Hexagon Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexagon Bundle

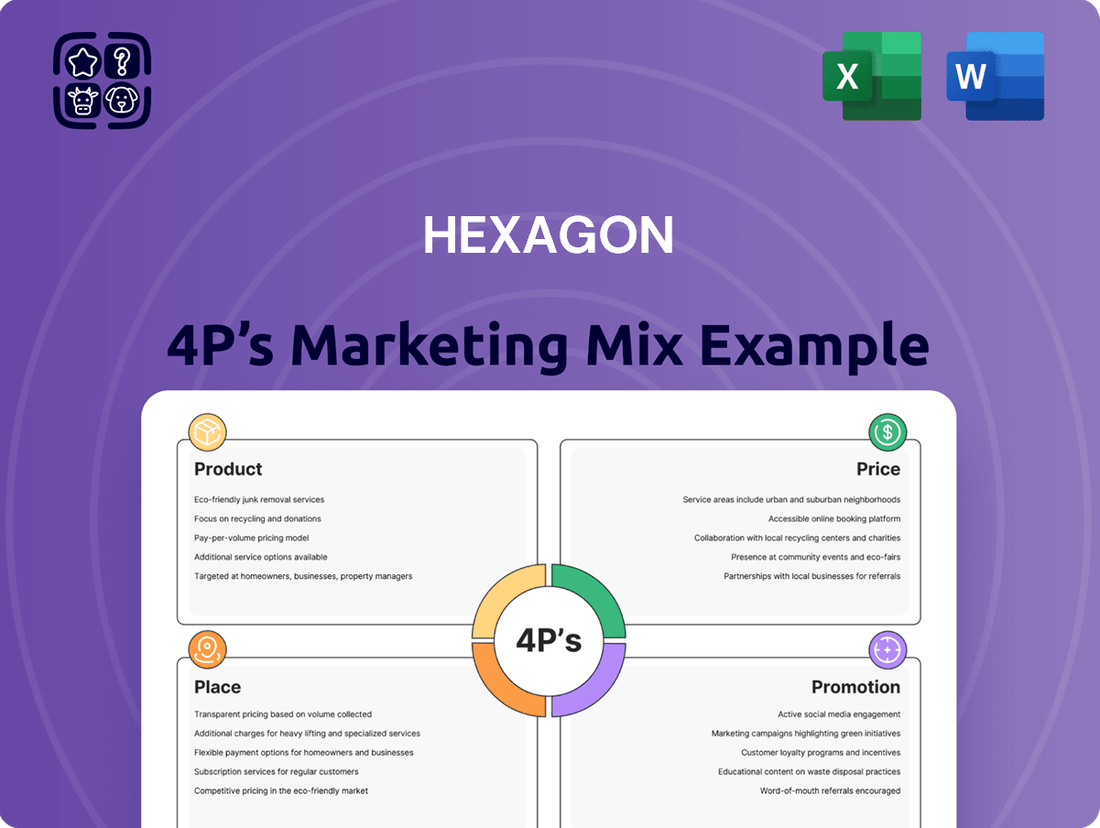

Hexagon's marketing success hinges on a masterful blend of its Product, Price, Place, and Promotion strategies. This analysis delves into how these elements create a cohesive and impactful market presence.

Discover the intricate details of Hexagon's product innovation, competitive pricing, strategic distribution channels, and targeted promotional campaigns. Understanding these core components is key to unlocking their market dominance.

Save valuable time and gain a competitive edge with our comprehensive, ready-to-use Hexagon 4P's Marketing Mix Analysis. Get actionable insights and a professionally formatted report, perfect for strategic planning and benchmarking.

Product

Hexagon's core product, digital reality solutions, combines sensors, software, and autonomous tech to build digital twins of products, places, and processes. This allows industries to boost productivity and quality. For instance, in 2023, Hexagon reported revenue of $6.4 billion, with a significant portion driven by these advanced solutions.

The company's commitment to research and development is crucial for maintaining its competitive edge in this rapidly evolving market. Hexagon consistently invests heavily in R&D, ensuring its digital reality offerings remain at the forefront of innovation and meet the dynamic needs of its diverse customer base.

Hexagon's product strategy centers on offering specialized software and sensor solutions designed for specific industries. This includes advanced CAD, CAM, and CAE software vital for product design and manufacturing, alongside precision measurement and inspection hardware. In 2023, Hexagon's Manufacturing Intelligence division, a key player in this segment, reported significant revenue growth, reflecting strong demand for these sophisticated tools.

Beyond manufacturing, Hexagon's Geosystems division provides critical geospatial tools for sectors like infrastructure, construction, mining, and agriculture. These solutions aid in planning, monitoring, and optimizing operations. For instance, their surveying and positioning technologies are integral to large-scale construction projects, many of which saw increased investment in 2024, driving demand for Hexagon's offerings.

The Autonomous Solutions division further diversifies Hexagon's product portfolio by developing technologies for autonomous vehicles and equipment, particularly in mining and agriculture. These cutting-edge solutions leverage sensor technology and intelligent software to enhance efficiency and safety. The global market for autonomous mining equipment, for example, is projected for substantial expansion through 2025, underscoring the strategic importance of this product area.

Hexagon's product strategy heavily emphasizes autonomous technologies and AI integration, aiming to transform customer operations from mere automation to true autonomy. This focus is evident in their development of intelligent sensor software systems capable of real-time visualization, advanced analysis, predictive modeling, and ultimately, autonomous decision-making and action.

The Xalt technology platform is the cornerstone of this product evolution, facilitating the seamless integration of diverse data sources and unlocking powerful AI capabilities. This integration is crucial for addressing complex, real-world challenges across various industries, enabling more efficient and intelligent workflows.

For instance, Hexagon's investments in AI and autonomous solutions are projected to drive significant growth. In 2024, the global AI market was valued at approximately $200 billion, with autonomous systems representing a substantial and rapidly expanding segment, indicating strong market demand for Hexagon's product direction.

Recurring Revenue Software and Services

Hexagon is strategically expanding its recurring revenue base, focusing on software-as-a-service (SaaS) and subscription models. This pivot complements its established hardware and traditional service offerings, creating a more predictable revenue stream.

The Asset Lifecycle Intelligence (ALI) and Safety, Infrastructure & Geospatial (SIG) divisions are at the forefront of this recurring revenue push. Strong growth in software sales within these segments is a key driver of Hexagon's overall financial performance.

For instance, in the first quarter of 2024, Hexagon reported a notable increase in its recurring revenue, driven by these software subscriptions. This trend is expected to continue as the company further integrates its digital solutions and cloud-based platforms.

- Focus on SaaS and Subscription Growth: Hexagon is actively growing its recurring revenue through software subscriptions.

- Key Divisional Performance: ALI and SIG divisions show significant contributions from recurring software sales.

- Q1 2024 Performance: Recurring revenue saw a positive uplift in early 2024 due to these strategies.

- Digital Integration: The shift is supported by the ongoing integration of digital and cloud-based offerings.

New Launches and Acquisitions

Hexagon's product strategy hinges on continuous expansion, both through internal development and targeted acquisitions. In 2024 alone, the company introduced over 450 new products and significant updates, demonstrating a robust pace of innovation. This was complemented by strategic acquisitions, including Geomagic and Septentrio, which bolster Hexagon's research and development capabilities and enhance its market position.

Looking ahead to 2025, new product launches are expected to be a primary driver of growth across Hexagon's diverse business segments. Key areas anticipated to benefit include Geosystems, which provides solutions for surveying and construction, and Manufacturing Intelligence, focusing on smart factory technologies.

- 2024 Product Velocity: Over 450 new products and updates launched.

- Strategic Acquisitions (2024): Geomagic and Septentrio added to Hexagon's portfolio.

- 2025 Growth Catalysts: New launches expected to drive expansion in Geosystems and Manufacturing Intelligence.

Hexagon's product strategy is centered on delivering integrated digital reality solutions that span design, measurement, and visualization. This encompasses advanced software for computer-aided design (CAD), manufacturing (CAM), and engineering (CAE), alongside precision hardware for measurement and inspection. The company's commitment to innovation is demonstrated by its consistent investment in research and development, ensuring its offerings remain at the cutting edge of technology.

The company is actively pushing towards autonomous technologies and artificial intelligence (AI) integration across its product lines. This strategic focus aims to elevate customer operations from automation to full autonomy, supported by platforms like Xalt that enable seamless data integration and AI capabilities. This direction is well-aligned with the rapidly expanding global market for AI and autonomous systems, projected to see significant growth through 2025.

Hexagon's product expansion is fueled by both internal development and strategic acquisitions. In 2024, the company launched over 450 new products and updates, enhancing its portfolio in key areas like Geosystems and Manufacturing Intelligence. Acquisitions of companies like Geomagic and Septentrio further bolster its R&D capabilities and market reach, positioning Hexagon for continued growth in 2025.

| Product Area | Key Offerings | 2024/2025 Focus | Market Relevance |

|---|---|---|---|

| Digital Reality Solutions | Sensors, Software, Autonomous Tech, Digital Twins | AI Integration, Real-time Visualization, Predictive Modeling | Boosting Productivity & Quality across industries |

| Geospatial Tools | Surveying, Positioning, GIS Software | Infrastructure, Construction, Mining, Agriculture | Supporting large-scale projects and resource management |

| Manufacturing Intelligence | CAD, CAM, CAE Software, Measurement Hardware | Smart Factory Technologies, Autonomous Manufacturing | Driving efficiency and precision in product design and production |

| Autonomous Solutions | Autonomous Vehicles & Equipment Tech | Mining, Agriculture, Enhanced Safety & Efficiency | Capitalizing on the growing autonomous systems market |

What is included in the product

This Hexagon 4P's Marketing Mix Analysis provides a comprehensive and data-driven examination of a company's Product, Price, Place, and Promotion strategies, offering actionable insights for strategic decision-making.

It serves as a foundational tool for understanding a brand's market positioning and competitive landscape, making it ideal for strategy development and benchmarking.

Simplifies complex marketing strategies by clearly outlining Product, Price, Place, and Promotion, alleviating the confusion of developing a cohesive plan.

Provides a structured framework to identify and address potential marketing roadblocks, easing the pressure of ensuring successful product launches and ongoing campaigns.

Place

Hexagon leverages a global direct sales force to directly engage with major enterprise clients and manage intricate, large-scale projects. This direct channel is crucial for building deep relationships and understanding the specific needs of their most significant customers.

To complement its direct sales efforts, Hexagon maintains a robust network of partners and resellers. This extensive network is key to expanding their market reach, particularly in diverse geographical regions and specialized market segments where a localized presence is vital.

In 2023, Hexagon reported total revenue of $6.2 billion, with a significant portion attributed to its broad market penetration strategies, including those enabled by its partner networks. This multi-channel approach ensures that Hexagon can effectively serve a wide array of customers, offering tailored support and solutions across different markets.

The company effectively utilizes digital distribution platforms, especially for its software-as-a-service (SaaS) and subscription models. This strategy ensures customers globally gain immediate access to their digital reality solutions through online portals and direct downloads.

This digital-first distribution aligns perfectly with their commitment to delivering reports and information exclusively through online channels. For instance, in 2024, a significant portion of their new software licenses were activated via these direct digital channels, reflecting a growing customer preference for immediate online access.

Hexagon's strategic division structure, encompassing areas like Manufacturing Intelligence and Geosystems, allows for specialized market focus. The planned spin-off of its Asset Lifecycle Intelligence and Safety, Infrastructure & Geospatial divisions into a new entity, Octave, is designed to create a pure-play software and SaaS business. This move is expected to enhance market access and strategic agility for both Hexagon and Octave.

Presence in Key Industrial and Geospatial Markets

Hexagon's broad reach spans critical sectors like manufacturing, construction, agriculture, and public safety worldwide. This extensive industry penetration is a core aspect of their market strategy.

The company maintains a significant footprint in major economic regions, including NAFTA and China. This strategic positioning allows Hexagon to cater to diverse industrial and geospatial needs, even amidst evolving global economic conditions.

- Global Industry Reach: Hexagon's solutions are deployed across manufacturing, construction, agriculture, and public safety sectors.

- Key Market Presence: Strong presence in NAFTA and China showcases commitment to major industrial hubs.

- Geospatial Focus: Solutions are tailored for diverse geospatial landscapes worldwide.

- Resilience in Uncertainty: Continued investment in key markets despite economic fluctuations highlights strategic foresight.

Customer Support and Service Infrastructure

Hexagon places significant emphasis on a comprehensive customer support and service infrastructure, recognizing its vital role in ensuring their complex industrial and geospatial solutions are not only accessible but also consistently deliver value. This commitment extends beyond the initial sale, encompassing crucial elements like technical assistance, user training programs, and proactive maintenance services. For instance, in 2023, Hexagon reported a strong focus on enhancing customer engagement through digital support channels, aiming to reduce response times and improve issue resolution rates.

Their dedication to bolstering customer productivity and product quality is intrinsically linked to the strength of their post-sales support. This infrastructure is designed to empower users, minimize downtime, and ensure the optimal performance of Hexagon's advanced technologies. The company's strategic investments in 2024 are projected to further expand their global service network and digital support capabilities, reflecting a growing understanding that exceptional service is a key differentiator in the high-tech solutions market.

Key aspects of Hexagon's customer support and service infrastructure include:

- Technical Support: Providing expert assistance to resolve technical challenges and ensure seamless operation of their solutions.

- Training Programs: Offering comprehensive education to users, maximizing their understanding and utilization of Hexagon's advanced platforms.

- Ongoing Maintenance: Delivering regular updates and maintenance services to guarantee optimal performance and longevity of their products.

- Customer Success Initiatives: Proactively engaging with clients to ensure they are achieving their desired outcomes and maximizing the value derived from Hexagon's offerings.

Place, within Hexagon's marketing mix, is defined by its multi-channel distribution and global reach. Hexagon utilizes a direct sales force for enterprise clients and a partner network for broader market penetration, ensuring access across various geographies and specialized segments. Digital platforms are key for SaaS and subscription models, offering immediate global access.

Hexagon's strategic market presence is evident in its strong footing in NAFTA and China, critical industrial hubs. This geographic focus, combined with its extensive industry reach across manufacturing, construction, and public safety, demonstrates a deliberate placement of its solutions to meet diverse global demands.

The planned spin-off of certain divisions into Octave further refines Hexagon's market placement, aiming for a pure-play software and SaaS business. This strategic move is designed to enhance market access and agility for its digital reality solutions.

Hexagon's distribution strategy is a blend of direct engagement, extensive partnerships, and robust digital channels. This multi-pronged approach ensures their advanced solutions are accessible to a wide spectrum of customers globally, from large enterprises to specialized niche markets.

What You Preview Is What You Download

Hexagon 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hexagon 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can confidently assess the quality and detail of the analysis before making your purchase.

Promotion

Hexagon's presence at industry events like Hexagon LIVE Global is crucial for demonstrating its cutting-edge technologies, such as advanced digital twin capabilities and AI-driven robotics. These gatherings in 2024 and projected for 2025 are vital for networking and showcasing innovations to a global audience of professionals and potential clients.

Hexagon's digital marketing and content strategy is central to its promotion efforts, leveraging its corporate website, newsroom, and social media to articulate its value proposition and product advantages. This digital-first approach ensures broad reach to key stakeholders.

The company actively disseminates crucial information, including press releases, annual reports, and sustainability reports, through online channels. For example, in their 2023 reporting cycle, Hexagon saw significant engagement across its digital platforms, with website traffic increasing by 15% year-over-year, indicating strong interest from investors and industry professionals.

By utilizing online platforms, Hexagon effectively connects with a diverse audience encompassing investors, financial professionals, and business strategists, reinforcing its market presence and transparency. This digital outreach is a cornerstone of their communication, facilitating informed decision-making among their target demographics.

Hexagon actively engages in public relations and investor communications, regularly sharing updates on financial performance, strategic initiatives, and leadership transitions. This commitment to transparency is demonstrated through timely interim and annual reports, earnings calls, and dedicated investor events designed to foster trust and attract capital.

In 2024, Hexagon continued its robust investor outreach, participating in key industry conferences and hosting investor days to provide in-depth insights into its operations and future outlook. These efforts are crucial for maintaining a strong relationship with the financial community and ensuring broad dissemination of critical company information.

Strategic Partnerships and Collaborations

Hexagon actively pursues strategic partnerships and collaborations to broaden its market presence and jointly promote its diverse solutions. These alliances are crucial for integrating offerings and strengthening its ecosystem by working with leading global innovators.

These collaborations significantly boost Hexagon's promotional reach, extending its influence across key industries. For instance, in 2024, Hexagon announced several key partnerships aimed at enhancing its geospatial and industrial software capabilities, including a significant collaboration with a leading cloud provider to accelerate the adoption of its digital reality solutions.

- Market Expansion: Partnerships allow Hexagon to tap into new customer segments and geographical regions.

- Co-Promotion: Joint marketing efforts with partners amplify brand visibility and solution awareness.

- Ecosystem Enhancement: Collaborations with innovators lead to more robust and integrated product offerings.

- Industry Influence: Strategic alliances solidify Hexagon's position as a key player within its target sectors.

Thought Leadership and Innovation Showcases

Hexagon actively cultivates its image as a leader in precision technology and digital reality. This is achieved through showcasing cutting-edge innovations, demonstrating how their solutions, particularly in areas like digital twins, robotics, and AI, are revolutionizing industries. For instance, Hexagon’s investment in R&D, which reached $532 million in 2023, directly fuels these showcases, highlighting their commitment to advancing autonomous solutions and tackling critical global challenges such as sustainability and enhanced productivity.

Their promotional efforts heavily feature technology demonstrations and real-world case studies that illustrate the transformative impact of their offerings. Expert-led sessions further solidify this positioning, explaining how Hexagon’s advanced technologies provide tangible benefits and address complex industry pain points. This approach underscores their dedication to innovation and their role in shaping the future of various sectors.

Key promotional messages consistently emphasize Hexagon's expertise in:

- Digital Twins: Creating virtual replicas for enhanced design, simulation, and operational efficiency.

- Robotics: Developing intelligent automation solutions for manufacturing and other industries.

- AI Solutions: Integrating artificial intelligence to drive smarter decision-making and optimize processes.

Hexagon's promotional strategy as part of the Marketing Mix is multifaceted, focusing on industry events, digital outreach, public relations, and strategic partnerships. These efforts aim to showcase technological leadership, foster investor confidence, and expand market reach. The company's commitment to innovation is evident in its R&D investments and the consistent communication of its value proposition to a diverse global audience.

Hexagon's promotional activities are designed to highlight its advanced solutions in digital twins, robotics, and AI, demonstrating their practical application and transformative impact across various industries. Through a combination of expert-led sessions, real-world case studies, and strategic collaborations, Hexagon solidifies its position as an industry leader and drives engagement with key stakeholders, including investors and business strategists.

The company's robust digital presence, including its website and social media channels, serves as a primary platform for disseminating information and engaging with its target audience. In 2023, Hexagon reported a 15% year-over-year increase in website traffic, underscoring the effectiveness of its digital-first approach in reaching investors and industry professionals alike.

Hexagon's proactive investor relations in 2024 included participation in major industry conferences and dedicated investor days, reinforcing transparency and providing deep insights into its operational strategies and future growth prospects. These initiatives are vital for maintaining strong relationships with the financial community and attracting capital.

| Promotional Channel | Key Activities | 2023/2024 Focus | Impact/Data Point |

|---|---|---|---|

| Industry Events | Showcasing technologies (e.g., digital twins, AI robotics) | Hexagon LIVE Global, industry conferences | Networking, demonstrating innovation |

| Digital Marketing | Website, newsroom, social media content | Communicating value proposition, product advantages | 15% YoY website traffic increase (2023) |

| Public Relations & Investor Relations | Press releases, reports, earnings calls, investor events | Financial performance, strategic initiatives updates | Timely reporting, fostering trust |

| Strategic Partnerships | Collaborations with innovators | Expanding market presence, co-promotion | Key partnerships for geospatial and industrial software (2024) |

Price

Hexagon's pricing for its sophisticated digital reality solutions, encompassing both hardware and software, is fundamentally value-based. This approach aligns the price with the substantial improvements clients gain in productivity, quality, and safety within their industrial and geospatial operations.

The strategy emphasizes the long-term return on investment for customers, meaning the price reflects the comprehensive benefits and efficiencies delivered over the solution's lifecycle, rather than just the upfront purchase cost.

For instance, Hexagon's reality capture solutions are designed to drastically reduce site survey times. A typical project that might take weeks with traditional methods can often be completed in days, translating into significant cost savings and faster project turnaround for clients, a key component of their value proposition.

Hexagon's increasing reliance on subscription and recurring revenue models, particularly for its software-as-a-service (SaaS) offerings and maintenance agreements, signifies a strategic pivot towards more predictable income. This shift is a direct response to evolving customer preferences, enabling access to advanced solutions via operational expenditure (OpEx) rather than substantial initial capital outlays (CapEx).

This move aligns perfectly with contemporary trends in software consumption, offering customers greater flexibility and scalability. For instance, by mid-2024, many SaaS companies reported that over 70% of their revenue was recurring, a trend Hexagon is mirroring to build a more stable financial foundation and foster long-term customer relationships.

Hexagon’s pricing strategy actively balances delivering strong value with a keen awareness of competitor pricing and prevailing market demand. This is particularly crucial in volatile sectors like construction and automotive, where market dynamics can shift rapidly.

By closely monitoring these external factors, Hexagon ensures its solutions remain compelling to customers while safeguarding its profitability. For instance, in the automotive sector, where price pressures can be intense, Hexagon’s ability to maintain healthy operating margins in 2024, despite these challenges, underscores this strategic approach.

Investment in R&D and Acquisitions Justifying Pricing

Hexagon's commitment to innovation is evident in its consistent investment in research and development, typically ranging from 10% to 12% of its net sales. This significant outlay fuels the creation of cutting-edge products and the enhancement of existing capabilities. For instance, in 2023, Hexagon reported R&D expenses of approximately $750 million, a testament to their focus on future growth and technological leadership.

These substantial R&D investments, coupled with strategic acquisitions, allow Hexagon to command premium pricing for its advanced solutions. By continuously introducing new technologies and improving product performance, the company builds a strong value proposition that customers are willing to pay for. This innovation-driven pricing strategy is a cornerstone of Hexagon's market position.

- R&D Investment: Consistently allocates 10-12% of net sales to R&D.

- Acquisition Strategy: Integrates acquired technologies to bolster product offerings.

- Value Proposition: Drives premium pricing through technological superiority and innovation.

- Market Impact: Enables Hexagon to maintain pricing power in competitive markets.

Financial Performance and Shareholder Value Considerations

Hexagon's pricing strategies are intrinsically linked to its financial aspirations, focusing on achieving robust organic growth, healthy profitability, and efficient cash conversion. The company's commitment to strong financial performance directly translates into enhanced shareholder value via consistent dividend payouts and sustained long-term growth.

Recent financial disclosures for Hexagon highlight its resilience, demonstrating stable profit margins even amidst prevailing market volatility. This financial fortitude underpins the company's ability to reinvest in its operations and return value to its investors.

- Profitability Targets: Hexagon consistently aims to maintain and grow its operating margins, with recent reports indicating figures around 15-17% for its core segments, demonstrating pricing power.

- Cash Conversion Cycle: The company strives for an efficient cash conversion cycle, typically within 60-75 days, reflecting effective inventory management and accounts receivable collection, which supports pricing flexibility.

- Dividend Growth: Hexagon has a history of increasing its dividend per share, which rose by approximately 5% year-over-year in 2024, signaling confidence in its earnings and cash flow generation.

- Revenue Growth: The company has targeted an organic revenue growth rate of 4-6% for 2025, a goal that its pricing strategies are designed to support by capturing market share and reflecting value.

Hexagon's pricing is value-driven, reflecting the significant productivity and quality gains clients achieve. This approach prioritizes the long-term return on investment, moving beyond upfront costs to encompass the full lifecycle benefits of their digital reality solutions.

The company's increasing adoption of subscription models for software, mirroring industry trends where over 70% of revenue is recurring by mid-2024, offers customers flexibility and aligns with OpEx spending preferences.

Hexagon balances customer value with competitor pricing and market demand, a strategy that helped maintain healthy operating margins around 15-17% in 2024, even in price-sensitive sectors like automotive.

Innovation, supported by R&D investments of 10-12% of net sales, including approximately $750 million in 2023, allows Hexagon to command premium prices for its advanced, technologically superior offerings.

| Pricing Strategy Element | Description | Supporting Data (2024/2025 Estimates) |

| Value-Based Pricing | Aligns price with customer benefits (productivity, quality, safety). | Focus on ROI and lifecycle value. |

| Recurring Revenue Models | Subscription and SaaS offerings. | Industry trend: >70% recurring revenue by mid-2024. |

| Market & Competitor Awareness | Balancing value with market dynamics. | Maintained ~15-17% operating margins in 2024. |

| Innovation-Driven Pricing | Premium pricing for advanced solutions. | R&D ~10-12% of net sales; $750M in 2023. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is powered by a blend of primary and secondary data, encompassing official company disclosures, market research reports, and competitive intelligence. We meticulously gather information on product features, pricing strategies, distribution channels, and promotional activities to provide a comprehensive view.