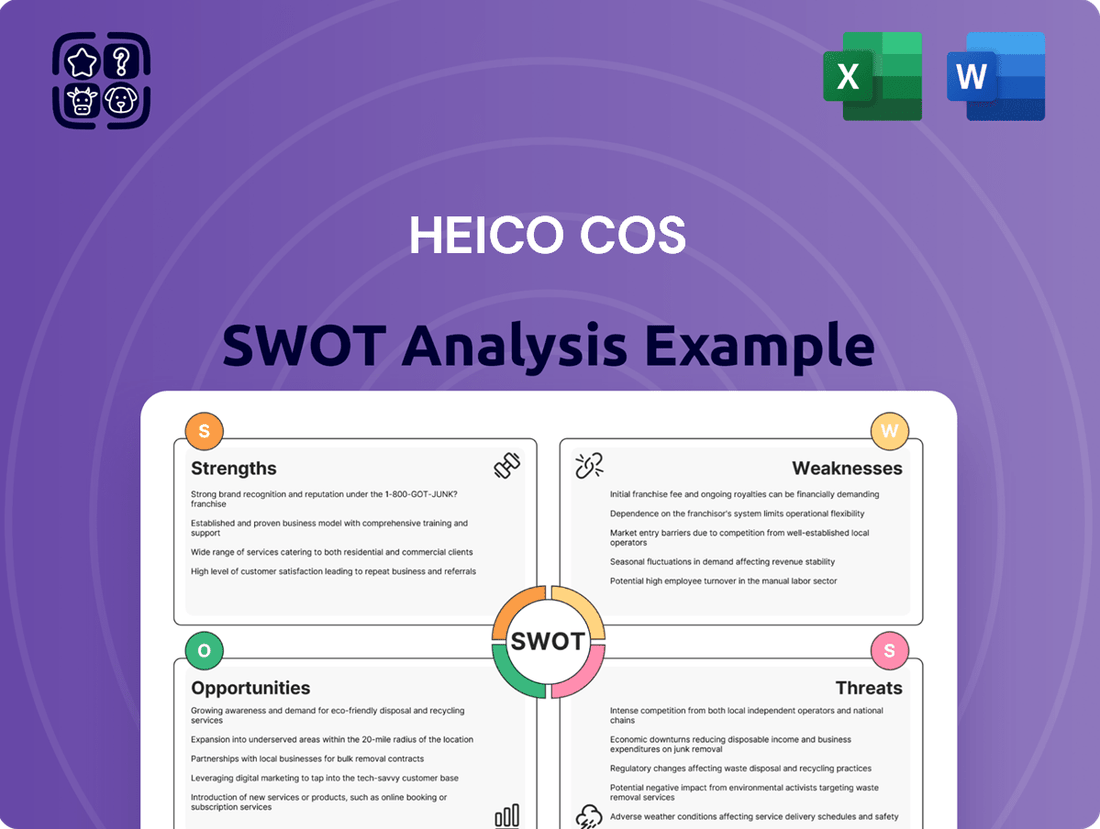

Heico Cos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heico Cos Bundle

Heico Companies' SWOT analysis reveals a robust market position built on strong engineering capabilities and a diversified product portfolio. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for sustained growth.

Want the full story behind Heico's competitive advantages, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

HEICO's strategic diversification across its Flight Support Group (FSG) and Electronic Technologies Group (ETG) is a significant strength. This dual focus allows the company to cater to critical, high-reliability sectors such as aerospace, defense, space, medical, and telecommunications, ensuring a robust revenue stream less susceptible to downturns in any single industry.

The company's leadership in niche markets, particularly as a premier independent producer of FAA-approved replacement parts for jet engines and aircraft components, solidifies its competitive advantage. This aftermarket specialization, a key component of its FSG, provides a stable and recurring revenue source, as demonstrated by its consistent growth in this segment.

HEICO has a history of delivering impressive financial performance, consistently achieving record-breaking sales and income. For instance, in the second quarter of fiscal year 2025, the company reported a significant 15% year-over-year increase in net sales, reaching an all-time high of $1.10 billion. This robust growth is a testament to their effective business strategies and market position.

The company's profitability has also seen substantial gains, with net income climbing by 27% to $156.8 million in the same Q2 fiscal 2025 period. This strong financial showing is a result of HEICO's ability to expand its operations organically while also successfully integrating strategic acquisitions, highlighting their operational prowess and pricing capabilities.

HEICO's strategic acquisition approach is a significant strength, consistently driving expansion into specialized markets and broadening its product offerings. This disciplined strategy has been a cornerstone of its growth, allowing it to enter and solidify its presence in niche segments of the aerospace and electronics industries.

The company's track record of successful integration and earnings accretion post-acquisition is notable. For example, the acquisition of Wencor Group bolstered its Flight Support Group, and recent moves in 2024 and 2025, including the purchases of Mid Continent Controls and Rosen Aviation LLC, further solidify its market position. These acquisitions typically become earnings-accretive within a year, demonstrating their immediate positive impact on HEICO's financial performance.

Strong Aftermarket Presence and Pricing Power

HEICO's Flight Support Group has carved out a significant niche by offering FAA-approved replacement parts that are typically more affordable than those from original equipment manufacturers (OEMs). This aftermarket focus not only generates a steady and profitable revenue stream but also provides a degree of insulation from broader geopolitical uncertainties impacting the aerospace industry.

The company's pricing power is evident in its consistent performance, with the Flight Support Group achieving nineteen consecutive quarters of sequential net sales growth. This sustained upward trend underscores the strong and persistent demand for HEICO's aftermarket solutions.

- Aftermarket Specialization: HEICO's Flight Support Group focuses on FAA-approved replacement parts, offering cost-effective alternatives to OEM products.

- Resilient Revenue: This aftermarket strategy provides a stable and profitable revenue base, less susceptible to certain market volatilities.

- Consistent Growth: The Flight Support Group has demonstrated impressive momentum, recording nineteen consecutive quarters of sequential net sales growth.

Experienced Management and Financial Discipline

HEICO's enduring strength lies in its experienced management, notably the Mendelson family's stewardship, which has cultivated a culture of disciplined growth and conservative financial management. This approach prioritizes robust free cash flow generation, a critical element for sustained success.

This financial discipline is evident in HEICO's commitment to shareholder returns, having consistently paid dividends for an impressive 50 consecutive years. This long track record underscores their ability to balance rewarding investors with strategic reinvestment for future growth and maintaining significant financial flexibility.

- Long-term Leadership: The Mendelson family's consistent leadership provides stability and a clear strategic vision.

- Financial Prudence: A focus on conservative financial management ensures resilience and adaptability.

- Shareholder Returns: A 50-year history of consecutive dividend payments highlights commitment to rewarding shareholders.

- Growth Reinvestment: The company effectively balances shareholder payouts with strategic investments for expansion.

HEICO's strategic diversification across its Flight Support Group (FSG) and Electronic Technologies Group (ETG) provides resilience, allowing it to serve critical sectors like aerospace and defense. This dual focus, coupled with a strong leadership position in niche aftermarket segments, ensures a stable revenue base. The company's consistent financial performance, including a 15% year-over-year net sales increase to $1.10 billion in Q2 fiscal 2025, underscores its operational effectiveness and market strength.

HEICO's acquisition strategy is a key strength, consistently expanding its reach into specialized markets. Recent acquisitions in 2024 and 2025, such as Mid Continent Controls and Rosen Aviation LLC, have further solidified its market position and demonstrated earnings accretion, often within a year of purchase. This disciplined approach fuels growth and enhances its product offerings.

The company's Flight Support Group excels in offering FAA-approved replacement parts that are more cost-effective than OEM alternatives. This aftermarket specialization has led to nineteen consecutive quarters of sequential net sales growth for the group, highlighting the persistent demand and HEICO's strong pricing power in this segment.

HEICO benefits from experienced leadership, particularly the Mendelson family's long-standing stewardship, which emphasizes disciplined growth and conservative financial management. This focus generates robust free cash flow and supports a 50-year history of consecutive dividend payments, demonstrating a commitment to both shareholder returns and strategic reinvestment.

| Metric | Q2 FY2025 | YoY Change |

|---|---|---|

| Net Sales | $1.10 Billion | +15% |

| Net Income | $156.8 Million | +27% |

| FSG Sequential Net Sales Growth | 19 Consecutive Quarters | N/A |

What is included in the product

Heico Cos’s SWOT analysis delivers a strategic overview of its internal capabilities and external market challenges, highlighting key growth drivers and potential weaknesses.

Offers a clear, actionable framework to identify and address Heico Cos's key competitive advantages and vulnerabilities.

Weaknesses

HEICO's significant reliance on the aerospace and defense sectors presents a notable weakness. While the company has expanded its offerings, its foundational revenue streams are still deeply connected to the health of these industries. For instance, in fiscal year 2023, the Electronic Technologies Group (ETG), which includes defense and medical products, saw revenue growth, but the overall performance is still susceptible to the cyclical nature of these markets.

Economic downturns, such as those impacting air travel, or changes in government defense budgets directly affect HEICO's financial performance. This dependency means that a slowdown in aircraft production or a decrease in defense spending can translate into reduced demand for HEICO's components and services. The company has acknowledged fluctuating demand in specific product lines, underscoring this vulnerability.

While HEICO's acquisition strategy is a significant growth engine, integrating these new entities presents inherent risks. Challenges such as clashing corporate cultures, difficulties in aligning operational systems, and the potential failure to achieve anticipated cost savings or revenue enhancements are always present.

For instance, in fiscal year 2023, HEICO completed several acquisitions, and while the company has a proven history of successful integration, each new deal introduces unique complexities. The sheer volume of integration activities can strain resources, and the inability to fully realize projected synergies, which are crucial for justifying acquisition premiums, remains a persistent concern for any acquisitive company.

HEICO operates in a fiercely competitive aerospace sector where rivals often boast greater brand recognition, larger stock of parts, and more comprehensive product lines or deeper pockets. This intense rivalry can squeeze pricing and chip away at market share, especially in specialized segments where success hinges on design, technology, quality, cost, service, and customer loyalty.

Supply Chain Vulnerabilities

The aerospace and defense sector is characterized by intricate and often inflexible supply chains. These chains are inherently vulnerable to disruptions stemming from geopolitical instability, shortages of critical components, and fluctuations in pricing or availability. For HEICO, such vulnerabilities can directly impede production schedules and the capacity to fulfill customer demand, potentially causing significant delays and escalating operational expenses.

These supply chain challenges can manifest in several ways:

- Component Scarcity: A shortage of specific, specialized parts can halt production lines, impacting HEICO's ability to deliver finished goods on time.

- Geopolitical Disruptions: International conflicts or trade disputes can disrupt the flow of materials and finished products, affecting HEICO's global operations.

- Price Volatility: Unexpected increases in the cost of raw materials or components can squeeze profit margins if not effectively managed or passed on to customers.

- Supplier Dependence: Reliance on a limited number of suppliers for critical components creates a risk if those suppliers experience their own operational issues.

Valuation Concerns

Heico Corporation's stock currently trades at a premium, with its price-to-earnings (P/E) ratio often exceeding industry averages. For instance, as of early 2024, HEICO's P/E ratio has been observed to be in the high 40s, significantly above the broader aerospace and defense sector average which typically sits in the low 20s. This elevated valuation, while signaling strong investor confidence in its future growth, also raises concerns about potential overvaluation.

The high P/E ratio suggests that investors are paying a premium for each dollar of Heico's earnings. While this can be justified by strong historical performance and optimistic future projections, it also means the stock might be more susceptible to price corrections if growth expectations are not met or if market sentiment shifts. This could limit short-term upside potential for investors.

- High P/E Ratio: Heico's P/E ratio often sits significantly above industry benchmarks, indicating a premium valuation.

- Investor Confidence vs. Overvaluation: While a high P/E reflects positive investor sentiment, it also carries the risk of the stock trading above its intrinsic value.

- Potential for Price Correction: An overvalued stock may experience sharper declines if growth targets are missed or market conditions change.

- Limited Short-Term Gains: The current valuation might cap immediate returns, as the stock price may need to align more closely with earnings growth.

HEICO's substantial reliance on the aerospace and defense sectors makes it vulnerable to market downturns and shifts in government spending. For instance, a slowdown in commercial aircraft manufacturing or reduced defense budgets directly impacts demand for HEICO's products and services. The company's fiscal year 2023 results, while showing growth in segments like the Electronic Technologies Group, still highlight this cyclical dependency.

The company's aggressive acquisition strategy, while a growth driver, introduces integration challenges. These include potential cultural clashes, system incompatibilities, and the risk of not realizing expected synergies, which are critical for justifying acquisition premiums. HEICO's fiscal year 2023 saw multiple acquisitions, each presenting unique integration complexities that can strain resources.

HEICO faces intense competition within the aerospace sector, where rivals may have greater brand recognition and more extensive product lines. This rivalry can pressure pricing and market share, particularly in specialized niches where design, technology, and customer loyalty are paramount.

Supply chain disruptions pose a significant weakness, with geopolitical instability and component shortages impacting production schedules and costs. For example, reliance on a limited number of suppliers for critical parts creates a bottleneck if those suppliers face operational issues.

HEICO's valuation, often characterized by a high price-to-earnings (P/E) ratio, frequently exceeding industry averages. As of early 2024, HEICO's P/E ratio has been noted in the high 40s, considerably higher than the aerospace and defense sector average in the low 20s. This premium valuation, while reflecting investor confidence, also signals a potential for overvaluation and increased stock price volatility if growth expectations aren't met.

| Weakness | Description | Impact | Example/Data Point |

| Sector Dependence | Heavy reliance on cyclical aerospace and defense markets. | Vulnerability to economic downturns and changes in government spending. | Fiscal Year 2023 revenue tied to these sectors. |

| Acquisition Integration Risk | Challenges in integrating acquired companies. | Potential for cultural clashes, system incompatibilities, and failure to achieve synergies. | Multiple acquisitions in Fiscal Year 2023. |

| Intense Competition | Operating in a highly competitive aerospace environment. | Pressure on pricing and market share, especially in niche segments. | Rivals with greater brand recognition and product breadth. |

| Supply Chain Vulnerability | Susceptibility to disruptions in complex supply chains. | Impacts production schedules, delivery times, and operational costs. | Geopolitical instability and component scarcity risks. |

| High Valuation | Premium P/E ratio compared to industry averages. | Risk of overvaluation, potential for price corrections if growth targets are missed. | P/E ratio in high 40s vs. sector average in low 20s (early 2024). |

Preview the Actual Deliverable

Heico Cos SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing a direct excerpt from the Heico Companies SWOT analysis, ensuring transparency and quality.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, gaining access to all strategic insights.

Opportunities

The aerospace and defense sector is booming, fueled by rising global defense spending and the ongoing modernization of military aircraft. This upturn is also supported by a strong recovery in commercial air travel, creating a fertile ground for HEICO's specialized components and services.

HEICO's Flight Support Group and Electronic Technologies Group are well-positioned to capitalize on this expansion, with significant demand anticipated for advanced technologies and essential aftermarket support. For instance, the U.S. Department of Defense's budget for fiscal year 2024 reached approximately $886 billion, indicating a substantial market for defense-related products.

The burgeoning air travel market, with its projected continued growth, directly fuels demand for aftermarket services and PMA parts. Airlines are increasingly focused on optimizing aircraft lifecycles, making cost-effective maintenance and component replacement crucial. HEICO's established expertise as a premier independent manufacturer of FAA-approved parts positions it to meet this rising need, offering airlines significant savings compared to OEM alternatives.

The accelerating adoption of AI and advanced automation within the aerospace and defense sectors opens significant avenues for HEICO. These technologies are crucial for improving predictive maintenance, streamlining complex supply chains, and boosting overall operational efficiency. For instance, the global AI in aerospace market was valued at approximately $1.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating substantial growth potential for companies offering AI-driven solutions.

Strategic Acquisitions and Market Consolidation

HEICO's established expertise in acquiring and integrating businesses can fuel continued expansion by focusing on companies within aerospace, defense, and related high-reliability sectors. The company's track record demonstrates a capacity to identify and successfully integrate targets, thereby enhancing its market position and product offerings.

The aerospace and defense electronics landscape, particularly in certain niche segments, remains somewhat fragmented. This presents HEICO with opportunities to pursue strategic acquisitions, leading to market consolidation and a significant expansion of its market share. For instance, HEICO's fiscal year 2023 saw a substantial increase in its acquisition pipeline, reflecting this ongoing strategy.

- Acquisition-driven growth: HEICO's successful integration of acquired businesses has consistently contributed to revenue growth, with acquisitions playing a pivotal role in expanding its product and service portfolios in fiscal year 2023.

- Market consolidation potential: The fragmented nature of key markets allows HEICO to pursue consolidation, thereby increasing its competitive standing and operational efficiencies.

- Synergistic integration: HEICO's proven ability to achieve synergies post-acquisition, both operationally and financially, makes it an attractive consolidator in its target industries.

Increased Defense Spending and Geopolitical Tensions

Ongoing geopolitical tensions are a significant tailwind for HEICO. Many nations are boosting their defense budgets, especially for advanced technologies like unmanned systems, next-generation air mobility, and robust cybersecurity solutions. This heightened demand directly benefits HEICO, as its specialized electronic equipment and components are critical for defense, space, and aerospace programs.

HEICO's exposure to this trend is substantial. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 emphasizes modernization, with significant allocations for advanced capabilities that align with HEICO's product portfolio. This strategic focus on upgrading military hardware worldwide translates into increased orders for HEICO's offerings.

- Increased Defense Budgets: Global defense spending is projected to continue its upward trajectory through 2025, driven by ongoing conflicts and strategic realignments.

- Demand for Advanced Technologies: HEICO's components are vital for the development and deployment of unmanned aerial vehicles (UAVs), electronic warfare systems, and secure communication networks.

- Aerospace Market Growth: Beyond defense, the broader aerospace sector, including commercial aviation, is also experiencing a recovery and expansion, further boosting demand for HEICO's aerospace products and services.

HEICO's strategic acquisitions continue to be a primary growth driver, with the company consistently integrating new businesses that expand its capabilities and market reach. This approach, evident in its fiscal year 2023 performance, allows HEICO to enter new niches and strengthen its position in existing ones. The fragmented nature of many aerospace and defense electronics markets also presents ongoing opportunities for HEICO to consolidate and gain market share through targeted acquisitions.

The increasing global demand for advanced aerospace and defense technologies, including AI-driven solutions and next-generation military hardware, directly benefits HEICO. As nations bolster their defense spending, particularly in areas like electronic warfare and unmanned systems, HEICO's specialized components and services become increasingly critical. This trend is supported by substantial increases in defense budgets, with the U.S. fiscal year 2025 budget request highlighting modernization efforts that align with HEICO's product offerings.

The recovery and continued growth in commercial air travel also present significant opportunities for HEICO's Flight Support Group. Airlines are prioritizing cost-effective maintenance and component replacement, making HEICO's FAA-approved PMA parts highly attractive alternatives to original equipment manufacturer components. This focus on lifecycle optimization within aviation creates a sustained demand for HEICO's aftermarket solutions.

Threats

Economic uncertainties and persistent inflationary pressures present a significant threat to HEICO Corporation. Rising costs for critical raw materials, such as specialty metals and advanced composites, directly impact HEICO's cost of goods sold, potentially squeezing profit margins. For instance, the Producer Price Index for raw materials in the aerospace sector saw notable increases throughout 2023 and into early 2024, a trend that could continue.

Furthermore, potential reductions or slower growth in government defense budgets, a consequence of broader economic belt-tightening driven by inflation, could dampen demand for HEICO's products and services. While the defense sector often shows resilience, prolonged inflationary periods can force governments to re-evaluate spending priorities, impacting HEICO's revenue streams.

Persistent supply chain inefficiencies and component shortages continue to plague the aerospace and defense industry, directly impacting HEICO's ability to fulfill orders. These ongoing disruptions can cause significant production delays and drive up manufacturing costs, potentially hindering HEICO's capacity to meet customer demand throughout 2024 and into 2025.

Original Equipment Manufacturers (OEMs) are increasingly looking to capture a larger share of the lucrative aftermarket parts business, which could put pressure on HEICO's pricing power and market standing. For instance, in 2024, several major aerospace OEMs announced expanded aftermarket service offerings, aiming to directly compete with independent repair providers.

The aerospace sector is also seeing a rise in new entrants, particularly those leveraging advanced manufacturing techniques like 3D printing for specialized parts. These companies, often unburdened by legacy structures, can introduce innovative solutions that challenge established players, potentially intensifying competition for HEICO in the coming years.

Labor Shortages and Workforce Challenges

The aerospace and defense sector, including companies like HEICO, continues to grapple with significant labor shortages, particularly for skilled technicians and engineers. This persistent challenge directly impacts production schedules and the ability to scale operations efficiently. For instance, reports from late 2023 and early 2024 highlighted a widening gap between the demand for specialized aerospace manufacturing talent and the available supply, leading to increased competition for qualified individuals.

These workforce challenges can hinder HEICO's growth trajectory and innovation efforts. A lack of sufficient skilled labor can slow down the development and manufacturing of new products or components, potentially impacting market share and competitive positioning. Furthermore, the increased costs associated with attracting and retaining this limited talent pool, through higher wages and benefits, directly affect HEICO's operational expenses and profitability margins.

- Skilled Labor Gap: Persistent difficulty in finding and keeping experienced aerospace technicians and engineers.

- Production Bottlenecks: Shortages can lead to delays in manufacturing and delivery of critical components.

- Increased Labor Costs: Competition for talent drives up wages and benefits, impacting profitability.

- Innovation Constraints: Limited availability of specialized talent can slow down research and development cycles.

Regulatory and Certification Changes

HEICO's position as a manufacturer of FAA-approved parts means it operates under intense regulatory scrutiny. Any shifts in aviation regulations, certification procedures, or defense purchasing strategies could significantly affect its business, from how it develops products to its ability to reach customers. For instance, a new directive requiring more rigorous testing for aftermarket parts could increase HEICO's compliance costs and slow down product approvals, impacting its competitive edge.

These regulatory shifts often necessitate substantial investments in new processes, equipment, or personnel to ensure ongoing compliance. For example, a change in material traceability requirements could force HEICO to overhaul its supply chain management systems, a costly undertaking. The company must remain agile and prepared to adapt its operations to meet evolving standards, which can be a significant operational challenge.

- Increased Compliance Costs: New regulations can lead to higher expenses for testing, documentation, and quality control.

- Extended Product Development Cycles: Stricter certification processes may lengthen the time it takes to bring new parts to market.

- Market Access Restrictions: Failure to comply with updated regulations could limit HEICO's ability to sell its products in certain markets.

- Need for Continuous Investment: Ongoing adaptation to regulatory changes requires sustained capital expenditure.

The increasing focus by Original Equipment Manufacturers (OEMs) on capturing a larger share of the aftermarket parts business presents a direct threat, potentially impacting HEICO's pricing power and market standing. This trend was evident in 2024 as major aerospace OEMs expanded their aftermarket service offerings, aiming to compete more directly with independent repair providers.

New entrants leveraging advanced manufacturing, such as 3D printing, challenge established players like HEICO by offering innovative solutions, potentially intensifying competition. These agile companies, unburdened by legacy systems, could disrupt market dynamics in the coming years.

The persistent skilled labor gap in the aerospace and defense sector, particularly for technicians and engineers, directly impacts HEICO's production schedules and ability to scale operations. This shortage, highlighted by reports in late 2023 and early 2024, leads to increased competition for talent, driving up labor costs and potentially hindering innovation.

HEICO faces threats from evolving regulatory landscapes and increased compliance costs. Shifts in aviation regulations or defense purchasing strategies could necessitate significant investments in new processes or equipment, impacting product development cycles and market access.

SWOT Analysis Data Sources

This Heico Cos SWOT analysis is built upon a foundation of verified financial filings, comprehensive market research, and insightful expert commentary. These reliable sources ensure that our assessment is data-driven and provides accurate, actionable strategic insights.