Heico Cos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heico Cos Bundle

Uncover the strategic positioning of Heico Cos's product portfolio with this insightful BCG Matrix preview. See how each product stacks up as a Star, Cash Cow, Dog, or Question Mark, offering a glimpse into their market share and growth potential. For a comprehensive understanding and actionable strategies to optimize your investments, purchase the full BCG Matrix report today.

Stars

HEICO's Flight Support Group (FSG), especially its aftermarket replacement parts and repair services, strongly aligns with the characteristics of a Star in the BCG Matrix. This segment has demonstrated remarkable financial performance, evidenced by nineteen consecutive quarters of net sales growth. Specifically, Q2 fiscal 2025 saw a significant 19% increase in net sales compared to the prior year's second quarter, with 14% of that being organic growth.

The market outlook for commercial aircraft aftermarket parts is exceptionally robust, with projections indicating continued strong expansion. For 2025, revenue forecasts for this sector are anticipated to reach $89.2 billion, highlighting a high-growth industry. FSG's substantial market share within this expanding market, coupled with its consistent sales growth, firmly establishes its position as a Star.

Within HEICO's Electronic Technologies Group (ETG), defense and space electronic products exhibit strong Star characteristics. The ETG saw a significant 16% net sales increase in Q1 fiscal 2025, with 11% organic growth directly fueled by demand in these sectors.

The broader defense electronics market is poised for robust expansion, anticipated to reach $244.38 billion by 2025, growing at a 5.4% compound annual growth rate. Concurrently, the space electronics market is also experiencing a healthy upswing, projected to hit $2.8 billion in 2025 with a 6.5% CAGR.

HEICO's strategy of acquiring companies in burgeoning markets, such as business jet avionics repair, effectively places these new additions as potential Stars in a BCG matrix. The February 2025 acquisition of Millennium International, for example, significantly bolsters HEICO's presence in a rapidly expanding sector.

This strategic move enables HEICO to swiftly capture market share within these growing industries. By integrating acquired businesses, HEICO leverages its established expertise and resources to foster accelerated growth, turning acquired entities into significant contributors.

Products Addressing Modernization and Efficiency

HEICO's products that drive fleet modernization and boost operational efficiency are positioned for significant growth. The demand for cutting-edge avionics and aircraft parts is a key factor in the aviation industry's recovery, creating a robust market for these solutions.

HEICO's strategy of providing affordable, high-quality replacement parts and aftermarket support directly addresses airlines' needs for cost savings and improved performance. This focus makes their modernization and efficiency-focused offerings particularly appealing in today's competitive aviation landscape.

- Market Growth: The global aviation aftermarket is projected to reach over $100 billion by 2027, with modernization and efficiency solutions being a key driver.

- HEICO's Strength: HEICO reported a 16% increase in net sales for its Electronic Technologies Group in fiscal year 2023, largely driven by demand for advanced avionics.

- Cost-Effectiveness: Airlines are increasingly seeking cost-effective alternatives to original equipment manufacturer (OEM) parts, a segment where HEICO excels.

Niche, High-Reliability Solutions

HEICO's strength lies in its specialized, high-reliability solutions. These are crucial components for demanding sectors like aerospace and defense, where failure is not an option. This focus on niche markets with consistent demand for performance solidifies their position.

Their products are engineered for harsh environments, a testament to their reliability. This specialization caters to industries with enduring needs, such as aviation and space exploration. For instance, HEICO reported a 14% increase in net sales for fiscal year 2023, reaching $2.4 billion, driven by strong performance in these core areas.

- Niche Market Focus: HEICO targets specialized sectors like aerospace, defense, and space.

- High Reliability Engineering: Products are designed for mission-critical applications in harsh environments.

- Consistent Demand: These sectors require consistently high levels of performance and reliability.

- Growth Driver: This specialization in growing, high-demand markets contributes to their strong market position.

HEICO's Flight Support Group (FSG), particularly its aftermarket replacement parts and repair services, embodies the characteristics of a Star. This segment has shown consistent financial strength, with nineteen consecutive quarters of net sales growth. For instance, Q2 fiscal 2025 recorded a 19% surge in net sales compared to the prior year's second quarter, with 14% stemming from organic growth.

The market for commercial aircraft aftermarket parts is expanding rapidly, with revenue projected to reach $89.2 billion in 2025. FSG's significant market share in this growing sector, combined with its sustained sales increases, solidifies its Star status.

Similarly, HEICO's Electronic Technologies Group (ETG), focusing on defense and space electronics, displays strong Star attributes. The ETG achieved a 16% net sales increase in Q1 fiscal 2025, with 11% organic growth driven by demand in these critical areas.

| HEICO Segment | BCG Category | Key Growth Drivers | 2025 Market Projections | HEICO Performance Highlight |

| Flight Support Group (Aftermarket Parts & Repair) | Star | Demand for cost-effective parts, fleet modernization | Commercial Aircraft Aftermarket: $89.2 billion | 19% Net Sales Increase (Q2 FY25) |

| Electronic Technologies Group (Defense & Space Electronics) | Star | Defense spending, space exploration growth | Defense Electronics: $244.38 billion (5.4% CAGR) | 16% Net Sales Increase (Q1 FY25) |

What is included in the product

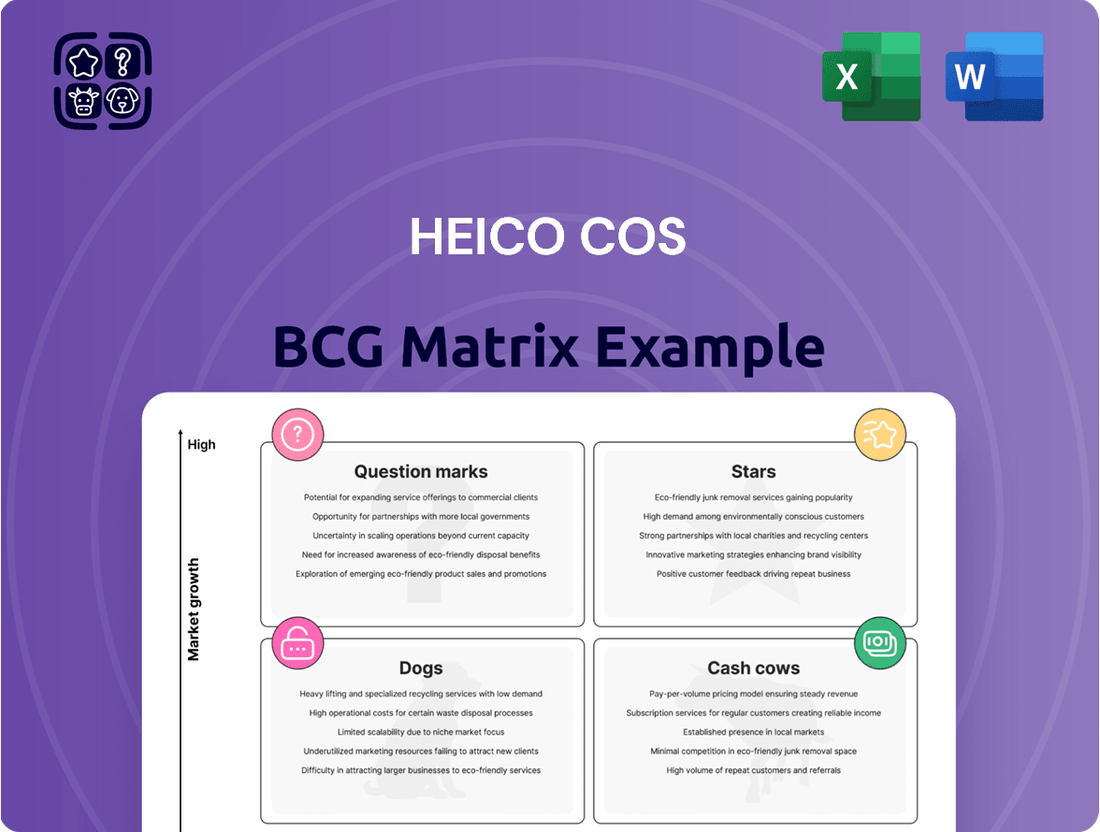

Heico Cos BCG Matrix analyzes product portfolio by market share and growth.

It guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

Heico Cos BCG Matrix provides a clear, visual roadmap to optimize resource allocation, alleviating the pain of inefficient investment decisions.

Cash Cows

HEICO's FAA-approved replacement parts for jet engines and aircraft components are a prime example of a Cash Cow. This segment benefits from a mature market where HEICO enjoys a dominant position, leading to consistent sales growth and high profitability.

These essential parts ensure the ongoing maintenance and operation of aircraft, creating a steady, reliable revenue stream. While growth might be slower, the high market share in this established sector solidifies its Cash Cow status.

HEICO's mature aircraft component repair and overhaul services are strong cash cows. These operations thrive in a stable, established market with consistent demand, providing a reliable source of significant cash flow for the company.

While the growth rate in this segment may not be as rapid as newer technologies, HEICO's deep expertise and high volume of repeat business ensure a dominant market share and robust profitability. For instance, HEICO's Performance Materials Group, which includes repair and overhaul, saw significant contributions to its overall performance in fiscal year 2023, reflecting the sustained strength of these mature offerings.

Certain legacy electronic equipment for defense, like HEICO's established radar systems or communication modules, can be classified as Cash Cows within the BCG Matrix. These products, often with long product lifecycles and secured through stable, multi-year government contracts, represent a consistent revenue stream for HEICO. For instance, HEICO's Electronic Technologies Group reported a 9% increase in net sales to $876.5 million in fiscal year 2023, with a significant portion likely attributable to these mature defense offerings.

Proven Power Conversion and Supply Products

Heico's established electrical power supplies and power conversion products, part of the Electronic Technologies Group, are classic examples of cash cows. These mature product lines serve as critical, stable components across diverse industries, ensuring consistent demand.

With Heico's deep-seated expertise and long history in these segments, they likely command a significant market share. This translates into dependable cash flow generation, even if growth prospects are more modest compared to newer ventures, reflecting high operational efficiency.

- Market Position: Likely strong market share in mature electrical power and conversion product segments.

- Demand Stability: Essential components across various industries ensure consistent, reliable demand.

- Cash Flow Generation: High efficiency and stable demand contribute to robust, predictable cash flow.

- Growth Prospects: Expected to have lower growth potential compared to newer, more innovative product lines.

Underwater Locator Beacons and EMI/RFI Shielding

Underwater locator beacons and EMI/RFI shielding products are likely Cash Cows for HEICO. These highly specialized items cater to niche but stable markets, such as aviation safety and sensitive electronics. Their critical nature and stringent regulatory compliance requirements often translate into high barriers to entry and, consequently, strong pricing power and healthy profit margins.

The consistent demand, coupled with HEICO's established market position and existing manufacturing capabilities, means these product lines typically require minimal reinvestment in marketing or product development to maintain their market share. This allows them to generate significant and predictable cash flows, which can then be redeployed to fund growth initiatives in other areas of the business.

- Niche Market Dominance: HEICO's expertise in specialized aerospace and electronics components positions them well in these niche segments.

- High Margins: Compliance, technical expertise, and specialized manufacturing contribute to robust profit margins.

- Stable Demand: Critical safety and performance applications ensure consistent, ongoing demand.

- Low Reinvestment Needs: Mature products with established customer bases require less capital for growth.

HEICO's established repair and overhaul services for aircraft components are a prime example of a Cash Cow. These operations benefit from a mature market with consistent demand, providing a reliable source of significant cash flow.

While growth may be slower, HEICO's deep expertise and high volume of repeat business ensure a dominant market share and robust profitability. For instance, HEICO's Performance Materials Group, which includes repair and overhaul, saw significant contributions to its overall performance in fiscal year 2023, reflecting the sustained strength of these mature offerings.

These services are crucial for maintaining aircraft fleets, creating a steady, predictable revenue stream that requires minimal new investment to sustain. This allows HEICO to leverage its established capabilities for consistent cash generation.

The consistent demand, coupled with HEICO's established market position and existing manufacturing capabilities, means these product lines typically require minimal reinvestment in marketing or product development to maintain their market share. This allows them to generate significant and predictable cash flows, which can then be redeployed to fund growth initiatives in other areas of the business.

| Segment | Product Type | BCG Category | Fiscal Year 2023 Net Sales (Millions USD) | Key Characteristic |

|---|---|---|---|---|

| Performance Materials Group | Aircraft Component Repair & Overhaul | Cash Cow | N/A (Part of larger segment) | Mature market, high repeat business, stable demand |

| Electronic Technologies Group | Legacy Defense Electronics | Cash Cow | $876.5 (Group total) | Long product lifecycles, stable government contracts |

| Electronic Technologies Group | Electrical Power Supplies & Conversion | Cash Cow | $876.5 (Group total) | Essential components, diverse industry use, consistent demand |

Delivered as Shown

Heico Cos BCG Matrix

The Heico Cos BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally crafted strategic tool ready for immediate application. You are seeing the exact final version, enabling you to assess its quality and relevance before committing. This comprehensive BCG Matrix report is designed to provide clear, actionable insights for your business planning and competitive analysis.

Dogs

Underperforming legacy products with declining demand, often found in mature or shrinking markets, would be classified as Dogs within HEICO Corporation's BCG Matrix. These offerings, characterized by low sales growth and market share, demand significant resources for upkeep but generate minimal returns. For instance, a legacy avionics component facing obsolescence due to technological advancements and a dwindling customer base exemplifies such a product.

HEICO's portfolio might include highly commoditized parts or services if they offer standard, interchangeable components with minimal unique features. These would likely face intense price pressure from numerous competitors, making it challenging to command premium pricing or achieve substantial profit margins. For instance, if HEICO were to supply very basic, widely available aircraft fasteners or simple maintenance kits without any proprietary technology or specialized service, these could fall into this category.

Products facing rapid technological obsolescence, such as older avionics systems or legacy communication hardware, could be classified as Dogs in HEICO's BCG Matrix. For instance, if HEICO has not proactively invested in developing or acquiring next-generation alternatives to its existing radar systems, these could quickly lose market relevance. This is particularly true in aviation where advancements in digital avionics and AI-driven navigation are constant.

Segments with High Overhead and Minimal Strategic Value

HEICO's portfolio might include business units or product lines demanding significant operational, manufacturing, or sales overhead, yet offering little in terms of revenue contribution or strategic importance. These segments can drain valuable resources that would be more effectively deployed in areas with higher growth potential or better profit margins. Identifying and addressing these "Dogs" is crucial for optimizing resource allocation and enhancing overall company performance.

For instance, if a particular legacy product line requires extensive, specialized manufacturing facilities and a dedicated sales team, but its sales volume has been declining and it doesn't align with HEICO's future technology focus, it would fit this category. Such a segment might represent a substantial portion of operational costs without yielding commensurate returns. An efficiency review could pinpoint these areas, potentially leading to divestiture or restructuring to free up capital and management attention.

- Segments with High Overhead and Minimal Strategic Value: These are business units that consume significant resources but contribute little to HEICO's overall financial health or long-term strategic goals.

- Resource Drain: Such segments can tie up capital, personnel, and management focus that could be better utilized in higher-potential areas of the business.

- Efficiency Review Focus: Identifying these "Dogs" is a key outcome of operational efficiency assessments, aiming to streamline the business portfolio.

- Potential Actions: Strategies for these segments might include divestiture, consolidation, or a strategic overhaul to either improve performance or exit the market.

Limited or Niche Offerings in Stagnant Markets

Limited or niche offerings in stagnant markets often fall into the Dogs category of the BCG Matrix. These are typically small, highly specialized products or services that serve a very restricted customer base in a market that isn't growing or is even shrinking. For HEICO, if they possess only a minor share of these niche segments, the resources dedicated to maintaining these offerings might not yield sufficient returns, making them prime candidates for divestiture or a substantial reduction in operational scale.

For instance, consider a specialized aerospace component that HEICO manufactures. If the overall aerospace market for that specific component has seen a decline, perhaps due to technological obsolescence or a shift in manufacturing, and HEICO's market share within that niche is below 10%, it would likely be classified as a Dog. In 2023, HEICO's Electronic Technologies Group, which includes many specialized offerings, reported a 10% increase in revenue to $1.2 billion, but the profitability of individual niche products within that segment would need careful scrutiny to determine their BCG status.

- Niche Market Share: HEICO's percentage of sales within the specific, limited market segment.

- Market Growth Rate: The annual percentage change in demand for that particular niche offering.

- Profitability Analysis: The net profit generated by the niche product relative to its operational costs.

- Strategic Fit: How well the niche offering aligns with HEICO's broader business strategy and future growth plans.

Dogs in HEICO's portfolio represent products or business units with low market share in slow-growing or declining industries. These offerings typically require substantial investment to maintain but yield minimal returns, acting as a drain on resources. For example, a legacy component for an older aircraft model with diminishing flight hours would fit this description.

These underperforming assets can hinder overall profitability and strategic focus. HEICO's strategy likely involves minimizing investment in these areas and exploring options like divestiture or consolidation. In 2023, while HEICO's overall revenue grew, careful analysis of individual product lines is essential to identify and manage these "Dog" segments effectively.

For instance, if a specific product line within HEICO's aerospace materials segment serves a niche market that has seen a consistent 5% annual decline in demand over the past three years, and HEICO holds only a 5% market share, it would be a prime candidate for classification as a Dog. Such a segment might also have high fixed costs associated with its production, further reducing its profitability.

Identifying and addressing these "Dogs" is crucial for optimizing HEICO's resource allocation. By strategically managing or divesting these underperforming assets, HEICO can redirect capital and management attention towards its Stars and Cash Cows, fostering more robust growth and profitability.

Question Marks

HEICO's strategic focus on new product development, particularly in emerging technologies like advanced AI and IoT for medical and telecommunications electronics, positions these ventures as potential question marks within the BCG matrix. These areas represent high-growth markets, with the medical electronics market expected to see a CAGR between 7.2% and 15.1% from 2025 to 2029, and the telecom electronic manufacturing services market projected to grow at a CAGR of 7.0% to 7.4% during the same period.

Despite the promising market expansion, HEICO's current market share in these nascent technological segments is likely low, necessitating substantial investment to achieve significant market penetration and establish a competitive foothold. This combination of high market growth and low market share is characteristic of question mark products, which require careful evaluation and strategic resource allocation to determine their future potential.

HEICO's strategic expansion into new or untapped geographic markets, particularly in high-growth regions where its current market share is minimal, would position it as a potential Star in the BCG matrix. These ventures demand significant capital for market penetration, establishing distribution networks, and cultivating brand recognition. The objective is to quickly secure a substantial portion of the market.

Within HEICO's Electronic Technologies Group (ETG), certain divisions might exhibit lower recent organic sales growth but are positioned in markets with significant future expansion potential. For instance, while the ETG reported 11% organic growth in Q1 2025, specific niche areas within it could be experiencing slower uptake despite robust underlying market demand.

These segments, though currently underperforming in terms of organic sales, represent opportunities for strategic investment. The challenge lies in identifying which of these slower-growing areas are truly poised for future market expansion to justify increased capital allocation or a shift in focus.

Initial Ventures into Advanced Manufacturing Techniques

HEICO's initial ventures into advanced manufacturing techniques, such as additive manufacturing for aerospace components, would likely be classified as Question Marks in a BCG Matrix. These investments are characterized by high capital expenditure and a need for specialized expertise, reflecting their early stage of market penetration. For instance, HEICO's reported capital expenditures for property, plant, and equipment in fiscal year 2023 were $341.9 million, a portion of which could be allocated to exploring such novel technologies. The potential for high returns is present if these techniques capture significant market share in burgeoning sectors like advanced aerospace or defense. However, the inherent risks associated with unproven technologies and market acceptance mean their future success is uncertain.

These ventures are strategically aimed at producing components for high-growth industries, aligning with HEICO's focus on specialized markets. The success of these advanced techniques hinges on their ability to demonstrate cost-effectiveness and superior performance compared to traditional methods. For example, the adoption rate of 3D printing in aerospace is projected to grow, with market forecasts indicating significant expansion in the coming years, suggesting a potentially lucrative, albeit risky, avenue for HEICO. The company must navigate the challenges of scaling production and meeting stringent industry quality standards.

- High Capital Investment: Significant upfront costs are required for acquiring and implementing novel manufacturing equipment and developing necessary expertise.

- Early Market Stage: These techniques are new to HEICO and are in the early phases of market adoption, carrying inherent uncertainties.

- High Growth Potential: Targeting high-growth industries offers the possibility of substantial returns if market penetration is achieved.

- Inherent Risks: The success of these ventures is not guaranteed, facing challenges from technological maturity, competition, and market acceptance.

Pilot Programs for Next-Generation Aerospace Solutions

Pilot programs for next-generation aerospace solutions, particularly those focusing on advanced materials or sustainable propulsion systems, represent Heico Cos's potential question marks. These initiatives are in the early stages of commercialization, addressing future industry needs but currently facing limited market adoption. The aerospace parts manufacturing sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.24% from 2025 to 2034, indicating a high-growth potential environment for these innovative solutions.

These ventures require significant investment in marketing and sales to transition from niche applications to mainstream acceptance. Their success hinges on their ability to quickly capture substantial market share, a common challenge for question mark products. For instance, a pilot program for a new lightweight composite material could see initial adoption by a few key aircraft manufacturers, but scaling production and securing broader contracts will be critical for its long-term viability.

- High Growth Potential: Operating within the expanding aerospace parts manufacturing market (4.24% CAGR 2025-2034).

- Limited Market Adoption: Solutions are nascent, requiring development and market education.

- Substantial Investment Needed: Significant marketing and sales efforts are essential for growth.

- Market Share Capture Crucial: Rapidly gaining traction is key to moving beyond the question mark phase.

HEICO's strategic investments in emerging technologies, such as advanced AI and IoT for medical and telecommunications electronics, represent classic question marks. These sectors are poised for significant growth, with the medical electronics market expected to expand at a CAGR of 7.2% to 15.1% between 2025 and 2029, and the telecom electronics manufacturing services market projected to grow at 7.0% to 7.4% in the same period. Despite this potential, HEICO's current market share in these nascent areas is likely low, demanding substantial investment to gain traction and establish a competitive position.

These ventures require careful evaluation and strategic resource allocation due to the high market growth coupled with low market share, a hallmark of question mark products. The company must invest heavily to build market presence and secure a significant portion of these expanding markets.

HEICO's exploration of advanced manufacturing techniques, like additive manufacturing for aerospace, also falls into the question mark category. These initiatives involve high capital expenditure, as evidenced by HEICO's $341.9 million in property, plant, and equipment capital expenditures in fiscal year 2023, and require specialized expertise. While targeting high-growth sectors like advanced aerospace offers substantial return potential, the inherent risks of unproven technologies and market acceptance remain significant.

The success of these new ventures hinges on their ability to achieve cost-effectiveness and superior performance, especially as the aerospace 3D printing market is projected for considerable expansion. HEICO must navigate the complexities of scaling production and meeting stringent industry quality standards to realize the potential of these question mark investments.

| HEICO's Question Marks | Market Growth Potential | Current Market Share | Investment Requirement | Key Challenges |

| AI/IoT in Medical & Telecom Electronics | High (Medical: 7.2%-15.1% CAGR 2025-2029; Telecom: 7.0%-7.4% CAGR 2025-2029) | Low | Substantial | Market penetration, establishing competitive foothold |

| Advanced Manufacturing (e.g., Additive) | High (Aerospace 3D Printing projected expansion) | Low | High Capital Expenditure ($341.9M in FY23 for PP&E) | Technological maturity, market acceptance, scaling production, quality standards |

| Next-Gen Aerospace Solutions (Materials, Propulsion) | High (Aerospace Parts Mfg: 4.24% CAGR 2025-2034) | Limited | Significant (Marketing & Sales) | Market adoption, scaling production, securing contracts |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial disclosures, market research reports, and competitive landscape analysis to provide a comprehensive view of Heico Cos's business units.