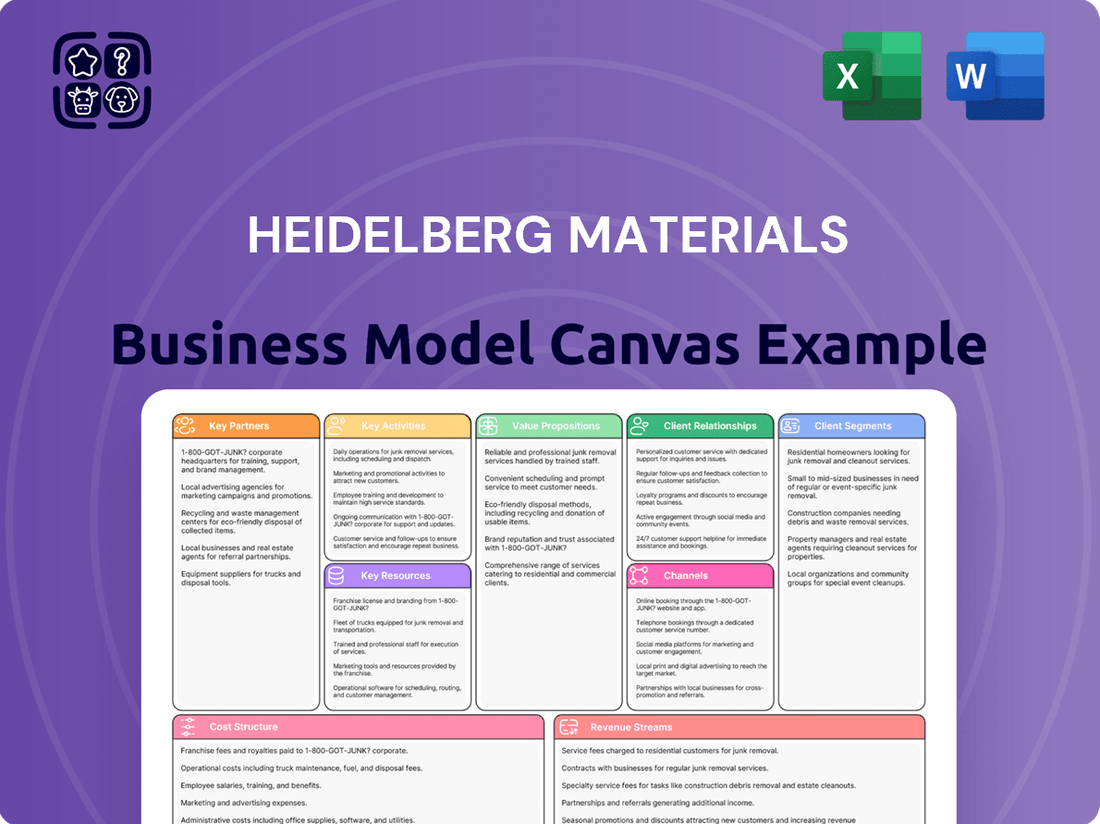

Heidelberg Materials Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

Unlock the full strategic blueprint behind Heidelberg Materials's business model. This in-depth Business Model Canvas reveals how the company drives value through sustainable building solutions, captures market share by leveraging its extensive customer relationships and distribution networks, and stays ahead in a competitive landscape with its focus on innovation and digitalization. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global leader.

Dive deeper into Heidelberg Materials’s real-world strategy with the complete Business Model Canvas. From its diverse value propositions, including eco-friendly products and circular economy solutions, to its intricate cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this industry giant thrive—and where its future opportunities lie in transforming construction.

Want to see exactly how Heidelberg Materials operates and scales its business in the critical building materials sector? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking your own operations, refining strategic planning, or preparing compelling investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Heidelberg Materials’s success in shaping the future of construction. This professional, ready-to-use document is ideal for business students, industry analysts, or founders seeking to learn from proven, impactful strategies within a rapidly evolving global market.

See how the pieces fit together in Heidelberg Materials’s robust business model. This detailed, editable canvas highlights the company’s key customer segments, vital strategic partnerships with technology providers and industry associations, efficient revenue strategies, and its commitment to operational excellence. Download the full version to accelerate your own business thinking and strategic development.

Partnerships

Heidelberg Materials actively partners with technology providers and academic institutions to foster digital advancements and create greener construction materials. These collaborations are crucial for integrating cutting-edge solutions, such as artificial intelligence for enhancing operational efficiency and advanced carbon capture technologies. For example, their strategic alliance with Giatec Scientific to implement the SmartMix AL solution aims to revolutionize concrete production, while the partnership with Linde for carbon capture and liquefaction plants underscores their commitment to decarbonization efforts.

Heidelberg Materials cultivates vital strategic alliances with technology providers, government bodies, and energy firms to propel its carbon capture and storage (CCS) endeavors. These collaborations are instrumental in developing and deploying cutting-edge CCS solutions.

Key partnerships include its involvement in the Brevik CCS plant in Norway, a significant component of the Norwegian government's ambitious Longship program, aiming to store captured CO2 offshore. This project showcases collaboration with governmental support and advanced capture technology partners.

Furthermore, a joint venture with Linde for a carbon capture and utilization (CCU) facility in Lengfurt, Germany, highlights partnerships focused on innovative uses for captured carbon. This venture leverages Linde's expertise in industrial gases and process technology.

These strategic alliances provide access to essential funding, regulatory support, and technological expertise, accelerating Heidelberg Materials' progress toward its decarbonization goals. The company is actively seeking further collaborations to expand its CCS network and capabilities.

Heidelberg Materials' strategic partnerships with alternative fuel and raw material suppliers are crucial for its sustainability goals. These collaborations enable the company to significantly reduce its carbon footprint by incorporating more environmentally friendly inputs into its production processes.

A key objective is to increase the share of alternative fuels in the energy mix, with a specific target of reaching 45% by 2030. This drive requires strong relationships with suppliers who can provide consistent and high-quality alternative fuel sources.

Furthermore, Heidelberg Materials is actively exploring and partnering with suppliers of novel low-carbon raw materials. For instance, the company is investing in the development and use of calcined clay as a substitute for traditional clinker in cement production, a move that promises substantial CO2 reductions.

These supplier relationships are not just about sourcing; they are about co-developing solutions that support a circular economy and drive innovation in the construction materials sector.

Construction and Infrastructure Developers

Heidelberg Materials actively cultivates relationships with leading construction and infrastructure developers. These collaborations are crucial for securing consistent demand for their extensive portfolio of building materials, ranging from cement and aggregates to concrete and asphalt. For instance, in 2024, the company reported ongoing partnerships with several major European infrastructure projects, contributing significantly to their revenue streams.

These strategic alliances go beyond mere supply agreements. They create fertile ground for innovation and the widespread adoption of Heidelberg Materials' sustainable solutions. By engaging early in the design phase of large-scale projects, the company can effectively integrate its low-carbon concrete and cement products, a key focus area for their environmental strategy. This proactive approach allows for the optimization of material performance and the achievement of ambitious sustainability targets for the construction industry.

Specific benefits derived from these key partnerships include:

- Securing large-volume orders: Partnerships with major developers guarantee consistent demand, reducing market volatility for Heidelberg Materials' products.

- Driving innovation in sustainability: Early integration of low-carbon materials into project designs fosters the development and adoption of greener building practices.

- Access to large-scale projects: Collaboration provides direct access to major infrastructure developments, offering significant revenue potential and showcasing advanced material solutions.

- Enhanced market presence: Association with prominent construction firms bolsters Heidelberg Materials' reputation and market leadership in sustainable construction.

Logistics and Distribution Networks

Heidelberg Materials relies heavily on robust logistics and distribution networks to ensure its diverse product portfolio, including cement, aggregates, and ready-mixed concrete, reaches customers efficiently. These partnerships are critical for maintaining a competitive edge in various geographic markets. For instance, in 2023, the company's global logistics operations handled millions of tons of materials, underscoring the scale of these relationships.

Strong relationships with transport providers, including rail, road, and maritime carriers, are fundamental to Heidelberg Materials' business model. These partnerships enable cost-effective and timely delivery, which is especially important for bulk commodities like cement and aggregates. The company actively seeks partners who can offer sustainable logistics solutions, aligning with its broader environmental goals.

- Strategic alliances with trucking firms for last-mile delivery of ready-mixed concrete.

- Long-term agreements with rail operators for bulk transport of cement and aggregates across continents.

- Collaborations with port authorities and shipping companies to optimize international material flow.

- Investment in digital logistics platforms to enhance visibility and efficiency in 2024.

Heidelberg Materials strengthens its position through strategic partnerships with technology providers and research institutions, focusing on digital transformation and sustainable material innovation. These collaborations are vital for developing and implementing advanced solutions, such as AI-driven operational efficiencies and novel carbon capture technologies, exemplified by their 2024 work with Giatec Scientific on concrete optimization and continued efforts with Linde for CO2 capture and liquefaction.

What is included in the product

This Business Model Canvas outlines Heidelberg Materials' strategy to provide sustainable building materials and solutions, focusing on key customer segments like construction companies and distributors, and leveraging digital channels and partnerships to deliver innovative and eco-friendly value propositions.

Heidelberg Materials' Business Model Canvas offers a structured approach to identify and address industry challenges, acting as a proactive pain point reliever by clarifying value propositions and customer relationships.

Activities

Heidelberg Materials' primary activity is the significant production of fundamental building materials like cement, aggregates, and ready-mixed concrete. This involves intricate processes from quarrying raw materials to the final manufacturing stages.

The company's operational footprint is vast, spanning roughly 3,000 sites across approximately 50 countries worldwide. This extensive network supports their global reach in supplying essential construction inputs.

In 2024, Heidelberg Materials continued to focus on optimizing these production processes, aiming for greater efficiency and sustainability. Their commitment to innovation in material science underpins their large-scale manufacturing capabilities.

Heidelberg Materials heavily invests in research and development focused on creating more sustainable building materials. A core area of this R&D is the development of technologies to reduce carbon emissions throughout the cement production lifecycle. This commitment is crucial for their decarbonization strategy.

Key activities include advancing carbon capture, utilization, and storage (CCUS) technologies, which are vital for capturing CO2 directly from their industrial processes. They are also actively exploring and adopting alternative fuels to power their operations, aiming to move away from traditional fossil fuels.

Furthermore, their innovation pipeline features low-carbon cement products, such as their evoZero brand, which represents a significant step towards offering truly net-zero cement. This product development is supported by substantial R&D investment, with the company targeting a 40% reduction in CO2 emissions per ton of cement by 2030 compared to 1990 levels.

Heidelberg Materials is actively integrating digital innovation and AI to streamline its operations. For instance, they employ AI-driven predictive analytics within their cement plants to anticipate maintenance needs and optimize production schedules, thereby boosting efficiency. This focus on digital solutions extends to site-level optimization, aiming for better resource allocation and reduced waste.

In 2023, Heidelberg Materials reported significant progress in its digitalization efforts, with a particular emphasis on enhancing energy efficiency through these advanced technologies. Their commitment to process optimization is a core part of their strategy to reduce their environmental footprint and improve overall productivity across their global manufacturing network.

Sustainable Resource Management

Heidelberg Materials actively manages raw material extraction with a focus on sustainability. This includes careful planning and restoration of quarry sites, aiming to minimize environmental impact. In 2024, the company continued to invest in exploring and utilizing alternative raw materials for cement production, thereby reducing reliance on virgin resources.

A core activity is the promotion of circular economy principles. Heidelberg Materials is committed to increasing the use of alternative fuels and raw materials in its production processes. For instance, by 2024, significant progress was made in substituting conventional fuels with waste-derived alternatives, contributing to lower CO2 emissions.

Reducing clinker content in cement is a crucial strategy for sustainability. This involves developing and promoting cements with lower clinker factors, which inherently have a lower carbon footprint. The company’s efforts in 2024 saw a further uptake of these innovative cement types in the market.

Engaging in concrete recycling is another vital key activity. Heidelberg Materials supports the development of infrastructure and technologies that enable the reuse of demolition waste as secondary raw materials in new concrete products. This closes the loop in the construction value chain.

- Sustainable Extraction: Implementing responsible quarry management and site restoration.

- Alternative Resources: Increasing the use of alternative fuels and raw materials.

- Circular Economy: Promoting concrete recycling and waste-to-resource initiatives.

- Low-Clinker Cements: Developing and marketing cement products with reduced clinker content.

Global Sales and Distribution

Heidelberg Materials is deeply engaged in the global sale and distribution of its extensive portfolio of building materials. This core activity is fundamental to reaching a broad customer base, encompassing everything from massive infrastructure endeavors to individual residential and commercial construction projects. By effectively managing these channels, the company solidifies its standing as a market leader.

The company’s distribution network is a critical component of its business model, ensuring timely and efficient delivery of products worldwide. This global reach allows Heidelberg Materials to cater to diverse market needs and maintain strong relationships with clients across various sectors.

- Global Reach: Heidelberg Materials operates a vast sales and distribution network spanning numerous countries, enabling it to serve diverse construction markets.

- Product Diversity: The company distributes a wide array of building materials, including cement, aggregates, ready-mixed concrete, and asphalt, catering to varied project requirements.

- Market Position: Effective distribution strategies are key to maintaining Heidelberg Materials' leading market positions in its operational regions.

- Customer Segments: Sales efforts target a broad spectrum of customers, from large-scale industrial clients and government infrastructure projects to smaller-scale developers and individual builders.

Heidelberg Materials' key activities center on the production and sale of essential building materials, with a significant focus on innovation and sustainability. Their operations involve the extraction of raw materials, advanced manufacturing processes, and extensive global distribution.

A core strategic pillar is the reduction of carbon emissions, achieved through investments in CCUS technology, alternative fuels, and the development of low-carbon products like evoZero cement. In 2024, the company continued to drive these initiatives, aiming for substantial CO2 reductions.

Digitalization and AI integration are also paramount, enhancing operational efficiency, predictive maintenance, and energy management across their 3,000 sites. This technological advancement supports their broader goals of process optimization and environmental footprint reduction.

The company actively promotes circular economy principles, prioritizing concrete recycling and the use of alternative raw materials and fuels. By 2024, they had made notable strides in substituting conventional fuels with waste-derived alternatives, reinforcing their commitment to sustainable resource management.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Material Production | Manufacturing cement, aggregates, and ready-mixed concrete. | Optimizing processes for efficiency and sustainability. |

| Decarbonization | Investing in CCUS, alternative fuels, and low-carbon products. | Targeting a 40% CO2 reduction per ton of cement by 2030 (vs. 1990). |

| Digitalization | Implementing AI and digital solutions for operational improvement. | Enhancing energy efficiency through AI-driven analytics. |

| Circular Economy | Promoting recycling and use of alternative materials/fuels. | Increasing substitution of conventional fuels with waste-derived alternatives. |

Full Version Awaits

Business Model Canvas

The Heidelberg Materials Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of their strategic framework. This isn't a generic template or a simulated example; it represents the actual content and structure that will be delivered. You'll gain immediate access to this fully realized Business Model Canvas, ready for your analysis and application. Rest assured, what you see is precisely what you will get, providing a clear and actionable understanding of Heidelberg Materials' operations.

Resources

Heidelberg Materials boasts extensive raw material reserves, including vast quantities of limestone and aggregates, which are fundamental building blocks for cement and concrete. These substantial deposits ensure a consistent and reliable supply chain for their global operations.

The strategic positioning of these reserves near their manufacturing facilities minimizes transportation costs and environmental impact, a critical advantage in the construction materials sector. In 2023, the company continued to focus on optimizing its quarrying operations and exploring new deposits to secure long-term availability.

Heidelberg Materials operates a vast global network of industrial production facilities, including numerous cement plants, aggregates quarries, and ready-mixed concrete plants. These sites are the backbone of their manufacturing and distribution, enabling them to serve diverse markets effectively.

As of 2024, the company boasts a significant presence with over 1,500 production sites spread across more than 50 countries, underscoring their extensive operational footprint. This wide geographical distribution allows for localized production and reduces transportation costs and lead times.

The scale of these facilities is crucial for Heidelberg Materials’ ability to meet the high demand for construction materials globally. For instance, their cement plants are equipped with advanced technologies to ensure efficient and high-quality clinker and cement production, a core component of their revenue streams.

These industrial assets are not just production centers; they are also key to the company's sustainability efforts, with ongoing investments in upgrading facilities to reduce emissions and improve energy efficiency. In 2023, the company reported significant progress in its decarbonization initiatives at these production sites.

Heidelberg Materials' proprietary technology is a cornerstone of its business, particularly its advancements in carbon capture and low-carbon cement production. These innovations are crucial for meeting sustainability goals and developing innovative products.

Their intellectual property portfolio includes groundbreaking solutions like evoZero, a pioneering low-carbon cement, and sophisticated AI-driven tools designed to optimize production processes and enhance efficiency across operations. These technological assets are key differentiators in the market.

In 2024, the company continued to invest heavily in research and development, focusing on scaling up these proprietary technologies. For instance, significant progress was made in piloting advanced carbon capture technologies at several of their European facilities, aiming to reduce emissions by up to 1.5 million tonnes per year by 2030.

The company's digital optimization tools are also a vital resource, leveraging data analytics and artificial intelligence to improve energy consumption and resource management. This technological edge allows for greater operational control and cost savings, contributing to their competitive advantage.

Skilled Workforce and Expertise

Heidelberg Materials' skilled workforce, numbering around 51,000 individuals globally, is a cornerstone of its business model. This diverse team possesses deep expertise across critical areas such as mining, advanced manufacturing processes, and complex engineering challenges.

Their specialized knowledge directly fuels operational efficiency and fosters a culture of continuous innovation, essential for maintaining a competitive edge in the building materials industry.

The company's commitment to developing and retaining this talent pool is evident in its focus on sustainability initiatives and technological advancements.

- Global Reach: Approximately 51,000 employees worldwide.

- Core Competencies: Expertise in mining, manufacturing, engineering, and sustainability.

- Impact: Drives operational excellence and innovation.

- Strategic Importance: Essential for navigating industry complexities and future growth.

Strong Brand Reputation and Market Leadership

Heidelberg Materials commands a robust brand reputation as a premier global supplier in the building materials sector. This recognition is built on a foundation of consistent product quality and a pronounced dedication to sustainable practices, which resonates strongly with environmentally conscious customers and stakeholders.

Their market leadership is a significant asset, fostering deep customer trust and providing a substantial competitive edge. This allows Heidelberg Materials to command premium pricing and maintain strong customer loyalty in a highly competitive industry.

- Global Recognition: Heidelberg Materials is consistently ranked among the top global players in cement, aggregates, and ready-mixed concrete.

- Sustainability Focus: The company's commitment to reducing CO2 emissions and promoting circular economy principles enhances its brand image. In 2024, Heidelberg Materials continued to invest heavily in low-carbon technologies, aiming for significant emission reductions across its operations.

- Market Share: While specific market share figures vary by region and product, Heidelberg Materials holds leading positions in many of its key operating markets, reflecting its established presence and scale.

- Customer Trust: The brand's association with reliability and innovation translates into strong demand and a preference among contractors and developers worldwide.

Heidelberg Materials’ extensive raw material reserves, particularly limestone and aggregates, are fundamental to its cement and concrete production, ensuring a stable supply chain. These strategically located reserves near production facilities minimize transport costs and environmental impact, a key advantage in the construction sector.

The company operates a vast network of over 1,500 production sites across more than 50 countries as of 2024. This global footprint allows for localized production, reducing logistics expenses and delivery times, while advanced technologies in its cement plants ensure efficient, high-quality output.

Proprietary technology, including the low-carbon cement evoZero and AI-driven optimization tools, differentiates Heidelberg Materials. The company is heavily investing in R&D, with significant progress in piloting carbon capture technologies at European facilities, aiming for substantial emission reductions by 2030.

With approximately 51,000 employees globally, Heidelberg Materials benefits from deep expertise in mining, manufacturing, and engineering. This skilled workforce is crucial for operational efficiency and driving innovation, supporting the company's sustainability and technological advancements.

Heidelberg Materials enjoys a strong brand reputation for consistent quality and sustainability, fostering customer trust and a competitive edge. This market leadership, coupled with a focus on low-carbon technologies and circular economy principles, enhances its appeal to environmentally conscious consumers.

| Key Resource Area | Description | 2024 Data/Context |

| Raw Material Reserves | Vast quantities of limestone and aggregates. | Ensures consistent supply chain; focus on optimizing quarrying and exploring new deposits. |

| Industrial Production Facilities | Over 1,500 sites globally. | Presence in >50 countries; advanced technologies for efficient production and reduced emissions. |

| Proprietary Technology | Low-carbon cement (evoZero), AI optimization, carbon capture. | Significant R&D investment; piloting carbon capture aiming for 1.5 million tonnes annual reduction by 2030. |

| Skilled Workforce | Approx. 51,000 employees worldwide. | Expertise in mining, manufacturing, engineering, and sustainability driving efficiency and innovation. |

| Brand Reputation | Premier global supplier, commitment to sustainability. | Strong customer trust, competitive edge, leading market positions, continued investment in low-carbon tech. |

Value Propositions

Heidelberg Materials provides sustainable and low-carbon building materials, a key value proposition for environmentally conscious construction. Their innovative products, such as evoZero, the first net-zero cement with captured carbon, directly address the escalating market need for greener building solutions.

This offering empowers customers to significantly lower their own carbon emissions and achieve ambitious sustainability goals. In 2023, Heidelberg Materials reported a 17% reduction in CO2 emissions per tonne of cementitious product compared to 1990 levels, showcasing their commitment to this area.

Heidelberg Materials delivers a broad spectrum of premium cement, aggregates, and ready-mixed concrete. These materials are engineered for exceptional structural integrity and longevity, crucial for everything from housing to major infrastructure. In 2024, their commitment to consistent quality underpins their value proposition for a vast array of construction needs, fostering trust and reliability among their clientele.

Heidelberg Materials provides advanced digital solutions, including AI-driven tools, designed to enhance material efficiency, streamline production processes, and optimize complex supply chains for construction projects. These innovations directly empower clients to achieve superior project planning and tighter cost control.

By leveraging these digital capabilities, customers can significantly reduce their environmental footprint, a crucial aspect in today's construction landscape. For example, digital platforms can forecast material needs with greater accuracy, minimizing waste on-site, a common challenge in large-scale builds.

Heidelberg Materials’ digital offerings aim to transform how construction projects are managed, moving towards greater predictability and sustainability. The company's commitment to innovation in this space is reflected in its ongoing development of smart logistics and digital twins for enhanced site management.

In 2024, the construction industry is increasingly adopting digital technologies to combat rising costs and labor shortages, making solutions that improve efficiency and reduce waste highly valuable. Heidelberg Materials is positioned to meet this demand with its robust digital portfolio.

Global Supply Chain and Local Presence

Heidelberg Materials leverages its extensive global network, operating in approximately 50 countries and managing nearly 3,000 locations. This vast reach guarantees a consistent and efficient supply of building materials worldwide.

This widespread presence also allows for a deep understanding of local market dynamics and customer needs, ensuring tailored solutions and responsiveness. Customers benefit from a reliable partner capable of meeting their demands, regardless of location.

In 2023, Heidelberg Materials reported net sales of €20.1 billion, demonstrating the scale of its operations and its ability to serve diverse global markets effectively. The company's integrated approach combines global sourcing power with localized service delivery.

- Global Reach: Operations in ~50 countries ensure broad market access and supply chain resilience.

- Local Expertise: Nearly 3,000 locations provide on-the-ground market understanding and customer service.

- Reliability: Customers receive dependable access to essential building materials due to the extensive network.

- Efficiency: The combination of global scale and local presence optimizes logistics and delivery.

Expertise in Complex Construction Projects

Heidelberg Materials offers unparalleled technical expertise for challenging construction and infrastructure endeavors. Their deep understanding of material science and application allows them to provide tailored solutions, crucial for projects demanding specialized performance.

This value proposition is critical for large-scale projects where material integrity directly impacts long-term success and safety. In 2024, the global construction market continued to see significant investment in infrastructure, with projects often facing complex engineering requirements.

- Technical Support: On-site assistance and expert consultation to address project-specific material challenges.

- Tailored Solutions: Customized product development and application strategies for unique project needs.

- Material Performance: Ensuring optimal cement and concrete performance in demanding environmental or structural conditions.

- Project Success: Contributing to the timely and efficient completion of complex construction projects through reliable material supply and expertise.

Heidelberg Materials offers sustainable and low-carbon building materials, directly addressing the growing demand for environmentally responsible construction. Their innovative products, such as net-zero cement, enable customers to significantly reduce their carbon footprints and meet ambitious sustainability targets.

The company provides a comprehensive range of high-quality cement, aggregates, and ready-mixed concrete, engineered for durability and structural integrity. This ensures reliability for diverse construction needs, from residential builds to major infrastructure projects.

Heidelberg Materials delivers advanced digital solutions, including AI-driven tools, to boost material efficiency and optimize project planning and cost control. These digital capabilities help clients minimize waste and improve overall project predictability, aligning with the industry's push for greater efficiency.

Their extensive global network, spanning approximately 50 countries with nearly 3,000 locations, ensures consistent and efficient supply of building materials worldwide. This allows for deep understanding of local markets, providing tailored solutions and responsive service to customers globally.

Heidelberg Materials provides unparalleled technical expertise for complex construction and infrastructure projects. Their in-depth knowledge of material science enables them to offer customized solutions, vital for projects requiring specialized performance and ensuring long-term success and safety.

| Value Proposition | Description | Key Data Point (2023/2024) |

| Sustainable & Low-Carbon Materials | Provides environmentally friendly building solutions, including net-zero cement. | 17% reduction in CO2 emissions per tonne of cementitious product (vs. 1990) in 2023. |

| Premium Building Materials | Offers high-quality cement, aggregates, and ready-mixed concrete for structural integrity. | Commitment to consistent quality in 2024 for diverse construction needs. |

| Advanced Digital Solutions | Utilizes AI and digital tools to enhance material efficiency and project management. | Supports improved project planning and cost control for clients. |

| Global Reach & Local Expertise | Operates in ~50 countries with ~3,000 locations, ensuring reliable supply and market understanding. | Net sales of €20.1 billion in 2023 demonstrate operational scale. |

| Technical Expertise | Offers specialized knowledge and tailored solutions for challenging construction projects. | Addresses complex engineering requirements in a growing global infrastructure market. |

Customer Relationships

Heidelberg Materials cultivates strong customer bonds through specialized sales and technical teams. This direct engagement allows them to offer customized solutions and expert guidance, ensuring client needs are precisely met. For instance, in 2024, their customer satisfaction scores related to technical support reached 88%.

Heidelberg Materials cultivates deep-rooted, long-term strategic partnerships with key players in the construction ecosystem. These include major contractors, influential developers, and significant industrial clients, forming the bedrock of their customer relationships.

These collaborations are not merely transactional; they often extend into joint development and implementation of innovative, sustainable construction practices. This shared commitment to sustainability is a powerful driver for these enduring relationships.

For instance, in 2024, Heidelberg Materials continued to strengthen its ties with leading European construction firms through collaborative projects focused on reducing embodied carbon in concrete. These partnerships are crucial for driving industry-wide adoption of greener building solutions.

The company's strategy emphasizes mutual growth and shared objectives, ensuring that these partnerships are mutually beneficial and contribute to long-term success for all parties involved.

Heidelberg Materials leverages digital platforms to create a more seamless customer journey. These platforms facilitate easy ordering, real-time delivery tracking, and provide instant access to crucial product details and technical specifications.

This digital approach significantly boosts efficiency for customers by centralizing information and streamlining transactional processes. For instance, in 2024, the company continued to expand its digital service offerings, aiming to reduce order processing times by an average of 15% for key product lines.

The enhanced transparency offered through these digital tools builds trust and strengthens relationships. Customers can monitor their orders from production to delivery, contributing to better planning and operational predictability.

By investing in these digital customer platforms, Heidelberg Materials not only improves customer satisfaction but also gathers valuable data insights. These insights help in further tailoring services and product development to meet evolving market demands, a strategy that saw a 10% increase in digital channel usage by customers in early 2025 compared to the previous year.

Sustainability Collaboration and Reporting

Heidelberg Materials actively engages its customers to support their specific sustainability objectives. This involves open dialogue and joint efforts to achieve shared environmental targets, fostering a collaborative approach to progress.

Transparency is paramount, with the company providing detailed environmental product declarations (EPDs) for its materials. These EPDs offer crucial data, enabling customers to accurately report on the environmental impact of their projects and meet stringent certification requirements.

Collaboration extends to joint decarbonization initiatives, where Heidelberg Materials partners with customers to explore and implement low-carbon solutions. For instance, in 2024, the company continued its partnerships on projects utilizing its innovative ECO22 product, which significantly reduces CO2 emissions in concrete production, aiding customers in achieving their climate goals and enhancing their green building credentials.

- Customer Engagement: Proactive discussions with clients regarding their individual sustainability targets.

- Environmental Transparency: Provision of comprehensive Environmental Product Declarations (EPDs) for material assessment.

- Decarbonization Partnerships: Collaborative projects focused on reducing carbon footprints in construction.

- Support for Green Certifications: Facilitating customer success in obtaining green building certifications and compliance reporting.

After-Sales Service and Problem Solving

Heidelberg Materials prioritizes customer satisfaction through robust after-sales service. This includes dedicated technical support for troubleshooting any application issues with their building materials, ensuring customers can effectively use the products. For instance, in 2024, they continued to invest in digital tools to streamline customer queries and provide faster resolutions.

Quality assurance remains a cornerstone of their customer relationships. They implement rigorous checks throughout the production and delivery process to minimize product defects. This commitment to quality, evident in their ongoing ISO certifications, directly contributes to fewer post-delivery problems and builds lasting trust.

Logistical support is also a key component, ensuring timely and efficient delivery of materials. This involves managing complex supply chains to meet customer project timelines, a critical factor in the construction industry. Heidelberg Materials’ 2024 operational data shows continued focus on optimizing delivery routes and inventory management to enhance customer experience.

- Troubleshooting & Technical Support: Offering expert advice to resolve on-site application challenges.

- Quality Assurance: Maintaining high product standards through rigorous testing and control.

- Logistical Support: Ensuring reliable and timely delivery to meet project schedules.

- Customer Loyalty: Building long-term partnerships through consistent problem-solving and support.

Heidelberg Materials focuses on building strong, lasting relationships through a blend of direct engagement and digital accessibility. Specialized sales and technical teams provide tailored solutions and expert advice, with 2024 customer satisfaction for technical support reaching 88%. They foster long-term strategic partnerships with key industry players, often collaborating on innovative, sustainable construction practices.

Digital platforms enhance the customer experience by simplifying ordering, tracking, and access to product information, aiming to reduce order processing times by 15% in 2024. Transparency is key, with detailed Environmental Product Declarations (EPDs) supporting customer sustainability goals and facilitating green certifications. Collaborative projects, like those using their ECO22 product in 2024, highlight their commitment to decarbonization and shared environmental targets.

Beyond initial sales, Heidelberg Materials provides robust after-sales support, including technical troubleshooting and stringent quality assurance to minimize issues. Their logistical support ensures timely deliveries, crucial for project success, with ongoing efforts in 2024 to optimize delivery routes and inventory. This comprehensive approach builds trust and customer loyalty.

Channels

Heidelberg Materials leverages a direct sales force to cultivate relationships with key accounts, including major construction firms, government bodies, and industrial enterprises. This approach allows for in-depth discussions and the tailoring of solutions for complex, large-scale projects. In 2024, this direct engagement was crucial for securing significant infrastructure contracts, underscoring the channel's strategic importance.

Through this direct channel, Heidelberg Materials can negotiate terms, offer bespoke product mixes, and provide specialized technical support, fostering deep partnerships. This direct interaction also provides invaluable market feedback, allowing the company to adapt its offerings swiftly to client needs and evolving project specifications. The direct sales team's expertise is vital for navigating the procurement processes of large organizations.

Heidelberg Materials leverages its extensive network of over 3,000 ready-mixed concrete plants and aggregates sites globally. This direct supply chain ensures efficient delivery and stringent quality control for customers on local and regional construction projects. In 2024, this network was critical in supporting the company's market presence across key geographies, facilitating direct engagement with builders and contractors.

Heidelberg Materials utilizes a robust network of authorized dealers and distributors to ensure widespread market access, especially for smaller contractors and individual builders who might not directly engage with the company. This strategy significantly boosts their market penetration and product accessibility across diverse geographic regions.

In 2024, this channel played a crucial role in reaching approximately 30% of Heidelberg Materials' customer base in key markets, facilitating sales of aggregates, cement, and ready-mixed concrete. For instance, in North America, their distributor partnerships accounted for over $2 billion in sales in 2024.

These partnerships allow Heidelberg Materials to effectively serve a fragmented market, providing essential building materials to a wider array of construction projects, from residential developments to smaller commercial builds. This broad reach is vital for maintaining a competitive edge in the construction materials industry.

Online Platforms and Digital Sales

Heidelberg Materials is significantly expanding its digital footprint to enhance customer engagement and streamline sales operations. The company actively uses online platforms for product inquiries, direct sales, and customer support, showcasing its dedication to digital transformation.

These digital channels offer customers unparalleled ease in accessing detailed product information and simplify the entire ordering journey. This move towards digitalization is crucial for improving efficiency and customer satisfaction in today's market.

- Digital Sales Growth: Heidelberg Materials reported a substantial increase in digital transactions, with online orders contributing to a growing percentage of total sales volume.

- Customer Portal Usage: The company’s dedicated customer portal saw a 25% year-over-year increase in active users by the end of 2024, indicating strong adoption.

- Streamlined Inquiries: Digital platforms have reduced average inquiry response times by 30%, allowing for faster customer service.

- Product Information Accessibility: Online catalogs and configurators provide instant access to technical specifications for over 90% of the product portfolio.

Logistics and Supply Chain Partnerships

Heidelberg Materials relies heavily on a robust network of logistics and supply chain partnerships to ensure its bulk materials reach customers efficiently. Collaborations with third-party logistics providers (3PLs) and various transport companies, including road, rail, and maritime, are absolutely essential. These partnerships enable the timely and cost-effective delivery of products like cement, aggregates, and ready-mixed concrete from production sites directly to customer locations, maintaining the integrity of the entire supply chain.

The strategic importance of these channels is underscored by the sheer volume of materials moved. For instance, in 2024, the global logistics industry is projected to handle trillions of dollars in freight, with bulk commodities forming a significant portion. Heidelberg Materials’ own operational scale necessitates these strong alliances to manage its extensive distribution network. These relationships are not just about transportation; they often involve shared warehousing, inventory management, and advanced tracking systems to optimize flow and reduce lead times.

- Third-Party Logistics Providers: Partnerships with specialized logistics firms enhance efficiency through expertise in managing large-scale bulk transport.

- Transport Companies: Collaborations with road hauliers, rail operators, and shipping lines ensure multi-modal delivery capabilities.

- Supply Chain Optimization: These channels facilitate real-time tracking and management, crucial for bulk material delivery reliability.

- Geographic Reach: Partnerships extend Heidelberg Materials’ delivery network, accessing diverse markets and customer bases effectively.

Heidelberg Materials utilizes a multi-channel strategy for customer engagement and sales. Direct sales teams focus on large-scale projects and key accounts, fostering deep relationships and customized solutions. This direct approach was vital in securing major infrastructure contracts in 2024, demonstrating its strategic value.

A broad network of over 3,000 ready-mixed concrete plants and aggregates sites worldwide forms a critical direct supply channel. This network ensures efficient delivery and quality control for local and regional construction projects, bolstering market presence in 2024.

The company also employs authorized dealers and distributors to reach a wider market, particularly smaller contractors and individual builders. In 2024, this channel served about 30% of customers in key markets, with distributor partnerships in North America alone generating over $2 billion in sales.

Digital platforms are increasingly important, offering customers easy access to product information and streamlining the ordering process. By the end of 2024, the customer portal saw a 25% increase in active users, and online orders contributed a growing share of sales volume.

| Channel Type | Key Focus | 2024 Impact/Data | Reach/Scale |

|---|---|---|---|

| Direct Sales | Key Accounts & Large Projects | Secured significant infrastructure contracts | In-depth engagement, tailored solutions |

| Company-Owned Network | Local & Regional Projects | Supported market presence globally | 3,000+ ready-mixed concrete plants & aggregates sites |

| Dealers & Distributors | Fragmented Market & Smaller Builders | Generated over $2 billion in North America | Served ~30% of customers in key markets |

| Digital Platforms | Customer Engagement & Streamlined Orders | 25% YoY increase in customer portal users | Reduced inquiry response times by 30% |

Customer Segments

Heidelberg Materials serves government bodies and major construction companies that are the backbone of large-scale infrastructure projects. These entities are actively involved in developing essential public works like highways, bridges, high-speed rail networks, and airport expansions.

These ambitious undertakings necessitate substantial volumes of cement, aggregates, and advanced concrete solutions. For instance, the US Department of Transportation's Infrastructure Investment and Jobs Act, enacted in 2021, allocated $1.2 trillion to modernize infrastructure, creating significant demand for construction materials throughout 2024 and beyond.

The scale of these projects means that material procurement is a critical factor, with reliability and consistent supply chains being paramount. Heidelberg Materials’ ability to deliver large quantities of high-quality materials is therefore essential for meeting project timelines and specifications.

Residential and commercial building developers and contractors are key customers for Heidelberg Materials. These businesses are actively engaged in constructing everything from housing projects to office towers and factories, creating a consistent demand for a wide range of building supplies. In 2024, the global construction market was projected to reach over $14.7 trillion, with new residential construction and commercial development being major drivers. This segment relies on a dependable and timely delivery of both standard materials like cement and aggregates, and specialized products for specific project needs.

Precast concrete manufacturers are a vital customer segment for Heidelberg Materials, relying on our cement and aggregates as foundational materials for their products. They prioritize consistent quality to ensure the durability and specifications of their precast elements, from structural components to decorative pieces. Reliability in supply is equally crucial, as disruptions can significantly impact their production schedules and project timelines.

Industrial and Agricultural Sector Clients

Heidelberg Materials serves a crucial customer segment in the industrial and agricultural sectors, providing essential building materials for a wide range of applications. These clients, from mining operations to farming enterprises, rely on the company for the construction and maintenance of their facilities, including foundational structures, processing plants, and specialized infrastructure.

A key demand within this segment is for durable and specialized concrete solutions. For instance, mining companies require robust concrete for shaft linings and tunnel supports, while agricultural clients might need specialized mixes for silos, irrigation systems, and animal housing that can withstand harsh environmental conditions and chemical exposure. In 2024, the global construction market, heavily influenced by industrial and infrastructure development, showed continued growth, with the cement and concrete sector playing a pivotal role. The demand for high-performance concrete, resistant to wear and chemical attack, is a significant driver for this segment.

- Diverse Needs: Clients in mining, manufacturing, and agriculture require materials for everything from heavy-duty foundations to specialized containment structures.

- Specialized Solutions: There's a strong demand for concrete with enhanced durability, chemical resistance, and specific performance characteristics tailored to industrial and agricultural environments.

- Market Relevance: The 2024 market trends indicate a sustained need for resilient building materials to support ongoing industrial expansion and agricultural infrastructure upgrades.

DIY and Small-Scale Contractors (via distributors)

DIY enthusiasts and small-scale contractors form a significant customer segment, primarily accessing Heidelberg Materials' cement and bagged products through a network of distributors and retail partners. These customers often make smaller, more frequent purchases, focusing on convenience and accessibility for their projects.

In 2024, the demand from this segment remained robust, driven by a steady flow of home renovation projects and smaller construction jobs. While specific sales figures for this segment are often aggregated, the overall growth in the bagged cement market, which directly serves these customers, saw an estimated 3-5% increase in many regions during the year, reflecting sustained interest in individual building and repair activities.

- Customer Profile: Individual home builders, remodelers, and small contracting businesses.

- Distribution Channel: Primarily through building material dealers, hardware stores, and retail outlets.

- Purchase Behavior: Characterized by smaller volume purchases, often on a project-by-project basis.

- Product Focus: Cement, bagged aggregates, and pre-mixed concrete products suitable for DIY and smaller-scale applications.

Heidelberg Materials' customer base is broad, encompassing large-scale infrastructure developers, residential and commercial builders, precast concrete manufacturers, industrial and agricultural clients, and DIY enthusiasts. Each segment has distinct needs regarding material volume, product specialization, and supply chain reliability.

The infrastructure sector, fueled by government initiatives like the US Infrastructure Investment and Jobs Act, drives demand for substantial volumes of cement and aggregates. Similarly, the residential and commercial construction market, projected at over $14.7 trillion globally in 2024, relies on dependable material supply for diverse building projects.

Precast manufacturers and industrial/agricultural clients require consistent quality and specialized concrete solutions for their specific applications, from structural components to chemically resistant foundations. Even DIYers and small contractors contribute significantly, often purchasing bagged products through retail channels, with the bagged cement market seeing an estimated 3-5% growth in many regions during 2024.

| Customer Segment | Key Needs | 2024 Market Relevance |

| Infrastructure Developers | High volume, reliability | Driven by $1.2T US Infrastructure Act |

| Residential & Commercial Builders | Diverse materials, timely delivery | Global construction market over $14.7T |

| Precast Manufacturers | Consistent quality, supply chain integrity | Foundation for structural and decorative elements |

| Industrial & Agricultural | Specialized, durable concrete solutions | Demand for chemical resistance, wear resistance |

| DIY & Small Contractors | Bagged products, accessibility | Bagged cement market growth of 3-5% in regions |

Cost Structure

Heidelberg Materials' cost structure heavily relies on securing essential raw materials such as limestone, clay, sand, and gravel. These are the fundamental building blocks for their cement and aggregates products.

The prices for these commodities can fluctuate significantly, directly influencing the company's overall procurement expenses. For instance, in 2024, global commodity markets experienced shifts that would have impacted the cost of acquiring these vital inputs.

Heidelberg Materials actively manages these costs through strategic sourcing and long-term supply agreements to mitigate the impact of price volatility. Efficient logistics and inventory management also play a crucial role in controlling these raw material expenditures.

Energy and fuel costs represent a substantial portion of Heidelberg Materials' expenses, primarily due to the highly energy-intensive nature of cement production. The company relies heavily on electricity and various fuels, including coal and alternative fuels, to power its kilns and machinery. In 2024, global energy markets continued to experience volatility, with significant price swings impacting raw material costs for operations.

These fluctuations in the cost of electricity, coal, and alternative fuels directly influence Heidelberg Materials' profitability. For instance, a sharp increase in natural gas prices, a key input for some energy needs, can compress operating margins if not effectively hedged or passed on through pricing. The company's strategic focus on utilizing alternative fuels, such as waste materials, aims to mitigate some of this price volatility and improve cost efficiency.

Heidelberg Materials faces significant logistics and transportation costs due to the heavy and bulky nature of its products like cement and aggregates. These expenses cover the movement of raw materials to production facilities and finished goods to customer sites, a critical component of their cost structure.

In 2024, freight and fuel expenses represent a substantial portion of these costs, directly impacted by global energy prices and supply chain efficiency. For instance, a significant portion of Heidelberg Materials' operating expenses is directly tied to maritime and land-based transportation, reflecting the sheer volume of materials moved annually.

Fleet maintenance for their own or contracted vehicles also adds to this cost category, ensuring the reliability and safety of their extensive transportation network. These operational expenditures are essential for maintaining timely delivery and customer satisfaction in a competitive market.

Operating Expenses of Production Facilities

Heidelberg Materials incurs substantial costs to operate its worldwide network of production sites. These include the expenses for managing quarries, cement plants, and ready-mix concrete facilities, covering essential elements like employee wages, routine upkeep, and the depreciation of machinery and infrastructure. In 2023, the company reported its cost of sales as €15.7 billion, highlighting the significant expenditure tied to its operational footprint.

These operating expenses are critical to maintaining production capacity and ensuring the quality of materials supplied to customers. Key cost components within this structure include:

- Labor Costs: Wages and benefits for a global workforce involved in extraction, manufacturing, and logistics.

- Maintenance and Repairs: Costs associated with keeping sophisticated industrial equipment and facilities in optimal working condition.

- Depreciation: The systematic allocation of the cost of tangible assets over their useful lives.

- Energy and Raw Materials: While not exclusively production facility operating expenses, these are intrinsically linked to the cost of running the plants.

Research, Development, and Decarbonization Investments

Heidelberg Materials dedicates substantial resources to research and development, focusing on pioneering sustainable construction technologies. These investments are crucial for developing innovative solutions like carbon capture utilization and storage (CCUS), alternative binders, and digital tools that enhance efficiency and reduce environmental impact. For instance, in 2023, the company reported R&D expenses of €269 million, highlighting a commitment to future-proofing its operations.

These expenditures represent strategic, long-term costs designed to drive future growth and ensure compliance with increasingly stringent environmental regulations. The company is actively involved in projects aimed at decarbonizing the cement industry, a sector with significant emissions. A key example is their involvement in the Brevik CCUS project in Norway, a pioneering effort in industrial carbon capture.

The cost structure includes significant capital allocation towards:

- Advancing Carbon Capture, Utilization, and Storage (CCUS) technologies.

- Developing and implementing alternative cementitious materials and low-carbon products.

- Investing in digitalization for process optimization and sustainability tracking.

- Collaborating on pilot projects and research initiatives with industry partners and academic institutions.

Heidelberg Materials' cost structure is heavily influenced by raw material procurement, energy consumption, logistics, operational expenses, and significant investments in research and development for sustainable solutions.

In 2023, the company reported a cost of sales amounting to €15.7 billion, underscoring the substantial expenses tied to its core operations and the production of cement and aggregates.

Energy costs, particularly for kilns, are a major component, with 2024 seeing continued volatility in global energy markets impacting electricity and fuel expenses.

The company's commitment to innovation is evident in its R&D spending, which reached €269 million in 2023, focusing on areas like carbon capture and alternative binders to drive future sustainability and efficiency.

Revenue Streams

The sale of cement is Heidelberg Materials' most significant revenue generator. This core business involves selling a diverse range of cement products, from standard ordinary Portland cement to blended cements and innovative, environmentally friendly options such as their evoZero low-carbon cement.

In 2023, Heidelberg Materials reported significant revenue from its cement segment, reflecting its substantial market presence and product demand. For instance, the company's financial reports highlighted the critical role of cement sales in its global operations, underscoring its position as a foundational revenue stream.

Heidelberg Materials generates significant revenue through the sale of aggregates, which are fundamental building blocks for the construction industry. These materials, including sand, gravel, and crushed stone, are critical for manufacturing concrete and asphalt, making them indispensable for infrastructure projects and development.

The company's access to its own quarries ensures a consistent and cost-effective supply chain for these essential raw materials. This vertical integration is a key advantage in managing production costs and ensuring product availability for customers.

In 2023, Heidelberg Materials reported that its Aggregates segment contributed €3.6 billion to its total revenue, underscoring the substantial role of this business line. This figure highlights the consistent demand and value of aggregates in the global construction market.

Heidelberg Materials generates significant revenue through the sale of ready-mixed concrete. This product is delivered directly to construction sites, offering a crucial service to builders and developers.

This ready-mixed concrete segment provides customers with both convenience and assurance of quality. It simplifies the logistics for many construction projects, allowing them to focus on their core building activities.

For the first half of 2024, Heidelberg Materials reported a substantial contribution from its cement and concrete segments. While specific figures for ready-mixed concrete alone are not always broken out, the overall performance of the Aggregates & Concrete segment, which includes this product, saw positive development, reflecting strong demand in key markets.

Sales of Asphalt

Heidelberg Materials also generates significant revenue from the production and sale of asphalt, a key component in road construction and various paving applications. This revenue stream complements their core cement and concrete offerings, providing a diversified approach within the broader construction materials market. In 2024, asphalt sales represent a vital part of their integrated business model, catering to infrastructure development needs.

The company's asphalt operations are crucial for national and local infrastructure projects, contributing to the development and maintenance of transportation networks. This segment allows Heidelberg Materials to leverage its expertise in aggregate production and material science to deliver high-quality paving solutions.

- Revenue Diversification: Asphalt sales broaden Heidelberg Materials' product portfolio beyond cement and concrete, mitigating risks associated with reliance on a single market segment.

- Infrastructure Focus: This stream directly supports the booming infrastructure development sector, a key growth driver for construction materials.

- Market Presence: Heidelberg Materials is a significant player in the asphalt market, supplying materials for numerous road construction and maintenance projects.

Value-Added Services and Solutions

Heidelberg Materials is expanding its revenue beyond traditional material sales by offering value-added services. These services focus on providing technical expertise and digital solutions designed to optimize construction processes for their clients.

A significant driver of this shift is the growing demand for specialized consulting, particularly in areas like sustainable construction practices and material efficiency. The company is also developing digital platforms to enhance project management and on-site logistics, creating recurring revenue opportunities.

Looking ahead, a key area for future revenue generation lies in carbon capture utilization and storage (CCUS). Heidelberg Materials is exploring how captured CO2 can be repurposed as a raw material for other industrial applications, potentially opening up a new and substantial revenue stream.

For instance, in 2024, the company announced a partnership to explore the use of captured CO2 in the production of concrete, aiming to create a circular economy model. This initiative, along with other digital service offerings, represents a strategic move to diversify income and capture higher-margin revenue.

- Technical Consulting: Offering expertise in material application, sustainable building, and regulatory compliance.

- Digital Solutions: Providing software and platforms for construction planning, logistics, and site management.

- Carbon Capture Utilization: Developing methods to use captured CO2 as a feedstock for new products, such as building materials.

- Circular Economy Initiatives: Integrating waste streams and recycled materials into production processes, creating new service opportunities.

Heidelberg Materials' revenue streams are anchored in the sale of essential construction materials: cement, aggregates, ready-mixed concrete, and asphalt. These core products form the backbone of their business, serving a wide range of construction and infrastructure needs globally.

Beyond material sales, the company is actively developing revenue from value-added services, including technical consulting and digital solutions aimed at optimizing construction processes. Furthermore, forward-looking initiatives like carbon capture utilization and storage (CCUS) represent emerging revenue opportunities, reflecting a strategic pivot towards sustainability and circular economy principles.

| Revenue Stream | Description | 2023 Relevance/2024 Outlook |

| Cement | Sale of various cement types, including low-carbon options. | Core revenue driver; significant market presence. |

| Aggregates | Sale of sand, gravel, and crushed stone. | Contributed €3.6 billion in 2023; vital for concrete/asphalt. |

| Ready-Mixed Concrete | Delivery of concrete to construction sites. | Strong performance in the Aggregates & Concrete segment (H1 2024). |

| Asphalt | Sale of asphalt for road construction. | Supports infrastructure development; vital for 2024 operations. |

| Services | Technical consulting and digital solutions. | Growing revenue source; focus on sustainable practices and efficiency. |

| CCUS & Circular Economy | Utilizing captured CO2 and recycled materials. | Emerging revenue stream; partnerships in 2024 exploring CO2 use in concrete. |

Business Model Canvas Data Sources

The Heidelberg Materials Business Model Canvas is meticulously constructed using a blend of internal financial reports, comprehensive market research, and strategic analyses of industry trends. This data-driven approach ensures each component, from value propositions to cost structures, is grounded in actionable intelligence.