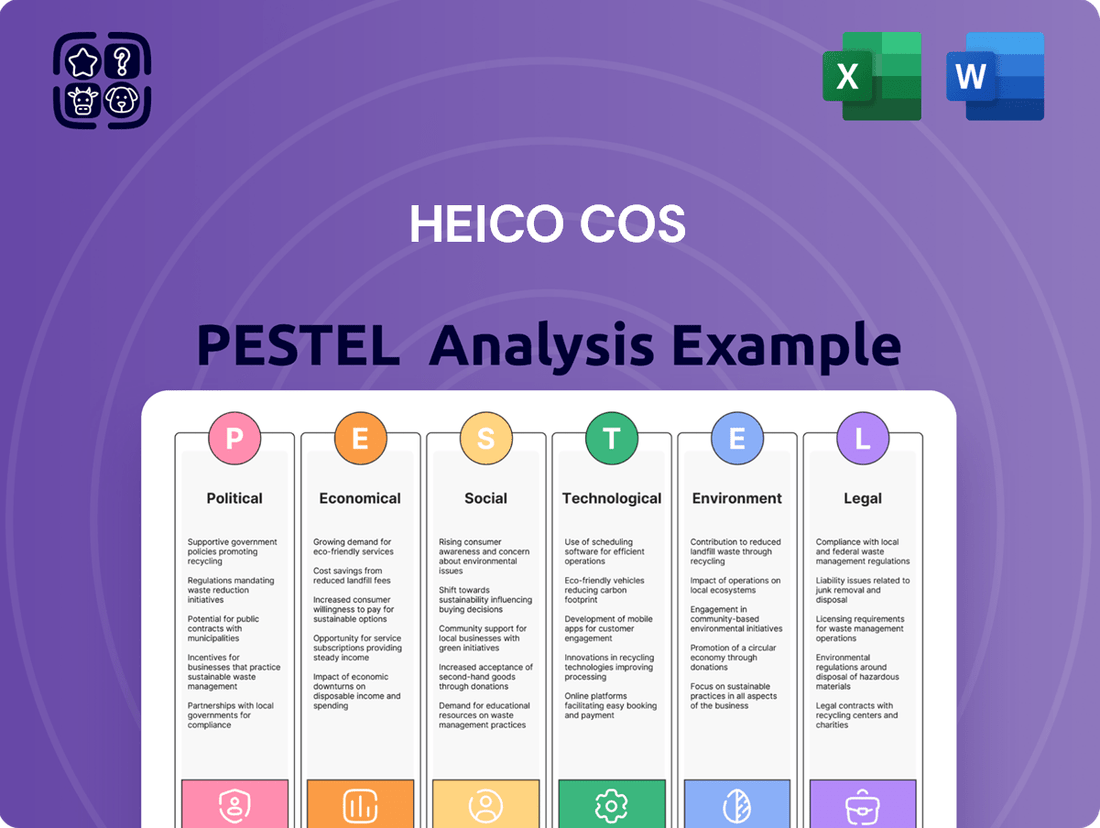

Heico Cos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heico Cos Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Heico Cos's trajectory. Our meticulously researched PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Make informed decisions and gain a competitive advantage—download the full analysis now!

Political factors

HEICO's Electronic Technologies Group's performance is closely tied to government defense spending. For instance, the U.S. Department of Defense's budget for fiscal year 2024 was approximately $886 billion, a significant figure that directly influences demand for HEICO's electronic components and systems.

Geopolitical shifts, such as ongoing global security concerns in 2024, often lead to adjustments in national defense priorities, impacting the allocation of funds and, consequently, the demand for HEICO's specialized products.

Changes in military procurement strategies or shifts in budget focus, which can occur annually, directly influence HEICO's revenue predictability and its strategic investment decisions within the defense industry.

The aerospace regulatory environment significantly impacts HEICO's Flight Support Group. The Federal Aviation Administration (FAA) imposes stringent rules on replacement parts, and any shifts in their certification procedures, safety benchmarks, or airworthiness directives directly influence HEICO's product innovation, production expenses, and ability to reach the market. For instance, in 2023, the FAA continued to emphasize enhanced oversight of aftermarket parts, requiring more rigorous testing and documentation, which can add to development timelines and costs for HEICO.

HEICO's extensive global footprint, encompassing both sourcing and distribution, is directly shaped by international trade policies. These agreements, along with any imposed tariffs, significantly influence the cost of components and the accessibility of markets for HEICO's diverse product lines.

Changes in trade relations, such as new import or export duties, can materially affect HEICO's raw material expenses and the price competitiveness of its offerings worldwide. For instance, in 2024, ongoing trade negotiations between major economic blocs could introduce new cost structures for imported materials critical to HEICO's manufacturing processes.

Furthermore, political tensions between nations can create substantial risks for HEICO, potentially leading to disruptions in its global supply chains. Such geopolitical instability might also result in restricted market access, impacting HEICO's ability to serve key customer bases or introduce new technologies.

Geopolitical Stability and Conflicts

Global geopolitical stability is a critical driver for HEICO's business, particularly impacting demand for defense products and the broader aerospace sector. Increased international tensions or conflicts can lead to higher defense spending, which directly benefits HEICO's Electronic Technologies Group (ETG). For instance, the ongoing geopolitical realignments observed through 2024 and into 2025 have seen many nations increase their defense budgets, a trend that supports ETG's revenue streams.

However, these same geopolitical events can create significant challenges. Disruptions to global supply chains, as seen with various regional conflicts in late 2023 and continuing into 2024, can impact HEICO's ability to source components for both its ETG and Flight Support Group (FSG) segments. Furthermore, instability can curtail commercial air travel, a key market for FSG, as seen by fluctuating passenger demand linked to global events.

- Defense Spending Growth: Global military expenditures were projected to exceed $2.4 trillion in 2024, a significant increase driven by geopolitical instability, directly benefiting HEICO's defense-related segments.

- Supply Chain Vulnerabilities: Events in regions such as Eastern Europe and the Middle East have highlighted the fragility of global aerospace supply chains, potentially increasing lead times and costs for HEICO's components.

- Commercial Aviation Impact: While recovering, the commercial aviation market's resilience remains sensitive to geopolitical shocks, influencing demand for HEICO's aftermarket services and parts.

Government Procurement Processes

Government procurement processes are a critical element for HEICO's defense segment. The efficiency and transparency of these systems directly influence HEICO's capacity to win new contracts and sustain its existing customer base. For instance, the U.S. Department of Defense, a major client, awarded over $700 billion in contracts in fiscal year 2023, highlighting the sheer volume and importance of these processes.

Any inefficiencies, such as extended timelines for contract awards or frequent alterations to bidding specifications, can pose significant challenges. HEICO's ability to secure new defense contracts in 2024 and beyond hinges on its adeptness at navigating these often complex bureaucratic landscapes. This necessitates strategic investment in government relations and a dedicated focus on compliance with evolving procurement regulations.

- Defense Contract Spending: The U.S. Department of Defense's contract obligations reached approximately $730 billion in FY2024, underscoring the market size.

- Procurement Reform Initiatives: Ongoing efforts to streamline defense procurement, such as the Biden administration's focus on faster acquisition, could impact HEICO's bid timelines.

- Supplier List Dynamics: Changes to approved supplier lists by agencies like the U.S. Air Force can directly affect HEICO's eligibility for specific bids.

- Regulatory Compliance Costs: Adhering to complex procurement rules can add overhead, with companies often dedicating significant resources to ensure compliance.

Government defense spending remains a primary political driver for HEICO, with global military budgets showing upward trends. For example, the U.S. Department of Defense's budget for fiscal year 2024 was approximately $886 billion, directly impacting demand for HEICO's electronic components. Geopolitical shifts in 2024 and into 2025 continue to influence national defense priorities, affecting HEICO's revenue streams and strategic planning within the defense sector.

Regulatory frameworks, particularly in aerospace, significantly shape HEICO's operations. The FAA's stringent rules on replacement parts, including enhanced oversight of aftermarket parts in 2023 requiring more rigorous testing, directly influence HEICO's product development costs and market access. Changes in these regulations can alter production expenses and innovation timelines.

International trade policies and geopolitical stability are crucial for HEICO's global supply chains and market access. Tariffs and trade relations, such as ongoing negotiations between major economic blocs in 2024, affect component costs and market competitiveness. Geopolitical tensions can lead to supply chain disruptions, impacting HEICO's ability to source materials and serve key markets.

| Factor | 2024/2025 Data/Trend | Impact on HEICO |

| Defense Spending | Global military expenditures projected over $2.4 trillion in 2024; U.S. DoD FY2024 budget ~$886 billion. | Increased demand for HEICO's Electronic Technologies Group (ETG) products. |

| Aerospace Regulations | Continued FAA emphasis on enhanced oversight of aftermarket parts (2023); potential for stricter certification procedures. | Increased product development costs and timelines for Flight Support Group (FSG); necessitates robust compliance. |

| Geopolitical Stability | Heightened global security concerns influencing national defense budgets; supply chain vulnerabilities highlighted by regional conflicts. | Supports ETG revenue but poses risks to FSG due to potential impacts on commercial air travel and supply chain disruptions. |

| Government Procurement | U.S. DoD contract obligations ~ $730 billion in FY2024; focus on procurement reform. | Efficiency and transparency of procurement processes affect HEICO's contract wins; navigating complex regulations is key. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Heico Cos, providing a comprehensive overview of the external forces shaping its operational landscape and strategic direction.

A clear, actionable PESTLE analysis for Heico Cos that highlights external factors impacting their business, providing relief by enabling proactive strategy development and risk mitigation.

Economic factors

Global economic growth directly impacts HEICO's performance, particularly in its Flight Support Group. A robust global economy in 2024 and projected for 2025 typically translates to higher passenger and cargo volumes, enhancing airline profitability and their capacity for capital investment in new aircraft and aftermarket services, which benefits HEICO.

Conversely, economic slowdowns or recessions can curb airline spending on new equipment and maintenance, and also put pressure on defense budgets. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for both 2024 and 2025, indicating a generally supportive, albeit moderate, economic environment for HEICO's diverse markets.

Rising inflation in 2024 and 2025 continues to exert upward pressure on raw material, labor, and energy costs, directly impacting HEICO's manufacturing expenses. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase throughout 2024, indicating higher input costs across industries.

As a producer of complex aerospace and electronic components, HEICO is particularly exposed to price volatility in specialized metals like titanium and aluminum, advanced composites, and critical electronic components. Fluctuations in global commodity markets, driven by supply chain disruptions and geopolitical events, directly affect these material prices.

Effectively managing these input costs through strategic procurement, long-term supplier agreements, and judicious price adjustments on its products is paramount for HEICO to maintain healthy profit margins in the current economic climate. The company's ability to pass on increased costs will be a key determinant of its financial performance.

The commercial aviation industry's economic health is a critical driver for HEICO's Flight Support Group. Airline profitability, directly influenced by passenger demand and operational costs like fuel prices, dictates their capacity for investment in fleet maintenance and upgrades. For instance, in 2024, global passenger traffic was projected to reach 95% of pre-pandemic levels, signaling a strong recovery and increased demand for replacement parts.

Fleet utilization rates also play a significant role; higher utilization means more flight hours, which in turn increases the wear and tear on aircraft components, boosting the market for FAA-approved replacement parts. As airlines aim to optimize their fleets, the demand for HEICO's cost-effective solutions for both new and aging aircraft continues to grow, with industry forecasts suggesting continued fleet expansion through 2025.

Interest Rates and Capital Access

Changes in interest rates directly impact HEICO's cost of capital. For instance, if the Federal Reserve raises the federal funds rate, HEICO's borrowing costs for new projects or acquisitions will likely increase. This could make it more expensive for them to finance expansion efforts or acquire new businesses, potentially affecting their growth trajectory.

Higher interest rates can also dampen overall economic activity. This means consumers and businesses might reduce their spending on discretionary items, which could translate to lower demand for HEICO's products and services. For example, a slowdown in commercial aviation, a key market for HEICO, could be exacerbated by higher borrowing costs for airlines.

- Impact on Borrowing: HEICO's ability to secure financing for capital expenditures, such as new manufacturing facilities or technology upgrades, is directly tied to prevailing interest rates.

- Acquisition Costs: Higher interest rates increase the cost of debt financing, making potential acquisitions more expensive and potentially impacting HEICO's inorganic growth strategy.

- Market Demand: Broader economic effects of interest rate policies, like reduced consumer spending or slower business investment, can decrease demand for HEICO's aerospace and electronics products.

- Financing for Customers: For HEICO's customers, particularly airlines, higher interest rates can make it more costly to finance aircraft purchases, indirectly affecting demand for HEICO's components and services.

Supply Chain Stability and Costs

The stability and cost-efficiency of HEICO's supply chain are critical, especially considering its need for specialized components in demanding industries like aerospace and defense. Economic downturns, geopolitical tensions, or logistical snags can directly impact HEICO by causing shortages of essential materials, driving up shipping expenses, and delaying production schedules.

For instance, the global semiconductor shortage experienced in 2021-2023 significantly affected manufacturing across many sectors, including aerospace, due to the reliance on these components. HEICO's proactive approach to managing these economic factors involves cultivating relationships with a broad base of suppliers and implementing strong inventory control measures to buffer against potential disruptions.

HEICO's commitment to supply chain resilience is evident in its strategic sourcing and inventory management. The company aims to mitigate economic risks through diversification and careful planning, ensuring it can continue to meet the high-reliability demands of its clientele. This focus is crucial for maintaining operational continuity and profitability in a volatile economic landscape.

- Supplier Diversification: HEICO actively seeks multiple suppliers for critical components to reduce reliance on any single source, a strategy that proved vital during the widespread supply chain disruptions of 2022.

- Inventory Management: Maintaining strategic inventory levels allows HEICO to absorb short-term shocks, such as unexpected spikes in raw material costs or shipping delays, ensuring production continuity.

- Cost Control: HEICO continuously monitors and negotiates pricing with suppliers to manage the impact of inflation and fluctuating commodity prices, aiming for cost-efficiency in its operations.

- Logistics Optimization: The company invests in optimizing its logistics network to reduce transportation costs and improve delivery times, a key factor given the global nature of its supply chain.

Global economic growth directly impacts HEICO's performance, particularly in its Flight Support Group. A robust global economy in 2024 and projected for 2025 typically translates to higher passenger and cargo volumes, enhancing airline profitability and their capacity for capital investment in new aircraft and aftermarket services, which benefits HEICO.

Rising inflation in 2024 and 2025 continues to exert upward pressure on raw material, labor, and energy costs, directly impacting HEICO's manufacturing expenses. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase throughout 2024, indicating higher input costs across industries.

Changes in interest rates directly impact HEICO's cost of capital and can dampen overall economic activity, potentially reducing demand for HEICO's products and services.

The stability and cost-efficiency of HEICO's supply chain are critical, with economic downturns or logistical snags impacting material availability and shipping expenses.

Same Document Delivered

Heico Cos PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Heico Cos PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Heico Cos operates within.

Sociological factors

HEICO's reliance on specialized talent, such as aerospace engineers and advanced manufacturing technicians, makes skilled labor availability a critical sociological factor. The demand for these professionals often outstrips supply, particularly in rapidly evolving sectors.

Data from the U.S. Bureau of Labor Statistics projected a 5% growth in aerospace engineers between 2022 and 2032, a rate faster than the average for all occupations. This heightened demand, coupled with an aging workforce in some technical fields, can create significant recruitment hurdles for companies like HEICO.

Shortages of qualified personnel directly impact HEICO by potentially driving up labor costs, extending hiring timelines, and even constraining production output or the pace of new product development. In 2024, many advanced manufacturing sectors reported difficulty filling roles requiring specialized certifications.

The aerospace and defense sectors are grappling with an aging workforce, a trend that presents a significant risk of losing invaluable institutional knowledge and decades of hands-on experience. For HEICO, this demographic shift necessitates proactive measures to ensure continuity and expertise. For instance, the U.S. Bureau of Labor Statistics reported that in 2023, nearly 20% of aerospace engineers were aged 55 and over, highlighting the urgency of this issue.

To counter this, HEICO must prioritize robust knowledge transfer initiatives, including comprehensive mentorship programs that pair seasoned professionals with emerging talent. Effective succession planning is also paramount to identify and groom future leaders, ensuring critical roles are filled by individuals equipped with the necessary skills and understanding. This proactive approach is vital for maintaining HEICO's competitive edge and operational excellence.

Furthermore, HEICO's long-term sustainability hinges on its ability to attract and retain younger generations of skilled workers. This involves fostering a culture of continuous learning and development, offering competitive compensation and benefits, and showcasing the exciting and impactful nature of careers in aerospace and defense. By investing in its future workforce, HEICO can effectively navigate the challenges posed by an aging demographic.

Public perception of the defense and aviation sectors significantly shapes HEICO's brand image and its capacity to draw skilled professionals. Negative public sentiment, often stemming from concerns about ethical sourcing in defense or the environmental footprint of aviation, can impact HEICO's reputation.

For instance, a 2024 survey indicated that 55% of consumers consider a company's ethical practices when making purchasing decisions, a trend that extends to talent acquisition in industries perceived as sensitive.

HEICO's commitment to responsible business practices, including transparent supply chains and environmental sustainability initiatives, is therefore crucial for fostering positive stakeholder relations and mitigating reputational risks.

Demand for Air Travel

Societal demand for air travel is a crucial, albeit indirect, driver for HEICO's Flight Support Group (FSG). As global middle-class populations expand, particularly in emerging economies, the desire for travel increases, leading to greater airline operations. For instance, the International Air Transport Association (IATA) projected that global air passenger traffic could reach 4.7 billion in 2024, a significant increase from pre-pandemic levels, directly translating to higher demand for aircraft maintenance and parts that HEICO provides.

Shifts in consumer preferences and travel habits also play a role. A growing interest in leisure travel and business connectivity fuels airline capacity expansion, which in turn benefits HEICO's aftermarket services. Conversely, any erosion of public confidence in air safety, perhaps due to high-profile incidents, could dampen travel demand and indirectly affect HEICO's FSG revenue streams.

- Growing Middle Class: The World Bank reported that the global middle class is expected to grow to over 5 billion people by 2030, a key demographic for air travel growth.

- Leisure Travel Trends: Post-pandemic, there's a noticeable surge in leisure travel bookings, with many airlines reporting strong demand for the 2024-2025 period.

- Business Travel Recovery: While still recovering, business travel is showing resilience, with projections indicating a return to near 2019 levels by late 2025 for some regions.

Corporate Social Responsibility (CSR)

Societal expectations for Corporate Social Responsibility (CSR) are increasingly shaping HEICO's operational landscape. This involves a focus on ethical labor practices, active community engagement, and transparent governance. For instance, in 2024, a significant portion of consumers indicated a willingness to pay more for products from companies with strong CSR commitments, with some studies showing this figure approaching 70% in developed markets.

Adherence to robust CSR standards can bolster HEICO's brand image, attract investors focused on Environmental, Social, and Governance (ESG) criteria, and positively impact employee morale. Conversely, a lapse in CSR could result in reputational harm and criticism from various stakeholders, including customers and investors. Companies that actively report on their CSR initiatives often see better access to capital, with ESG-focused funds growing substantially, reaching trillions globally by 2024.

- Ethical Labor: Ensuring fair wages and safe working conditions throughout the supply chain.

- Community Engagement: Investing in local communities through philanthropic efforts or job creation.

- Transparent Governance: Maintaining clear and ethical decision-making processes and reporting.

- Environmental Stewardship: Minimizing ecological impact and promoting sustainable practices.

The availability of specialized talent is a critical sociological factor for HEICO, as the demand for aerospace engineers and advanced manufacturing technicians often outpaces supply. For example, the U.S. Bureau of Labor Statistics projected a 5% growth in aerospace engineers between 2022 and 2032, indicating a competitive hiring landscape.

An aging workforce in technical fields presents a risk of knowledge loss, with nearly 20% of U.S. aerospace engineers being 55 and over in 2023, necessitating robust knowledge transfer programs. Public perception also significantly influences HEICO's brand and ability to attract talent, with 55% of consumers considering ethical practices in 2024.

Societal demand for air travel, driven by a growing global middle class and leisure travel trends, directly benefits HEICO's Flight Support Group. The International Air Transport Association projected global air passenger traffic to reach 4.7 billion in 2024, underscoring increased demand for HEICO's services.

Corporate Social Responsibility (CSR) is increasingly important, with many consumers willing to pay more for products from companies with strong CSR commitments. Companies actively reporting on CSR initiatives benefit from better access to capital, as ESG-focused funds globally reached trillions by 2024.

| Sociological Factor | Impact on HEICO | Supporting Data (2023-2025) |

|---|---|---|

| Skilled Labor Availability | Recruitment challenges, increased labor costs | 5% projected growth for aerospace engineers (2022-2032); difficulty filling specialized roles in advanced manufacturing (2024) |

| Demographics (Aging Workforce) | Risk of knowledge loss, need for succession planning | ~20% of aerospace engineers aged 55+ (2023) |

| Public Perception & Ethics | Brand image, talent attraction, reputational risk | 55% of consumers consider ethical practices (2024 survey) |

| Travel Demand (Societal) | Revenue driver for Flight Support Group | 4.7 billion projected air passengers (2024); strong leisure travel demand (2024-2025) |

| Corporate Social Responsibility (CSR) | Brand enhancement, investor attraction, employee morale | Consumers willing to pay more for CSR-committed products; trillions in ESG funds (2024) |

Technological factors

Continuous innovation in aerospace materials, such as advanced composites and high-strength alloys, directly benefits HEICO's Flight Support Group by enabling the creation of more efficient and durable replacement parts. These material advancements can lead to lighter aircraft components, potentially reducing fuel consumption and maintenance needs.

The development of new manufacturing techniques, like additive manufacturing (3D printing) for aerospace components, allows for complex geometries and on-demand part production, which HEICO can leverage to expand its product portfolio and service offerings. For instance, the global aerospace materials market was valued at approximately USD 25.5 billion in 2023 and is projected to grow significantly.

The ongoing trend of electronics miniaturization and integration significantly impacts HEICO's Electronic Technologies Group. This push for smaller, more powerful, and energy-efficient components is vital for advancements in defense, space exploration, and medical devices, markets where HEICO is a key player. For instance, the defense sector's demand for lighter, more compact avionics systems, like those found in advanced fighter jets or unmanned aerial vehicles, directly benefits from this technological shift.

HEICO must continuously invest in cutting-edge design and manufacturing techniques to remain competitive. The global semiconductor market, a foundational element for miniaturization, saw significant growth, with revenue projected to reach over $600 billion in 2024. Staying ahead in developing sophisticated, integrated electronic solutions, such as advanced sensor arrays or compact communication modules, is essential for HEICO to meet the evolving needs of its high-tech customer base.

HEICO, as a key supplier of electronic equipment for defense and high-reliability industries, confronts substantial cybersecurity risks. Protecting its valuable intellectual property, sensitive manufacturing data, and confidential customer information from increasingly sophisticated cyber threats is absolutely critical for maintaining trust and operational integrity.

The company's technological strategy must therefore prioritize significant investment in advanced cybersecurity infrastructure and protocols. This includes implementing multi-layered defenses, continuous monitoring, and rapid response capabilities to mitigate potential breaches.

Furthermore, HEICO's commitment to developing secure-by-design products is a crucial technological imperative. This proactive approach ensures that security is embedded into the very architecture of their electronic systems from the initial development stages, reducing vulnerabilities and enhancing overall resilience against cyberattacks.

Automation and Additive Manufacturing

The increasing adoption of automation and additive manufacturing is poised to significantly impact HEICO's production capabilities. These advanced technologies, including robotics and 3D printing, offer the potential to streamline operations, minimize material waste, and facilitate the creation of intricate designs. This integration is crucial for achieving operational excellence and maintaining a competitive edge.

By embracing these manufacturing advancements, HEICO can anticipate several key benefits:

- Enhanced Efficiency: Automation can accelerate production cycles, allowing for higher output volumes.

- Cost Reduction: Optimized processes and reduced material waste contribute to lower manufacturing costs.

- Product Innovation: Additive manufacturing enables the production of complex geometries previously unachievable, fostering new product development.

- Faster Time-to-Market: Streamlined development and production cycles can shorten the time it takes to bring new products to customers.

The global market for industrial automation is projected to reach approximately $300 billion by 2025, indicating a strong industry trend towards increased adoption. Similarly, the additive manufacturing market is expected to see substantial growth, with some estimates suggesting it could reach over $50 billion by 2027, underscoring its growing importance in manufacturing sectors.

Emerging Aircraft and Space Technologies

The aerospace sector is witnessing rapid innovation, with electric vertical takeoff and landing (eVTOL) aircraft and next-generation military jets poised to reshape air travel and defense. HEICO must stay abreast of these developments, as they create demand for new components and MRO services. For instance, the eVTOL market, projected to reach $30 billion by 2030 according to some industry forecasts, will require specialized electrical systems and lightweight materials.

Advancements in space exploration, including the growth of commercial spaceflight and expansive satellite constellations, also present significant opportunities. Companies like SpaceX and Blue Origin are driving down launch costs, making space more accessible. HEICO's ability to supply critical components for these burgeoning space ventures, potentially tapping into a market segment that could exceed hundreds of billions in the coming decade, will be key to its future growth.

HEICO's strategic response to these technological shifts involves continuous monitoring and adaptation of its product lines. Ensuring compatibility with evolving industry standards, such as those for advanced avionics and propulsion systems in both aircraft and spacecraft, is paramount. This proactive approach allows HEICO to capitalize on emerging trends and maintain its competitive edge.

- eVTOL Market Growth: Forecasts suggest the eVTOL market could reach $30 billion by 2030, requiring new component suppliers.

- Space Exploration Investment: Global investment in space exploration and commercialization is rapidly increasing, creating new revenue streams.

- Technological Integration: HEICO must ensure its offerings are compatible with future aerospace and space industry standards.

- MRO Demand: New aircraft and spacecraft platforms will drive demand for specialized maintenance, repair, and overhaul services.

Technological advancements in aerospace materials, such as advanced composites, are crucial for HEICO's Flight Support Group, enabling lighter and more durable aircraft parts. The ongoing miniaturization of electronics significantly impacts HEICO's Electronic Technologies Group, driving demand for smaller, more powerful components in defense, space, and medical sectors.

The increasing adoption of automation and additive manufacturing offers HEICO opportunities for enhanced efficiency, cost reduction, and product innovation. HEICO must also address substantial cybersecurity risks by investing in robust infrastructure and secure-by-design principles.

Emerging trends like eVTOL aircraft and commercial spaceflight present new markets for HEICO's components and MRO services, requiring continuous adaptation to evolving industry standards.

| Technology Area | Impact on HEICO | Market Data/Outlook |

|---|---|---|

| Advanced Materials | Lighter, more durable aircraft parts | Aerospace materials market valued at ~$25.5 billion in 2023 |

| Electronics Miniaturization | Demand for smaller, integrated components | Global semiconductor market revenue projected over $600 billion in 2024 |

| Automation & Additive Manufacturing | Increased efficiency, reduced costs, product innovation | Industrial automation market projected ~$300 billion by 2025; Additive manufacturing market potentially >$50 billion by 2027 |

| eVTOL & Space Exploration | New component and MRO opportunities | eVTOL market forecast ~$30 billion by 2030; Growing investment in commercial spaceflight |

Legal factors

HEICO's Flight Support Group operates under the watchful eye of the FAA, a critical legal factor. This means every replacement part they design and manufacture must meet rigorous standards for safety and reliability. Failure to comply with these FAA regulations, including airworthiness directives and quality assurance protocols, isn't just a minor inconvenience; it can lead to substantial financial penalties and even halt operations, directly impacting HEICO's ability to serve the aviation market.

HEICO's Electronic Technologies Group navigates a complex legal landscape shaped by ITAR and export control regulations. These laws dictate the handling and transfer of defense-related technologies, making strict adherence paramount. Failure to comply can result in substantial fines and the revocation of export licenses.

In 2023, the U.S. Department of State, which oversees ITAR, continued to emphasize enforcement, with significant penalties levied against companies for violations. HEICO's commitment to robust internal compliance programs is therefore crucial for mitigating these risks and ensuring continued operation in the defense sector.

Protecting HEICO's vast intellectual property, encompassing patents, trademarks, and trade secrets, is paramount to maintaining its competitive edge. These legal protections are the bedrock upon which HEICO builds its market position, safeguarding its innovative designs and proprietary manufacturing techniques.

The legal frameworks governing intellectual property rights provide HEICO with the essential tools to defend its innovations. For instance, in 2023, HEICO reported significant investments in research and development, underscoring the value of these IP assets.

Vigorous enforcement of these rights against any infringement is not just a legal necessity but a strategic imperative. This protects HEICO's substantial R&D investments and its hard-won market share, ensuring continued profitability and growth.

Product Liability and Safety Standards

HEICO operates within sectors where product liability is a critical legal factor. Adherence to stringent safety standards is paramount to prevent failures that could result in accidents or injuries, particularly in aerospace and defense. For instance, the Federal Aviation Administration (FAA) mandates extensive testing and certification for aircraft components, a process HEICO actively engages in. In 2023, the aerospace industry saw a significant focus on supply chain integrity, with regulatory bodies like the FAA increasing scrutiny on part manufacturers to ensure compliance with safety directives.

Mitigating legal exposure from product liability claims necessitates robust quality control, comprehensive testing protocols, and strict compliance with industry-specific safety regulations. This proactive approach is essential for companies like HEICO. The company's commitment to quality is reflected in its operational efficiency, with a focus on minimizing defects and ensuring product reliability. Industry reports from 2024 highlight a trend of increased litigation related to product failures in high-risk industries, underscoring the importance of HEICO's rigorous compliance measures.

- Rigorous Compliance: HEICO must navigate product liability laws, especially critical in aerospace and defense.

- Safety Standards: Adherence to stringent safety standards is non-negotiable to prevent product failures and potential harm.

- Mitigation Strategies: Robust quality control, extensive testing, and regulatory compliance are key to reducing legal risks.

- Industry Focus: The FAA's increased oversight in 2023 on part manufacturers emphasizes the critical nature of HEICO's safety protocols.

Contract Law and Government Procurement

HEICO's substantial dealings with government entities and major corporations place it under the purview of intricate contract law and specific government procurement rules. Navigating these legal frameworks, which dictate everything from product specifications to how disagreements are settled, is absolutely essential for smooth operations. For instance, in the fiscal year 2023, HEICO reported that approximately 20% of its total sales were to U.S. government customers, highlighting the significant impact of these regulations on its business.

The company's ability to successfully secure and manage these agreements relies heavily on expert legal guidance. This ensures that all contractual obligations are met and that HEICO is protected against potential legal challenges. The complexity of these contracts often involves detailed clauses regarding intellectual property, performance standards, and payment terms, all of which require meticulous legal review and management.

- Contractual Compliance: Adherence to the terms of contracts with government and large corporate clients is paramount, impacting revenue recognition and operational execution.

- Procurement Regulations: HEICO must comply with various federal acquisition regulations (FAR) and other government-specific procurement policies, which can influence bidding processes and supply chain management.

- Dispute Resolution: The legal framework for resolving contract disputes is critical, as significant financial and reputational implications can arise from disagreements.

- Legal Counsel's Role: Expert legal advice is indispensable for negotiating favorable contract terms and ensuring ongoing compliance with evolving legal landscapes.

HEICO's operations are significantly influenced by international trade laws and sanctions, particularly concerning its global supply chains and export activities. Navigating these regulations, which can change rapidly, requires constant vigilance and expert legal interpretation to avoid penalties. For example, in late 2023 and into 2024, geopolitical shifts have led to increased scrutiny and new sanctions regimes impacting various industries, including aerospace and defense, which are core to HEICO's business.

Compliance with these international legal frameworks is crucial for maintaining market access and avoiding disruptions. HEICO's proactive approach to understanding and adhering to these evolving global legal standards is essential for its international business strategy. The company's ability to adapt to new trade restrictions and export controls directly impacts its ability to source materials and sell products globally.

The company's commitment to ethical business practices is also governed by various legal statutes, including anti-bribery and anti-corruption laws such as the Foreign Corrupt Practices Act (FCPA). Ensuring strict adherence to these laws is vital, especially for a company with a global footprint like HEICO. Violations can lead to severe financial penalties and reputational damage, underscoring the importance of robust compliance programs and ongoing training for employees involved in international dealings.

Environmental factors

Stricter emissions regulations for aviation, driven by global climate change concerns, are a significant environmental factor for HEICO. For instance, the European Union's 'Fit for 55' package aims to cut greenhouse gas emissions by 55% by 2030, impacting air travel within its airspace. This pressure on airlines to decarbonize necessitates a shift towards more fuel-efficient aircraft and the adoption of sustainable aviation fuels (SAF).

Consequently, HEICO’s customers, the airlines and aircraft manufacturers, are increasingly seeking components that enhance fuel efficiency and reduce their environmental footprint. This trend could boost demand for HEICO's lightweight composite materials and advanced aerodynamic solutions, aligning with the industry's push for sustainability. HEICO's ability to innovate and offer products that directly aid customers in meeting these stringent environmental compliance goals will be crucial for its future success.

Growing environmental awareness and stricter regulations are pushing HEICO to embrace sustainable manufacturing. This means focusing on reducing waste, using energy more efficiently, and handling hazardous materials with care across its operations.

For instance, in 2024, the aerospace industry, a key sector for HEICO, saw increased scrutiny on its carbon footprint, with many companies setting ambitious net-zero targets. HEICO's commitment to these practices can improve its public image and operational savings.

Adopting eco-friendly production methods not only aligns HEICO with global sustainability trends but also offers long-term benefits like reduced resource costs and enhanced brand value, crucial in today's market.

The availability and sustainable sourcing of raw materials, particularly specialized metals and rare earth elements crucial for HEICO's aerospace and electronics sectors, present significant environmental challenges. For instance, the Democratic Republic of Congo, a major source of cobalt used in batteries and electronics, faces ongoing scrutiny regarding mining practices and environmental impact, a factor HEICO must consider in its supply chain risk assessment.

Geopolitical tensions and increasingly stringent environmental regulations globally can disrupt supply chains and elevate material costs. For example, China's dominance in rare earth element production, coupled with potential export restrictions driven by environmental concerns or trade disputes, directly impacts the cost and accessibility of these vital components for HEICO's advanced manufacturing processes.

HEICO must proactively assess and manage the environmental footprint tied to its material procurement, including the energy intensity of extraction and processing. Reports from the European Environment Agency in 2024 highlighted the substantial carbon emissions associated with mining and refining critical raw materials, underscoring the need for HEICO to explore alternative materials or more sustainable sourcing partnerships.

Waste Management and Recycling

Effective waste management and recycling are paramount for HEICO, particularly considering its manufacturing operations. The company must ensure proper disposal of industrial byproducts and actively seek ways to minimize landfill waste. This involves exploring avenues for material recycling and repurposing, aligning with broader sustainability goals.

Compliance with evolving environmental waste regulations is non-negotiable for HEICO. Failure to adhere to these mandates can result in significant penalties and damage the company's reputation. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that industrial non-hazardous waste generation reached approximately 7.5 billion tons, highlighting the scale of the challenge and the importance of robust management systems.

- Industrial Waste Reduction: HEICO's manufacturing processes generate various industrial wastes that require careful handling and disposal according to strict environmental standards.

- Recycling Initiatives: The company is encouraged to implement and expand recycling programs for materials used in its production, such as metals, plastics, and packaging, to reduce its environmental footprint.

- Regulatory Compliance: Staying abreast of and complying with federal, state, and local waste management regulations is critical to avoid fines and maintain operational integrity.

- Circular Economy Opportunities: Exploring partnerships or internal processes to repurpose waste materials into new products or raw materials can offer both environmental and economic benefits.

Climate Change Impact on Operations

Extreme weather events and rising temperatures, direct consequences of climate change, pose a tangible threat to HEICO's operational infrastructure. These physical impacts could disrupt manufacturing processes at their facilities or strain supply chain logistics, potentially affecting customer service delivery. For instance, a severe hurricane in 2024 impacting a key supplier’s region could halt production lines, leading to significant delays.

HEICO must proactively assess and mitigate these climate-related risks. This includes developing robust business continuity plans to ensure operations can resume quickly after disruptive events. As of the latest reports in early 2025, companies across the aerospace and electronics sectors are increasingly investing in resilient infrastructure and diversified supply chains to counter these emerging environmental challenges.

Adapting to a changing climate is no longer just an environmental consideration; it's a strategic imperative for long-term viability. HEICO's ability to navigate these environmental shifts will be crucial for maintaining its competitive edge and ensuring sustained growth in the coming years.

- Physical Disruptions: Extreme weather events (floods, storms) can halt production or damage facilities.

- Supply Chain Vulnerability: Climate impacts on raw material sources or transportation routes can create significant bottlenecks.

- Business Continuity: Developing and testing plans to maintain operations during climate-related crises is essential.

- Strategic Adaptation: Integrating climate resilience into long-term business strategy is a growing necessity for companies like HEICO.

Stricter emissions regulations, like the EU's 'Fit for 55' aiming for a 55% greenhouse gas reduction by 2030, directly impact HEICO's airline customers, driving demand for fuel-efficient components. Growing environmental awareness also pushes HEICO towards sustainable manufacturing practices, focusing on waste reduction and energy efficiency, which can lead to operational savings and enhanced brand value.

The sourcing of critical raw materials, such as rare earth elements, presents environmental challenges due to mining impacts and potential supply chain disruptions, as highlighted by the European Environment Agency's 2024 reports on mining emissions. Furthermore, extreme weather events, a consequence of climate change, pose a physical risk to HEICO's operations and supply chains, necessitating robust business continuity plans.

| Environmental Factor | Impact on HEICO | Supporting Data/Trend (2024/2025) |

| Emissions Regulations | Increased demand for fuel-efficient products | EU's 'Fit for 55' targets significant aviation emission cuts. |

| Sustainable Manufacturing | Operational efficiency, cost savings, brand value | Aerospace sector setting net-zero targets in 2024. |

| Raw Material Sourcing | Supply chain risk, cost volatility | EEA reports on mining emissions in 2024. |

| Climate Change/Extreme Weather | Operational and supply chain disruption risk | Increased investment in resilient infrastructure in early 2025. |

PESTLE Analysis Data Sources

Our Heico Cos PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the aerospace and defense industry.