Heidelberg Materials SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

Heidelberg Materials, a global leader in building materials, boasts significant strengths in its established brand and broad geographic reach, yet faces challenges from fluctuating raw material costs and increasing environmental regulations. Understanding these dynamics is crucial for any stakeholder navigating the competitive construction sector.

Want the full story behind Heidelberg Materials' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Heidelberg Materials stands as a titan in the global building materials sector, commanding significant market share in cement, aggregates, and ready-mixed concrete. This robust and diversified product offering shields the company from downturns in any single market segment, enabling it to provide comprehensive solutions across a wide array of construction needs.

The company's expansive footprint, spanning roughly 50 countries and close to 3,000 operational sites, highlights its immense global reach and operational capacity. For instance, in 2023, Heidelberg Materials reported a revenue of €22.1 billion, a testament to its substantial market presence and the demand for its diverse product lines.

Heidelberg Materials showcased impressive financial resilience throughout 2024, even with a dip in sales volumes. The company posted a record result from current operations (RCO) of €3.2 billion. This strong performance underscores effective cost management and pricing strategies.

Further bolstering its financial health, Heidelberg Materials reported an 11% increase in adjusted earnings per share, reaching €11.9 for the year. The company also maintained a healthy return on invested capital (ROIC) hovering around 10%.

This robust financial performance and solid ROIC position Heidelberg Materials favorably for future growth initiatives and sustained shareholder value creation.

Heidelberg Materials is a leader in the construction materials sector's transition to sustainability and decarbonization. They are actively pursuing carbon neutrality and a circular economy model, setting industry benchmarks.

The company achieved a notable 1.3% reduction in specific net CO2 emissions in 2024, demonstrating tangible progress. Furthermore, Heidelberg Materials is set to launch evoZero in 2025, which is slated to be the world's first carbon-captured net-zero cement.

Their strategic investments in Carbon Capture and Storage (CCS) technologies, exemplified by the Brevik plant in Norway, underscore a deep commitment to developing and delivering sustainable building solutions. These initiatives position them at the forefront of environmentally responsible construction.

Strategic Acquisitions and Portfolio Optimization

Heidelberg Materials has strategically enhanced its market position through targeted acquisitions, notably in North America and the Asia-Pacific region. This focus on key growth areas has strengthened its operational footprint and is crucial for achieving both expansion and sustainability goals. For instance, in 2024, the company continued its strategy of acquiring cement and aggregates businesses, aiming to consolidate its market share and leverage synergies for improved profitability.

These strategic moves are designed to optimize the company's overall portfolio, ensuring that investments are directed towards the most promising and sustainable markets. The company's proactive approach to portfolio management allows it to adapt swiftly to evolving market demands and competitive pressures, reinforcing its dynamic presence in the global construction materials sector.

- Portfolio Enhancement: Actively acquiring businesses in growth markets like North America and Asia-Pacific.

- Growth and Sustainability: Acquisitions directly support both expansion objectives and the company's sustainability targets.

- Market Position: Bolsters presence and competitiveness in key geographical areas.

- Synergy Realization: Focus on integrating acquired assets to drive efficiency and profitability.

Digital Innovation and Operational Efficiency

Heidelberg Materials is a leader in digital innovation, actively employing technologies like Artificial Intelligence to streamline cement production processes and significantly cut down on emissions. This commitment to technological advancement is a key strength, positioning the company at the forefront of industry modernization.

The company's 'Transformation Accelerator' program, initiated in November 2024, is a prime example of their dedication to operational efficiency. This initiative is designed to generate substantial annual savings through smarter network operations and improved cross-functional efficiencies, highlighting a proactive approach to optimizing performance.

These digital and operational improvements are not just theoretical; they translate into tangible benefits. For instance, the company aims for a €200 million annual run-rate improvement by the end of 2025 through these efficiency drives, demonstrating a clear financial impact of their strategic focus.

Key aspects of their digital innovation and operational efficiency include:

- AI-driven optimization of cement production for reduced emissions and enhanced output.

- 'Transformation Accelerator' program targeting significant annual savings through operational streamlining.

- Focus on network optimization and cross-functional efficiency improvements.

- €200 million annual run-rate improvement target by the end of 2025.

Heidelberg Materials boasts a diverse portfolio encompassing cement, aggregates, and ready-mixed concrete, providing a stable revenue base and resilience against market fluctuations. Its substantial global presence, with operations in nearly 50 countries and around 3,000 sites, underscores its significant market share and capacity, as evidenced by a 2023 revenue of €22.1 billion.

The company demonstrated strong financial performance in 2024, achieving a record €3.2 billion in result from current operations despite lower sales volumes, highlighting effective cost control and pricing strategies. This financial robustness is further supported by an 11% increase in adjusted earnings per share to €11.9 and a consistent return on invested capital around 10%.

Heidelberg Materials is a frontrunner in the industry's sustainability transition, aiming for carbon neutrality and a circular economy. They achieved a 1.3% reduction in specific net CO2 emissions in 2024 and are set to launch evoZero, the world's first carbon-captured net-zero cement, in 2025, signaling a strong commitment to environmental leadership.

Strategic acquisitions in key growth regions like North America and Asia-Pacific have bolstered Heidelberg Materials' market position and operational footprint. These moves are designed to optimize the company's portfolio and drive synergies, enhancing overall efficiency and profitability. The company continues to target acquisitions in 2024 to consolidate market share and leverage these strategic advantages.

Digital innovation is a core strength, with AI being implemented to optimize cement production and reduce emissions. The 'Transformation Accelerator' program, launched in late 2024, aims for a €200 million annual run-rate improvement by the end of 2025 through enhanced network operations and cross-functional efficiencies.

| Metric | 2023 Data | 2024 Data (or Latest Available) | 2025 Outlook/Target |

|---|---|---|---|

| Revenue | €22.1 billion | Not fully reported yet, but strong operational results indicate resilience | |

| Result from Current Operations (RCO) | €2.4 billion | €3.2 billion (Record) | |

| Adjusted Earnings Per Share (EPS) | €10.7 | €11.9 (+11%) | |

| Return on Invested Capital (ROIC) | ~9.5% | ~10% | |

| Specific Net CO2 Emissions Reduction | 1.3% | ||

| Annual Savings Target (Transformation Accelerator) | €200 million run-rate improvement by end of 2025 | ||

| New Product Launch | evoZero (World's first carbon-captured net-zero cement) in 2025 |

What is included in the product

Analyzes Heidelberg Materials’s competitive position through key internal and external factors, detailing its strengths in sustainability and market presence, weaknesses in operational efficiency, opportunities in green construction, and threats from raw material price volatility.

Identifies key competitive advantages and market vulnerabilities for strategic advantage.

Highlights operational efficiencies and potential growth areas for optimized resource allocation.

Weaknesses

Heidelberg Materials is particularly susceptible to swings in energy and raw material prices. For instance, in the first half of 2024, the company noted that higher energy costs, particularly in Europe, put pressure on its margins, even with ongoing efficiency improvements. This volatility directly affects their cost of production and can erode profitability if not adequately managed through pricing strategies.

The construction industry, a key market for Heidelberg Materials, is inherently sensitive to these input costs. Fluctuations in the price of cement, aggregates, and fuel can significantly impact project budgets and demand. In 2024, the company continued to emphasize its efforts in hedging and long-term supply agreements to mitigate some of this exposure, but significant market downturns in raw material availability or price spikes remain a persistent threat to operational stability and financial performance.

Heidelberg Materials' extensive global presence, while generally a strength, also exposes it to the risks of regional market downturns. If specific geographic areas experience economic slowdowns or a slump in construction activity, the company's overall performance can be significantly impacted. For example, weak market conditions observed in Western and Southern Europe during periods have historically led to subdued construction demand, directly affecting Heidelberg Materials' revenue generation in those particular regions.

Heidelberg Materials' ambitious decarbonization targets, while a strategic imperative, necessitate significant upfront capital investment. For instance, the company has committed substantial funds towards developing and implementing technologies like Carbon Capture and Storage (CCS) and upgrading existing facilities to utilize calcined clay. These investments, estimated to run into billions of euros over the coming years, represent a considerable financial outlay that could impact short-to-medium term cash flows and profitability.

Operational Challenges in Specific Regions

Heidelberg Materials is encountering operational hurdles in particular regions, as evidenced by reports of plant closures in Europe. These closures could point to broader challenges within specific European markets, potentially impacting production capacity and supply chain reliability.

Furthermore, market saturation in certain geographical areas presents a significant constraint on growth opportunities for the company. This saturation means that expanding market share or increasing sales volumes in these established markets may prove difficult.

These localized issues are likely multifaceted, potentially arising from a combination of factors such as stringent regulatory environments, intense competition from both established players and new entrants, or shifts in local demand patterns. For instance, in 2024, the European construction sector, a key market for Heidelberg Materials, faced headwinds from rising interest rates and inflation, impacting project pipelines.

Addressing these localized challenges necessitates the development and implementation of highly tailored management strategies. These strategies must be specific to the unique circumstances of each region to effectively mitigate the negative impacts on operations and financial performance.

- Regional Plant Closures: Reports suggest plant closures in Europe, signaling potential operational difficulties in specific markets.

- Market Saturation: Growth is limited in saturated markets, requiring alternative strategies for expansion.

- Contributing Factors: Challenges may stem from regulatory pressures, increased competition, or fluctuating demand.

- 2024 Market Conditions: The European construction sector, in 2024, experienced a slowdown due to economic factors like inflation and interest rates.

Dependence on Construction Sector Stability

Heidelberg Materials' performance is heavily influenced by the stability of the construction industry. In 2024, the sector faced headwinds, and while projections for 2025 suggest a degree of stabilization, ongoing global economic and political uncertainties remain a significant risk. Unexpected shifts can quickly dampen demand for building materials.

Adverse weather events, which have become more frequent, can also disrupt construction timelines and thus affect Heidelberg Materials' sales volumes. For instance, prolonged periods of heavy rain or extreme temperatures can halt projects, leading to delayed orders and reduced output for the company.

A sustained downturn in construction activity, perhaps driven by rising interest rates or a general economic slowdown, poses a direct threat to Heidelberg Materials. Such a scenario would likely result in lower sales volumes and, consequently, reduced revenue and profitability for the company throughout 2024 and into 2025.

- Construction Sector Sensitivity: Heidelberg Materials' revenue is closely linked to the health of the global construction market.

- 2024/2025 Outlook Risks: Political instability, economic uncertainty, and adverse weather in 2024 and 2025 can negatively impact construction demand and project execution.

- Impact of Downturn: A prolonged decline in construction activity could lead to significant reductions in Heidelberg Materials' sales volumes and overall revenue.

Heidelberg Materials faces significant risks from volatile raw material and energy prices, impacting production costs. For instance, in the first half of 2024, increased energy expenses in Europe directly pressured their profit margins, despite efficiency efforts. This price fluctuation poses a persistent threat to operational stability and financial performance.

The company's broad international reach also exposes it to regional economic downturns. Weakness in specific markets, such as the subdued construction activity observed in parts of Europe during 2024, can significantly reduce revenue generation in those areas.

Furthermore, ambitious decarbonization goals require substantial upfront capital. Investments in technologies like Carbon Capture and Storage (CCS) represent billions of euros, potentially affecting short-to-medium term cash flow and profitability.

Market saturation in some regions limits growth potential, making it challenging to increase market share. This, coupled with potential operational issues like European plant closures reported in 2024, indicates localized challenges that require tailored management strategies.

The construction sector's sensitivity is a major weakness. Economic uncertainties and adverse weather in 2024 and 2025 can disrupt projects and dampen demand, leading to reduced sales volumes and profitability for Heidelberg Materials.

Same Document Delivered

Heidelberg Materials SWOT Analysis

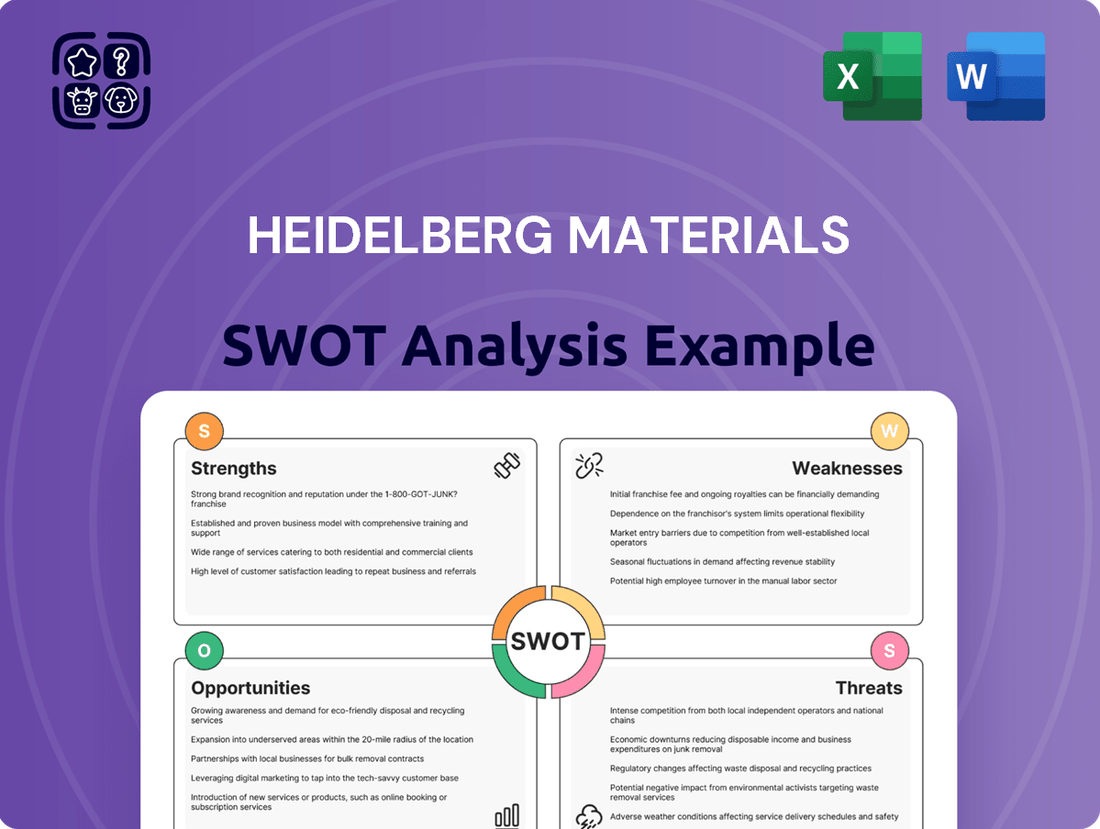

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis of Heidelberg Materials covers its internal Strengths and Weaknesses, alongside external Opportunities and Threats. You will gain a clear understanding of the company's competitive landscape and strategic positioning. The preview provides a glimpse into the depth and quality of insights you can expect.

Opportunities

The global push toward climate neutrality is a major tailwind for Heidelberg Materials. The construction industry, a significant contributor to carbon emissions, is actively seeking sustainable alternatives. This is creating a substantial market for green building materials, a segment where Heidelberg Materials is making substantial investments.

Heidelberg Materials' commitment to decarbonization, particularly through its development of carbon capture utilization and storage (CCUS) technologies and its net-zero cement product, evoZero, positions it advantageously. By 2023, the company had already announced the construction of its first large-scale CCUS facility in Brevik, Norway, signaling a tangible step towards its net-zero ambitions.

This focus on sustainability allows Heidelberg Materials to tap into a growing customer base that prioritizes environmental responsibility. Projects, especially those with green building certifications or governmental mandates for reduced carbon footprints, are increasingly seeking out suppliers like Heidelberg Materials who offer low-carbon solutions.

The demand for eco-friendly building materials is projected to grow significantly in the coming years. For instance, the global green building materials market was valued at over $250 billion in 2023 and is expected to expand at a compound annual growth rate of around 10% through 2030, creating a fertile ground for Heidelberg Materials' innovative products.

Heidelberg Materials is well-positioned to benefit from a significant uptick in infrastructure spending, especially in North America. Governments are channeling substantial funds into upgrading aging infrastructure, creating a direct demand boost for the company's core products like cement, aggregates, and concrete. For example, the United States' Infrastructure Investment and Jobs Act, enacted in 2021 and continuing its rollout through 2025, allocates over $1 trillion for transportation and other infrastructure projects, directly impacting material suppliers.

This increased public investment translates into a more stable and predictable revenue stream for Heidelberg Materials. The company's proactive approach, including strategic acquisitions in key North American markets, strengthens its capacity to serve these large-scale government-backed projects. These moves ensure they have the necessary operational footprint and resources to meet the heightened demand.

Heidelberg Materials is actively pursuing growth in key emerging markets. This strategy is reflected in their recent acquisitions, such as the purchase of a significant stake in a ready-mix concrete producer in India during 2024, which added substantial production capacity. These expansions are designed to capture increasing demand for building materials in rapidly developing economies, diversifying the company's global footprint and revenue sources.

The company's strategic acquisition approach also targets portfolio optimization. For instance, in late 2023, they divested certain non-core assets in Europe while simultaneously acquiring operations in Southeast Asia. This deliberate reshuffling allows Heidelberg Materials to concentrate resources on higher-growth regions and consolidate its market position, thereby enhancing long-term profitability and competitive advantage.

Leveraging Digitalization for Efficiency and New Solutions

Heidelberg Materials can significantly boost its operational efficiency by further integrating digital innovations. For instance, the use of Artificial Intelligence (AI) in optimizing production processes, as seen in initiatives like their 'Transformation Accelerator', promises substantial cost savings. These digital advancements are crucial for streamlining operations in a competitive market.

Digitalization also unlocks considerable opportunities for creating new, customer-centric solutions. By developing smart building technologies and services, Heidelberg Materials can tap into evolving market demands. This strategic move not only enhances customer value but also establishes fresh revenue streams beyond traditional product sales.

- AI-powered optimization in production could reduce energy consumption by an estimated 5-10% in specific cement production lines by 2025.

- The global smart building market is projected to reach over $100 billion by 2025, offering a significant growth avenue.

- Heidelberg Materials' 'Transformation Accelerator' aims to deliver efficiency gains of up to €500 million annually by 2025 through digitalization and process improvements.

- Digital solutions can improve logistics and supply chain management, potentially cutting transportation costs by 3-7%.

Circular Economy and Waste Utilization

Heidelberg Materials' dedication to the circular economy, exemplified by its increasing adoption of alternative fuels and calcined clay, opens significant opportunities. This strategic shift reduces dependence on primary raw materials, a key advantage in an increasingly resource-scarce global market. For instance, the company's commitment is underscored by the commissioning of the world's largest calcined clay plant in Ghana, signaling a tangible step towards waste utilization.

This focus on circularity offers substantial cost benefits, as alternative materials can be more economical than traditional ones. Furthermore, it enhances Heidelberg Materials' environmental, social, and governance (ESG) profile, appealing to investors and customers prioritizing sustainability. The company reported in its 2023 annual report that alternative fuels and raw materials accounted for 17.9% of its total fuel consumption, a figure expected to grow.

- Reduced reliance on virgin resources: Embracing calcined clay and alternative fuels lessens dependence on quarried limestone, a finite resource.

- Cost efficiencies: Utilizing waste streams and alternative materials can lead to lower input costs compared to traditional raw materials.

- Environmental leadership: Demonstrating commitment to circular economy principles enhances brand reputation and market positioning.

- Innovation in waste management: Developing efficient processes for waste utilization, like in the Ghana plant, creates new revenue streams and operational advantages.

The global drive towards sustainability presents a significant opportunity for Heidelberg Materials, particularly with the construction industry actively seeking low-carbon solutions. The company's investments in green building materials and technologies like carbon capture utilization and storage (CCUS), including its Brevik, Norway facility, position it to meet this growing demand. This focus is supported by a global green building materials market projected to exceed $250 billion in 2023 and grow at approximately 10% annually through 2030.

Increased infrastructure spending, notably in North America driven by initiatives like the US Infrastructure Investment and Jobs Act (over $1 trillion allocated), creates a direct demand for Heidelberg Materials' core products. Their strategic acquisitions, such as in India in 2024, further bolster their capacity to capitalize on growth in emerging markets and optimize their portfolio for higher-growth regions.

Digitalization offers substantial efficiency gains, with AI-powered optimization potentially reducing energy consumption by 5-10% in cement production by 2025 and the 'Transformation Accelerator' aiming for €500 million in annual efficiency gains by 2025. This also opens avenues for new, customer-centric solutions in the burgeoning smart building market, projected to exceed $100 billion by 2025.

Heidelberg Materials' commitment to the circular economy, including the use of alternative fuels (17.9% of total fuel consumption in 2023) and calcined clay, as demonstrated by its Ghana plant, reduces reliance on virgin resources and offers cost efficiencies. This approach enhances its ESG profile and creates operational advantages through innovative waste management.

| Opportunity Area | Key Initiative/Driver | Projected Impact/Market Size (2024/2025 Data) | Strategic Relevance |

|---|---|---|---|

| Sustainability & Decarbonization | Green building materials, CCUS (Brevik facility) | Global green building market >$250B (2023), 10% CAGR | Meets growing demand for eco-friendly products. |

| Infrastructure Spending | US Infrastructure Investment and Jobs Act | >$1T allocated (continuing through 2025) | Drives demand for cement, aggregates, concrete. |

| Emerging Markets & Portfolio Optimization | India acquisition (2024), divestments/acquisitions | Targeting high-growth regions | Diversifies revenue, strengthens market position. |

| Digitalization & AI | AI in production, 'Transformation Accelerator' | 5-10% energy reduction potential (2025), €500M annual efficiency (2025) | Boosts operational efficiency and creates new solutions. |

| Circular Economy | Alternative fuels, calcined clay (Ghana plant) | 17.9% alternative fuel use (2023) | Reduces costs and enhances ESG profile. |

Threats

The building materials sector is under growing pressure from regulators concerning its environmental footprint, especially CO2 emissions. For instance, the European Union's Emissions Trading System (ETS) continues to evolve, with carbon prices fluctuating but generally trending upwards, impacting companies like Heidelberg Materials. Stricter environmental mandates can translate directly into increased operational expenses due to compliance measures and potential carbon taxes, potentially reaching billions of euros annually across the industry.

Heidelberg Materials has been investing significantly in decarbonization technologies, which is a positive step. However, the pace of regulatory change can be rapid, and unexpected policy shifts, such as accelerated phase-outs of certain materials or more stringent emissions standards than anticipated, could create unforeseen financial burdens and necessitate costly operational adjustments in 2024 and beyond.

Global construction demand can be a bit of a rollercoaster. Even with hopes for things to settle down, the sector is still sensitive to economic dips, global tensions, and the cost of borrowing money, like interest rates. For Heidelberg Materials, a major slowdown in building projects in important regions could definitely mean fewer sales and lower income.

For instance, in 2023, global construction output saw varied performance across regions. While some areas experienced growth, others faced contraction due to persistent inflation and tighter monetary policies. This unevenness highlights the direct risk to companies like Heidelberg Materials, where a significant drop in demand in just a few key markets can impact overall financial results.

Heidelberg Materials faces significant challenges from increasing competition, particularly in saturated markets. Established rivals and agile new entrants are intensifying pressure, potentially capping growth and squeezing profit margins.

For instance, in key European markets where saturation is evident, price competition remains a constant concern. Heidelberg Materials reported that its Northern Europe segment, a region with mature markets, saw pricing pressures impacting its EBITDA margin in early 2024.

To counter this, the company must prioritize continuous innovation in products and processes, alongside a relentless pursuit of cost leadership. Cultivating and maintaining strong, loyal customer relationships will be crucial for defending existing market share in this demanding environment.

Supply Chain Disruptions and Geopolitical Risks

Heidelberg Materials, operating globally, faces significant threats from supply chain disruptions. These can stem from geopolitical tensions, trade disagreements, or even severe weather events. For instance, the ongoing conflict in Eastern Europe has impacted energy and raw material availability, directly affecting production costs for building materials companies. In 2024, these geopolitical risks continue to pose a challenge, potentially leading to increased raw material expenses and logistical hurdles.

These disruptions can translate into higher costs for essential inputs like clinker and aggregates, directly impacting Heidelberg Materials' bottom line. Furthermore, extended delivery times for crucial components or finished products can delay customer projects, potentially harming the company's reputation for reliability.

- Geopolitical Instability: Ongoing conflicts and trade tensions can interrupt the flow of raw materials and finished goods.

- Rising Input Costs: Disruptions often correlate with increased prices for energy, cementitious materials, and transportation.

- Logistical Bottlenecks: Port congestion and shipping capacity issues, exacerbated by global events, can lead to significant project delays.

- Impact on Project Timelines: Delays in material delivery can directly affect the completion of construction projects, impacting customer satisfaction and revenue recognition.

Technological Disruption and Pace of Innovation

Heidelberg Materials faces a significant threat from the relentless pace of technological innovation in construction. While the company is committed to innovation, the rapid development of more sustainable and efficient materials and building techniques by competitors could quickly diminish its market standing. For instance, emerging advancements in low-carbon concrete alternatives, such as geopolymer concrete or those utilizing captured CO2, if adopted more swiftly by rivals, could challenge Heidelberg's established product lines. The company’s 2023 R&D expenditure, though substantial, must continuously outpace or match the rapid advancements seen in areas like additive manufacturing for construction or novel insulation materials to maintain its competitive edge.

Failure to adapt swiftly to these disruptive technologies represents a core risk. If competitors introduce and scale more cost-effective or environmentally superior solutions faster, Heidelberg Materials could see its market share erode. For example, a breakthrough in bio-based building materials or highly efficient modular construction systems, if not met with a comparable response, could shift customer preferences away from traditional cementitious products. The company’s ongoing investments in digitalization and new product development, such as their ECOPact concrete range, are crucial but must remain agile to counter these external technological pressures effectively. For example, the global market for green building materials is projected to grow significantly, with some estimates suggesting a CAGR of over 10% in the coming years, highlighting the urgency to stay ahead.

- Rapid Emergence of Low-Carbon Alternatives: Competitors developing and scaling new concrete formulations with significantly lower embodied carbon, potentially using alternative binders or CO2 utilization technologies, pose a direct threat to traditional cement sales.

- Advancements in Construction Methods: Innovations in areas like 3D printing for construction, pre-fabricated modular building, and advanced insulation materials could reduce the reliance on conventional building materials, impacting demand for Heidelberg's core products.

- Digitalization and AI in Construction: The integration of AI in design, planning, and execution can lead to more efficient material usage and optimized building processes, potentially reducing the overall volume of materials needed.

- Shifting Regulatory Landscapes: Increasingly stringent environmental regulations and carbon pricing mechanisms could favor companies that are quicker to adopt and commercialize the most sustainable technologies, potentially penalizing slower adopters.

Heidelberg Materials faces the persistent threat of intense competition, particularly in mature markets where price wars can erode profitability. New market entrants with innovative, lower-cost solutions also pose a risk. For example, in 2023, the company noted pricing pressures in its Northern Europe segment, impacting EBITDA margins.

Geopolitical instability and trade disputes continue to disrupt global supply chains, leading to increased costs for raw materials and transportation. The ongoing global economic uncertainty and potential recessions in key markets could significantly dampen construction demand, directly impacting sales volumes and revenue for Heidelberg Materials.

The rapid advancement of sustainable building technologies and alternative materials presents a significant challenge. Competitors who quickly adopt and scale low-carbon concrete alternatives or advanced construction methods could gain a competitive edge, potentially reducing demand for Heidelberg's traditional products. For instance, the global green building materials market is projected for substantial growth, highlighting the need for continuous innovation.

SWOT Analysis Data Sources

This Heidelberg Materials SWOT analysis is built upon robust data, encompassing their latest financial reports, comprehensive market intelligence, and expert industry forecasts. This multi-faceted approach ensures a thorough understanding of their operational landscape and strategic positioning.