Heidelberg Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

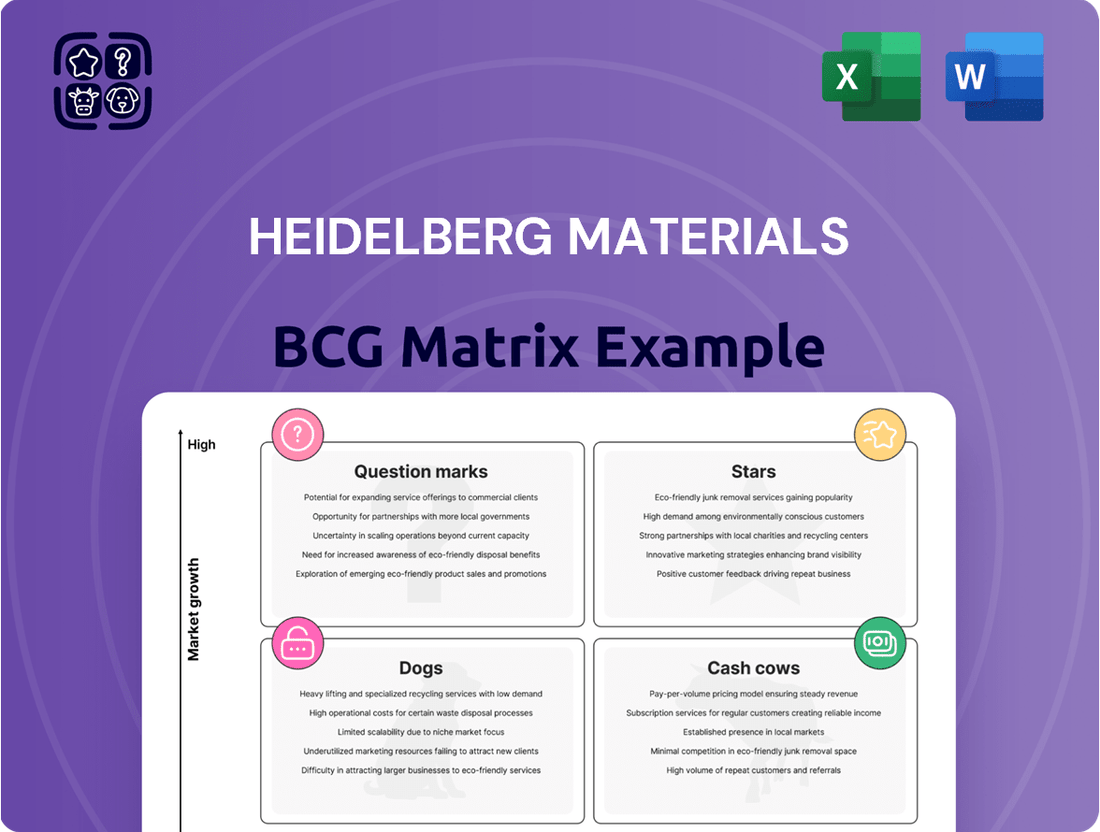

Heidelberg Materials' BCG Matrix offers a powerful lens to understand its diverse product portfolio. See which segments are driving growth and which may be plateauing, providing a visual roadmap for strategic resource allocation. This analysis is crucial for any investor or stakeholder looking to grasp the company's current market standing.

This preview highlights the critical need for a deeper dive into Heidelberg Materials' strategic positioning. Understanding the nuances of each quadrant—Stars, Cash Cows, Dogs, and Question Marks—is essential for informed decision-making. Don't miss out on the complete picture.

Ready to unlock a comprehensive understanding of Heidelberg Materials' market performance? Purchase the full BCG Matrix report for detailed quadrant analysis, actionable insights, and a clear strategy for future growth and investment.

Stars

Heidelberg Materials is aggressively pursuing carbon capture and storage (CCS) technologies, positioning itself as a leader in this vital decarbonization sector. The Brevik CCS plant in Norway, a prime example, reached mechanical completion in late 2024 and commenced CO2 capture in the first quarter of 2025, marking a significant milestone. This early and substantial investment in large-scale deployment underscores their commitment and expertise in a market poised for considerable growth.

With a global portfolio encompassing nine industrial-scale CCUS projects, Heidelberg Materials is building a formidable presence. These projects collectively represent a substantial commitment to the future of carbon capture, indicating a strategic focus on securing significant market share in this emerging and critical technology. This widespread development signals a clear pathway to becoming a dominant player in industrial decarbonization solutions.

evoZero® Carbon-Captured Cement is positioned as a Star in Heidelberg Materials' BCG Matrix. This designation reflects its status as a high-growth product in a rapidly expanding market for sustainable building materials. The company anticipates commencing customer supply of this groundbreaking net-zero cement in 2025, underscoring its commitment to leading the charge in low-carbon construction solutions.

Heidelberg Materials is making significant strides in adopting advanced digital solutions and AI to revolutionize its operations. For instance, their collaboration with Carbon Re leverages AI to optimize cement production, directly contributing to emission reductions. This focus on digital innovation is not just about efficiency; it's about creating new value in a construction sector increasingly shaped by technology.

The integration of tools like ABB Ability™ Expert Optimizer further highlights their commitment to enhancing operational performance across their plants. By embracing these digital advancements, Heidelberg Materials is positioning itself to gain a competitive edge by offering highly efficient, tech-driven solutions to the market. This strategic push into digital transformation is expected to capture greater market share in the efficiency-focused segments of the construction industry.

Growth in North American Markets

Heidelberg Materials is seeing significant expansion in North America, fueled by strategic acquisitions. This region is projected to be a major growth engine for the company in 2025. The company's strong market position in North America is further bolstered by its ability to capitalize on increased infrastructure spending across the continent.

The company's performance in North America is a crucial contributor to its overall financial results. For instance, in the first half of 2024, North America accounted for a substantial portion of Heidelberg Materials' revenue, demonstrating the market's importance. This robust showing underscores the effectiveness of their expansion strategy.

- Strategic Acquisitions: Heidelberg Materials has actively pursued acquisitions in North America to consolidate its market share and expand its operational footprint.

- Infrastructure Investment Tailwinds: Government-led infrastructure projects across the US and Canada are creating increased demand for building materials, directly benefiting Heidelberg Materials.

- Projected 2025 Growth: The company anticipates North America to be a leading contributor to its growth trajectory in 2025, leveraging its established presence.

- Market Leadership: Heidelberg Materials is solidifying its leading positions in key North American markets, benefiting from economies of scale and brand recognition.

Calcined Clay as SCMs

Heidelberg Materials is strategically investing in calcined clay as a key supplementary cementitious material (SCM). This move is central to their low-carbon cement production strategy, with the commissioning of the world's largest calcined clay plant in Ghana in April 2025 underscoring this commitment.

Calcined clay offers a significant advantage by largely replacing carbon-intensive clinker in cement production. This positions Heidelberg Materials at the forefront of sustainable building materials, catering to the increasing global demand for environmentally friendly construction solutions.

The company’s focus on calcined clay aligns with its broader BCG matrix positioning, likely identifying it as a "Star" due to its high growth potential and strategic importance in the evolving green construction market. This innovation directly addresses the industry's urgent need to decarbonize.

- Global Market Growth: The market for SCMs, including calcined clay, is projected to grow significantly, driven by environmental regulations and demand for sustainable construction.

- Technological Advancement: Heidelberg Materials' investment in advanced calcination technology is a key differentiator, enabling efficient and large-scale production of this low-carbon material.

- Environmental Impact: Utilizing calcined clay can reduce CO2 emissions in cement production by up to 40% compared to traditional Portland cement, a critical factor for meeting climate targets.

- Strategic Location: The Ghana plant’s location is strategic for serving growing African markets, which are increasingly adopting greener building practices.

Heidelberg Materials' evoZero® Carbon-Captured Cement and its calcined clay SCMs are clearly positioned as Stars within their BCG Matrix. These products represent high-growth opportunities in the rapidly expanding market for sustainable building materials, a sector driven by increasing environmental awareness and regulatory pressure. The company's proactive investments and technological advancements in these areas indicate a strong strategic focus on capturing significant market share as the construction industry transitions towards net-zero solutions.

| Product/Technology | BCG Category | Market Growth | Heidelberg Materials' Position | Key Developments (2024-2025) |

| evoZero® Carbon-Captured Cement | Star | High (Sustainable Construction Market) | Leading Innovator | Customer supply commencing 2025; Brevik CCS plant operational Q1 2025 |

| Calcined Clay SCMs | Star | High (Low-Carbon Cement Market) | Key Developer | World's largest calcined clay plant commissioned April 2025 (Ghana) |

What is included in the product

This BCG Matrix analysis categorizes Heidelberg Materials' business units by market share and growth, guiding strategic investment decisions.

A clear BCG Matrix visual helps leadership quickly identify strategic priorities, easing the pain of resource allocation uncertainty.

Cash Cows

Heidelberg Materials commands significant market share in traditional cement production within mature economies. These established operations are reliable cash generators, benefiting from consistent demand and the company's strong market presence.

In 2024, traditional cement segments are expected to continue their role as cash cows, supporting the company's overall financial health. For instance, the European cement market, a key region for Heidelberg Materials, saw a slight recovery in demand in early 2024 after a challenging 2023.

Capital allocation for these mature businesses focuses on operational enhancements and cost reduction strategies rather than aggressive expansion. This approach ensures sustained profitability and maximizes cash flow generation from these stable business units.

Heidelberg Materials' aggregates business, a cornerstone of its operations, holds a dominant market share in its core European and North American markets. This segment is characterized by its stable revenue generation, contributing significantly to the company's profitability despite moderate growth expectations.

In 2024, the aggregates division of Heidelberg Materials continued to be a primary driver of consistent cash flow, benefiting from ongoing infrastructure development and construction projects in its established operational areas. The company's extensive network of quarries and production facilities in these regions allows for efficient supply and robust margins.

Heidelberg Materials' ready-mixed concrete operations, especially in established urban and industrial areas, represent a significant cash cow. These segments typically hold a strong market position, benefiting from steady demand in ongoing construction and infrastructure development.

This stability translates into reliable, robust cash flow for Heidelberg Materials. The mature nature of these markets means less capital is required for aggressive marketing or expansion, allowing for efficient profit generation. For instance, in 2024, the construction sector, a key driver for ready-mixed concrete, saw continued investment in infrastructure projects across many developed economies, underpinning consistent demand.

Furthermore, ongoing efforts to improve operational efficiency and optimize logistics within the ready-mixed concrete business directly contribute to enhanced profitability. These gains, coupled with the inherent demand, solidify its status as a strong cash generator for the company.

Optimized European Production Networks

Heidelberg Materials' optimized European production networks, particularly those benefiting from the 'Transformation Accelerator' initiative, function as significant cash cows. Despite varied demand across the continent, these mature assets continue to generate substantial profits, underscoring their importance to the company's financial health.

Efficiency improvements and network optimization are key to maximizing returns from these established European operations. This focus ensures that even in softer markets, such as some Western and Southern European regions, these production sites remain highly profitable.

- Network Optimization: Heidelberg Materials invested heavily in optimizing its European production footprint. For instance, in 2024, the company reported that initiatives within its 'Transformation Accelerator' program yielded significant efficiency gains across its Western European cement plants.

- Resilient Eastern European Markets: The Eastern European segment of Heidelberg Materials' network demonstrated notable resilience, contributing consistently to stable cash flow throughout 2024. This region's performance highlights the diverse revenue streams within the European operations.

- Profitability of Mature Assets: The established nature of these European production assets, combined with ongoing efficiency drives, ensures they operate at high profitability levels, providing a reliable source of cash for the company.

Leveraged Global Supply Chain and Distribution

Heidelberg Materials' robust global supply chain and distribution network for its fundamental building materials acts as a significant cash cow. This well-established infrastructure, characterized by its efficiency and vast reach, translates into strong profit margins. Factors like optimized logistics and broad market access contribute to its profitability.

The company's established network requires minimal investment for growth, yet it consistently generates substantial returns. For instance, in 2024, Heidelberg Materials reported significant operational efficiencies within its logistics, contributing to a notable portion of its earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Global Reach: The company's distribution network spans numerous countries, ensuring broad market penetration.

- Logistical Efficiency: Optimized transportation routes and warehousing reduce costs and enhance delivery speed.

- Scale Advantages: The sheer volume handled through the network allows for better negotiation power with suppliers and carriers.

- Consistent Cash Generation: This segment provides a reliable stream of income with limited need for capital expenditure.

Heidelberg Materials' mature businesses, particularly in traditional cement and aggregates within established markets like Europe and North America, function as its primary cash cows. These segments benefit from consistent demand and the company's strong market positions, generating reliable profits with limited need for further investment.

In 2024, these core operations continued to be the bedrock of the company's financial stability. For example, the company's European cement business saw a steady performance, with specific initiatives aimed at optimizing production networks contributing to enhanced profitability, even amidst varied regional demand.

The aggregates division also played a crucial role, supported by ongoing infrastructure projects across developed economies, ensuring a consistent cash flow. Similarly, ready-mixed concrete operations in urban centers provided a stable income stream, demonstrating the robust nature of these mature business units.

These cash cows are vital for funding other strategic initiatives and investments within the company.

| Business Segment | Market Position | 2024 Cash Flow Contribution (Illustrative) | Key Drivers |

|---|---|---|---|

| Traditional Cement (Europe) | Strong Market Share | Significant | Consistent Demand, Operational Efficiencies |

| Aggregates (Europe & North America) | Dominant | High | Infrastructure Development, Stable Revenue |

| Ready-Mixed Concrete (Established Markets) | Strong | Reliable | Ongoing Construction, Urban Demand |

Preview = Final Product

Heidelberg Materials BCG Matrix

The Heidelberg Materials BCG Matrix preview you see is the identical, fully polished document you will receive upon purchase, ensuring no surprises and immediate usability. This comprehensive analysis, meticulously prepared, will be delivered directly to you, ready for strategic implementation without any watermarks or demo content. You can confidently use this preview as a direct representation of the high-quality, analysis-ready file you'll download instantly after your purchase. This means the exact same detailed insights and professional formatting will be yours to leverage for your business planning and decision-making processes.

Dogs

Heidelberg Materials likely has legacy assets, such as older cement plants or quarries, that could be classified as Dogs in a BCG Matrix. These are often located in regions with persistent economic slowdowns or significant downturns in the construction sector, leading to reduced demand.

These underperforming segments typically hold a small market share and operate within markets that are not growing, resulting in low or even negative profitability. For instance, a facility in a region experiencing a decade-long construction slump might see its output fall by 50% compared to its peak.

In 2024, for example, European construction output saw varied performance, with some markets contracting. Assets situated in these contracting markets, especially older ones with higher operating costs, would fit the Dog profile.

The strategic response for such Dog assets usually involves either divesting them to exit the market or undertaking substantial operational restructuring to improve efficiency and reduce costs, aiming to salvage any remaining value.

Within Heidelberg Materials' portfolio, certain niche products might fit the 'dog' category. Imagine specialized concrete additives or legacy cement types that, despite their initial purpose, haven't captured substantial market share. These often reside in low-growth segments where newer, more eco-friendly options are increasingly preferred. For instance, a specific type of high-early-strength cement, perhaps developed for a now-obsolete construction technique, might fall here.

These products typically exhibit both low market share and operate within industries experiencing minimal growth. Think of a specialized admixture for a particular type of historical building restoration that has limited ongoing demand. The challenge with such products is that they can tie up valuable resources – research and development, manufacturing capacity, and sales efforts – without generating significant returns.

By 2024, the global construction chemicals market, while growing, sees a clear shift towards sustainability. Products not aligned with these trends, like certain older formulations of admixtures or specialized grouts with limited application, could be candidates for the dog quadrant. Their low adoption rates mean they contribute little to overall profitability and might even represent a drag on resources.

Consider a scenario where a company has a line of decorative concrete sealants designed for a specific aesthetic trend that has since faded. Such a product, with declining sales and minimal market penetration, consumes inventory space and marketing attention. In 2024, with a strong emphasis on lifecycle assessment and green building certifications, these less sustainable, niche products are prime candidates for strategic review, potentially leading to their discontinuation to focus on more promising ventures.

Heidelberg Materials' involvement in highly fragmented local markets, often characterized by intense competition and tight profit margins, can be categorized as potential Dogs in the BCG Matrix. In these segments, securing a substantial market share proves difficult, and growth prospects are inherently limited, often resulting in performance that hovers around break-even or incurs losses. For instance, regional aggregate quarries with a multitude of small local competitors might fall into this category, where price competition severely erodes profitability.

The strategic approach for such operations typically involves a rigorous review aimed at minimizing further investment or, in many cases, planning an exit strategy. The company must meticulously assess whether any turnaround potential exists or if divesting these underperforming assets would unlock capital for more promising ventures. In 2023, for example, the building materials sector globally saw mixed performance, with some regional markets struggling to maintain profitability due to oversupply and intense local rivalry.

Inefficient Logistics and Distribution Hubs

Outdated logistics and distribution hubs represent potential 'dogs' within Heidelberg Materials' operations. These facilities might be characterized by aging infrastructure, suboptimal locations that increase transportation costs, or inefficient processes leading to high operating expenses and slow inventory turnover. Such operations can drain capital without generating sufficient returns, impacting the company's overall supply chain efficiency and profitability.

For example, a distribution center in a region with declining industrial activity or one that hasn't been updated to handle modern material flows could be a prime candidate for this classification. These inefficiencies directly translate into higher per-unit handling costs and slower delivery times, undermining competitiveness. Heidelberg Materials would likely focus on initiatives to either upgrade these facilities to meet current operational demands or consider consolidation strategies to streamline its network.

- High Operational Costs: Older hubs may incur significantly higher energy, maintenance, and labor costs compared to modernized facilities. For instance, a facility relying on manual sorting instead of automated systems could see labor costs increase by up to 30% per unit handled.

- Geographic Disadvantages: Hubs situated far from key markets or raw material sources increase inbound and outbound transportation expenses, potentially adding 10-15% to logistics costs.

- Low Throughput: Inefficient layouts and outdated equipment can limit the volume of materials processed, resulting in underutilization of assets and reduced revenue generation.

- Cash Consumption: These 'dog' units require ongoing investment for upkeep without yielding proportionate returns, negatively impacting free cash flow.

Non-Core, Stagnant Joint Ventures or Minority Stakes

In the context of Heidelberg Materials' potential BCG Matrix, non-core joint ventures or minority stakes in low-growth industries with consistently poor market share and profitability would be classified as Dogs. These holdings represent capital that isn't generating significant returns or contributing meaningfully to the company's strategic objectives.

For instance, if Heidelberg Materials held a minority stake in a joint venture focused on traditional concrete additives in a mature, declining market, and this venture consistently reported low single-digit profit margins and flat revenue growth, it would likely be a 'Dog'. Such an investment ties up valuable resources that could be better allocated to higher-growth areas.

Heidelberg Materials, like any forward-thinking company, would aim to exit or reduce its exposure to these 'Dog' assets. For example, a divestment strategy might see such a stake sold to a competitor or a private equity firm specializing in turnaround situations. In 2023, the global construction materials market experienced varied growth, with some segments showing resilience while others faced stagnation, underscoring the importance of portfolio management.

- Non-Core Assets: Minority stakes in ventures outside Heidelberg Materials' primary strategic focus.

- Stagnant Industries: Investments in markets characterized by low growth and limited innovation.

- Poor Performance: Holdings demonstrating consistently low market share and profitability, failing to meet internal benchmarks.

- Capital Inefficiency: These ventures consume capital without providing adequate returns or strategic advantage.

Heidelberg Materials' 'Dogs' are typically legacy assets or niche products operating in low-growth, competitive markets with minimal market share. These segments, such as older cement plants in economically stagnant regions or specialized concrete additives with fading demand, often exhibit low profitability and can consume resources without generating substantial returns. For example, in 2024, facilities in European markets experiencing construction output contractions would likely fit this profile, especially if they have higher operating costs and reduced demand.

The strategic imperative for these 'Dog' assets is usually divestment or significant operational restructuring to improve efficiency and reduce costs. Non-core joint ventures or minority stakes in stagnant industries also fall into this category, representing capital that could be better deployed elsewhere. By 2023, the global construction materials market's varied performance highlighted the need for rigorous portfolio management to exit or reduce exposure to these underperforming ventures.

| Asset Type | Market Characteristics | Heidelberg Materials' Potential Position | Strategic Implication |

|---|---|---|---|

| Legacy Cement Plants | Low growth, economic slowdowns | Low market share, low profitability | Divestment or restructuring |

| Niche Concrete Additives | Fading demand, shifting trends | Low adoption, resource drain | Discontinuation or repositioning |

| Outdated Logistics Hubs | High operational costs, geographic disadvantage | Low throughput, cash consumption | Upgrade or consolidation |

| Non-Core Joint Ventures | Stagnant industries, poor performance | Capital inefficiency | Exit or reduce exposure |

Question Marks

Early-stage carbon capture and utilization (CCU) projects, such as Heidelberg Materials' facility in Lengfurt, are currently positioned as question marks in the BCG matrix. While these projects are in a nascent but potentially high-growth sector, their market share remains minimal as they navigate early operational phases. The commercial viability and market acceptance of captured CO2, particularly for applications in the food and chemical industries, are still being established, demanding substantial upfront investment.

Heidelberg Materials is actively exploring pilot circular economy initiatives to drive sustainability and innovation. A prime example is CIRCO₂BETON® in France, a project focused on producing low-carbon cement from recycled demolished concrete. This venture aligns with strong growth trends in the sustainability sector.

While these pilot projects are technologically advanced, they currently represent a small fraction of the overall market. Significant investment is needed to prove their scalability and achieve broad market adoption, which is characteristic of "question mark" assets in a BCG Matrix.

Heidelberg Materials' investments in emerging digital construction platforms and services, extending beyond their established AI operations, are positioned as question marks. These ventures are designed to capitalize on the rapid digitalization trend within the construction sector.

However, these platforms often face challenges such as limited user adoption and low market penetration in their early stages. Significant financial commitment is necessary to cultivate market share and achieve a leading position in these nascent digital construction markets.

For instance, the global construction technology market was valued at an estimated USD 28.6 billion in 2023 and is projected to grow at a compound annual growth rate of 11.2% from 2024 to 2030, indicating substantial growth potential for Heidelberg Materials' question mark investments.

Expansion into New, Highly Competitive Emerging Markets

Heidelberg Materials' expansion into certain new, highly competitive emerging markets presents a classic question mark scenario within the BCG matrix. While the allure of high growth potential in these regions is undeniable, the presence of entrenched local competitors and nascent construction sectors means the company may enter with a relatively low market share.

This situation demands substantial investment and a meticulously crafted strategy to carve out a significant presence. For instance, in markets where the construction sector is still developing, the demand for materials might be volatile, requiring Heidelberg Materials to adapt its production and distribution models. The company's ability to leverage its global expertise while tailoring its approach to local nuances will be critical for success.

- High Growth Potential, Low Market Share: Emerging markets often exhibit robust GDP growth, which directly correlates with construction activity and cement demand. However, Heidelberg Materials may find itself a smaller player against established domestic firms.

- Intense Local Competition: Many emerging markets have strong, locally owned cement producers who understand the market deeply and may have cost advantages.

- Nascent Construction Sectors: In some regions, the construction industry is still maturing, meaning infrastructure development, housing demand, and overall project pipelines might be less predictable than in developed economies.

- Capital Investment Needs: Gaining market share in competitive environments typically requires significant capital for new plants, acquisitions, or aggressive marketing and distribution network development.

Developing New Low-Carbon Product Formulations (Beyond Current Offerings)

Heidelberg Materials' pursuit of entirely novel low-carbon cement and concrete formulations, distinct from current offerings like evoZero, represents a strategic investment in future high-growth sustainable construction markets. These nascent technologies, while not yet commercialized, are crucial for capturing emerging demand driven by stricter environmental regulations and increasing consumer preference for green building solutions.

- R&D Focus: Ongoing research into breakthrough low-carbon binders and admixtures.

- Market Potential: Targeting future markets for net-zero construction and circular economy building materials.

- Investment: Requires sustained R&D expenditure with inherently uncertain near-term commercial returns, characteristic of question mark investments.

- Strategic Importance: Essential for maintaining long-term competitive advantage and leadership in the decarbonization of the construction industry.

Heidelberg Materials' ventures into emerging low-carbon technologies and new market entries are positioned as question marks. These initiatives, while holding significant future growth potential, currently possess a low market share due to their early developmental stages and competitive landscapes.

The company’s investments in novel cement formulations and digital construction platforms exemplify this. For instance, the global construction technology market was valued at USD 28.6 billion in 2023, with projected growth of 11.2% annually through 2030, highlighting the potential for these question marks to evolve.

Significant capital is required to scale these operations and gain traction against established players, a hallmark of question mark assets that need strategic nurturing to transform into stars or cash cows.

Heidelberg Materials' strategic focus on developing next-generation low-carbon binders, separate from existing products like evoZero, represents a significant investment in future sustainable construction markets. These nascent technologies are vital for capturing emerging demand driven by stricter environmental regulations and a growing preference for green building materials.

| Category | Current Market Share | Growth Potential | Investment Need | Strategic Outlook |

| Emerging Low-Carbon Tech | Low | High | Substantial | High Risk, High Reward |

| Digital Construction Platforms | Low | High | Significant | Nurture for Market Leadership |

| New Geographic Market Entry | Low | Variable (Market Dependent) | High | Requires Tailored Strategy |

BCG Matrix Data Sources

Our Heidelberg Materials BCG Matrix is informed by comprehensive market data, including financial disclosures, industry growth rates, and competitive landscape analysis.