Heidelberg Materials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

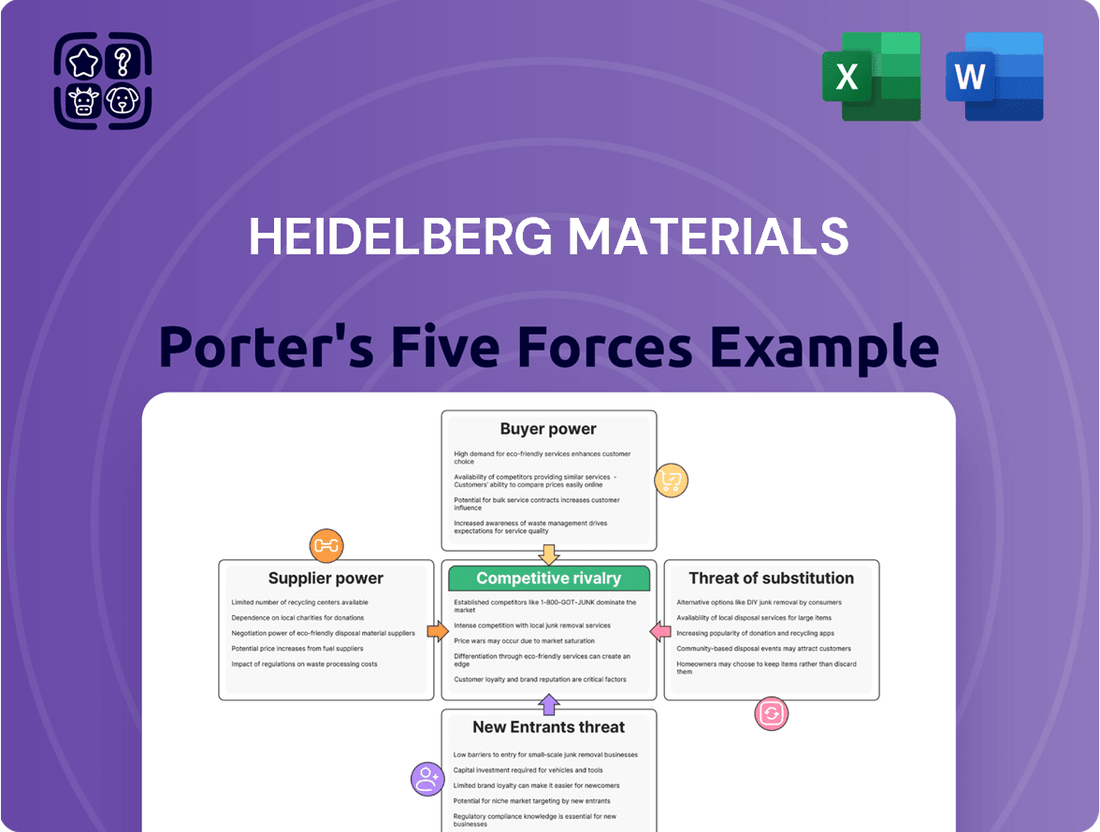

Heidelberg Materials navigates a construction materials landscape shaped by intense rivalry and significant buyer power, demanding strategic agility. The threat of new entrants is moderate, but the looming presence of substitutes requires constant innovation in product offerings. Supplier leverage, while present, is manageable within the industry's established supply chains.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Heidelberg Materials’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Heidelberg Materials relies heavily on energy and fuel providers, as cement, aggregates, and concrete production are incredibly energy-intensive processes. This makes suppliers of electricity, coal, and natural gas absolutely critical to their operations. For instance, in 2023, energy costs represented a significant portion of Heidelberg Materials’ cost of goods sold, with global energy price volatility directly impacting their profitability.

The limited number of major energy providers in many of Heidelberg Materials' operating regions grants these suppliers considerable bargaining power. This leverage allows them to influence the company's operating costs, especially during periods of high demand or supply chain disruptions. The ongoing energy transition also plays a role, as the availability and cost of alternative fuels and electricity sources can shift this power dynamic.

Heidelberg Materials, while possessing significant landholdings, still procures certain raw materials and quarry access from external landowners and smaller operators. This reliance, particularly for specialized additives or in regions with limited prime geological deposits, grants these suppliers a degree of bargaining power. For instance, in 2024, the global cement industry faced fluctuating raw material costs, with some regions experiencing price hikes due to localized supply constraints.

Suppliers of specialized equipment like kilns and mills, along with advanced production technologies crucial for building materials, often hold significant leverage. These vendors are typically few and highly specialized, meaning Heidelberg Materials has limited alternatives when sourcing such critical components.

This concentration of specialized suppliers grants them considerable bargaining power. They can influence equipment pricing, dictate terms for maintenance services, and control the availability of essential spare parts, directly impacting Heidelberg Materials' operational continuity and the timing of necessary technology upgrades.

For instance, the lead time for a new cement kiln can extend for years, and the cost can run into tens of millions of euros, underscoring the suppliers' ability to command favorable terms. In 2023, major equipment manufacturers reported strong order books, reflecting sustained demand and the suppliers' robust market position.

Logistics and Transportation Services

The bargaining power of suppliers in the logistics and transportation sector for Heidelberg Materials is notably high, primarily due to the inherent characteristics of moving bulk construction materials. Cement, aggregates, and concrete are heavy and voluminous, making transportation a substantial cost driver, often representing 20-30% of the total product cost for materials sourced from distant quarries or plants. Major global shipping companies, large rail networks, and specialized trucking firms that can handle these large volumes and have the necessary infrastructure, like dedicated rail sidings or port access, hold significant leverage. Their ability to offer economies of scale and specialized equipment allows them to negotiate favorable rates.

This concentration of power among a few key logistics providers means that Heidelberg Materials faces considerable pressure on its transportation expenses. For instance, in 2024, global shipping rates for bulk cargo, as tracked by indices like the Baltic Dry Index, experienced volatility, with certain periods seeing increases of over 50% due to factors such as port congestion and increased demand for raw materials. Similarly, domestic trucking costs in many regions have risen due to driver shortages and fuel price fluctuations, directly impacting the cost of delivering finished products to construction sites. The specialized nature of transporting cement, which requires careful handling and specific types of carriers, further limits the pool of viable and cost-effective suppliers, thereby strengthening their bargaining position.

- High Transportation Costs: Logistics often accounts for a significant portion of the delivered cost of cement and aggregates.

- Supplier Concentration: A limited number of large, specialized logistics providers dominate the market for bulk material transport.

- Economies of Scale: Major carriers can leverage their scale to negotiate better terms, which can translate to higher prices for smaller or less consolidated customers.

- Market Influences: Global shipping rates and domestic trucking costs, influenced by fuel prices and driver availability, directly impact supplier pricing power.

Suppliers of Sustainable Technologies and Solutions

The bargaining power of suppliers for sustainable technologies and solutions is a critical factor for Heidelberg Materials as it pursues decarbonization. As the company invests heavily in areas like carbon capture, utilization, and storage (CCUS) and alternative fuels, specialized suppliers hold significant leverage. These suppliers often possess proprietary technologies and deep expertise, making them essential partners in achieving sustainability goals.

For instance, companies developing advanced CCUS systems or novel low-carbon binders provide indispensable components for Heidelberg Materials' future operations. The limited number of providers for these cutting-edge solutions means they can command higher prices and dictate terms. This trend is likely to intensify as regulatory pressures and market demand for green building materials grow throughout 2024 and beyond.

- Growing Demand for Green Tech: The global market for climate tech, including carbon capture and alternative fuels, is experiencing rapid expansion, increasing supplier influence.

- Proprietary Innovations: Suppliers with unique, patented technologies for decarbonization have a distinct advantage, commanding premium pricing.

- Limited Supplier Pool: The specialized nature of these sustainable solutions means fewer companies can offer them, concentrating power among them.

- Strategic Partnerships: Heidelberg Materials' reliance on these suppliers for its transformation strategy strengthens their negotiating position.

The bargaining power of suppliers for Heidelberg Materials is notably high across several key areas, significantly impacting operational costs and strategic decisions.

Energy and fuel providers wield considerable influence due to the energy-intensive nature of cement production, with energy costs being a substantial portion of operating expenses. Specialized equipment manufacturers and providers of sustainable technologies also hold strong leverage due to the limited number of highly specialized vendors, commanding premium pricing and dictating terms for critical components and innovations.

Logistics and transportation suppliers benefit from the high volume and weight of construction materials, with a few dominant players able to influence rates. Raw material suppliers, particularly for specialized additives or in regions with limited deposits, also possess a degree of bargaining power.

| Supplier Category | Key Factors Influencing Power | Impact on Heidelberg Materials | Supporting Data/Trends (2023-2024) |

|---|---|---|---|

| Energy & Fuel | High energy intensity, limited provider options, energy transition impact | Significant cost pressure, profitability fluctuations | Energy costs a major component of COGS; global energy price volatility |

| Specialized Equipment & Technology | Proprietary tech, few specialized vendors, long lead times | High capital expenditure, reliance on vendor expertise and timelines | Multi-million euro costs for kilns; strong order books for manufacturers |

| Logistics & Transportation | Bulk nature of materials, supplier concentration, market rate fluctuations | Elevated transportation expenses, sensitivity to global shipping and trucking costs | Logistics can be 20-30% of product cost; Baltic Dry Index volatility, driver shortages |

| Sustainable Technologies | Demand for green tech, proprietary innovations, limited supplier pool | Increased costs for decarbonization efforts, reliance on key partners | Rapid growth in climate tech market; intensified regulatory pressure for green building |

| Raw Materials | Limited prime deposits, specialized additives, regional supply constraints | Fluctuating raw material costs, potential supply disruptions | Global cement industry faced price hikes due to localized constraints in 2024 |

What is included in the product

This analysis unpacks the competitive forces impacting Heidelberg Materials, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the cement and building materials industry.

Unlock strategic advantages with a streamlined Porter's Five Forces model for Heidelberg Materials, offering instant clarity on competitive pressures and guiding proactive decision-making.

Customers Bargaining Power

Large construction companies and major developers hold considerable bargaining power when sourcing materials. Their substantial purchase volumes for large-scale projects, such as infrastructure development or major housing complexes, allow them to negotiate aggressively on price and terms. For instance, in 2024, a single large infrastructure project in the UK might require hundreds of thousands of tons of cement and aggregates, giving the primary contractor significant leverage with suppliers like Heidelberg Materials.

The competitive bidding process, common in the construction industry, further amplifies customer power. Developers can easily solicit quotes from numerous suppliers for basic building materials, which are often seen as commodities. This competitive environment means that suppliers must offer attractive pricing and reliable delivery to secure contracts, especially when dealing with entities that represent a significant portion of a supplier's annual sales volume.

The bargaining power of customers in the ready-mixed concrete and aggregates sector is significantly shaped by regional and local market dynamics. High transportation costs inherently localize these markets, meaning that customer options and thus their power can differ dramatically from one area to another.

In regions where Heidelberg Materials faces a robust competitive landscape with many ready-mixed concrete suppliers, customers typically wield greater bargaining power. They can easily switch providers to secure more favorable pricing or terms, as seen in competitive urban centers across Europe. For example, in 2024, areas with over five significant concrete suppliers often experienced price pressures, forcing established players to offer more competitive bids.

For commodity products like cement, aggregates, and ready-mix concrete, customers often find little to distinguish one supplier from another. This lack of differentiation means that price becomes the dominant factor in their purchasing decisions.

This high price sensitivity significantly amplifies the bargaining power of customers. When products are essentially the same, buyers can easily switch to a competitor offering a lower price, forcing suppliers to compete on cost.

In 2024, the construction industry experienced fluctuating material costs, making price even more critical for project budgets. For instance, cement prices in key European markets saw an average increase of 5-7% year-on-year, intensifying the focus on cost-effectiveness for buyers.

This dynamic is particularly evident in competitive bidding processes, where customers can leverage multiple quotes to drive down prices. Heidelberg Materials, like its peers, faces constant pressure to maintain competitive pricing in such environments, directly impacting its profit margins.

Project-Based Procurement

In project-based procurement, customers frequently source materials for distinct construction or development endeavors. This approach means they re-evaluate suppliers for each new project, rather than committing to long-term, all-encompassing supply agreements. For Heidelberg Materials, this translates to heightened competition as it must continually prove its value and pricing for every individual contract.

This dynamic significantly amplifies the bargaining power of customers. They can leverage the competitive landscape to negotiate better terms and pricing for each specific project. For instance, a major infrastructure project in Germany in 2024 might involve multiple large-scale concrete orders, giving the client the leverage to solicit bids from several suppliers, including Heidelberg Materials, to secure the most favorable deal.

- Project-Specific Bidding: Customers often issue tenders for each new project, allowing them to compare offers from various suppliers.

- Reduced Switching Costs: For buyers, changing suppliers between projects is generally less costly than breaking long-term contracts.

- Price Sensitivity: The project-based nature often makes price a primary decision factor, especially in competitive bidding environments.

- Supplier Competition: This model fosters intense competition, driving down prices and increasing customer leverage.

Potential for Backward Integration (Limited)

While cement production is exceptionally capital-intensive, making full backward integration by customers rare, some very large construction conglomerates might explore limited moves into aggregates or ready-mix concrete. This theoretical capability, even if seldom exercised, can subtly enhance their negotiating stance with cement suppliers like Heidelberg Materials. For instance, a major construction firm undertaking a massive infrastructure project could, in principle, invest in its own quarrying operations for aggregates, thereby reducing its reliance on external cement suppliers for a portion of its material needs.

The bargaining power of customers is influenced by their potential for backward integration, though this is limited in the cement industry due to significant capital requirements.

- High Capital Intensity: The cement manufacturing process demands substantial investment, deterring most customers from backward integration into cement production itself.

- Limited Scope for Integration: Larger construction firms might consider backward integration into less capital-intensive areas like aggregates or ready-mix concrete, offering a minor but present leverage point.

- Theoretical Leverage: Even the possibility of a customer developing its own aggregate sources or concrete batching plants can subtly strengthen their position when negotiating prices or terms with cement producers.

- Industry Example: While not widespread, a hypothetical scenario involves a large construction group securing its own aggregate supply for a major road project, potentially impacting its cement procurement strategy.

Customers, particularly large construction firms and developers, possess significant bargaining power due to their substantial purchase volumes and the commoditized nature of building materials. This power is amplified by competitive bidding processes where price and reliable delivery are paramount. For example, in 2024, a single major infrastructure project in Germany could necessitate hundreds of thousands of tons of concrete, granting the contracting company considerable leverage over suppliers like Heidelberg Materials.

Preview Before You Purchase

Heidelberg Materials Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces Analysis for Heidelberg Materials details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes. This in-depth analysis provides actionable insights into the strategic positioning of Heidelberg Materials within the global building materials industry.

Rivalry Among Competitors

The building materials sector sees fierce competition, with giants like Holcim, Cemex, and CRH operating alongside many smaller regional players. This dynamic fuels intense rivalry as these companies battle for market share.

Companies actively pursue market share through competitive pricing, superior customer service, and strategic acquisitions. This consolidation trend is evident in both established and developing markets, reshaping the competitive landscape.

For instance, in 2023, Holcim completed several acquisitions, including a significant deal in the US, to expand its aggregates and concrete operations. Similarly, CRH made strategic investments in its European and North American businesses during the same period.

Heidelberg Materials operates in an industry characterized by substantial fixed costs. The significant investment required for plants, quarries, and extensive logistics networks means companies must run these assets at high capacity to be profitable. For example, cement production facilities represent a massive capital outlay, and their operational efficiency is directly tied to how much product they can churn out.

This drive for high capacity utilization often translates into aggressive pricing. When demand softens or when there's an oversupply of cement, companies are incentivized to lower prices to keep their plants running and cover those high fixed costs. This can lead to price wars, especially noticeable in regional markets where transportation costs make it difficult to import cheaper alternatives, thereby intensifying competitive rivalry.

Heidelberg Materials' core products like cement, aggregates, and ready-mix concrete are largely seen as commodities. While the company strives for differentiation through sustainability initiatives and enhanced customer service, the fundamental nature of these building materials means price often dictates purchasing decisions.

This commodity status intensifies competitive rivalry within the sector. Companies are constantly pressured to minimize production costs and optimize logistics to offer the most attractive pricing. For instance, in 2023, the global construction materials market saw significant price volatility, directly impacting profitability for players like Heidelberg Materials.

The aggressive competition on price forces companies to focus heavily on operational efficiency and economies of scale. Even small cost advantages can translate into significant market share gains when products are largely undifferentiated. This dynamic fuels a continuous drive for innovation in production processes and supply chain management.

Strategic Focus on Sustainability and Innovation

Competitive rivalry in the building materials sector is rapidly evolving. It's no longer just about offering the lowest price; companies are now vying for dominance based on their commitment to sustainability and their ability to innovate. This means that a company's environmental, social, and governance (ESG) performance is becoming a crucial differentiator.

Heidelberg Materials is a prime example of this shift. They are making substantial investments in developing low-carbon cement alternatives and embracing digital technologies to enhance efficiency and customer service. For instance, their 2023 financial report highlighted a significant portion of their capital expenditure directed towards decarbonization projects, aiming to reduce their CO2 emissions intensity. This strategic focus on green solutions allows them to attract a growing segment of environmentally aware customers and build a stronger market position.

- Sustainability as a Competitive Differentiator: Companies are increasingly judged on their carbon footprint and development of eco-friendly products.

- Investment in Low-Carbon Solutions: Heidelberg Materials, for example, is channeling significant capital into developing and scaling up products like ECOPact concrete, which offers a lower carbon footprint.

- Digitalization in Operations: The adoption of digital tools for process optimization and customer engagement is becoming a key aspect of competition.

- Attracting Environmentally Conscious Customers: A strong sustainability profile is crucial for winning business from clients with their own ESG targets, especially in public tenders and large-scale projects.

Market Growth Rates and Geographic Focus

Competitive rivalry within the cement and building materials sector, including for Heidelberg Materials, is notably shaped by regional market growth dynamics. In developed economies with slower expansion, such as parts of Europe, competition intensifies as established players vie for incremental market share. For instance, the European cement market experienced relatively modest volume growth in the low single digits in recent years leading up to 2024, prompting fierce price competition and a focus on operational efficiency.

Conversely, emerging markets, while presenting greater growth potential, often see heightened rivalry due to the influx of both local and international competitors. These regions can experience double-digit growth rates, attracting significant investment and leading to aggressive market entry strategies. For example, regions in Asia and Africa have historically shown higher growth trajectories for construction materials, consequently drawing more players into the competitive landscape, which can impact pricing power and profitability.

- Regional Disparities: Competition is more cutthroat in mature markets (e.g., Western Europe) with slower growth, while emerging markets (e.g., parts of Asia, Africa) offer expansion but attract aggressive competition from new entrants.

- Growth Impact on Rivalry: Slowing growth in established markets forces companies like Heidelberg Materials to compete more fiercely on price and efficiency.

- Emerging Market Dynamics: Rapidly growing emerging economies, with growth rates potentially exceeding 5-10% annually in construction, see intense competition as both local and global companies seek to capture market share.

- Strategic Implications: Heidelberg Materials must balance defending its position in mature markets with capturing opportunities in high-growth, high-competition emerging markets.

Competitive rivalry in the building materials sector is intense, driven by high fixed costs and the commoditized nature of products like cement and aggregates. Companies like Heidelberg Materials must maintain high capacity utilization, often leading to aggressive pricing strategies, especially in regional markets. This dynamic forces a constant focus on operational efficiency and cost reduction, as even minor advantages can secure significant market share.

The landscape is evolving with sustainability becoming a key differentiator, pushing companies to invest in low-carbon solutions and digital technologies. This shift attracts environmentally conscious customers and influences market positioning. Regional growth disparities also play a crucial role; slower growth in mature markets intensifies competition, while high-growth emerging markets attract numerous players, leading to aggressive market entry and pricing.

| Metric | Heidelberg Materials (2023 Data) | Key Competitors (Approx. 2023 Data) |

|---|---|---|

| Revenue (€ billion) | 23.2 | Holcim: ~30.0, CRH: ~28.0, Cemex: ~15.0 |

| EBITDA Margin (%) | ~16.5 | Holcim: ~19.0, CRH: ~17.5, Cemex: ~15.0 |

| Capital Expenditure for Sustainability (€ million) | ~1,000 (Targeted for decarbonization) | Significant investments by Holcim and CRH in green initiatives |

SSubstitutes Threaten

Alternative building materials like timber, steel, and advanced composites pose a growing threat to Heidelberg Materials' core offerings. For instance, the rise of mass timber construction, particularly in mid-rise and even some high-rise projects, directly substitutes for concrete in structural elements. In 2024, the global mass timber market continued its expansion, with projections indicating significant growth driven by sustainability initiatives and evolving building codes.

While concrete remains dominant for many applications, the increasing adoption of these alternatives in specific segments, such as residential construction and eco-friendly commercial buildings, erodes potential demand for cement and aggregates. This shift is particularly noticeable in regions with strong environmental regulations and a focus on carbon footprint reduction in the built environment.

The threat of substitutes for asphalt in road construction is moderate. While aggregates are essential, asphalt itself competes directly with concrete for paving projects. For instance, in 2024, the U.S. Department of Transportation continued to invest heavily in both asphalt and concrete infrastructure, reflecting the ongoing choice between materials. The decision often hinges on factors like initial cost, projected lifespan, and maintenance requirements, creating a clear alternative for road builders.

The increasing adoption of prefabricated and modular construction presents a significant threat of substitutes for traditional on-site ready-mixed concrete. These off-site methods, which saw substantial growth in 2024, streamline building processes by manufacturing components in controlled factory environments. While pre-cast concrete elements still rely on cement and aggregates, the overall volume of fresh concrete delivered to individual construction sites can decrease, potentially impacting Heidelberg Materials' sales volumes and delivery logistics.

Innovative Low-Carbon Binders and Geopolymers

Emerging low-carbon binders, like geopolymers and alkali-activated materials, represent a growing threat of substitution for traditional Portland cement. These innovative materials offer a more sustainable alternative, directly addressing the increasing global demand for environmentally friendly construction solutions. For instance, the global market for geopolymers was valued at approximately USD 5.5 billion in 2023 and is projected to reach USD 13.2 billion by 2030, indicating significant growth potential.

The primary driver for the adoption of these substitutes is their reduced carbon footprint compared to Portland cement, which is responsible for roughly 8% of global CO2 emissions. As regulations tighten and consumer preferences shift towards greener products, these alternatives become increasingly attractive. If these new binders achieve cost parity and scalability with traditional cement, they could significantly erode market share.

- Growing Environmental Regulations: Stricter emissions standards globally encourage the adoption of low-carbon materials.

- Cost Reduction Potential: As production scales, the cost competitiveness of geopolymers and similar binders is expected to improve.

- Performance Improvements: Research continues to enhance the durability and application range of these alternative binders.

- Market Penetration: Early adoption in specific construction sectors is already underway, signaling future market disruption.

Material Optimization and Digital Design

Advances in digital design, particularly through Building Information Modeling (BIM), are significantly impacting material consumption. For instance, the UK's construction sector, a major consumer of materials, saw BIM adoption grow, with an estimated 65% of projects using BIM in some capacity by 2023, according to industry reports. This technology enables architects and engineers to optimize structural designs, meaning less raw material might be needed for a given project. This efficiency can act as a substitute for the sheer volume of traditional materials.

Material science innovations also play a crucial role. Researchers are developing stronger, lighter, and more sustainable materials that can perform the same function with less mass. This trend, evident across global construction markets, means that a single innovative material could potentially displace larger quantities of conventional ones. For example, advanced composites or high-strength concretes might reduce the required thickness or volume of structural elements, thereby substituting for traditional, bulkier materials.

- BIM adoption: Increased use of BIM in construction allows for precise material calculation and waste reduction.

- Structural optimization: Digital tools enable designs that require less material for the same structural integrity.

- Material innovation: Development of high-performance materials can reduce the volume needed compared to conventional alternatives.

- Sustainability focus: Growing emphasis on sustainable building practices encourages the adoption of optimized designs and efficient material use.

The threat of substitutes for Heidelberg Materials is amplified by the increasing adoption of mass timber construction, particularly in mid-rise projects. In 2024, the global mass timber market demonstrated robust growth, driven by sustainability goals and evolving building codes, directly challenging concrete's dominance in structural applications.

Furthermore, alternative paving materials like polymer-modified asphalt compete with concrete in road construction. In 2024, the U.S. Department of Transportation's continued significant investments in both asphalt and concrete for infrastructure projects highlighted this ongoing material choice, influenced by cost and lifespan considerations.

The rise of prefabricated and modular construction methods, which saw substantial growth in 2024, also poses a threat. While these often still use concrete components, they can reduce the volume of fresh, on-site ready-mixed concrete, impacting Heidelberg Materials' sales volumes.

Emerging low-carbon binders, such as geopolymers, are gaining traction due to their reduced environmental impact. The global geopolymer market, valued at approximately USD 5.5 billion in 2023, is projected for substantial growth, directly substituting for traditional Portland cement as sustainability regulations tighten.

| Substitute Material | Application | Key Drivers | 2024 Trend Example | Impact on Heidelberg Materials |

| Mass Timber | Structural elements (mid-rise) | Sustainability, Building Codes | Continued market expansion | Reduced demand for concrete in specific segments |

| Asphalt | Road Paving | Initial Cost, Lifespan | Ongoing DOT investment in both materials | Direct competition for paving projects |

| Prefabricated/Modular | Construction components | Efficiency, Streamlining | Substantial growth in adoption | Potential decrease in on-site ready-mixed concrete volume |

| Low-Carbon Binders (Geopolymers) | Cement replacement | Reduced Carbon Footprint, Regulations | Projected market growth (USD 5.5B in 2023) | Erosion of Portland cement market share |

Entrants Threaten

Establishing new cement plants, aggregates quarries, and ready-mix concrete operations requires substantial upfront investment. For instance, building a new cement plant can easily cost hundreds of millions of dollars, covering land, advanced machinery, and specialized infrastructure.

The sheer scale of capital needed for land acquisition, heavy machinery, and sophisticated production technology creates a formidable barrier. This financial commitment, often exceeding $500 million for a modern integrated cement facility, deters many potential entrants from even considering the market.

Heidelberg Materials, like other major players, benefits from this high capital requirement. The need for extensive logistics networks and distribution channels further inflates the initial investment, making it incredibly difficult for newcomers to compete on scale and reach.

The building materials sector, including companies like Heidelberg Materials, faces significant challenges from extensive regulatory hurdles and permitting processes. Stringent environmental regulations, zoning laws, and lengthy permitting for quarrying, manufacturing, and emissions control act as a substantial deterrent for potential new entrants. For instance, in 2024, the average time to secure permits for new industrial facilities in many developed economies can stretch over several years, adding considerable cost and uncertainty.

Securing access to high-quality and strategically located limestone, clay, and aggregate reserves is fundamental for cement and concrete production, directly impacting cost structures and operational continuity. Heidelberg Materials, like other established players, often possesses extensive, long-term concessions and control over vast reserves. This existing ownership creates a significant barrier, as new entrants face substantial challenges and considerable costs in acquiring competitive raw material sources, especially in desirable geographic locations.

Established Distribution and Logistics Networks

Heidelberg Materials, like many in the heavy building materials sector, benefits from deeply entrenched distribution and logistics networks. These established systems are not just about moving products; they represent decades of investment in infrastructure, from specialized transportation fleets for bulk cement and aggregates to strategically located depots. For a new entrant, replicating this efficiency and reach is a monumental hurdle.

Consider the sheer scale of capital required. Building a national or even regional logistics network comparable to Heidelberg Materials would involve significant upfront costs for vehicles, terminals, and specialized handling equipment. For instance, in 2024, the cost of a new cement truck can range from $150,000 to over $250,000, and a fleet of hundreds is often necessary for broad market coverage. This substantial financial commitment, coupled with the time needed to establish operational expertise and secure regulatory approvals, creates a formidable barrier to entry.

- Significant Capital Investment: Replicating established logistics requires immense capital for transportation fleets, storage facilities, and specialized handling equipment.

- Operational Expertise: New entrants lack the decades of experience in managing complex, geographically dispersed supply chains efficiently.

- Time to Market: Developing a robust distribution network is a time-consuming process, delaying a new competitor's ability to serve customers effectively.

- Economies of Scale: Incumbents leverage their large-scale operations to achieve lower per-unit logistics costs, a benchmark difficult for new players to match.

Economies of Scale and Experience Curve

The threat of new entrants into the building materials sector, particularly for a company like Heidelberg Materials, is significantly mitigated by the formidable advantages of economies of scale and the experience curve. Existing large-scale producers, including Heidelberg Materials, benefit from substantial cost efficiencies derived from their vast production volumes, optimized procurement of raw materials, and ongoing investment in research and development. These factors translate directly into lower unit costs, creating a formidable barrier for any newcomer attempting to enter the market.

New entrants would face a steep uphill battle to match the cost efficiencies that established players have cultivated over years of operation. Without achieving a similar scale of production and operational experience, new companies would likely operate at a considerable cost disadvantage. For instance, in 2023, the global cement market, a core segment for Heidelberg Materials, saw production costs vary significantly, with major players often reporting lower per-tonne costs due to their integrated supply chains and energy efficiency initiatives. A new entrant would need to invest heavily to replicate these operational advantages.

- Economies of Scale: Heidelberg Materials leverages its global network of plants and quarries to achieve significant cost reductions in raw material sourcing and production, making it difficult for smaller, less integrated competitors to compete on price.

- Experience Curve: Years of operational experience have allowed Heidelberg Materials to refine its production processes, leading to improved efficiency and lower manufacturing costs per unit, a benefit new entrants would take considerable time and investment to replicate.

- Capital Intensity: The building materials industry is highly capital-intensive, requiring massive upfront investment in plant, equipment, and logistics. This high barrier to entry deters many potential new players.

- R&D Investment: Continuous investment in research and development for product innovation and process improvement, a hallmark of established companies like Heidelberg Materials, further widens the gap for potential new entrants.

The threat of new entrants for Heidelberg Materials is significantly low due to the industry's high capital requirements and the necessity of establishing extensive logistics networks. Building new cement plants alone can cost hundreds of millions of dollars, a prohibitive sum for most potential competitors. Furthermore, securing essential raw material reserves and navigating complex, multi-year permitting processes present substantial hurdles.

Established players like Heidelberg Materials benefit immensely from economies of scale and the experience curve. They have refined production processes and supply chains over decades, leading to lower per-unit costs that are difficult for newcomers to match. For instance, in 2023, major cement producers often reported lower production costs per tonne due to integrated operations and energy efficiency initiatives, a benchmark a new entrant would struggle to achieve without massive investment.

| Barrier to Entry | Description | Implication for New Entrants |

|---|---|---|

| Capital Requirements | Building a new cement plant can cost upwards of $500 million, requiring significant investment in land, machinery, and infrastructure. | Prohibitive upfront costs deter most potential competitors. |

| Logistics & Distribution | Establishing a national or regional network of specialized transportation and depots is complex and capital-intensive. | Replicating established reach and efficiency is a major challenge. |

| Regulatory Hurdles | Lengthy permitting processes for quarrying and manufacturing, along with stringent environmental regulations, can take years. | Adds considerable cost and uncertainty, delaying market entry. |

| Raw Material Access | Securing exclusive or long-term concessions for high-quality limestone and aggregate reserves is critical. | New entrants face difficulty acquiring competitive, strategically located resources. |

| Economies of Scale & Experience | Incumbents leverage vast production volumes and decades of operational refinement for cost advantages. | New entrants face significant cost disadvantages without comparable scale and expertise. |

Porter's Five Forces Analysis Data Sources

Our Heidelberg Materials Porter's Five Forces analysis is built upon a robust foundation of data, including annual reports, investor presentations, industry association publications, and market research reports from firms like Statista and GlobalData.