customer Support

Hexagon's professional services are vital for ensuring customers can fully leverage its advanced technology. This includes comprehensive implementation, tailored training programs, expert consulting, and responsive ongoing technical support. These offerings are designed to facilitate seamless integration and maximize the value customers receive from Hexagon's solutions, directly impacting their operational efficiency and satisfaction.

These services are fundamental to driving solution adoption and fostering customer loyalty. By providing robust support, Hexagon helps clients overcome challenges and achieve their business objectives, building enduring trust and strong, long-term relationships. For instance, in 2023, Hexagon reported that customers utilizing their implementation and support services showed a 15% higher rate of continued engagement with new product features.

- Implementation Excellence: Ensuring smooth and efficient deployment of Hexagon's software and hardware solutions.

- Customer Training: Equipping users with the knowledge and skills to effectively operate and benefit from the technology.

- Consulting Services: Offering expert advice to optimize workflows and integrate Hexagon's solutions into existing business processes.

- Technical Support: Providing timely and effective assistance to resolve issues and maintain system performance.

Hexagon's key activities are deeply rooted in innovation and customer enablement. The company actively engages in research and development to advance its digital reality technologies, focusing on both hardware and software. This is complemented by robust sales and marketing efforts to reach a global customer base and comprehensive professional services designed to ensure successful adoption and ongoing value realization.

In 2024, Hexagon continued its strategic investment in R&D, particularly in cloud-based geospatial software, and enhanced its manufacturing capabilities for hardware. The company also emphasized its global sales and marketing reach through direct sales, partnerships, and digital engagement, while its professional services division focused on implementation, training, and support to maximize customer success.

| Key Activity | Focus Area | 2024 Highlight/Data Point |

|---|---|---|

| Research & Development | Digital Reality Technologies | Continued investment in cloud-based software for Geosystems division. |

| Design & Manufacturing | Advanced Hardware & Sensors | Enhanced manufacturing capabilities to improve efficiency and reduce lead times. |

| Sales, Marketing & Distribution | Global Market Reach | Strengthened digital presence and strategic partnerships for customer acquisition. |

| Professional Services | Customer Enablement & Support | Focus on implementation, training, and consulting to maximize solution value. |

Delivered as Displayed

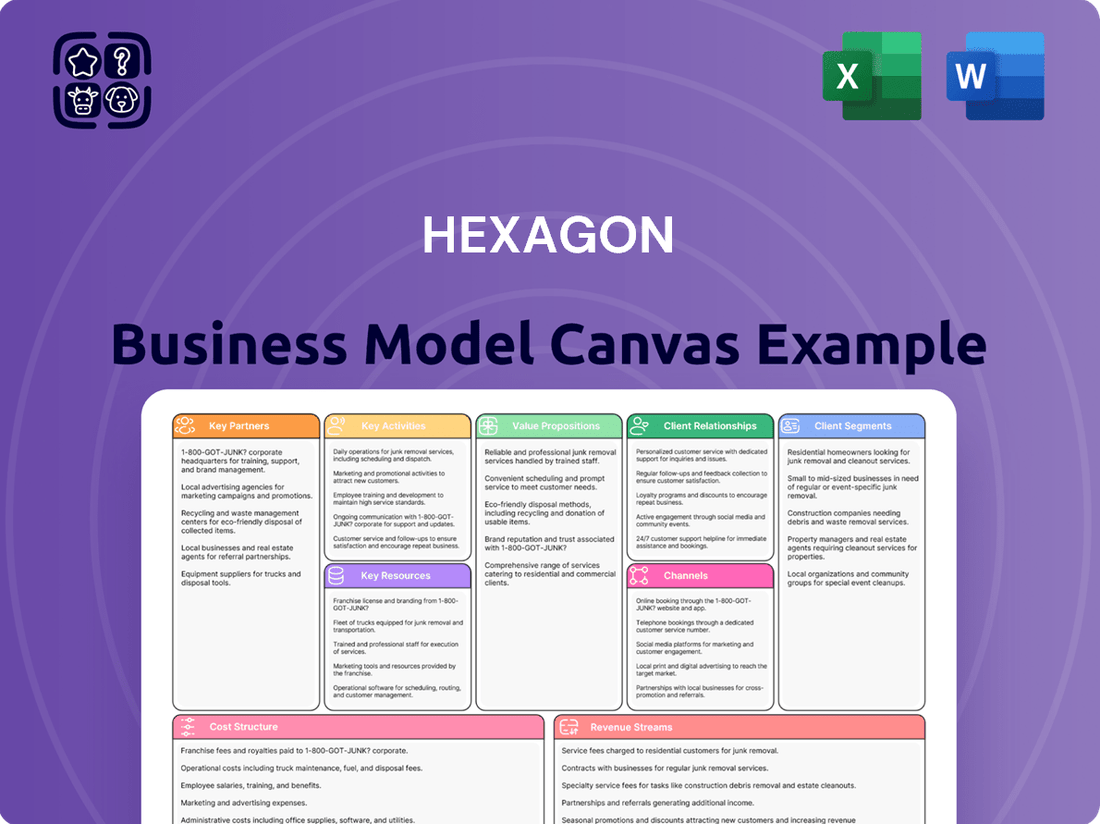

Business Model Canvas

The Hexagon Business Model Canvas preview you are seeing is the actual document you will receive upon purchase. This means that the structure, formatting, and content displayed here are exactly what you'll get, ensuring no surprises. You'll be downloading this complete, ready-to-use canvas, allowing you to immediately start strategizing and visualizing your business model.

Resources

Hexagon’s proprietary software and algorithms are the engine behind its digital reality solutions, encompassing advanced analytics, simulation tools, and visualization engines. These unique capabilities, integral to their Business Model Canvas, provide a substantial competitive edge.

This intellectual property allows Hexagon to offer sophisticated data processing and insights, differentiating their offerings in the market. For instance, their investments in R&D, which fueled these innovations, reached $707 million in 2023, highlighting the commitment to this key resource.

Hexagon's patents and intellectual property portfolio are a cornerstone of its business model, safeguarding its technological advancements. This portfolio boasts a significant number of patents covering sensor technologies, sophisticated geospatial data processing, and cutting-edge autonomous systems.

These intellectual assets are not merely protective; they actively create a competitive moat, deterring rivals from replicating Hexagon's innovations. For instance, in 2023, Hexagon continued to invest heavily in R&D, filing numerous new patent applications to solidify its position in emerging markets.

This robust IP protection directly translates into Hexagon's sustained technological leadership. It enables the company to command premium pricing and maintain market share by offering unique, high-value solutions that competitors cannot easily replicate.

Hexagon's global workforce, particularly its R&D engineers and data scientists, represents a critical key resource. Their deep expertise in fields like computer vision, AI, and geospatial intelligence is the engine driving innovation and the development of Hexagon's advanced solutions.

This human capital is fundamental to Hexagon's technological leadership. In 2023, Hexagon reported a significant portion of its employees were engaged in research and development, underscoring the company's commitment to leveraging specialized talent for competitive advantage.

Global Sales, Service, and Distribution Network

Hexagon's extensive global sales, service, and distribution network is a cornerstone of its business model, allowing it to connect with and support customers across diverse geographical markets. This network comprises direct sales teams, a broad base of reseller partners, and dedicated technical support staff, ensuring comprehensive customer engagement and assistance.

The company's robust global infrastructure is critical for achieving deep market penetration and maximizing customer reach. As of early 2024, Hexagon operates in over 50 countries, demonstrating a significant international footprint. This expansive presence facilitates localized support and sales strategies, catering to the specific needs of different regions.

Key components of this network include:

- Direct Sales Force: Highly trained professionals who engage directly with clients, understanding their unique requirements and offering tailored solutions.

- Reseller and Partner Network: A strategic alliance with numerous partners worldwide, extending Hexagon's market access and service capabilities.

- Service Centers: Facilities providing essential technical support, maintenance, and repair services, ensuring operational continuity for customers.

- Distribution Channels: Efficient logistics and supply chain management to deliver products and solutions reliably to a global customer base.

Advanced Manufacturing and Testing Facilities

Hexagon's advanced manufacturing and testing facilities are the backbone of its hardware offerings, ensuring the precision and reliability that customers expect. These specialized sites handle the intricate production and assembly of Hexagon's high-performance sensors and measuring equipment. For instance, Hexagon invested significantly in its manufacturing capabilities, with its 2023 capital expenditures reflecting a commitment to maintaining state-of-the-art production lines.

- Manufacturing Excellence: Dedicated facilities for producing complex, high-precision hardware components.

- Quality Assurance: Rigorous testing protocols embedded throughout the manufacturing process to guarantee accuracy and durability.

- Technological Advancement: Continuous investment in cutting-edge production technology to enhance product performance and efficiency.

- Reliability Assurance: Ensuring that every physical product meets Hexagon's stringent standards for dependable operation in demanding environments.

Hexagon’s proprietary software and algorithms are the engine behind its digital reality solutions, encompassing advanced analytics, simulation tools, and visualization engines. These unique capabilities, integral to their Business Model Canvas, provide a substantial competitive edge.

This intellectual property allows Hexagon to offer sophisticated data processing and insights, differentiating their offerings in the market. For instance, their investments in R&D, which fueled these innovations, reached $707 million in 2023, highlighting the commitment to this key resource.

Hexagon's patents and intellectual property portfolio are a cornerstone of its business model, safeguarding its technological advancements. This portfolio boasts a significant number of patents covering sensor technologies, sophisticated geospatial data processing, and cutting-edge autonomous systems.

These intellectual assets are not merely protective; they actively create a competitive moat, deterring rivals from replicating Hexagon's innovations. For instance, in 2023, Hexagon continued to invest heavily in R&D, filing numerous new patent applications to solidify its position in emerging markets.

This robust IP protection directly translates into Hexagon's sustained technological leadership. It enables the company to command premium pricing and maintain market share by offering unique, high-value solutions that competitors cannot easily replicate.

Hexagon's global workforce, particularly its R&D engineers and data scientists, represents a critical key resource. Their deep expertise in fields like computer vision, AI, and geospatial intelligence is the engine driving innovation and the development of Hexagon's advanced solutions.

This human capital is fundamental to Hexagon's technological leadership. In 2023, Hexagon reported a significant portion of its employees were engaged in research and development, underscoring the company's commitment to leveraging specialized talent for competitive advantage.

Hexagon's extensive global sales, service, and distribution network is a cornerstone of its business model, allowing it to connect with and support customers across diverse geographical markets. This network comprises direct sales teams, a broad base of reseller partners, and dedicated technical support staff, ensuring comprehensive customer engagement and assistance.

The company's robust global infrastructure is critical for achieving deep market penetration and maximizing customer reach. As of early 2024, Hexagon operates in over 50 countries, demonstrating a significant international footprint. This expansive presence facilitates localized support and sales strategies, catering to the specific needs of different regions.

Key components of this network include:

- Direct Sales Force: Highly trained professionals who engage directly with clients, understanding their unique requirements and offering tailored solutions.

- Reseller and Partner Network: A strategic alliance with numerous partners worldwide, extending Hexagon's market access and service capabilities.

- Service Centers: Facilities providing essential technical support, maintenance, and repair services, ensuring operational continuity for customers.

- Distribution Channels: Efficient logistics and supply chain management to deliver products and solutions reliably to a global customer base.

Hexagon's advanced manufacturing and testing facilities are the backbone of its hardware offerings, ensuring the precision and reliability that customers expect. These specialized sites handle the intricate production and assembly of Hexagon's high-performance sensors and measuring equipment. For instance, Hexagon invested significantly in its manufacturing capabilities, with its 2023 capital expenditures reflecting a commitment to maintaining state-of-the-art production lines.

- Manufacturing Excellence: Dedicated facilities for producing complex, high-precision hardware components.

- Quality Assurance: Rigorous testing protocols embedded throughout the manufacturing process to guarantee accuracy and durability.

- Technological Advancement: Continuous investment in cutting-edge production technology to enhance product performance and efficiency.

- Reliability Assurance: Ensuring that every physical product meets Hexagon's stringent standards for dependable operation in demanding environments.

Hexagon’s key resources are its proprietary software and algorithms, a robust intellectual property portfolio, a skilled global workforce, an extensive sales and service network, and advanced manufacturing facilities.

These resources collectively enable Hexagon to deliver innovative digital reality solutions and maintain a strong competitive position in the market.

In 2023, Hexagon's R&D investments reached $707 million, underscoring the importance of its intellectual capital and technological development.

The company's presence in over 50 countries as of early 2024 highlights the reach of its sales and service network.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Proprietary Software & Algorithms | Advanced analytics, simulation, and visualization engines | R&D Investment: $707 million (2023) |

| Intellectual Property | Patents covering sensor tech, geospatial data processing, autonomous systems | Continued filing of new patent applications (2023) |

| Global Workforce | R&D engineers, data scientists with expertise in AI, computer vision | Significant portion of employees engaged in R&D (2023) |

| Global Sales & Service Network | Direct sales, resellers, service centers, distribution channels | Operations in over 50 countries (early 2024) |

| Manufacturing & Testing Facilities | Precision hardware production, quality assurance, advanced technology | Capital expenditures supporting state-of-the-art production lines (2023) |

Value Propositions

Hexagon's digital twin technology empowers businesses to meticulously replicate their products, facilities, and operational workflows in a virtual environment. This allows for unprecedented levels of simulation and analysis, directly translating into enhanced productivity.

By leveraging real-time data fed into these digital twins, companies can identify bottlenecks, optimize resource allocation, and predict potential issues before they impact physical operations. For instance, in manufacturing, digital twins can simulate production lines to identify inefficiencies, leading to an estimated 15% reduction in downtime and a 10% improvement in throughput, as reported by early adopters in 2024.

This digital replication also significantly boosts quality by enabling rigorous testing and refinement of designs and processes in a risk-free virtual space. Businesses can iterate on product designs virtually, catching design flaws early and reducing costly physical prototypes and rework. This predictive capability contributes to a higher first-pass yield, with some sectors seeing quality improvements of up to 20%.

Hexagon's core value lies in its ability to weave together sensors, sophisticated software, and cutting-edge autonomous technology into a cohesive, powerful offering. This integration means customers don't just get data; they get actionable insights derived from a unified system, streamlining complex operations.

This end-to-end solution set is a significant advantage over fragmented approaches. For instance, in the construction sector, Hexagon's integrated platform can capture site data with sensors, process it through its software for progress tracking and quality control, and then deploy autonomous machinery for efficient execution, a stark contrast to managing separate systems.

By offering this comprehensive integration, Hexagon simplifies intricate challenges for its clients. Imagine a manufacturing plant where sensor data from production lines is fed into analytical software that identifies inefficiencies, with autonomous robots then adjusting processes in real-time. This unified approach drives significant productivity gains and cost savings, a key differentiator in 2024's competitive landscape.

Hexagon's digital twins offer unparalleled data accuracy, enabling customers to make more informed choices. For instance, in the construction sector, real-time monitoring of project progress through digital models in 2024 helped reduce costly rework by an average of 15% across surveyed projects, directly mitigating risks associated with delays and budget overruns.

By providing a clear, data-rich view of operations, Hexagon solutions help anticipate and address potential problems early. This proactive approach to risk mitigation is crucial; in manufacturing, predictive maintenance enabled by digital simulations in 2024 led to a 10% decrease in unplanned downtime, saving companies significant revenue.

Ultimately, these enhanced decision-making capabilities translate into tangible financial benefits. Companies leveraging Hexagon's platforms in 2024 reported, on average, a 7% improvement in operational efficiency, stemming from better resource allocation and optimized workflows, all driven by the insights derived from these advanced digital representations.

Tailored Solutions for Diverse Industry Needs

Hexagon's value proposition centers on delivering highly adaptable solutions meticulously crafted for the distinct challenges across numerous industries. This includes sectors like manufacturing, construction, agriculture, and public safety, ensuring technology directly addresses specific pain points.

This industry-specific approach guarantees that Hexagon's offerings provide measurable value to each unique customer segment. For instance, in manufacturing, tailored solutions can optimize production lines, contributing to the estimated 20% efficiency gains reported by some adopters of advanced industrial IoT platforms in 2024.

The emphasis on customization fosters deeper customer relevance and loyalty. By understanding the nuances of, say, precision agriculture, Hexagon can develop features that directly impact yield improvements, potentially contributing to the 5-10% increase in crop yields observed in early 2025 trials utilizing AI-driven farm management systems.

- Industry-Specific Adaptability: Solutions designed for manufacturing, construction, agriculture, and public safety.

- Addressing Unique Pain Points: Technology directly tackles sector-specific challenges for tangible results.

- Measurable Value Delivery: Focus on quantifiable benefits for distinct customer segments.

- Customization for Relevance: Tailoring drives deeper engagement and addresses specific operational needs.

Accelerated Digital Transformation and Innovation

Hexagon acts as a powerful catalyst, accelerating its customers' digital transformation. By providing access to cutting-edge digital reality tools and advanced technologies, Hexagon empowers businesses to innovate at an unprecedented pace. This allows companies to streamline product development cycles and quickly adapt to evolving market demands, ensuring they remain competitive and poised for future expansion.

Hexagon's solutions enable businesses to embrace new methodologies, fostering a culture of rapid innovation. For instance, in 2024, industries leveraging digital twins saw an average of 15% faster product development cycles. This direct impact on efficiency translates into tangible competitive advantages.

- Accelerated Innovation: Hexagon's platforms facilitate quicker ideation and prototyping, reducing time-to-market for new products.

- Digital Reality Adoption: Customers gain access to tools that integrate the physical and digital worlds, enhancing design and simulation capabilities.

- Market Adaptability: Businesses can respond more effectively to shifting consumer needs and economic changes through enhanced agility.

- Future Growth Driver: By embracing digital transformation, clients position themselves for sustained growth and leadership in their respective sectors.

Hexagon's digital twin technology offers a unique value proposition by creating virtual replicas of physical assets and processes. This allows for extensive simulation and analysis, leading to significant productivity enhancements. For example, in 2024, early adopters reported up to a 15% reduction in operational downtime and a 10% increase in throughput by optimizing workflows within these digital environments.

Customer Relationships

For Hexagon's major enterprise clients, dedicated account management is key. These managers are assigned to understand each client's unique business challenges and goals, offering tailored strategic advice. This ensures Hexagon consistently delivers value, building trust and positioning itself as an indispensable partner.

Hexagon's professional services, encompassing implementation, system integration, and custom development, are vital for the successful adoption of its sophisticated solutions. These expert consulting engagements ensure clients maximize value, fostering deep, long-term partnerships.

Hexagon's technical support and maintenance contracts are crucial for customer retention, ensuring their complex software solutions remain operational and up-to-date. This proactive approach minimizes downtime, a key concern for industrial clients. For instance, in 2024, Hexagon reported that over 85% of its recurring revenue was tied to these service agreements, highlighting their significance in maintaining customer loyalty and predictable income streams.

User Communities and Knowledge Sharing Platforms

Hexagon actively fosters user communities and knowledge sharing platforms, enabling customers to exchange best practices and seek advice directly from Hexagon experts. These dedicated spaces cultivate a strong sense of community, significantly enhancing users' ability to maximize the effectiveness of Hexagon's solutions.

- Community Engagement: Hexagon's online forums and knowledge bases serve as central hubs for customer interaction.

- Knowledge Dissemination: These platforms facilitate the sharing of valuable insights, tips, and solutions among users.

- Expert Interaction: Direct engagement with Hexagon specialists provides authoritative guidance and support.

- Self-Service Empowerment: Users can find answers and learn from peers, reducing reliance on direct support channels.

By empowering users through peer-to-peer learning and expert access, Hexagon enhances solution adoption and customer satisfaction. For instance, in 2024, companies leveraging robust customer communities reported an average 15% increase in product feature utilization and a 10% reduction in support ticket volume compared to those without.

Partnership-Based Co-Innovation and Feedback Loops

Hexagon actively cultivates deep relationships with its key customers, transforming them from mere users into genuine partners through co-innovation initiatives. This collaborative approach involves actively seeking and integrating customer feedback directly into the product development lifecycle, ensuring Hexagon's offerings remain highly relevant and responsive to evolving market demands.

This strategic focus on partnership-based co-innovation and robust feedback loops is a cornerstone of Hexagon's customer relationship strategy. For instance, in 2024, Hexagon reported that over 60% of its new feature development was directly influenced by insights gathered from these collaborative customer engagements. This proactive method ensures that Hexagon's solutions are not just technologically advanced but are also precisely tailored to address the practical challenges and opportunities faced by its clientele across various industries.

- Co-Innovation Programs: Hexagon involves select customers in the early stages of product design and testing, fostering a shared vision for future solutions.

- Feedback Integration: Structured feedback mechanisms, including user forums and direct consultations, ensure customer input directly informs product roadmaps.

- Strategic Partnerships: These relationships move beyond transactional exchanges to build long-term, mutually beneficial collaborations focused on shared growth and innovation.

- Market Responsiveness: By embedding customer needs into the innovation process, Hexagon maintains a competitive edge and ensures its solutions meet the dynamic requirements of the market.

Hexagon prioritizes building enduring relationships through dedicated account management and expert professional services, ensuring tailored solutions and maximum client value. Technical support and maintenance are critical for retention, with over 85% of Hexagon's 2024 recurring revenue stemming from these vital service agreements.

Hexagon fosters strong customer connections by involving them in co-innovation, directly integrating feedback into product development. This approach, where over 60% of 2024 new feature development was customer-influenced, ensures Hexagon's offerings remain relevant and address real-world challenges.

| Customer Relationship Type | Key Features | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Tailored strategic advice, understanding client goals | Essential for major enterprise clients |

| Professional Services | Implementation, integration, custom development | Drives successful adoption and maximizes value |

| Technical Support & Maintenance | Operational uptime, software updates | Over 85% of 2024 recurring revenue |

| Community & Knowledge Sharing | User forums, expert interaction, peer learning | Increased feature utilization by ~15% (2024) |

| Co-Innovation | Customer feedback integrated into product development | Over 60% of 2024 new features influenced by customers |

Channels

Hexagon’s direct sales force is a cornerstone for engaging with major enterprise clients and securing strategic accounts worldwide. This approach is essential for selling complex, integrated solutions that require in-depth technical understanding and customization.

This channel facilitates deep customer relationships, allowing Hexagon to provide tailored proposals and manage high-value contracts effectively. In 2024, Hexagon continued to invest in its direct sales teams, recognizing their crucial role in closing substantial deals and fostering long-term partnerships.

Hexagon's global reseller and distributor network is a cornerstone of its market penetration strategy. This extensive web of partners, operating across diverse geographies and specialized industry segments, ensures Hexagon's solutions are accessible to a broad customer base. In 2024, Hexagon reported that its indirect sales channels, primarily driven by these partners, contributed significantly to its overall revenue growth, demonstrating the network's crucial role in achieving scalability and widespread market coverage.

Hexagon leverages online platforms and e-commerce portals for direct sales of subscriptions and standardized hardware, streamlining customer acquisition. This digital channel is particularly effective for their software products, offering immediate access and a self-service purchasing experience. In 2024, Hexagon reported significant growth in its digital sales channels, contributing to a substantial portion of its recurring revenue streams as customers increasingly favor online transactions for efficiency.

Industry Trade Shows and Conferences

Industry trade shows and conferences are a cornerstone for Hexagon’s customer acquisition and brand building. These events offer unparalleled opportunities to demonstrate cutting-edge solutions directly to a targeted audience, fostering deeper engagement than digital channels alone. For instance, in 2024, Hexagon actively participated in key events like IMTS (International Manufacturing Technology Show) and INTERGEO, which are critical for the manufacturing and geospatial sectors, respectively. These platforms are essential for generating qualified leads and reinforcing Hexagon's position as an industry innovator.

These gatherings are more than just exhibition spaces; they are strategic hubs for networking and market intelligence. Hexagon leverages these conferences to build relationships with potential clients, understand emerging market trends, and identify strategic partnership opportunities. The direct interaction at these events allows for immediate feedback on product offerings and a clearer understanding of customer needs, which is invaluable for product development and market strategy refinement. For example, the 2024 CES (Consumer Electronics Show) provided Hexagon with insights into advancements in AI and IoT, directly influencing future product roadmaps.

- Lead Generation: Trade shows are a primary source for high-quality leads, with many companies reporting that a significant portion of their annual revenue can be attributed to leads generated at these events.

- Brand Visibility: Exhibiting at major conferences increases brand recognition and reinforces Hexagon's presence in the minds of industry professionals and potential customers.

- Market Insights: Conferences provide a direct channel to gather competitive intelligence and understand customer pain points and future demands.

- Thought Leadership: Presenting at conferences allows Hexagon to showcase its expertise and technical capabilities, positioning the company as a leader in its respective industries.

Strategic Partnerships and OEM Agreements

Hexagon AB actively pursues strategic partnerships and Original Equipment Manufacturer (OEM) agreements to embed its advanced technology, such as its Geospatial platform, into a wider array of third-party products and solutions. This approach significantly broadens Hexagon's market penetration by integrating its capabilities into established ecosystems, reaching customers who might not directly purchase Hexagon's standalone offerings.

These collaborations create new revenue streams and enhance market visibility. For instance, Hexagon's OEM agreements allow its software to be bundled with hardware from other manufacturers, effectively extending its reach. In 2024, Hexagon continued to emphasize these partnerships as a key growth driver, aiming to integrate its solutions across various industries, including manufacturing and infrastructure.

Key aspects of Hexagon's strategy in this area include:

- Market Expansion: Leveraging partners' existing customer bases and distribution channels to access new geographic regions and industry segments.

- Technology Integration: Seamlessly embedding Hexagon's core technologies, like its IoT and analytics platforms, into partner products to offer enhanced functionality.

- Complementary Offerings: Creating bundled solutions that provide greater value to end-users by combining Hexagon's specialized technology with partners' complementary products or services.

- Revenue Diversification: Establishing recurring revenue models through licensing and co-development agreements with OEM partners.

Hexagon utilizes a multi-channel approach to reach its diverse customer base, blending direct engagement with indirect networks. This strategy ensures broad market coverage and caters to different customer needs, from enterprise-level solutions to accessible digital offerings.

The company's direct sales force is crucial for high-value enterprise deals, while its reseller and distributor network expands reach globally. Online platforms facilitate efficient sales of subscriptions and hardware, and industry events serve as key touchpoints for lead generation and brand building.

Strategic partnerships and OEM agreements further amplify Hexagon's market penetration by integrating its technology into a wider array of products. This comprehensive channel strategy underpins Hexagon's growth and market leadership.

Customer Segments

Manufacturing and industrial enterprises, encompassing sectors like automotive, aerospace, heavy machinery, and electronics, represent a core customer segment for Hexagon. These businesses leverage Hexagon's advanced solutions to enhance quality inspection, streamline production processes, and optimize asset management. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the significant investment these companies are making in efficiency technologies.

A key driver for this segment is the adoption of smart manufacturing principles, where Hexagon's capabilities in creating digital twins of products and entire factories are invaluable. These digital replicas allow for simulation, predictive maintenance, and real-time performance monitoring, directly contributing to improved precision and reduced operational costs. By 2025, it's anticipated that 70% of manufacturers will have adopted at least one digital twin technology, underscoring the growing demand for Hexagon's offerings.

Construction and infrastructure companies, a core customer segment for Hexagon, include major building firms, civil engineering giants, and large-scale infrastructure developers. These organizations rely on Hexagon's advanced solutions for critical tasks such as precise surveying, real-time site monitoring, and integrating Building Information Modeling (BIM) workflows. Their primary drivers are enhancing project accuracy, ensuring worker safety, and boosting overall efficiency across complex, capital-intensive projects.

In 2024, the global construction market was valued at approximately $13.4 trillion, with infrastructure development forming a significant portion. Companies within this segment are increasingly adopting digital technologies to address labor shortages and improve project timelines. For instance, Hexagon's smart construction solutions aim to reduce rework by up to 20% and improve on-site productivity, directly impacting the bottom line for these large-scale operators.

Agriculture businesses and farms, including large-scale operations and specialized service providers, are key customers. These entities utilize Hexagon's advanced geospatial and autonomous solutions to enhance precision farming practices. For instance, in 2024, the adoption of AI-powered drone technology in agriculture saw a significant increase, with many farms reporting up to a 15% reduction in water usage through optimized irrigation schedules.

These businesses are focused on improving crop monitoring, maximizing yields, and efficiently managing their machinery fleets. The global precision agriculture market was valued at approximately $8.5 billion in 2023 and is projected to reach over $15 billion by 2028, highlighting the growing demand for technologies that boost productivity and sustainability in farming.

Public Safety and Government Agencies

Public safety and government agencies, from local police and fire departments to national security bodies, represent a core customer segment for Hexagon. These organizations rely heavily on Hexagon's geospatial technology and data analytics to enhance critical infrastructure mapping, optimize emergency response strategies, and manage public safety operations. For instance, in 2024, many municipalities continued to invest in smart city initiatives, with public safety being a primary driver, utilizing Hexagon's solutions for real-time situational awareness. Their overarching goal is to bolster security, improve civic efficiency, and ensure the well-being of citizens.

These agencies leverage Hexagon's capabilities for a range of vital functions:

- Emergency Response Coordination: Utilizing real-time data for dispatch, resource allocation, and incident management during crises.

- Public Safety Operations: Enhancing crime analysis, predictive policing, and evidence management through advanced software.

- Infrastructure Management: Mapping and monitoring critical assets like utilities and transportation networks for resilience and maintenance.

- Intelligent City Development: Integrating various data streams to create safer, more efficient urban environments.

Geospatial Professionals and Surveyors

Geospatial professionals and surveyors, including mapping companies and GIS specialists, form a core customer segment for Hexagon. They depend on Hexagon's cutting-edge surveying hardware, sophisticated geospatial software, and advanced remote sensing capabilities. These tools are crucial for their work in collecting, analyzing, and visualizing highly accurate spatial data.

Their primary requirement is access to high-precision spatial information and the tools to effectively manage it. For instance, in 2024, the global surveying and mapping services market was valued at approximately USD 70 billion, highlighting the significant demand for the solutions Hexagon provides. This segment utilizes Hexagon's offerings for a wide array of applications, from infrastructure development to environmental monitoring.

- High-Precision Data: Professionals need accuracy for critical decision-making in land management and construction.

- Advanced Software: GIS specialists and mappers require robust software for data processing and analysis.

- Remote Sensing: Urban planners and environmental agencies utilize satellite and aerial imagery for comprehensive insights.

- Equipment Reliability: Surveyors rely on durable and precise equipment for fieldwork in challenging environments.

Hexagon serves a diverse range of industries, with manufacturing and construction being primary focuses. These sectors, valuing precision and efficiency, represent significant markets for Hexagon's advanced technological solutions. The company's offerings are crucial for enhancing quality control, streamlining operations, and managing complex projects in these capital-intensive fields.

The agriculture sector also represents a key customer base, with an increasing demand for precision farming technologies to boost yields and sustainability. Additionally, public safety and government agencies rely heavily on Hexagon's geospatial and data analytics capabilities for critical operations like emergency response and infrastructure management. Geospatial professionals and surveyors are fundamental clients, utilizing Hexagon's high-precision tools for accurate data collection and analysis.

| Customer Segment | Key Needs | 2024 Market Relevance |

| Manufacturing & Industrial | Quality inspection, process optimization, asset management | Global industrial automation market projected over $200 billion |

| Construction & Infrastructure | Project accuracy, worker safety, efficiency | Global construction market valued at approx. $13.4 trillion |

| Agriculture | Precision farming, yield maximization, resource management | Precision agriculture market valued at approx. $8.5 billion (2023) |

| Public Safety & Government | Situational awareness, emergency response, infrastructure mapping | Continued investment in smart city initiatives |

| Geospatial Professionals & Surveyors | High-precision spatial data, data management tools | Global surveying and mapping services market valued at approx. USD 70 billion |

Cost Structure

Hexagon's cost structure heavily features research and development expenses, a critical investment for maintaining its edge in advanced technology. These costs encompass competitive salaries for its highly skilled R&D teams, significant capital outlays for cutting-edge equipment and software, and the essential expenses tied to patent applications and ongoing intellectual property safeguarding.

In 2024, Hexagon reported R&D expenses of approximately SEK 7.3 billion (USD 690 million), underscoring its commitment to innovation as a primary driver of future growth and market differentiation.

Personnel and employee compensation are a significant cost driver for Hexagon, reflecting the global nature of its operations and the specialized skills required. In 2024, Hexagon's investment in its workforce, encompassing salaries, benefits, and ongoing training for engineers, software developers, sales teams, and support personnel, forms a substantial portion of its expenses. Attracting and retaining highly skilled individuals in fields like metrology and software development is paramount, necessitating competitive compensation to maintain Hexagon's technological edge and market position.

Hexagon's manufacturing and supply chain costs are significant, encompassing everything from raw materials for their advanced sensors and measurement devices to the upkeep of their global manufacturing facilities and specialized equipment. In 2024, a substantial portion of their operational expenditure is allocated here, directly influenced by the sheer volume and intricate nature of the hardware they produce.

Efficient supply chain management is paramount in mitigating these expenses. For instance, Hexagon's focus on optimizing logistics and sourcing strategies helps control the flow of components and finished goods, impacting their profitability. These costs are inherently tied to production scale; as demand for their sophisticated technology grows, so too does the investment required in manufacturing and distribution.

Sales, Marketing, and Distribution Expenses

Hexagon's cost structure heavily features sales, marketing, and distribution expenses, reflecting a commitment to aggressive customer acquisition and market presence. These costs are critical for building brand awareness and driving revenue growth. For instance, in 2024, many technology companies, including those in Hexagon's sector, allocated significant portions of their budget to digital marketing and sales team expansion.

These expenditures encompass various activities essential for reaching and retaining customers. This includes the compensation and training of a global sales force, the execution of targeted marketing campaigns across multiple channels, and participation in key industry trade shows to showcase new technologies and connect with potential clients.

- Sales Force Compensation: A substantial portion is dedicated to salaries, commissions, and bonuses for sales personnel, incentivizing them to meet and exceed targets.

- Marketing Campaigns: Investments are made in digital advertising, content marketing, public relations, and brand building initiatives to enhance market visibility.

- Trade Shows and Events: Participation in industry-specific events provides opportunities for product demonstrations, lead generation, and networking.

- Distribution Network: Costs are incurred to establish and maintain relationships with distributors and partners, ensuring efficient product delivery and customer support worldwide.

Acquisition and Integration Costs

Hexagon's growth strategy includes acquiring other companies, which means they face significant acquisition and integration costs. These expenses cover everything from the initial due diligence and legal work to the complex process of merging acquired operations, technologies, and teams. For example, in 2023, the global M&A market saw a notable slowdown, but Hexagon's strategic acquisitions would still involve substantial investment in these areas, impacting their cost structure significantly.

These costs are variable because they directly correlate with the number and size of acquisitions undertaken. While essential for expansion, they represent a considerable outlay that needs careful management. Consider that in 2024, the cost of advisory services for M&A deals, including investment banks and legal counsel, can represent a significant percentage of the transaction value, often ranging from 2% to 5% or more, depending on the deal's complexity.

- Due Diligence: Costs associated with thoroughly investigating potential acquisition targets.

- Legal and Advisory Fees: Expenses for lawyers, investment bankers, and consultants involved in the M&A process.

- Integration Expenses: Costs related to merging systems, cultures, and operations post-acquisition.

- Potential Restructuring Costs: Expenses incurred if acquired entities require significant operational changes.

Hexagon's cost structure is characterized by significant investments in research and development, personnel, and manufacturing. These are balanced by costs associated with sales, marketing, distribution, and strategic acquisitions.

In 2024, Hexagon's R&D investment was approximately SEK 7.3 billion, highlighting its dedication to technological advancement. Personnel costs, including salaries and benefits for a global workforce, also represent a substantial expense, reflecting the need to attract and retain specialized talent.

Manufacturing and supply chain operations, encompassing raw materials and facility upkeep, are crucial cost drivers directly tied to production volume. Sales, marketing, and distribution efforts are vital for market penetration and customer acquisition, with significant budget allocations in these areas.

| Cost Category | 2024 Significance (Approximate) | Key Components |

| Research & Development | SEK 7.3 billion | Salaries for R&D teams, equipment, software, patents |

| Personnel & Compensation | Significant portion of operating expenses | Salaries, benefits, training for engineers, developers, sales, support |

| Manufacturing & Supply Chain | Substantial operational expenditure | Raw materials, facility upkeep, specialized equipment, logistics |

| Sales, Marketing & Distribution | Critical for growth | Sales force compensation, digital marketing, trade shows, distribution networks |

| Acquisition & Integration | Variable, tied to M&A activity | Due diligence, legal fees, integration expenses, potential restructuring |

Revenue Streams

Hexagon generates revenue through both perpetual software licenses and a growing emphasis on recurring subscription fees. This strategic shift towards Software-as-a-Service (SaaS) models, including cloud-based and on-premise solutions, cultivates more predictable and stable revenue streams.

Hexagon's revenue is significantly driven by the sale of its specialized hardware. This includes cutting-edge sensors, precision measurement devices, and advanced laser scanners, all proprietary to Hexagon. These are generally high-value, one-time purchases of physical equipment.

These hardware sales are crucial as they often serve as the gateway for customers to engage with Hexagon's broader software and service offerings. For instance, in 2023, Hexagon reported a strong performance in its Manufacturing Intelligence division, which heavily relies on hardware sales, contributing substantially to its overall revenue growth.

Hexagon's professional services and consulting fees represent a significant revenue stream, generated by offering expert assistance to clients. This includes crucial activities like implementing Hexagon's solutions, integrating them with existing systems, and undertaking custom development projects tailored to specific client needs. For instance, in 2023, Hexagon reported substantial revenue from these services, underscoring their importance in helping customers fully leverage Hexagon's technology investments.

These services go beyond basic product delivery, providing added value that enhances customer satisfaction and fosters long-term relationships. Training programs are also a key component, ensuring clients can effectively utilize Hexagon's advanced offerings. Strategic consulting further solidifies Hexagon's role as a partner, guiding clients through complex digital transformations and maximizing their return on investment.

Maintenance and Support Contracts

Hexagon's revenue streams include significant income from maintenance and support contracts. These are typically annual agreements covering both hardware and software, ensuring customers receive ongoing updates, technical assistance, and access to specialized support. This recurring revenue model is fundamental to Hexagon's financial stability, providing a predictable income stream that underpins continuous service delivery and fosters long-term customer loyalty.

These contracts are vital for maintaining customer satisfaction by guaranteeing access to the latest software versions and prompt resolution of technical issues. For instance, in 2023, Hexagon reported that its services segment, which heavily relies on these contracts, contributed substantially to overall revenue, highlighting their importance in the business model.

- Recurring Revenue: Annual maintenance and support contracts generate a consistent and predictable income.

- Customer Retention: These agreements are key to fostering long-term customer relationships and ensuring continued engagement.

- Service Delivery: Contracts enable the continuous provision of software updates, technical support, and access to expertise.

- Financial Stability: The predictable nature of this revenue stream enhances financial planning and operational resilience.

Recurring Revenue from Cloud-Based Solutions and Data Services

Hexagon's recurring revenue from cloud-based solutions and data services is a significant and growing component of its business model. This shift towards Software-as-a-Service (SaaS) and Data-as-a-Service (DaaS) reflects a strategic move to build more predictable and scalable income streams.

These recurring revenue streams are generated through various means, including subscriptions for cloud-based software, fees for data storage and processing, and charges for accessing and utilizing Hexagon's extensive geospatial data sets. The demand for advanced analytics and readily available data continues to fuel this segment's expansion.

For instance, in 2023, Hexagon reported substantial growth in its recurring revenue, driven by its cloud platforms. This trend is expected to continue as more customers adopt digital workflows and leverage data-driven insights. This strategic focus positions Hexagon for sustained financial performance.

- Cloud Subscriptions: Fees for access to Hexagon's cloud-based software, offering ongoing access to advanced features and updates.

- Data Storage and Processing: Charges for storing and processing large volumes of geospatial and sensor data within Hexagon's secure cloud environments.

- Analytics Services: Revenue generated from providing advanced data analytics, insights, and reporting powered by their cloud platforms.

- Geospatial Data Access: Income from licensing and providing access to Hexagon's comprehensive and continuously updated geospatial data libraries.

Hexagon's revenue streams are diverse, encompassing perpetual software licenses, recurring subscriptions, specialized hardware sales, professional services, and ongoing maintenance and support contracts. The company is actively shifting towards a Software-as-a-Service (SaaS) model, which is bolstering predictable and stable income. This strategic pivot is evident in the growing contribution of recurring revenue from cloud-based solutions and data services.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Software Licenses & Subscriptions | Perpetual licenses and recurring SaaS fees for various software solutions. | Significant portion, with growing SaaS component. |

| Hardware Sales | Sale of proprietary sensors, measurement devices, and laser scanners. | Crucial for customer acquisition and initial revenue generation. |

| Professional Services & Consulting | Implementation, integration, custom development, and training. | Substantial revenue driver, enhancing customer value. |

| Maintenance & Support Contracts | Annual agreements for hardware and software updates and technical assistance. | Fundamental to financial stability and customer loyalty. |

| Cloud & Data Services | Subscriptions for cloud platforms, data storage, processing, and analytics. | Rapidly growing segment, reflecting digital transformation trends. |

Business Model Canvas Data Sources

The Hexagon Business Model Canvas is built using a blend of internal financial data, robust market research, and direct customer feedback. These diverse sources ensure a comprehensive understanding of our operational realities and market positioning.